Country Report: China

CR

CR

Country Report: China

AS CHINA’S CONSUMER-DRIVEN ECONOMY TAKES ROOT AND EXPANDS, DOMESTIC TISSUE CONSUMPTION COULD EASILY DOUBLE - EVEN AT THE SAME POPULATION LEVEL As the world tissue leader continues its rapid growth stage, sectors in which it lagged behind are also being swept away as old, slow and narrow machines and replaced with world-class technology, and inefficient, polluting mills are closed.

C

hina is papermaking's birthplace and possibly the first to use hygienic paper frequently and consistently. Papermaking then kickstarted a whole new age in Europe before spreading

projected 2022 saw China driving most new global tissue machine installations (about 65 to 95%) each year. This has been a boom to both the European tissue machine builders and the development of home-

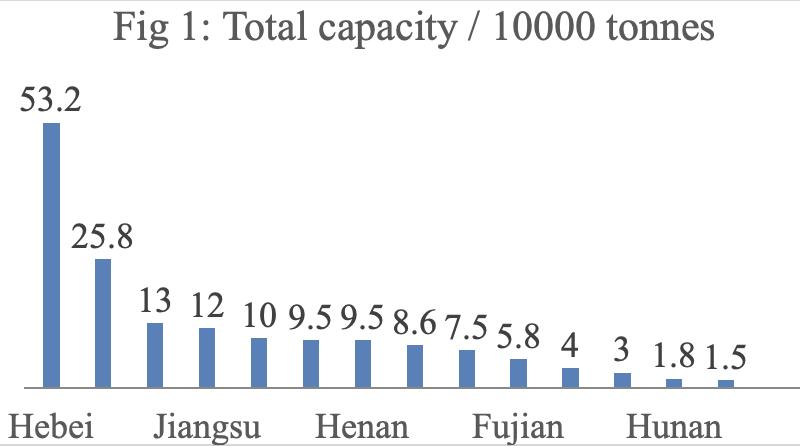

to North America with the Fourdrinier continuous paper machine's invention. The development of tissue-making technology started in North America over 100 years ago in order to create a new class of consumer hygienic paper use that eventually spread to developed countries worldwide. However, China's rapid economic development has now returned to become the centre of global papermaking. In less than 15 years, tissue production and consumption grew swiftly to make the country the new centre of the tissue business. Figure 1 shows the current top ten tissue producing countries with their relative production rates. As we can see, China has more than double the production rate of the United States, the next largest producer. Because of this rapid growth, the installation of new tissue machines each year was required, as shown in Figure 2. This recent growth period from 2007 to

based tissue production machine builders in China. This addition rate slowed in 2015 as we see some machines were taken out as replacements came in. 2018 and 2019 saw more machine reductions as older mills with high pollution effects were removed. The trend also shows that commercial tissue or AfH tissue production capacity began to grow. In 2021, we will see the pace of new machines increase and the 2022 rate shown is expected to be revised upward. Fisher International's China Insights February report projects that around three million tonnes of new tissue capacity will be released in 2021. China's tissue machines have not

Figure 1

employed advanced technology to produce textured or structured tissue except for anecdotal evidence of home-grown TAD experimentation. This has changed as Hengan International Group announced two Toscotec TADVISION TAD tissue machines in 2022 at its Shandong and Hunan mills.

CHINA'S RAPID ECONOMIC DEVELOPMENT HAS NOW RETURNED TO BECOME THE CENTRE OF GLOBAL PAPERMAKING. IN LESS THAN 15 YEARS, TISSUE PRODUCTION AND CONSUMPTION GREW SWIFTLY TO MAKE THE COUNTRY THE NEW CENTRE OF THE TISSUE BUSINESS.

TISSUE PRODUCTION LEADERS

Source: FisherSolve Next ©2021 Fisher International, Inc.

Bruce Janda Senior consultant, Fisher International

2021 CHINA TISSUE MACHINE COUNT CHANGES

Source: FisherSolve Next ©2021 Fisher International, Inc.

Figure 2 Tissue World Magazine | March/April 2021

8