6 minute read

Does Exness Have a Micro Account?

When starting your trading journey, finding the right account type can make or break your experience. Micro accounts are popular among beginners due to their lower risk profile and manageable trade sizes. Curious about whether Exness offers this option?

Let's dive into Exness's account offerings to determine if a micro account is available and what features you might expect if you're looking to start small.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

What is a Micro Account?

A micro account is a type of trading account designed specifically for traders who want to start with minimal capital. Unlike standard accounts, micro accounts allow you to trade with much smaller lot sizes—typically 0.01 lots, which equals 1,000 units of the base currency. This means your positions have less exposure to market fluctuations, and consequently, your potential losses are limited.

As a trader for over 15 years, I've seen many newcomers blow their accounts because they started too big. Micro accounts solve this problem by letting you trade with real money but at a fraction of the risk. You can practice execution, test strategies, and experience the emotional aspects of trading without risking significant capital.

Does Exness Offer a Micro Account?

Yes, Exness does offer a micro account option, but they call it the "Standard" account. Don't let the name fool you—this account type functions exactly like what most brokers market as a micro account. I switched to Exness a few years back and was initially confused by the naming, but their Standard account gives you all the benefits you'd expect from a micro account.

With the Exness Standard account, you can trade with position sizes as small as 0.01 lots. The minimum deposit is just $1, making it accessible to almost anyone interested in forex trading. This is significantly lower than many competing brokers who require $50-$100 minimum deposits for their micro accounts.

Account Features of Exness Micro Account

The Exness Standard account (their version of a micro account) comes with several features that make it attractive for beginners and cautious traders:

Minimum deposit of just $1

Leverage up to 1:2000 (use with caution!)

Minimum position size of 0.01 lots

Spreads from 0.3 pips

No commission on trades

Access to 100+ trading instruments

MT4 and MT5 platform compatibility

No restrictions on trading strategies

Instant execution of orders

24/7 customer support

I particularly appreciate the flexible leverage options. While the maximum is dangerously high, you can choose to use much lower leverage based on your risk tolerance.

Who Should Use Exness Micro Account?

From my experience, Exness's micro account is ideal for several types of traders. Beginners who are just learning the ropes will benefit most, as the small position sizes mean mistakes won't be catastrophic. I still remember my first few months of trading where I lost half my account due to position sizing errors—something that could have been avoided with a micro account.

Risk-averse traders who prefer a more conservative approach will also find value in this account type. By trading smaller positions, you can diversify across more currency pairs without overexposing yourself.

Traders with limited capital who want to participate in the forex market without a substantial initial investment will find the $1 minimum deposit extremely attractive. When I started, I had to save up $500 just to open my first trading account!

Strategy testers looking to validate their trading systems with real money (rather than in a demo environment) will also appreciate the low-risk nature of micro accounts.

How to Open a Micro Account with Exness

Opening a micro account (Standard account) with Exness is straightforward. I've walked several friends through this process, and it typically takes less than 10 minutes.

First, visit the Exness website and click on the "Open Account" or "Register" button. You'll need to provide basic personal information including your name, email, phone number, and country of residence.

After creating your login credentials, you'll need to verify your identity by uploading a government-issued ID and proof of address. This KYC process is standard across the industry and required for regulatory compliance.

Once your documents are verified (usually within 24 hours), you can fund your account using various payment methods including credit/debit cards, bank transfers, and e-wallets.

Select "Standard Account" when prompted to choose an account type. Configure your preferred leverage and base currency, then make your initial deposit. Remember, you can start with as little as $1, but I recommend at least $100 to give yourself some breathing room.

After your account is funded, download either MetaTrader 4 or 5, log in with your credentials, and you're ready to start trading micro lots!

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Pros and Cons of Exness Micro Account

Like any trading account, Exness's micro account has its advantages and disadvantages. Based on my years of trading experience, here's what stands out:

Pros:

Extremely low minimum deposit ($1)

Small position sizes reduce risk exposure

No commissions on trades

High leverage available (though use cautiously)

Access to full range of trading instruments

Real market conditions unlike demo accounts

Perfect for learning proper risk management

No restrictions on trading strategies

Fast execution speeds

Multiple platform options (MT4/MT5)

Cons:

Higher spreads compared to Exness's other account types

The high leverage can be dangerous for inexperienced traders

Limited educational resources compared to some competitors

No access to Exness's copy trading features

Not ideal for high-volume traders due to spread costs

Limited analytics tools compared to professional accounts

I've found that the pros outweigh the cons, especially for newer traders. The slightly higher spreads are a fair trade-off for the reduced commission structure.

Frequently Asked Questions (FAQs)

Does Exness offer a Micro Account?

Yes, Exness offers micro trading capabilities through their Standard account, which allows trading with position sizes as small as 0.01 lots (equivalent to micro lots) and requires only a $1 minimum deposit, making it functionally identical to what most brokers call a micro account.

What is the minimum deposit for a Micro Account with Exness?

The minimum deposit for Exness's Standard account (micro equivalent) is just $1, though I typically recommend new traders start with at least $100 to allow for proper risk management and to withstand normal market fluctuations without immediately facing margin calls.

What instruments can I trade on a Micro Account?

With an Exness Standard account, you can trade over 100 instruments including major and minor forex pairs, cryptocurrencies, commodities like gold and oil, stock indices, and selected individual stocks, all with position sizes as small as 0.01 lots.

Can I switch from a Micro Account to another type of account?

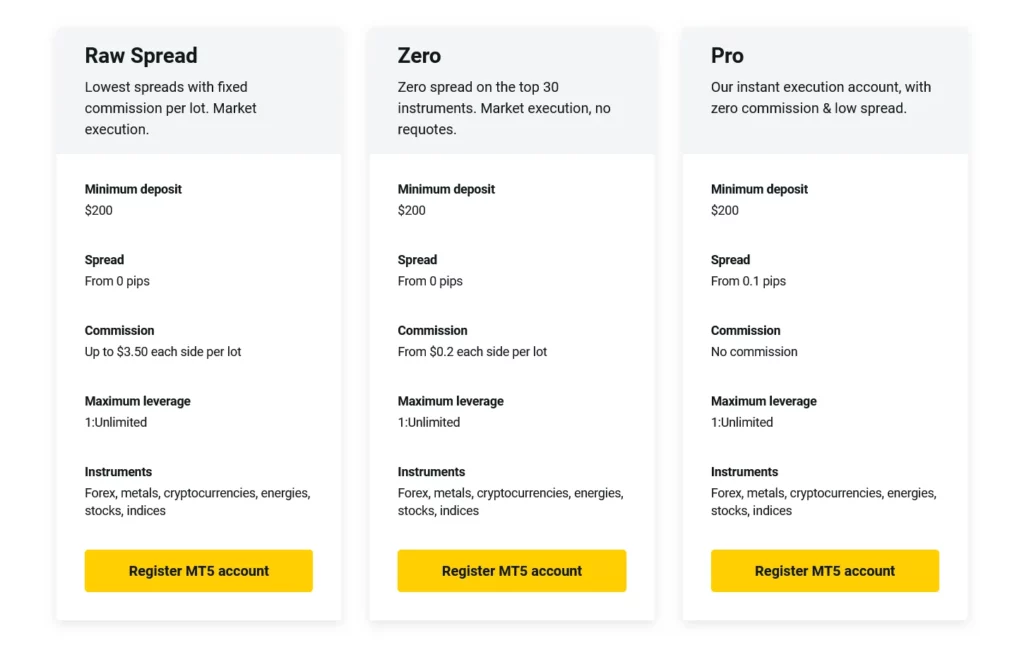

Yes, Exness allows easy switching between account types through your personal area on their website, so you can start with a Standard account (micro) and later upgrade to a Zero or Raw Spread account as your trading volume increases, without needing to create an entirely new account.

Is the Micro Account suitable for scalping and high-frequency trading?

While Exness's Standard account technically allows scalping and high-frequency trading strategies, I've found that the variable spreads can make these approaches less profitable than on their Zero or Raw Spread accounts, though for beginners learning these strategies, the micro lot sizing still makes this account type a reasonable choice.