13 minute read

What Leverage Is Good for $100?

Starting with just $100 in forex trading requires smart leverage choices. Too little and your profits might be negligible; too much and you risk blowing your account quickly. The right leverage balance lets you capture meaningful market moves while keeping risk in check. Understanding your trading style, risk tolerance, and how different leverage ratios work with small accounts is essential before placing your first trade.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

How Leverage Works in Forex Trading

Leverage in forex is like trading with borrowed money. When you use 1:100 leverage, every $1 in your account controls $100 in the market. This multiplier effect can significantly boost your potential returns, but it also magnifies losses.

Here's the nuts and bolts: If you have $100 and use 1:100 leverage, you can control positions worth $10,000. Without leverage, your $100 would barely move the needle in forex markets where currency prices typically change by fractions of a penny.

Think of leverage as a double-edged sword. I've seen new traders get excited about those big leverage numbers, only to get wiped out after a few losing trades. The key is understanding that leverage doesn't just amplify your profits—it amplifies everything, including your mistakes.

When you open a position, your broker sets aside a portion of your account as margin. This is essentially collateral. With 1:100 leverage, you'd need just $100 to control a standard lot ($100,000), requiring only 1% margin. But if the trade moves against you by just 1%, you've lost your entire account!

I learned this lesson early—higher leverage means smaller market movements can trigger margin calls. When your equity drops below maintenance margin requirements, you'll either need to deposit more funds or watch your positions get automatically closed, usually at the worst possible time.

Choosing the Right Leverage for a $100 Account

With just $100, you need to be extremely cautious about leverage. I recommend starting with 1:30 or lower if you're new to trading. This gives you enough power to make meaningful trades while providing some buffer against normal market fluctuations.

Your experience level matters tremendously here. As a rule of thumb:

For absolute beginners: Stick to 1:10 or 1:20. Yes, your position sizes will be smaller, but you'll have time to learn without getting wiped out.

For those with some experience: 1:30 might be appropriate if you have a solid risk management strategy.

For experienced traders: Even with experience, I wouldn't exceed 1:50 with such a small account.

Remember that your goal with $100 isn't to get rich overnight—it's to learn the ropes and gradually grow your account. I've seen too many traders destroy their $100 in minutes by using excessive leverage like 1:500 or 1:1000.

Another factor to consider is your trading style. Day traders might need higher leverage than swing traders since their profit targets are smaller. However, with $100, even as a day trader, exceeding 1:50 is playing with fire.

The Risks of Using High Leverage with $100

Let me be straight with you—trading with high leverage on a $100 account is like walking a tightrope without a safety net. The math just doesn't work in your favor.

The biggest danger is rapid account depletion. With 1:500 leverage, a 0.2% move against you wipes out your entire account. Normal market noise can easily move a currency pair 0.2% in minutes.

I once helped a new trader who had blown through three $100 accounts in a week using 1:500 leverage. Each time, he got caught in small retracements that would have been survivable with lower leverage.

Psychological pressure is another huge risk. When each pip movement represents a significant percentage of your account, you'll likely make emotional decisions—cutting winners too soon, letting losers run, or abandoning your trading plan altogether.

High leverage also encourages overtrading. With the ability to open multiple positions, there's a temptation to trade everything that moves. I've seen traders with small accounts open 5-10 positions simultaneously, effectively guaranteeing they'll hit a margin call when the market inevitably moves against some of those positions.

Finally, high leverage often leads to improper position sizing. Even with $100, you should never risk more than 1-2% on a single trade. With excessive leverage, you might be risking 10%, 20%, or even your entire account on one position.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Leverage Options on Different Forex Brokers for a $100 Account

Different brokers offer varying leverage options for small accounts. Most reputable brokers offer anywhere from 1:30 to 1:500, but availability depends on your location and regulatory restrictions.

In the EU and UK, regulations limit retail trader leverage to 1:30 for major pairs and even lower for other instruments. This is actually a blessing in disguise for small accounts. US brokers typically cap leverage at 1:50 for forex.

Offshore brokers often advertise extreme leverage like 1:1000 or even 1:3000, targeting small account holders with the promise of huge trading power. In my 15 years of trading, I've never seen a consistently profitable trader use anything close to these levels.

When I started with a small account years ago, I chose a broker offering 1:30 leverage despite having options for much higher levels. This forced discipline in my trading and prevented the catastrophic losses that plague highly leveraged accounts.

Some brokers also offer variable leverage based on position size—higher leverage for smaller positions and reduced leverage as your exposure increases. This can be ideal for $100 accounts, allowing reasonable leverage without excessive risk.

Remember that high leverage often comes with wider spreads or other hidden costs. The broker offering 1:1000 leverage is likely compensating with higher trading costs, which further erodes your small account.

Best Leverage for Beginners Trading with $100

For true beginners with $100, I strongly recommend using no more than 1:20 leverage. This gives you enough margin to open micro-lot positions while maintaining a reasonable buffer against normal market movements.

At 1:20, your $100 controls about $2,000. This means you can trade 0.02 lots (2 micro-lots) while risking only about 5% of your account on a 50-pip stop loss. That's still higher risk than I'd normally recommend, but workable for learning purposes.

Start with just one currency pair—preferably a major like EUR/USD or GBP/USD that has tighter spreads. Trading multiple pairs splits your focus and increases the likelihood of mistakes.

As you gain experience and grow your account, you can gradually increase leverage, but with $100, conservative is better. Each trade should be a learning opportunity, not a make-or-break moment for your account.

I've mentored dozens of new traders, and those who started with lower leverage almost always outlasted those who went for the maximum. They developed patience, learned proper risk management, and avoided the crushing psychological blow of blowing up their first account.

Remember that with a small account, your primary goal should be survival and education, not massive profits. The skills you develop trading conservatively with $100 will serve you much better than trying to turn $100 into $1,000 in a week through excessive leverage.

Example of How Leverage Works with $100

Let's walk through a practical example of trading with different leverage levels on a $100 account:

Scenario: You want to buy EUR/USD at 1.0500, with a stop loss at 1.0450 (50 pips) and a take profit at 1.0575 (75 pips). This gives you a 1:1.5 risk-reward ratio.

With 1:20 leverage: Your $100 controls $2,000. Trading 0.02 lots (2 micro-lots), a 50-pip stop loss means you're risking $10, or 10% of your account. If your take profit is hit, you make $15.

With 1:50 leverage: Your $100 controls $5,000. Trading 0.05 lots (5 micro-lots), the same 50-pip stop loss means you're risking $25, or 25% of your account. Your potential profit is $37.50.

With 1:100 leverage: Your $100 controls $10,000. Trading 0.1 lots (1 mini-lot), the 50-pip stop loss means you're risking $50, or 50% of your account. Your potential profit is $75.

I personally wouldn't risk more than 2% on a single trade, which with $100 means just $2. With a 50-pip stop loss, this limits you to 0.004 lots using 1:20 leverage. Yes, that's tiny, but it's realistic risk management for a $100 account.

This example illustrates why proper position sizing is more important than high leverage. I'd rather take 50 small trades with appropriate risk than 5 overleveraged trades that could wipe me out.

How to Manage Risk with $100 and Leverage

With just $100, risk management isn't just important—it's everything. Here's how I approach it:

Never risk more than 2% per trade. With $100, that's just $2. This means taking very small positions, but it keeps you in the game.

Always use stop losses. They're non-negotiable with a small account. Place them based on technical levels, not account considerations.

Avoid trading during high-impact news events. The volatility can trigger stop losses or cause slippage that a small account can't absorb.

Track your win rate and average R (risk multiple). With $100, you need to be brutally honest about your edge in the market.

Don't overtrade. Limit yourself to 1-3 trades per day maximum. Quality over quantity.

I once helped a trader turn $100 into $500 over three months using these principles. The key was consistency and discipline—not hitting home runs.

Another crucial aspect is avoiding the martingale trap. Don't double your position size after a loss thinking you'll recover quickly. This is a fast track to blowing your account.

Consider using guaranteed stop losses if your broker offers them. They might cost slightly more, but they ensure you don't suffer slippage during volatile market conditions.

Finally, keep detailed trading records. With a small account, you need to identify and eliminate mistakes quickly. Review your trades weekly to spot patterns and improve your approach.

Exness and Leverage for $100 Accounts

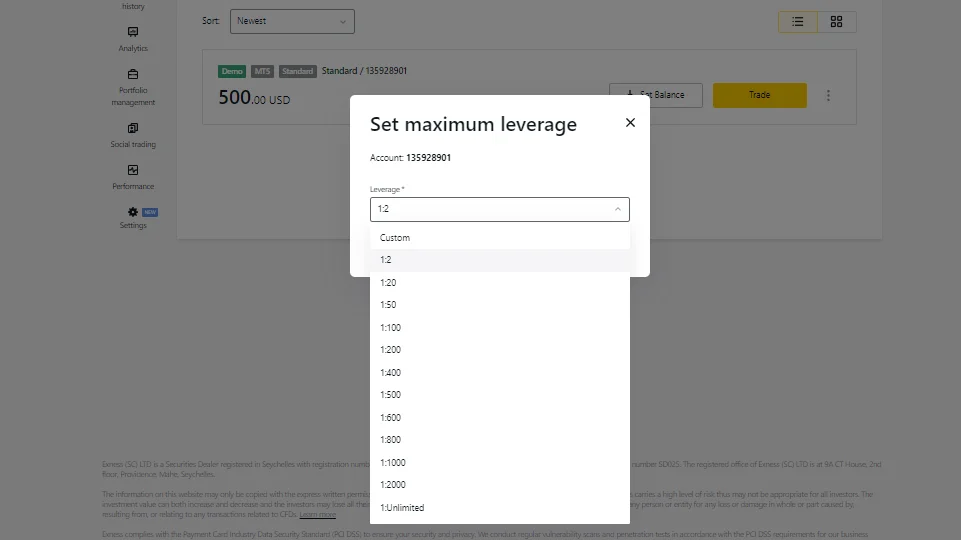

Exness offers flexible leverage options that can work well for $100 accounts. They provide leverage up to 1:2000, but that doesn't mean you should use it all.

What makes Exness suitable for small accounts is their micro-lot trading capability and relatively tight spreads. You can trade positions as small as 0.01 lots, which is essential for proper risk management with $100.

Their platform includes built-in risk management tools like stop losses, take profits, and margin calculators. These features help you visualize risk before entering trades—critical for small account survival.

From my experience, Exness's negative balance protection is particularly valuable for small accounts using leverage. This prevents you from losing more than your deposit if the market gaps against your position.

Their instant execution policy (on certain account types) helps avoid slippage, which can be devastating when you're working with tight margins on a small account.

Remember though, just because a broker offers ultra-high leverage doesn't mean you should use it. I recommend sticking to 1:30 or lower even if you have access to 1:2000.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Conclusion

Trading forex with $100 requires a careful approach to leverage. While it might be tempting to use maximum leverage to grow your account quickly, this path almost always leads to account blowups.

I recommend starting with 1:20 or 1:30 leverage maximum, using proper position sizing (never risking more than 2% per trade), and focusing on one or two currency pairs. This approach won't make you rich overnight, but it will give you the experience needed to become a consistently profitable trader.

Remember that with a $100 account, your primary goal should be education and skill development. The habits you form now will determine your long-term success or failure, regardless of account size.

If you must use higher leverage, increase it gradually as your skills improve and your account grows. There's no rush—the markets will always be there tomorrow.

Finally, choose a broker like Exness that offers appropriate tools for small accounts, including micro-lot trading, tight spreads, and solid risk management features. Your broker should be a partner in your trading journey, not an obstacle.

Frequently Asked Questions (FAQs)

What is the best leverage for a $100 Forex account?

For most beginners with $100, leverage between 1:10 and 1:30 provides the best balance between opportunity and risk. This lets you open meaningful positions while giving your trades room to breathe. I personally started with 1:20 leverage when I had a small account, focusing on learning proper trade management rather than gunning for big profits. If you're more experienced and have a proven strategy, you might consider up to 1:50, but I wouldn't recommend going higher with such a small balance.

How much leverage can I use with $100 in my trading account?

Technically, you can access leverage as high as 1:2000 with some brokers, which would let your $100 control positions worth $200,000. However, just because you can doesn't mean you should. The practical leverage you should use depends on your risk management. If you're limiting risk to 2% per trade with a 50-pip stop loss on EUR/USD, you should be trading just 0.004 lots (or $400 worth of currency), which requires only about 1:4 leverage. Start low and increase only when you've proven you can trade consistently.

Can I trade with $100 using 100:1 leverage?

Yes, you can, but it's extremely risky. At 100:1 leverage, a 1% move against you wipes out your entire account. Normal daily currency fluctuations often exceed 1%, making this a dangerous proposition. I've seen countless traders blow up small accounts using excessive leverage. If you must use 100:1 leverage with $100, reduce your position sizes dramatically. Never control more than $1,000-$2,000 worth of currency (0.01-0.02 lots) even though your leverage would allow for much larger positions.

How can I manage risk with $100 and leverage?

The most important risk management principle with a small account is position sizing. Never risk more than 1-2% of your account on a single trade. With $100, that's just $1-$2. Use stop losses based on technical levels, not just arbitrary numbers. Diversify your trades across different sessions rather than concentrating risk. Track your metrics closely—win rate, average win/loss, and maximum drawdown. Consider using guaranteed stops if available to prevent slippage in volatile markets. Finally, have a drawdown rule—for example, if your account drops below $90, reduce position sizes or take a break to reassess.

How does Exness help manage leverage for small accounts?

Exness provides several features that help manage leverage risks for small accounts. Their platforms include built-in calculators that show exactly how much margin is required and the potential profit/loss before you enter a trade. They offer negative balance protection, preventing you from losing more than your deposit. The ability to trade micro-lots (0.01) and even smaller positions enables proper position sizing with just $100. Their one-click trading interface includes preset stop loss and take profit options, encouraging good risk management habits. Finally, their educational resources include specific sections on leverage risks and how to properly size positions based on your account balance.