5 minute read

Does Exness Offer the Volatility 75 Index?

Looking for information about trading the Volatility 75 Index on Exness? I've been trading for over a decade and can tell you exactly what's available. Exness has built a solid reputation as a forex and CFD broker, but when it comes to synthetic indices like the VIX 75, things aren't as straightforward as you might hope. Let's break down what you need to know about Exness and the Volatility 75 Index.

After reviewing Exness's current offerings, I'll explain what alternatives they provide for traders seeking similar high-volatility opportunities. I'll also share some practical strategies for trading volatile markets using the instruments that are actually available on their platform.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

What Is the Volatility 75 Index?

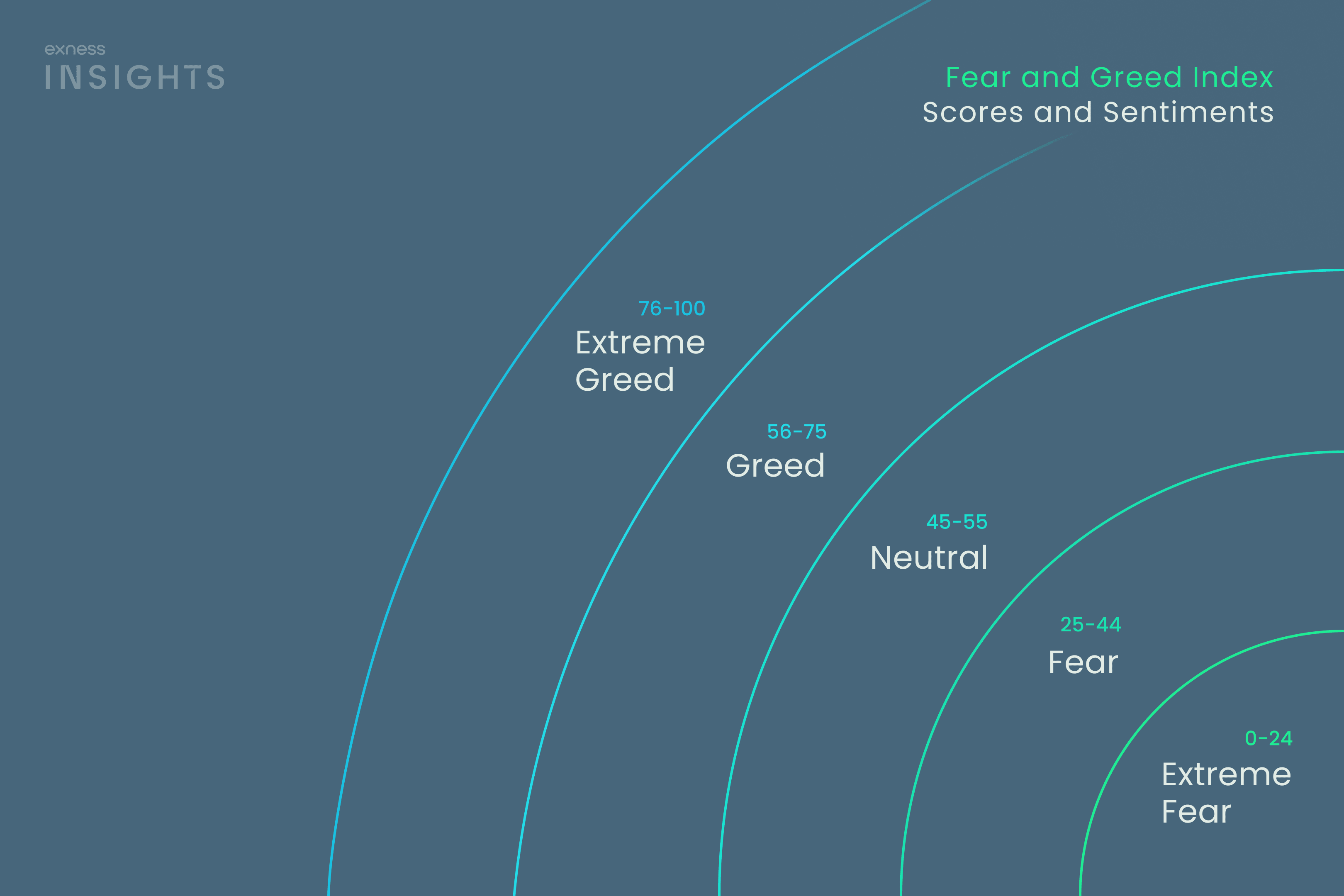

The Volatility 75 Index (also known as VIX 75 or simply V75) is a synthetic index that simulates market volatility. Unlike traditional indices that track actual stocks or commodities, the V75 is specifically designed to mimic extreme price fluctuations. It's based on a volatility algorithm that creates rapid price movements, making it particularly attractive to day traders and scalpers looking for quick opportunities.

What makes the V75 stand out is its exceptional volatility – price can swing dramatically within minutes or even seconds. This creates numerous entry and exit points throughout the trading day. The index is calculated using a complex formula that incorporates market volatility expectations, which is why it's sometimes called the "fear index." Traders are drawn to it because of the potential for substantial profits in short timeframes, though this comes with proportionally higher risk. The V75 typically follows technical patterns more reliably than many traditional markets, making it popular among traders who rely heavily on technical analysis.

Does Exness Provide Access to the Volatility 75 Index?

No, Exness does not currently offer the Volatility 75 Index on its platform. I've checked their complete instrument lineup, and the V75 isn't available among their trading instruments. This might disappoint traders specifically looking for this synthetic index, but it's important to understand that brokers select their instrument offerings based on regulatory requirements and their target market focus.

Exness has primarily positioned itself as a forex and CFD broker specializing in currency pairs, commodities, stocks, and cryptocurrency trading. Their business model focuses on these more traditional markets rather than synthetic indices. From my experience dealing with various brokers, I've noticed that synthetic indices like the V75 are more commonly found on platforms that specifically cater to high-volatility traders. If you're dead set on trading the Volatility 75 Index, you'll need to look at alternative brokers that specialize in synthetic indices. However, before jumping ship, it's worth exploring the volatility-focused alternatives that Exness does provide.

Alternative Trading Instruments at Exness

While Exness doesn't offer the V75 specifically, they provide several alternatives that can satisfy traders seeking volatile instruments:

Major currency pairs during high-impact news events (EUR/USD, GBP/USD)

Exotic currency pairs with naturally higher volatility (USD/TRY, USD/ZAR)

Cryptocurrency CFDs including Bitcoin, Ethereum, and altcoins

Gold and oil during periods of market uncertainty

Stock CFDs during earnings seasons

Index CFDs like US30, US100, and US500 during volatile market periods

These alternatives might not match the exact characteristics of the V75, but they can provide similar trading opportunities when approached with the right strategy. I've personally found that trading crypto CFDs on Exness can deliver comparable volatility to synthetic indices, especially during market-moving news or adoption events. The key advantage here is that these instruments track real-market assets, making price movements somewhat more predictable than purely synthetic calculations.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

How to Trade Volatile Markets with Exness

Choose the Right Instruments – Focus on forex majors, indices, commodities, and cryptocurrencies.

Use a Suitable Strategy – Apply scalping, day trading, or swing trading based on market conditions.

Manage Risk Effectively – Set stop-loss and take-profit levels, avoid over-leveraging.

Monitor Market News – Stay updated on economic events and geopolitical factors.

Utilize Trading Tools – Use indicators like Bollinger Bands, ATR, and moving averages.

Optimize Leverage – Adjust leverage settings to control risk in high volatility.

Practice with a Demo Account – Test strategies risk-free on Exness platforms.

Stay Disciplined – Stick to your trading plan and avoid emotional decisions.

Following these steps can help traders navigate volatile markets successfully with Exness.

Frequently Asked Questions (FAQs)

Does Exness offer the Volatility 75 Index?

No, Exness doesn't currently offer the Volatility 75 Index among its tradable instruments. The broker focuses primarily on forex pairs, commodities, cryptocurrencies, stocks, and traditional indices rather than synthetic volatility indices like the V75.

What are the best alternatives to the VIX 75 on Exness?

The best alternatives to the VIX 75 on Exness include cryptocurrency CFDs (especially during active market periods), exotic forex pairs like USD/TRY, and gold during times of market uncertainty – these instruments often display high volatility patterns that can be suitable for traders seeking rapid price movements similar to those found in the V75.

Can I trade other volatility indices on Exness?

Currently, Exness doesn't offer dedicated volatility indices in its instrument lineup; however, you can track market volatility through VIX-related CFDs that are occasionally available depending on your region and account type – check the current instrument specifications in your trading platform for the most up-to-date offerings.

What is the leverage for volatility-related instruments?

Exness offers varying leverage for volatile instruments: up to 1:2000 for major forex pairs (though I recommend using much less), 1:20 for cryptocurrencies, and between 1:10 and 1:50 for commodity CFDs including gold and oil – always remember that higher leverage amplifies both profits and losses, so adjust according to the instrument's volatility.