THE ULTIMATE ROADMAP TO DOWNSIZING YOUR HOME TownRG.com | 770-280-4560

N T E N T S

ONE | OUR MISSION AND PROMISE

TWO | WHAT IS DOWNSIZING?

THREE | BENEFITS TO DOWNSIZING

FOUR | HOW TRG CAN HELP YOU

FIVE | HOME BUYING PATH

SIX | MORTGAGE SOLUTIONS

SEVEN | HOUSE HUNTING: DO'S & DO NOT'S

EIGHT | MAKING AN OFFER

NINE | YOU'RE BINDING

TEN | THE APPRAISAL

ELEVEN | PRE-INSPECTIONS TO CONSIDER

TWELVE | MEET THE TEAM

THIRTEEN | MOVING SOLUTIONS

FOURTEEN | WHY TOWNSEND REALTY GROUP

FIFTEEN | WHY HIRE A TEAM

SIXTEEN | OUR SERVICE AREAS

C

O

Be the most trusted and well-respected solutionbased Real Estate Group in our Market Area.

Our Mission: Our Promise:

Our promise to you is to deliver the best service imaginable. We promise to focus on your needs to ensure the best possible outcome. We promise to be proactive against all challenges along the way. We will put all of our focus on making this a five-star experience that exceeds all your expectations

WHAT IS DOWNSIZING?

DOWNSIZING?

Downsizing your home means moving to a smaller, more manageable living space. It can lead to financial savings, a simpler lifestyle, and a better match for your current needs and circumstances. If you're considering downsizing, consulting with a realtor can help you find suitable properties that align with your goals and preferences.

DO YOU NEED TO SIMPLIFY YOUR LIFE?

The decision to downsize your home is often driven by various factors. One common reason is to minimize living expenses. By moving to a smaller property, you can potentially reduce mortgage or rent payments, property taxes, and utility bills. This can free up your financial resources for other purposes, such as saving for retirement, paying off debts, or pursuing personal interests.

Downsizing can also be motivated by a desire to simplify your lifestyle. A smaller home requires less maintenance, cleaning, and upkeep. With fewer rooms and less space to manage, you can spend less time and energy on household chores and have more leisure time to enjoy other activities.

BENEFITS TO DOWNSIZING

Lowers the cost of upkeep, insurance, mortgage bills, and utility bills

Reduces your property taxes.

Makes your living space more manageable.

Removes the stress of maintaining your home.

You can move to a location that best suits your needs.

HOW TOWNSEND REALTY GROUP CAN HELP YOU

THE HOME BUYING PATH

START HERE

GET PRE-APPROVED

You'll want to make sure to get this process started asap, as getting pre-approves for financing is essential.

CHOOSEANAGENT

Choose an agent whose personality meshes with your own and whose experience can work in your favor!

HOUSEHUNTING BEGINS APPRAISALORDER

Order within first week of contract, appraisal inspection is completed

MAKEANOFFER

We'll draw up an offer and negotiate on your behalf

We'll take note of your requirements and start searching for properties that fit the bill

HOME!

CLOSING MOVEIN!

You are at the finish line! All parties sign closing documents with bank attorney

Get the keys and move into your new home!

HOME BUYING PROCESS REMOVE CONTINGENCIES OBTAIN MORTGAGE FINANCING CREDIT CHECK UNDERWRITING APPRAISAL SURVEY INSURANCE Accept The Contract Negotiate Terms Write An Offer To Purchase View Properties Select Properties Analyze Your Needs In A Buyer Consultation Obtain Financial Pre- Approval Select a Real Estate Agent Obtain Funds for Closing Close on the Property Take Possession of Home! Conduct Title Search Remove Any Encumbrances Obtain Title Insurance Conduct Inspections Resolve Any Issues

BREAKDOWN THE PROCESS

#1 #2 #3

GET PRE-APPROVED NEED ANALYSIS

Getting pre-approved before beginning your home search will allow you to determine what you can comfortably afford and allow us to move quickly once we find the right home.

Pre-approval shows that you are a seriousbuyer Savesyoutime

Give you leverage in a multiple offersituation

Describe your perfect home What are your "must haves?" When do you need to be in your home by?

SELECT & VIEW PROPERTIES

all brokers have access to the same information

if you see a home on a website, at an open house, at a new construction development, etc.... CONTACT US!

Our average buyer looks at #3 properties before finding the right HOME

Communication is key to finding the right home quickly!

#4

WRITING AN OFFER

Be prepared to move quickly once we have found the right home

Understanding a Seller's Market vs Buyer's Market

Earnest Money Deposit

Proof of funds for your down payment and closing costs

Pre-approval letter

Letter to the seller

#5 NEGOTIATE

After we present your offer to the listing agent, it will either be accepted, rejected, or the seller will make a counter-offer. This is when we will use our knowledge of the market & expert negotiate the terms of the contract on your behalf.

CONTRACT TO CLOSE

#6 #7 #8

CONDUCT APPLICABLE INSPECTIONS REMOVE CONTINGENCIES

Once seller has accepted your offer to purchase their property, it is time to bring in a professional home inspector to ensure the property meets the required standards Any serious issues that arise will be brought to the attention of the seller and we will help you negotiate who will be responsible for fixing the noted repairs.

#9

CLOSING ATTORNEY TO

CONDUCT TITLE SEARCH

Remove any encumbrances

Obtain title insurance

Financial Contingency- If financing the purchase, the contract will state that it is contingent on the home appraising for the contract price and financing Inspection ContingencyPurchase is contingent on the property being professionally inspected and repairs done by the seller

Home sale ContingencySelling your current home

#10

OBTAIN FUNDS FOR CLOSING

MORTGAGE LENDER

Credit Check

Underwriting Survey

Appraisal Insurance

#11

FINAL WALK THROUGH

#12

CLOSE ON THE PROPERTY!!

MORTGAGE SOLUTIONS

Understanding the Loan Process

We believe that the customer comes first. Hear that phrase a lot? At Supreme Lending, we prove that it's not just a catchphrase. Experience what it's like to be our priority when you work with loan officers that stay in touch throughout the process and get you and your family into your new home quickly and conveniently.

Buy with Cash

Make a winning, all-cash offer today.

Real estate transactions can be really stressful. You're either competing with other buyers or worried about settling for the seller's terms and timeline. The thought of losing a home you love or being out-negotiated often leads to overpaying and bad decisions. But now there's an alternative.

We designed Buy with Cash to strengthen your offer so that you can win the home you want on your terms.

Buy with Cash ConvenienceFee

Our standard convenience fee is 1.9%. But when you use our preferred lender, all of that is credited back to you at closing, reducing your cost to buy with cash at 0%

Rent Deferred until closing

We prorate your rent by day, so you only pay for the time you need.

HOUSE HUNTING

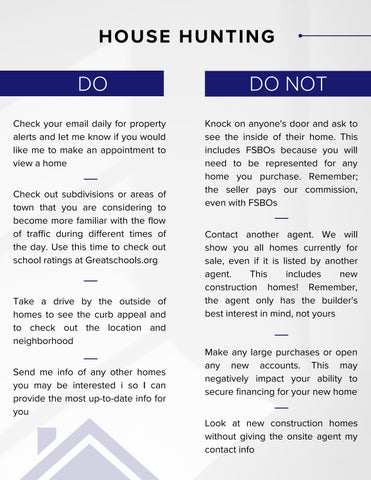

DO DO NOT

Check your email daily for property alerts and let me know if you would like me to make an appointment to view a home

Check out subdivisions or areas of town that you are considering to become more familiar with the flow of traffic during different times of the day. Use this time to check out school ratings at Greatschools.org

Knock on anyone's door and ask to see the inside of their home. This includes FSBOs because you will need to be represented for any home you purchase. Remember; the seller pays our commission, even with FSBOs

Take a drive by the outside of homes to see the curb appeal and to check out the location and neighborhood

Contact another agent. We will show you all homes currently for sale, even if it is listed by another agent. This includes new construction homes! Remember, the agent only has the builder's best interest in mind, not yours

Send me info of any other homes you may be interested i so I can provide the most up-to-date info for you

Make any large purchases or open any new accounts. This may negatively impact your ability to secure financing for your new home

Look at new construction homes without giving the onsite agent my contact info

MAKE AN OFFER

Once you have found the property you want, we will write a purchase agreement While much of the agreement is standard, there are a few areas that we can negotiate:

THE PRICE

In our current market, the lit price is often the starting price and you may need to be prepared to go above the listing price. What you offer on a property depends on a very large number of factors, including its condition, length of time on the market, buyer activity, and the urgency of the seller. While some buyers want to make a low offer just to see if the seller accepts, this often isn't a smart choice, because the seller mat be insulated and decide not to negotiate at all.

DUE DILIGENCE

In this market, we are seeing many buyers waive their Due Diligence, this is not something we would suggest you do unless you've had their home inspected Due Diligence is the time frame in which you have all of the home inspectors, pest/termite inspections, radon inspections, etc. This is also the perfect time for you to research the area, neighborhood, school list, sex offender list, and crime rates.

THE MOVE-IN DATE

If you can be flexible on the possession date, the seller will be more apt to choose your offer over others. Many sellers like to have a few days after closing to be able to relocate.

CLOSING COSTS

Beyond the cost of the home and the cost inspections, there are other fees associated with obtaining a loan, having the attorney close the transaction and the title company that will insure the loan and ensures you as an owner. These fees are called "Closing Costs". The Buyer will pay all the costs associated with obtaining the home other than the fee the seller has agreed to pay the Real Estate Agent (s). In an effort to reduce "out of pocket" expenses or reduce the amount of cash you will need to bring to the table, we can ask the Seller to cover a certain amount of those fees, however in this market it may be difficult to request this and you would most likely need to add anything you are asking the seller to pay into your offer

Once you have found the property you want, we will write a purchase agreement. While much of the agreement is standard, there are a few areas that we can negotiate:

SPECIAL STIPULATIONS

Additional items of the contract for negotiation are known as special stipulations This would include home warranties, clearance of HVAC systems, transferring of any existing termite bonds, pieces of existing furniture, etc. Sellers take these items into consideration and calculate them into their net amount. We will be keeping this in mind when preparing an offer because in the current market sellers are not finding any special requests appealing.

Typically, you will not be present at the offer presentation- we will present it to the listing agent and/or seller the seller will then do one of the following:

By far the most common is the counteroffer. In these cases, our experience and negotiating skills become powerful in representing your best interests When a counteroffer is presented, it may be sent to us on a contract or it may be sent to us by email or even verbally. Any manner in which we receive the seller's counter does not mean it is not a viable counter, it just means that if we counter verbally we MUST have a fully signed and bound contract before you are under contract. A seller has the right to accept another offer, even if we have agreed to terms verbally, up to a point of a fully bound contract.

We will work together to review each specific are of the counter, making sure that we move forward with your goals in mind and ensuing that we negotiate the best possible price and terms on your behalf.

Accept the offer Reject the offer Counter the offer with changes

YOU'RE BINDING

We have come to terms and now you are officially under contract to purchase the property! Now what?

EARNEST MONEY:

This is an area where you can stand out as a buyer. You will want to show the seller how serious you are and will want to make your Earnest Money deposit reflect how dedicated you are to purchasing the home. Our agent will be able to guide you in what will make your offer stand out. Earnest Money will be due just a few days from when we go binding and should always be paid in the form of a check from the account of the purchaser on the loan. Be sure to reference your contract for the deadline. You will need to take a photo of the check for your records and then send the check to the holder. In a typical market, we usually see 1% of the purchase price is offered as earnest money.

INSPECTIONS:

If the terms of the contract allow you a period to inspect the property, then you will want to move forward quickly and schedule all the inspections you wish to have done within the first 24 houses of going Under Contract. That way if issues are found we have time to negotiate repairs before your due diligence period expires and you are forced to purchase "as is". Some of the common inspections buyers choose to have done are radon, home inspections, surveys, termite, foundation, HVAC, septic and well. You, as a buyer, are responsible for your own due diligence and must determine which additional inspections, if any, are needed.

NEGOTIATING REPAIRS:

You've hired the inspector with the intention of learning more about the condition of the home. In the event they should find any item that needs to be further addressed, you do have a few options. Depending on the item, whether it be large or small, you may need to do a further investigation with a licensed professional in that field such as roof, plumbing, electrical, etc. In most cases, the inspection report, which is provided to us typically within a 24-hour period, is enough to be able to draft an amendment to address property concerns We use this amendment to either request that the seller make repairs or we ask them to provide money instead of repairs.

THE APPRAISAL

The dollar amount the bank will lend you is based on the appraised value of the house rather than the agreed-upon purchase price between the buyer and the seller The house you are buying may come in at a higher price or lower value depending on its comparable age, square footage, physical attributes, and number of bedrooms and bathrooms.

Since today's buyers and sellers are savvier and more informed about a home's "going price", houses are much less likely to fall below their appraisal price than in years past. However, fair market values can shift, potentially adjusting your appraisal by thousands. If this happens to you consider the following options:

RENEGOTIATE THE DEAL WITH THE SELLER

You can ask the seller to drop the purchase price to the appraised value. The seller may be willing to do this if the property was on the market for several months. If they do not lower the price, the seller risks losing you as a buyer. They will have to incur the trouble of putting their property back on the market again and it may take some time to receive another offer Additionally, the next buyer may incur the same problem with the appraisal. Unless the home is in a highly desirable and competitive area, you will have the advantage of negotiating with the seller.

MAKE UP THE DIFFERENCE

If you have the financial means, you can make up the difference between the purchase price and the appraised value by putting extra cash down. If there were multiple offers on the house, another buyer may be willing to pay above the appraisal value, so the seller may be less likely to negotiate with you. If this is the house of your dreams and will be your "forever" home, you may want to pursue this option

SPLIT THE DIFFERENCE

The seller and buyer can split the difference. The seller can reduce the purchase price by a certain amount and the buyer makes up the difference by bringing cash to the table if the seller has shown good faith in the transaction, for instance, by being fair and reasonable in responding to repairs requested as a result of the home inspection, you may want to go this route. In my experience, this is the most common solution when there is a difference between the purchase price and appraisal value

REQUEST A SECOND APPRAISAL

Either the buyer or seller requests a second appraisal. If the sellers were surprised by the home's lower-than-expected appraisal value, they may opt to pay for the second appraisal, which will still be ordered by the buyer's lender. If there were attributes of the home that were overlooked or if recent comps in the immediate area were not included in the original appraisal, this should be pointed out to the second appraiser. The second appraisal could come in higher if the first appraiser was inexperienced or was out of the area

CANCEL THE TRANSACTION

Most purchase agreements that contain financing include loan and appraisal contingencies. If the appraisal comes in low and all else fails, a buyer can cancel the transaction and request to receive back their earnest money deposit. However, buyers should be aware of contingency deadlines. For instance, a 10-day appraisal deadline means that the appraisal must be performed within 10 days after the contract ratification date. If the deadline is missed then the contingency is no longer in effect

PRE-INSPECTIONS TO CONSIDER

Appraisal: $300-$450

Home Inspection: $350-$600

Termite Inspection: $35-$50

HVAC Inspection: $125-$250

Radon Inspection: $150-$250

Survey: $1,200+

Septic Inspection: $450-$650

Well Inspection: $150

Roof Inspection: $250

Foundation Inspection: $400

THE TEAM

TOM TOWNSEND REALTOR

In 1999, Beth and I packed up our three babies and left everything in Michigan for a new opportunity in Atlanta. By 2002, I had left corporate America and found myself "flipping" houses for a living. Since then, we have built a Real Estate company that has served over 1,500 clients. I have obtaiined my Certified General Appraisal license in the state of Georgia, am a home inspector, and a REALTOR. We are recognized as one of the top producing teams in the Keller Williams Realty Partners office in Woodstock, Ga.

BETH TOWNSEND REALTOR

Being a Realtor isn't the only thing I do: I am a local educator and have been since 2002 and also serve as a state commissioner. I am a mother to 3 kids who are now grown up and have started their own lives. Away from work, I love to relax and will rad any book you in put in front of me.

JANE

JANE

I am the youngest of the 3 Townswend kids. I graduated from College of Coastal Georgia in May of 2020. I got my degree in Marketing and have become very passionate about all things marketing. Working for the family business has been a joy, a challenge, and exciting all at the same time. I am responsible for all of our marketing efforts, Including managing our listing inventory and our day-to-day operations.

I came to the real estate industry with over 13 years of operations, marketing, and management experience. I oversee your transaction and guide you throughout the process from the beginning to the end while striving for 100% customer transactions.

TOWNSEND Marketing & Operations Manager

KAELA MATTHEWS-WEBB Transaction Manager

TOWNSEND Marketing & Operations Manager

KAELA MATTHEWS-WEBB Transaction Manager

WHY TOWNSEND REALTY GROUP?

Our team us made up of experts and specialists to make the process of selling your home as easy as possible. We are dedicated to providing the best service possible.

Our Team:

Seller's Specialists

Showing Assistants

Operations Manager

Marketing Manager

Transaction Manager

Preferred Mortgage Specialists

Vendors on Call

Attorney on Call

WHY HIRE A TEAM

A real estate team unites clients, agents, and administrative staff together to provide multiple services efficiently and with great attention to detail. A tight-knit family, like Townsend Realty Group, has many years of experience and can provide you with high-quality service that can bring real value to a transaction.

THE WORDS

Got the best price on our new home.

Tom did a great job in selling our home and helping us find a new one. His knowledge of current market trends helped us price our home and helped us get the best price on our new home!

-Karl Barbour

Tom was very professional and knowledgeable in the real estate field. He provided a professional photographer to take pictures and had the property advertised in several social media outlets. I would definitely recommend and use his expertise again in the future.

What can I say about Tom and Bethany Townsend? They have been with us for 2 houses now. They would meet with us just to talk and advise on even if we should sell. When it was time to sell and buy, they were all business. No pressure at all, and compassion to our changing needs. They were sensitive to what we were looking for and they brought the right people to our home. Both of our homes sold quickly, and we found a great home to live in Jane and Kaela are great to work with and speedy in communication I have recommended them to anyone living in the area they serve, and if they don’t serve in the area you are moving to, they will make sure they find somebody to take care of you. Thank you Townsend Realty for taking care of our family.

I have worked with many realtors over the years and haven't always been pleased with their services. Our new non-profit business required a commercial realtor to find a property to lease & I was fortunate to find Tom Townsend. He's an extraordinary realtor - he's kind, responsive, knowledgeable & professional!! Thanks again

- Denise Lee-Hinds

- Cartner Family

-Darlene DeMesa

OUR SERVICE AREAS

READY TO GET STARTED? 770-280-4560 | Townrg.com | Sales@Townrg.com FOLLOW ALONG

JANE

JANE

TOWNSEND Marketing & Operations Manager

KAELA MATTHEWS-WEBB Transaction Manager

TOWNSEND Marketing & Operations Manager

KAELA MATTHEWS-WEBB Transaction Manager