6 minute read

Exness Unlimited Leverage: How Does It Work?

Exness unlimited leverage is an exciting concept for traders, offering the potential to control much larger positions with a relatively small amount of capital. This powerful tool can amplify both profits and risks, making it crucial for traders to fully understand how it works and how to use it responsibly. In this article, we’ll explore what unlimited leverage is and how it functions within platforms like Exness.

What is Unlimited Leverage?

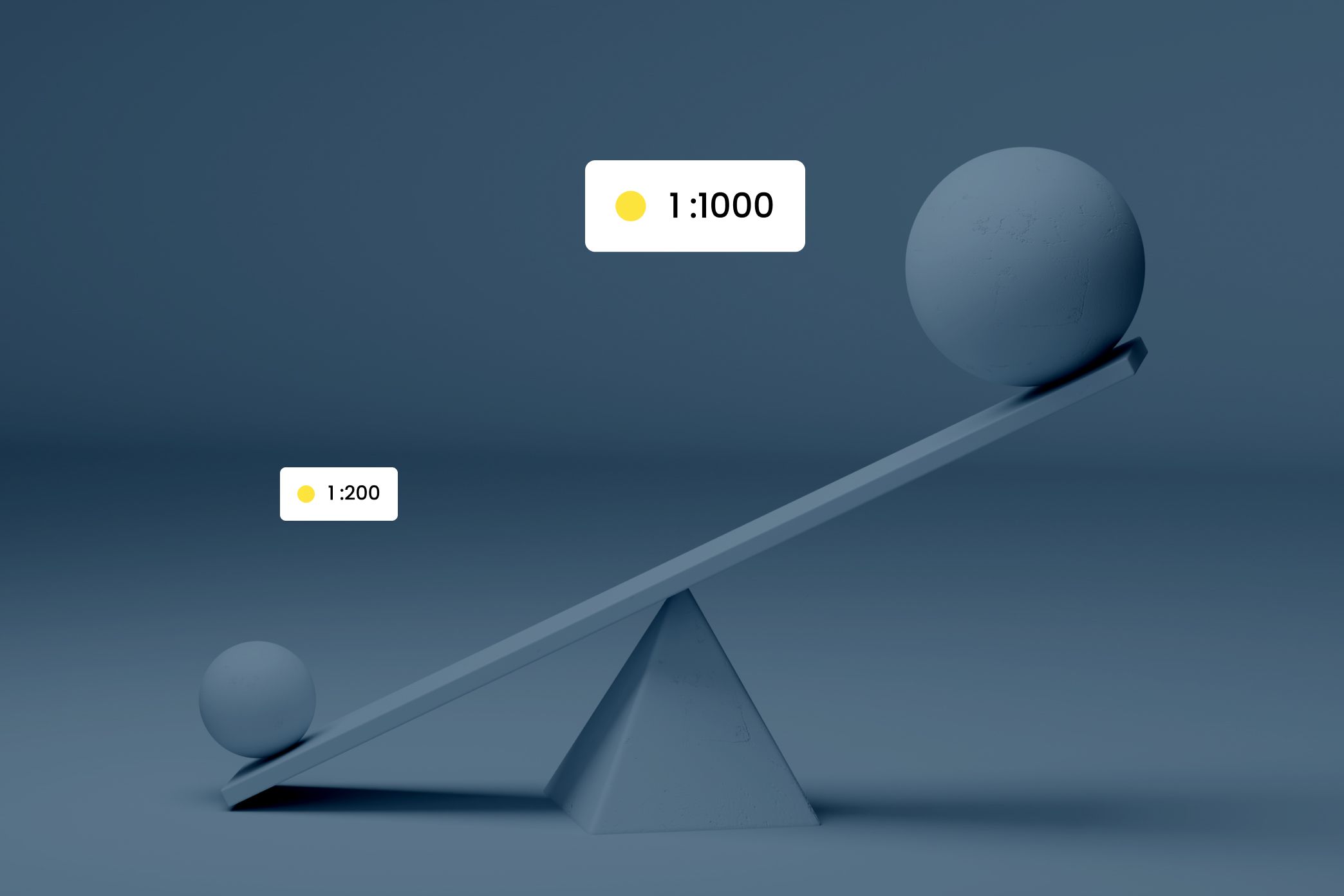

Unlimited leverage means you can trade positions much larger than your initial deposit, without a specific maximum limit imposed by the broker. Unlike traditional leverage, where a ratio like 1:100 or 1:200 limits how much you can borrow, unlimited leverage allows you to open positions beyond typical restrictions, giving you the freedom to potentially gain more from smaller market movements.

For example, with unlimited leverage, if you deposit $100, you could open trades worth hundreds or even thousands of dollars. However, while this offers great opportunities for profit, it also comes with increased risk. It’s essential to use unlimited leverage wisely, as even small market shifts can result in significant losses.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

How Does Unlimited Leverage Work?

Unlimited leverage allows you to trade with a larger position than the money you initially deposit. For example, if you deposit $100, you could open trades worth $1,000 or more. This is possible because the broker lends you extra capital to control a larger trade.

While this can lead to bigger profits if the market moves in your favor, it also increases risk. A small price change in the wrong direction can result in large losses, potentially wiping out your entire deposit.

Who Should Use Exness Unlimited Leverage?

Exness unlimited leverage is best suited for experienced traders who understand how leverage works and how to manage the risks. If you are new to trading, it’s better to start with lower leverage until you gain more experience.

Here are the types of traders who should consider using unlimited leverage:

Experienced Traders – Traders who know how to handle large positions and understand the risks of leverage.

Scalpers – Traders who aim to make small profits from quick trades might benefit from the extra flexibility.

Risk-Conscious Traders – Traders who have strong risk management strategies, such as using stop-loss orders to limit losses.

Professional Traders – Those who trade larger amounts of money and are comfortable with the risk of using high leverage.

If you're new to trading or still learning the basics, unlimited leverage may not be the right choice, as it increases the risk of significant losses.

Setting Up Your Exness Account for Unlimited Leverage

Setting up your Exness account to use unlimited leverage is simple. Here’s how to do it:

Step 1: Sign Up for an Exness Account

First, create an account with Exness. Provide your personal details and complete the verification process.

Step 2: Deposit Funds

Next, deposit money into your Exness account. The more you deposit, the larger the positions you can open using unlimited leverage.

Step 3: Enable Unlimited Leverage

Once your account is set up and funded, you can request unlimited leverage. This may require you to contact Exness customer support to enable the feature on your account.

Step 4: Choose the Right Account Type

Exness offers different account types. Some accounts allow unlimited leverage, so choose one that suits your trading style and goals.

Step 5: Set Up Risk Management

Before you start trading, it’s important to set up risk management tools, like stop-loss orders. This helps protect you from large, unexpected losses.

Once you’ve completed these steps, you’ll be ready to use unlimited leverage and start trading with larger positions. Just remember that the higher the leverage, the higher the risk, so always trade carefully.

🏆 Start Trading With Exness – Register Now! 🚀 or Visit the Broker’s Website ⭐

Pros and Cons of Exness Unlimited Leverage

Unlimited leverage has both advantages and disadvantages. Here’s a simple breakdown:

Pros:

More Trading PowerUnlimited leverage lets you trade larger positions with a smaller deposit. This can help you earn more from small market moves.

More FlexibilityYou can open bigger trades without limits, which gives you more freedom to manage your positions.

Benefit from Small Market MovesTraders who make quick, short-term trades (like scalpers) can benefit from unlimited leverage by amplifying their profits from small price changes.

Access to More MarketsWith larger positions, you can trade a wider range of assets, even those that might require more capital.

Cons:

Higher Risk of LossThe major downside is that unlimited leverage increases risk. A small price move in the wrong direction can lead to big losses.

Needs Good Risk ManagementTo protect yourself, you need solid risk management strategies, like using stop-loss orders, to limit your losses.

Not Ideal for BeginnersBeginners may find unlimited leverage too risky, as it can quickly lead to large losses if not used properly.

Margin CallsIf the market moves against your trade, you may face a margin call, which means you’ll have to add more funds to your account or close your position.

Conclusion: Is Exness Unlimited Leverage Right for You?

Exness unlimited leverage can be useful for experienced traders who know how to manage risk. It gives you the ability to trade large positions and potentially earn more. But it also comes with higher risk.

If you're a beginner or not confident in your risk management skills, it’s better to start with lower leverage. Unlimited leverage can lead to significant losses if the market moves against you, so it’s important to be cautious and understand the risks.

Frequently Asked Questions (FAQs) about Exness Unlimited Leverage

What account types at Exness offer Unlimited Leverage?

Unlimited leverage is available on Pro and Raw Spread accounts at Exness. These accounts offer higher leverage but also come with more risk. You’ll need to verify your account and deposit funds to access unlimited leverage.

Can beginners use Exness Unlimited Leverage?

It’s not recommended for beginners. Unlimited leverage is risky, and without experience, it’s easy to lose more money than you expect. Beginners should start with lower leverage or practice with a demo account first.

Is there a maximum leverage limit on certain instruments?

Yes, some instruments have a leverage limit. For example, cryptocurrencies or volatile assets may have lower leverage limits due to their high risk. Always check the leverage limits for each asset before trading.

What are the risks of using Unlimited Leverage?

The biggest risk is losing more than your initial deposit. Unlimited leverage amplifies both profits and losses, so a small move in the wrong direction can result in big losses. Strong risk management, like using stop-loss orders, is essential to protect your funds.