9 minute read

Exness vs HFM Comparison - Which Broker is Better?

When comparing Exness and HFM, it’s essential to look at their key features, including the trading platforms they offer, account types, fees, and more. Both brokers are reputable in the industry, but each offers unique features that could appeal to different types of traders. Let's explore how they stack up against each other.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Overview of Exness and HFM

Exness is a global leader in the forex and CFD brokerage industry, established in 2008. Known for its low-cost structure, robust customer support, and a wide range of instruments, Exness caters to both beginners and professionals.

HFM, formerly HotForex, started in 2010 and has grown rapidly, focusing on offering various trading options and account types. It is known for its extensive educational resources, solid customer service, and competitive spreads.

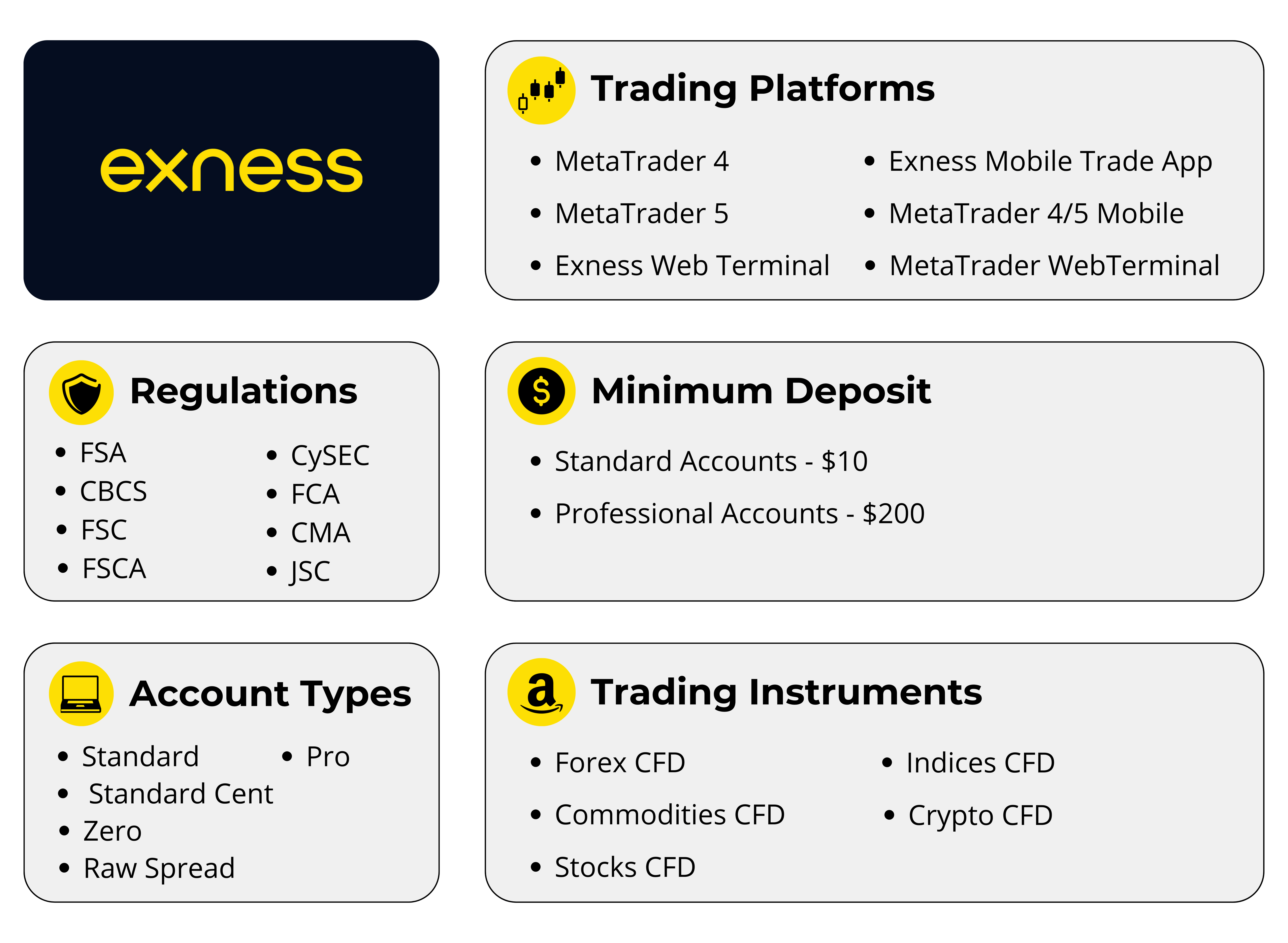

Trading Platforms Offered by Exness and HFM

Both brokers offer MetaTrader 4 (MT4) and MetaTrader 5 (MT5), the most widely used platforms in the trading world. However, there are some notable differences:

Exness also provides its own Exness Trader platform, which is mobile-friendly and simple to use, perfect for traders who need to access their accounts on the go.

HFM sticks to the popular MT4 and MT5, which offer comprehensive features for advanced traders. Additionally, WebTrader is available for those who prefer trading directly from a browser.

Comparison of Account Types Available on Exness and HFM

Both Exness and HFM offer a variety of account types designed to meet different trading needs:

Exness offers:

Standard Accounts (ideal for beginners),

Pro Accounts (for active traders),

Zero Accounts (for tight spreads and no commissions),

Islamic Accounts (swap-free).

HFM provides:

Micro Accounts (designed for small capital traders),

Premium Accounts (for professional traders),

Zero Spread Accounts (for no spreads, but with commissions),

Islamic Accounts (swap-free options).

Trading Instruments

Both brokers offer a wide range of instruments, but there are some differences in the selection.

Range of Instruments Offered by Exness

Exness offers a broader selection across several asset classes:

Forex: 100+ currency pairs.

Metals: Gold, silver, platinum, and others.

Indices: Global indices such as the S&P 500, NASDAQ, and more.

Commodities: Including oil and natural gas.

Cryptocurrencies: Popular cryptos like Bitcoin, Ethereum, and Litecoin.

Range of Instruments Offered by HFM

HFM also offers a good selection but with a focus on more traditional markets:

Forex: 50+ currency pairs.

Metals: Including gold and silver.

Indices: Major global indices like US30 and DAX.

Commodities: Oil, natural gas, and other popular commodities.

Cryptocurrencies: A limited selection, including Bitcoin and Ethereum.

While Exness offers a more extensive range, especially in the crypto space, HFM focuses on traditional assets but still provides plenty of choices.

Fees and Spreads

When choosing a broker, understanding the fees and spreads is critical, as they directly impact your trading costs and profitability. Both Exness and HFM offer competitive spreads, but there are differences in their fee structures.

Spreads, Commissions, and Other Fees on Exness

Exness offers highly competitive spreads, particularly on Standard Accounts with spreads starting as low as 0.3 pips for major currency pairs. For Zero Accounts, Exness offers ultra-tight spreads, but a commission of $3.5 per lot is charged. Pro Accounts offer slightly higher spreads but come with no commission, making them ideal for traders who prefer low-cost, high-volume trading.

In addition to spreads, Exness does not charge withdrawal fees for most payment methods, though third-party charges may apply. This makes Exness one of the most cost-effective brokers for global traders.

Spreads, Commissions, and Other Fees on HFM

HFM provides a range of competitive spreads, especially on Premium Accounts, with spreads starting from 1.1 pips for major forex pairs. On Zero Spread Accounts, traders pay zero spreads but incur a commission of $6 per lot.

HFM charges similar withdrawal fees depending on the payment method, and the availability of fee-free withdrawal options can vary. While it has flexible options, the costs can be higher for specific withdrawal methods compared to Exness.

Regulation and Security

Regulation and security are key factors when choosing a broker. Both Exness and HFM are regulated by major financial authorities, which ensures they comply with the highest industry standards.

Regulatory Licenses Held by Exness

Exness is licensed by several prominent financial regulators, ensuring its legitimacy and reliability:

Cyprus Securities and Exchange Commission (CySEC), under license number 178/12.

Financial Conduct Authority (FCA) in the UK, under registration number 730729.

Financial Services Commission (FSC) in the British Virgin Islands.

Seychelles Financial Services Authority (FSA) for global operations.

These licenses provide traders with the assurance that Exness operates within legal frameworks that prioritize customer protection and transparency.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Regulatory Licenses Held by HFM

HFM is also well-regulated, offering a secure trading environment for its users. Key licenses include:

Cyprus Securities and Exchange Commission (CySEC) under license number 183/12.

Financial Services Commission (FSC) in Mauritius.

Dubai Financial Services Authority (DFSA), which adds further credibility in the MENA region.

With these licenses, HFM adheres to international standards for client protection, ensuring traders are safeguarded from potential risks.

Trading Conditions and Features of Exness vs. HFM

When it comes to trading conditions, both Exness and HFM offer solid platforms for traders, but each has unique features suited to different trading styles.

Exness is known for its high leverage options, offering up to 1:2000 for retail accounts, which is a significant advantage for traders looking to amplify their positions. Exness’s trading conditions are highly customizable, and its ability to support both MT4 and MT5 platforms makes it easy for traders to switch between platforms based on their needs. Additionally, Exness offers zero commissions for certain account types, making it attractive for those trading in high volumes.

HFM also offers high leverage (up to 1:1000), but with slightly more restrictive conditions than Exness in some areas. HFM’s spread-only accounts are useful for traders who don’t want commission-based fees, but the spreads are slightly higher than Exness’s tight spreads, especially for Micro Accounts. HFM also offers both MT4 and MT5 and has a strong presence in the MENA region, offering a variety of local payment methods and customer support in multiple languages.

While both brokers offer strong trading conditions, Exness stands out with its lower spreads, higher leverage, and more flexible trading options. HFM, however, offers more regional-specific services, making it a great choice for traders in the MENA area or those seeking local payment options.

Customer Support and Educational Resources of Exness vs. HFM

Both Exness and HFM offer strong customer support and educational resources to help traders succeed, but their offerings differ in some ways.

Exness provides 24/7 customer support in multiple languages, including English, Chinese, Arabic, and more. The support team is available through live chat, email, and phone. Additionally, Exness offers a comprehensive Help Center with articles, video tutorials, and webinars to guide traders at all levels.

HFM, on the other hand, also offers 24/7 customer support in various languages, with a strong presence in the MENA region. HFM provides access to live chat, phone support, and email assistance. Their Educational Hub is filled with tutorials, guides, webinars, and even an online trading academy designed to help both new and experienced traders improve their skills.

While both brokers offer excellent support and educational content, Exness has a more globally accessible educational platform, while HFM shines with region-specific resources, particularly for traders in the MENA region.

Pros and Cons of Exness and HFM

Pros of Exness:

Wide Range of Instruments: Exness offers a large variety of forex pairs, metals, indices, and cryptocurrencies.

Low Spreads: Exness provides some of the tightest spreads in the industry, especially on Zero Accounts.

High Leverage: Exness offers leverage up to 1:2000 for retail traders, making it a great choice for those who prefer to trade with higher risk.

Advanced Platforms: With MT4, MT5, and Exness Trader, traders have access to reliable and advanced trading platforms.

Cons of Exness:

Limited Regional Focus: While Exness is a global broker, its customer support and services are better suited to regions with high market activity like Europe and Asia.

Inactivity Fees: Exness charges inactivity fees for accounts that remain dormant for an extended period.

Pros of HFM:

Wide Educational Resources: HFM’s comprehensive educational tools, including webinars and online trading academies, cater to traders of all levels.

Low Minimum Deposit: HFM allows traders to start with a relatively low minimum deposit, making it accessible for beginners.

Localized Support: HFM has strong customer support, especially in the MENA region, with local payment methods and region-specific solutions.

Multiple Account Types: HFM offers various account types suited for different traders, including micro accounts and zero spread options.

Cons of HFM:

Higher Spreads: While HFM offers some competitive options, its spreads can be slightly higher compared to Exness, especially on micro accounts.

Limited Cryptocurrencies: HFM offers fewer cryptocurrency trading options than Exness, which may be a disadvantage for crypto traders.

Frequently Asked Questions About Exness vs. HFM

Which broker offers lower fees?

Exness generally offers lower fees, especially with its Zero Accounts, which provide tight spreads without additional commissions. HFM, on the other hand, offers competitive spreads but often includes commissions, particularly on their zero-spread accounts.

Is Exness or HFM better for beginners?

Both brokers cater to beginners, but Exness has a slight edge due to its more extensive educational content and a simpler interface on the Exness Trader platform. HFM also offers a great educational hub, but its focus on more advanced features might make it slightly more complex for new traders.

What are the main regulatory differences between Exness and HFM?

Both Exness and HFM are well-regulated by major authorities. Exness holds licenses from CySEC, FCA, and FSA (among others), providing a solid regulatory foundation. HFM is regulated by CySEC, FSC, and DFSA, with a strong emphasis on compliance, particularly in the MENA region.

Which broker has a wider range of trading instruments?

Exness offers a wider variety of trading instruments, especially in the cryptocurrency market, with access to a broad range of forex pairs, commodities, indices, and cryptocurrencies. HFM has a good range of instruments but focuses more on traditional forex pairs and commodities, offering fewer options in the crypto space.

Can I use both brokers at the same time?

Yes, you can use both Exness and HFM at the same time. Many traders diversify their portfolio across multiple brokers to take advantage of the different features and trading conditions each broker offers. However, it’s important to monitor both accounts closely to avoid confusion and ensure proper risk management.