8 minute read

Exness Founded in Which Year? Broker Review

Looking for a reliable broker with a solid track record? Exness has been around longer than many traders realize. As someone who's watched this broker evolve over the years, I can tell you that understanding when and how Exness started gives you valuable insight into why it's become such a powerhouse in the trading world today.

Before you fund an account with any broker, it's crucial to know their history and reputation. This deep dive into Exness's founding year, growth trajectory, and current standing will help you make an informed decision about whether this platform aligns with your trading needs.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Introduction to Exness and Its History

Exness emerged during a transformative period in online trading. The 2008 financial crisis had just rocked markets worldwide, creating both challenges and opportunities for new financial service providers. This timing proved crucial for Exness, as traders were actively seeking more transparent and reliable alternatives to traditional brokers.

The company began with a clear focus on providing a better trading experience than what was available at the time. Early on, Exness differentiated itself by offering unlimited leverage and instant withdrawals—features that were practically unheard of back then. While the industry landscape has changed significantly since those early days, that initial commitment to addressing trader pain points has remained consistent throughout the company's evolution.

When Was Exness Founded?

Exness was founded in 2008, making it one of the more established online brokers in the retail trading space. The company launched its operations during a particularly turbulent time in financial markets, with the global financial crisis in full swing. This timing actually worked in their favor, as many traders were looking for alternatives to traditional financial institutions that had lost credibility during the crisis.

The initial team was small but ambitious, starting operations from scratch with a vision to create a more transparent trading environment. The founding year of 2008 puts Exness ahead of many competitors in terms of experience—they've weathered multiple market cycles and regulatory changes over their 17-year history. This longevity is significant in an industry where many brokers come and go within just a few years.

The Growth and Evolution of Exness

Exness didn't become a major player overnight. The broker's growth trajectory shows a steady expansion from a small startup to a global trading provider. Around 2011-2013, Exness began gaining serious traction, expanding beyond its initial markets and increasing its trading volume significantly year over year.

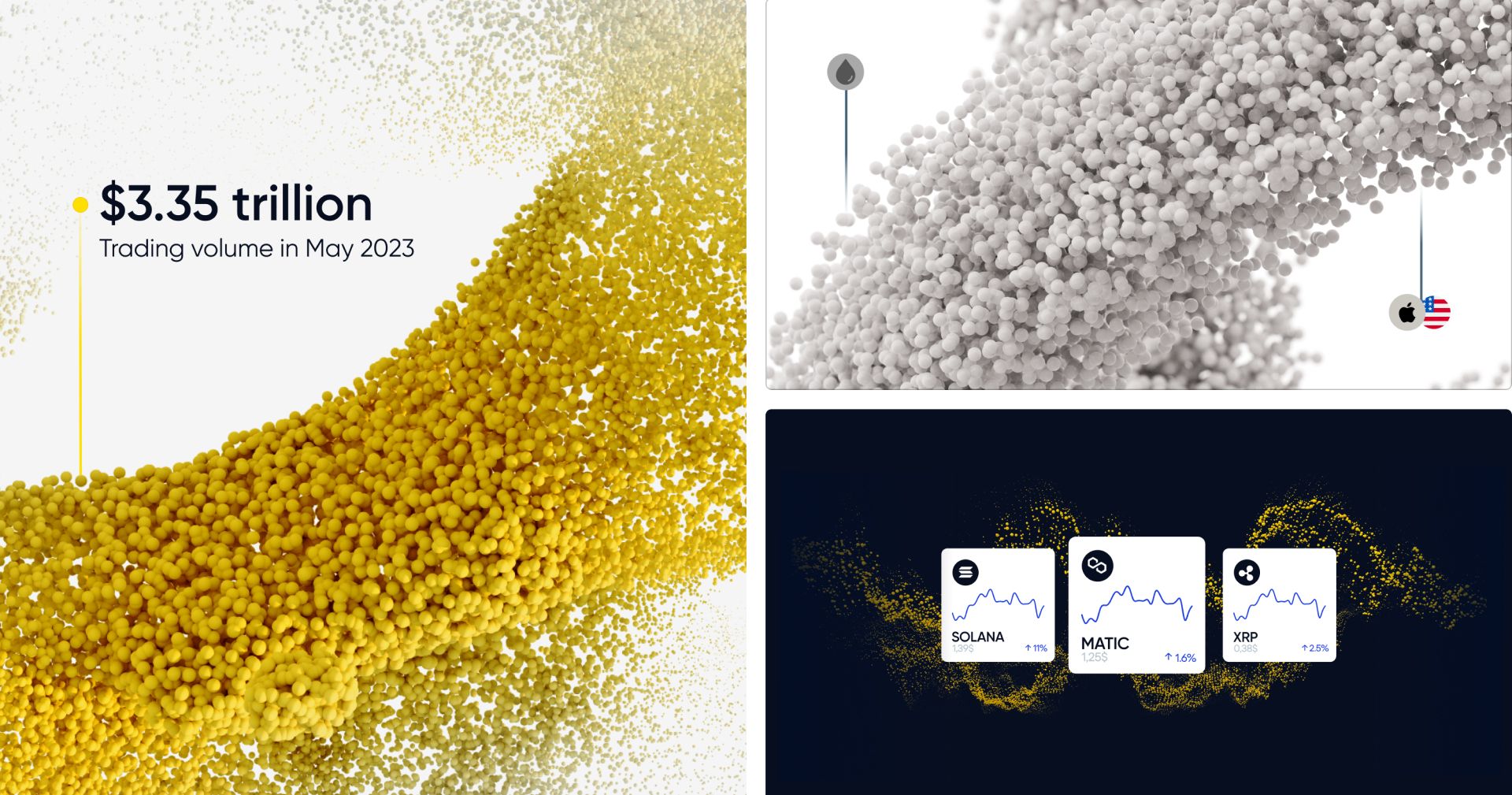

By 2014, Exness was processing over $1 trillion in yearly trading volume—a milestone that demonstrated its rising prominence. The broker continued this expansion by securing key regulatory licenses in various jurisdictions, each opening doors to new markets. What's particularly noteworthy about Exness's growth is how they've managed scale while maintaining core services like fast withdrawals. Many brokers sacrifice service quality as they grow, but Exness has largely avoided this trap by continuously investing in their technological infrastructure. Recent years have seen particularly aggressive expansion into emerging markets in Asia, Latin America, and Africa.

Exness' Mission and Vision Since Its Founding

Since day one, Exness has maintained a consistent core mission: to provide traders with transparent access to financial markets. Their founding vision emphasized removing traditional barriers that retail traders faced, such as slow withdrawal processes and opaque fee structures. This trader-first philosophy has guided their product development and expansion strategies throughout their history.

Over time, their mission has evolved to embrace technological innovation more explicitly. Early on, they focused primarily on solving basic problems like execution speed and withdrawal times. As they matured, their vision expanded to leverage advanced technologies like AI for risk management and automation to improve trader experiences. Despite these evolutions, the fundamental promise of transparency remains at the heart of their business philosophy. Company leadership has consistently reinforced this commitment in public statements and business decisions, even as they've grown from a small startup to a broker handling trillions in trading volume.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

The Exness Brand Today

Today, Exness has transformed from an upstart broker to a global trading powerhouse. Monthly trading volumes regularly exceed $4 trillion—numbers that place them among the largest retail brokers worldwide. The company employs over 1,500 people across multiple international offices, serving clients from more than 150 countries. Their platform offerings have expanded dramatically from the basic MetaTrader terminals they started with.

The modern Exness brand emphasizes technological sophistication and financial strength. They've worked hard to position themselves as more than just another forex broker, highlighting their advanced trading infrastructure and institutional-grade liquidity relationships. Their marketing efforts now extend to high-profile sponsorships, including partnerships with major football clubs like Real Madrid and Barcelona FC. These sponsorships reflect both their marketing ambitions and financial capabilities—they're a far cry from the modest operation that launched back in 2008.

Exness Regulation and Security Measures

Regulation has been a cornerstone of Exness's development strategy. Currently, Exness operates under multiple regulatory licenses, including oversight from the Financial Sector Conduct Authority (FSCA) in South Africa, the Financial Services Authority (FSA) of Seychelles, and the Cyprus Securities and Exchange Commission (CySEC). These licenses require the broker to maintain strict operational standards and client fund protections.

Beyond basic regulatory compliance, Exness implements several security measures that exceed minimum requirements. Client funds are held in segregated accounts with major banks, providing an additional layer of protection beyond what many competitors offer. Their risk management systems include real-time monitoring tools that help detect unusual trading patterns or potential security breaches. For individual traders, they provide advanced verification procedures and two-factor authentication options to secure account access. These security measures have evolved significantly since their founding, reflecting both changing regulatory requirements and emerging cybersecurity threats in the financial industry.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Why Exness Continues to Attract Traders

Exness's staying power comes down to a few key factors that consistently attract and retain traders. First, their execution speed and reliability sets a high standard in the industry. When market volatility spikes, many brokers struggle with execution quality, but Exness has invested heavily in infrastructure that maintains performance even during challenging conditions. This reliability matters enormously to active traders.

Another major draw is their withdrawal system. While many brokers take days or even weeks to process withdrawals, Exness offers instant withdrawals to many payment methods—often processing requests within minutes. This focus on capital accessibility creates genuine trust with traders who've experienced the frustration of delayed withdrawals elsewhere. Additionally, their competitive trading conditions, including tight spreads and minimal commission structures, make them economically attractive for both new and experienced traders. These practical advantages explain why they've continued to grow their client base year after year despite intense competition in the online trading space.

Conclusion: Exness' Journey from Foundation to Global Success

Exness's evolution from a small broker founded in 2008 to a global trading giant represents one of the more successful growth stories in retail trading. Their journey hasn't been without challenges—they've navigated regulatory changes, market crashes, and intense competition. Throughout these challenges, they've maintained their core focus on serving trader needs rather than chasing short-term profits.

For traders considering Exness as a potential broker, their longevity provides valuable reassurance. The broker has demonstrated staying power through multiple market cycles and continues to invest in improving their services. While past performance doesn't guarantee future results, Exness's trajectory since their founding year suggests a company built on sustainable business practices rather than flashy marketing promises. As they continue expanding their global footprint, their founding principles of transparency and trader focus remain apparent in their operations today.

Frequently Asked Questions (FAQ)

When was Exness founded?

Exness was founded in 2008, during the global financial crisis, and has since become a leading online broker with 17 years of experience.

Who are the founders of Exness?

Exness was co-founded by Igor Lychagov and Petr Valov, who combined expertise in technology and finance to shape the company's vision for transparent online trading.

How has Exness grown since it was founded?

Exness has grown from a small team to a global operation with over 1,500 employees, expanding its offerings from forex to metals, stocks, and cryptocurrencies, with monthly trading volumes exceeding $4 trillion.

Where is Exness headquartered?

Exness's main office is in Limassol, Cyprus, with additional offices in Seychelles, South Africa, and other regions, supporting their global operations and regulatory requirements.

Is Exness regulated by financial authorities?

Yes, Exness is regulated by multiple authorities, including CySEC, FSCA, and FSA, ensuring strict compliance with financial guidelines and protecting traders' interests globally.