The future of an embattled sector

Maybe, just maybe, it isn’t all doom and gloom. Firstly, let’s be frank here. I’m not suggesting there isn’t a costof-living crisis, that inflation isn’t at stupendous rates or that house prices aren’t dropping.

But let’s look at some of the news we’ve seen come out in the past few weeks. Firstly, mortgage applications dropped heavily in the final quarter of 2022. Hands up if you were surprised by that. The mini-Budget knocked wind out of the proverbial sails of the market. It was carnage. No one can honestly have expected any less than a drop, surely?

Meanwhile house prices are down. Again, unsurprising considering the impact of Kwasi and Liz’s “We got carried away” (Kwarteng’s words) mini-Budget. Also, while we’re at it they “got carried away”? It was a national budget not the rice order at their favourite Indian restaurant!

I digress. Despite the drops, which look set to be significantly less than the 15% bandied about at the back end of last year, things, again aren’t that bad.

Earlier this month the Halifax House Price Index revealed that house prices had jumped unexpectedly in February, potentially reflecting improvements in consumer confidence and the mortgage market.

Ryan Fowler Publisher

Felix Blakeston Associate Publisher

Jessica Bird Managing Editor

Jessica O’ Connor Reporter editorial@theintermediary.co.uk

Claudio Pisciotta BDM claudio@theintermediary.co.uk

Maggie Green Accounts

finance@theintermediary.co.uk

Barbara Prada Designer

Bryan Hay Associate Editor

Lorraine Moore Subscriptions

subscriptions@theintermediary.co.uk

Prices were up 1.1% month-on-month, following a 0.2% rise in January, Halifax said.

Equally the RICS Residential Survey shows that while the housing market remains downbeat, there are some indications of a more stable outlook emerging. And this issue we look at the buy-to-let sector in our feature on Page 34 where Hannah Smith considers the impact of what many landlords perceive as the ongoing war on buy-to-let.

In the past few weeks alone the sector has been referred to as both “dead” and a “golden opportunity”, in the same national newspaper no less. But data from Moneyfacts shows that overall buy-to-let product availability, for both fixed and variable, has improved month-on-month, returning to levels not seen since August 2022 (2,375). As such there are now 2,400 options available, the highest count since July 2022 (2,746), which is an encouraging sign of recovery.

While rates are still some 2% higher than before the mini-Budget it will be interesting to see what impact increased competition will have on them.

The point of this rant is that things are not as bad as they could be, or were anticipated to be late last year. Could things be be er, most certainly. However, things could be a whole lot worse. ●

Adrian Moloney | Alison Pallett | Alpa Bhakta

Andrew Hosford | Andy Dean | Anna Lewis

Ashley Pearson | Barry Luhmann | Brian West

Chris Pearson | Colin Sanders | Conor Murphy

David Jones | Gregor Sked | Helen Scorer

Herbie Bone | Hiten Ganatra | Jacqui Gillies

Jacqueline Dewey | Jane Simpson | Jeremy

Duncombe | Jodie White | Jonathan Stinton

Kelly Melville-Kelly | Leon Diamond | Les Pick

Louise Pengelly | Lucy Barrett | Marie Grundy

Mark Davies | Martese Carton | Matt Tristram

Moubin Faizullah Khan | Natalia Kusiak

Nick Russell | Paresh Raja | Paul Brett

Paul Carter | Pete Dockar | Phil Gamblin

Raheel Butt | Ranjit Narwal | Richard Rowntree

Robin Johnson | Sofia Jones | Steve Goodall

Steve Swyny | Susan Baldwin | Tanya Elmaz |

Tanya Toumadj | Tom Denman-Molloy | omas

Brett | Tom Rowlands | Tracy Simpson | Will Hale

Cartoons by Giles Pilbrow Printed by

FEATURES & REGULARS

Feature 34

Hannah Smith looks at the future of the buy-to-let sector

This month The Intermediary takes a look at the housing market in Cardiff

An eye on the revolving doors of the mortgage market: the latest industry job moves

SECTORS AT-A-GLANCE

Residential 6

Buy-to-let 40

Later Life 54

Specialist Finance 62

Technology 78

Second Charge 88

Protection 94

INTERVIEWS & PROFILES

The Interview 50

QUANTUM

Quantum Mortgages tell us how they plan to support brokers and their landlord clients

In Profile 18

NOTTINGHAM BUILDING SOCIETY

Alison Pallett discusses the return to her mutual roots

Q&A 30

BLUE PLANET MORTGAGE NETWORK

Martin Swann, managing director of Blue Planet Mortgage Network, talks economy, regulation, technology and more

In Profile 64

GREENFIELD MORTGAGES

Steve Smith discusses how he has built a lender focused on personal customer service

ACCORD MORTGAGES

Angelika Christian tells us about the challenges and opportunities she faces as a business development manager

As we close in on our 1,000th broker firm going live — that’s more than 23,000 brokers with access to our mortgages — it’s a natural point to reflect on the journey since we launched our broker proposition back in late 2014.

Even more importantly, it’s a logical platform from which to look ahead at what the market holds in store for 2023, and where we can evolve our proposition here at HSBC.

In terms of reflections, our recently published annual results show another year of growth for our mortgage business, with our broker channel playing a huge role in that success, alongside our direct channels.

We don’t take that success for granted, and we’ve been continually investing in our people, platform, products and service, from a very manual spreadsheet approach in 2014 to a state of the art broker platform, backed by hundreds of people both in the UK and globally, who support the overall broker proposition.

We know that our brokers fight hard to both win and then support clients through the mortgage journey. It’s our job as a lender to make sure we make the lending journey as smooth and seamless as possible when brokers entrust us with their mortgage applications.

Technology supports that process, but it is our people who interact with brokers every day, either in the field or over the phone, and who make the difference and bring to life the standards we want to set.

Our mantra is to be the ‘natural choice’ for brokers. Every interaction should feel like we’re open for

business, helpful, knowledgeable, fast, and as keen to get that deal over the line as you are.

We have invested heavily in our phone and live chat capabilities, bringing in more and more colleagues to support our growth, and then continually training and coaching them to be up there with the very best in the industry.

Our approach is pre y simple: when you want to speak to us, you can get through to us fast, and the person you speak to is knowledgeable, personable and sorts your query, fast. Brokers can then get on and do what they do best, supporting more customers with their mortgage needs.

Whilst 2023 is likely to be an uncertain year for the market overall, one thing I can guarantee from HSBC UK is that it will be another year where we’ll continue to push the boundaries on service as well as propositional enhancements.

Turning further to what 2023 holds in store, in gross lending terms the market is going to be substantially down on 2022 levels, as we all know. That means we’re all going to have to step up to the challenges ahead, and in particular the extra work involved in both winning new customers and then guiding them through today’s market conditions, ensuring expectations are clear in terms of ongoing costs and affordability, given where interest rates are at the moment.

There will be many brokers —newer to the industry — who will have to develop fresh skills where ‘top of the funnel’ activity in winning new customers is just as important as advising on the right mortgage.

Sleeves rolled up, elbows out and hustling for business, so to speak,

will be a key skill in this market. Those brokers with a mature book of customers will no doubt be having early conversations around options — that’s certainly a sensible place to start. Keeping up to date with the evolving needs of customers around protection will also be key, and a great conversation starter; as people’s lives change, so may their protection needs.

It will be no different for lenders, and at HSBC UK we know we’re going to need to earn that business by being visible in front of brokers and having the right balance of products, policies and service for those brokers to entrust us with their hard-earned customer applications. We’re up for that challenge, and we’ll play our part, that’s another guarantee for 2023.

I’m of a certain vintage where I’ve come through several tricky cycles, the Covid-19 pandemic being a recent example, but also the financial crisis back in 2008. What I know on the back of those experiences is that this is a very resilient industry, and it is well served by hugely talented people.

At HSBC UK, our support and optimism for the industry we serve continues to shine brightly. ●

Sleeves rolled up, elbows out and hustling for business, so to speak, will be a key skill in this market”

Choose Landbay and you’ll find experts at the end of the line, smart technology designed for you, and fast decisions you can count on.

At the end of this month the Help to Buy Equity Loan scheme will come to an end in England. Launched 10 years ago by then Chancellor George Osborne to support the property market in the wake of the financial crisis, the scheme helped first-time buyers buy a new-build property with just a 5% deposit, with the Government providing a loan of 20% of the property value.

In most parts, the scheme has been a success in supporting the new-build sector. Latest figures from September 2022 from the Department for Levelling Up, Housing and Communities show, since its launch in April 2013, more than 375,000 people used it to buy more than £105.4bn worth of new-build properties.

The scheme hasn’t been without its critics, as many believe it has cost the taxpayer and fuelled house price growth in some areas, although there are counter arguments that it has allowed first-time buyers to jump a

rung, arguably saving the associated second-stepper fees.

Furthermore, a report from the Home Builder Federation indicates that the Treasury has had a 10% return on its investments, for those loans that have been repaid.

We can take encouragement that builders have been weaning themselves off Help to Buy over recent years, and whilst the removal of the scheme could have come at a be er time, given the wider market backdrop, the new-build market is in a much be er place today.

Net dwelling additions have grown from circa 125,000 in 2012-13 to circa 233,000 in 2021-22, and its unlikely we will see those numbers fall sharply. Misgivings over build quality that previously marred the sector are less common, and the recent introduction of the New Homes Quality Board will help further. Moreover, the recent focus on energy costs, combined with a desire for greener living, has increased appeal.

Recent research by the Home Builders Federation highlights that

85% of new-build dwellings are rated A to B compared with just 4% of existing housing stock, and the average saving for a new build home is now over £3,000 per annum.

The industry is showing its resilience, with most housebuilders already now signed up to support the Deposit Unlock scheme, which also allows borrowers to purchase a new-build property with as li le as a 5% deposit. This scheme has a broader appeal when compared with Help to Buy, as it is available for second-steppers as well as first-time buyers. There are also no additional costs, and borrowers can access lenders’ standard mortgage rates.

Nationwide is the largest lender offering the scheme, but we expect and would welcome other major lenders also joining, which is likely to happen once Help to Buy has been withdrawn. Housebuilders are having to become more creative to support buyers, through increasing the use of incentives, such as mortgage subsidies and introducing their own schemes, to help encourage buyers through the door. At the same time, there has been a slowing of ‘forward selling’, which should make it easier to keep buying chains intact, a key issue in the newbuild sector last year.

Brokers, too, have a huge part to play in navigating customers through the complexity and nuances of the new-build market, and we remain commi ed to supporting them and their customers through that journey. ●

Complex incomes accepted

We specialise in finding solutions for your clients with more complex circumstances

Lending in and into retirement

First time buyer, first time landlord

All foreign currencies and countries considered for ex-pat applicants

Flexible approach to construction stages for self-build applicants

CONTACT YOUR INTERMEDIARY SUPPORT TEAM TODAY

Call 01384 489195 or email intermediaries@dudleybuildingsociety.co.uk

To find out more about our criteria and products please visit dudleybuildingsociety.co.uk/intermediaries

@DudleyBS

Dudley Building Society

Dudley Building Society

@dudleybuildingsociety

Keeping in mind the ever changing market conditions, there is reason to be cautiously optimistic. Here’s what brokers need to keep their eyes on in 2023.

A er the uncertainty caused by the mini-Budget, mortgage rates climbed higher than many borrowers had seen in over a decade, subduing demand from homebuyers in the final months of 2022.

However, Zoopla’s UK House Price Index shows that buyer demand has now returned to pre-pandemic levels – in fact, data shows that activity is on par with 2018 figures, and 10% higher than it was in 2019. New buyers seem to be more confident about commi ing to their purchase, as cautious optimism about the market and economy grows.

Rates have been falling – the average 2- and 5-year fixed rate mortgage fell back from 5.69% and 5.63% in January to 5.44% and 5.20%, respectively, and this trend may continue through the year.

Concerns about a fall in house prices also need to be put into context. Over the past few years, the market has seen prices rise significantly, with data from the Land Registry showing that average property prices rose by 12.6% in 2022 alone.

A predicted fall of 5% or 10% would therefore only bring the market back to levels seen in early 2021.

A fall may even help bolster demand by improving affordability for those looking to step onto the ladder, and while some parts of the market may suffer more, others will continue to outperform.

We expect to see remortgaging activity driving business this year, with brokers and lenders facing a wave of fixed rate maturities.

More than half of homeowners will see the fixed rate on their mortgage end within the next three years, with upwards of £289bn-worth of fixed rate products – both residential and buyto-let – maturing in 2023 alone.

Many of these borrowers will have been locked into lower fixed rates over the past two to five years, and they may be concerned at the prospect of fixing on a higher rate at this time.

We expect to see a lot of these consumers turning to brokers as a result, leaning on mortgage market experts to help them find the most affordable deals.

However, intermediaries will still need to remain proactive and reach out to their customers to make sure they get the advice and support they need during these challenging times, and to help them find not just the most affordable product, but the one which best suits their needs.

Finally, there is a growing need to focus on education going forwards, particularly when it comes to green mortgages.

A growing number of consumers are switching on to the impact of climate change, with research by Credit Suisse finding a strong willingness among younger consumers in particular to increase spending on sustainable products. Others are trying to find ways to reduce costly energy bills by making their homes more efficient.

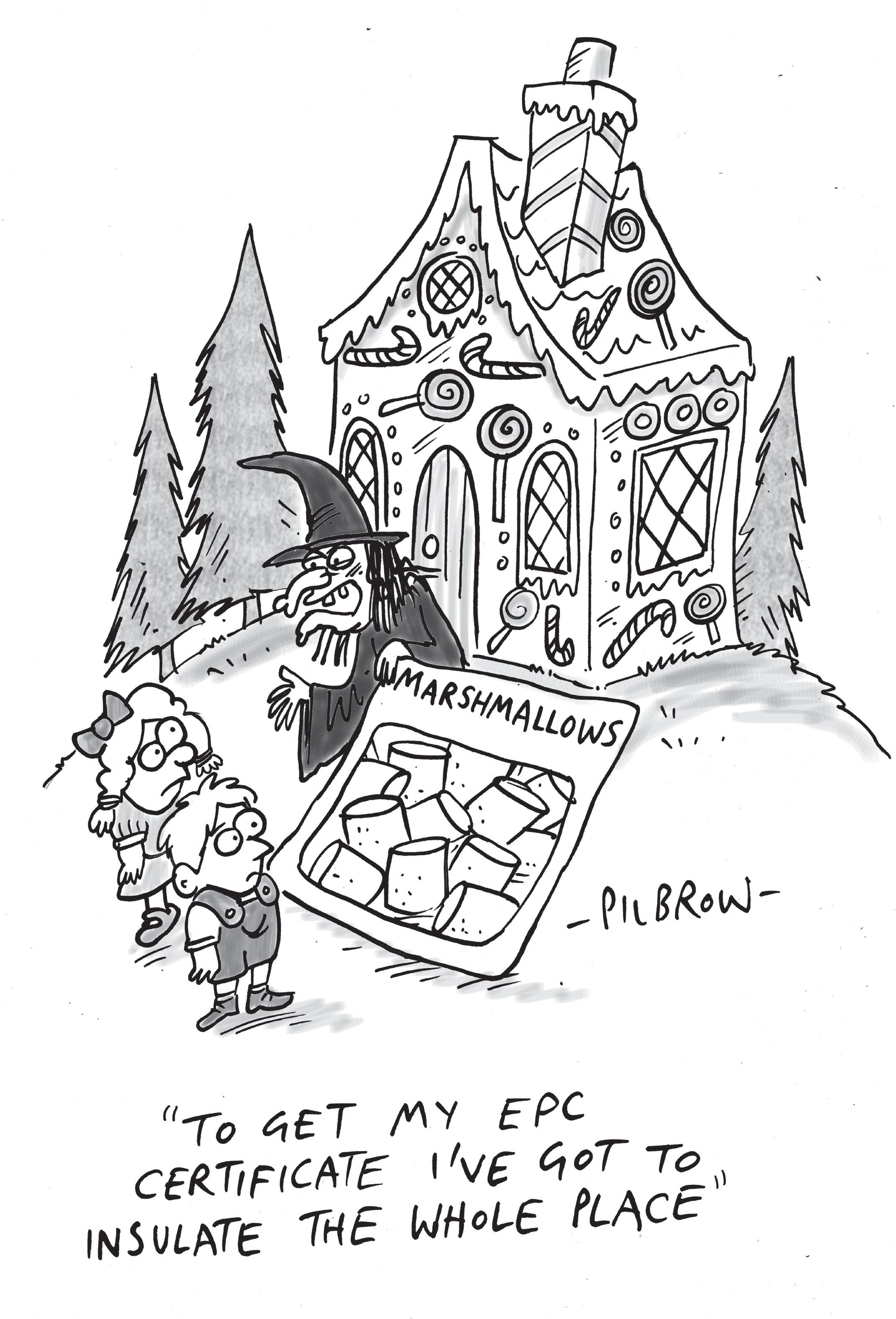

With an estimated 59% of property in England and Wales having an Energy Performance Certificate (EPC) rating of D or below, according to Rightmove, renovating existing housing stock and making it more efficient could help millions cut their heating bills, while ensuring their property is cleaner for the planet.

Green solutions will also be crucial for landlords, who face the prospect of new legislation to raise minimum EPC rating requirements to Band C from 2025 for new tenancies and 2028 for existing ones.

The mortgage market has an important role to play here, and intermediaries may find themselves increasingly asked about green products. Brokers must ensure they build up a strong knowledge of these solutions and the different product types that now exist in this growing market. This includes be er rates for energy efficient homes, or schemes that offer financial incentives for those who plan to carry out work that improves their property’s energy efficiency rating, such as Coventry’s Green Together Reward.

Keeping up with new products will also be critical to meeting brokers’ wider responsibilities under the Financial Conduct Authority’s (FCA) new Consumer Duty.

Tasked with supporting customers to make good financial decisions and avoid foreseeable harm, brokers will need to invest their time, expertise and efforts into ensuring their processes fit the requirements of the Consumer Duty, and continue to offer the best solutions for their customers. ●

At the start of this year we were hopeful that, with swap rates falling from their peaks last autumn and more control at the helm, we would see a more buoyant market than many of the pessimistic experts had forecast.

As we approach the end of the first quarter, we’ve definitely seen that at Accord; however, it’s not all been plain sailing. The market swap interest rates which govern fixed rate pricing have risen again in the past month, and all the signs are that rates may have stabilised, for the time being, at a higher point than some expected.

The factors contributing to that uptick in rates include lower unemployment figures and greater consumer spending over in America than anticipated, resulting in the Federal Reserve having to implement successive rate changes to try to keep a lid on this activity and stem inflation. As we know, what starts in the US often heads quickly over here, and in the UK, too, many people are continuing undeterred with shopping and socialising, while the job market remains strong. It’s perhaps interesting to reflect on why this might be the case – perhaps they’ve got so used to carrying on regardless through successive macroeconomic crises, so much so that it is now almost a way of life.

The mortgage market is rarely a smooth path to a destination, which is why great advice is always so important. Gambling on the market or waiting for a specific rate point to arrive can backfire, so the important thing is advising based on the information that’s in front of you.

Bank of England Governor Andrew Bailey recently

signalled his intention to take a watchand-wait approach to future base rate changes, after taking the central rate up a further 0.5% to 4% in February.

We think there could be at least another 0.25% rise before the end of this year, to 4.25%, with markets currently pricing in higher expectations of between 4.5% and 4.75%. The base rate could be dialled down a little after that, potentially to 3.5% by 2024, although any return to the breathtakingly low rates we’ve seen over the past 20 years is very unlikely.

Nevertheless, all forecasts come with a serious health warning, as we know from recent experience. There are signs that borrowers are adjusting their aspirations to this kind of new normal, and if we enter a period of rate stability where the markets and borrowers know what to expect, we could continue to see a pick-up in activity over the next three months.

Representatives from the Intermediary Mortgage Lenders Association (IMLA) and the Association of Mortgage Intermediaries (AMI) told a recent podcast featured in our Growth Series broker resource centre, that we could see a potential 20% decrease in house purchase activity during 2023 –though this could be offset by record numbers of product transfers.

There could also be a 25% decrease in buy-to-let purchasing activity due to pressures facing that sector,

including affordability and increasingly stringent taxation. Averaging out predictions from both organisations suggests gross mortgage lending could total £270bn this year, £41bn less than in 2022, thanks to a 20% drop in transaction levels

Interest rates are a key tool for controlling inflation,

of course, and the Government may have to increase the base rate by more than anticipated if this key consumer and business costs benchmark doesn’t start to drop from its current level.

While the recently announced fall in wholesale gas prices will help, what won’t help is that food bills continue to soar by 18% and historically high pay awards are being given to support employees, of 6% or more in many cases. Of course, the mood set by where the base rate lands in light of all this has a major impact on market swap rates.

As with all periods of volatility, this one presents opportunities to come out on the other side stronger, for those who choose to grasp them.

Intermediaries are one group of potential winners, because one thing that’s for certain is that borrowers need their services now more than they ever have done, to help them navigate a path through a market which is changing on an almost daily basis.

There could even be more potential revenue streams to be had for those who see the potential to expand their portfolio of services to include things like protection insurance, and support people with their wider financial planning.

Accord is 20 years old this year, and in the intervening years we’ve seen many market upheavals come and go.

The fact that we’ve managed to adapt and overcome each time, and watched the brokers we serve do the same, gives us the confidence the same will be true this time. ●

March 1st, 1990, has long been an important date in the history of the UK mortgage market. It was the date when mortgage rates hit their alltime peak of 15.4%.

Rates stayed this high until October of that year, when they were reduced to 14.5%. Record interest rates were one of the main drivers for the record level of arrears and repossessions seen in 1991, where more than 75,000 homes were repossessed.

Of course, the market back in 1990 was totally different to today’s. Fixed rate and tracker mortgages were still very much in their infancy, which meant borrowers had li le or no protection from escalating interest rates and the spectre of falling house prices and negative equity.

Thankfully, today the market is much more advanced, and borrowers have lots of choice regarding products. However, today’s borrowers have not been immune from their own worries, and have faced real financial worries, as political upheaval and the reaction to last September’s mini-Budget caused the cost of fixed rate mortgages to increase rapidly.

The fallout from the miniBudget was huge. Money markets were spooked, and some lenders temporarily pulled out of the mortgage market altogether. The choice of products was severely reduced, and the price of 2-year fixed rate mortgages hit a high of 6.43% — an increase of around 50% in a ma er of weeks.

To protect themselves from rising interest rates, borrowers turned to tracker rate mortgages — where the interest rate is pegged to the bank base rate — rather than take a risk with fixed rate loans, which reflect the volatility of the money markets. The speed at which borrowers opted for tracker loans was enlightening.

According to broker London Money, only 2% of its customers took out tracker mortgages in September, but by November this figure had increased to 63%. By January, a er the gap between fixed and tracker rates had narrowed, its customers were opting for an almost equal split between 2- or 5-year fixed rates and tracker mortgages.

Many commentators are now saying that a er 10 successive increases in base rates since December 2021, interest rates could peak this year at around 4.50%. If this is accurate, it could mean that the Monetary Policy Commi ee (MPC) meeting in March might be the final time in the current cycle that interest rates are increased.

It is expected that base rates will then remain at this level until 2024, when they will start to fall again, and quite quickly. We are already beginning to see this reflected in money markets, highlighting the market’s expectation of future base rate falls.

The general feeling in the industry is that fixed rates are likely to fall further. Fixed rates are governed by not only the bank base rate, but also by what the markets expect borrowing rates might be in the future. These are generally known as swap rates. With base rates at, or near, their peak, a typical 2-year tracker product will currently be priced at around 5%, whilst a 2-year fixed rate loan is heading downwards from its current average of around 5.5%. It now looks as though the ‘financial crossover point’ could be a ma er of months away.

The popularity of fixed rate deals is well known. They allow borrowers to lock in and give them the chance to cap their mortgage payments. Many borrowers will also want to fix their payments ahead of the forthcoming general election — traditionally a time

of political and financial unrest for money markets.

The other key part in this mortgage conundrum is the fact that around 1.4 million borrowers will be coming off existing fixed rate deals this year — with many currently being on sub-2% deals. Lenders will be keen to hang on to their market share, and borrowers will be desperate to keep their rates as low as possible. This fact will inevitably drive fixed rate pricing down still further.

Here at Leeds, we have seen a lot more remortgaging right across the board. Much of this is due to landlords trying to protect themselves from interest rate rises, but there are still some landlords raising deposits. Although research shows that many landlords have sold or intend to sell properties over the coming months, some professional landlords are still looking to increase their buy-to-let portfolios.

Currently about a quarter of our new mortgage applications are for tracker mortgages, but we certainly expect to see this percentage fall as the popularity of fixed rate loans increases once again.

There is li le doubt, however, that the volatility caused by last year’s mini-Budget has caused financial pain to millions of borrowers, and that this financial pressure will continue for months to come. Research has shown that borrowers prefer the certainty of fixed rate mortgages.

So, as we approach the 35th anniversary of the introduction of fixed rate deals in the UK, I expect that once the ‘financial crossover point’ is reached, most borrowers will once again opt for the safe harbour that fixed rate deals offer. ●

(you’ve never heard of)

It’s no coincidence that we’ve lent over £1 billion in BTL mortgages in our short 4 year history.

Speak to us about why we “can do”, where others can’t.

5 Year fixed rates with tiered fees to increase your clients’ leverage, allowing them to borrow more

Low ERC profile 5 year fixed rates allowing borrowers to exit early to a more competitively priced product

ERC-free 2 year trackers giving your clients the option to monitor the market and exit inexpensively to a fixed rate product, when it suits them

HMOs up to 8 bedrooms

No upper limit on units in a MUFB

£3m maximum loan per asset

£10m aggregate borrowing

Individuals / Ltd Co / SPV / Trusts

Offshore / Ex-Pats / Foreign Nationals

No country or currency restrictions for Ex-Pats

Ex-Pats maximum loan £2m @ 75% LTV Speaktosales

conveyancing process to create be er outcomes for our clients.

Gen H Legal is available to direct customers and all brokers on our panel. Its ethos and systems are built from the ground up, focused around the same customer obsession that has driven Gen H to develop some of the innovative mortgage products and features found in the market today.

Perhaps we shouldn’t be so critical of the conveyancing process. Its mechanics are vestiges of earlier times – perhaps singlehandedly responsible for the longevity of the fax machine in the UK.

Conveyancers themselves can o en be overworked and undercompensated for their efforts, which can inevitably cause customer service to take a backseat.

Especially post-pandemic, conveyancers have had to meet incredible demand as they’ve worked to support the housing market through a deeply turbulent period.

This is to say nothing of the opacity of the process itself, which doesn’t help homebuyers who may already be feeling anxious about their purchase.

I should correct myself: while it may be understandable how we’ve got to this point in conveyancing, we should, in fact, be very critical of its shortcomings.

Without taking stock of the many challenges facing conveyancing today, how could we bring about meaningful change?

It isn’t right that a simple mention of the conveyancing process brings an all-too-familiar grimace to the faces of lenders and brokers I meet.

At Gen H, we are working to build a mortgage lender that sets a new standard for service, affordability and quality in England and Wales.

We routinely interrogate the principles that underpin our operations to ensure they work in service of our number one value, which we call our customer obsession.

Since we began lending, conveyancing – the point at which we outsource our service, as lenders have had to – has not always yielded the high quality of care we demand of ourselves.

This means entering the conveyancing process is o en a jarring experience for our customers, and as we learned, there is no quick fix. Where legacy systems like conveyancing are concerned, change must come from within.

That’s why we created Gen H Legal, our own conveyancing firm, with the modest goal of redesigning the entire

Gen H Legal offers customers a simple, transparent pricing structure with no hidden or surprise costs, and takes a proactive approach to managing the entire conveyancing process.

Our prices are fair, and our team provides an excellent, collaborative customer service, working with third-parties along the way to remove blockers, mitigate the risk of unexpected surprises, and help homebuyers move sooner.

Because Gen H Legal works with Gen H as a lender under one roof, our customers are able to benefit from efficiency between the two businesses. This creates a truly seamless, end-toend home buying service – a first of its kind.

Our efforts alone may not be the silver bullet, but we’re ambitious, and we’re working to make ours the best homebuying experience in the market today.

We hope that by se ing a new standard for the process of buying a home, others will follow suit and find ways to create be er outcomes for their own customers.

We owe it to our customers to do be er. And at Gen H and Gen H Legal, we are. ●

Sometimes a fresh start is exactly what the doctor ordered.

In a wake of a year that may have scared off many industry professionals – and justifiably so – Alison Pallett chose to tackle issues head on, jumping into her new role at Nottingham Building Society during a period of industry tumult.

Following three years at LiveMore, Pallett has assumed her latest role as the society’s sales director, and has taken the current market challenges in her stride.

To find out more, The Intermediary spoke with Pallett about her move, what attracted her to the Nottingham, and her plans for the year ahead.

Having a wealth of industry experience working with Bank of Ireland and LiveMore, to name just a few, Pallett brings a high level of expertise to her new role. Despite being a new step, joining Nottingham Building Society also felt familiar.

“I started my working life for a mutual building society – I was a branch cashier with the Leicester Building Society before it became the Alliance of Leicester, so I feel as if I’ve returned to my roots,” Pallett says.

“The Nottingham has enough propositions to make it a really interesting lender, but not so many to make it too complicated.

“The thing that’s really exciting for me is that we work for several different markets.

“We do mainstream residential, but we’re also really strong in buy-to-let [BTL], limited company buy-to-let, holiday buy-to-let, and of course retirement interest-only [RIO].”

She adds: “The Nottingham has been busy building a really impressive team, to show the world how serious we are about being brilliant at mortgages. For me, it was a bit of a ‘no-brainer’ when the job came up.”

The Nottingham has plenty on offer in terms of its proposition, particularly when it comes to BTL.

However, in the face of a post mini-Budget market, and with many hailing the private rented sector (PRS) as one on the brink of doom, Pallett has some concerns about the challenges facing this sector.

“I do sometimes get a little bit frustrated about how private landlords are treated,” she explains.

“It looks like the private landlord is someone under attack, with the changes to Capital Gains Tax [CGT] and the recent pressures that have been brought to bear.”

She adds: “But we can’t successfully house and give people the quality of properties that we deserve without the private sector.

“We’re seeing more professionalisation in the limited company BTL space, and it’s probably at the expense of the smaller private landlords. A lot of those smaller landlords who’ve got a couple of properties, in the main, have been really good landlords and have tried to do the right thing.”

With frustrations on the rise regarding housing policy, Pallett believes that Government should be doing more.

“One of the things that’s interesting about housing policy in general at the moment, is we’ve got three component parts – the private landlord sector, the social housing sector and the residential sector,” she says.

“We don’t have a very joined-up approach to those three, and this can sometimes have the unintended consequence where something that happens in one part of the sector will have a knock-on effect in the other.”

Pallett suggests that a coalition around housing might get the best result, bringing together these disparate concerns, and weeding out potential knock-on effects ahead of time.

She adds: “It is very politicised, but it should be one of the core fundamentals that we all work on.”

Aside from multiple buy-to-let options, Nottingham Building Society also prides itself on its RIO offerings. However, this part of its offering has previously taken something of a back seat in terms of publicity – a situation which Pallett hopes to change.

“I think when RIO first came to the market when the [Financial Conduct Authority (FCA)] made the changes, it was really interesting to see that a number of the mutual building societies did enter this space,” Pallett says.

“What’s interesting is that it has almost always been a little bit in the background.”

“We’ve got some really strong criteria points around RIO, but it was a bit like a best kept secret for us,” she adds.

“It’s a growing and emerging market, but it’s not the biggest focus for many people. It’s another part of the market that really excites me, and there’s great opportunities there.”

A key component of the Nottingham’s approach is its commitment to supporting women in finance.

With a female CEO and a strong cohort of women across its leadership team, Pallett says that the Nottingham is certainly doing its bit.

However, this is not necessarily the norm, and Pallett suggests that more needs to be done in the wider industry to push progress onwards, creating a more diverse and inclusive market.

“I’ve been in this industry for more years than I care to remember, and for me, the progress is still too slow,” she says.

Nevertheless, Pallett does point to some signs of success, adding: “Within the sector we have a variety of different trade bodies, and I think where we’ve seen the likes of [the Association of Mortgage Intermediaries (AMI)] and [the Intermediary Mortgage Lenders Association (IMLA)] work together on some issues, particularly around diversity and inclusivity, and we’ve seen much more rounded outcomes.”

Pallett recommends going beyond occasions like International Women’s Day when it comes to getting the word out.

She adds: “Try and post your soundbites more regularly, and get behind some of them.

“Last year alone, Sue Hayes was appointed as our CEO, I was hired as director of sales, and we’ve got Christie Cook as head mortgages and product.

“We’re making great progress at the Nottingham, but we need to see more done industry-wide, and at a faster pace.”

After over three months in her new role, and with plenty of time to settle in, Pallett has big plans for the year ahead.

“What really excites me about working at the Nottingham is the real chance to extend and build out on our propositions,” she says.

“We’ve got these great propositions that not enough brokers are aware of, so I’m on a mission to make sure as many people as possible know what we’re about.

“Another key priority for me is growing the team. I believe passionately in face-to-face business development managers, giving us a greater geographical spread.

“We want to continue building some closer partnerships with our key people – Legal & General and Openwork to name two – and also help to support the process around some of the wider partnerships that we do.

“The retail funding we are providing to fintech lender Gen H means we can support the more specialist first-time buyer market and multiple buyer propositions – it’s a trailblazing partnership.

“And of course, making sure we get Consumer Duty over the line.”

Pallett concludes: “What’s great about The Nottingham is that we are at both ends of the sector. There’s immense opportunity around some of the first-time buyer stuff, there’s further opportunity around the older borrower stuff, and then there’s this huge swathe in the middle around all the buy-to-let options that we have, so it’s really exciting times ahead for us.” ●

Recent times have dictated a significant shi in thinking by lenders, brokers and borrowers alike about the value of standard variable rate (SVR) products. For a long time, SVRs were a pricing dynamic that was almost irrelevant in an era of historically low interest rates, where borrowers simply and seamlessly moved from one fixed rate to another.

Now, the SVR product is featuring in many brokers’ calculations in answering the question: in a fluctuating market, what is the right advice for my client?

Only a couple of months ago, fixed rates were no longer a feature of many new borrowers’ financial options. Swap rates had rocketed as a result of the infamous Truss-Kwarteng mini-Budget, and all of a sudden, discounted variable rates became a popular choice — offering as they did a cheaper initial rate and the ability to refinance without any penalty in the near to medium-term.

This created a further challenge of its own, because until the chaos of last September, some brokers — particularly those who came into the business post-2007 — have had li le need to understand the mechanics of SVRs.

An SVR is an interest rate set by a financial institution that can fluctuate over time based on a variety of factors, including changes in the wider economy, market conditions, and the bank’s own cost of borrowing.

It can change at any time and is usually set as a certain percentage above a base rate, such as the Bank of England’s, but even this relationship is at the discretion of the lender. It is not set in stone.

As swap rates se le, fixed rates come down in price, and SVRs move in response to a rising Bank of England base rate, the task of giving mortgage advice has become less straighforward since October 2022.

With the Financial Conduct Authority’s (FCA) new Consumer Duty rules coming into effect on 31 July, ‘to fix or not to fix’ becomes a genuine consideration in providing good outcomes for borrowers.

Delivering these good outcomes is arguably nothing new for mutuals, whose purpose for more than a century has been exactly that. It hasn’t always been plain sailing, of course, but by and large we know our purpose.

But taking a long-term view is easier when you are the lender. The shortterm pressures of managing a cashbased intermediary business can be very different.

So, as discounted variable rate products track higher and fixed rates slowly do the opposite, what is the right advice for borrowers in a world where the outcome will be under scrutiny like never before?

A couple of months ago, the right advice might have been a discounted variable rate or lifetime tracker. Fixed rates have gone from as low as 2% nine months ago to a staggering 7% in October. By February, products priced at less than 4% — the base rate — had begun to reappear. For some borrowers, simply defaulting onto a SVR and delaying the decision until the dust se les might have been a sensible option. Borrowers of a more nervous disposition may well have insisted upon fixing no ma er what.

Arguably, some of the best rates available today are on longer-term fixed rates; but the question remains,

TRACY SIMPSON is head of lending at Cambridge Building Society

are there any borrowers for whom taking a product like a 5-year fix today will result in the best outcome? Might rates fall further?

This ma ers, because arrangement fees are not inconsequential to the cost of a fixed rate product, not to mention if rates move and end up costing the borrower thousands of pounds more than sticking with a variable rate for another 12 months. These products o en come with he y early repayment charges (ERCs), so moving out of the fixed rate may be prohibitively expensive.

Andrew Bailey said consumer price inflation is likely to fall back from more than 10% to around 4% this year. The markets — and myself for that ma er — are inclined to believe him. But many investor advisors are still expecting a moment of correction.

The mood at the moment is that inflation appears to be stubbornly built into the economic framework, so we may have higher rates for longer. But that is a view, not a reality. As John Lennon once said, “Life is what happens while you’re making other plans.”

Discounted SVR products are not ready to become a distant memory just yet. ●

Only a couple of months ago, fixed rates were no longer a feature of many new borrowers’ financial options”

hen Harold Macmillan was once asked by a journalist what he feared most as a Prime Minister, he allegedly replied: “Events, my dear boy, events.”

If you were a broker or a borrower searching for a mortgage at the back end of last year, there is one event in particular that would have sent a shiver down your spine.

That, of course, was the former Chancellor Kwasi Kwarteng’s ill-fated mini-Budget.

What happened a er is still fresh in the minds of many of us, so I won’t spend long going over old ground in this column.

But I think it is worth, six months on, looking at what has happened to mortgage pricing, and considering where it might go from here.

Any brokers reading this column won’t need me to tell them that rates have jumped significantly since September 2022.

However, the data really drives home how much more expensive mortgage finance is now than it was pre-Budget.

According to Moneyfacts, the average 60% loan-to-value (LTV) mortgage leapt from 4.34% in September to 6.19% in November. From that recent peak, the average 60% LTV loan had se led back down at 5.27% by last month. A similar trend can be seen right across the LTV bands.

Curiously, though, mortgage rates have edged lower as swaps rates have started to increase again.

At the end of February, 2- and 5-year swaps rates were around 4.49% and 4.01%, respectively. That means they

Ware both around 50 basis points higher than at the end of January.

If swap rates have a direct impact on the price of fixed-rate mortgages, why are they going in different directions? I think there are two plausible reasons for this peculiar phenomenon.

The first goes back to fallout from the mini-Budget itself. In the days following, many lenders pulled their entire fixed rate range, simply because they had no idea how to price them.

Lenders I spoke to at the time said they would prefer to temporarily bide their time on the sidelines, rather than risk coming to market with a product proposition that would be loss-making five minutes later.

Some lenders came back to market quicker than others, of course, but I imagine all lenders are now feeling that they need to make up for lost ground. A er all, lenders need to lend money, and last year, many of them probably didn’t do enough of it, for reasons that are entirely understandable, of course.

Secondly, many of those lenders came back with fixed rates that were,

LUCY BARRETT is managing director of

in my opinion, priced significantly out of kilter with where the rest of the market was at the time.

Again, that’s understandable. I imagine the laggards eventually concluded it was be er to be in the game with an uncompetitive range than si ing in the stands watching their rivals hoover up volumes.

Regardless, those lenders are now feeling as though they have a bit of slack to give when it comes to the price of their fixed rates.

Both of these factors have created intense competition in the market. This competition, I believe, is the reason swap and mortgage rates have uncoupled since the end of last year.

In my opinion, that should act as a natural cap on pricing for the rest of the year, barring any unforeseen deterioration in either economic or market conditions.

That is not to say mortgage rates won’t rise this year. If swap rates continue to edge higher, lenders will have no choice but to tweak their rates to avoid lending at a loss.

However, if that happens, I don’t think lenders will raise their fixed rates in line with swaps, but at a slower pace, for the reasons I’ve outlined above.

Of course, if swap rates level off, then we may see fixed rates stabilise or even edge a li le lower, as they have done so far this year.

Given the events of the past six months, we ought to consider that to be a positive outcome for the market. ●

Competition is the reason swap and mortgage rates have uncoupled since the end of last year. That should act as a natural cap on pricing for the rest of the year”

Newspaper headlines may herald stagnating house prices, but the reality for most firsttime buyers is that demonstrating the income to achieve the mortgage they need to buy their first home remains a considerable challenge.

In fact, according to a recent report by Schroders, a typical property now costs nine times average wages, pu ing house prices at their most expensive level for 147 years. In London, the study found, the average home now costs 12 times the average wage in the city.

With the cost-of-living crisis continuing to rumble on, and interest rates se ling at a level higher than we have seen for many years, it seems that affordability is going to continue to prove a significant hurdle to homeownership, even if property prices do take a dip.

The affordability landscape has evolved, with many lenders taking a more data-driven approach to affordability calculations, enabling a more diverse approach to meeting different client requirements.

This has resulted in some lenders actually reducing affordability calculations, while others continued to offer similar loan sizes, and some even enhanced their affordability.

One example is HSBC, which has made a number of enhancements to its proposition, such as mortgages for professionals, those on higher incomes, and Joint Borrower Sole Proprietor products.

In addition to this approach, a number of new providers have

launched in recent years, providing an alternative approach to help clients stretch their affordability enough to get a grip on the housing ladder.

These providers use methods such as second charges and shared equity to open up new opportunities for first-time buyers, and in some circumstances, home movers as well.

Here are some of the options:

Proportunity: Provides Help to Buy style shared equity loans for owner-occupier property purchases of both new and old builds in England and Wales, boosting client deposits by up to 25% to help them maximise their affordability. This can enable them to potentially buy higher value properties and pay less per month by accessing a cheaper main mortgage deal at a lower loan-to-value (LTV).

For example, a Proportunity shared equity loan with a Halifax mortgage will o en significantly extend the borrowing capability of a client by up to six times loan-to-income (LTI), with as low as 5% deposit.

Generation Home: A new affordability-focused lender that helps buyers enhance their borrowing using friends and family funds as ‘boosters’.

Income boosters enable family members to be added to the mortgage and their income to be included in the affordability calculation, up to a maximum of six applicants. While deposit boosters enable buyers to receive help towards their deposit in the form of an interest-free loan, either as a gi or equity.

According to MBT Affordability data, Generation Home can increase the average borrowing power of their first-time buyers by an extra £65,000.

StrideUp: A unique product offering that combines a first charge mortgage with a top-up equity sharing loan, meaning that it can

provide up to 6.5 times LTI where affordable for homebuyers. The lender supports buyers with complex income streams, such as overtime, bonus or commission, and it also accepts one year of trading history for standard self-employed applicants.

Each of these lenders provide alternative solutions that could help thousands more buyers achieve their dreams, and could help you to meet the needs of even more clients.

Understanding which approach would be most suitable for your clients and how each compares against the loan sizes available from a standard lender is the key to unlocking this opportunity. Sophisticated research so ware like Mortgage Broker Tools can present these alternative options clearly as part of an affordability search, enabling you to source innovative solutions as simply as more standard options. ●

The affordability landscape has evolved, with many lenders taking a more data-driven approach to affordability calculations, enabling a more diverse approach to meeting different client requirements”

We Provide:

Client's credit score and report - straight to the desktop in minutes. Consolidated income and expenditure reports via Open Bankingstraight to the desktop in minutes.

100% online solution - no face-to-face required.

Save time and immediately identify customers that you can help.

Simple to use, keeping you rmly in the driving seat of the advisory process. No more sifting through reems of bank statements to ascertain the TRUE picture.

Branded customer portal and communications.

Easy integration into existing CRMs or Point of Sale systems.

If the 2020 Financial Lives Survey marked a low point for the sector, with one in four saying they lacked confidence in financial services, and only slightly above one in three agreeing that firms are honest and transparent in their dealings with them, then this summer will see a significant step up in the rights of consumers. On 31st July, the Financial Conduct Authority (FCA) implements its new Consumer Duty rules.

Modelled on four pillars, firms will be expected to provide appropriate support to borrowers that meets their needs throughout the life of the product or service.

Bold and new, this comprehensive charter for consumers promises a paradigm shift by shining a spotlight on consumer outcomes. The customer, it insists, must be better protected and offered increased levels of care.

The current cost-of-living crisis has given fresh meaning to these new rules, which in relation to the residential mortgage industry, capture equally the whole ecosystem, barely differentiating between the players.

Whether manufacturer or distributor, the regime promises a ‘nowhere to hide’ ethos, and the

current economic climate suggests there will be no soft launch.

A key tenet is that consumers should be supported when they experience financial difficulties. It seems likely that, as thousands struggle to pay their mortgages, the regulator will be inclined to follow the money and target the biggest and most influential elements of the value chain: the lenders.

The new diktat insists that each and every company in the sector follow the same principles, and demonstrate that the consumer is truly at the centre of their business. So, lenders are not excused scrutiny. The manufacture, distribution and administration of mortgages all receive equal attention.

Products must be ‘fit for purpose’ and market segments targeted at a granular level. Under the new guidance, there will be no excuses for poor commercial behaviour

Even if customer contact is via independent brokers, the rules insists that mortgage companies carefully consider their distribution channel when designing products. So, under the new regulatory regime, if it goes wrong, the lender will be as culpable as the distributor. Equally post-sale, the rules cover

MARK DAVIES is managing director of BCMGlobal

what forbearance lenders offer and how they treat customers who find themselves in financial difficulty.

The ambition and scope of the Consumer Duty extends to new and innovative technology initiatives, such as artificial intelligence (AI) and data analytics programmes. Even if, by using these, lenders or brokers deduce more about their customers, the regulator makes it very clear

that they must be made aware of any incremental insights and potential for further revenue generation.

The rules are foundational, and to be compliant, firms have been told to focus on building and maintaining the availability, stability and security of systems and processes.

With their multiple verticals, mortgage companies are affected by all the rules. Firms need to design products with the consumer in mind, explain them adequately, sell them appropriately, and of course, support customers throughout the process. Also, the expectation is that firms assess, test, understand and evidence the outcomes.

This is likely going to be far more

difficult to achieve in reality than it is to write in a sentence of a guideline.

So, the need for the entire industry to demonstrate that they are embracing the rules by proving and recording the evidence of good process isn’t just a game changer, but will drill deep into the corporate skeletons of all players.

After a period of review and analysis, the FCA announced that some firms have underestimated the requirement and are being complacent in their preparations. It is five months until the official launch, but firms are being asked to evidence their preparedness before 23rd July.

The rules require a focus on the client in a way that has not been seen before. Their tone demands a different relationship, more partnership than

transactional, more understanding and empathic than confrontational.

To make it work, the probability is that the regulator will actively enforce from launch. So, if proportionality is a reality in terms of expectations, remedial measures cannot be entirely loaded on small brokerages. Lenders will also have to demonstrate their support, with resources appropriately trained and qualified to comply with the spirit of the duty. As the consumer is stretched financially already, the extra cost will also stretch the industry for sure.

If it goes wrong and firms fail, history tells us the regulator will follow the money. Lenders and brokers beware. ●

Do you have a favourite bit of London? Maybe it’s trendy Shoreditch or the trim stucco of Kensington and Chelsea, with Instagram-ready houses dripping with lilac. You may prefer North of the river or South, lean toward East London grit or hanker for West London privilege. Anyone who understands London knows it isn’t one thing, one place, one culture or one property market.

It’s also worth remembering that London is not just ultra, super and prime, suburbia or social housing tower blocks. Certain areas are characterised by one type of building, and in others you’ll find council estates flanked by Victorian mansion blocks.

A four-bedroom stucco Victorian terraced house in South Kensington will set you back just shy of £6m, but in Dalston might cost around £2.5m, and in Croydon £500,000.

It’s all too easy to accept average house price indices which conclude that the London market is struggling. However, that is just not true.

London agent Benham and Reeves recently did some research which illustrates this point precisely. While the Greater London area on average saw house price inflation of 2.2% last year, Rightmove data shows pockets where values have soared.

Benham and Reeves identified a group of up-and-coming neighbourhoods where average house price inflation has significantly outperformed. Churchill in Westminster has seen prices rise by 64.5% in the past year, to sit at a current average of £1m. In Northcote, which connects the north side of Clapham Common with Wandsworth

Common, prices are up by 61.4%, to an average of £1.3m. Rightmove’s February analysis, meanwhile, suggests that Camden house prices are up 17.2%, in a year while average values in Kensington & Chelsea fell by 2.2%.

The huge diversity of location, property type, age, condition, and proximity to amenities makes it impossible to judge if the London market is in good or ill health. The reality is that it is always in both.

Activity in the prime market has recovered strongly a er September’s mini-Budget. Property analysts at LonRes said the upset following the move to cut taxes for the wealthy had, conversely, kicked the prime London market back into action.

Neal Hudson of BuiltPlace said: “The turmoil of the last few months has returned the market back to the levels of sales and under offers recorded prior to the pandemic.”

Sellers have become more realistic about pricing, with the highest number of price reductions recorded in January since 2018. Average achieved prices across prime London fell 1.4% over the year, but despite the challenges, Hudson said the top end of the market remains strong, with sales up 56% and new instructions up 43%.

The le ings market in London is experiencing different fortunes, however. Private landlords face stricter energy efficiency rules on new tenancy agreements, along with significantly higher mortgage costs.

The improvements necessary to take a property from Energy Performance Certificate (EPC) Band E to C will cost several thousand pounds minimum. Depending on the condition, that figure could rise to tens of thousands.

JOHNSON

JOHNSON

Such a huge jump in the cost of maintaining rental stock at a time when margins have been eroded by rising interest rates is having an adverse effect on rents across the UK, but in London — where rents are already high compared with takehome income — the effect is amplified.

Rightmove’s rental price tracker shows that average London asking rents have hit a record high of £2,480 per calendar month, while in inner London rents surpassed £3,000 for the first time.

High rental inflation reflects the ongoing imbalance between supply and demand. According to Rightmove, the number of properties available to rent nationally is down by 38% compared with 2019, while the number of people enquiring about a property to rent is 53% higher. Owing to this ongoing imbalance, Rightmove predicts that average asking rents for newly available properties will rise by a further 5% in 2023.

These shi s in supply dynamics are worth watching. Valuations are already taking account of the effect that net zero deadlines will have on both saleability and rentability of properties. The knock-on effect on supply will also affect valuations in both the residential and le ing sectors. We are seeing a significant realignment of market make-up at the moment — one that looks set to persist for the next few years.

All of this serves to underline the importance of nuance when trying to understand London’s many markets. ●

Let’s start on a positive note. The latest Lloyds Bank ‘Business Barometer’ showed confidence among firms rose for the second consecutive month. The upturn was driven by a more optimistic assessment of the wider economy, which has posted sizeable gains since November’s slump.

Firms’ own trading prospects were unchanged month on month, but continued to outperform economic optimism, suggesting some resilience in the outlook for business activity in the face of economic headwinds. Headline business confidence rose by five points to 22%, taking it to the highest level for six months. Given that the long-term average is 28%, that is significant headway.

Anticipated staffing levels for the year ahead edged higher, though the broad trend is still lower since the summer.

Investors are unsure that things are totally rosy, however.

Swap rates in Europe indicate that markets expect the European Central Bank (ECB) to raise interest rates to an all-time high, amid a persistent nag that inflation will remain stubbornly high. If markets are proved correct, the ECB will have hiked its central bank rate from 2.5% today to 3.75% by September. Although investors seem reasonably se led in the UK and US, both economies have recently posted growth more positive than expected.

While growth is positive, it is under threat from wage inflation. That is a major concern in Britain, as well as across the English Channel.

Union action has ramped up over the past year, as junior doctors, railway staff, teachers, public prosecutors, nurses, ambulance workers, university staff, civil servants, firefighters and postal workers have walked out of work. All are demanding higher pay rises based,

quite reasonably in many cases, on the disproportionate rise in the cost of living.

It is those earning at the lower end of the scale who are feeling the worst ravages of inflation. The proportion of household income going on housing costs, bills and food is far higher than for those in higher paid jobs.

The Resolution Foundation calculates that the cost-of-living gap between the richest and poorest households grew to 2.9 percentage points in January. The poorest tenth of households experienced an inflation rate of 11.7%, compared with just 8.8% for the richest tenth.Then, consider that Office for National Statistics (ONS) records show private sector pay grew 6.9% between August and October 2022, while public sector pay grew 2.7%. With inflation still running over 10%, both are losing purchasing power in real terms, highlighting why central banks are watching wage inflation very closely.

If it slips out of control, we could be in for another bout of rate rises, which would have a material impact on the housing and mortgage markets.

The thing about economies is that they rarely do the absolute best or absolute worst thing investors can imagine. It’s more likely — unexpected events such as the pandemic and Russia’s invasion of Ukraine notwithstanding that we will rumble on somewhere in the middle of these two scenarios.

Provided the Bank of England doesn’t feel obliged to push the base rate up significantly in the near-term, the mortgage market should remain reasonably stable. Yes, monthly repayments are rising enough to dent homeowners’ finances as they come to the end of fixed rates, but no one is expecting mass repossessions.

Unemployment is the key measure to watch there, and we remain near full employment.

STEVE GOODALL is managing director of e.surv Chartered Surveyors

The majority of existing borrowers can afford higher mortgage rates, even if they don’t like it. Those who can’t are being offered help by lenders to manage their affordability.

House price inflation, as our House Price Index and others show, is slowing, and that is likely to continue as the effects of the stamp duty holiday fall out of the annual comparisons. But the idea of a property market collapse is wrong.

The toughest thing facing the housing industry is to reinvigorate transactions, particularly in the purchase market. House builders, as we approach the end of Help to Buy, are flagging the fall in firsttime buyers.

Meanwhile, Energy Performance Certificate (EPC) regulations are impacting the buy-to-let market, as our own Property Watch Report highlights, but the remortgage market looks strong for the foreseeable future, and swaps indicate that pricing has fallen back from last year’s post miniBudget hiatus, and has now stabilised.

We are not out of the woods, but we’re not lost in a panic either.

My own view is that the considerable heat generated by pandemic support packages is coming out of the market, and that’s no bad thing.

A generation of people in business are facing this volatility for the first time without the certainty of government support.

That might change slightly with the upcoming Budget but and it’s a big ‘but’ if it does, it will not be anything of the order we have seen in recent times. ●

It’s not exactly a secret that saving a decent-sized deposit has been incredibly challenging in recent years. Since the pandemic, renters have faced the inflationary pressures of rising prices and interest rates, making saving even harder. Even if these would-be owners reorganised their finances to deal with these hurdles, they will likely have seen any spare money eaten up by increased rental payments.

Figures from Hamptons recently found that rents rose by 7.7% in the 12 months to December 2022, equating to an extra £1,000-plus a year for the typical tenant.

All of this has come at a time when house prices have rocketed at a frankly incredible rate.

What would have been a sufficient deposit six months prior may no longer be enough for that first-time buyer to get onto the housing ladder a er all.

However, I would argue that the prospects may not be as bleak as you would think.

A er years of rapidly rising house prices, 2023 appears to be a year in which prices may move downwards at last. We have seen a succession of house price indices, from lenders and the Office for National Statistics (ONS) alike, report that house prices are falling.

The turmoil of the end of 2022, the subsequent knock-on effect on mortgage pricing, and general economic uncertainty have all led to buyers across the board taking a ‘wait and see’ approach.

Those expected house price falls may well make that first purchase a li le more a ainable.

What’s more, with some innovation, lenders are still able to support first-time buyers who aspire to own their own property.

That desire to do things differently led to the development of the Family Assist mortgage, which allows the borrower to obtain a mortgage for 100% of the value of the property they wish to purchase.

To access the mortgage at 100% loan-to-value (LTV), a family member needs to open a savings account or allow a legal charge over their property equal to 20% of the purchased property price.

It offers clients the best of both worlds. All being well, the family member can retain their finance or equity long-term, rather than handing over a gi ed deposit, while the borrower can pick up their first home without needing a deposit at all.

TOM DENMAN-MOLLOY is intermediary sales manager at Mansfield Building Society

It’s easy to talk about wanting to help first-time buyers, but the proof is in whether lenders really offer a cando a itude.

We regularly hear from mortgage brokers who have been frustrated by how lenders go about assessing applications from a client who has anything slightly out of the ordinary in their circumstances.

This could be as simple as being on a zero hours contract, having a couple of different income sources, or even the odd historic credit blip. There’s nothing inherently risky about clients in these situations, and yet we frequently hear about lenders seeing that perceived complication as a reason to decline a case outright.

Lenders can make a real difference by taking the time to actually get to grips with the important elements of a case, rather than those slight deviations from the norm which – in practice – make li le to no difference.

Of course, such a product won’t be right for everyone, and there’s still very much a need for mortgages with low deposits. We wanted to maintain greater choice for those borrowers who have managed to build some level of deposit.

Our recently launched fixed rate up to 95% LTV also includes our flexible approach, such as allowing gi ed deposits and Joint Borrower Sole Proprietor, allowing loved ones to contribute to the mortgage payments without ownership rights over the property.

First-time buyers are the lifeblood of the property market – the sector simply cannot work if those new to homeownership are unable to purchase their first home.

Yet in order to do that, these clients require lenders to embrace innovation in product design, and then find reasons to say yes to an application rather than excuses to walk away.

Working with lenders which adopt that more positive, versatile a itude will help brokers assist more clients in taking that first step onto the housing ladder. ●

Clients require lenders to embrace innovation in product design”

This month, Chancellor Jeremy Hunt will present his first Spring Budget. I believe this much anticipated moment represents a golden opportunity for the Government to show its commitment to supporting aspiring homeowners.

Many in the mortgage sector – not to mention those looking to own their own home – were surprised when the Government confirmed it would not be pursuing a mandatory target for building new homes at the end of last year. The Prime Minister’s decision to water down housebuilding targets, following a reported rebellion from Conservative backbenchers, was criticised for pu ing party unity over the national interest, and exacerbating the existing housing crisis.

In response, many local authorities have scrapped or delayed their housebuilding plans, with analysts estimating that the confusion over targets could cost 100,000 new homes over a five-year period – a significant shortfall that will detrimentally impact those in genuine need of affordable homes. Furthermore, a report from Policy Exchange last month found that failure to build enough homes could see the UK miss out on an economic boost of nearly £18bn.

While housebuilding targets were central to the Conservatives’ 2019 manifesto and levelling up mission, this policy U-turn is further evidence of the need to set a new course to ensure people can secure the homes they crave.

We have seen four different Housing Ministers in the past five years, and that lack of continuity is reflected

in a housing strategy which feels unfocused and unclear. This needs to change.

With homeownership a widespread and fundamental ambition for younger people, it is understandable that many are disappointed and worried by recent developments around housebuilding targets, which will impact access to affordable housing. Studies show that almost three-quarters of renters would prefer to own their home if they had a choice. Yet youth home ownership halved between 1989 and 2016.

On top of this, the current cost-ofliving crisis and surging interest rates and inflation – which reached an all-time high of 11.10% in October –are impacting people’s ability to save and borrow.

The effects of this economic backdrop are particularly acute for a growing cohort of aspiring homeowners with complex incomes or working pa erns, for whom it is o en harder than normal to secure a mortgage. People who are selfemployed, have different income streams, or don’t have a strong credit history, may find themselves disadvantaged – not only by a lack of housing, but also by the ability to secure a mortgage offer that suits their circumstances.

The upcoming Spring Budget presents a chance to provide focus and clarity for current and future homeowners everywhere. At the very least, I would like to see a recognition of the importance of new homes to both the economy and to the aspirations of millions of people. But I would also like to see action.

The current approach to housing must become less political. A first

ALISON PALLET is sales director at Nottingham Building Society

step would be the creation of a new coalition, including representatives from the mortgage industry, to work together to develop a housing strategy designed to meet the needs of this generation of homeowners.

We know that joined-up activity between industry and government works. Trade bodies across financial services have proven they can work effectively with the Government to develop practical policy solutions. Take the Association of Mortgage Intermediaries (AMI), for example, which is in conversation with the EU Commission to structure legislation so that it does not hurt the UK mortgage market.

Mutuals like us have always been strong supporters of the housing market, and we want to be part of the solution. Mutuality is the bedrock on which The No ingham has been run since its inception, a principle that ma ers more than ever now, and we are proud of our longstanding determination to help people own their own home.

A new approach is needed. I encourage the Government to reinstate the housebuilding target and ensure that houses are being built that meet the needs of aspiring homeowners. Together, we can forge a new, be er approach which directly addresses the needs of homeowners in these extraordinary times – from younger generations looking to get on the ladder, right through to older ones looking to downsize or considering other options. ●

From 31st July 2023, all companies selling financial products or services to retail customers will be required by the Financial Conduct Authority’s (FCA) new Consumer Duty to act to deliver good outcomes for their customers in four key areas by ensuring:

Customers receive communications at the right time, that they can understand;

Products and services meet the need of their target customers;

Products and services offer fair value;

Customers are given the support they need.

In order to ensure the requirements are met, firms will need to assess and monitor whether they are delivering good outcomes to customers, with additional reporting required for their board. For some businesses, this level of insight may mean entering a new territory of increased data collection and information gathering. As specialists in financial services

consumer insight, Smart Money People is perfectly placed to help companies with their Consumer Duty reporting requirements, as we have been collecting feedback from customers on key FCA outcomes for over eight years.

With more than 1 million reviews captured over this time, we have a wealth of historical data on the industry to support and supplement a business’ reporting requirements, and to ensure good outcomes for your customers.

Our service ensures companies are provided with an independent and impartial view of their performance, using genuine customer data that can help with Consumer Duty needs. This includes always-on customer surveys that provide 24/7 capture data on Consumer Duty outcomes throughout the customer’s interaction with a company, as part of our standard review process.

Brokers working with us are able to implement the feedback requests into their processes with ease, allowing

JACQUELINE DEWEY is CEO of Smart Money People

JACQUELINE DEWEY is CEO of Smart Money People

them to achieve greater insight into customer satisfaction and Consumer Duty outcomes, as well as specific data on key truth moments in the customer lifecycle, such as purchase, renewal and post-interaction.

This includes data on whether customers feel they have been fairly treated, as well as whether they understood product details and thought the products were good value for money.

These specialist customer insight capabilities can also prove integral in providing companies with the ability to benchmark their feedback against that of their peers on both a product and industry basis, ensuring your business maintains a competitive edge. Data can be accessed at any time using an always-on dashboard, and we can also provide a consultative approach to advise on best practice for reporting and data collection.

Smart Money People provides an independent source for reporting and data collection that can help brokers by providing greater insight into their business.

This impartial view of their performance, using genuine customer data, not only helps to enhance a business offering, it also helps to deliver good outcomes for customers, while simultaneously meeting the requirements of the regulator.

The solution is easy to implement. Firms can claim their review page on Smart Money People for free and start collecting and listening to their customer feedback straight away. ●

Over the years, the evolution of building societies has continued with the first ‘permanent’ building society, Metropolitan Equitable, created in 1845 in response to those seeking a safe haven for their money, rather than to solely purchase land or a house.

This resulted in the creation of deposit accounts and the offering of a broader range of financial services to the wider population.