9 minute read

Is Exness Trade App Legal in India?

Indian traders can use the Exness Trade App legally, provided they follow local financial regulations. While Exness operates under international licenses, Indian laws such as the Liberalized Remittance Scheme (LRS) by the Reserve Bank of India (RBI) govern how traders can send funds abroad for trading purposes. Compliance is key for a smooth experience.

What is the Exness Trade App?

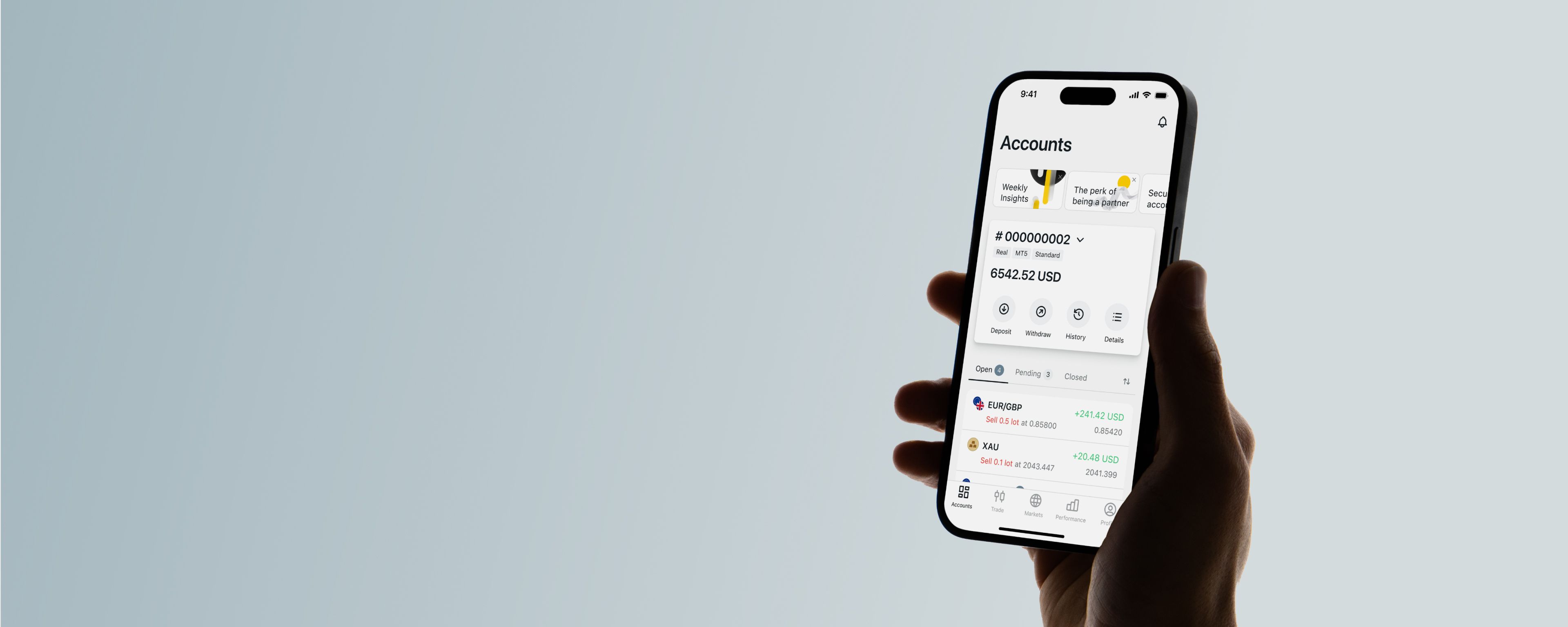

The Exness Trade App is a modern, user-friendly trading platform designed to make trading accessible for everyone, whether you're a beginner or an experienced trader. It allows users to trade forex, commodities, indices, and cryptocurrencies, all from the convenience of a smartphone.

The app provides real-time market data, advanced charting tools, and flexible trading options. It supports one-click trading for quick decisions and offers features like stop loss and take profit for better risk management. With its secure design and intuitive interface, the app makes it easy to monitor markets, place trades, and manage accounts on the go.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Exness Global Licenses and Compliance

Exness is a globally regulated broker, ensuring its operations are secure and transparent. It holds multiple licenses from trusted financial authorities around the world, including:

Cyprus Securities and Exchange Commission (CySEC): Ensures compliance with European regulations and promotes transparency in operations.

Financial Conduct Authority (FCA): Regulates Exness in the UK, emphasizing strong consumer protection standards.

Seychelles Financial Services Authority (FSA): Oversees the broker’s activities in selected global markets, ensuring fair trading practices.

Financial Sector Conduct Authority (FSCA): Covers Exness’ operations in South Africa, reinforcing its commitment to compliance in emerging markets.

These licenses require Exness to adhere to strict anti-money laundering (AML) and know-your-customer (KYC) protocols. This compliance ensures that traders globally, including in India, can rely on a secure and well-regulated trading environment.

Role of SEBI in Regulating Financial Markets

The Securities and Exchange Board of India (SEBI) is responsible for ensuring fairness and transparency in the Indian financial markets. It regulates domestic brokers, ensuring they operate under strict guidelines to protect investors and maintain market integrity. SEBI oversees a variety of financial activities, from stock exchanges to mutual funds, aiming to build trust in the financial system.

However, SEBI’s jurisdiction is limited to Indian brokers and entities. It does not regulate foreign platforms like Exness. Despite this, SEBI’s rules indirectly influence Indian traders by setting expectations for trading practices and financial disclosures. Understanding SEBI’s framework is essential for anyone navigating India’s financial landscape, whether through local or global platforms.

Applicability of Indian Regulations to Exness

As an international broker, Exness is regulated by global authorities, but Indian regulations still play a role in how traders from India can use the platform. Indian traders are governed by the Liberalized Remittance Scheme (LRS) of the Reserve Bank of India (RBI). This allows residents to remit funds abroad for trading, but only through approved channels and within an annual limit of USD 250,000.

While Exness is not SEBI-regulated, Indian users must ensure that their activities comply with RBI rules and avoid unauthorized payment methods. Failure to follow these guidelines can lead to legal complications. By aligning their trading practices with Indian regulations, traders can safely access Exness while benefiting from its global trading services.

How Indian Traders Can Use Exness Legally

Indian traders can use Exness legally by following these steps:

Understand the Liberalized Remittance Scheme (LRS):The RBI permits Indian residents to remit funds abroad for trading within the annual limit of USD 250,000. Ensure all transactions comply with this rule.

Use Authorized Payment Methods:Always use banking channels or other RBI-approved payment methods for deposits and withdrawals. Avoid unregulated fund transfer methods.

Maintain Proper Records:Keep detailed records of all transactions for compliance and future reference, as these may be required during audits or legal inquiries.

Trade Responsibly:Stay informed about the risks of forex and CFD trading. Use the platform’s risk management tools and ensure your trading activity aligns with Indian regulations.

By following these steps, Indian traders can access the benefits of Exness while staying within the bounds of the law.

Benefits Exness Offers to Indian Traders

Exness provides Indian traders with a reliable platform to access global markets, including forex, commodities, indices, and cryptocurrencies. One of the key benefits is the platform’s competitive pricing, with tight spreads and no hidden fees, allowing traders to manage their costs effectively. Additionally, Exness offers flexible leverage options, giving traders the ability to adjust their trading strategies based on their risk tolerance and market conditions.

For Indian traders, the ease of instant withdrawals is a standout feature. The platform supports a variety of payment methods, ensuring that funds can be accessed quickly and conveniently. With a focus on transparency and user security, Exness makes trading accessible for both beginners and experienced traders in India.

Key Features and Tools Offered by the App

The Exness Trade App provides a range of features designed to meet the needs of traders. Here are some of its key tools and functionalities:

User-Friendly Interface: Simplifies navigation for both new and experienced traders.

Real-Time Market Data: Offers live updates on market prices and trends.

Advanced Charting Tools: Includes multiple chart types, technical indicators, and drawing tools for in-depth analysis.

One-Click Trading: Allows quick execution of trades to seize market opportunities.

Risk Management Tools: Features stop loss and take profit options to manage trading risks effectively.

Account Management: Enables users to monitor balances, open positions, and transaction history.

Secure Transactions: Protects user data and trades with advanced encryption.

These features make the Exness Trade App a comprehensive and reliable tool for traders seeking flexibility and efficiency in their trading activities.

How to Verify Exness Legality in India

Verifying the legality of Exness in India requires understanding its global regulatory framework and aligning it with Indian financial rules. Exness operates under licenses from respected authorities like CySEC and FCA, ensuring compliance with international standards. Indian traders must ensure that all fund transfers to Exness comply with the Liberalized Remittance Scheme (LRS) set by the Reserve Bank of India (RBI).

To further confirm its legitimacy, traders should review the broker’s licenses and terms directly on the Exness website. Consulting a financial expert or legal advisor familiar with Indian regulations can also provide additional clarity. By staying informed, traders can confidently use Exness while adhering to local laws.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Availability of Customer Support Exness in India

Exness offers robust customer support tailored to the needs of Indian traders. With 24/7 availability, users can get assistance at any time, whether they have questions about account setup, trading tools, or technical issues. The support team is knowledgeable and responsive, ensuring quick resolution of queries.

Indian traders also benefit from localized services, including support in Indian languages like Hindi and Bengali. This makes it easier for users to communicate effectively and understand the platform’s features. With multiple communication channels, including live chat, email, and phone support, Exness ensures a smooth and accessible experience for its Indian users.

Practical Advice for Indian Traders Considering Exness

Indian traders planning to use Exness should be mindful of a few key points to ensure a safe and effective trading experience:

Comply with Indian Regulations:Use the Liberalized Remittance Scheme (LRS) by the Reserve Bank of India (RBI) for transferring funds. Ensure all transactions are made through authorized banking channels.

Start Small:Begin with smaller trades to familiarize yourself with the platform. This approach helps reduce risk while you learn how Exness works.

Leverage Wisely:Exness offers flexible leverage, but use it cautiously. High leverage can amplify profits but also increase risks. Choose a level that matches your trading experience.

Understand the Risks:Forex and CFD trading is volatile. Always use risk management tools like stop loss and take profit to minimize potential losses.

Maintain Proper Records:Keep detailed records of your trades and transactions. This is essential for tax compliance and for tracking your trading performance.

Use Customer Support:Exness provides 24/7 support in multiple languages, including Hindi and Bengali. Reach out for help whenever needed to resolve issues or clarify questions.

Learn Continuously:Take advantage of Exness’ educational resources. Staying informed about market trends and trading strategies will help improve your success.

By keeping these points in mind, Indian traders can maximize the benefits of Exness while staying compliant with local laws and minimizing risks.

Frequently Asked Questions

Is it legal for Indian residents to trade with Exness?

Yes, Indian residents can legally trade with Exness as long as they follow Indian rules. This includes complying with the Liberalized Remittance Scheme (LRS) by the Reserve Bank of India (RBI), which allows fund transfers for trading with international brokers.

Can Indian users deposit and withdraw funds easily through the Exness app?

Yes, Indian traders can easily deposit and withdraw funds using the Exness app. The app supports several payment methods, making the process smooth and fast. However, users need to ensure they follow Indian regulations for foreign transactions.

What are the risks of using Exness Trade App in India?

The main risk is that Exness is not regulated by SEBI, which means Indian authorities may not offer support in case of disputes. Additionally, trading forex and CFDs is risky due to market volatility, which can lead to significant losses if not managed carefully. Always trade responsibly and understand the risks involved.

Does Exness provide support for Indian traders?

Yes, Exness offers 24/7 support for Indian traders. Whether you have questions about your account or face technical issues, the support team is always available to assist. Exness also provides useful educational materials to help traders improve their skills.

Does Exness offer customer service in Indian languages?

Yes, Exness provides customer service in Indian languages like Hindi and Bengali. This ensures that Indian traders can communicate easily and get the help they need in their preferred language. It makes the platform more accessible and user-friendly for local traders.