11 minute read

Best App for Trading Stocks, Forex, and More

Looking for a reliable trading app that won't let you down when markets are moving fast? After testing dozens of platforms over my 15-year trading career, I can confidently say Exness stands out from the crowd. Their apps combine professional-grade tools with user-friendly interfaces, making them suitable for both newbies and veterans like myself. Let's dive into what makes Exness my go-to trading solution.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

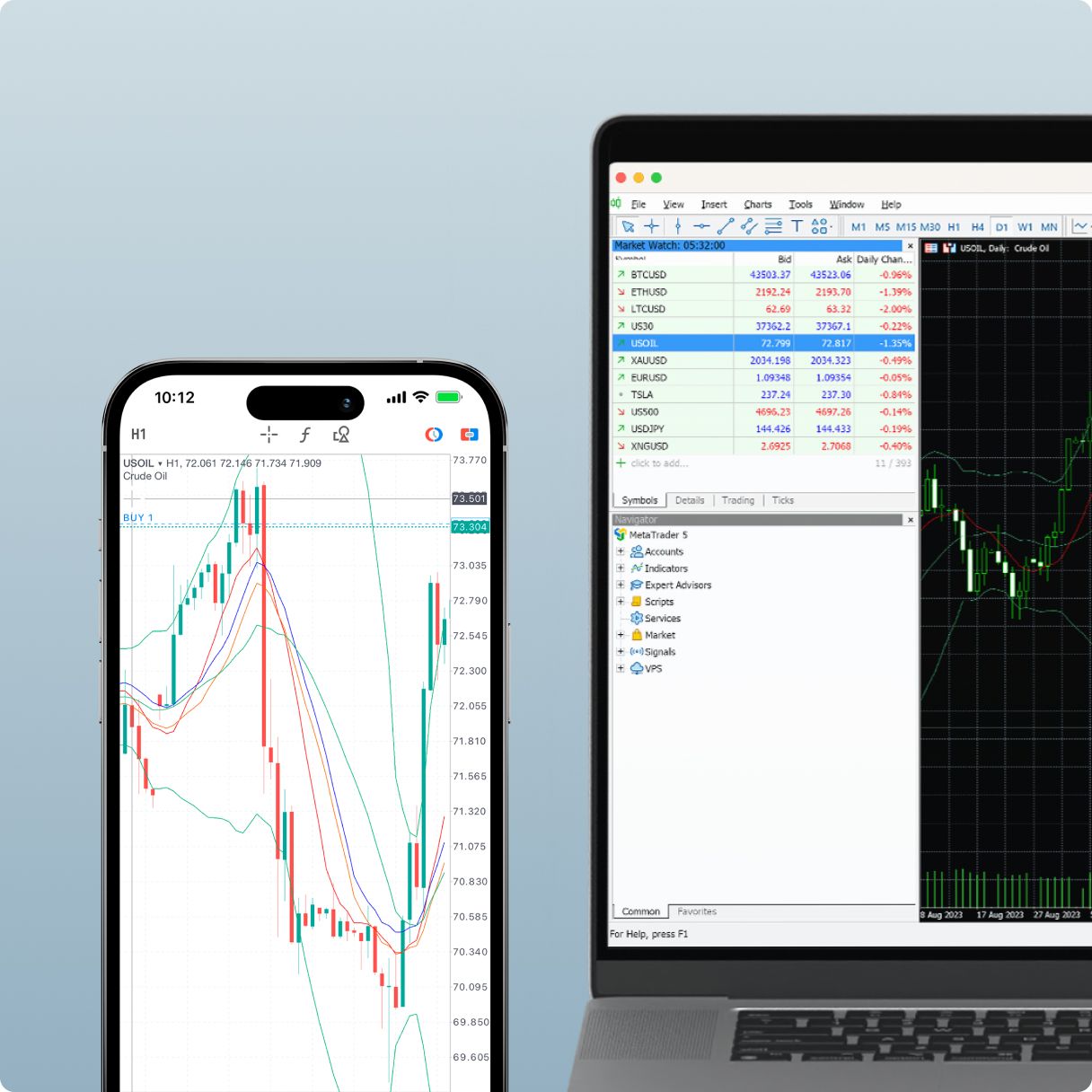

Exness Trader App: The Best Mobile Trading Solution

I remember the days of being chained to my desktop to place trades. Not anymore. The Exness Trader app has completely transformed how I approach the markets. Based on the powerful MetaTrader platform, this app gives you professional-level trading capabilities right in your pocket.

What impresses me most is how they've managed to pack so much functionality into a mobile interface without making it feel cluttered. The app runs smoothly even during volatile market conditions when every second counts. I've used it to execute critical trades while waiting for coffee, sitting on trains, and even during my kid's soccer games (don't tell my wife).

Unlike other trading apps that feel like watered-down versions of their desktop counterparts, Exness Trader delivers the full trading experience. The learning curve is surprisingly gentle, too. Within a day of downloading it, I was navigating between charts, placing orders, and managing positions as efficiently as on my main trading station.

Key Features of Exness Trader App

Fast and Secure Trading Execution

Speed matters in trading. Period. The Exness Trader app delivers some of the fastest execution speeds I've experienced on mobile. My market orders typically execute in under 0.1 seconds. This might not sound like much, but when you're trying to catch a breakout or exit a failing position, those milliseconds make all the difference.

The app uses advanced encryption protocols to keep your account secure. I appreciate that they've implemented biometric login options - my trades and account balance stay protected even if someone gets hold of my phone.

What really sets them apart is server reliability. In five years of using Exness, I've experienced minimal downtime compared to other brokers. When major news hits and markets go crazy, their servers stay rock solid while competitors' platforms often freeze or lag.

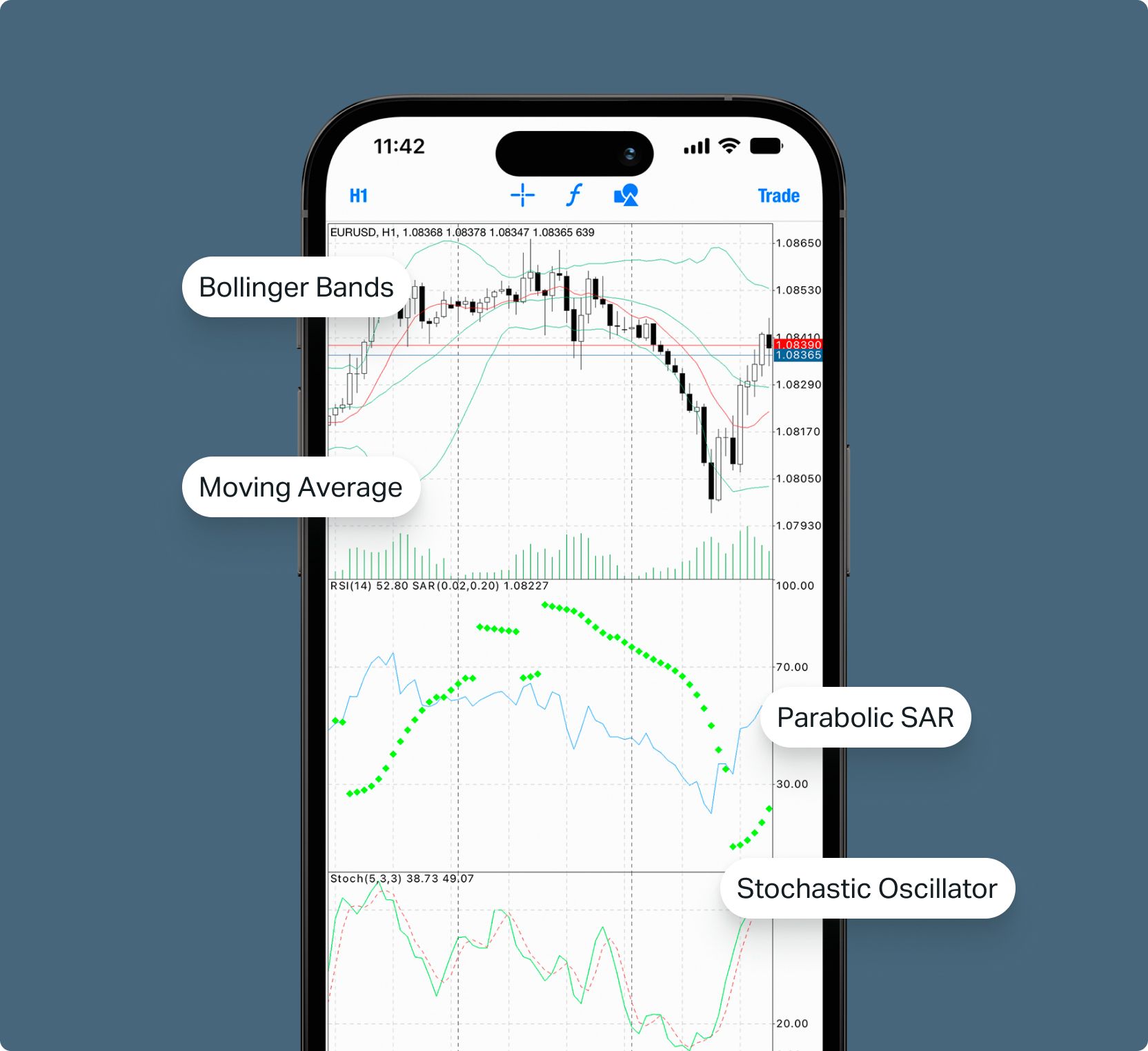

Advanced Charting and Analysis Tools

Chart analysis is my bread and butter, and Exness doesn't disappoint. The app includes over 50 technical indicators and drawing tools that work smoothly on touchscreens. You get multiple timeframes from 1-minute to monthly charts, perfect for both scalpers and position traders.

I particularly like the customizable templates feature. I've set up different chart layouts for various trading strategies - one for trend following, another for breakout trades, and a third for options analysis. Switching between them takes just two taps.

The price alert function has saved me countless times. Last month, while grocery shopping, I got an alert that EUR/USD had hit my target level. I placed my trade right there in the cereal aisle and caught a nice 80-pip move.

Multi-Asset Trading on One Platform

Why juggle multiple apps when one can do it all? With Exness Trader, I can switch between forex pairs, commodities, cryptocurrencies, indices, and stocks without changing platforms. This versatility has expanded my trading opportunities significantly.

During the recent tech sector correction, I was able to quickly shift capital from my forex positions to short some overvalued tech stocks, all within the same interface. The ability to diversify across different asset classes has improved my overall risk management and helped smooth out my returns.

The search function makes finding specific instruments a breeze. Just type in a ticker symbol or company name, and it instantly pulls up the asset with current bid/ask prices and daily range information.

Automated Trading and Expert Advisors (EAs)

For those nights when markets move while you sleep, automated trading is a game-changer. Exness fully supports Expert Advisors (EAs) in their mobile app - something many competitors still don't offer.

I run a simple breakout strategy EA during Asian sessions that would otherwise require me to be awake at 3 AM. The implementation is seamless - once you've uploaded your EA to the platform, it runs just as efficiently on mobile as on desktop.

The backtesting feature lets you verify your EA's performance before risking real money. I've tested dozens of strategies this way, saving myself from potentially costly mistakes. Just remember that past performance doesn't guarantee future results - a lesson I've learned the hard way.

Risk Management Tools

Protecting capital is job number one for any serious trader. Exness provides robust risk management tools that I use religiously. Stop-loss and take-profit orders work flawlessly, even during high volatility.

The trailing stop feature is particularly useful for letting winners run while protecting profits. Last quarter, I caught a major gold rally using a trailing stop that locked in profits as the price climbed, eventually securing a 287-pip gain without me having to manually adjust my exit point.

I also appreciate the margin calculator that helps prevent overexposure. Before entering positions, I can quickly check how much margin will be used and adjust my position size accordingly. This feature has kept me from blowing up my account during periods of overconfidence.

Exness Markets App: A Dedicated Stock and Index Trading Solution

While the Trader app handles everything well, Exness also offers a specialized Markets app focused on stocks and indices. This reflects a deep understanding that different assets sometimes need different trading approaches.

The Markets app provides detailed company fundamentals, earnings reports, and news feeds right alongside price charts - essential info for making informed stock trades. The interface prioritizes visual data presentation with clean, easy-to-read charts optimized for equity analysis.

What I find particularly valuable is their economic calendar integration. Before trading major stocks, I can check upcoming earnings announcements or economic data releases that might impact price. This has saved me from entering positions right before major volatility events several times.

The stock screener function helps identify potential opportunities based on technical or fundamental criteria. Last month, I used it to find oversold dividend stocks with positive earnings growth, leading to three solid positions that are currently up 8-12%.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Seamless Deposits and Instant Withdrawals

Nothing frustrates traders more than funding delays. Exness has nailed this aspect of the trading experience with multiple deposit options including credit cards, e-wallets, and bank transfers. Funds usually hit my account within minutes regardless of which method I choose.

Even more impressive are their withdrawals. Most brokers make you wait days or even weeks, but Exness processes most withdrawal requests instantly. Last Thursday, I withdrew profits at 2 PM and they were in my bank account by 2:05 PM. This kind of liquidity access gives tremendous peace of mind.

They've eliminated minimum deposit requirements on standard accounts, making it accessible to beginners. The transparent fee structure means no nasty surprises – what you see is what you get. No hidden commissions eating into your profits.

Regulation and Security: Trading with Confidence

In an industry with its fair share of shady operators, Exness stands out for its regulatory compliance. They're regulated by multiple tier-1 authorities including the Financial Sector Conduct Authority (FSCA) and the Financial Services Authority (FSA).

Client funds are held in segregated accounts, meaning your money isn't mixed with company operational funds. This practice provides crucial protection if something were to go wrong with the broker.

Their risk disclosure is straightforward and honest - they don't make unrealistic promises about guaranteed profits. As someone who's seen plenty of brokers come and go over the years, these signs of legitimacy matter tremendously.

The platform employs SSL encryption for all transactions and communications. In my years using Exness, I've never experienced any security breaches or unauthorized access attempts. Their two-factor authentication feature adds another welcome layer of protection.

How to Get Started with Exness Trader App

Getting up and running with Exness is surprisingly simple. Download the app from the App Store or Google Play, and the registration process takes about 5 minutes. You'll need to verify your identity with standard KYC documents – a passport or driver's license plus a recent utility bill usually does the trick.

The demo account option is perfect for test-driving the platform without risking capital. I spent two weeks on demo before switching to a real account, which helped me learn the interface quirks and develop confidence in my execution process.

Funding your account is straightforward with multiple payment options. Start small – I began with just $500 to get comfortable with the platform before increasing my trading capital.

The built-in educational resources are worth exploring, especially if you're new to certain markets. Their video tutorials on chart pattern recognition significantly improved my technical analysis skills when I was branching out from forex into commodities.

Conclusion

After years of using various trading platforms, I've found Exness apps to offer the best balance of functionality, reliability, and user experience. Whether you're primarily a forex trader, stock investor, or commodity speculator, their ecosystem provides the tools needed to analyze markets and execute trades effectively.

What ultimately separates great trading apps from good ones is how they perform when it really matters – during high volatility and major market moves. Exness has consistently delivered rock-solid performance when I needed it most. Their combination of fast execution, comprehensive analysis tools, and robust security creates a trading environment where I can focus on strategy instead of worrying about platform limitations.

Is it perfect? No platform is. The learning curve might be slightly steeper than some ultra-simplified apps, but that's the tradeoff for having professional-grade tools at your fingertips. For serious traders looking for a complete mobile trading solution, Exness should be at the top of your list.

Frequently Asked Questions (FAQ)

Can I trade stocks using the Exness Trader App?

Yes, you can trade stocks through the Exness Trader app, though the selection is more limited compared to their dedicated Markets app. The Trader app focuses primarily on CFDs (Contracts for Difference) for stocks, which means you're trading on price movements without owning the underlying assets. If your strategy involves longer-term stock investing or you need access to a wider range of equities, I'd recommend downloading their Markets app as well. I personally use both – Trader for my shorter-term trading and Markets when I'm looking at position trades on individual stocks.

What trading instruments are available in the Exness Trader App?

The Exness Trader app offers an impressive range of instruments. You'll find over 120 forex pairs including exotics, major commodities like gold, silver, and oil, cryptocurrency CFDs for Bitcoin and other major coins, global stock indices, and individual stock CFDs. The selection is comprehensive enough that I rarely need to look elsewhere. Last quarter, I traded everything from EUR/USD to natural gas futures to Tesla stock, all from the same platform. They regularly add new instruments based on market demand – they added several DeFi tokens just last month.

Does Exness support automated trading?

Absolutely. Exness fully supports automated trading through Expert Advisors (EAs) on their MetaTrader-based platforms. You can run your custom algorithms or third-party EAs with minimal setup. The platform handles complex strategies without lagging, even when running multiple EAs simultaneously. I currently run three different automated strategies – a trend-following system for major forex pairs, a breakout detector for commodities, and a mean-reversion algo for indices. The implementation is seamless across both desktop and mobile versions, which means your EAs keep working even when you're away from your computer.

What are the advantages of Exness in terms of trade execution speed?

Exness shines when it comes to execution speed, which is critical for active traders. Their average execution time for market orders is under 0.1 seconds, with extremely low rejection rates compared to other brokers I've used. They maintain multiple server locations globally to minimize latency regardless of your location. During high-impact news events when many brokers experience delays, Exness typically maintains solid performance – I've successfully traded NFP releases without the platform freezing or requoting me excessively. Their NDD (No Dealing Desk) execution model also eliminates potential conflicts of interest that might affect execution quality at market-maker brokers.

Is there a mobile app specifically for stock trading?

Yes, Exness offers a dedicated app called Exness Markets specifically optimized for stock and index trading. While their main Trader app handles stocks well, the Markets app provides deeper fundamental analysis tools, more comprehensive company data, and a more stock-focused interface. The charting tools are tailored for equity analysis with specialized indicators like volume profile and money flow index that stock traders rely on. I particularly value the earnings calendar integration and analyst rating aggregator. If stocks make up a significant portion of your trading activity, the Markets app is definitely worth downloading alongside the main Trader app.