4 minute read

Opinion - Generation Media

Barb starts measuring YouTube: what this means for toys & games brands

Lisa reveals that YouTube is finally playing by the same rules as television and says, for brands aiming to connect with kids and families, that is game changing news.

For decades, toys & games advertising has been built on the power of the screen. From the iconic Saturday morning cartoon slots of the 1980s to glossy Christmas campaigns that become part of family rituals, television has provided the stage where toys are brought to life. It has been the heartbeat of the industry sparking imagination, creating demand and driving sales.

But the screen that matters most today is not always the one it used to be. Children and parents are no longer gathered exclusively around the TV set watching live broadcast. Instead, they are increasingly streaming, scrolling and most of all, watching YouTube. The platform has become the main stage for discovery and entertainment, reshaping how toys are introduced to kids and how demand is built.

The scale of this shift is striking. According to Ofcom, nearly 70% of UK children aged 4-15 now watch YouTube on a television set each week. By comparison, only a fraction of their time is spent on live TV. For toy brands, the implications are enormous: the audience is there, but up until now, independent, reliable measurement of YouTube’s performance has been missing. Without it, marketers have been forced to rely on platform provided numbers, making it difficult to compare YouTube with broadcast TV or justify investment to boards and stakeholders.

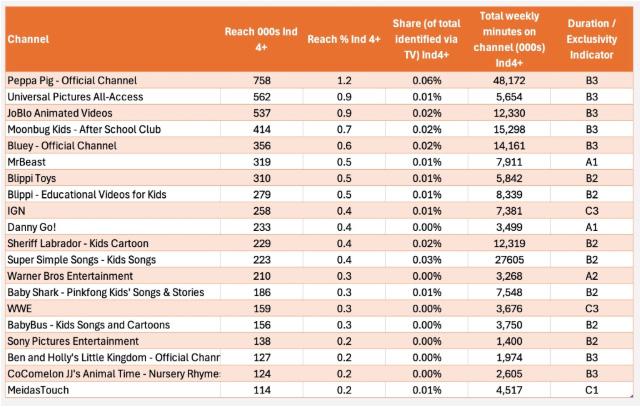

That landscape is about to change. In a global first, Barb (Barb Audiences) has begun measuring YouTube viewing on television sets in the UK. It’s a breakthrough moment, one that brings YouTube into the same trusted measurement framework as traditional TV and BVOD for the very first time. For Toys & Games advertisers, it could be one of the most important developments in media planning in years. Barb’s reporting now covers 200 of the most-watched YouTube channels, carefully selected both for their scale and for brand safety. The data tracks weekly reach, share of viewing, minutes watched and demographic breakdowns by age and gender. Importantly, it currently applies only to viewing on television sets, though mobile and tablet measurement are expected to follow.

What makes this step so significant is comparability. For the first time, YouTube can be judged by the same benchmark as broadcast TV. That means advertisers can finally see not just how YouTube performs on its own terms, but how it stacks up directly against linear TV and broadcaster VOD. It transforms the platform from a black box into a transparent, accountable part of the media ecosystem.

This new perspective also raises questions for content creators. Historically, investment decisions have been influenced by subscriber numbers and total views. Barb’s reporting, which reframes reach in TV equivalent terms, provides a new lens. Even highly popular creators may appear smaller when assessed in the UK TV context and boardroom narratives around reach and influence can shift accordingly. For example, the Peppa Pig YouTube Channel was identified as the No.1 channel in the UK but in terms of total share of TV viewing this was just 0.06% (albeit for all UK individuals).

The speed at which YouTube can shape toy trends has already left its mark on the industry. Last Christmas, viral content such as Skibidi Toilet created sudden demand, leaving toy companies scrambling to adapt. For marketers, the challenge is not only spotting trends early but also understanding how widely they are spreading and on what screens. This is where Barb’s new data provides vital context. By placing YouTube viewing alongside TV benchmarks, it becomes possible to see whether a viral trend is genuinely mass-reach visible on the family television or largely confined to mobile consumption. That distinction can be the difference between a fleeting craze and a product line worth backing with significant marketing and distribution.

Barb’s decision to measure YouTube viewing marks the beginning of a new era for toys & games advertisers. It elevates YouTube from a digital add-on to a fully measurable, accountable part of the video advertising ecosystem. For marketers, this means greater confidence in campaign performance, smarter budget allocation and true cross-platform comparisons that reflect where young audiences are really spending their time.

With children’s content dominating the YouTube charts, the connection to toys & games could not be stronger. Whether launching a hero product for Christmas or nurturing year-round brand affinity, YouTube is now a platform that can be planned, measured and held to the same standards as TV.