7 minute read

Is Exness Legal in UAE?

Exness is a well-known global broker that offers forex and CFD trading services. The legality of Exness in the UAE is a common concern among traders. While Exness is not directly regulated by the UAE’s local authorities, it operates legally through international licenses and offers services to UAE-based traders.

What is Exness?

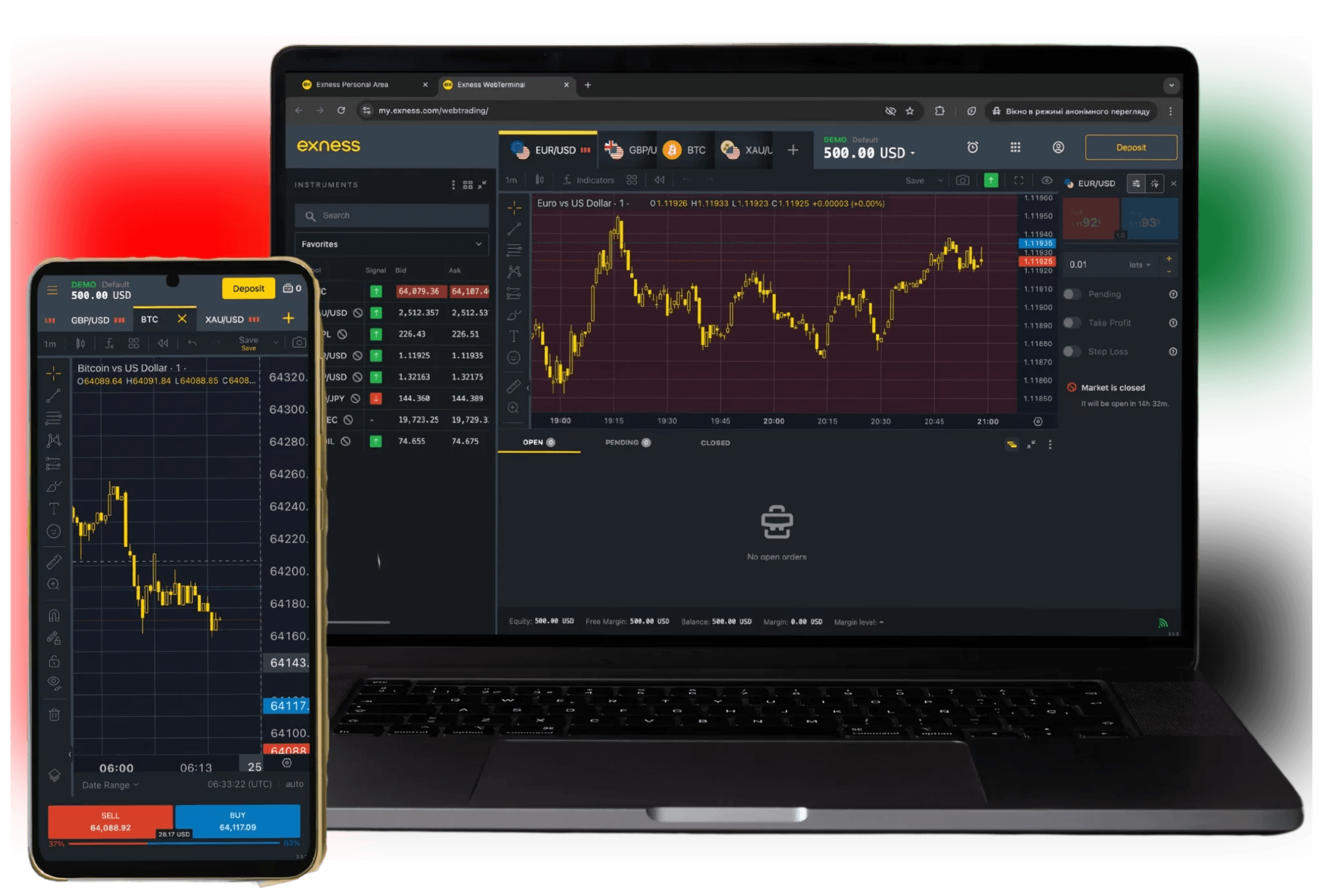

Exness is an international brokerage firm established in 2008, providing a platform for online trading in a variety of financial instruments, including forex, stocks, commodities, and indices. The company caters to both beginner and professional traders by offering a range of tools and services. Exness is known for its competitive spreads, robust trading platform, and high leverage options. The broker operates in over 180 countries and holds licenses from several leading regulatory bodies around the world, such as the FCA (UK), CySEC (Cyprus), and ASIC (Australia). It offers services that allow traders to access financial markets easily, using MetaTrader platforms and its proprietary platform, Exness Trader.

Regulatory Framework in the UAE

The UAE has strict rules for financial services to protect traders and ensure fair markets. Two main regulators oversee this: the Securities and Commodities Authority (SCA) for mainland UAE, and the Dubai Financial Services Authority (DFSA) for the DIFC. These bodies make sure companies follow laws that protect investors and ensure transparency.

For forex brokers to operate legally in the UAE, they must be licensed by one of these authorities. However, brokers regulated internationally, like Exness, can still offer their services to UAE traders as long as they follow global rules. Exness is not regulated by UAE authorities but complies with high international standards.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

The Legality of Exness in the UAE Market

Exness is legal for traders in the UAE. Although it isn’t regulated by UAE regulators, it holds licenses from trusted authorities like the FCA (UK), CySEC (Cyprus), and ASIC (Australia). This means Exness can legally offer services to traders in the UAE.

The UAE does not prohibit trading with foreign brokers, so UAE residents can use Exness. However, traders should make sure that their broker follows secure practices and global regulations. Exness also offers Islamic accounts that are Sharia-compliant, which is important for Muslim traders in the UAE.

Benefits of Trading with Exness in UAE

Trading with Exness in the UAE comes with several benefits:

1. Global Regulation

Exness is regulated by trusted international authorities like the FCA and CySEC, which helps ensure security and trustworthiness.

2. Wide Range of Assets

Exness offers many types of assets for trading, including forex, commodities, cryptocurrencies, stocks, and indices. This allows traders to diversify and find opportunities in different markets.

3. Low Trading Costs

Exness offers low spreads and competitive commission fees, which is beneficial for traders who want to keep their trading costs as low as possible.

4. Easy-to-Use Platforms

Exness provides popular platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its own Exness Trader. These platforms are user-friendly and come with powerful tools for analyzing markets and automating trades.

5. High Leverage

Exness offers high leverage, meaning traders can control bigger trades with less capital. However, it’s important to use leverage carefully, as it can increase both profits and risks.

6. Islamic Accounts

Exness offers Islamic accounts with no swap fees or interest, making them suitable for traders who follow Islamic finance principles.

7. 24/7 Customer Support

Exness offers customer support 24/7 in several languages, including Arabic, which is helpful for UAE traders who may need assistance at any time.

These benefits make Exness a strong option for traders in the UAE looking for a secure, flexible, and affordable trading experience.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Potential Risks of Using Exness in UAE

Although Exness offers many benefits, there are a few risks to consider:

1. No Local Regulation

Exness is not regulated by UAE authorities like the Securities and Commodities Authority (SCA). It is regulated by international bodies like the FCA and CySEC, which are reliable, but some traders may prefer brokers regulated within the UAE for added confidence.

2. Risk with Leverage

Exness offers high leverage, which can help amplify profits but also increase the risk of losses. Beginners, in particular, should be careful with leverage and understand how it works before using it.

3. Market Volatility

The forex and CFD markets can be very volatile, meaning prices can change quickly. Exness offers tools to help manage risk, but traders need to be prepared for sudden market movements that could lead to losses.

4. Currency Conversion Fees

Traders in the UAE might face fees when converting currencies or withdrawing funds. It’s important to check these fees before making transactions to avoid unexpected costs.

5. Regulatory Changes

The UAE could introduce new regulations that might affect how international brokers like Exness operate. While this is unlikely to happen suddenly, it’s something traders should be aware of.

Customer Support Efficiency Exness in UAE

Exness provides good customer support, which is important for UAE traders who need help.

1. 24/7 Support

Exness offers customer support 24/7, meaning you can get help whenever you need it, regardless of the time.

2. Arabic Support

Exness offers customer support in Arabic, which is useful for traders in the UAE who prefer to speak in their native language.

3. Multiple Ways to Contact

Exness provides several ways to reach support, including live chat, email, and phone. Live chat is great for quick answers, while email and phone support can help with more detailed issues.

4. Helpful Resources

Exness has a help center with articles and guides that can answer common questions and solve problems without needing to contact support.

5. Fast Response Times

Exness is known for quick response times, so you won’t have to wait long to get help when you need it.

Conclusion

Exness is a reliable broker for UAE traders, offering good trading conditions, a variety of assets, and strong customer support. Although it is not regulated by UAE authorities, it is licensed by trusted international bodies like the FCA and CySEC, which ensures safety and trust.

However, traders should be aware of some risks, such as the lack of local regulation, the potential for high leverage losses, and market volatility. With proper risk management, Exness can be a good choice for traders in the UAE who want to access global markets.

FAQs

Is Exness licensed in the UAE?

No, Exness is not licensed by the UAE’s local regulators like the Securities and Commodities Authority (SCA). However, Exness is regulated by well-known international authorities, such as the FCA in the UK and CySEC in Cyprus, ensuring that it meets global standards for safety and reliability.

Can I legally use Exness in the UAE?

Yes, it is legal to use Exness in the UAE. While Exness is not regulated by UAE authorities, there are no laws preventing traders in the UAE from using international brokers like Exness. As long as the broker is regulated by trusted global authorities, you can trade legally with Exness.

What are the benefits of trading with a regulated broker in the UAE?

Trading with a regulated broker in the UAE offers safety for your funds, as regulated brokers must follow strict rules. They also provide transparency, making sure fees and conditions are clear. If any issues arise, you can rely on the regulator to help resolve them. Additionally, regulated brokers follow fair trading practices, which protects you from fraud or unfair actions.

Are there any restrictions on trading forex in the UAE?

Forex trading is allowed in the UAE. However, Muslim traders may need to use Islamic accounts, which are designed to comply with Sharia law. While there are no other restrictions, it’s important to choose a broker that follows global regulations for a safe trading experience.