Financial Statements

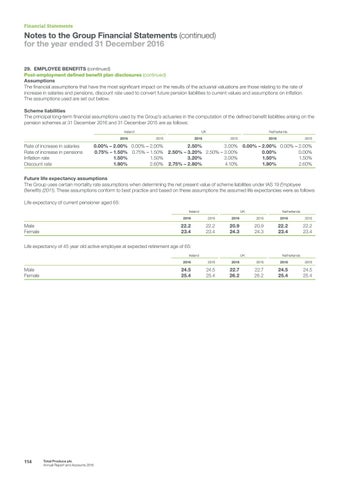

Notes to the Group Financial Statements (continued) for the year ended 31 December 2016 29. EMPLOYEE BENEFITS (continued) Post-employment defined benefit plan disclosures (continued) Assumptions The financial assumptions that have the most significant impact on the results of the actuarial valuations are those relating to the rate of increase in salaries and pensions, discount rate used to convert future pension liabilities to current values and assumptions on inflation. The assumptions used are set out below. Scheme liabilities The principal long-term financial assumptions used by the Group’s actuaries in the computation of the defined benefit liabilities arising on the pension schemes at 31 December 2016 and 31 December 2015 are as follows: Ireland 2016

Rate of increase in salaries Rate of increase in pensions Inflation rate Discount rate

UK

Netherlands

2016

2015

2016

2015

0.00% – 2.00% 0.00% – 2.00% 2.50% 3.00% 0.75% – 1.50% 0.75% – 1.50% 2.50% – 3.20% 2.50% – 3.00% 1.50% 1.50% 3.20% 3.00% 1.90% 2.60% 2.75% – 2.80% 4.10%

2015

0.00% – 2.00% 0.00% – 2.00% 0.00% 0.00% 1.50% 1.50% 1.90% 2.60%

Future life expectancy assumptions The Group uses certain mortality rate assumptions when determining the net present value of scheme liabilities under IAS 19 Employee Benefits (2011). These assumptions conform to best practice and based on these assumptions the assumed life expectancies were as follows: Life expectancy of current pensioner aged 65: Ireland

Male Female

UK

Netherlands

2016

2015

2016

2015

2016

2015

22.2 23.4

22.2 23.4

20.9 24.3

20.9 24.3

22.2 23.4

22.2 23.4

2016

2015

2016

2015

2016

2015

24.5 25.4

24.5 25.4

22.7 26.2

22.7 26.2

24.5 25.4

24.5 25.4

Life expectancy of 45 year old active employee at expected retirement age of 65: Ireland

Male Female

114

Total Produce plc Annual Report and Accounts 2016

UK

Netherlands