7 minute read

Who Is a Scalper Trader: Quick Profits Strategy Explained

In the fast-paced world of financial markets, scalper traders stand out as the sprinters of trading. They zoom in and out of positions within minutes or even seconds, aiming to capture small price movements and accumulate profits through high-volume trading. Unlike position traders who might hold trades for weeks or months, scalpers rarely keep positions open beyond a few minutes.

The scalping approach relies on quick decision-making, razor-sharp focus, and the ability to execute numerous trades throughout a single trading session. For many traders, scalping offers an appealing alternative to longer-term strategies because it minimizes exposure to overnight market risks and provides almost immediate feedback on trading decisions.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Key Characteristics of a Scalper Trader

Short holding periods - Scalpers typically hold positions for seconds to minutes, rarely longer than an hour

High trade frequency - Often executing dozens or even hundreds of trades per day

Small profit targets - Usually aiming for 5-15 pips per trade rather than large price swings

Strict risk management - Using tight stop-losses and maintaining strict risk-reward ratios

Strong discipline - Following trading plans without emotional interference

Excellent focus - Maintaining concentration through rapid market changes

Technical analysis skills - Relying heavily on charts and technical indicators rather than fundamentals

Quick execution - Using direct market access or advanced order types for rapid entry and exit

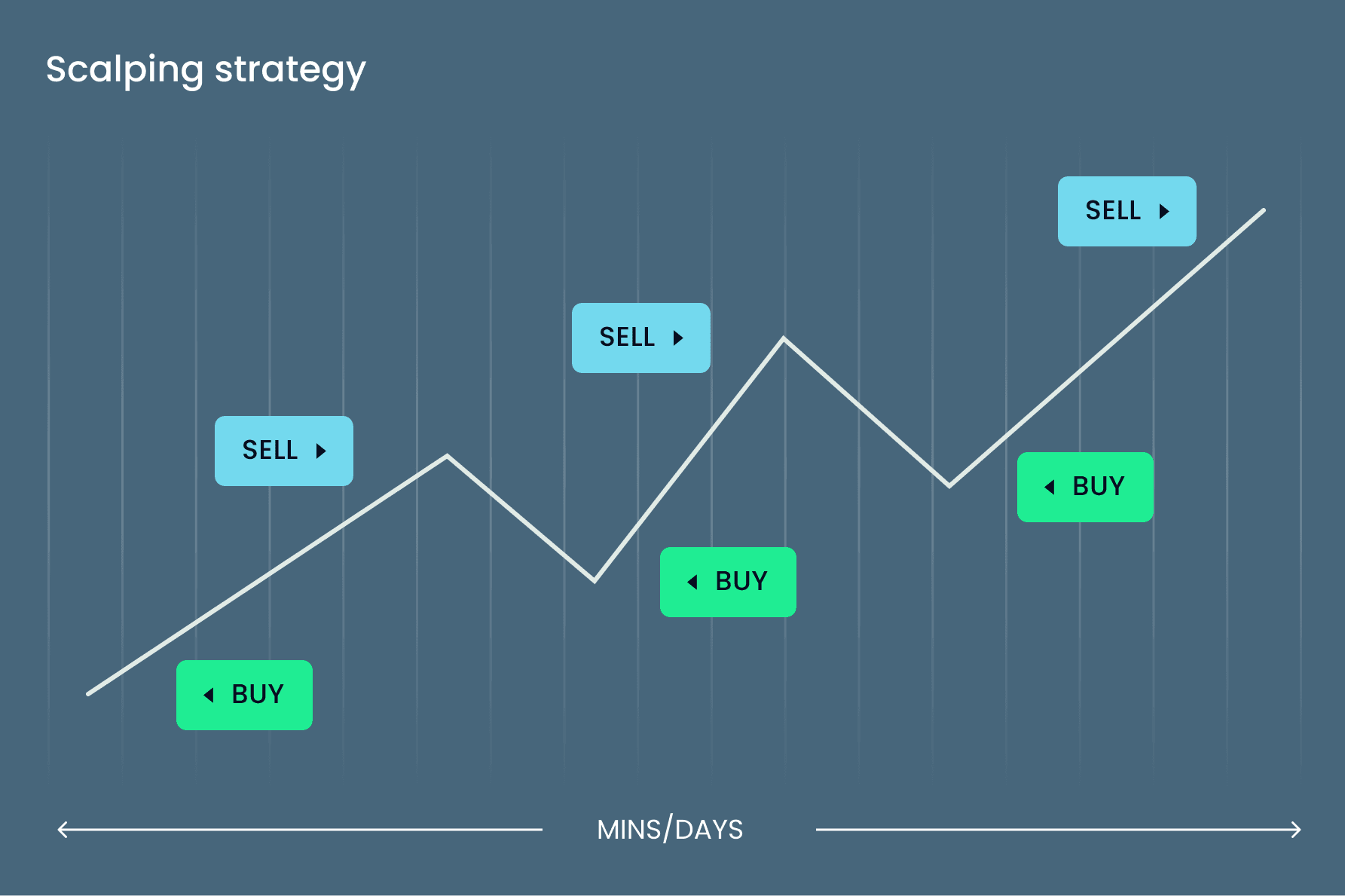

Scalping Strategies for Quick Profits

Successful scalping boils down to identifying small inefficiencies in the market and exploiting them before they disappear. The bread and butter of most scalpers is the range breakout strategy. Here, traders wait for price consolidation in a narrow range, then jump in when price breaks above or below this range, riding the momentum for quick profits.

Another popular approach is trend-following scalping. When a strong trend is established, scalpers enter in the direction of the trend after small pullbacks or consolidations. This works particularly well in liquid markets during active trading hours. Many seasoned scalpers also employ order flow analysis, watching the volume and speed at which orders are filled to gauge short-term market sentiment. This gives them an edge in predicting the next few price ticks.

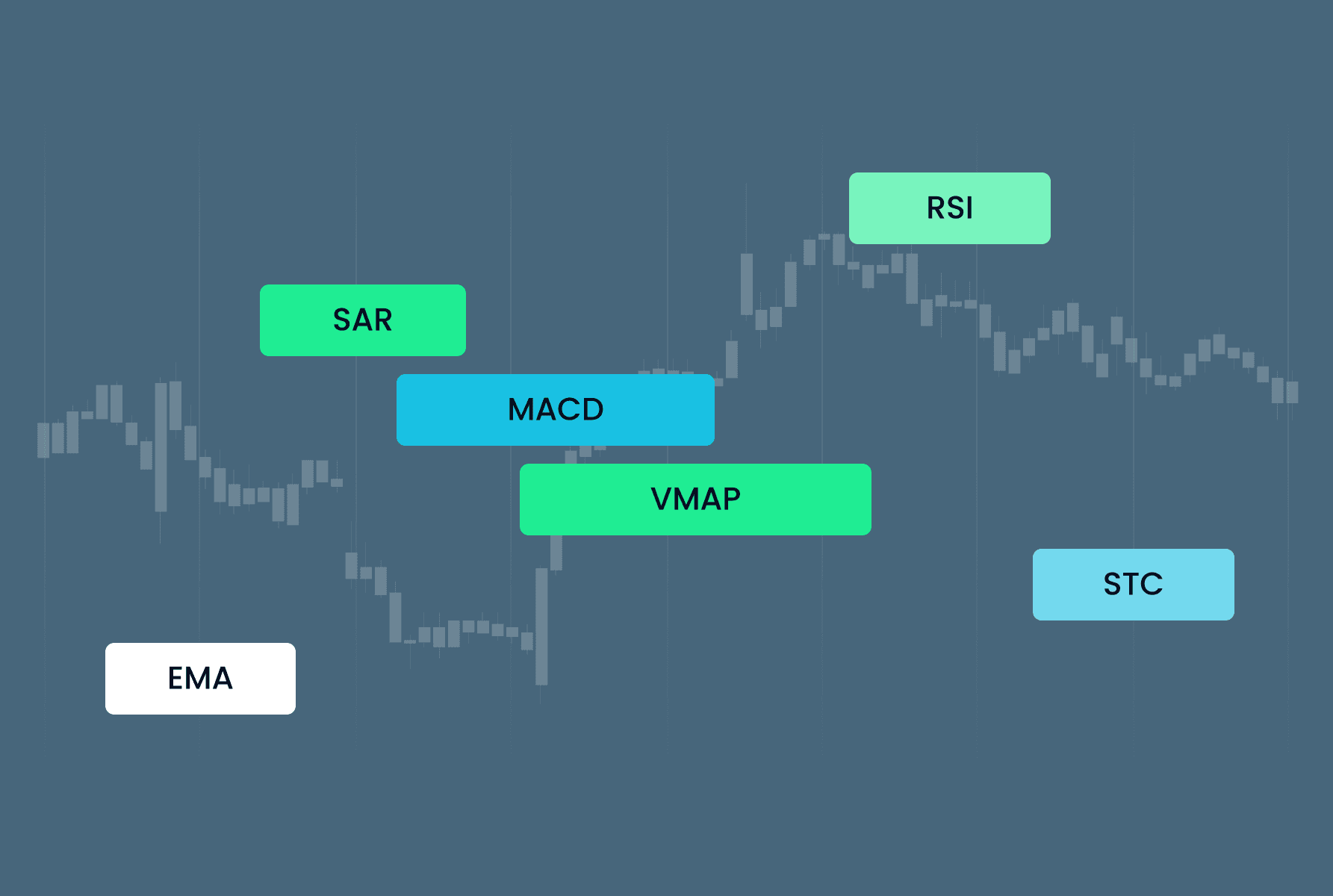

Essential Tools and Indicators for Scalpers

For scalpers, having the right tools is as crucial as having the right strategy. A lightning-fast trading platform with minimal latency sits at the top of the list. Even a few milliseconds of delay can mean the difference between profit and loss in this game. Direct market access is also vital, allowing traders to place orders directly to the exchange order books.

On the technical side, scalpers typically rely on real-time indicators that don't lag behind price action. The 1-minute and 5-minute MACD (Moving Average Convergence Divergence) helps identify short-term momentum shifts. Stochastic oscillators spot overbought and oversold conditions that often lead to quick reversals. Volume indicators are indispensable too, as they confirm the strength behind price movements. Many successful scalpers also use market depth charts and Level II data to see pending buy and sell orders, giving them insight into where price might head next.

Risks and Challenges of Scalping

Transaction costs - Frequent trading racks up significant commission fees and spreads

Psychological pressure - Making split-second decisions repeatedly can lead to mental fatigue

Technology dependence - System failures or internet disruptions can be catastrophic

Slippage - Orders may not execute at expected prices during volatile conditions

Overtrading - The temptation to trade too frequently can lead to poor decision-making

Market noise - Short-term price movements often include random fluctuations unrelated to trends

Spread impact - Even small spreads significantly affect profitability on tiny price movements

Broker restrictions - Some brokers discourage or prohibit scalping strategies

Scalping on Exness: Features and Advantages

Exness has emerged as a top choice for scalpers globally, and for good reasons. The platform offers some of the tightest spreads in the industry, starting from 0.0 pips on major pairs during optimal market conditions. This is crucial when you're targeting just a few pips of profit per trade. Their execution speed is another game-changer for scalpers—orders get filled in milliseconds, which can make all the difference when capitalizing on fleeting market opportunities.

What really sets Exness apart for scalping is their no-requotes policy. When markets move rapidly, many brokers will reject your order and requote you at a less favorable price. Exness doesn't do this—if you click to trade, you get exactly the price you see. This transparency extends to their unlimited leverage options too. While high leverage should be used cautiously, having the flexibility to scale positions precisely gives scalpers the capital efficiency they need without overcommitting their trading balance.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Best Trading Conditions for Scalping on Exness

The Raw Spread account on Exness is specifically designed with scalpers in mind. It offers institutional-grade direct market access with spreads starting from just 0.0 pips plus a small commission. For active scalpers, this commission structure often works out cheaper than traditional spread-based accounts. The platform's advanced charting capabilities include all the technical indicators scalpers rely on, from momentum oscillators to volume profiles.

Market timing matters enormously in scalping, and the best opportunities typically arise during overlapping market sessions. The London-New York overlap (8:00-12:00 EST) provides peak liquidity for EUR/USD and GBP/USD pairs, creating ideal scalping conditions on Exness. Major economic news releases also generate the volatility scalpers thrive on, though these require extra caution due to potential slippage. Using Exness's guaranteed stop-loss orders during these volatile periods helps protect capital while still allowing aggressive trade entries when opportunities arise.

Conclusion

Scalping isn't for everyone—it demands intense focus, split-second decision making, and ironclad discipline. But for traders who thrive in fast-paced environments and have the right temperament, it offers a way to generate consistent profits without exposure to overnight risks. Success comes down to having the right broker platform, proper risk management, and a thoroughly tested strategy.

Whether you're an experienced trader looking to add scalping to your toolkit or a beginner drawn to the excitement of rapid trading, understanding the fundamentals outlined here gives you a solid foundation. Remember that profitable scalping is a marathon of sprints—each individual trade matters less than your overall performance across hundreds of trades. With practice, the right tools, and proper risk controls, scalping can become a viable and rewarding trading approach.

Frequently Asked Questions (FAQs)

Can I use scalping strategies on Exness?

Yes, Exness fully supports scalping strategies and doesn't impose restrictions on minimum holding periods or trading frequency like some brokers do. Their platform is specifically optimized for high-frequency trading with features like instant execution and minimal slippage that benefit scalpers directly.

Exness account type is best for scalping?

The Raw Spread account is ideal for scalping on Exness, offering direct market access with spreads from 0.0 pips plus a small fixed commission. For very active scalpers trading major pairs like EUR/USD or USD/JPY, this typically proves more cost-effective than standard accounts with wider spreads and no commissions.

What leverage should I use for scalping on Exness?

While Exness offers high leverage options, experienced scalpers typically use moderate leverage between 10:1 and 30:1 even when higher levels are available. This provides enough capital efficiency to profit from small movements while keeping risk manageable, as scalping requires strict position sizing rather than maximum leverage to succeed consistently.

How can I minimize risks while scalping on Exness?

Minimize risks by using tight stop-losses (typically 5-10 pips), limiting each trade's risk to 1% of your account or less, avoiding major news releases unless experienced with their impact, trading only during high-liquidity hours, and using Exness's guaranteed stop-loss feature during volatile conditions to prevent slippage on your protective stops.