7 minute read

Which Leverage Is Good for Beginners?

Starting out in forex or CFD trading can feel overwhelming, especially when trying to understand leverage. While high leverage might seem attractive, beginners should approach with caution. The right leverage choice can protect your capital while you're still learning the ropes and developing your trading strategy. Let's break down what leverage means for new traders and find the right balance for your trading journey.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

What Is Leverage in Trading?

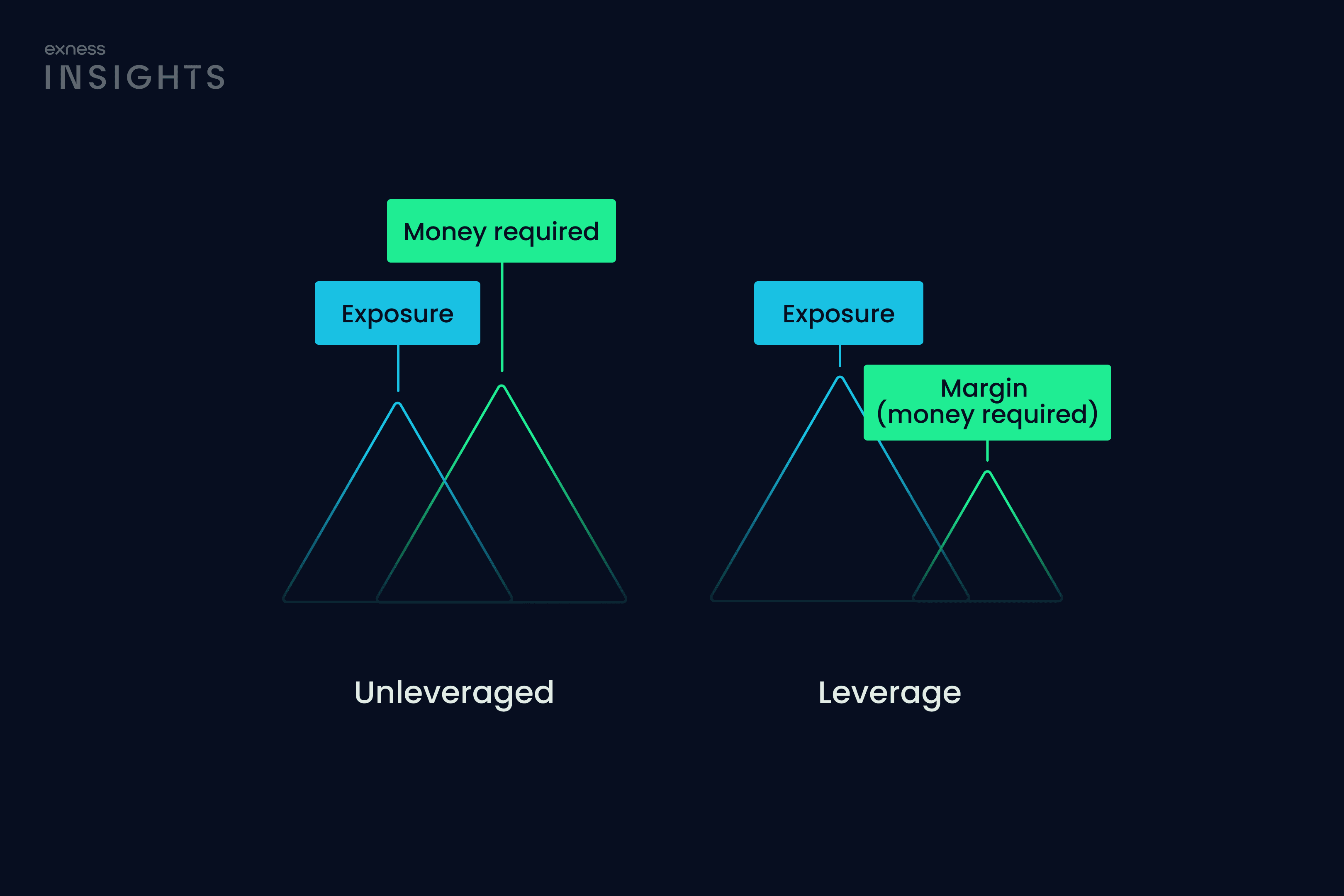

Leverage in trading is essentially borrowed capital that allows you to control larger positions with a relatively small amount of your own money. Think of it as a multiplier for your trading power. When you use 1:100 leverage, for example, you can control $100,000 worth of assets with just $1,000 of your own capital.

It's like using a lever in physics – you can move something much heavier than you could with your bare hands. In trading terms, leverage gives you the ability to make larger trades and potentially earn more profit from smaller market movements. However, this works both ways, as your losses can also be magnified.

Most brokers express leverage as a ratio, such as 1:10, 1:50, or 1:500. The first number represents your capital, while the second shows how much you can control.

How Leverage Works and Its Impact on Trading

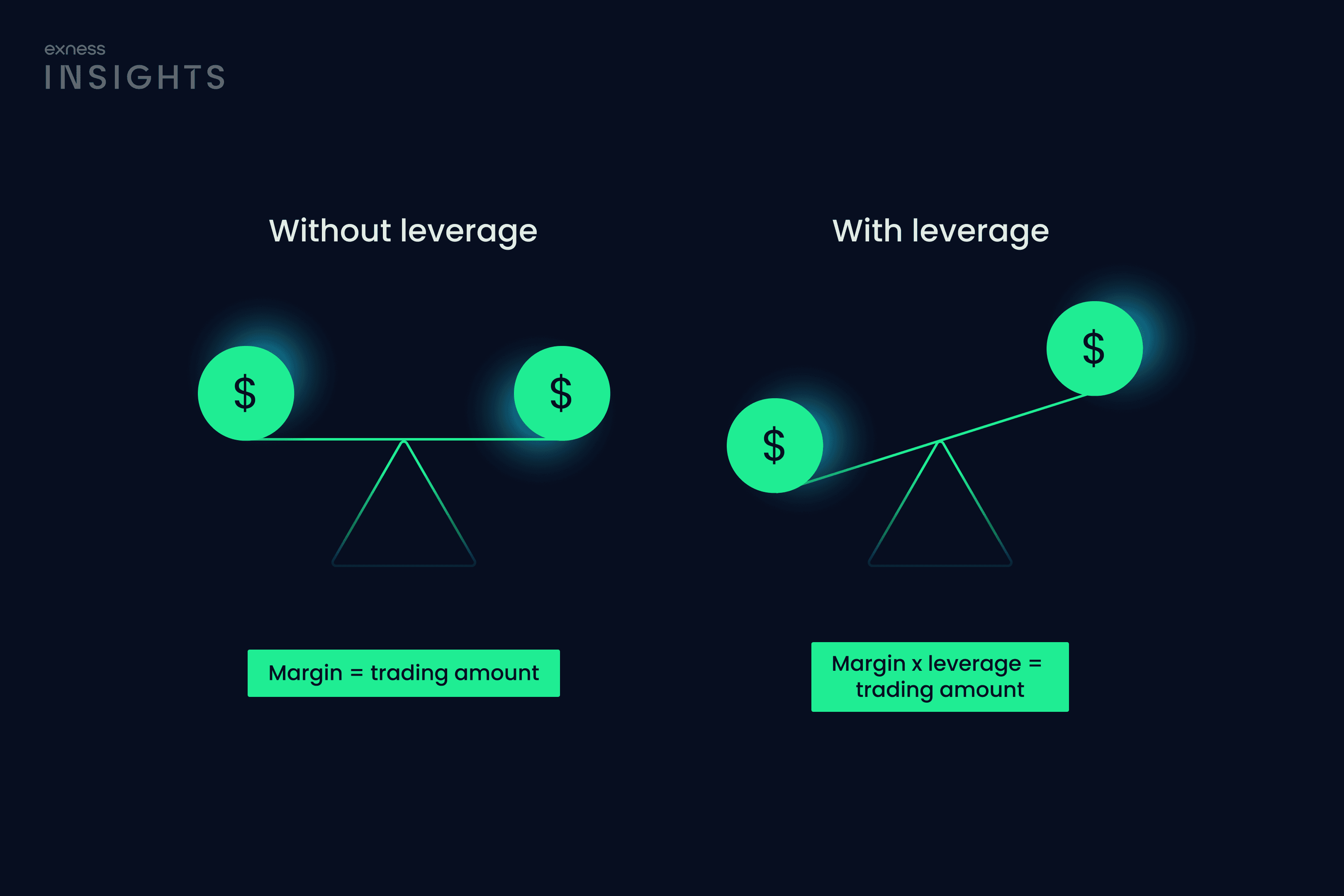

Let's say you have $1,000 in your trading account and want to buy EUR/USD. Without leverage, you could only purchase $1,000 worth of currency. But with 1:100 leverage, you could control a position worth $100,000.

If the market moves 1% in your favor, your profit would be $1,000 without leverage (a 100% return on your investment). With 1:100 leverage, that same 1% move would yield $1,000 in profit (a 100% return on your investment).

Sounds great, right? Here's the catch: if the market moves 1% against you, you'd lose $1,000 – your entire trading capital – with 1:100 leverage. Without leverage, you'd only lose $10 (1% of your $1,000).

The impact of leverage on your trading can be enormous:

Small market movements become significantly magnified

Trading opportunities become more accessible with less capital

Profits can grow exponentially with successful trades

Losses can wipe out your account quickly if trades go wrong

Emotional trading becomes more dangerous with high leverage

I've seen too many new traders blow their accounts in days because they didn't understand how quickly leverage can turn against them.

Recommended Leverage Ratios for Beginners

For beginners, I strongly recommend starting with low leverage – ideally 1:10 to 1:20. These ratios provide enough trading power while limiting your exposure to catastrophic losses.

When I first started trading, I used 1:200 leverage and nearly wiped out my account in a week. It took that painful lesson for me to realize that high leverage isn't a shortcut to success.

As you gain experience and develop solid risk management habits, you can gradually increase your leverage. Remember, successful trading isn't about making huge gains overnight – it's about consistency and capital preservation.

For different markets, consider these starting points:

Forex majors: 1:10 to 1:30

Forex minors and exotics: 1:10 to 1:20

Commodities: 1:10

Indices: 1:5 to 1:10

Stocks: 1:2 to 1:5

Cryptocurrencies: 1:2 or no leverage

These recommendations aren't set in stone. Your personal risk tolerance, trading style, and strategy all play important roles in determining your ideal leverage.

Pros and Cons of Using Leverage as a New Trader

Let's weigh the advantages and disadvantages of leverage for beginners:

Pros:

Amplifies buying power with limited capital

Allows diversification across more instruments

Provides access to otherwise unaffordable markets

Can magnify profits on successful trades

Enables trading strategies that require larger positions

Less capital tied up in margin requirements

Cons:

Magnifies losses just as much as profits

Can wipe out trading accounts quickly

May encourage overtrading and poor position sizing

Often leads to emotional decision-making

Increases the impact of market volatility

Makes risk management more challenging

May result in margin calls and forced liquidations

The hard truth is that most beginners focus only on the pros while underestimating the cons. This mindset usually results in painful lessons.

Risk Management When Trading with Leverage

Proper risk management is absolutely essential when using leverage. Here are practical steps to protect your capital:

Never risk more than 1-2% of your account on a single trade. With high leverage, this means using much smaller position sizes than your leverage would allow. For example, with a $1,000 account and 1:100 leverage, you could theoretically control $100,000 – but that doesn't mean you should.

Always use stop-loss orders. These automatically close your position if the market moves against you beyond a certain point. Place your stop-loss before entering any trade, and never move it further away once the trade is active.

Calculate your position size based on where your stop-loss will be, not on how much leverage you have available. If you're willing to risk $20 on a trade with a 20-pip stop-loss, your position size should be calculated accordingly.

I've made it through some rough market conditions by sticking to these principles. During the March 2020 crash, many traders with excessive leverage were wiped out in days, while those with proper risk management survived to trade another day.

How to Change Leverage Settings on a Trading Platform

Most platforms allow you to adjust your leverage settings. Here's how to do it on most trading platforms:

Log in to your trading account through the web platform or desktop/mobile app

Navigate to your account settings or profile section

Look for "Leverage" or "Account Settings"

Select your desired leverage ratio from the available options

Confirm your selection (some platforms may require verification)

Check that your new leverage settings have been applied before placing trades

Remember that changing leverage might affect your existing open positions. Some brokers require you to close all positions before adjusting leverage settings.

It's worth noting that in some jurisdictions, maximum leverage is regulated by law. For example, in the EU and UK, retail traders are limited to 1:30 for major forex pairs and even lower for other instruments.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Leverage Options for Beginners on Exness

Exness offers various account types with different leverage options suitable for beginners. Their Standard accounts provide leverage up to 1:2000, but don't let that high number tempt you into overtrading.

New traders on Exness should consider starting with their Standard account but manually reducing the leverage to a more manageable level, like 1:10 or 1:20. The platform makes it easy to adjust your leverage settings through your personal area.

Exness also offers negative balance protection, which means you can't lose more than you deposit. This is particularly important when using leverage, as it prevents you from going into debt if the market makes a sudden, dramatic move against your position.

The demo account option is also valuable for beginners. It allows you to practice with different leverage settings without risking real money. I spent three months on a demo account before switching to live trading, and it helped me understand the true impact of leverage.

Frequently Asked Questions (FAQ)

What is the safest leverage for beginner traders?

Leverage between 1:5 and 1:20 is safest for beginners. 1:10 is a good starting point — it balances risk and flexibility. The key is proper risk management, not just the leverage ratio.

How does leverage affect margin and potential losses?

Higher leverage = lower margin requirement, but higher risk. Losses are based on full position size, not margin. A small market move can wipe out your margin if leverage is too high.

What leverage options does Exness offer to beginners?

Exness offers 1:1 to 1:2000 leverage, depending on account and asset. Beginners should start with 1:10 or 1:20 and use tools like stop-loss and negative balance protection.

Does higher leverage mean higher profits?

No. Higher leverage increases potential risk, not guaranteed profit. Many experienced traders use low leverage (e.g., 1:5) for more consistent, controlled results.