8 minute read

What is Exness HMR Period?

The Exness HMR period refers to the time frame within which a trader's positions are held before they are automatically closed due to margin or time constraints. It is an important concept in managing risk and understanding the trading environment, especially for traders who need to monitor their positions closely to avoid unexpected closures.

Understanding the HMR Period in Trading

In trading, the HMR Period (Hourly Margin Requirement Period) is essentially the timeframe during which a trader must meet the margin requirements to keep their positions open. On Exness, this period is defined based on the broker's trading rules, and exceeding it may lead to the automatic closure of the position.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Explanation of HMR in the Context of Exness

In the context of Exness, the HMR Period ensures that traders maintain adequate margin to cover their open positions. If the margin requirement is not met during the specified HMR period, Exness will automatically close the position. This is particularly important for traders who use high leverage or trade volatile instruments, as their margin can fluctuate rapidly.

The HMR period is part of Exness's risk management system, which protects both the trader and the broker from the possibility of substantial losses due to insufficient margin. By setting a limit on how long a position can stay open without meeting the margin, Exness ensures that traders don't face unexpected margin calls or stop-outs.

Why the HMR Period is Important for Traders

The HMR period is crucial for traders because it dictates how long they can hold their positions before the risk of forced closure arises. Traders must monitor their margin levels carefully during this period to avoid automatic position closures that could lock in losses or miss potential gains.

For those using high leverage or trading volatile assets, the HMR period provides a structured time frame to adjust their positions or add funds. Without this period in place, traders would risk facing more frequent and unpredictable stop-outs, making it harder to maintain control over their trades and profits.

Understanding the HMR period allows traders to better manage their positions, improve their risk management strategies, and ensure they can act before the system takes action. This makes it a vital aspect of trading discipline.

Key Features of the Exness HMR Period

The Exness HMR Period comes with several key features that traders must understand to effectively manage their positions and avoid unwanted closures. These features ensure a more predictable trading environment, especially when dealing with high leverage or volatile instruments:

Time Limit for Position Maintenance: The HMR period is essentially a time frame in which the trader is required to meet the margin requirements for an open position. If this period expires without the trader having sufficient margin, the position will be closed automatically.

Automatic Closure Mechanism: If the margin requirement is not fulfilled during the HMR period, Exness's system will automatically close the position. This prevents the trader from accumulating losses that might exceed the available equity in the account.

Real-Time Margin Monitoring: Exness monitors your margin in real-time and provides alerts and updates within the HMR period, helping traders stay on top of their margin levels and make necessary adjustments.

Leverage Control: High leverage positions are more likely to trigger margin calls or stop-outs if the margin isn't sufficient. The HMR period helps manage this by setting a time window during which the trader must adjust to keep their positions active.

How the Exness HMR Period Affects Your Trading

The Exness HMR period plays a significant role in how traders manage their risk and execute their strategies. It affects trading in the following ways:

Risk Management: Traders must be aware of their margin levels throughout the HMR period. If they fail to meet the margin requirement in time, they risk having their position automatically closed, which can lead to losses.

Margin Call Avoidance: By understanding and respecting the HMR period, traders can avoid margin calls and the automatic closure of positions. Properly managing the time and margin ensures that positions remain open and under control, even during volatile market conditions.

Flexibility to Adjust Positions: The HMR period provides flexibility, allowing traders time to adjust their positions. If a trader sees that their margin is running low, they can either add funds or close some positions before the system takes action.

Practical Examples of the HMR Period Influencing Exness Traders

Example 1: High Leverage TradeSuppose a trader has a position with high leverage, and the margin required to maintain the position is $500. During the HMR period, the trader’s equity drops due to a minor market fluctuation, and the margin requirement rises to $600. If the trader doesn't add funds before the period expires, Exness will automatically close the position, locking in a loss.

Example 2: Insufficient MarginImagine a trader has an open trade in a volatile market, and their used margin is $2,000. If the trader’s equity drops below the required margin during the HMR period, the position will be closed automatically by Exness to prevent further losses. In this case, the trader will miss out on any potential recovery if the market reverses.

These examples show how the HMR period affects traders' ability to manage positions, especially when market conditions are unpredictable.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Benefits of the Exness HMR Period

The Exness HMR Period offers several key benefits for traders, making it a vital feature in risk management:

Prevents Overexposure: By automatically closing positions that no longer meet the margin requirements, the HMR period prevents traders from taking on more risk than they can handle, especially in volatile conditions.

Increases Predictability: Traders can plan their positions better, knowing that the HMR period gives them a defined window of time to ensure sufficient margin. This removes the uncertainty of unexpected stop-outs and margin calls.

Supports Better Decision Making: With the HMR period, traders can adjust their positions or add funds before a potential automatic closure, allowing for better decision-making and more control over their trades.

Enhances Account Protection: The HMR period provides an additional safety net by reducing the chances of a trader incurring substantial losses due to insufficient margin. This gives traders more time to manage their risk effectively.

Overall, the HMR period on Exness helps traders manage their positions, avoid unnecessary losses, and maintain better control of their trading strategy.

Comparing the Exness HMR Period to Other Brokers

Exness offers a more flexible approach with its HMR period compared to other brokers. Unlike brokers like IC Markets, where margin calls are triggered immediately once margin requirements are not met, Exness gives traders a defined time frame to meet margin requirements and avoid automatic position closures.

FXTM (ForexTime) also triggers margin calls based on margin levels but lacks a specific HMR period, leaving less time for traders to react. Similarly, Admiral Markets has margin calls at certain levels but doesn’t offer the structured HMR period Exness does.

In comparison, Exness's HMR period gives traders more control and time to manage their positions, which is a significant advantage over brokers with more immediate margin call systems.

Frequently Asked Questions About the Exness HMR Period

What does the HMR period represent on Exness?

The HMR period is the time frame within which you must meet the margin requirements for your open positions. If you don’t meet these requirements during the HMR period, your position will be automatically closed by Exness.

How does the HMR period impact my trades on Exness?

The HMR period affects your trades by giving you a time window to maintain the margin needed to keep your positions open. If the required margin isn’t met within this period, Exness will close the position to prevent further losses.

Can I adjust HMR settings on the Exness platform?

No, you cannot adjust the HMR period on Exness. It is a system setting, but you can manage your margin during the period by adding funds or adjusting your positions to avoid automatic closure.

Is the HMR period the same for all trading instruments on Exness?

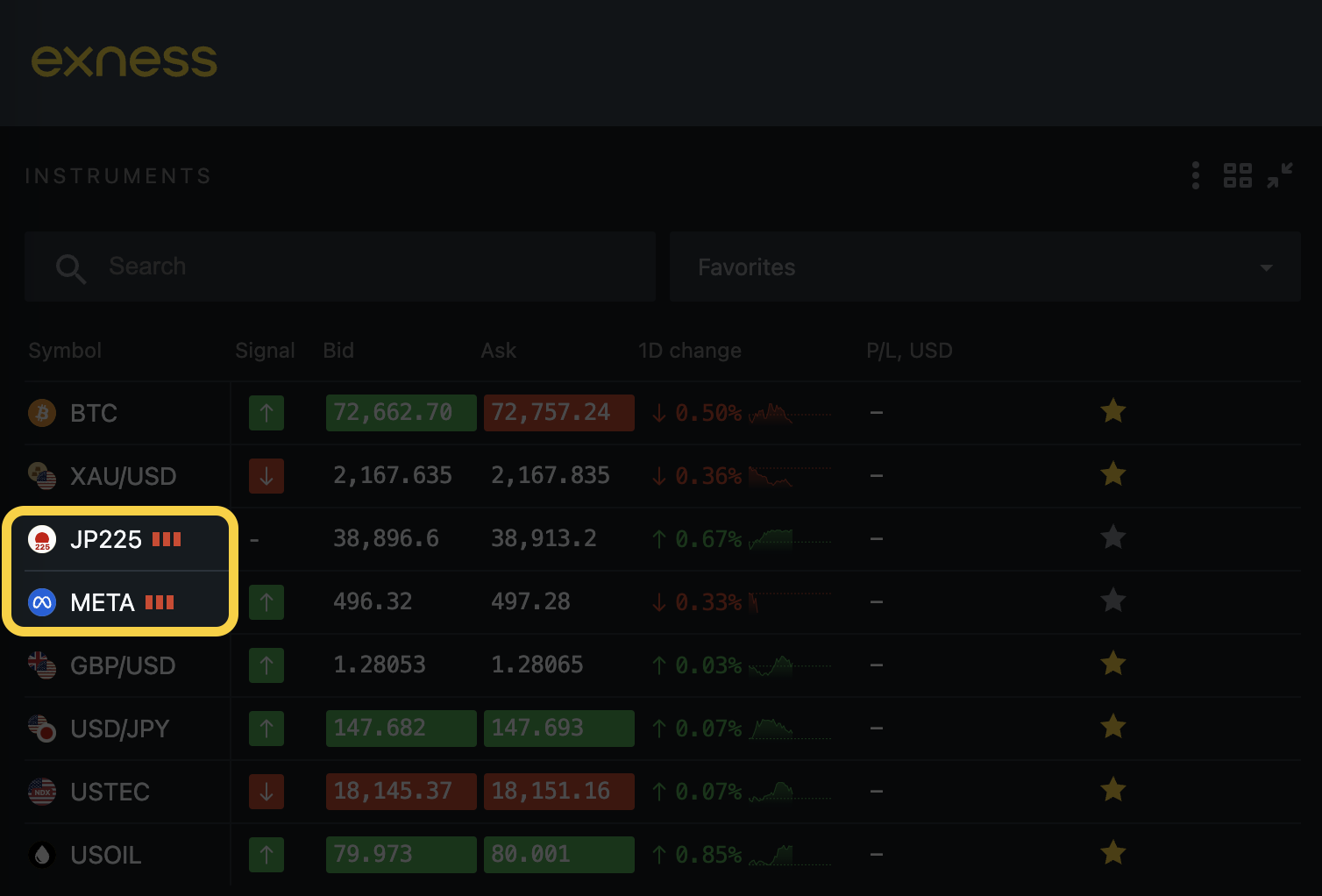

In general, the HMR period is similar for most instruments on Exness. However, some instruments, like those with higher volatility or leverage, might have slightly different margin requirements. Always check the margin details for each instrument you trade.

Are there risks linked to the Exness HMR period?

Yes, the main risk is that if you don’t meet the margin requirement during the HMR period, your position will be closed automatically. To avoid this, make sure to keep an eye on your margin and add funds if needed, especially during times of high market volatility.