9 minute read

Best MTF Brokers for Margin Trading Facility

When it comes to trading on margin, selecting the right broker can make all the difference. A good margin trading facility (MTF) broker offers competitive leverage, low fees, and seamless execution. Among the top choices, Exness stands out for its flexible margin options, instant withdrawals, and a secure trading environment. Let’s dive into why Exness is a leading choice for margin traders.

Introduction to Margin Trading Facility (MTF)

Margin Trading Facility (MTF) allows traders to amplify their positions by borrowing funds, effectively increasing their potential returns. This mechanism is widely used in forex, stocks, and CFDs, providing traders with the ability to control larger positions than their initial deposit would typically allow.

While MTF offers significant profit potential, it also carries higher risks. If the market moves against a trader, losses can exceed the initial margin. This is why proper risk management and choosing a broker with protective measures, such as negative balance protection and stop-out features, are essential.

Why Choose Exness for Margin Trading?

Exness is a preferred broker for margin traders due to its robust trading conditions, fast execution speeds, and wide range of instruments. Here’s why Exness stands out:

Unlimited Leverage – Unlike most brokers, Exness offers up to unlimited leverage for qualified traders, maximizing trading potential.

Instant Withdrawals – Get access to your funds immediately without delays.

Low Spreads and Commissions – Competitive spreads starting from 0.0 pips on Raw Spread and Zero accounts.

Advanced Risk Management – Stop Out Protection reduces the likelihood of margin calls and stop-outs.

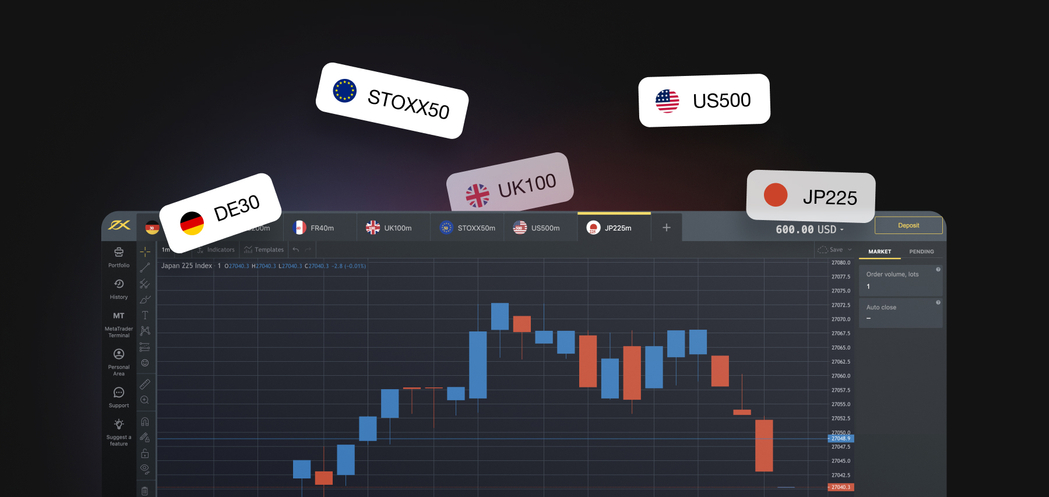

Diverse Trading Instruments – Trade forex, stocks, metals, indices, energies, and cryptocurrencies.

Exness also ensures a seamless trading experience with ultra-fast order execution, robust liquidity, and reliable customer support.

How Exness Stands Out Among Other MTF Brokers

Exness differentiates itself from other MTF brokers by offering an optimal balance between high leverage, low trading costs, and strong security measures. Unlike many brokers that impose strict leverage limits, Exness provides an industry-leading unlimited leverage option, allowing experienced traders to maximize their capital efficiency.

Additionally, Exness is known for its transparent pricing model, featuring some of the lowest spreads in the industry. The broker continuously invests in advanced trading technology, ensuring that orders are executed with precision and speed. Combined with its reliable support team, Exness offers a superior margin trading environment compared to many competitors.

Trading Instruments Available for Margin Trading on Exness

Traders at Exness can access a wide range of financial instruments for margin trading. The broker offers over 100 forex currency pairs, including majors like EUR/USD and GBP/USD, minors, and exotic pairs. This extensive selection provides traders with numerous opportunities to profit from different market movements.

In addition to forex, Exness provides CFDs on metals, energies, stocks, indices, and cryptocurrencies. Traders can speculate on the price of gold, crude oil, major tech stocks, and popular cryptocurrencies such as Bitcoin and Ethereum. With a diverse portfolio of instruments, traders can build strategies tailored to different market conditions.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Exness Account Types and Their Benefits for Margin Trading

Exness offers several account types to cater to different trading styles. The Standard account is ideal for beginners, offering low spreads and no commissions. More experienced traders can opt for the Raw Spread or Zero accounts, which feature tight spreads starting from 0.0 pips and fixed commissions for greater cost transparency.

For professional traders, the Pro account provides instant execution and lower trading costs. Each account type offers different margin requirements and leverage options, ensuring traders can find a suitable choice for their risk tolerance and strategy. With a focus on flexibility, Exness makes it easy for traders to optimize their margin trading experience.

Exness Trading Platforms: MT4, MT5, and WebTrader

Exness supports multiple trading platforms to provide traders with a seamless trading experience. MetaTrader 4 (MT4) remains a favorite among forex traders due to its user-friendly interface, customizable charts, and compatibility with Expert Advisors (EAs) for automated trading.

For those looking for advanced features, MetaTrader 5 (MT5) offers additional timeframes, more indicators, and economic calendar integration. Traders who prefer a browser-based solution can use WebTrader, which requires no downloads and syncs with MT4 and MT5 accounts. With mobile trading options also available, Exness ensures that traders can access their accounts and execute trades from anywhere.

Deposit and Withdrawal Options for Intraday Traders on Exness

For intraday traders, having quick and easy access to funds is crucial. Exness offers instant deposits and withdrawals, ensuring traders can efficiently manage their capital without delays. With multiple payment options, including bank transfers, credit/debit cards, e-wallets (Skrill, Neteller), and even cryptocurrency transactions, traders can fund their accounts seamlessly and withdraw profits whenever needed.

One of Exness' standout features is instant withdrawal processing, which eliminates long waiting times. Unlike many brokers that take hours or even days to process withdrawals, Exness executes them within seconds, allowing traders to reinvest or cash out their funds without hassle. Additionally, Exness does not charge internal deposit or withdrawal fees, making it a cost-effective choice for frequent traders.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Leverage and Margin Trading on Exness

Leverage is a key tool for intraday traders, as it allows them to open larger positions with a smaller capital investment. Exness provides customizable leverage options, including up to unlimited leverage for eligible traders, giving them the flexibility to maximize their trading potential while managing risk effectively.

The broker also offers dynamic margin requirements, which adjust based on market conditions and account settings. This ensures traders always have optimal conditions to execute their strategies. By providing access to high leverage with proper risk protections, Exness enables traders to take advantage of even small market movements without excessive capital exposure.

Risk Management Strategies for Intraday Trading with Exness

Intraday trading requires strict risk management to protect capital and ensure long-term profitability. Exness provides risk management tools such as stop-loss, take-profit, and negative balance protection, helping traders minimize potential losses.

Additionally, the broker offers Stop Out Protection, a unique feature that reduces the chances of forced liquidation by delaying stop-outs in volatile conditions. This can be especially useful for traders operating with high leverage, as it provides an extra buffer against sudden price swings. By combining smart risk management strategies with Exness’ built-in protections, traders can execute trades more confidently and sustain consistent performance.

Fees, Commissions, and Spreads for Intraday Trading on Exness

Cost efficiency is critical for intraday traders who place multiple trades throughout the day. Exness offers some of the lowest spreads in the industry, with Raw Spread and Zero accounts featuring spreads as low as 0.0 pips. This allows traders to enter and exit the market without excessive costs eating into their profits.

Additionally, Exness provides commission-free trading on Standard accounts, making it ideal for traders who prefer a simple cost structure. For those opting for Raw Spread or Zero accounts, commissions are transparent and competitive, starting from just $3.50 per lot per side. With no hidden fees, predictable trading costs, and ultra-tight spreads, Exness ensures traders can execute their intraday strategies efficiently.

Exness Customer Support and Educational Resources for Traders

A strong support system is essential for traders who need quick assistance. Exness offers 24/7 multilingual customer support through live chat, email, and phone, ensuring traders can get help whenever required. The broker’s instant withdrawal processing and technical issue resolution make it highly reliable for intraday traders who cannot afford downtime.

In addition to responsive customer service, Exness provides a wealth of educational resources, including market analysis, trading tutorials, and webinars. These materials help traders refine their skills, stay informed on market trends, and optimize their strategies. Whether you're a beginner or a seasoned trader, Exness equips you with the knowledge and support needed for success.

Conclusion: Why Exness is the Best Broker for Intraday Trading

Exness stands out as a top choice for intraday traders due to its fast execution speeds, ultra-low spreads, instant withdrawals, and high leverage options. The broker's transparent pricing, advanced risk management features, and reliable trading platforms create an optimal environment for short-term trading strategies.

Additionally, Exness' commitment to fair trading conditions, superior customer support, and educational resources makes it an excellent broker for both beginner and professional intraday traders. Whether you're scalping, using breakout strategies, or trading high-volume positions, Exness provides everything you need to trade efficiently and profitably.

Frequently Asked Questions (FAQs)

What makes Exness a good choice for intraday trading?

Exness offers ultra-tight spreads, instant execution, and high leverage, making it perfect for traders who need fast market access and low costs. Additionally, instant withdrawals and no hidden fees further enhance the trading experience for intraday traders.

Does Exness offer zero commission intraday trading?

Yes, Standard accounts on Exness have zero commission trading, allowing traders to avoid additional costs. However, Raw Spread and Zero accounts offer ultra-low spreads with small, transparent commissions for those who prefer tighter pricing.

What leverage does Exness provide for intraday traders?

Exness offers flexible leverage options, with up to unlimited leverage available for eligible traders. This allows traders to maximize their market exposure while effectively managing their risk levels.

How fast are order executions on Exness for intraday trading?

Exness provides lightning-fast execution, with orders processed in milliseconds. This ensures minimal slippage, which is crucial for intraday traders who rely on quick market movements to capitalize on short-term price changes.

What are the best trading strategies for intraday trading on Exness?

Successful intraday strategies on Exness include scalping, breakout trading, and momentum strategies. By utilizing tight spreads, fast execution, and Exness’ risk management tools, traders can maximize their potential profits while keeping their risks under control.