Artificial Intelligence Toolkit 2025

Leverage our established global network.

We generate high levels of engagement for our clients and members by leveraging our established global wealth management community. Our user base includes representatives from leading financial services institutions, consultants, and investors from around the world.

285,000+ Annual Users

35,000+ Contacts

30m Annual Impressions

15,000+ Subscribers

15,000+ Social Followers

AI TOOLKIT Contents

This report examines how AI is reshaping the future of wealth management, driving innovation across advisory, investment, and client service models, analysing its impact on the strategies and operations of wealth management firms.

Topic

The first part of each Showcase is the Topic. Each contributor establishes a Topic, introduces it, highlights its relevance to wealth management, and explains why a wealth management business should consider it for their business.

Solution

The second part of each Showcase is the Solution. The Solution is designed to support the Topic, with each contributor tasked with highlighting how their Solution delivers on the Topic. This includes elements such as its features and functions, use cases and other relevant elements of their offering.

Showcase #1 Adviser Efficiency

In today’s fast-paced financial environment, wealth managers and advisers are increasingly time-poor. This is where AI, is starting to show its value.

Contributed by aveni

Showcase #2 Future Foundation

To unlock AI's full potential, wealth managers must first address a foundational requirement: data.

Contributed by Point

Showcase #3 Generative AI

GenAI gives financial firms a powerful way to process and respond to unstructured and structured data, driving efficiencies and growth.

Contributed by InvestCloud

Showcase #4 AI-powered Video

Leverage personalised AI-powered videos to increase the value and frequency of client engagement, and acquire incremental AUM.

Contributed by Storyline AI

Showcase #5 Portfolio Intelligence

AI is not changing the principles of sound wealth management –but it is redefining what is possible.

Contributed by Pebble

Showcase #6 Portfolio Management

Investment portfolio optimisation has long relied on historical data analysis to model uncertainty and guide decisions. These traditional methods are being disrupted by AI.

Contributed by Raise Partner

Showcase #7 AI Agents

Investment teams are rethinking their technology strategies to stay competitive and future-proof their processes. Traditional operating models are being replaced by new approaches that harness AI.

Contributed by Jacobi

Showcase #8 Intelligent Workflows

AI is unlocking growth opportunities through intelligent workflows.

Contributed by Zeplyn

Showcase #9 Future Proof

Today, thanks to major advancements in Big Data, chatbots and deep learning, AI is no longer speculative; it’s essential.

Contributed by Objectway

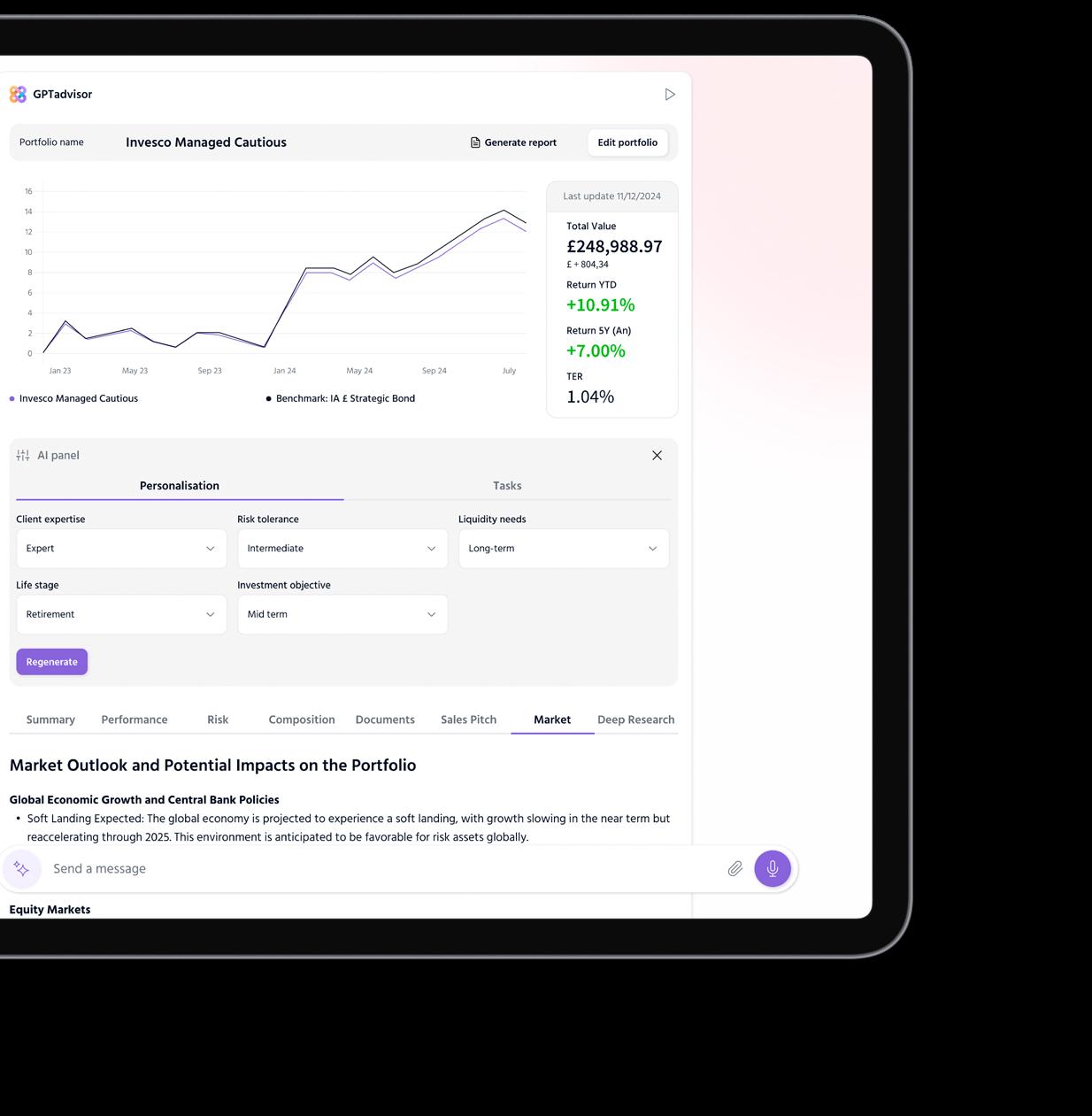

Showcase #10 GenAI Portfolio Solutions

Wealth managers operate in an increasingly complex landscape where clients expect tailored, datadriven investment insights. This is where Gen-AI portfolio advisory solutions come into play.

Contributed by GPTadvisor

Showcase #11 AI For The Next Gen

AI’s successful implementation hinges on robust cloud infrastructure.

Contributed by AWS

FOREWORD

The direction of travel is clear. From digitalisation to intelligence. From the experience economy to the AI-native economy. Rethinking wealth management completely with intelligence baked in every dimension and aspect of your business is no longer optional –it’s essential. Start the journey now.

The extraordinary pace of recent Artificial Intelligence (AI) innovation marks a significant departure from the previous major technology cycles of cloud and mobile, promising a profound transformation in wealth management. We are at the cusp of shifting from digital-native business archetypes to AInative businesses. This is a paradigm shift in our technological and business strategies which is being born as we speak. These businesses go beyond just using AI tools here and there. They are set up and managed as businesses with AI baked-into every aspect, from the enterprise itself to everything that is customer facing, and also in the ways they operate within their ecosystem.

This evolution aligns with "Thinking like an AI native business" a concept I explored in "The Fast Future Blur: Discover Transformative Interconnections Shaping the Future". In this future-proofing book, we suggest viewing AI's integration through interconnected dimensions – customer, enterprise, and ecosystem – alongside elements like discovery, design, decision, dexterity, and deduction. This framework is crucial for understanding AI's groundbreaking potential.

The acceleration imperative

The velocity of change is staggering. Several large industry players began their AI journeys as early as two years ago. Morningstar launched Mo in 2023, the first personified next-gen chatbot for investment research, for both enterprise and customer discovery. BloombergGPT, trained on Bloomberg's proprietary data, became available for Bloomberg customers, and Moody's launched GenAI Research Assistant. Also, JP Morgan developed LLM Suite by finetuning OpenAI to augment its employees (enterprise/ discovery, decision) and designed IndexGPT, an AIpowered tool for personalised investment strategies (enterprise/design and customer/dexterity).

There is a clear buy-in from decision makers. Similar to all major transformative technology cycle, time is needed. Doing nothing is the riskiest choice of all.

We are at the cusp of shifting from digital-native business archetypes to AInative businesses, a paradigm shift in our technological and business strategies.

The extraordinary pace of recent AI innovation marks a significant departure from the previous major tech cycles of cloud and mobile, promising a profound transformation in wealth management.

Beyond efficiency: strategic AI adoption

The future requires a dual focus. First, start focusing on gaining efficiencies as a stepping-stone and a training ground while always aiming to go beyond efficiencies. Explore AI's potential to create new businesses, transform customer experiences, and redefine value propositions. Decide on a systematic and strategic roadmap. Second, establish guardrails and ethical frameworks while preserving dexterity as the technologies are evolving.

It’s

time to rethink your business…again!

While AI clearly offers immediate efficiency gains especially at the discovery dimension, true differentiation and real economic value lies at leveraging AI at the interconnections of all other dimensions.

As in the digital era, companies that thrive will adopt an AI-native mindset and fundamentally rethink their businesses. Start now, experiment, and learn from both successes and failures. Don't expect that knowledge retrieval efficiencies will lead to sustainable differentiation.

Those who will be more successful will be those that leverage AI to unlock economic value both for the customer and their business. This combination will create long-lasting value with network effects.

Global FinTech & Technology Thought Leader

Proudly human authored and inspired by my WealthTech passion.

Dr. Efi Pylarinou

INTRODUCTION

Welcome to the AI Toolkit Report 2025

The integration of Artificial Intelligence (AI) into wealth management is revolutionising the industry. Wealth managers are using new, AIdriven technologies to drive enhanced efficiency, greater levels of personalisation in their investment recommendations, and in their decision-making.

This report features 16 articles contributed by a range of industry participants – from wealth managers, to vendors, to consultants focused on financial services. In the case of the contributions from technology vendors, each has also been tasked with providing a Showcase formed of a Topic consistent with the AI theme of the report, alongside a Solution that supports the delivery of that Topic.

Where we are today...

One prominent trend is the growing use of AI-powered tools, which offer automated, algorithm-driven financial planning services. These provide tailored investment recommendations based on client data, risk tolerance, and financial goals, democratising access to high-quality financial advice. By integrating and leveraging Natural Language Processing (NLP) and Machine Learning (ML), wealth managers are able to leverage technology to continuously refine their investment strategies and adapt to market fluctuations in real time, offering clients more precise and more cost-effective solutions.

Another significant trend is the application of AI in portfolio management and risk assessment. Advanced analytics tools harness AI to identify patterns and predict market movements, enabling wealth managers to make data-driven investment decisions. These tools also allow for more granular risk profiling, helping firms better align investment strategies with client needs.

As we saw during the course of last year with contributions to our CX Toolkit Report, and discussions during the related CX Toolkit roadshow events, AI is also reshaping client engagement through enhanced personalisation and communication. By analysing significant amounts of data, AI-driven systems provide wealth managers with insights into client behaviour, preferences, and life events. This in turn enables hyper-personalised recommendations and timely interventions, fostering deeper client relationships. Additionally, the integration of NLP-powered chatbots and virtual assistants ensures seamless, 24/7 support, improving the client experience.

As AI continues to advance, its ability to combine human-like interaction with sophisticated analytics is setting a new standard for the wealth management industry, driving innovation and delivering greater value to both clients and advisers.

Against this exciting and fast-paced backdrop of ever evolving technology, we are pleased to introduce you to our AI Toolkit Report 2025. This report follows on the heels of an initial AI Toolkit Roadshow event hosted by AWS in Zürich late last year, and our first Toolkit Roadshow event held in New York earlier this year. We have captured some of the insights from the discussions and exchanges at these events, and have included them in this, our second Toolkit Report in what is an ongoing series of reports.

Where we are headed tomorrow...

Looking ahead, it is clear to all that the future of AI in wealth management holds transformative potential, driven both by advancements in technology and evolving client expectations. One key development will be the integration of generative AI, enabling wealth managers to create custom financial models and reports that address unique client scenarios.

Artifical Intelligence Toolkit 2025

The AI Toolkit 2025 is the second report within our new Toolkit Report Series. If the application of AI is becoming central to the business of wealth management, the purpose of this report is to highlight relevant technology Topics and Solutions, packaged into eleven individual Showcase entries, which could or should be part of a wealth manager's thinking when considering the potential application of AI related technology, to benefit their advisers and also, their end clients.

What is a Showcase?

Each Showcase is intended to focus on a specific Topic with the contributor introducing their topic and explaining its relevance to the report's overall relevance to the theme of AI. Supporting the Topic is a Solution entry which then highlights the firm's supporting technology offering. The overall contribution of each firm features a Topic and a Solution, and both together should educate and inform the reader on an aspect (and potential application) of AI that they may consider for their business.

This capability will streamline complex processes, making wealth management more accessible and efficient while allowing advisers in turn to focus on higher-value tasks.

Another emerging trend is the convergence of AI and sustainability in investment strategies. As environmental, social, and governance (ESG) considerations become increasingly important, AIpowered tools will help wealth managers assess the impact of investments more accurately. By analysing ESG data and forecasting long-term sustainability outcomes, these tools will empower clients to align their portfolios with their values, fostering more responsible and impactful investing practices.

Finally, the future of AI in wealth management will be marked by increased collaboration between human advisers and AI systems. Rather than replacing human expertise, AI will act as an augmentative tool, providing actionable insights and automating routine tasks. This relationship will enhance the decisionmaking process, enabling advisers to deliver even more highly personalised and strategic advice. As AI continues to evolve, its role in wealth management will expand, ensuring a more adaptive, client-centric, and innovative industry landscape.

Toolkit Report Series

Following this, our second Toolkit Report focused on AI, our Toolkit series will feature ongoing reports mixing thematic, geography and wealth manager-segment focused releases. In the series planned for 2025, we will be publishing:

• UK Toolkit

• Future View Toolkit

• Adviser Toolkit

• US RIA Toolkit

• APAC Toolkit

Toolkit Roadshow events

Following each report, we will look to deliver supporting Roadshow events. For the AI Toolkit Roadshow, we have so far hosted events in Zürich, New York and shortly in London too. We plan further events in the Middle East and APAC later in the year. These events are free to attend for any form of wealth manager and provide technology vendors an opportunity to sponsor or demo.

Editorial Programme Toolkit Reports 2024/2025

The Toolkit Report Series covers thematic, geography and wealth manager segment-focused reports, each tasked with delving into the topics and supporting technologies of relevance to help wealth managers of all types better understand how they should bring technology into their business and in which areas.

UK Toolkit

Geographic

Q2 2025

Focused on the United Kingdom, the UK Toolkit 2025 Report will seek to bring in 10-15 Showcases from contributors, each tasked with highlighting how an area of technology and their offering can support the business needs of a wealth management firms in the region. The report will be supported by a Toolkit Roadshow event in London in September 2025.

Future View

Toolkit

Thematic

Q2 2025

This report will look at the technologies that will support wealth managers in future proofing their businesses. Regardless of positioning on the infrastructure map, each participant vendor needs to highlight why and how their topic and solution is relevant. The report will be supported by Toolkit Roadshow events in Q2-Q3 2025.

US RIA Toolkit

Segment

Q3 2025

The US Registered Investment Advisor market plays a significant role in the wider US wealth management sector, with a wide range of technologies built to support its needs. This Toolkit will showcase a range of topics and solutions focused on the needs of the US RIA market.

CX in WEALTH

Showcasing the application of CX in wealth management

SCENE SETTER Data Insights

Welcome to our Data Insights section. This is designed to provide a curated collection of relevant insights and data points, sourced from reputable third parties, to help contextualise the role of AI in wealth management. The section serves as a foundation for understanding key trends, challenges, and opportunities, offering valuable perspectives for industry professionals navigating the AI-driven shift in wealth management.

For any wealth management firm, as well as any technology vendor offering services to the sector, the potential impact of Artificial Intelligence (AI) on the industry is too significant to overlook. AI is rapidly transforming financial services, enabling firms to enhance decision-making, improve operational efficiencies, and deliver highly personalised client experiences, among a wide range of potential benefits for those that engage.

Beyond wealth management, AI’s impact extends across society, economies, and businesses worldwide. From automating complex workflows to generating predictive analytics, AI is reshaping industries at an unprecedented pace. As firms adopt AI-powered tools, they must balance innovation with ethical considerations, ensuring transparency, security, and compliance. Understanding these dynamics is essential for any organisation aiming to remain competitive in an increasingly digital and data-driven financial landscape.

The rapid rise of AI in wealth management

A recent study by Accenture found that 84% of wealth managers believe AI will significantly transform the industry within the next five years. This transformation is already evident, with firms leveraging AI-powered analytics to optimise portfolio management, automate compliance processes, and provide hyperpersonalised investment recommendations.

AI is also reshaping regulatory compliance and risk management within wealth management. Compliance costs have been a major burden for financial firms, but AI is helping mitigate these expenses by streamlining processes and improving accuracy. AI-driven tools can process vast amounts of data in real time, identifying patterns and anomalies that might indicate fraudulent activity or regulatory breaches. This capability is essential as regulatory requirements continue to evolve and become more complex.

The shift toward AI-powered solutions is also evident in client engagement and advisory services. AI chatbots and virtual assistants are now handling routine client inquiries, freeing up advisers to focus on high-value interactions. Predictive analytics is enabling firms to anticipate client needs, offering tailored financial strategies based on real-time market data and behavioural insights. As AI continues to develop, its role in wealth management will only expand, driving greater efficiency, innovation, and client-centric services across the industry.

AI’s impact on wealth management

The influence of AI on wealth management is expected to be profound. PwC’s 2023 Global Asset and wealth management Survey predicts that AI-enabled digital investment platforms will manage assets worth nearly US$6 trillion by 2027 – almost double the US$3 trillion figure from 2022. This shift highlights the increasing role of algorithm-driven platforms in wealth management, as they provide data-driven insights, risk assessment, and personalised investment strategies with unparalleled precision.

PwC's most recent 2024 Asset & wealth management Report further highlights the transformative impact of AI on the industry. Key predictions include:

• Revenue growth: 80% of investment and wealth management firms anticipate that disruptive technologies like AI will drive revenue growth. Firms that rapidly adopt 'tech-as-a-service' models could see a 12% revenue boost by 2028.

• AI as a transformational technology: 73% of investment and wealth management organisations view AI as the most transformative technology over the next two to three years, underscoring its pivotal role in shaping the industry's future.

Moreover, AI's role extends beyond investment management to operational efficiency. A 2025 survey by NVIDIA indicates that nearly 70% of financial services professionals have observed revenue increases of 5% or more due to AI, with many witnessing boosts between 10-20%. Furthermore, over 60% of respondents reported AI-driven cost reductions of at least 5% annually, demonstrating the technology’s potential to enhance profitability while reducing expenses. Nearly a quarter of surveyed firms are also leveraging AI to create new business opportunities and revenue streams, positioning AI as a key driver of innovation in the financial sector.

As AI continues to reshape wealth management, financial institutions must prioritise investments in machine learning, automation, and data analytics to stay competitive.

84% of wealth managers believe AI will significantly transform the industry within the next five years (Accenture).

DATA INSIGHTS

AI and client experience –the power of personalisation

AI is transforming client experiences by enabling unprecedented levels of personalisation. Businesses across industries are leveraging AI-driven insights to understand customer preferences, anticipate needs, and deliver tailored solutions in real time.

One of AI’s key strengths is its ability to analyse vast amounts of data, identifying patterns in customer behaviour that would be impossible for humans to process efficiently. This allows companies to offer hyper-personalised recommendations, whether in e-commerce, financial services, or healthcare. For instance, AI-powered chatbots can provide instant, context-aware responses, while recommendation engines, like those used by streaming services and online retailers, enhance user satisfaction by suggesting relevant content or products.

AI also improves client experience through predictive analytics. Businesses can leverage AI to better anticipate and in many cases predict customer needs before they arise, offering proactive solutions. Banks, for example, use AI to detect spending habits and suggest financial products tailored to individual users. Similarly, AI-driven personalisation in healthcare helps doctors recommend customised treatment plans based on patient history and genetic profiles.

However, while AI-driven personalisation enhances customer engagement, it also raises concerns about data privacy and ethical use. Businesses must balance customisation with transparency, ensuring clients understand how their data is used while maintaining security and trust.

Businesses can leverage AI to better anticipate and in many cases predict customer needs before they arise.

In the future, AI will continue refining client experiences, making interactions more intuitive and efficient. Companies that invest in responsible AIdriven personalisation will not only enhance customer satisfaction but also gain a competitive edge in an increasingly digital marketplace.

Wealth management firms employing AI broadly are also leading the charge in revolutionising client engagement, with 65% expecting major AI-driven transformations in client relationship management in the next one to two years (Wipro).

9/10

investors believe AI can be used effectively for researching financial products and services; eight in ten say AI can better support advisers in portfolio management.

KPMG, 2024

63% of investors expect their digital experiences with wealth management firms to match those of leading technology companies, increasing emphasis on omnichannel delivery.

KPMG, 2024

76% of firms report enhanced operational efficiency due to AI, allowing advisers to focus more on personalised client services.

Wipro, 2024

70%

of firms that are leveraging AI report a positive impact on client interactions.

Wipro, 2024

77% of firms acknowledge better decisionmaking capabilities through AI-driven predictive analytics, facilitating more tailored investment strategies.

IBS Intelligence, 2024

72%

of wealth managers say personalisation is the most critical trend shaping the industry.

PwC, 2023

Up to 23%

the level by which AI-based nudges can improve investor decision-making accuracy.

JP Morgan, 2023

Up to 90%

the reduction in client response time that can be driven by AI-powered customer service.

Gartner, 2023

DATA INSIGHTS

AI and portfolio optimisation

AI is revolutionising portfolio optimisation by enhancing data analysis, risk assessment, and decision-making. Traditional optimisation methods have relied more on historical data and statistical models, but AI leverages ML and deep learning techniques that identify patterns, predict market trends, and therefore allow advisers to adapt their investment recommendations to changing conditions in near real time.

One major advantage of the application of AI in portfolio optimisation is its ability to process significant amounts of data, including financial statements, news, and other macroeconomic indicators. AI-driven models can dynamically rebalance portfolios based on market shifts, reducing risk while maximising returns. Additionally, AI algorithms can be used to optimise asset allocation by taking multiple factors into account, such as volatility, correlations, and investor preferences.

Another innovation is reinforcement learning, where AI continuously learns from market feedback to improve trading strategies. This approach enables portfolios to become more adaptive, reducing human biases and emotional decision-making.

Despite its advantages, AI-driven portfolio optimisation does face challenges, such as data biases, model interpretability, and regulatory concerns. However, as AI technology advances, its role in portfolio management will continue to grow, offering investors smarter, more efficient ways to optimise their investments while simultaneously and effectively managing risk.

AI-driven models can dynamically rebalance portfolios based on market shifts, reducing risk while maximising returns.

14%

the potential level of improvement seen in AI-powered portfolio management risk-adjusted returns. BlackRock, 2023

63% of asset managers now incorporate AI-driven predictive analytics in what they do.

Deloitte, 2023

22%

the level of improvement in portfolio resilience generated by AI-driven stress testing. McKinsey, 2023

$19 billion

the sum Deloitte Insights projects global spending by financial services firms on quantum computing will escalate to by 2032, from $80 million in 2022, reflecting a 10-year compound annual growth rate of 72%.

Deloitte, 2023

5.3%

the level by which Pictet's AI-driven fund, based on the MSCI World index, outperformed the benchmark over a six-month period, demonstrating AI's potential in stock selection.

thetimes.co.uk

10-25% increase

is what investment firms utilising AI in their strategies have reported in investment returns compared to traditional methods. algoaiacademy.com

DATA INSIGHTS

AI and risk management / compliance

AI is transforming risk management and compliance by improving accuracy, efficiency, and adaptability. Traditional approaches rely on rule-based systems and manual oversight, but AI introduces advanced analytics, machine learning, and automation to detect risks, ensure regulatory compliance, and enhance decision-making.

In risk management, AI can analyse vast data-sets in real time to identify potential threats, such as market volatility, credit risks, and fraudulent activities. Machine learning models are able to detect patterns and anomalies that advisers might overlook, allowing for proactive risk mitigation. AI-driven predictive analytics therefore also help financial institutions forecast potential risks and adjust strategies accordingly.

Compliance is another area where AI is seen to be having a significant impact. Regulatory requirements are constantly evolving, making manual compliance checks time-consuming and error-prone. AI-powered compliance tools can monitor transactions, flag suspicious activities, and ensure adherence to regulations such as AML (anti-money laundering) and KYC (know your customer). Natural Language Processing (NLP) helps in reviewing legal documents and regulatory changes efficiently.

Despite its advantages, AI in risk management and compliance faces challenges, including data privacy concerns, model transparency, and regulatory acceptance. However, as AI technology advances, it will play an increasingly critical role in strengthening financial security, reducing fraud, and ensuring regulatory adherence.

Regulatory requirements are constantly evolving, making manual compliance checks time-consuming and error-prone.

60 million hours per year that could potentially be saved on compliance and enforcement activities through the efficiencies of AI.

Deloitte, 2023

50%

the reduction in financial losses generated by AI fraud detection.

McKinsey, 2023

60%

the amount by which KYC verification times are improved , driving greater onboarding efficiency, thanks to the use of AI.

Deloitte, 2023

50%

of organisations have not conducted AI risk assessments, indicating a significant gap in addressing potential AI-related risks.

airmic.com

53%

of firms say risk management is a key area where AI has already driven significant disruption.

Wipro, 2024

35-40%

the volume of reduction in regulatory breaches generated thanks to AI-driven compliance

PwC, 2023

25%

the level by which AI-based risk scoring enhances loan approval accuracy.

FICO, 2023

84%

of organisations experienced regulatory compliance issues stemming from a lack of transparency in AI applications within business processes. securitymagazine.com

DATA INSIGHTS

Challenges to adopting AI in wealth management

As has been outlined in earlier sections of our Data Insights section, AI indeed has the potential to enhance efficiency and decision-making in wealth management, but its adoption still faces several challenges.

• Regulatory and compliance concerns are a major hurdle. The financial industry is highly regulated, and AI-driven models must comply with strict legal frameworks. The lack of transparency in some AI algorithms, often referred to as “black box” models, can make it difficult to justify investment decisions to regulators and clients.

• Client trust and acceptance present another barrier. Many investors, particularly high-networth individuals, prefer interacting with human advisers and are reluctant to rely on AI-driven recommendations. Building confidence in AI’s accuracy and reliability is essential for widespread adoption.

• Implementation costs and talent shortages further slow adoption. AI requires significant investment in technology, infrastructure, and skilled professionals, which many firms lack.

• Market unpredictability can also limit AI’s effectiveness. Financial markets are influenced by unforeseen events, making it difficult for AI to adapt in real time (although rapid progress is being made in this area).

• Data security and privacy also pose significant risks. AI systems require significant amounts of client data, increasing the potential for cyber threats and regulatory scrutiny. Consequently, ensuring data integrity and security is critical.

Overcoming these challenges requires regulatory clarity, strong security measures, and strategic investment in AI capabilities.

5 out of 10

advisers feel like their firms are challenged to act on their AI vision. Accenture, 2022

68% of firms underscore the need for AIspecific training and talent acquisition – with many firms citing a significant skills gap in the AI domain.

Wipro

74% of companies struggle to move beyond pilot projects to fully scaled AI implementations, indicating difficulties in achieving widespread impact.

Boston Consulting Group, 2024

78% of businesses face challenges in AI adoption due to inadequate data infrastructures, underscoring the importance of robust data management for successful AI integration.

MIT / businessof.tech

55% of UK investors are unwilling to use AI tools for investment support, indicating a significant trust gap between clients and AI-driven advisory services.

Avaloq / workingexcellence.com

DATA INSIGHTS Summary

AI is poised to transform wealth management by enhancing efficiency, personalisation, and decisionmaking. As AI technologies advance, financial institutions will increasingly leverage them to provide smarter investment strategies, optimise portfolio management, and enhance client experience.

One key application is personalised financial advice, with AI-driven digital platforms using Machine Learning (ML) and NLP to analyse clients’ financial goals, risk tolerance, and spending to offer personalised investment strategies. Over time, these systems will continuously adapt to changing financial conditions and user preferences. AI-driven behavioural finance insights will help advisers better understand client emotions and biases, allowing them to offer tailored guidance that aligns with investors’ long-term financial well-being.

AI-powered predictive analytics will analyse significant data-sets to identify emerging market trends, assess risks, and provide real-time market insights. This will allow wealth managers to anticipate market shifts and adjust portfolios accordingly, leading to more proactive and data-driven investment decisions.

Fraud detection and cybersecurity will also benefit from AI innovations. Advanced AI models will be able to detect suspicious activities in real time, safeguarding clients' assets from fraudulent transactions and cyber threats.

AI will also improve operational efficiency by automating repetitive tasks such as portfolio rebalancing, tax optimisation, and regulatory reporting. This will allow human advisers to focus on strategic decision-making and high-value client interactions.

The above applications are just a snapshot of where AI is relevant in this industry. As AI continues to evolve, its applications in wealth management will dive into all aspects of the business of wealth management, redefining the industry and creating a more intelligent, efficient, and client-centric financial ecosystem.

Conclusion

The integration of AI into wealth management is transforming the industry, offering innovative solutions for personalisation, efficiency, and decision-making. From predictive analytics to hyper-personalised financial planning and blockchain integration, the applications of AI are vast, and grow by the day.

As AI technologies continue to advance, wealth managers must embrace these tools while at the same time addressing challenges such as data privacy and algorithmic biases. By leveraging the power of AI, the wealth management industry can enhance client experiences, democratise access to financial services, and continue their path of digital transformation.

INDUSTRY Perspectives

In this section, we present a diverse range of insights from wealth managers and a leading consulting firm. They offer an industry perspective on the transformative impact of AI, highlighting both the vast opportunities and the pressing challenges ahead. From optimising investment strategies to navigating regulatory complexities, these experts share their outlook on how AI is reshaping the financial landscape – and what it means for the future of wealth management.

Understanding the industry’s perspective on AI is crucial in today’s rapidly evolving financial landscape. Staying ahead requires keeping a finger on the pulse of AI advancements – what’s being done, what’s working, and where challenges lie. That’s why we’ve gathered insights from a specialist in AI who brings deep, focused expertise from his consulting firm employer offering a broad and multi-client perspective on how AI is reshaping wealth management.

Beyond theory, we explore real-world examples that demonstrate AI in action – how firms are leveraging it to enhance decision-making, streamline operations, and create new value. These insights serve as a foundation for the perspectives that follow, where solution providers will dive deeper into the technologies driving these changes. By combining strategic industry viewpoints with practical applications, this section is designed to give you a clear, informed, and actionable understanding of AI’s transformative role in the future of financial services.

Our aim with this report –as with all our Toolkit Reports – is to bring together a range of relevant, insightful and though-provoking opinions and commentaries from wealth managers, technology vendors, consultants and other players in the sector. Together, these will provide a view of some of the main themes and focus areas around the role and potential application of Artificial Intelligence (AI) in the wealth management industry today, and tomorrow.

The rise of chatbots for exploring specialised business content 1

By Geoffroy de Ridder, Head of Technology and Operations, Lombard Odier Group

Large Language Models (LLMs) now occupy a central position in the AI landscape, particularly in the Machine Learning (ML) branch. Using Deep Learning (DL) architectures, a sub-branch of ML, LLMs are revolutionising natural language processing, enabling significant advances in text comprehension and generation. These systems are trained on huge corpora of text to master the subtleties of natural language, and to learn the contextual relationships between words and sentences.

What are Large Language Models and how do they work?

ML has crucial, proven applications in many fields. In finance, for example, ML is used to detect fraud and analyse risks and trends in financial markets. Unlike other ML-based systems, LLMs do not need to be explicitly trained for each specific task such as translation or text summarisation. By learning from large datasets, they can quickly adapt to new user instructions. By providing an appropriate prompt, a user can therefore obtain accurate responses adapted to the context without needing to retrain or adjust the model.

How do banks interact with generative AI such as LLMs?

Interaction with generative AI technologies takes place mainly through chatbots, which enable users to communicate and explore data in a conversational manner. These virtual assistants facilitate access to a variety of services and information. For example, chatbots automate the analysis of legal contracts with banking counterparties or key service providers (e.g. market data), scanning thousands of pages in seconds to identify key clauses, contractual obligations and potential risks.

What is the level of adoption of these technologies in the banking sector?

Financial institutions are increasingly adopting use of these chatbots. Institutions that prefer a cautious and methodical approach to AI are starting by carefully evaluating solutions in terms of security and compliance, usually starting with less critical

functions. We observe in these cases that opensource solutions are often preferred with in-house development, offering greater control (i.e. flexibility and transparency), but sometimes requiring more time and expertise to implement effectively. This 'cautious' strategy can help minimise risks and ensure a smoother integration process.

On the other hand, banks with a greater appetite for innovation frequently choose cloud-based services that offer ready-to-use solutions, including highperformance models that can be rapidly deployed with full support and regular updates. By adopting these technologies quickly, they aim to gain competitive advantage and capitalise on the benefits of AI sooner.

What are the current limitations of using such technologies?

Chatbots based on generative AI offer great promise for banks, but several considerations must be made before their deployment. Firstly, data confidentiality is crucial. Chatbots handle large amounts of often sensitive information, and banks must therefore maintain robust security measures to ensure that it is treated in compliance with data protection laws.

Ensuring the quality of the data used by these technologies is also essential; poor quality data can lead to erroneous or incomplete results. Moreover, some LLMs are trained on text corpora that may contain biases or unethical information, which can lead chatbots to reflect and perpetuate human biases in their responses. We believe that effective data management and governance contribute to strong chatbot performance.

What approach has Lombard Odier taken to adopting this technology?

When it comes to deploying chatbot technology within an organisation, we distinguish between two strategies:

• Universal access: offer all employees access to chatbot tools and observe the different ways they use the technology to identify its added value.

• Targeted use: start with specific business use cases and a select group of pilot users to refine and perfect the technology before a wider roll-out.

At Lombard Odier, we chose the second approach: targeted use. This allowed us to experiment with and master the technology in a controlled environment, ensuring its reliability and effectiveness before deploying it on a large scale.

Geoffroy de Ridder Head of Technology and Operations Lombard Odier Group

Scan here to get in touch.

Deploying chatbot technology at Lombard Odier

What can this chatbot do?

Our chatbot, primarily aimed at bankers and assistant bankers, is custom-designed and integrated on our servers. It gives employees rapid access to complex and specialised information, and enables them to navigate the rules and procedures for forming new banking relationships and managing the client lifecycle thereafter. This approach improves the efficiency of the process and ultimately speeds it up.

What challenges have you overcome?

It is essential to ensure that chatbots do not produce misleading or incorrect information. Our tool needs to provide clear answers in order to build user confidence. In addition, we have had to deal with teething problems such as ‘hallucinations’ and incomplete responses. Our tool therefore also includes mechanisms to limit the generation of erroneous data.

Why did you opt for in-house development?

By designing the open-source LLM solution in-house, we were able to fully customise it to meet the needs of our core businesses. The tool was designed to understand the nuances of our industry, the specialist terminology and our internal processes. This customisation ensures greater accuracy and relevance in the answers provided, leading to better adoption and an optimised user experience.

What are your plans for the future development and expansion of the tool?

Although this tool is optimised for client lifecycle management, its modular design allows for future expansion, and we have already identified other potential uses for it. As an example, we plan to develop it to cover internal directives and policies, articles and content from our intranet, and our current legal contracts. We are convinced that exciting new use cases, particularly through interactions between multiple chatbots, will soon be a reality.

The role of AI in behavioural analytics: transforming wealth management for the mass affluent 2

By Sahba Hadipour, Founder & CEO, Figg

The wealth management industry is undergoing a profound transformation driven by Artificial Intelligence (AI). While traditional wealth managers have long focused on high-net-worth individuals (HNWIs), the mass affluent segment remains largely underserved. AI-driven behavioural analytics offer a powerful solution, enabling wealth managers to better understand, engage with, and serve this demographic. By leveraging AI, firms can enhance customer acquisition, improve retention rates, drive higher return on investment (ROI), and maintain compliance within regulatory frameworks.

Today, AI’s ability to process vast amounts of data allows wealth managers to deliver personalised investment strategies at scale, bridging the gap between high-touch services for HNWIs and digital solutions for the broader market. The financial industry has recognised AI’s potential, with firms increasingly integrating machine learning models to uncover patterns in customer behaviour, predict financial needs, and automate processes for efficiency. As regulatory environments evolve, AI is also being utilised to ensure compliance and reduce risks associated with financial transactions.

Understanding behavioural analytics in wealth management

Behavioural analytics involves using AI to interpret financial behaviours, spending habits, and investment patterns. By analysing large volumes of client data, AI can predict future behaviours, personalise financial products, and optimise client interactions. AI-driven models assess not just historical transactions but also social, economic, and psychological factors influencing financial decisions.

For the mass affluent, whose financial behaviours often differ from those of HNWIs, AI-driven insights can help wealth managers craft tailored financial strategies. Unlike traditional portfolio management, which relies heavily on static client profiling, AI allows for dynamic, real-time adjustments based on evolving client needs and external market conditions. This continuous monitoring ensures that wealth managers can proactively address client concerns before they escalate.

The business case for AI in wealth management

1. Enhancing customer acquisition

Wealth managers struggle with cost-effective client acquisition, particularly in the mass affluent segment. AI enables predictive lead scoring, identifying highpotential prospects based on their financial activity, online behaviour, and demographic data. Automated marketing campaigns powered by AI further refine engagement strategies, ensuring wealth managers reach clients with relevant offerings at the right time.

AI-driven chatbots and virtual advisors also help with customer acquisition. They provide potential clients with instant information on financial products, increasing conversion rates. Moreover, AI can segment audiences more precisely, enabling firms to create highly targeted marketing campaigns that address the specific needs of different customer groups.

2. Improving client retention and engagement

Traditional retention strategies often fall short due to a lack of personalisation. AI-driven behavioural analytics can create hyper-personalised engagement strategies by monitoring changes in client behaviour. When a client shows early signs of financial stress or disengagement, AI can trigger proactive interventions, such as customised investment recommendations or personalised financial coaching.

AI enhances engagement by enabling wealth managers to provide real-time financial insights and automated alerts on market changes that may impact client portfolios. This level of responsiveness builds trust and encourages long-term relationships between clients and firms.

Use case: predictive retention strategies

A leading wealth management firm implemented an AI-driven client retention system that identified clients at risk of disengagement. By personalising outreach with tailored product offerings, they experienced a 30% improvement in retention rates over six months.

3. Driving higher ROI

AI optimises portfolio performance by continuously analysing risk factors, market trends, and individual client preferences. This enables wealth managers to maximise investment returns while minimising risks. Additionally, automating routine tasks reduces operational costs, allowing firms to reallocate resources to more strategic client-facing activities.

Furthermore, AI provides greater transparency by offering clients detailed reports on investment performance, including risk assessments and potential growth opportunities. By using AI-driven robo-advisors, firms can offer clients more accurate, data-backed recommendations, increasing investor confidence.

Use case: AI-powered investment optimisation

A mid-sized wealth management firm deployed AIdriven portfolio management tools that adjusted asset allocations based on real-time market conditions. Over a one-year period, clients experienced an average portfolio return increase of 12%, compared to 7% for traditional models.

4. Ensuring compliance within regulatory parameters

Regulatory compliance presents a significant challenge in wealth management, given the stringent requirements for transparency and suitability. AI can enhance compliance by monitoring transactions in real-time, identifying potential risks, and ensuring adherence to regulations. Tools driven by AI also generate comprehensive audit trails, minimising the risk of regulatory breaches and fostering trust between clients and institutions.

AI-powered systems assist firms in maintaining compliance by automating Know Your Customer (KYC) and Anti-Money Laundering (AML) processes, which reduces human error and enhances detection rates. Regulatory authorities are also starting to adopt AI for oversight, indicating that firms which proactively implement AI-driven compliance solutions are likely to enjoy smoother regulatory interactions.

Implementation strategies for wealth managers

• Data integration: Aggregating structured and unstructured data from multiple sources to create a holistic client profile.

• AI-driven insights: Deploying machine learning models to identify patterns and predict future client behaviours.

• Automation of client interactions: Employing AIpowered chatbots and robo-advisors to enhance client engagement, while ensuring human oversight for complex advisory requirements.

• Continuous monitoring and optimisation: Implementing AI systems that evolve based on real-time data to refine engagement and investment strategies.

Conclusion

The integration of AI-driven behavioural analytics signifies a paradigm shift for wealth managers, especially in meeting the needs of the mass affluent. By enhancing customer acquisition, improving retention, driving ROI, and ensuring compliance, AI enables wealth managers to provide more personalised, efficient, and effective financial services. As AI technology continues to develop, its role in wealth management will only become more essential – and impactful.

Sahba Hadipour Founder & CEO Figg

Can the world’s largest and fastest growing wealth pools embrace AI? 3

By Phil Watson, CIO, Betteredge Capital, and CEO, Lightbox Wealth

Family offices are experiencing substantial growth. By 2030, the number of single-family offices worldwide is projected to grow a third - reaching 10,720. At the same time, those family offices will manage a total of US$5.4 trillion in assets - an increase of 75% (Deloitte). Both highlight the rising complexity of wealth management within these organisations. With the rising client and / or AUM loads, operational efficiency has become a focal point. With family offices spending up to a fifth of their time on administrative tasks and compliance, it is unsurprising that 40% of family offices plan to hire additional staff. However, maintaining cost discipline remains paramount and AI has emerged as a solution.

During recent years, there has been a growing institutionalisation of family offices – taking a more structured and professionalised approach, similar to institutional investors. Many have adopted sophisticated risk management frameworks, invested in technology-driven portfolio analytics, and hired experienced talent. According to the UBS Global Family Office Report 2024, 44% of family offices have implemented a governance framework, an equal percentage have documented investment processes, and 56% have an investment committee. As this process continues, AI is expected to play an ever more important role.

Away from governance, AI has become a chosen destination for family office investments. Awareness of the opportunities in AI has grown supported by the fact that AI has overtaken HealthTech, food security, and other typical themes the as top-ranked investment theme among family offices. In the recent UBS survey, nearly 80% of respondents in the UBS survey indicated their intention to invest in AI within the next two years.

Altogether, this transformation is also occurring against the backdrop of an intergenerational wealth transfer. By 2045, an estimated US$84 trillion will change hands in the US alone, with a substantial portion transitioning before 2030. As wealth moves from one generation to the next, family offices must adapt to new investment philosophies, risk appetites, and technological expectations.

Despite its promise, AI adoption in family offices is not without challenges. The motivations of family offices vary significantly.

Horses for AI courses

Despite its promise, AI adoption in family offices is not without challenges. The motivations of family offices vary significantly. Many are investment-led, prioritising wealth preservation and growth, while others focus on legacy planning, philanthropy, tax efficiency, or lifestyle management. These differences or relative priorities shape their approach to AI adoption.

Geographical boundaries further influence AI integration. Regulatory environments vary widely, dictating data usage, privacy protections, and compliance obligations. Family offices, typically small teams of fewer than ten members, often rely on personal relationships rather than technological infrastructure. This human-centric approach can slow the adoption of digital tools, let alone advanced AI capabilities.

And although family offices do not have the extensive legacy architecture of large banks, those that do have more advanced technology frequently operate with a fragmented technology stack. Many use multiple systems – from accounting, portfolio management, and reporting, resulting in inefficiencies and siloed data. Moreover, concerns over data privacy and reputational risks make AI adoption a delicate balancing act.

Cost considerations add another layer of complexity. With staffing and asset management costs comprising over 80% of expenses, family offices must weigh the benefits of AI against its implementation costs. While AI is often touted as a juggernaut of efficiency, its societal implications and governance challenges cannot be ignored. The rapid pace of AI innovation must be met with responsible oversight, ensuring that progress is not only swift but also secure and ethical.

Key question: how can AI address these complexities and enhance the efficiency of family offices?

The prevailing wisdom in the AI consulting world has been that family offices should create expansive ‘data lakes’ – centralised repositories where all possible data sources are ingested, waiting to be processed by AI. The problem? A data lake full of unstructured, unreliable, and unverified information is actually just a ‘data swamp’.

A typical family office will accumulate a wide variety of documents pertaining to their client(s), markets, products, office documents, contractual and regulatory obligations and if, however, these documents are simply thrown into a database without a system for standardisation, tagging, and validation, AI models trained on them will produce inconsistent and potentially misleading results. Without rigorous structuring, an AI model might treat a 2018 venture fund report with the same weight as a 2025 real estate projection – without adjusting for time, context, or reliability.

The other issue is duplication and misinformation. A large data lake inevitably includes redundant or conflicting data points – multiple valuations for the same asset, different assumptions across fund reports, overlapping exposure in alternative investments. If AI is working off raw, unfiltered inputs, the insights will be noisy at best, and catastrophically misleading at worst.

A data lake isn’t a strategy. Structured, reliable, and high-quality data is. And for family offices looking to harness AI effectively, that distinction is everything.

The real key: structured, decision-useful data

Instead of chasing volume, family offices should be laser-focused on data quality, structure, and provenance. That means:

1. Creating a standardised data taxonomy

Every data point needs a clear definition, timestamp, and source attribution.

2. Enforcing data validation and cleansing

Before feeding data into AI systems, it needs to be verified, deduplicated, and reconciled. This is especially critical for alternative assets, where valuations can fluctuate based on methodology.

3. Prioritising high-fidelity sources over volume

More data isn’t always better. A handful of high-quality, trusted data sources will always outperform an ocean of unverified information.

4. Integrating contextual and qualitative data

AI models struggle with non-quantitative factors – yet in family offices, these are often the most critical. AI should be designed to ingest and interpret qualitative data, whether from structured interviews, sentiment analysis, or expert annotations.

5. Building a feedback loop for human oversight

AI is not a replacement for human judgment – it’s a tool to enhance it. Every AI-driven insight should be auditable and explainable, with clear pathways for human analysts to validate, challenge, and refine recommendations. The best AI implementations don’t just automate decisions; they augment the expertise of investment teams by surfacing insights they might have overlooked.

AI is not a replacement for human judgement –it’s a tool to enhance it.

Solution: AI as a catalyst for operational efficiency

Family offices are increasingly leaning towards buying rather than building solutions. The proliferation of asset and liability aggregators (consolidators) is a testament to this trend, as family offices seek streamlined access to financial data across multiple custodians.

For family offices that get this right, AI can be a powerful differentiator. Structured, reliable data ensures AI is poised to enhance several key aspects of family office operations, for example:

• Data aggregation and insights

• Deal flow and investment research

• Governance and compliance automation

• Cybersecurity and fraud detection

• Tax optimisation and estate planning

• Cost management and operational streamlining

Beyond operational enhancements, AI is becoming a key investment focus for family offices, with family offices increasingly viewing AI as both a tool and an investment.

Challenges and considerations in AI adoption

Despite its advantages, AI adoption is not without hurdles. A critical factor is data integrity. AI models are only as effective as the data they process. Without structured, high-quality, and validated data, AI can generate misleading insights rather than actionable intelligence.

The governance of AI is another pressing concern. Ethical AI deployment, data security, and compliance with evolving regulations require careful consideration. AI literacy among family office executives and staff is equally important. Without the necessary expertise, AI implementations may fall short of their potential.

Finally, cybersecurity is another area where AI plays a dual role. While AI enhances security protocols, it also introduces new vulnerabilities. AI-powered attacks are an emerging threat, making robust security frameworks a prerequisite for AI adoption.

Conclusion: AI as an enabler, not a replacement

Family offices are uniquely positioned to benefit from AI, but successful implementation requires a structured approach. AI adoption must be aligned with a clear strategy, prioritising structured and decisionuseful data. Without this foundation, AI becomes a liability rather than an asset.

As the investment community continues to explore AI's potential, family offices must strike a balance between innovation and governance. AI’s value is not in replacing human insight but in empowering decision-makers with better tools, deeper intelligence, and enhanced security.

AI is everywhere, and it will transform everything. For family offices, the question is not whether to adopt AI but how to do so in a manner that is intelligent, secure, and sustainable. Steering clear of jargon and approaching it pragmatically would seem a sensible starting point.

Phil Watson

CIO, Betteredge Capital CEO, Lightbox Wealth

The state of AI adoption in wealth management – challenges, opportunities, and a roadmap to success 4

By Vincenzo Chiochia, Head of AI & Data, Banking Practice, Deloitte

A recent survey reveals that 69% of banking executives anticipate AI to significantly impact their organisations, with 42% predicting a reduced reliance on personal investment advisers. However, this sentiment varies based on client demographics and geographical trends, particularly with private banks engaging with younger, tech-savvy wealthy individuals.

What is clear today is that the use of Artificial Intelligence (AI) in the financial market is increasing –and the increasing pace of adoption of AI brings with it both opportunities and risks.

Indeed, regulators expect supervised institutions that use AI to actively consider the impact of this use on their risk profile and to align their governance, risk management and control systems accordingly. Besides the size, complexity, structure and risk profile of the supervised institutions, the materiality of the AI applications used and the probability that the risks resulting from the use of these applications will materialise must be taken into account (FINMA).

In this article, we outline some of the key points related to AI adoption today, touch on some of the challenges that need to be overcome to continue on our collective journey of industry transformation to leverage AI and fully realise the potential it brings.

Key trends in AI adoption

The adoption of AI in client engagement is increasingly shifting towards hybrid models that combine AI-driven tools with traditional personal interactions. This trend reflects a growing recognition of AI's potential to enhance relationship management without replacing the human touch. Over the next three years, 60% of relationship managers anticipate leveraging AI tools to improve client service, while 67% of firms plan to integrate digital solutions alongside face-to-face meetings. This dual approach ensures that AI supplements human expertise, offering a seamless blend of efficiency and personalisation in client interactions.

In these hybrid models, AI operates largely behind the scenes, empowering relationship managers with actionable insights and streamlined workflows. By automating preparatory tasks, such as analysing client portfolios or tracking follow-ups, AI allows managers to focus on deeper, more meaningful engagement during meetings. Additionally, AI-driven tools can generate tailored insights, enabling firms to offer personalised advice that resonates with clients' unique needs and goals. As a result, the hybrid model is poised to redefine client engagement, combining the analytical power of AI with the relational strength of human interaction.

The adoption of AI in client engagement is increasingly shifting towards hybrid models that combine AI-driven tools with traditional personal interactions.

The rising demand for digital experiences

Investors are increasingly driving demand for advanced digital experiences, urging banks to prioritise innovative solutions that cater to their evolving expectations. A significant 68% of investors express a strong preference for banks that emphasise digital tools and platforms, highlighting a clear shift in client priorities. Among the technologies shaping this transformation, AI and cloud computing stand out as top investment areas, owing to their synergistic capabilities. Together, these technologies enable seamless data management, personalised client interactions, and scalable solutions that redefine how financial services are delivered.

Generational dynamics further amplify this trend, particularly in regions like APAC, where younger wealthy individuals are reshaping the landscape of private banking. For Gen Y and Z investors, digitalfirst banking experiences are not just a preference but a baseline expectation. This demographic envisions a future with minimal reliance on traditional advisory services, with 60% predicting a significant shift by 2030. To stay competitive, financial institutions must adapt, embracing transformative technologies and strategies that resonate with this tech-savvy generation’s demands for convenience, speed, and personalisation.

Opportunities for AI application across the bank value chain

AI offers transformative opportunities across multiple dimensions of banking:

• Efficiency and cost optimisation

• Enhanced customer experience

• Risk and compliance

• Support functions

The potential impact of AI on different demographic segments

While different demographic segments have slightly differing expectations on the potential benefits and positive impact of AI, the underlying view is clear: AI has huge potential to transform wealth management (and other industries). For example:

Bank executives

• 69% of bank executives believe AI will significantly change their firm’s work.

• 55% of executives say born-digital firms will transform the wealth industry, and 42% think that personal investment advisers will become less necessary.

Investors

• 68% of investors want their bank to offer digital experiences on par with those from leading borndigital companies.

• In the next three years, AI will be the top tech investment for banks (58%), followed by cloud (44%), and data analytics and collaboration tools (42%).

Relationship managers / investment advisers

• 60% of advisers expect to use AI tools to serve clients over the next three years.

• 67% of firms will move to a hybrid model where digital and AI-enabled tools will augment the RM in direct interactions with clients.

Clients

• 60% of Gen Y and Z do not expect to use advisers due to advances in technology (e.g. AI) by 2030.

Challenges in AI adoption

Despite its significant transformative potential, AI adoption in banking is not without hurdles. As mentioned in a recent FINMA report (specific to the Swiss market, but the following observations can be applied in a broader geographic context): "The risks from the use of AI are mainly in the area of operational risks, in particular model risks (e.g. lack of robustness, correctness, bias and explainability) as well as IT and cyber risks. They also result from a growing dependence on third parties such as providers of hardware solutions, models or cloud services in an increasingly concentrated market. Finally, there are legal and reputational risks as well as challenges in the allocation of responsibilities due to the autonomous and difficult-to-explain actions of these systems and scattered responsibilities for AI applications at supervised institutions" (FINMA).

So, how should wealth managers and financial institutions best go about addressing these risks to overcome the many challenges in pursuing AI adoption? The following points form a non-exhaustive list of areas firms should consider addressing to stay on track as they embark on their AI journey:

Data privacy and security

Banks must address concerns about hosting sensitive client data in the cloud. While some institutions adopt on-premise solutions, others explore hybrid models to strike a balance.

Workforce adaptation

Employees may perceive AI as a threat. Effective change management and training programmes are essential to position AI as a tool that enhances, rather than replaces, their roles.

Regulatory risks

Banks must establish robust governance frameworks to manage AI-related risks, including model reliability, data security, and compliance.

What are the key building blocks for AI success?

To harness AI’s potential while managing risks, banks should focus on eight critical areas:

Operating model

Define roles, including the Chief AI Office, and clarify governance structures.

Value realisation

Track AI initiatives using clear KPIs to measure impact and prioritise resources effectively.

Use case delivery

Assemble skilled teams to implement AI projects.

Platform development

Choose between cloud-based or onpremise solutions, ensuring data security and scalability.

Ecosystem partnerships

Collaborate with FinTechs, tech partners, and other external organisations.

Learning and development

Consider equipping employees with skills including data science, machine learning, and prompt engineering.

Operational excellence

Ensure seamless integration of AI tools into existing workflows.

Change management

Promote AI as an enabler and provide a clear vision for its integration into the workforce.

Strategic steps to accelerate AI adoption

Pragmatically, firms should focus on the following key areas to ensure successful and timely adoption of their AI initiatives:

• Secure leadership support

Gain C-level buy-in to prioritise AI as a strategic advantage.

• Prioritise investments

Identify key focus areas – be it back-office efficiency or client-facing innovation – and allocate resources accordingly.

• Establish governance

Implement a minimum viable governance model to manage risks and ensure regulatory compliance.

• Scale thoughtfully

Start with pilots, refine use cases, and scale successful initiatives while monitoring their impact.

Conclusion:

The future of AI in banking

AI is set to be a defining factor in banking competitiveness, shaping client preferences and employee choices. By addressing challenges and adopting a structured approach, banks can unlock AI’s full potential. The road may be complex, but with the right strategy, AI will transform the banking landscape, offering unparalleled opportunities for growth and innovation.

The successful adoption of AI in wealth management is not a sprint – it’s a marathon with an ever shifting finish line! To be successful, and to stay in the race, firms need to adopt a holistic view to tackle the numerous categories or risk associated with effective AI implementation, and stay consistently stay one step ahead of the competition.

AI is set to be a defining factor in banking competitiveness, shaping client preferences and employee choices. By addressing challenges and adopting a structured approach, banks can unlock AI’s full potential.

Vincenzo Chiochia Head of AI & Data, Banking Practice Deloitte

Five practical steps to help increase organic growth: transforming advisory firms for the next generation 5

By Patrick Hannon, VP of SaaS Commercialisation, Fidelity Labs

The wealth management industry is poised for unprecedented opportunity. Cerulli updated its forecast for assets transferred in the next twenty years from $84 trillion to US$124 trillion through 2048. It projects that US$105 trillion will be passed to heirs, with US$18 trillion going to charity. While US$21 trillion in mass affluent assets remains largely unserved by traditional advisory firms, the industry clings to service models designed for high-net-worth clients. Meanwhile, artificial intelligence promises to revolutionise adviser capacity just as next-generation clients demand a fundamentally different wealth management experience.

The transformation of wealth management comes as many firms struggle with the basics of profitable growth. Fidelity's 2024 RIA Benchmarking Study reveals that even growing firms are grappling with compressed margins and rising expenses. Yet some firms have discovered how to thrive in this changing landscape, achieving superior growth while maintaining stronger profitability.

Transform raw data into actionable intelligence

Today, the traditional advisory firm still operates with surprisingly high levels of inefficiency. Advisers spend up to 70% of their time on manual back-office tasks, leaving limited capacity for client engagement and strategic planning that drives value. This administrative burden can make effectively serving the mass affluent market impossible – the economics may simply not work.

Leading firms are revolutionising this equation through intelligent automation and data integration. Rather than viewing AI as a threat, they are using it to help transform their operational model. The impact appears in their numbers – high-performing firms maintain overall expenses at just 10.5% of revenue, while other firms spend nearly double that amount, at 18.5%

This efficiency isn't about cost-cutting, however. It is about a fundamental transformation of advisory firms' operations. By automating routine tasks and integrating systems effectively, these firms can create capacity for advisers to serve more clients without sacrificing service quality. The result? Higher revenue yields (68 basis points versus 64) and dramatically better operating margins (26% versus 15%).

Understanding growth metrics that matter

The mass affluent market represents both enormous opportunity and serious challenge. Traditional client acquisition approaches, built around high-touch prospecting and relationship building, may simply not scale to serve this market. Yet this segment, representing one-third of U.S. households, demands and deserves quality financial advice.

Leading firms are rethinking growth from the ground up. Rather than scaling traditional prospecting methods, they're building systematic approaches to client acquisition and service. The data validates this strategy: high–performing firms see similar or fewer prospects on average (66 versus 67), but convert them at higher rates (73% versus 68%).

More importantly, these firms generate substantially more referrals – 29 new clients from referrals compared to 20 for other firms. This efficiency in client acquisition becomes crucial when serving the mass affluent market, where client acquisition costs must be carefully managed.

Rather than viewing AI as a threat, leading firms are using it to transform their operational model.

Addressing top client concerns

The next generation of clients brings fundamentally different expectations. They demand transparency in fees, clarity in service offerings, and efficiency in delivery. Most firms attempt to meet these demands by simply adding services, often without corresponding fee increases. The result? Compressed margins and unsustainable service models.

High-performing firms take a different approach. They maintain clear service boundaries and appropriate pricing while using technology to deliver services efficiently. Where 18.5% of traditional firms bundle ten or more services under a single fee, only 10.5% of high-performing firms follow this path. Instead, they focus on delivering core services exceptionally well, using automation to maintain profitability while ensuring quality.

Supporting ageing clients with technology

The industry faces a stark reality: 75% of RIAs don't offer communication beyond e-mail, even though clients increasingly demand seamless digital experiences. This gap between service delivery and client expectations can threaten both current relationships and next-generation transfers.

Leading firms are bridging this gap through strategic technology deployment. Rather than viewing digital transformation as a cost centre, they see it as key to scaling quality advice. They spend less on technology overall but achieve better results through focused deployment on capabilities that matter to clients.

Next-generation engagement strategy

The most significant transfer of wealth in history coincides with the greatest transformation in client expectations. Millennials and Gen Z don't want their parents' wealth manager – they expect tech-first platforms, transparent fees, and seamless digital experiences. Most firms remain woefully unprepared for this shift.

High-performing firms are building for this future today. They're creating service models that naturally accommodate client preferences while maintaining operational efficiency. This approach helps explain their superior growth rates – these firms typically grow faster (13.1% three-year AUM CAGR versus 8.9%) while maintaining higher revenue yields.

The path forward requires fundamental transformation. Firms must leverage AI to dramatically increase adviser capacity while building scalable service models that profitably serve the mass affluent market. They should embrace digital transformation not as a cost to be minimised, but as the key to future growth.

The rewards for making this transition can be substantial. Firms that successfully evolve their approach can capture this opportunity while maintaining profitability. Those that cling to traditional models risk becoming increasingly irrelevant in a rapidly changing market.

The choice facing advisory firms isn't whether to make this transition but how quickly they can execute it. The technology exists, and the market opportunity is clear. The only question is which firms will lead this transformation and which will be left behind.

Patrick Hannon VP, SaaS Commercialisation Fidelity Labs

AI Toolkit 2025 Roadshow / London

20TH MAY 2025

Hosted at the Pan Pacific Hotel, in the heart of the City of London, the London edition of the AI Toolkit Roadshow 2025 from The Wealth Mosaic (TWM) is the third event after editions in Zurich and New York. Focused on the role of Artificial Intelligence (AI) in the UK, and wider wealth management space, the event will run from 8:30 AM to 12:00 PM and mix short presentations, vendor demos and an industry panel discussion.

Don't miss the opportunity to hear several AI-focused technology demos and stay ahead in the industry on all things AI!

Interested in participating in the roadshow?

Contact us for more info and sponsorship opportunities. Register Now

Disclaimer

This event is free for wealth managers to attend, although registration is required, while there are a limited number of paid tickets available to technology vendors, consultants and others. Access to the event is limited and is available on a first-come, first-served basis. All registrations are subject to approval by the event organiser.

AI in ACTION

Showcasing the application of AI in wealth management HIGHLIGHTS

EVENT INSIGHTS

AI Toolkit Roadshow 24/25

'Live and Unplugged'