27 minute read

Forecast 2021—Return to Normalcy

By Phillip M. Perry

“Businesses can look forward to an increasingly favorable operating environment in 2021 as the economy gradually rebounds from the effects of the Covid-19 pandemic. A robust housing market should help generate activity in many business sectors, while higher corporate profits should fuel a gradual return to more aggressive capital investments. The arrival of a Covid-19 vaccine, anticipated to be widely available by the middle of the year, should invigorate consumer and business confidence, and elevate employment levels.”

Relief is in sight. Battered by the pandemic and scrambling to shore up finances, businesses can look forward to an easing of the pain over the next 12 months. Economists anticipate a gradual but noticeable recovery fueled by a surge in corporate profits, a strong housing market, and the successful roll out of a vaccine.

“The Covid-19 recession is over, and the economy is currently in an early-cycle expansion,” says Sophia Koropeckyj, Managing Director of Industry Economics at Moody’s Analytics, a research firm based in West Chester, PA (economy.com).

The healthier the economy, the better for business profits. And Moody’s expects the nation’s Gross Domestic Product (GDP) to increase at a 4 percent clip for 2021. That’s a welcome rebound from the previous year’s decline, expected to come in at 4 percent when figures are finally tallied. (The GDP, the total of the nation’s goods and services, is the most commonly accepted measure of economic growth.)

The Joe Biden presidential win should support an economic rebound in three areas. “Biden has proposed significantly more fiscal stimulus, which will pack a punch in the coming year as aggregate demand is still recovering from the pandemic,” says Koropeckyj. “Second, Biden would [likely] not resume Trump’s tariff wars with China, which have acted as a tax increase for consumers. Finally, Biden will liberalize international immigration, which will boost the supply of labor and in turn the economy’s potential.”

Faster economic growth, says Moody’s, should in turn help boost corporate profits by an expected 17.1 percent in 2021—a dramatic turnaround from the 13.8 percent decline of the past 12 months, and reason for optimism about a return to the aggressive capital expenditures so critical to an economic rebound.

Slow and steady

For most businesses, the return to normal should be gradual. During the first half of 2021 households will continue to self-quarantine as a wave of bankruptcies boosts the number of permanent job losses. By summer, says Koropeckyj, things should look different. “The economy will regain its stride in the second half of the year, when a vaccine or treatment is assumed to be widely available.”

Business owners seem to share Moody’s optimistic mindset. “Even though there's still a lot of uncertainty out there, many companies have a positive outlook,” says Tom Palisin, Executive Director of The Manufacturers' Association, a York, PA-based regional employers' group with more than 370 member companies (mascpa.org).

“Maybe they're being overly confident, but our members seem to feel that in six months’ time things will have turned around significantly.”

With its diverse membership in food processing, defense, fabrication, and machinery building, the Pennsylvania trade group can be viewed as a proxy for American industry. The organization’s members are reporting results that seem to position the tail end of 2020 as something of a springboard for future months. “Conditions for our members have improved, with increasing revenues, since the April and May timeframe,” reports Palisin.

Springboard or not, it’s a sure bet that few businesses will regret seeing 2020 in their rear-view mirrors. “It's been a rough year for many manufacturers,” says Palisin. “We're looking at pretty significant revenue declines of 30 percent to 40 percent through much of the year for many of our members, who have had to do furloughs and layoffs to maintain operations while dealing with supply chain problems.”

Palisin acknowledges that for many operations the road ahead will be rocky. That’s especially true for those with limited resources. “Smaller companies aren't as well equipped as far as financing and cash flows to weather an economic downturn,” says Palisin. “Things have been significantly tougher for them.”

Housing Surges

An important driver for the economy at large, residential construction is doing extremely well and promises more good news in 2021. “Housing demand has bounced back thanks to very low mortgage rates and the release of pent-up demand,” says Koropeckyj, who points to healthy builder confidence as the nation enters the new year.

The road ahead looks sunny indeed: “We forecast housing starts will surge by 16.8 percent in 2021, after slowing to a 2.9 percent rate in 2020 due to the initial impact lockdown orders had on construction,” says Koropeckyj. The comparable 2019 figure was a positive 3.8 percent.

Median prices for existing homes are also increasing at a healthy rate, expected to top 7.6 percent when 2020 figures are finally tallied, which would surpass the 5 percent increase of the previous year. One key reason: tight supply. “Housing has been a seller’s market with low inventory levels as homeowners have been reluctant to offer their residences up for sale for fear of contracting the coronavirus,” says Koropeckyj.

The industry itself has engaged in practices that have contributed to its success. “Real estate professionals have done a great job adapting to social distancing, and enabling the buying and selling of homes, appraisals, title insurance policies, and closings at the same pace as before the pandemic,” says Bill Conerly, principal of his own consulting firm in Lake Oswego, Oregon (conerlyconsulting. com). “With the shift to suburban living, more new homes will be built.”

Despite its recent success, the housing industry faces its own headwinds. “We expect prices to fall by 0.3 percent in 2021 as foreclosures mount due to an unwinding of forbearance measures by the federal government and private lenders,” says Koropeckyj. “According to the latest Senior Loan Officer Opinion Survey, banks have tightened standards across all sorts of mortgage products.”

And the housing sector faces other issues that will sound familiar to anyone who has watched the industry over the past several years. “Construction costs are rising quickly, and builders are still grumbling about the inability to find buildable lots and skilled labor,” says Koropeckyj.

As for construction of non-residential buildings, the bag is equally mixed. “Although office and retail construction will be soft in the near future, they account for less than one-fourth of private nonresidential construction,” says Conerly. “The big categories of power production, manufacturing, health care and warehouses should do fine in the transition to post-Covid business.”

Strong Retailers

Retailing tends to reflect and invigorate the nation’s economy, and this is a sector that has registered notable gains that promise to continue. “Our current 2021 forecast is for 6.2 percent growth in core retail sales,” says Scott Hoyt, Senior Director of Consumer Economics for Moody’s Analytics. That forecast represents a substantial improvement over 2020, when the 2.1 percent increase expected when numbers are finalized represented a deceleration from the 3.9 percent growth clocked in 2019. (Core retail sales exclude the volatile auto and gasoline segments.)

The positive growth rate for retailers in 2020 has come about as consumers have rechanneled their purchasing away from services and toward merchandise. “While consumer spending has been hammered pretty badly, retailers have not been hit nearly as hard as service businesses,” says Hoyt. Moody’s forecasts a decline of 5.2

percent in services spending when 2020 numbers are in—a stark reversal from the 4.3 percent gain in 2019. “Because of people's hesitancy to travel, to go to entertainment facilities, and to do things with other people, to a certain degree they're replacing such activities with buying goods.”

The positive retail reports will come as a surprise to anyone who has encountered the long rows of shuttered storefronts in America’s cities and towns. Two reasons account for the disparity. The first is the increasing purchase of merchandise through digital channels—a long-term trend that has only been exacerbated by the stay-at-home nature of the pandemic. The second is that consumers have become highly selective, abandoning many merchandise categories in favor of a select few that are either essential to living, or which enhance the enjoyment of pandemic-enforced leisure time. Both trends have merged to create a retail environment that favors some sectors and decimates others.

Capital Investment

Despite the strength of housing and retailing, the economy will face headwinds in 2021. Not least among them is the sluggish state of capital investment. Corporate decision-makers, faced with uncertainty, are reacting in a predictable way: keeping their powder dry. By the end of 2020 total real fixed investment had fallen by 27 percent annualized, according to Moody’s Analytics. “In uncertain times, investors hold onto cash and delay investments,” says John Manzella, a consultant on global business and economic trends, Amherst, NY (JohnManzella.com). “This undoubtedly puts downward pressure on economic growth. As a result, uncertainty has become the enemy of prosperity.”

More robust investments in commercial buildings and machinery are not expected to arrive any time soon. “Low capacity utilization and still-high uncertainty will make expansion decisions difficult, though the declining cost of corporate borrowing will provide some offset,” says Koropeckyj. “Major segments of investment will be weak, with transportation equipment and structures especially hard-hit.” Structures investment is expected to decline by more than 12.3 percent in the months ahead, led by the collapse in retail and reduced demand for office space.

Bank loan availability poses one barrier to a rapid return of capital investment. “While interest rates are low, many companies have taken financial hits that can affect their ability to qualify for loans,” says Palisin. “With corporate financials changed so drastically from the prior year, there is some tightening of access by lending institutions.”

Moody’s identifies technology as one bright spot in an otherwise shadowed capital investment picture. Palisin concurs with the observation, reporting an increase in spending by his members to boost efficiencies. “The pandemic will probably accelerate the trend toward more

Consumer Confidence

Spending by consumers accounts for some 70 percent of economic activity and is arguably even more important than capital investment for the nation’s overall business health. Household spending, though, is driven by public psychology, and the most recent reports from Moody’s Analytics show that the nation has a lot of catching up to do: By late 2020 consumer confidence was running as low as it was in March and April during the worst early days of the pandemic.

If uncertainty about the course of the pandemic and the availability of a reliable vaccine are reason enough for high anxiety, there’s a more immediate driver of consumer discontent: the noticeable drop in take-home pay over the past year. “Wage and salary income, including the value of benefits, is forecast to decline 1.3 percent when 2020 numbers are finalized,” says Hoyt. Those numbers represent a reversal in fortune from the 4.4 percent increase of 2019. (Wage and salary income figures exclude government payments such as the 2020 pandemic relief checks).

Pandemic-related furloughs and business closings accounted for a major portion of wage declines. Moody’s expects the unemployment figure to come in around 8.5 percent when 2020 numbers are finally tallied. That’s a sharp increase from the robust 3.5 percent level consumers were enjoying as recently as last February. Consumers might improve their outlook if the unemployment picture were brightening. Yet the expectations here are, once again, for only gradual improvement. The unemployment rate is expected to decline to 7.8 percent by the end of 2021. “The labor market will not recover all Covid-19-related job losses until the second half of 2023,” says Koropeckyj.

A brightening jobs picture should translate directly into a boost in take home pay. Moody’s anticipates 2021 wage increases to come to 2.5 percent—a level high enough to allow shoppers to exhale but too low to spark rapid spending. Hoyt’s expectations for improvements in the public psychology are suitably conditional: “We are assuming a slight upward trend in consumer confidence until we get a vaccine or an effective treatment, at which point it will probably move up faster.”

Tight Labor

Conditions in the labor market are also preventing a faster recovery. Not only is the unemployment level high, but employers are not finding the job applicants they need. “Companies are having problems recruiting and getting folks to apply for work,” says Palisin. “Some things going on in the labor market are probably contributing to that. First, the portion of the workforce still on furlough will probably not take another job but will return to the one they were furloughed from. Second, there are childcare issues as students go back to school online and it’s difficult for those people to get back into the labor pool. Finally, there is some level of health concern by employees going back into the workplace, especially if they are older workers or higher risk people.”

While the future of the labor market remains unsettled, the opening months of 2021 might provide clues as to whether hiring difficulties will continue. “Perhaps as we get into the new year people will start to feel more comfortable returning to the workforce, the childcare issues may be resolved, and a vaccine will be developed,” says Palisin. “But right now, there seems to be a lot of hesitancy in the labor pool. People are sitting on the sidelines to see what is going to happen.” Competition for quality workers makes the hiring process all the more difficult. “Some sectors of the manufacturing economy, such as the food and automobile industries, are hiring quite a bit,” says Palisin. “And sectors such as construction and healthcare are competing with manufacturers for workers.”

When the labor market gets tight, upward wage pressurecan’t be far behind. “To remain competitive companies are restructuring their compensation packages to retain higher-end skilled workers,” says Palisin. “Retirements by the baby boomers and a decline in immigration are also putting higher pressure on wages.” Companies aren’t likely to take a wait and see attitude while the best people go elsewhere, he adds. “Even during this period, talent is one of the top, if not the top, factor to keep a company growing.”

New Deal

In the opening months of 2021, some key indicators should offer clues to how the year will turn out. Palisin feels the level of durable goods orders may signal the economy’s trajectory, as will the level of capital expenditures. “Businesses will be looking for increased certainty on matters such as market stabilization, the ability to hire, access to a qualified labor pools, and workplace safety protocols,” he says. “It would be good to have some kind of resolution around trade issues as well. All of those concerns will be front-burner ones.”

As for the view at Moody’s Analytics, Koropeckyj looks to consumer sentiment levels in early 2021 for insight into how freely shoppers will spend the rest of the year. “We will also look closely at the number of business bankruptcies,” she says. “And the core unemployment rate, which excludes temporary layoffs, will gauge how much joblessness is attributable to permanent layoffs which leave behind long-lasting scars on the labor market.”

But perhaps the best economic indicator of all will be the rate of progress toward a cure for the not-so-hidden elephant in the room: the pandemic. “Businesses will be concerned about the timeline of a vaccine,” says Koropeckyj. “The path towards some semblance of economic normality hinges upon its development and widespread distribution.”

On the Ag Side

The Turf News editors share highlights from the Ag Industry forecasts they have been monitoring. On December 4, 2020, in www.thedailyscoop.com, Margy Eckelkamp highlighted key points made by industry panelists during a session at the 2020 Agricultural Retailers Association (ARA) Conference & Expo, that “shed light on the horizon for what’s to come after the 2020 election.”

As she reported, in Biden’s first 100 days, the ag market “… can expect Biden to fill his cabinet, address the Covid-19 pandemic, reverse Trump’s administrative policies (including many executive orders), and set forth the administration’s legislative priorities.

“As ARA’s Richard Gupton explains, after such a close election, there are many areas to watch. One of which would be the runoff for the Senate seats in Georgia.” The ability of the Biden administration to move their initiatives forward effectively hinges on that outcome.

She noted four key issues reported by Scott Rawlins of Wilbur-Ellis: “Waters of the U.S. returns in some fashion no matter what. We can expect TPP [the TransPacific Partnership] to come back. And a slogan everyone should get used to hearing is ‘environmental justice.’ For the 2022 Farm Bill, watch for nutrition programs and green payments.”

Eckelkamp closed her article with this. “Rawlins and Gupton see two of the biggest vulnerabilities for the industry under the jurisdiction of the Biden EPA: climate change and FIFRA. Another issue the panelists raise is ag retail should expect a more active regulatory approach. As Rawlins explains, the Trump administration gave a four-year pause in how regulatory agencies had typically operated, but the industry should prepare to quickly reenter a phase of inspections and fines to bring compliance.”

And, in the broader business perspective, as most expert agricultural forecasters are reporting, investments in Ag Tech will grow in 2021 and beyond, especially in the areas of precision farming and high-speed, reliable internet access.

Supply Chain Woes

Businesses are facing a familiar challenge carried over from the pre-pandemic world: supply chain fragility. “Trade disputes are still a problem that has not been resolved,” says Tom Palisin, Executive Director of The Manufacturers' Association, a York, PA-based regional employers' group with more than 370 member companies (mascpa.org). “The hope is that there’s some kind of trade deal with China. Higher tariffs don’t help in the middle of an economic slowdown.”

The pandemic has made the situation more severe. “In the worst of the Covid-19 lockdown nothing was coming out of China,” says Bill Conerly, Principal of his own consulting firm in Lake Oswego, Oregon (conerlyconsulting.com). “That only exacerbated the problem of time lags for foreignsourced goods.” So far, he adds, few companies seem to be making radical shifts in their sourcing, due to a natural hesitancy to change suppliers. But there is growing pressure to obtain materials not only from domestic suppliers but also from multiple factories.

Another effect of recent supply disruptions may be the building of inventories to higher levels. “Companies should no longer rely on just-in-time inventory strategies, which too often have become just-too-late failures, and stockpile more supplies both in the United States and abroad,” says John Manzella, a consultant on global business and economic trends, Amherst, NY (JohnManzella.com). “This approach reduces efficiencies but favors risk reduction.”

Bio: Phillip M. Perry is an award winning business journalist with over 20 years of experience under his belt. A three time recipient of the American Bar Association's "Edge Award" for editorial achievement, Perry freelances out of his New York City office. His byline has e has appeared over 3,000 times in the nation’s business press and he maintains a website at www.editorialcalendar.net.

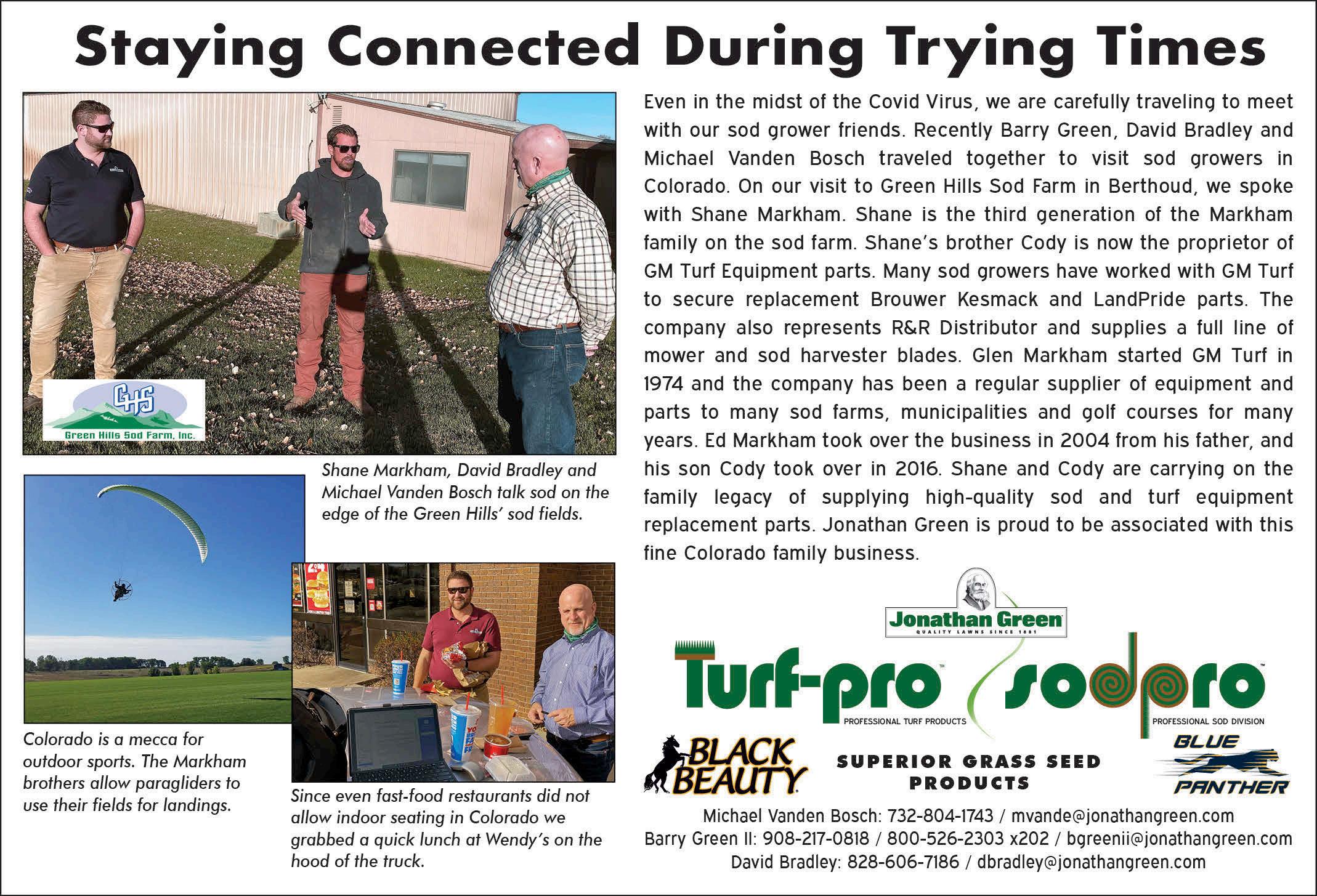

PASSIONATE CANADIAN SOD PRODUCER,

By Marie-Claude Darveau and Michele de Repentigny

Editors’ Note: This is the ninth in a series of articles showcasing TPI member businesses whose operations are growing through a combination of innovation, utilization of technology, and outreach to upcoming generations, internally and externally. If you have a story to tell or know of someone that you’d like to hear more about, please contact your editors.

Turfgrass Producers International (TPI) is an association of family businesses; each based on the dream of the founders and built on their vision for the future. Their commitment to achieving their goals took continual improvement accomplished through a combination of dedication and innovation. That laid the groundwork for the next generation and created the opportunity to grow the company by working together.

Here, Marie-Claude Darveau, company Agronomist and Sod Farm Manager, and Michele de Repentigny, company marketing specialist, tell the Groupe Richer story.

Groupe Richer has Cultivated Passion from Generation to Generation

Founder Jean-Guy Richer began his career in commercial hay production. In 1962, he acquired land and started growing grass, and Groupe Richer’s adventure kicked off under the name of Gazons Fairlawn. A turfgrass cultivation pioneer across the province of Quebec in Canada, Jean-Guy Richer continued to cultivate his passion.

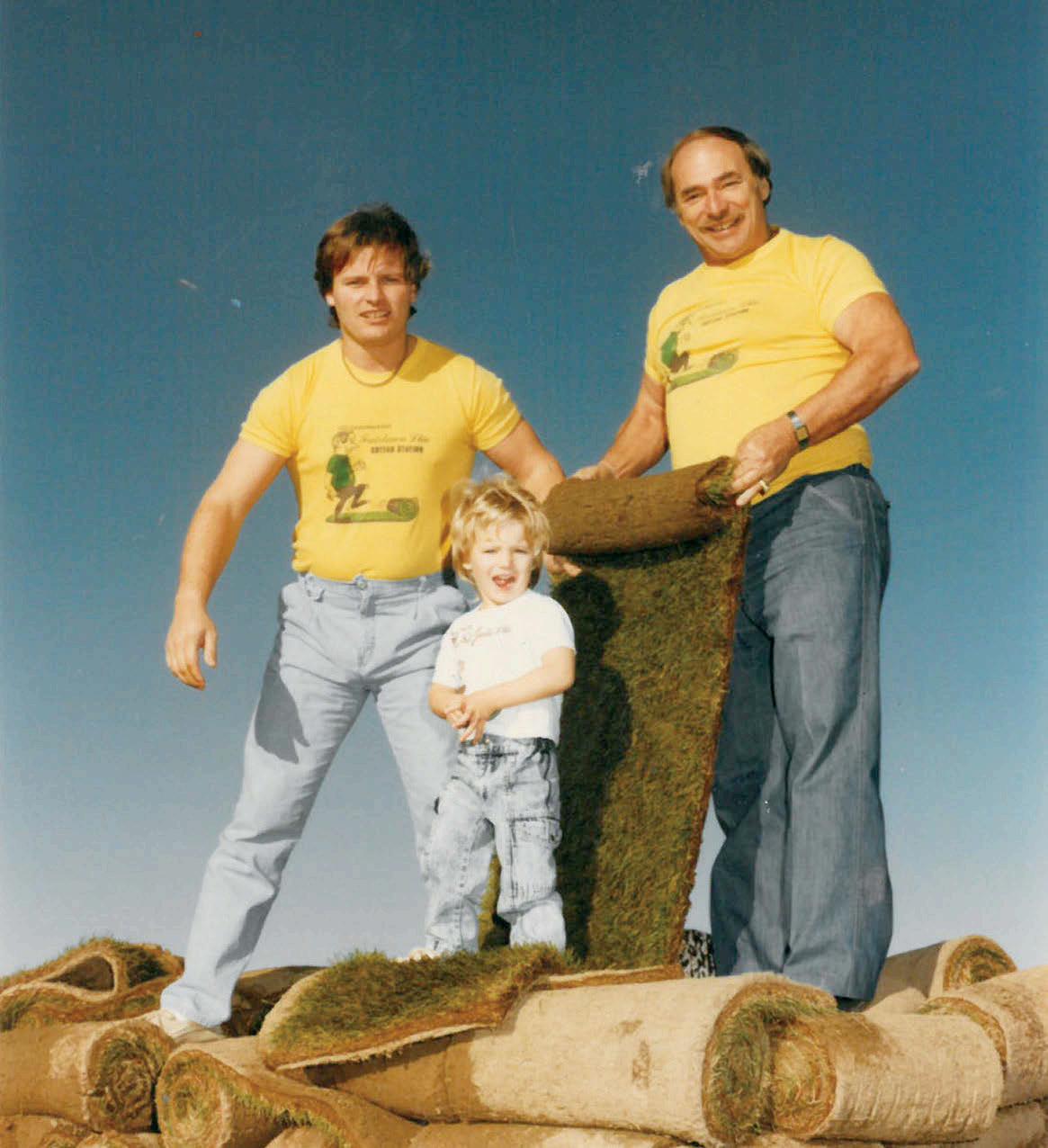

Manual production in the field in 1969 using the well-known Ryan sod-cutter. This 1988 photo shows three generations, Company Founder Jean-Guy Richer, holding the roll of sod; his son, Robert Richer; on the left, and his grandson, Julien Richer, in the center.

In the 1980s, his son Robert took over the reins as President, and the company began to experience dramatic growth. He took part in various research projects, made multiple acquisitions, and diversified the company, notably through the addition of landscaping product lines that would later lead Groupe Richer to become Quebec’s largest paving stone distributor.

A Family Business That Has Been Setting Itself Apart for Nearly 60 Years

Both father and son left a strong legacy through their contribution to Quebec’s first turf research centre and as official suppliers for the 1967 World's Fair (Expo 67) and the 1976 Olympic Games, both held in Montreal.

In the 1990s and 2000s, the family-run business excelled when it came to proactivity, acquiring innovative, cuttingedge equipment; implementing sustainable agricultural practices; and hiring an agronomist, among other things.

Six harvesters in action in July 1988. Rolls then were 9 square feet; today they are 10 square feet, much easier for coverage calculations

A Third Generation Looks Ahead to a Sustainable Future

The arrival of Groupe Richer’s third generation in the 2000s continued to build on Groupe Richer’s momentum. Julien, as General Manager, and Gabriel, as Operations Manager, coordinated the company’s operations and focused their efforts on development while also remaining active in the field. Today, they ensure the family business’ continuity with a shared creative vision and contagious dynamism.

These two enthusiasts have one goal in mind: to pass on fertile land to the next generation through sustainable practices, thereby also passing on strong entrepreneurial values.

A Solid, Ambitious Company Ready to Face Any Challenge

Through the years, Groupe Richer acquired sod farms and land and became Quebec’s largest producer, with more than 3,000 acres under its management. More recently, growth has continued with one acquisition per year over the last five years. Other acquisitions and expansion projects are being considered for the coming years. Currently, Groupe Richer produces eleven distinct varieties of turfgrass on five different farms. With its numerous branch offices and sod farms, the company can deliver sod anywhere in Quebec.

Julien Richer (left) is now General Manager and Gabriel Richer (right) is Operations Manager.

Groupe Richer Locations Les Coteaux (branch and sod farm) Terrebonne (branch) Montreal (Dorval) (branch) Trois-Rivieres (branch and sod farm) Sainte-Julie (branch and sod farm) Lacolle (sod farm) South Shore of Montreal, Mercier (branch) Victoriaville (sod farm)

The extended Groupe Richer family consists of over 150 employees during the peak season. While the farms can count on 75 workers from Mexico or Guatemala, in addition to the loyal employees who have been working there for ten, twenty, thirty or even forty years, recruitment and human resources management remain a significant challenge in all the company’s departments. Moreover, Groupe Richer operates its own fleet of over 30 transport trucks; given exploding transport costs and increasingly strict control of driving hours, transportation is a mounting challenge. Otherwise, the company has also invested in promoting the benefits of turf, commercializing many varieties, and marketing. The company is proud to be the first in Quebec to sell sod online through its cutting-edge website, groupericher.com.

Increasingly, the company faces new challenges. At the operational level, it has had to adapt to global warming and find solutions to overcome new realities, such as more frequent droughts and heatwaves. The Groupe Richer team has also recently acquired new irrigation equipment.

At the marketing level, Groupe Richer must invest more and more effort in promoting sod to counter other methods such as hydroseeding, seeding, or artificial turf use, which might otherwise snap up a larger share of the market.

The challenges are many; transferring the farm to the next generation is one of them!

A Clear Vision: Partnerships are the Key to Groupe Richer's Success

Groupe Richer partners with landscapers all over Quebec. Over the years, the company has diversified and become a one-stop-shop for landscapers, so that they source sod, pavers, and other landscaping products through a single distributor. At the end of the 1990s, the company began offering a new service: sod installation. Today, six teams install sod full-time for landscaping clients. Groupe Richer's approach is to be involved at every stage of the process to provide unparalleled service and guarantee a top-notch customer experience.

Like in many other places around the world, people in Quebec are increasingly aware of climate change and the need for environmental protection. In 2003, a new provincial law prohibiting many pesticides for aesthetic purposes shook the green space maintenance sector. Since then, some municipalities have even banned the use of synthetic fertilizers on their territory in addition to having banned all pesticides.

This new reality only confirmed the thinking and initiatives of Groupe Richer, and the third generation has begun to offer more eco-friendly products. While virtually all of Quebec's turfgrass production was 100 percent Kentucky Bluegrass in the early 2000s, low-maintenance blends that include Kentucky Bluegrass, Creeping Red Fescue, Chewing Fescue, and Hard Fescue appeared in Groupe Richer's production farms in 2012. A few years later, a Microclover®-boosted low-maintenance turf was introduced under the name Eco-Turf.

Although drought is less of an issue in Quebec than in many other regions in the world, the use of Turfgrass Water Conservation Alliance (TWCA) and/or Alliance for Low Input Sustainable Turf (A-LIST) certified cultivars in all Gazon Richer's products gives Groupe Richer the advantage when it comes to production. This also allows the company to promote turf that will stay green longer, even without an irrigation system, when droughts hit. In fact, even though Quebec has been experiencing particularly dry summers for the past few years, rainfall generally meets 90 percent of the plant's water needs, and the population at large increasingly understands and accepts the dormancy phenomenon. Slowly but surely, the company feels that consumers who used to insist on having a very dark and perfectly uniform green lawn, mowed to a height less than one inch, are making way for more environmentally conscious consumers who are willing to adapt their maintenance practices and don’t want to spend entire weekends tending their lawns.

Educating cities, landscape architects, landscapers, and consumers to encourage them to adopt sustainable practices is part of Groupe Richer's mission. TWCA and A-LIST drought tolerance certifications, biodiversified lawns, the use of endophytic species, higher mowing heights (3-4 inches), grasscycling, applying a quality topsoil and insuring no compaction at the time of installation are just a few things Groupe Richer promotes

to encourage people to adopt best practices and obtain a more sustainable lawn that’s also more resistant to climate change.

The logical next step for Gabriel and Julien was to ask themselves whether producing turf organically was possible. But the big question was, would the consumer be willing to pay for organic sod that would likely have “imperfections?” The game was afoot!

Groupe Richer Launches 100 Percent Organic Sod

After several years of trial and error, Groupe Richer’s first organically grown sod was launched in September 2020. Two organic varieties are available, a low-maintenance turf consisting of Kentucky Bluegrass, Creeping Red Fescue, Chewing Fescue, and Hard Fescue; and a biodiversity turf grown in an old elk pasture, which includes pasture grass species and native plants and wildflowers.

Groupe Richer promotes its various sod varieties under its own Économie d’eau (Water Saver) brand, which means that the cultivars used are TWCA and/or A-LIST certified and will stay green longer during dry periods, as shown in this image of a regular Kentucky field (left) and an Eco-Turf field (« Économie d’eau (Water Saver) » certified low-maintenance Microclover boosted turf) (right). Organic agricultural management prohibits the use of pesticides and chemical fertilizers for a minimum of three years on all the parcels of land used. Moreover, soil conservation and regeneration practices are used. The experience acquired with its organic turf adventure has also helped Groupe Richer refine its sustainable agriculture practices on all its acreage.

Sustainable Agricultural Practices

Marie-Claude Darveau, Agronomist and Sod Farm Manager, says that, without a doubt, sustainable lawns impact our living environment in a positive way thanks to the plethora of systemic services their natural urban ecosystems provide. For instance, sustainable lawns cut down on heat islands, boost carbon capture and so much more. On the other hand, in addition to the changes to be made in lawn care, she stresses that changes to our agricultural practices are also needed since, at the global level, 10 percent to 12 percent of man-made greenhouse gases are produced by the agricultural sector (excluding gasoline use).

The non-profit organization Regeneration International lists several agricultural practices that regenerate soil health, biodiversity, and fertility while restoring climate stability through the soil's ability to store carbon by photosynthesis, which is a natural process. Actions that can be implemented by turfgrass producers include increasing biodiversity in mixes, selecting highperformance and more drought-resistant species and

Gazon Richer Biodiversity sod is grown in an old elk pasture. This organically managed field boasts rich microbial life and higher than average organic matter levels, making this turf exceptionally green 100 percent naturally. Gazon Richer BIO (Organic) sod: an organic, low-maintenance variety that includes Kentucky Bluegrass and Fine Fescue, certified Économie d’eau (Water Saver).

Gazon Richer BIODIVERSITY (Organic) sod: an organic variety grown in an old elk pasture that also includes pasture grass species as well as native plants and wildflowers.

cultivars, managing irrigation water in a smart way, reducing pesticides and using fertilizers judiciously (the right product at the right time in the right dose), importing compost, manure or sludge to increase organic matter in the soil and reduce the need for chemical fertilizers, planting windbreak hedges that can be used as wildlife corridors, rotating crops, planting cover crops and green manure, reducing tillage, and more. Technology and precision farming can also support more sustainable production and reduce reliance on chemical inputs.

Adding cultivated buckwheat as green manure to the soil and spreading compost, as shown here, before sowing are just a few examples of Groupe Richer’s sustainable agriculture agri-environmental practices. Richer's fourth generation inspires the company to continue to innovate and become greener.

Groupe Richer doesn't hesitate to think outside the box to find solutions to climate change rather than contributing to it! The fourth generation is keeping a keen eye on the company's actions. In a few years, the company’s managers will be proud to tell them about their pioneering role in marketing and promoting 100 percent organic turfgrass!

Marie-Claude Darveau, is Agronomist and Sod Farm Manager for Groupe Richer. Michele de Repentigny is a marketing specialist for Groupe Richer. All photos courtesy of Groupe Richer.