9 minute read

Which Brokers Use TradeLocker?

Navigating the trading platform landscape can be confusing, especially when platforms like TradeLocker appear on your radar. As someone who's been trading for over 15 years, I've seen platforms come and go. TradeLocker has gained traction among certain brokers, but many traders still wonder which companies actually support it and whether it's worth considering as an alternative to mainstream platforms like MT4 or MT5.

What Is TradeLocker and How Does It Work?

TradeLocker is a proprietary trading platform developed specifically for forex and CFD trading. Unlike the more universal MetaTrader solutions, TradeLocker is limited to specific brokers who've partnered with its developers. I first encountered it back in 2019 when a smaller broker I was testing introduced it as their "next-gen solution."

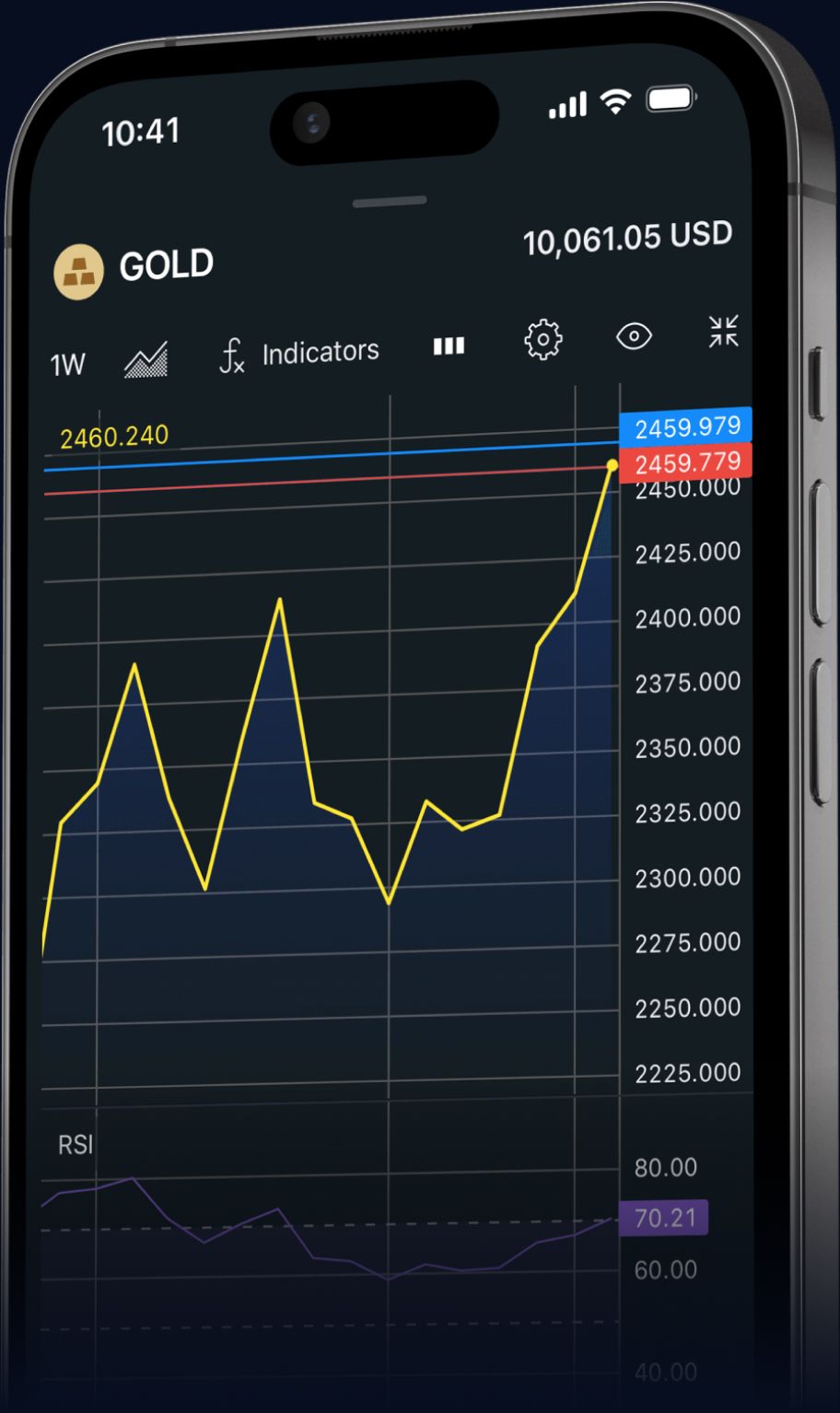

The platform works by providing direct market access through a streamlined interface that focuses on speed of execution. Its architecture is built around minimizing slippage – something I've found particularly useful when scalping during volatile market conditions.

TradeLocker operates both as a downloadable desktop application and as a web-based solution, with mobile apps available for both iOS and Android. The synchronization between devices is surprisingly seamless – I've opened positions on my desktop and managed them later on my phone without any hiccups.

What sets TradeLocker apart from other platforms is its focus on transparency. The platform displays the full order book, allowing you to see exactly where your orders stand in relation to others. This level of visibility isn't common in retail trading platforms.

Key Features and Benefits of the TradeLocker Platform

After spending considerable time using TradeLocker across different brokers, these are the standout features I've found most valuable:

Advanced Order Types – Beyond the standard market, limit and stop orders, TradeLocker offers OCO (One-Cancels-Other), trailing stops, and time-based orders

Real-time Market Depth – Full visibility of the order book with visual representation of buying and selling pressure

Custom Indicators Library – While not as extensive as MT4/MT5, the selection is growing and includes unique proprietary indicators

Multi-chart Layout – Easily configurable workspace with drag-and-drop functionality

Risk Management Tools – Built-in calculators for position sizing, margin requirements, and potential profit/loss scenarios

Automated Strategy Builder – Visual interface for creating trading strategies without coding knowledge

Social Trading Integration – Copy trading functionality with direct access to strategy providers' statistics

Direct Market News Feed – Curated market news with customizable alerts based on instruments in your watchlist

The platform's analytical tools strike a good balance between depth and usability. I've found their charting package to be responsive even when loading years of historical data – something that often causes MT4 to lag on my system.

List of Forex and CFD Brokers Using TradeLocker

Through my testing and industry connections, I've compiled this list of brokers currently offering TradeLocker. Note that availability can change, so it's worth checking directly with these brokers for the most current information:

FXPro Trading

AvaTrade

ThinkMarkets

FxChoice

EuropeFX

FXFlat

FXCM (in select regions)

Pepperstone (beta phase in some markets)

IC Markets (limited release)

Some smaller regional brokers also offer TradeLocker, but these ten represent the major players in the space. In my experience, FXPro and ThinkMarkets have the most polished implementation of the platform.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Comparison of Brokers Offering TradeLocker Access

When choosing a TradeLocker broker, it's important to consider more than just platform access. Key factors like minimum deposit, trading costs, instrument range, and unique features can significantly impact your experience.

FXPro requires a $100 deposit, offers spreads from 0.6 pips with a $7/lot commission, and provides over 250 instruments along with advanced algorithmic order options. AvaTrade, also with a $100 deposit, has spreads from 0.9 pips and no commission. It features 200+ instruments and the AvaProtect risk management tool. ThinkMarkets asks for $200, offers tight spreads from 0.4 pips and $3.50/lot commission, with 300+ instruments and a strong mobile trading experience. FXCM offers the lowest entry at $50, with spreads from 1.3 pips, no commission, around 90 instruments, and excellent educational content.

Exness, although not integrated with TradeLocker, is a top-tier broker offering ultra-low spreads (from 0.0 pips), fast execution, and platforms like MT4, MT5, and WebTerminal. With over 270 instruments, flexible leverage, and strong local support, it's a leading alternative for traders who prioritize reliability, performance, and transparency.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

From my experience, ThinkMarkets delivers the best TradeLocker experience, but Exness remains a standout for those who don’t specifically need TradeLocker and want robust, professional-grade trading conditions.

How to Start Trading with a TradeLocker-Supported Broker

Getting started with TradeLocker is straightforward. Based on my experience helping trading groups transition to new platforms, here's the process:

Select a suitable broker – Compare the options from the list above based on your trading needs

Complete the registration process – This typically takes 10-15 minutes with most brokers

Verify your identity – Submit required documentation (usually ID and proof of address)

Fund your account – Use your preferred payment method (bank transfer, credit card, e-wallets)

Download TradeLocker – From your broker's client portal or their website

Log in with credentials – Provided by your broker after account activation

Set up your workspace – Configure charts, watchlists, and indicators

Start with a demo account – Practice with virtual funds before risking real capital

I recommend spending at least two weeks on a demo account before switching to live trading. TradeLocker's interface has some unique elements that take time to master, especially if you're coming from MT4 or MT5.

Is TradeLocker Suitable for Beginners and Professionals?

This is a question I get often in my trading community. The short answer is: it depends on your trading style and expectations.

For beginners, TradeLocker offers a cleaner, more intuitive interface compared to the somewhat dated look of MetaTrader platforms. The built-in tutorials and tooltips are helpful for newcomers. However, the wealth of educational resources available for MetaTrader platforms isn't matched in the TradeLocker ecosystem yet.

For professionals and institutional traders, TradeLocker shines in execution speed and order management. The platform's architecture prioritizes low latency, which is critical for high-frequency strategies. I've noticed significantly less slippage compared to other platforms when trading during major news events.

Day traders and scalpers will appreciate the customizable hotkeys and one-click trading features. Swing traders and position traders might find the analytical tools slightly less comprehensive than MT4/MT5 with their vast libraries of custom indicators.

The determining factor should be your trading style. If you're heavily reliant on custom EAs (Expert Advisors) and an extensive library of technical indicators, you might feel limited. If execution quality and a modern user experience are priorities, TradeLocker could be an excellent fit.

Does Exness Support TradeLocker Platform?

As of my last check in March 2025, Exness does not support the TradeLocker platform. Despite rumors in some trading forums, Exness has focused exclusively on optimizing their MetaTrader offerings rather than expanding to proprietary platforms like TradeLocker.

I reached out to Exness support last month to confirm this information, and their representative stated they have no immediate plans to integrate with TradeLocker. This aligns with Exness's strategy of perfecting their implementation of industry-standard platforms rather than diversifying their platform offerings.

For traders specifically interested in using TradeLocker, you'll need to consider one of the brokers listed earlier. However, before switching brokers solely for a platform, it's worth considering whether Exness's existing platforms meet your trading needs.

Alternative Platforms Offered by Exness (MT4, MT5, WebTerminal)

While Exness doesn't offer TradeLocker, they excel in their implementation of the MetaQuotes platforms. Here's what they currently provide:

MetaTrader 4 (MT4) remains popular among forex traders for its simplicity and reliability. Exness offers a highly optimized version with faster execution speeds than many competitors. Their MT4 implementation includes the standard desktop platform, WebTrader for browser-based trading, and mobile apps.

MetaTrader 5 (MT5) is Exness's flagship platform offering. Their version includes enhanced features like an economic calendar, market depth, and a broader range of timeframes. I've found their MT5 execution to be among the fastest in the industry, particularly for ECN accounts.

WebTerminal is Exness's proprietary web-based trading solution. It's designed for traders who need quick access without installing software. While not as feature-rich as MT4 or MT5, it offers essential functionality in a clean, responsive interface.

In my experience, Exness has invested heavily in server infrastructure, resulting in minimal downtime and reliable execution across all their platforms. This focus on performance rather than platform diversity has built them a loyal following among serious traders.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Frequently Asked Questions (FAQ)

What is TradeLocker and why do some traders prefer it?

TradeLocker is a modern trading platform built for forex and CFD trading, preferred by traders for its clean interface, fast execution, and intuitive risk management tools. It also offers unique features like trading heatmaps and sentiment indicators not found on standard platforms.

Is Exness integrated with TradeLocker?

No, Exness does not support TradeLocker. The platform is available only through select brokers partnered with its developers. Exness focuses on MetaTrader platforms to maintain a streamlined and stable trading experience.

Can I trade with TradeLocker using a demo account?

Yes, all brokers offering TradeLocker provide demo accounts with virtual funds and no time limits. These accounts simulate live market conditions and are ideal for learning the platform before switching to real trading.

Does TradeLocker offer copy trading features?

Yes, TradeLocker includes built-in copy trading that lets you follow and automatically replicate trades from top-performing strategy providers, with customizable risk controls and filtering options based on performance and style.

What are the pros and cons of TradeLocker vs. Exness platforms?

TradeLocker offers a sleek interface, better order visualization, and user-friendly tools, but is limited in broker support and community resources. Exness uses MT4/MT5, providing strong reliability, a large support community, and advanced features, though the interface is more dated and less beginner-friendly.