11 minute read

What Is Exness Trading and How Does It Work?

Exness is an online broker that connects regular traders like you and me to the global financial markets. I've been trading with them for over five years now, and what stands out is their straightforward platform and competitive trading conditions. They offer access to forex, commodities, indices, and cryptocurrencies, all through their MetaTrader platforms.

The way it works is pretty simple - you deposit funds, analyze the markets using their tools, then open positions based on where you think prices are heading. Their unlimited leverage on some account types is a double-edged sword - great for experienced traders but risky for beginners.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

How Does Trading Work on Exness?

Trading on Exness works similarly to other online brokers, but with some key differences I've noticed over years of using their platform. At its core, you're speculating on price movements of various financial instruments without actually owning the underlying assets. When you open an Exness account and make a deposit, you gain access to their trading platforms - mainly MetaTrader 4 and MetaTrader 5.

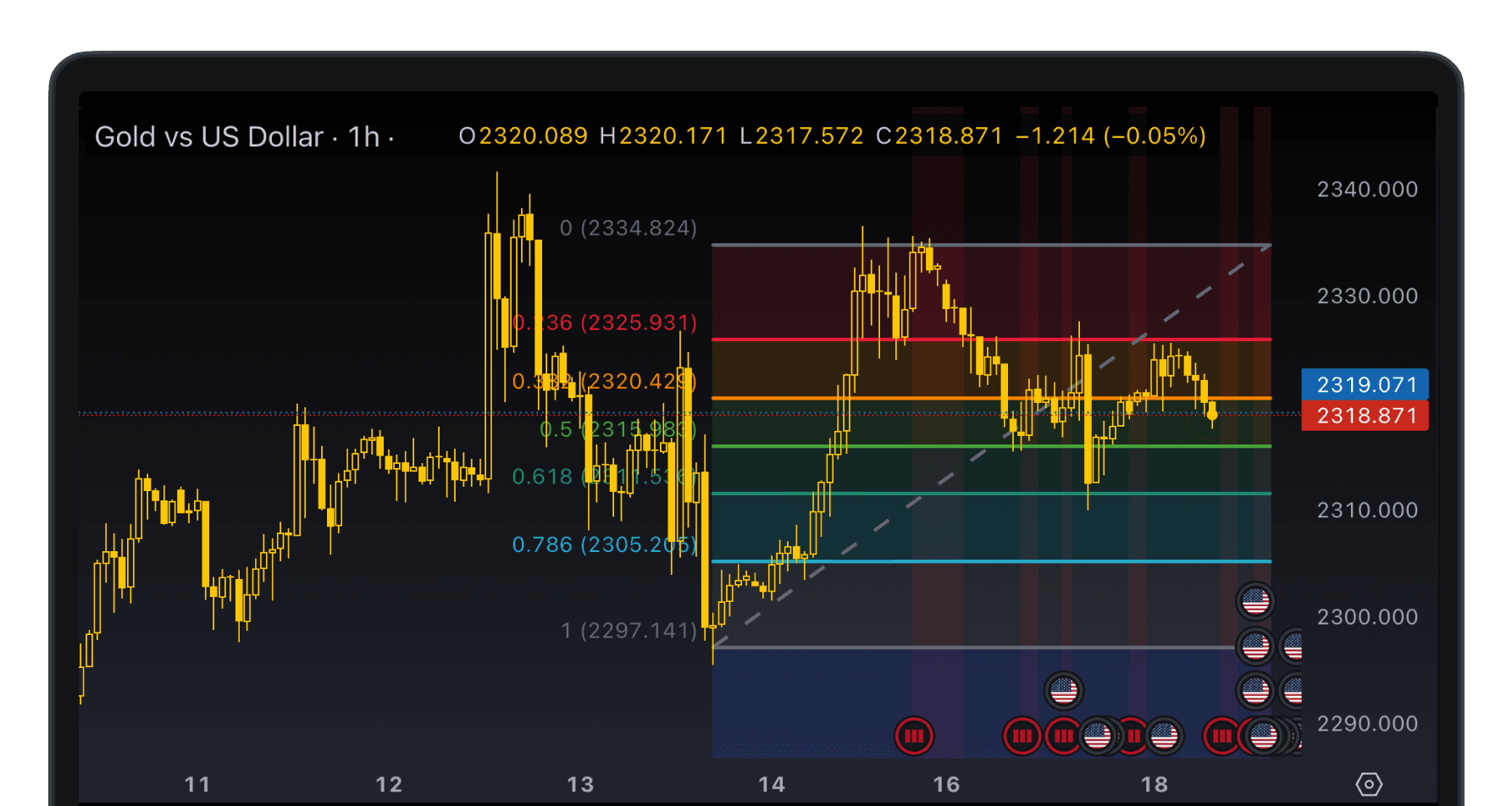

The actual trading process is straightforward. You select the instrument you want to trade, analyze price charts using technical indicators, and decide whether to go long (buy) if you think the price will rise or go short (sell) if you expect it to fall. What I particularly appreciate about Exness is their execution speed - I rarely experience slippage even during volatile market conditions. They operate on a market execution model for most account types, meaning your orders are filled at the best available price at that moment. For professional traders, they offer instant execution on specific accounts, allowing you to lock in exact prices. The platform calculates your profits and losses in real-time, and you can close positions manually or set take-profit and stop-loss orders to automate exits. One thing to note - Exness uses a floating spread model on most accounts, so your trading costs will vary depending on market conditions.

Exness Account Types and Their Features

After testing various Exness accounts over the years, I've found they offer something for every type of trader. Their account structure is designed to accommodate different trading styles, capital levels, and experience.

The Standard Account is where most beginners should start - it has no commission, offers floating spreads (typically starting around 0.3 pips for major pairs), and requires just $1 to open. I used this when I first started out, and it's perfect for learning the ropes. For more active traders, the Zero Account might be better - it features raw spreads starting from 0 pips but charges a $3.5 commission per lot. This becomes more cost-effective once you're trading larger volumes. Pro accounts are geared toward experienced traders who need faster execution and tighter spreads, while the Raw Spread account offers institutional-grade pricing with commission-based trading. What truly sets Exness apart from competitors is their unlimited leverage option on certain accounts - though I'd strongly caution beginners against using high leverage. Each account type also varies in terms of available instruments, maximum lot sizes, and swap-free options. Most importantly, all accounts offer negative balance protection, which means you can't lose more than you deposit - a feature that saved me during a particularly volatile market event last year.

Financial Instruments Available for Trading on Exness

Exness offers a diverse range of trading instruments that I've explored extensively over my trading career. Their selection is comprehensive enough for most traders without being overwhelming.

Forex pairs form the backbone of their offerings, with over 60 currency pairs available. These range from major pairs like EUR/USD and GBP/USD to exotic pairs involving currencies from emerging markets. The spreads on major pairs are particularly competitive - I regularly see EUR/USD at just 0.3 pips during normal market hours. Beyond forex, they provide access to metals trading (spot gold and silver), which has become my go-to during periods of economic uncertainty. Their energy markets section covers crude oil and natural gas futures, while their indices selection includes major global stock indices like the S&P 500, NASDAQ, and DAX. Recently, they've expanded their cryptocurrency CFD offerings to include not just Bitcoin and Ethereum, but also newer altcoins. One limitation I've noticed is their relatively small selection of individual stocks compared to some competitors - they focus mainly on blue-chip companies rather than offering extensive stock options. Each instrument comes with different trading conditions, including varying leverage limits, spreads, and swaps. I particularly appreciate how Exness clearly displays all these specifications directly in the platform, making it easy to compare trading costs across different markets without having to dig through websites or documents.

How to Get Started with Exness Trading

Getting started with Exness is straightforward, and I remember the process being smoother than with other brokers I've tried. Here's the step-by-step process based on my experience:

Registration and Account Creation - Visit the Exness website and click "Open Account." You'll need to provide basic information like your email, name, and phone number. The initial signup takes about 5 minutes.

Identity Verification (KYC) - Upload your identification documents (passport or ID card) and proof of address (utility bill or bank statement less than 3 months old). Verification usually takes 1-2 business days, though mine was approved within hours.

Choose Your Account Type - Select from Standard, Zero, Pro, or Raw Spread accounts based on your trading style and capital. I started with Standard before eventually moving to Zero for better pricing on larger trades.

Download and Install the Platform - Install MetaTrader 4 or 5 from Exness's website or your app store. The desktop versions offer more features than mobile apps.

Make Your First Deposit - Fund your account using one of their many payment methods. I typically use bank cards for instant deposits, but they also offer e-wallets, bank transfers, and local payment methods depending on your region.

Set Up Risk Management Rules - Before placing your first trade, determine your risk parameters. I never risk more than 2% of my capital on a single trade, which has kept me in the game during rough patches.

Begin with Demo Trading - I strongly recommend practicing on a demo account first, especially if you're new to trading. I spent two months on demo before switching to real money.

Place Your First Trade - Start with smaller position sizes on familiar instruments. My first trades were on EUR/USD with just 0.01 lots until I gained confidence.

This process should take you from complete beginner to placing your first trades within a week, assuming verification goes smoothly. One tip from my experience: bookmark Exness's educational resources page for quick reference during your early trading days.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Exness Trading Conditions and Fees

After years of trading with different brokers, I find Exness's fee structure to be quite transparent, though it varies significantly across account types. Understanding these conditions is crucial for long-term profitability.

Exness trading costs come from spreads, commissions, and swaps. Standard accounts have no commission but wider spreads (EUR/USD 0.9-1.2 pips), while Zero accounts offer 0.1-0.3 pips with a $3.5 per lot commission—a better deal for high-volume traders. Swap fees apply to overnight positions, with triple swaps on Wednesdays, which can significantly impact long-term trades.

Deposits & withdrawals are mostly fee-free, though payment providers may charge. E-wallets and bank cards process instantly without Exness fees. Unlike some brokers, Exness has no inactivity fees. The minimum deposit is $1, but at least $100 is recommended for effective trading. Leverage goes up to 1:Unlimited, depending on regulations, though I prefer to keep it under 1:20 for risk management.

Risk Management and Trading Tools on Exness

Risk management is what separates successful traders from the rest, and Exness provides several tools that have helped me maintain a sustainable trading approach. Here's what I find most valuable:

Stop Loss and Take Profit Orders - The most basic but essential tools. I always set these before entering a trade, typically placing stop losses at logical market levels rather than arbitrary percentages.

Trailing Stops - These automatically adjust your stop loss as the market moves in your favor. I use these primarily for trend-following strategies to lock in profits while giving trades room to run.

Leverage Control - Despite offering high leverage, Exness lets you set your own leverage limits. I keep mine at 1:20 maximum, even though higher options are available.

Negative Balance Protection - This prevented a catastrophic loss during the Swiss Franc event years ago. Your account can't go negative regardless of market gaps or volatility.

Calculator Tools - The built-in calculators help determine position sizes based on your risk percentage. I aim for 1-2% risk per trade, and these tools make the math simple.

Customizable Charts and Indicators - MetaTrader platforms offer extensive technical analysis capabilities. I rely on a combination of moving averages, RSI, and support/resistance levels.

Economic Calendar - Integrated into the Exness website, this helps me avoid trading during high-impact news events unless that's specifically my strategy.

One-Click Trading - For faster execution when opportunities arise, though I use this cautiously to avoid impulse trades.

The platform also offers real-time market depth information, which I find invaluable for gauging potential slippage before entering large positions. Beyond the tools themselves, Exness provides reasonable margin call policies - they'll notify you when your margin level drops below 100% and only liquidate positions at 50%, giving you time to manage your risk manually. This saved my account during a volatile trading session last quarter when I might otherwise have been automatically liquidated.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Exness Customer Support and Educational Resources

Customer support can make or break your trading experience, especially during critical moments. In my five years with Exness, I've found their support to be responsive and knowledgeable, though with some room for improvement.

Exness offers 24/7 live chat, with responses usually within 2-3 minutes, even on weekends. Simple queries are handled quickly, while technical issues may take longer as they get escalated to specialists. Phone support is available in multiple languages, and email responses typically arrive within 24 hours. Their educational content is a standout feature, covering everything from basics to advanced strategies. Webinars feature experienced traders, providing practical insights, while their market analysis includes daily updates with both fundamental and technical perspectives.

For beginners, the unlimited demo account allows risk-free practice, and even experienced traders can use it to test strategies. One drawback is the lack of a trader community platform for idea sharing. However, their resources focus on real education rather than just driving more trading, which I appreciate.

FAQs About Trading with Exness

Is Exness a regulated and trustworthy broker?

Yes, Exness is regulated by multiple authorities, including the FSA (Seychelles), FSCA (South Africa), and CySEC (Cyprus). It has been operating since 2008 and provides transparent trading volume reports. Client funds are segregated in tier-1 banks, and withdrawals are processed quickly, often within the same day for electronic methods. However, regulations vary by region, so check which entity serves your country.

How much do I need to start trading with Exness?

The minimum deposit for Standard accounts is $1, but for practical trading, a $100-$200 deposit is recommended to manage risk effectively. Zero accounts require a minimum $200 deposit, as they offer raw spreads with commissions. The minimum trade size across all accounts is 0.01 lots (1,000 units of the base currency).

What are the trading hours on Exness?

Forex trading on Exness is available 24/5, from Monday 00:00 to Friday 23:59 (GMT+2 standard time, GMT+3 daylight saving time). Liquidity is highest during the London-New York overlap (13:00-17:00 GMT). Cryptocurrencies trade 24/7, while stocks and indices follow their respective exchange hours. The platform clearly displays market status for all instruments.

Can I trade on Exness using my mobile phone?

Yes, Exness offers MetaTrader 4 & 5 mobile apps for iOS and Android, allowing users to place trades, manage positions, and conduct technical analysis. While mobile trading is efficient, some advanced indicators and custom scripts available on desktop are missing. Exness also has a web trader for mobile browsers, with security features like biometric login and session timeouts.

What leverage does Exness provide?

Exness offers leverage from 1:1 up to 1:Unlimited, depending on account type and region. Standard accounts can access 1:Unlimited, while professional accounts go up to 1:2000. In regulated regions like Europe, limits apply: 1:30 for major forex pairs, 1:20 for minors, 1:5 for stocks, and 1:2 for crypto. Traders can adjust leverage in their Personal Area, and beginners should start with lower leverage (1:10 or less) to manage risk effectively.