9 minute read

Exness vs Vantage Markets - Which Broker is the Best?

When choosing a broker, it's essential to weigh various factors such as trading platforms, account types, leverage options, and more. Exness and Vantage Markets are two popular brokers, each offering a broad range of features for traders. In this article, we’ll compare Exness and Vantage Markets to help you determine which one is the best for your trading style and needs.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Introduction to Exness and Vantage Markets

Exness is a well-established broker that has been serving clients for over a decade. With a strong presence in the forex market, Exness has earned a reputation for offering high-quality services, competitive spreads, and a broad range of trading tools. The broker provides access to both retail and professional traders with an emphasis on flexibility, low costs, and fast execution speeds.

On the other hand, Vantage Markets (formerly known as Vantage FX) is also a major player in the industry. Vantage Markets provides a solid platform for both beginner and experienced traders. With low spreads, a range of account types, and competitive leverage, it offers similar features to Exness but caters to a slightly different clientele. Vantage Markets is especially popular in regions like Australia, the UK, and Southeast Asia.

When comparing Exness and Vantage Markets, both brokers provide excellent trading conditions, but some distinct differences may make one more appealing depending on your individual trading preferences.

Trading Platforms Offered by Exness and Vantage Markets

Exness offers several trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary WebTerminal. MT4 and MT5 are the industry standards for forex traders, known for their powerful charting tools, automated trading capabilities (via Expert Advisors), and fast execution. Exness's platform is highly rated for its user-friendly interface, stability, and extensive range of technical indicators.

Vantage Markets, similarly, provides access to MT4 and MT5 platforms, offering traders the same tools and features as Exness. In addition, Vantage also supports TradingView for those who prefer a web-based charting and analysis tool. TradingView is especially popular for its excellent charting options and social trading features, which some traders might prefer over MT4/MT5 for certain market analysis needs.

Both brokers offer access to mobile versions of their platforms, ensuring traders can manage their trades on the go. However, Exness has the edge with its WebTerminal, a browser-based platform that allows clients to trade without needing to install any software.

Account Types and Conditions: Exness vs Vantage Markets

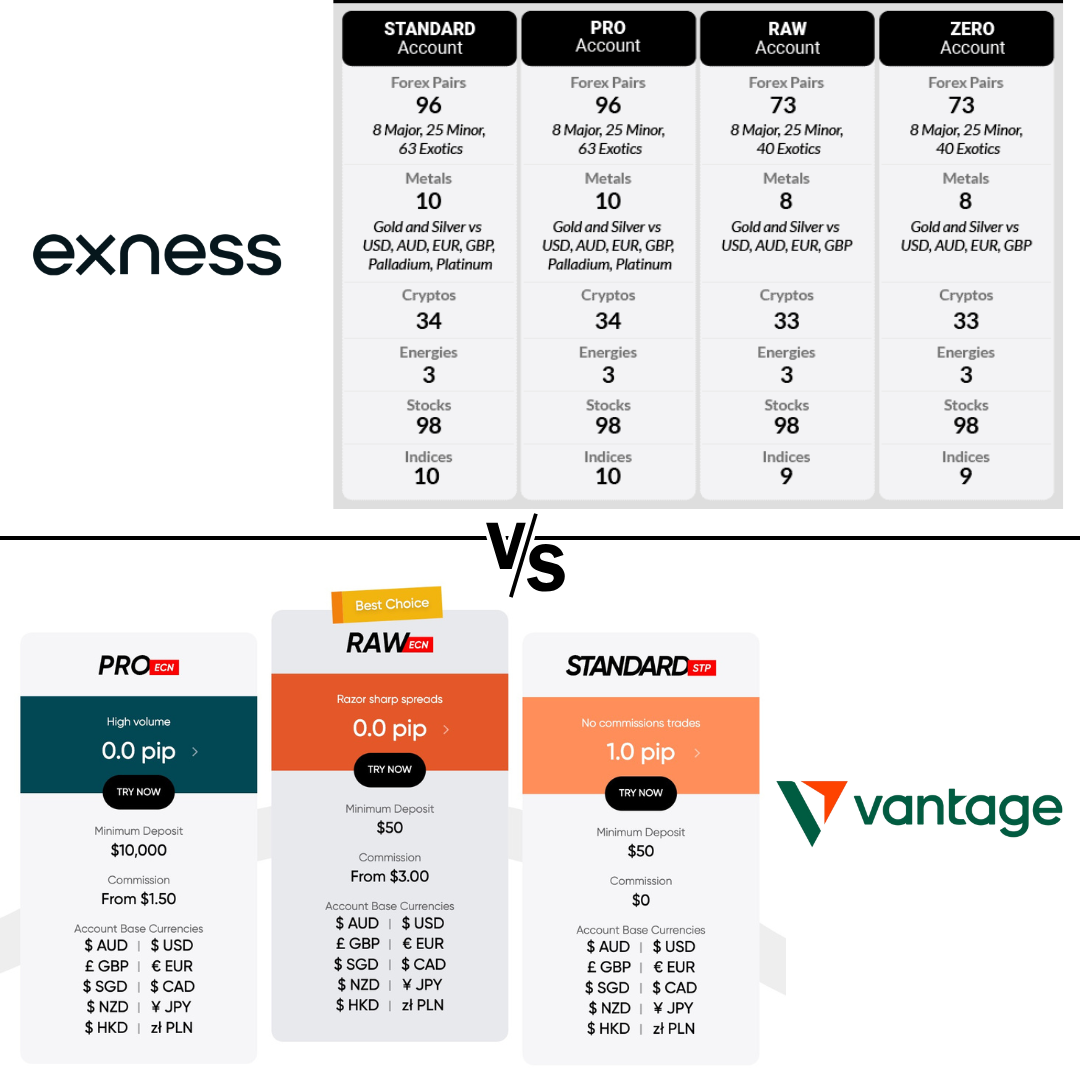

Exness offers a variety of account types to cater to different trading styles. These include:

Standard Account: Ideal for beginners with competitive spreads.

Pro Account: Offers tighter spreads and is suited for more experienced traders.

Zero Account: Offers raw spreads, perfect for scalpers and high-frequency traders.

Raw Account: Designed for professional traders, offering access to the best available liquidity.

Exness’s account types come with flexible leverage options, with the ability to adjust the leverage depending on the trader’s experience and risk tolerance.

Vantage Markets also offers a range of account types:

Standard Account: Suitable for beginners, with a minimum deposit of $200.

Raw ECN Account: Ideal for experienced traders looking for tighter spreads and higher leverage.

Pro Account: Offers more advanced features and tighter spreads compared to the standard account.

While both brokers provide similar account structures, Exness offers more flexibility with its ECN accounts, which can be a major advantage for traders seeking low spreads and high liquidity.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Trading Instruments Offered by Exness and Vantage Markets

Exness provides a wide range of trading instruments, including:

Forex Pairs: Over 100 currency pairs, including majors, minors, and exotics.

Commodities: Gold, silver, and other precious metals.

Indices: Global indices such as the S&P 500 and NASDAQ.

Cryptocurrencies: Bitcoin, Ethereum, and several other digital currencies.

Stocks and CFDs: Equities from major stock markets and CFDs on a variety of commodities.

Exness’s diversity in trading instruments ensures that traders can access a wide variety of markets, whether they are interested in forex, commodities, or newer asset classes like cryptocurrencies.

Vantage Markets, while offering a similar range of instruments, focuses heavily on Forex, offering more than 40 currency pairs. It also provides CFDs on commodities, indices, and shares. However, Vantage does not offer as many cryptocurrency pairs or stock CFDs as Exness.

While both brokers provide a good selection of instruments, Exness edges out slightly with its broader range of assets, especially in newer markets like cryptocurrencies.

Leverage and Margin Requirements: Exness vs Vantage Markets

Exness is well known for its high leverage options, offering traders up to 1:2000 on certain accounts, which is one of the highest in the industry. This can be advantageous for traders who prefer to trade with larger positions using a smaller amount of capital. However, it’s important to understand the risks associated with high leverage, as it can amplify both profits and losses.

Vantage Markets, on the other hand, offers leverage up to 1:500, which is still competitive, but lower than Exness’s offering. This lower leverage might be more suitable for traders who want to manage risk more carefully, especially beginners.

Both brokers have competitive margin requirements, with Exness offering flexible margin levels depending on the account type. Vantage Markets provides lower margin requirements on its Raw ECN accounts, allowing for more capital-efficient trading.

When deciding between Exness and Vantage Markets, the leverage options might influence your decision. Exness offers much higher leverage, but traders should carefully consider their risk tolerance before choosing such high levels of leverage.

Customer Support and Education: Exness vs Vantage Markets

Both Exness and Vantage Markets provide strong customer support, but they each have different approaches to assisting traders. Exness has a reputation for excellent customer service. They offer 24/7 live chat support in multiple languages, ensuring that traders across different time zones can access help whenever they need it. Additionally, Exness provides email and phone support, making it easy for traders to get in touch with a representative. Exness also boasts a comprehensive help center, filled with guides, FAQs, and troubleshooting tips.

On the educational side, Exness offers a wide range of resources for both beginners and advanced traders. These include video tutorials, webinars, market analysis, and a detailed knowledge base that covers everything from platform setup to complex trading strategies. Exness’s educational content is available in several languages, making it accessible to a global audience.

Vantage Markets, while offering responsive customer support, has fewer contact options than Exness. They provide live chat, email, and phone support during business hours but do not offer the same level of 24/7 availability. Vantage Markets also has a knowledge base and some educational resources available, such as webinars and trading guides, but they are more limited compared to Exness's offerings.

If you’re a beginner and looking for robust educational support, Exness might be the better option due to its more comprehensive and easily accessible resources.

Deposit and Withdrawal Methods at Exness and Vantage Markets

When it comes to deposit and withdrawal methods, both Exness and Vantage Markets offer a variety of options to cater to traders worldwide. Exness supports a wide range of payment methods, including credit/debit cards, bank transfers, e-wallets like Skrill and Neteller, and even cryptocurrency deposits and withdrawals. The main advantage of Exness is its fast withdrawal processing times, often completed within 24 hours for e-wallets and up to 1-3 business days for bank transfers. Exness also has no fees for most deposit and withdrawal methods, which is a major benefit for traders.

Vantage Markets also supports several payment options, including credit/debit cards, bank transfers, and e-wallets. However, unlike Exness, Vantage Markets may charge fees on certain payment methods, particularly for withdrawals. The withdrawal processing time with Vantage Markets is generally 1-2 business days for e-wallets, and it can take 3-5 business days for bank transfers, which is slightly slower compared to Exness.

In terms of flexibility, Exness has the edge, particularly with its cryptocurrency support and faster processing times.

Regulation and Safety: Exness vs Vantage Markets

Regulation is a crucial factor when choosing a broker, and both Exness and Vantage Markets are regulated by reputable authorities. Exness holds licenses with the CySEC (Cyprus Securities and Exchange Commission), the FCA (Financial Conduct Authority), and the FSCA (Financial Sector Conduct Authority), among others. This ensures that Exness complies with strict financial standards and offers protection for clients’ funds through segregated accounts and the Investor Compensation Fund.

On the other hand, Vantage Markets is regulated by the ASIC (Australian Securities and Investments Commission) and CySEC, and it is also registered in various jurisdictions. While Vantage Markets offers solid regulation, the scope of its regulatory coverage is slightly more limited compared to Exness, particularly when it comes to regions outside of Australia and Europe.

Both brokers offer strong security measures, including SSL encryption to protect traders’ data, but Exness’s broader regulatory footprint makes it a more secure choice for traders concerned about oversight and client protection.

Exness vs Vantage Markets: Pros and Cons

Exness Pros:

Higher leverage (up to 1:2000) for certain accounts

Extensive educational resources for all experience levels

Fast withdrawal processing and no fees for most payment methods

Wide regulatory coverage, ensuring greater security

24/7 customer support in multiple languages

Exness Cons:

Limited cryptocurrency trading options compared to other brokers

Some advanced trading tools may not be available for all account types

Vantage Markets Pros:

Competitive leverage (up to 1:500)

Low spreads, especially for ECN accounts

Solid choice for active traders due to low commission costs

Strong educational resources and market analysis

Vantage Markets Cons:

Slower withdrawal processing compared to Exness

Fee charges for certain withdrawal methods

Limited customer support availability outside business hours

Frequently Asked Questions (FAQs)

Which broker offers lower spreads, Exness or Vantage Markets?

Exness typically offers lower spreads on its Zero Account and ECN accounts, which are ideal for active traders and scalpers. However, Vantage Markets also offers tight spreads on its Raw ECN accounts, making it a competitive option for traders looking for low-cost entry.

Can I use the same platform on both Exness and Vantage Markets?

Yes, both Exness and Vantage Markets support the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, meaning you can use the same trading platform for both brokers. This ensures a seamless experience for traders who are familiar with these platforms.

Is Exness more reliable than Vantage Markets for beginners?

Exness may be a better option for beginners due to its comprehensive educational resources, 24/7 customer support, and easy-to-use platform. However, Vantage Markets still provides a solid option for beginners, particularly with its user-friendly interface and low minimum deposit requirements.

What’s the maximum leverage available with both brokers?

Exness offers up to 1:2000 leverage on certain account types, which is one of the highest in the industry. Vantage Markets offers up to 1:500 leverage, which is still competitive but lower than Exness’s offering.