Pro-Pac Packaging sells A/NZ businesses to Knoxcorp P05

Administrator McGrathNicol said the deal represents a positive outcome for PPG’s customers, suppliers, and employees

Miraclon names Raja Ramalingam as APAC service manager P06

Ramalingam will lead the company’s regional service organisation, driving excellence in customer service and technical support, field performance, and operational execution across the region

Xeikon launches Ecolyne under subscription-based model P06

Allows label converters to access production capacity rather than make a traditional equipment purchase

IVE puts sustainability and smart packaging in focus in 2026 P08

IVE has tipped sustainability proof points and smart, connected packaging as two of the biggest forces shaping how FMCG and retail brands will market in 2026

Foodcare streamlines expertise with UPAC acquisition P08

Foodcare’s market strengths and UPAC’s packaging capabilities will offer a single point of manufacturing supplies for customers

East Coast and Meadow Kapsul deliver new canning P10

Strategic partnership results in the creation of an advanced, resealable, and sustainable aluminium can technology

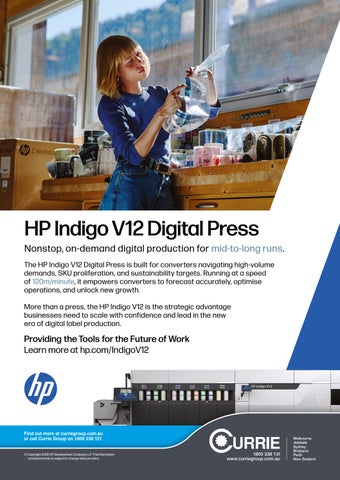

HP sees accelerated adoption of Indigo and PageWide presses P10

Eighteen months on from drupa 2024, HP is seeing strong global momentum across its HP Indigo and HP PageWide install base

The annual ProPack.pro Packaging Leaders Forum P11-32

Thought leadership from:

12 CS Graphics

14 Currie Group

16 DieLine Solutions

18 Durst Oceania

20 Graffica

22 Hybrid Software

24 BrightCast Advisory

25 C4C Packaging

26 Detpak

27 Impact International

28 Impact Labels

29 Kuhn Corp Print & Packaging

30 Opal

31 Platypus Print Packaging

32 Tweak Design

Winning in sustainable packaging: Bringing it all together P34-37

McKinsey & Company provides a strategic framework on where to play and how to overcome barriers and seize opportunities

Innovative corrugated packaging – more than just a box P38

The value-added, digitally enabled corrugated packaging that converters can offer brands

Pack diary P39

A guide to the upcoming packaging events that will be happening locally and internationally

Welcome to the first issue of ProPack.pro for 2026, and hope the new year has been kind to everyone so far. This time of the year is always one of reflection and planning, with many businesses evaluating what worked, what didn’t, and calculated risks they plan to take.

The general sentiment for 2025, for the packaging industry, is one that businesses expected and could navigate around. Opportunities for 2026 are also aplenty, with some of the main trends impacting this space including sustainability, AI, and value-added packaging.

This issue is dedicated to the Packaging Leaders Forum, where industry thought leaders assess the year that was and look into their crystal globes to weigh in on key factors that guide 2026. We hope you enjoy the read.

ASX-listed Pro-Pac Packaging Limited (ASX:PPG) has announced the successful sale of its Australian and New Zealand businesses to Knoxcorp, a privately-owned Australian investment company founded and led by Jim Knox.

Knoxcorp is a Brisbane-headquartered business that holds and manages a diverse portfolio of enterprises and property developments.

Knox previously owned and operated Cospak, a successful packaging company serving both Australia and New Zealand, prior to its sale to San Miguel Yamamura Packaging in 2009.

McGrathNicol Restructuring, who were appointed administrators following PPG going into voluntary administration in October 2025, entered into a Business Sale Agreement for the sale of PPG’s Australian business and assets, excluding the Perfection Packaging business, to Consolidated Packaging Australia, a subsidiary of Knoxcorp.

The Perfection Packaging business in Dandenong, Victoria, is separately being wound down and will close by the end of February, with the sale of PPG’s Australian business expected to be complete by March.

Separately, a Business Sale Agreement has also been executed for PPG’s New Zealand business and assets with Consolidated Packaging Limited, a New Zealand subsidiary of Knoxcorp. This sale was completed on 30 January.

“Both acquisitions are on a going concern basis and provide for the transfer of employment for all

current employees, except for those within Perfection Packaging,” a statement from PPG on the ASX said.

McGrathNicol partner and administrator Rob Smith said, “We are pleased to announce the sale of both PPG’s Australian and New Zealand continuing businesses, which represents a positive outcome for PPG’s customers, suppliers, and employees”.

“We are delighted with the acquisition of PPG. We look forward to further developing the business and continuing to serve its loyal customers. Local manufacturing remains essential to its customers’ supply chains and we will make significant investments in machinery to deliver on our core value proposition,” Knox added.

Not long after the announcement of PPG’s bankruptcy, its CEO Ian Shannon was officially made redundant in November 2025.

Miraclon has appointed Rajagurulingam (Raja) Ramalingam as its new service manager for the Asia Pacific region.

Based in Singapore, Ramalingam will lead the company’s regional service organisation, driving excellence in customer service and technical support, field performance, and operational execution across the region.

Ramalingam joins Miraclon with more than 20 years of leadership experience in printing inks and packaging production.

Throughout his career, he has combined technical expertise with strategic commercial insight, supporting both regional and global growth initiatives with a consistent focus on collaboration and

Xeikon has launched a new digital press for the Asia-Pacific label market named Ecolyne, delivered through a subscriptionbased capacity service.

The company said this approach allows label converters to access production capacity rather than making a traditional equipment purchase.

Making its first public appearance at the Labelexpo Asia Show in Shanghai late last year, the new machine is a fully managed digital label press solution with subscription-based capacity.

Designed for high-quality label production, the machine boasts a 330mm web width, 25 m/min print speed and 1,200dpi resolution with the ability to run substrates from coated or uncoated paper to PP (white or clear), PET and metallised film. Using a food-safe dry toner system, the Ecolyne press is also available in a 4-colour (CMYK) and 5-colour (CMYK+ white) configuration. According to Xeikon, in today’s label printing landscape, many converters face the same barrier: the high upfront investment of buying a press, coupled with rapidly increasing demands for smaller runs, quicker turnarounds and flexible capacity.

The global digital label-printing market is expanding and projected to grow from roughly US$12.3 billion in 2025 to US$20.6

continuous improvement that led to longterm customer satisfaction and success.

“Raja brings an exceptional balance of technical depth, customer understanding and leadership experience to Miraclon,” Miraclon Asia pacific regional commercial director Andy Yarrow said.

“His proven ability to drive highperforming teams and deliver valuedriven solutions for customers make him an excellent fit to lead our service organisation in the region. I’m delighted to welcome him to the team.”

Miraclon global commercial service business director Robbert Merkus added, “Over the past year, Miraclon has made a considerable investment in its service organisation to guarantee continued world-class service and access to our team’s exceptional expertise to help our customers stay at the leading edge and maximise return on their FLEXCEL Solutions investments.

“Raja’s expertise further strengthens the service team and underscores our commitment to ensure customers’ long-term success.”

Xeikon’s Ecolyne is available through a subscription-based capacity service

billion by 2035; yet smaller printers and e-commerce-driven label converters still hesitate because they often lack the capital or the operational bandwidth to adopt digital production solutions, Xeikon added.

As a result, with the Ecolyne press, by subscribing to label-printing capacity rather than owning the hardware, converters can scale production when needed and sidestep heavy investment.

Xeikon president Walter Benz said with a capacity-first approach, the focus shifts from machine ownership to printing performance, precisely what many

emerging label printers are looking for.

“In many parts of Asia, the label-printing scene is changing fast,” Benz said.

“Small to mid-sized converters also see increasing demand for shorter runs and faster turnaround. They need access to digital label-printing capacity now. That’s why we bring Ecolyne to Asia first; we see a strong need here for simple, reliable digital production without the burden of ownership.

“Beyond the commercial benefits, this service lets you stay current with technology trends and keep your digital label production line equipped with the latest capabilities.”

IVE has tipped sustainability proof points and smart, connected packaging as two of the biggest forces shaping how FMCG and retail brands will market in 2026, in a new report that positions packaging as a “heavyhitting” channel rather than just a container.

The company’s 12 Marketing Trends That Will Shape 2026 report argues that brands will win not by shouting louder, but by using data, design, and physical experiences, including packaging, to create more relevant, measurable and human connections with shoppers.

One of the most packaging-relevant trends is a clear warning that “in 2026 sustainability shifts from claim to proof”, with consumers now looking for verifiable evidence rather than broad green promises, the report noted.

IVE frames packaging as a critical canvas for that evidence, from materials and sourcing through to transport and end-oflife, and urges brands to replace vague language with simple, checkable facts. That includes using QR codes, traceability pages, and always-updated proof libraries so shoppers can see exactly what sits behind a product’s sustainability story.

The market is already grappling with regulatory pressure and retailer expectations around recyclability, recycled content and waste reduction. Recent coverage from the Packaging Leaders Forum highlighted how eco-friendly materials, process optimisation, and looming compliance obligations are

Foodcare has announced an upgrade of its packaging capacity with the acquisition of UPAC – a specialist manufacturer and distributor of food packaging including printed bags and associated flexibles.

The company said the acquisition represents a strategic step as the combination of Foodcare’s market strengths and UPAC’s packaging capabilities will offer a single point of manufacturing supplies for customers –making it a more streamlined process.

Foodcare is known for its customer service and ‘In-Stock’ assurance. UPAC brings food

IVE Group’s 12 Marketing Trends That Will Shape 2026 report identifies smart packaging as a focus

reshaping packaging decisions for Australian converters and brands.

That shift is echoed at brand owner level, where many are now prioritising recyclable and biodegradable formats to meet both consumer demand and future regulation.

The report’s eighth trend, “Smart packaging”, argues that packaging will “seriously carry its weight in the marketing mix” and act as a heavy-hitting media channel in 2026.

IVE describes packs that work across three “moments of truth”: discovery before purchase, the on-shelf decision, and the post-purchase unboxing experience. Simple on-pack triggers such as QR, NFC or dynamic codes link shoppers to reviews, how-to content, loyalty shortcuts and easy re-order – turning each pack into an always-on, datarich touchpoint rather than a static label.

While much of the conversation around smart packaging is digital, IVE’s report

packaging experience and technical expertise, specifically in printed food packaging. This allows the combined entity of Foodcare and UPAC to assist customers if they’re navigating complex packaging requirements and compliance standards.

Commenting on the acquisition, Foodcare CEO Garry Pagden said, “We are delighted

also calls out an “offline comeback”, where physical channels such as print, catalogues and in-store touchpoints cut through digital noise.

For packaging, that means structural design, materials and print quality still earn the first grab on shelf, even as connected features sit quietly in the background. The report encourages brands to treat offline pieces – including cartons, sleeves and POS –as premium experiences that are beautiful enough to keep and distinctive enough to share, with digital layers used to extend rather than replace the physical moment.

The trends land as IVE continues to scale its own ambitions in packaging, following its acquisition of Melbourne-based JacPak and a strategy to build a $150 million packaging business across Sydney and Melbourne, supported by its national 3PL network.

Its packaging division has also secured ISO 22000 certification, underpinning work with FMCG clients in categories where food safety, traceability and consistent quality are non-negotiable.

For Australian brands, the practical takeaway from IVE’s report is that sustainability and smart packaging can no longer sit in separate conversations. Packs must simultaneously prove environmental performance, enable circular systems such as reuse or recycling, and deliver the personalised, connected experiences shoppers now expect –all while remaining commercially viable.

As local converters and brand owners continue to experiment with recycled materials, connected codes and data-driven packaging design, the report suggests that those who treat the pack as both a sustainability statement and a strategic media asset will be best placed to stand out in 2026 and beyond.

to welcome UPAC to the Foodcare family. This acquisition is a fantastic fit, immediately enhancing our ability to offer deeper expertise in the technical packaging space.

“By combining UPAC’s deep product knowledge and long experience with Foodcare’s legendary ‘In-Stock’ promise and customer service, we are creating a powerful single-source solution. This move is squarely focused on delivering more value and better more reliable solutions to our customers.”

UPAC co-founder and managing director Gavin Wilson added, “Joining Foodcare is an exciting next chapter for UPAC.

“Our team’s passion for food packaging and technical understanding will now be backed by Foodcare’s robust logistics and service network. This means our existing customers will benefit from the same highlevel product consultation, now coupled with Foodcare’s renowned reliability and inventory assurance.”

The acquisition took effect on 2 February 2026, subject to customary conditions.

to eliminate US$3.9B in net debt

Multi-Color Corporation (MCC), a global leader in prime label solutions, has commenced its prepackaged Chapter 11 filing in the US Bankruptcy Court to implement a financial restructuring support agreement (RSA) that aims to eliminate about US$3.9 billion in net debt.

“The transactions contemplated by the RSA will significantly deleverage MCC’s balance sheet, reducing its net debt load from approximately US$5.9 billion to approximately US$2.0 billion,” the company said, in a statement.

In addition, the RSA is expected to reduce MCC’s annualised cash interest from approximately US$475 million to US$140 million in 2026 – lowering it by more than $330 million – with long-term debt maturities extending to 2033 following consummation of the restructuring transactions.

Additionally, the RSA provides for an US$889 million equity investment that aims to support MCC’s long-term growth and

investment. Upon emergence, MCC said it will have more than US$500 million of liquidity.

The RSA also provides for US$250 million of new money debtor-in-possession (DIP) financing to capitalise the business throughout the prepackaged Chapter 11 process.

Subject to the court’s approval, this additional financing is expected to allow MCC to continue operating in the ordinary course during the restructuring without impacting trade creditors, customers, employees, vendors, or suppliers, and will allow the company to honour its commitments to strategic partners.

MCC has also filed a series of customary “first day motions” that, subject to court approval, will allow it to continue to operate in the ordinary course of business while it works to deleverage its capital structure.

In addition to seeking approvals related to the DIP financing, MCC intends to seek authority to allow the company to maintain wages and benefits without interruption, satisfy employee-related claims, pay trade vendors and suppliers in full in the ordinary course, and perform other critical functions and processes necessary to continue with uninterrupted operations.

CD&R is MCC’s equity sponsor.

Ball & Doggett introduces application-led Cartonboard Swatch Kits

Australian distributor of printable materials and packaging substrates Ball & Doggett has launched its new Cartonboard Swatch Kits, created to give printers, designers, and brand owners a clearer, more tactile way to assess packaging board options.

The individual kits aim to offer an intuitive, hands-on view of how each board performs in production, reflecting the industry’s growing focus on fit for purpose, fibre-based packaging solutions.

The first release showcases four core cartonboard grades: Barry Bleach Board, Sumo Super Hi-Bulk GC1, Sumo Celsius GC2 and Sumo Greyback.

Unlike traditional swatches, Ball & Doggett said these kits are built around practical print outcomes rather than standalone material samples, adding that they are designed as a working reference tool, helping packaging teams gain greater confidence in decisions around print quality, structural rigidity and overall performance.

Ball & Doggett marketing executive Josh

Gleeson said, “We wanted to create a tool that genuinely supports the way printers and designers work. These swatches bridge the gap between specification sheets and what actually happens on press and through finishing, making material selection simpler and more informed”.

Each kit features a wrap-around wallet containing a tuck-end box that houses DL sample cards. Together, they demonstrate board performance across scoring and folding, die-cutting, gluing and finishing.

The print shows both topside and underside performance (topside only for Greyback), allowing users to evaluate how each board

behaves in realistic end-use application.

The DL samples also showcase print, coatings, and embellishment comparisons alongside key technical information, while inside the wallets contains details on reel sizes, application suitability and mill accreditations.

Ball & Doggett fibre based packaging national manager Tammy Arhontissas said, “These kits are designed to make board selection faster, clearer and more confident. By showing real production outcomes, we’re helping customers choose materials based not just on specification, but on proven performance”.

New South Wales-based East Coast Canning + Printing has announced a strategic partnership with Sweden-based packaging technology company Meadow Kapsul delivering its resealable aluminium can technology.

The advanced technology offers a sustainable and versatile packaging solution across a diverse range of consumerpackaged goods, particularly for the beverage category across the Australian and New Zealand markets.

Chris ‘CK’ Kelly co-founder of East Coast said the company will work closely with craft beer producers to unlock the potential of the new technology.

“Our role is to actively prompt that creativity within beverage first, and then more broadly across FMCG. Innovation doesn’t come from forcing products into new categories; it comes from enabling new ways of thinking about format, function and use.

“We’ll work closely with our brewing partners and drinks manufacturers across Australia to help identify, test and realise these opportunities. Importantly, Meadow also opens the door for Australian drinks producers to leverage existing equipment, capabilities and expertise to step beyond

traditional beverages and unlock new revenue streams without abandoning what they already do well,” he said.

“Meadow isn’t about chasing trends. It’s about building a platform where innovation in drinks packaging can genuinely evolve.”

Excited to deliver Meadow Kapsul’s advanced technology to the Australian supply chain, Kelly said the only limitation to its success is a lack of imagination.

“We’ve been closely following Meadow Kapsul’s journey for nearly three years, recognising the immense potential of this transformative technology. This unlocks entirely new possibilities for brands across many sectors, including food and beverage, beauty, home, and personal care,” he said.

“Our deep understanding of the canning supply chain, from printing to filling and consultation, makes East Coast Canning uniquely positioned to accelerate the adoption of this game-changing solution in Australia and New Zealand. This partnership goes beyond beer, spanning into health, beauty and personal care.”

Aluminium is known for its recycling

ease and is also widely available, with one of the fastest recyclable loops in the world, making it one of the most sustainable packaging materials.

However, East Coast and Meadow Kaspul have recognised that the potential of aluminium cans for multi-use, refillable, and extended-consumption products has long been constrained by complex engineering challenges.

Introducing an innovative resealable design that supports refill and reuse models opens new possibilities for industries seeking to reduce plastic waste and meet consumer demand for eco-friendly packaging in Australia.

Meadow CEO and co-founder Victor Ljungberg said, “Partnering with East Coast Canning marks a major step in making aluminium-based packaging accessible on a global scale. Their deep integrated expertise and commitment to innovation make them an ideal partner to introduce Meadow Kapsul to Australia and New Zealand.

“Together, we are empowering brands to unlock the full potential of aluminium cans across multiple categories, delivering improved usability and more sustainable product experiences.”

East Coast Canning will primarily focus on supplying the complete Meadow Kapsul packaging inputs, including printed cans and proprietary dispensers, enabling existing contract producers and brands to integrate the technology into their own operations.

The Australian company’s integrated operations – spanning supply chain, printing, filling, and packaging consultation – enables brands and businesses of all sizes to adopt aluminium packaging quickly and efficiently.

HP reports accelerated adoption of Indigo and PageWide presses worldwide

Eighteen months on from drupa 2024, HP is seeing strong global momentum across its HP Indigo and HP PageWide install base. As demand grows for shorter runs, faster turnarounds and smarter production, providers across commercial, labels and packaging are scaling digital faster than ever, reflecting a shift towards non-stop digital print.

This momentum is being driven by increased adoption of HP Indigo LEP/LEPx and high-performance PageWide inkjet platforms, combined with AI-enabled PrintOS workflows that improve quality and deliver tighter, data-led operational control. Together, these technologies are enabling more automated and scalable production environments.

Recent customer adoption items include:

• Cimpress – Added 16 HP Indigo presses since drupa, including 10 Indigo 120Ks, with more than three million impressions, achieving OEE levels above 60 per cent across European sites, with Pixartprinting USA reaching LS Mark Champion status at 180 per cent.

• RRD – Accelerating its multi-segment digital strategy with new HP PageWide and HP Indigo installations, including the HP PageWide T4250 HDR, to drive

productivity across direct mail, labels, packaging, and commercial print.

• Friedmann Print – Built a fully automated production floor using HP Indigo presses and HP Site Flow, enabling up to 10,000 unique orders per day, 25-30 per cent paper savings and personalised applications at scale.

HP industrial print senior vice-president and division president Haim Levit said, “drupa 2024 reset expectations for what digital can deliver. The surge in customer investment since then reflects a clear belief in a high-productivity, AI-enabled, end-toend digital future and the production gains we’re seeing today confirm that belief is paying off.

“Since the flagship tradeshow, customers have rapidly expanded their adoption of HP Indigo LEP/LEPx HP PageWide and highperformance inkjet platforms, supported by AI-driven workflow tools that improve productivity, quality stability and operational reliability.

“Together, these technologies are advancing HP’s vision for a fully digital production ecosystem and shaping the Future of Work in industrial print.”

After three decades in the narrow web printing industry, I’ve witnessed countless shifts in what drives purchasing decisions. But the change we’re seeing right now in the A/NZ market is different – it’s not about incremental improvements or the latest finishing technique; it’s about survival.

Sustainability, short run efficiency, waste reduction, and reduced set up times are the topics we have all been discussing now for more than decade. When I sit down to talk with printing companies across A/NZ, these questions have now changed. They’re asking: What does it cost, have you got any more affordable options, and who can operate it.

The answer isn’t simple, but it is clear. Two forces are reshaping our industry: affordability and automation. Let me be direct about something: ‘affordable’ doesn’t always mean cheap. The A/NZ market has moved beyond the false economy of buying low-cost equipment that breaks down, requires constant maintenance, or becomes obsolete within three years.

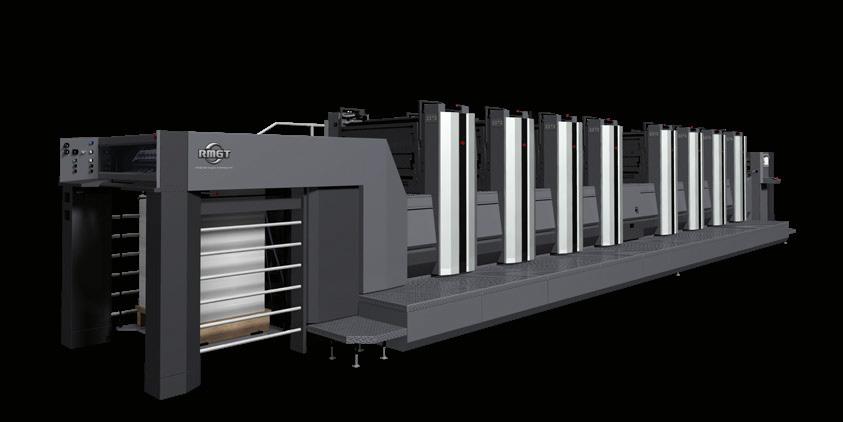

Whilst equipment manufactured in China often has a tempting sticker price, it’s hard to find the trinity of quality, price and service, unless you know who to talk to and only select the very best that China has to offer. Converters are now demanding cutting-edge technology at competitive prices with predictable total cost of ownership. They’re scrutinising every aspect of the investment.

At CS Graphics, we’ve focused our portfolio on brands that offer genuine value engineering – equipment designed from the ground up to minimise operating costs without compromising capability and offer maximum profit to investment ratio.

Why does simplicity sell, you may ask. The uncomfortable truth is, A/NZ has one of the most severe skilled-operator shortages in the global print industry. You can’t fix it by paying more – there simply aren’t enough people with the expertise that our industry requires. This reality is fundamentally changing what ‘good equipment’ means. A press that requires an expert flexo operator to achieve acceptable register is no longer sustainable. Maintenance programs that assume you have a qualified technician on staff are no longer realistic. Training programs that take six months to get someone productive are no longer viable.

The equipment that’s moving in today’s market needs:

• Automated plate mounting that eliminates the expertise barrier

• Remote diagnostic capability so manufacturers can support operators directly

• Automated registration, ink and impression setting.

It’s about intelligent design that makes expertise optional rather than mandatory. The smart manufacturers build ‘operator assistance’ into their equipment. Equipment from manufacturers like

Rhyguan are responding directly to the operator skills shortage. Its inspection slitter rewinders feature advanced automation and simplified operation so that operators without extensive experience can achieve consistent results. Rhyguan machines are easily attainable with lower entry prices for high quality equipment supported locally.

Another trend impacting the industry is FMCG brands responding to consumer demand for variety by shrinking SKU sizes and increasing product ranges – same total volume, but completely different production requirements. This creates the dual-track investment pattern we’re seeing everywhere:

• Established converters with volume contracts continue investing in highspeed flexo for efficiency, substrate versatility, and cost-per-impression. These presses are getting more sophisticated – automated plate mounting, smart register systems, quick-change print units – but the fundamental value proposition remains volume production.

• Meanwhile, emerging and mid-market converters are accelerating digital adoption for short runs, rapid changeovers, variable printing, and waste reduction.

As such, we’re increasingly building hybrid workflows – flexo/digital hybrid presses are becoming common, and offer the best of both worlds. UV LED inks are also gaining serious traction in A/NZ, and it’s not primarily about sustainability. It’s about uptime and reduction in maintenance/consumable costs and consistent curing performance. Using at least 50 per cent less electricity and not requiring replacement lamps every 1,000 hours; not guessing about curing results that rely heavily on reflector condition, these benefits translate directly to revenue.

The GEW systems we represent exemplify this trend. The ArcLED hybrid technology lets converters operate with both mercury arc and LED lamp technology on the same press. It’s flexibility that directly addresses the affordability imperative – you can adopt LED where it makes economic sense, while maintaining conventional capability where it doesn′t.

As such, the future of label and packaging printing in A/NZ won’t be determined by who has the most advanced technology. It’ll be determined by who has the right technology, properly integrated, economically sustainable, and operational with the workforce you can realistically hire and retain. That’s not a technology challenge; it’s a business strategy challenge. And it’s one we need to get right.

Once again, 2025 demonstrated the resilience of the labels and packaging industry. Despite ongoing challenges, including skilled labour shortages and rising operational costs, the sector continues to adapt and move forward.

Digital printing remains central to industry conversations, with HP Indigo maintaining its position as the digital press of choice for many A/NZ converters. The question is no longer whether digital print is the answer – but which manufacturers will shape the next phase of intelligent automation. This is the new race we are in, with leading manufacturers such as HP continuing to push the boundaries.

Currie Group has seen accelerated growth in digital print volumes for flexible packaging, supported by recent HP Indigo 200K installations in Australia at Ultra Labels & FlexPack and QLM. Conversations with label converters, in general, indicate that flexible packaging is firmly on their radar. From a digital print perspective, flexible packaging is the fastest growing segment across all verticals.

A major highlight for Currie Group in 2025 was the sale of the HP Indigo V12 press to Ultra Labels & FlexPack at Labelexpo Barcelona in September. This was a first for A/NZ, and notably the first installation in the Asia-Pacific region. This milestone signals a growing readiness to embrace a non-stop,

digital-first manufacturing mindset. As we look ahead to 2026, Currie Group is well-positioned to support the evolving needs of our customers. The addition of global brands such as Uteco, Bimec, and our FlexCA partners further strengthens our flexible packaging machinery portfolio and reinforces our role as a fully integrated solutions provider.

Equally exciting is the next chapter in our journey, with Currie Group entering a new phase of growth. This evolution builds on the long-standing relationships and values that underpin our business and will enable further expansion of our end-to-end technology and service capabilities.

The alignment also brings clear plans for continued investment in our people, systems, and capabilities to support long-term growth.

Sustainability will remain front and centre in 2026, with growing expectations around transparency from converters to brands and consumers alike. Currie Group will continue to build on the foundations of the Close the Loop program, including planned customer tours of the local facility and new initiatives designed to encourage broader adoption. To date, through our partnership with Close the Loop, we are proud to report more than 185 tonnes of landfill savings achieved by our HP Indigo customers, with even greater progress anticipated in the year ahead.

Building on the success of previous years, we also expect strong attendance at the Dscoop Global events taking place early this year in both the US and Europe. Dscoop continues to offer a valuable forum for customers to connect with global peers, explore emerging trends, and bring new ideas and value propositions back to their own businesses.

2026 will be a pivotal one for the industry, as smart technologies, software, and AI-driven solutions improve on predictability and deliver smarter outcomes. The vision for a fully connected, AI-driven industrial print ecosystem where brands and print converters collaborate seamlessly, with production running autonomously and presses operating with minimal intervention, is fast becoming the reality.

Printing itself is not the issue – the question is, what can converters do to integrate different workflows, eliminate labour intensive tasks, respond quickly to changes and simplify their production complexities. The near future will see the use of AI play a role in all aspects of print production, from automation, marketing, predictive maintenance, prepress efficiency and of course operation analytics.

Digital embellishment is a clear example of an analogue-driven technology moving to digital means, which ultimately delivers faster turnaround times, lower costs, reduced tooling requirements and less reliance on specialised operators.

With multiple AB Graphic DigiJet installations already across the South Pacific region, and the recent arrival of JetFx digital embellishment print bars enabling both high-build effects and foiling in a single pass, we expect strong local uptake – both on new press platforms and through retrofitting existing equipment. It’s a practical, cost-effective way to add meaningful value for both converters and brands.

That said, traditional print technologies such as flexo continue to play an important role in the industry. Ongoing technological advancements and automation from established manufacturers like OMET Srl demonstrate continued commitment to this space. The recent announcement of the new K6 platform highlights how innovative manufacturers such as OMET are delivering bespoke, multi-combination solutions that provide customers with the flexibility they need, at the right price.

As always, our focus remains on standing alongside our customers, and the broader industry as we navigate these changes together and help shape the future of labels and packaging.

Australia’s packaging industry underwent a significant period of transformation over the past year, driven by rapid shifts in consumer behaviour, regulatory pressures, and evolving market expectations.

Sustainability became a defining force across the sector, with demand growing for recyclable, compostable, and responsibly sourced packaging. Companies accelerated their transition to eco-friendly substrates, incorporating flexible packaging formats, fibre-based alternatives, and reduced-plastic solutions as consumers and retailers placed greater emphasis on environmental responsibility.

To remain competitive in this changing environment, print packaging businesses pursued a range of strategic initiatives. Many invested in new technologies to improve efficiency, enhance production agility, and support the increasing customisation demanded by both brands and consumers.

Others focused on diversifying their product offerings and strengthening their supply-chain resilience to address ongoing disruptions in material availability and transportation. Digital transformation also played a central role as companies integrated smarter systems to improve forecasting, workflow automation, and collaboration across production teams.

Industry consolidation reshaped the market as well. The acquisition of Oji Fibre

Solutions Australia by Abbe in 2025, for example, marked a notable shift in the industry, signalling a trend toward larger, more vertically integrated players. With the Australian print packaging market shrinking in certain segments, more mergers and acquisitions are expected.

2025 was clearly defined by uncertainties and hesitation around the world. Despite the need for caution, with persistent labour shortages and rising competitive pressure, maintaining the status quo was not enough.

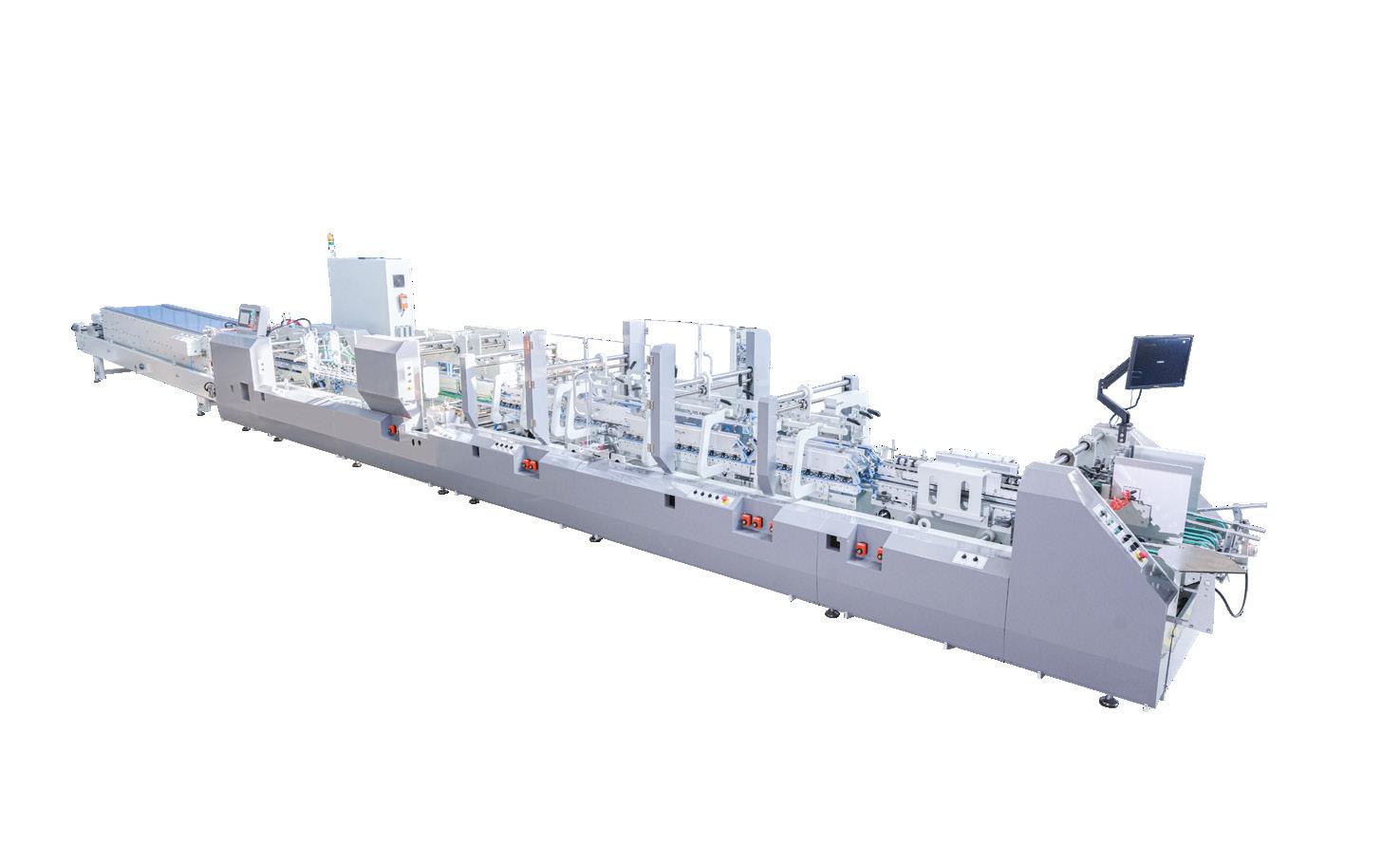

DieLine Solutions and Impack recognised this shift and understood the unique challenges of the region, which is why we partnered in 2023 to bring pragmatic and results-driven automation into Australia and New Zealand.

Impack has always designed solutions that evolve with producers’ needs. It focuses on robust manufacturing and long-term reliability – not planned obsolescence.

For 25 years, it has specialised in automating the end of the folder-gluer line, where the work remains predominantly manual and where fit-for-purpose automation is scarce.

In this environment, Impack’s Ergosa system is more relevant than ever. Its modular architecture allows producers to automate progressively, increasing throughput while easing labour demands – an approach perfectly aligned with the realities shaping 2026 and beyond.

As the past five years have delivered a rapid succession of disruptions and opportunities, 2026 will introduce its own set of pressures; but it also offers the industry a moment to pause, reassess, and recalibrate priorities.

A key trend emerging for 2026 is a stronger emphasis on extracting more productivity from existing assets rather than investing solely in increased capacity. Labour shortages are expected to persist, and carton-volume expansion will remain limited.

Yet this environment presents a real opportunity: businesses will have the space to focus on internal processes, efficiency improvements, and targeted automation.

As labour rates in Australia continue to rise, customers are increasingly prioritising automation as a means to improve productivity and protect margins.

Furthermore, automation not only reduces reliance on manual labour but also enhances workplace safety, helping companies mitigate injury risks associated with repetitive or physically demanding tasks.

Automation is unavoidable, but our message to packaging producers is that it must be strategic. Automation is a longterm process, not a single quick fix, and the wrong investment can compound challenges rather than resolve them.

Specifically, growth opportunities within automation and streamlined production lie in robotics, automated finishing equipment, MIS/ERP integration, and enhanced web-to-print systems. They are becoming essential tools for reducing operational costs and addressing persistent labour shortages, which will also result in further consolidation in the sector.

As consolidation continues throughout 2026, businesses that embrace advanced technologies, optimise workflows, and align with sustainability expectations will be best positioned to thrive in a rapidly evolving print packaging market.

Digitalisation and AI are gaining momentum as well, and the industry now faces the critical task of identifying which technologies deliver tangible, measurable value.

In addition, branching out into other segments of the industry will prove beneficial for many. Companies such as IVE Group are rapidly expanding their presence in the folding carton sector, positioning themselves as major contenders in the next phase of market consolidation.

These movements suggest a competitive environment where scale, efficiency, and innovation will determine longterm sustainability.

2026 is one of the most exciting times to be in the labels and packaging industry. With new technology continuously entering the market, it has proven that digitally printed packaging in the corrugated sector, in particular, is a force to be reckoned with. The reason more global companies are choosing digital presses is clear – this demonstrates and reinforces the market belief that quality and speed from this new technology far exceeds the output from traditional commercially available technology.

At Durst, we see the corrugated sector as the last bastion of the digital revolution. There have been huge advances in press technology from the analogue side and the methods in which these presses operate; however, a fully end-to-end digital workflow has always been the dream for converters globally.

Like many other industries that have recently experienced their digital revolution, Durst has consistently remained at the forefront of the digitisation of technology with the transition of the photographic industry to digital, the wide format printing industry to digital, ceramic printing to digital, label printing to digital and we are also perfectly placed to deliver the urgently required digital solution for the corrugated packaging industry.

The Durst advantage is simply the number of products available to service the needs of our customers including through our partnership with Koenig & Bauer – a joint venture of two powerhouses in printing.

The Koenig & Bauer Durst Delta SPC 130 represents a unique opportunity for corrugated packaging converters looking to embrace the benefits of digital production or upgrade from their current digital system as well as to take advantage of world-first ink technology. The gamechanging digital water-based white ink is ideal for primary food packaging printing as it is food-safe, sustainable and meets all current and future regulatory and environmental standards, delivering a broad range of applications for end customers. The Delta SPC 130 is ideal for converters with annual production volumes between 3 million and 5 million square metres annually, by printing at 60m/min on coated and 90m/min on uncoated boards.

At the top end of the corrugated printing portfolio is the Koenig & Bauer Durst VariJET 106. Offering speeds of 6,000 B1 sheets per hour, this is a solution that integrates the best of both worlds – the Durst digital inkjet technology with the reliability of the Koenig & Bauer Rapida 106 offset sheetfed press.

Our message to the corrugated industry is, for many years you have led the way in high volume packaging and delivered outstanding results; however, the world is changing constantly and quickly and as a result customers are demanding shorter runs, customisation, and some niche effects and products. With our solutions running alongside already established and solid production processes, converters can provide a complementary solution that grows their digital offering and future proofs their business.

Additionally, Durst also has UV capable presses from the new Durst P5 SMP all the way through to small standalone box printers from its Vanguard product line. We have seen a wide range of attractive packaging that we offer to traditional high volume offset and litho printers that want to introduce flexible short- to medium-run on-demand corrugated box solution.

Durst is truly a one-stop shop – not only do we have the hardware, but also the software to manage a fast-paced packaging operation – with Lift ERP and Workflow solutions through to the B2B Smart Shop software.

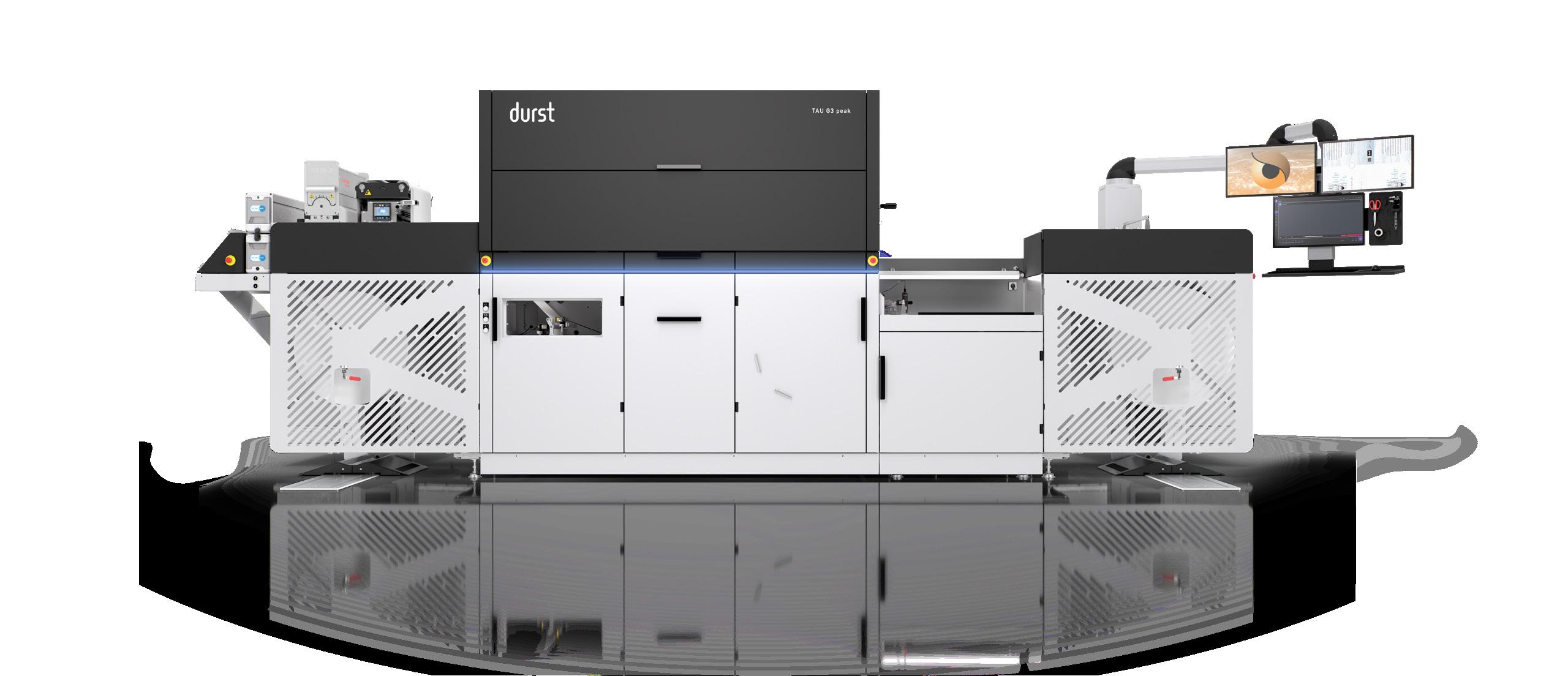

In the labels category, Durst launched its long-awaited third generation label printers – the Tau G3 Core and Tau G3 Peak at Labelexpo in Barcelona last year. The new Tau G3 platform delivers 1,200dpi by 1,200dpi native resolution for razor-sharp print quality. In terms of speed, the Tau G3 Core reaches 61m/min, while the Tau G3 Peak achieves 80m/min and can optionally be expanded to 100m/min, depending on configuration. Print widths range from 244mm to 510mm, offering scalability for different production needs.

Supporting the entire labels & flexible packaging portfolio is the Durst Tau ink system. The UV 3 inks deliver superior adhesion and durability across diverse substrates, while the LED inks enable energy-efficient curing, reduced environmental impact, compatibility with heat-sensitive materials, and the most competitive TCO. Together, they provide converters with maximum flexibility and sustainability in their labels business.

Durst HAWK AI, Durst’s intelligent monitoring and assistance system, can be included to automate the colour-to-colour register and to provide closed loop nozzle correction during printing. Alongside the Tau G3, Durst continues to offer the Tau 340 RSC E as an entry-level solution, its proven Tau RSCi high-end model, and the hybrid OMET systems KJET and XJET for advanced production requirements. With more than 550 high-end Tau systems in the field and over 4,200 active inkjet installations worldwide, Durst is the leading force in digital label production.

The packaging industry has undergone a significant period of transformation over the past few years and continues to evolve at a rapid pace. Driven by changing consumer expectations, economic pressures, sustainability requirements, and technological advancements, the sector looks markedly different to how it did even a decade ago.

One of the most visible and ongoing shifts has been industry consolidation. For many years now, the number of packaging printers has been steadily reducing as larger, well-capitalised players acquire smaller operations or as businesses exit the market altogether. This trend shows no signs of slowing and is expected to continue in the near future, as competitive pressures intensify and customers demand higher levels of efficiency, consistency, and service.

Alongside consolidation, another trend gaining momentum is the reliance on ageing finishing equipment across the sector. Many print finishing companies – including specialist finishers and printers that provide finishing services to other printers – are still operating machinery that was installed years ago. While these machines may still function, they are often no longer suited to current market demands.

As packaging specifications become more complex and turnaround times shorten, the limitations of older equipment become increasingly apparent. This is

driving a growing need for machinery upgrades, particularly solutions that can deliver faster set-up times, improved automation, and greater consistency, all while reducing labour reliance.

A more recent but equally important change has been seen in print volumes within the packaging space. Overall volumes have grown, reflecting increased demand for packaged goods across a wide range of industries.

However, despite this growth, buying behaviour has shifted. End users are increasingly unwilling to tie up capital and warehouse space by holding large inventories. As a result, shorter run lengths are becoming the norm, even as total annual volumes increase. This shift places significant emphasis on machine efficiency, particularly when it comes to make-ready times.

The ability to set up quickly, change jobs efficiently, and minimise downtime is now just as important as raw production speed. This is an area where Graffica places strong focus, ensuring the equipment we represent is well aligned with these evolving needs.

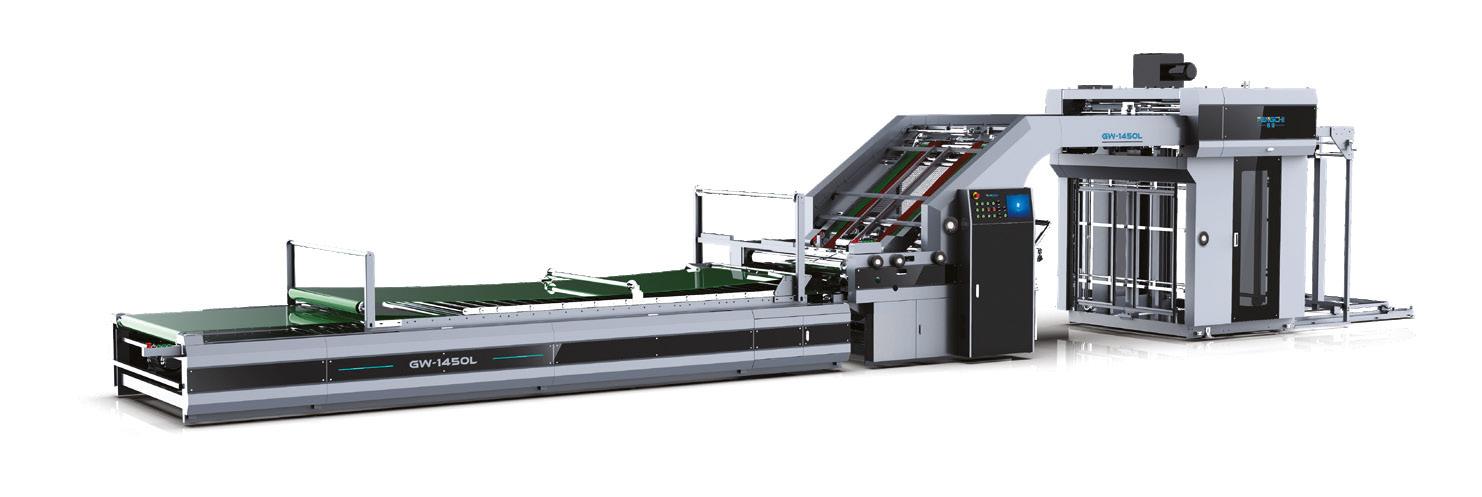

In 2025, Graffica experienced a strong year of installations across Australia and New Zealand, reflecting the market’s appetite for modern, automated solutions. In Australia, we installed the country’s first Century 1670 Auto Die Cutter in Adelaide, alongside a Century 106 in Victoria. We also installed the first carton fold machine

in Melbourne, marking a significant step forward for local finishing capabilities.

Additionally, our first two Fengchi largeformat 1700 laminating machines were installed at converter sites in Melbourne, helping customers significantly improve both throughput and efficiency.

Across the Tasman, Graffica continued to strengthen its footprint in New Zealand with the installation of a fully automated, highspeed corrugated box slotting machine. This investment further underscores the growing demand for automation and productivity improvements within the corrugated packaging segment.

Momentum has carried into 2026, which begins with another Fengchi machine installation in New Zealand, paired with a Flip Flop auto stacker. These solutions reflect a clear market trend towards fully integrated, automated production lines that reduce manual handling, improve consistency, and increase overall output.

Looking ahead, Graffica plans to further build on the growth of its CorrFold and CartonFold box gluer ranges, as well as its Fengchi laminating machines, throughout 2026. Notably, all Fengchi sales to date have been to customers replacing older, inefficient equipment. Our focus is not on start-up operations, but rather on established businesses seeking to modernise their production environments.

The objective is to deliver substantial improvements in both running speed and set-up efficiency, enabling customers to remain competitive in a demanding market.

In addition, Graffica is looking to enhance its custom box-making portfolio through the expansion of Wonderjet corrugated box printing capabilities, including the introduction of white ink. This will complement existing inline box forming, slotting, and die-cutting solutions, further broadening the options available to customers producing short-run, high-quality corrugated packaging.

The corrugated box printing sector, in particular, continues on a strong upward growth trajectory. Corrugated packaging is widely recognised as a sustainable and environmentally responsible option, aligning well with brand owners’ increasing focus on environmental credentials.

The ability to economically produce small runs, combined with high-quality full-colour printing on both brown and white uncoated stock, makes corrugated packaging even more relevant in today’s market. These developments position corrugated solutions as an ideal fit for modern supply chains, where flexibility, sustainability, and efficiency are paramount.

See our range of folding box gluers, board slitters, creasing machines, auto loaders, unloading cutting tables and more.

Fengchi GW Series, 16,000 SPH

• Handles single face, F flute up to 10mm

• Top sheet range: 120 gsm – 700 gsm

• Single-sided, double-sided, and partial laminating 3-minute job changeover

• Available sizes: 1060 / 1450 / 1700 / 2200

Available in 650, 850, and 1100 with auto-set and job recall. Features crash-lock and 4/6 point gluing. Optional pre-feeder/ packer operates at 450 M/min.

The CorrFold range is also available in 1450, 1700, 2100, 2300, 2800, and 3200, also with crash-lock and 4/6 point gluing. Includes auto-set/recall, pre-creasing unit, and pre-feeder/stacking, operating at 300 M/min.

• Available from 52 cm to 300 cm, and everything in between

2025 was Hybrid Software’s strongest year in its 11 year history worldwide. While the Australian market remained steady, we saw exceptional growth internationally – particularly from our North America division, which delivered outstanding results. The year also reaffirmed something fundamental to our success: listening to our customers and adapting to their needs work. By staying close to real world challenges and developing solutions that match them, we continued to grow despite the broader industry pressures.

In 2026, Hybrid Software is focused on enabling packaging converters to thrive in a highly regulated and rapidly digitising environment. Our key priorities are:

• Deepening automation across prepress and production workflows to reduce touchpoints, eliminate errors, and support scalable growth.

• Strengthening MIS/ERP integrations to ensure centralised, accurate, and data driven job management.

• Enhancing collaboration tools, including Cockpit and CLOUDFLOW dashboards, to break down information silos across organisations.

• Driving interoperability with both brand owner systems and production equipment to support seamless end to end digitisation.

These priorities align with industry demands around speed, sustainability, and traceability – and position Hybrid Software as a key technology partner in this transition. In 2026, workforce shortages and declining skill availability

remain some of the biggest challenges across the packaging sector. As experienced operators become harder to find, the pressure on efficiency continues to rise. This skills gap, however, also creates opportunity. Businesses can significantly improve performance by streamlining processes, removing manual touchpoints, and automating the “carpeted” parts of the business – data entry, administration, prepress setup, and job preparation. The companies who invest in automation now will be the ones who thrive in a tighter labour marketplace.

I anticipate 2026 to be a showcase year for practical, applied automation. We will also see several high growth areas that align directly with Hybrid Software’s strengths in workflow automation, collaboration, and digital integration. They include:

• Automation and workflow digitisation, as companies look to reduce labour dependency and remove production bottlenecks.

• Connected packaging technologies –including QR codes, digital product passports, and smart sensors – that deliver transparency and traceability.

• Sustainable packaging innovations, especially advanced biopolymers and next generation paper based substrates.

Hybrid Software’s sustainability commitments for 2026 focus on helping our customers operate more responsibly and efficiently, while also improving the environmental impact of our own software technology.

On the customer side, our focus remains on enabling meaningful reductions in waste and resource consumption through smarter automation, such as:

• Reducing waste through automated prepress, digital proofing, and highly accurate workflows that minimise errors and rework.

• Lowering physical touchpoints, which naturally decreases chemical usage, substrate waste, and unnecessary plate reruns.

• Enabling end to end digital transformation, giving converters tools to produce more with fewer resources and less manual intervention.

In addition to empowering our customers, we are also investing heavily in the sustainability of our own software development. Internally, Hybrid Software is benchmarking every major component to ensure it runs as efficiently as possible. One of our major engineering projects for 2026 involves transitioning more of our processing from CPU based architecture to GPU based computing. The objective of this is to make our software dramatically more efficient, faster, and less resource intensive.

For software and workflow technology, 2026 will also be the year that AI moves from buzzword to reality. We expect to see tangible, production ready solutions emerging across the market, from AI that reads and interprets customer emails for automated data entry, to AI driven production workflows that reduce manual touchpoints and increase accuracy. Although AI has been around for years, 2026 represents the real start of AI powered automation becoming mainstream and commercially impactful. As such, across major events this year, we anticipate a strong push towards:

• Next generation AI tools for design automation, defect detection, and workflow optimisation.

• More accessible automation technologies, with cloud native workflow platforms – such as Hybrid Software’s CLOUDFLOW and Cockpit –taking centre stage.

It’s no secret that the packaging industry is evolving quickly, and businesses are facing more pressure than ever – whether through regulation, workforce shortages, or increasing SKU complexity.

Hybrid Software’s message is simple: embrace automation and digitisation now. The companies that invest in smarter, connected workflows today will lead the market tomorrow. Hybrid Software remains committed to supporting this transformation by delivering solutions that make packaging production faster, smarter, and more sustainable.

Enterprise workflows

Native PDF editors

Color management

3D prototyping & visualization

High-speed RIPs and DFEs

Printheads electronics

2025 was, by most measures, a challenging year for the Australian packaging industry. Publicly, the sector faced significant scrutiny with Pro-Pac Packaging entering administration, the insolvency of Great Wrap, and ongoing challenges at Pact and Opal’s Maryvale Mill. Less visible, but equally important, financial stress extended well beyond the listed players, impacting many private businesses across the industry.

A contributor to this was volume pressure cascading into broader financial strain. 2025 exposed a clear divergence between well-capitalised businesses able to invest and restructure, and those struggling to fund turnarounds or even maintain operations. A standout highlight, however, was the completion of the Abbe-Oji acquisition, alongside generally healthy domestic M&A activity that played a critical role in industry consolidation.

In a difficult trading environment, relevance was maintained through focus and discipline. Many businesses prioritised protecting their core customers and strengths rather than chasing declining volumes at the expense of price and margin.

Acquisitions and partnerships were used strategically to consolidate capability and strengthen long-term positioning, while tighter working capital management

and cost controls became essential to maintaining resilience.

Looking ahead, priorities for 2026 are firmly centred on execution. Operational excellence and margin protection remain critical, particularly as top-line growth is expected to remain challenging. There is also a renewed emphasis on rebuilding strong sales capability, an area that proved difficult across the industry in 2025.

Integrating recent acquisitions, deepening customer relationships through broader offerings, and continued investment in people, systems, and emerging technologies such as AI will be key.

The packaging landscape in 2026 is likely to continue consolidating. M&A will remain a defining feature as scale, capability, and balance sheet strength become increasingly important. This will be driven by the need to consolidate, relieve financial stress, and address talent and succession planning challenges.

Customers will apply greater scrutiny to supplier financial stability, while tolerance for underperformance in service, quality and delivery will diminish. Price will remain important, but execution and reliability will increasingly differentiate winners from the rest. Customers are also expected to further rationalise their supplier bases, favouring fewer, more reliable partners.

Demand for flexibility with shorter runs, faster changeovers and customised formats, will continue to grow. Sustainability expectations will become more practical as associated costs are better understood. The separation between operators who can invest and those who cannot will become even more pronounced. Growth opportunities will favour businesses offering value-added and integrated packaging solutions rather than standalone products.

Short-run and customised offerings will continue to gain traction, as will packaging solutions linked to broader marketing and customer engagement strategies. Selective geographic or segment expansion can also deliver growth, but only where there is a clear right to win.

However, the most significant opportunities lie in winning share as weaker competitors exit or consolidate, and in building deeper, more strategic customer partnerships. Businesses that continue to invest through the cycle will be better positioned for longterm competitiveness.

At the same time, challenges remain. Managing cost pressure without sacrificing service, funding investment in a tighter capital environment, and integrating acquisitions effectively will test leadership teams across the industry.

In terms of innovations, 2026 tradeshows are expected to be pragmatic rather than speculative. There will be a strong focus on cost-effective sustainability solutions, addressing the perennial question of how to achieve environmental outcomes without compromising commercial realities.

But across much of the client base, significant new sustainability commitments are unlikely in 2026. Progress in this area will be constrained by broader business underperformance, rising costs, and competing customer pressures. For many, sustainability will remain a balancing act rather than a step-change.

I also expect continued digitisation of print, faster and more cost-effective production, and technology that improves flexibility and reduces run sizes efficiently to feature prominently in tradeshows this year as well.

My message for the industry in 2026 is this: the industry’s resilience should not be underestimated, but the next phase will reward financial discipline, execution capability and strong balance sheets.

Customers and suppliers must work more closely together, building strategic relationships based on trust and mutual support. M&A can be an effective way to scale quickly, but integration and execution ultimately determine success.

In 2025, the businesses that remained relevant were those that adapted early and took a holistic view of the market. Throughout 2025, C4C Packaging closely monitored consumer behaviour across international markets, alongside tightening regulatory frameworks –particularly in Europe – where extended producer responsibility (EPR) schemes, recycling obligations and sustainability levies materially altered the cost structure of traditional packaging.

At the same time, transportation and shipping costs continued to rise, adding further pressure to both producers and consumers. These costs are ultimately passed on to producers through margin compression or to consumers through higher retail prices at a time when costof-living and cost-of-doing-business pressures were already acute.

The broader packaging and beverage industries, too, faced mounting pressure in 2025. Rising glass costs, labour shortages, and heightened sustainability requirements challenged traditional production models.

At the same time, these pressures accelerated a necessary conversation across the industry: how to adapt to new consumption occasions, new markets and new generations of drinkers. C4C was built to support that transition. By investing in advanced co-manufacturing capability,

it is helping strengthen Australia’s wine and beverage ecosystem, providing producers with the tools, formats, and infrastructure required to compete and grow in a rapidly changing global market.

As today’s consumers want products that fit how they live – portable, responsibly packaged, and globally compliant – without compromising quality or brand integrity, that founding vision moved decisively into execution for C4C Packaging in 2025.

In 2026, our goal is straightforward: scale with intention. We will:

• Bring a full aseptic packaging production online in Western Australia

• Expand our packaging portfolio with formats that better serve wine, altbeverages, and functional drinks

• Strengthen export pathways for Australia’s producers – especially in markets proactively favouring lowcarbon packaging, such as the Nordics, Japan and the UK

• Launch our ‘Grow Global’ advisory program to help producers navigate compliance, labelling, and logistics so they can enter new markets with confidence.

It’s going to be a big year – one that lays the foundation for the next decade of packaging transformation. The opportunity in front of us is enormous. We have the chance

to redefine how Australia exports wine and beverages, giving producers smarter packaging that opens new markets, lowers costs, and dramatically reduces environmental impact. This is not incremental change; it’s structural progress.

The real challenge is not technology; it’s mindset. Our industry has been built on glass for generations, and traditions don’t change overnight. Modern consumers and modern society require updated packaging that offers a guilt-free choice.

Food and beverage waste caused by outdated or inefficient packaging remains a significant challenge, and this is driving a clear shift in demand. We are seeing growing momentum toward sustainable packaging solutions that protect the content, reduce waste, lower environmental impact and better reflect contemporary lifestyles.

These formats deliver tangible advantages: convenience, lower production and transport costs, improved logistics efficiency, and clearer communication of sustainability credentials – while protecting the quality and integrity of premium beverages. This is exactly what today’s producers and consumers are looking for.

As such, 2026 will be about momentum, not promises. We’ll see renewable materials move from pilot projects into real volume. Aseptic technology will step into the spotlight as producers realise that smarter formats unlock entirely new markets and occasions.

Any brand that positions itself at this intersection of sustainability, convenience, and global readiness will be ahead of the curve.

AI will quietly become the engine room – optimising supply chains, forecasting demand, cutting waste and cost at the same time. Traceability will no longer be a reporting exercise; it will become a competitive advantage, helping brands move faster across borders with confidence.

What excites me most is collaboration. Equipment manufacturers, packaging innovators and sustainability platforms will stop working in silos. Together, they’ll build systems that make carbon impact visible in real time – simple, actionable and impossible to ignore.

Change is already happening. In every conversation I have with producers, I see the same signal: they’re no longer asking if things should change, but how fast. Producers today are looking for solutions that fit the world as it is now – not the world of 30 years ago. Those who move early will lead. Those who wait will follow.

With 2025 behind us and a year of opportunities ahead, Detpak has been gaining strong momentum in expanding fibre-based packaging solutions, driven by retailer sustainability commitments. At Detpak, we continue to strengthen our position in Australia and have expanded our fresh produce packaging solutions across Asia, including a recent implementation in Korea.

In south-eastern Australia, the outbreak of Tomato Brown Rugose Fruit Virus (ToBRFV) disrupted supply chains and delayed progress on transitioning to sustainable packaging formats, as many producers shifted focus to managing biosecurity and product integrity.

We see working closely with industry as being essential. We have been strengthening partnerships with growers and retailers to co-develop sustainable packaging formats, which we see continuing into 2026.

This year, Detpak is planning to accelerate growth in the fresh produce sector, building on our success in Australia and Asia and engaging with wider markets such as the Middle East and North America.

We aim to drive the implementation of sustainable packaging across more fresh produce categories, expanding our portfolio to align with retailer priorities. With more fresh-food retailers likely to explore and introduce fibre-based packaging, Detpak is well-placed to work collaboratively with them to meet their needs.

As packaging evolves, packaging formats will need to change to enable growers and retailers to maintain or improve shelf life while ensuring packaging remains fully kerbside-recyclable.

For Detpak, performance and sustainability will go hand-in-hand in 2026. Fibre-based packaging formats will increasingly replace plastic as bans and retailer mandates tighten. Consumers are demanding greater recyclability, and the industry is adapting to stringent sustainability regulations. Premium grocers are leading the charge, prioritising carbon footprint reduction and lifecycle analysis in packaging decisions.

If growers and suppliers are investing in new packaging capability, manufacturers will need to ensure equipment is compatible with fibre-based formats to future-proof operations and avoid costly retrofits. The faster and more effectively we can transition to fibre-based packaging, the better we will be able to meet grower, retailer and consumer needs. This means we will also see retailers pushing for low carbon packaging and transparent sustainability reporting.

Detpak is also committed to global sustainability. We’re aiming for at least 60 per cent of electricity for our China operations to come from renewable sources, significantly reducing the carbon footprint of our products. Our Indonesian operations will undertake an energy audit to identify short-term efficiency wins and medium to long-term options to further reduce emissions.

These initiatives will positively impact the sustainability profile of products we supply to our customers, reinforcing our commitment to lowering environmental impact across the supply chain. At Detpak, sustainability is not optional, and collaboration is key to driving meaningful change. With the rapid adoption of sustainable packaging, there will also be great opportunities for Detpak as we build retailer partnerships and grow export markets, particularly in Asia and the Middle East, where sustainability is becoming a key priority for buyers.

We hope to see innovations that could drive sustainable packaging including:

• Advanced barrier coatings for fibre trays that maintain recyclability while extending shelf life.

• High-speed automation solutions designed for fibre-based packaging formats to improve efficiency and scalability.

• Smart packaging technologies that enable traceability and freshness indicators, enhancing food safety and consumer confidence.

• Lightweight fibre designs that reduce material usage without compromising strength and performance.

In 2026, we also anticipate an increased demand for automation-ready designs to reduce labour costs and improve efficiency. To build industry resilience, Detpak has been enhancing its automation compatibility for fibre trays and paper flow wrap to support highspeed packing lines.

In 2026 PFAS-free compliance will become non-negotiable across all major markets, and there will be a surge in demand for automation-compatible fibre trays and paper flow wrap. However, there will be challenges for many in the industry, with cost pressures weighing heavily, balanced with the need to innovate. Companies will also need to navigate complex compliance requirements and scale production capacity. There will also be challenges for companies working on implementing sustainability measures, such as enhancing moisture resistance to reduce food waste or improving shelf-life to minimise spoilage, while still trying to remain profitable. The industry will also need to adapt to fast-changing retailer specifications and global regulatory shifts.

At Detpak, we believe fibre-based innovation is the future. We want to see the industry work cohesively to make it scalable and cost-effective. It’s also time to embrace automation to stay competitive in a rapidly-evolving market. 2026 is the year to lead, not follow, and we encourage the industry to commit to bold sustainability goals, and deliver on them.

For Impact, 2025 was a tale of two halves with order levels deteriorating in the first six months of the year, then stabilising and slowly increasing in the back half of 2025. It is fair to say a lot of confidence seemed to disappear from the market and forecasts went out the window.

This presented us with numerous challenges, including how much stock to hold, what lead times to quote and how to price our products accurately. Our 400kW solar system continues to deliver more than 1.3MW of electricity per day to our factory and our forest open day was well attended. We remain extremely proud that Impact is the only manufacturing/printing company in Australia to own its own forest infrastructure for the sole purpose of carbon offsetting the packaging we produce.

In the last quarter of 2025, we installed and commissioned three new electric moulding machines that will manufacture the caps that we place on our tubes. In 2026, we will focus on getting a return on our investment and ensuring that we realise the full benefits of this.

Many of our customers have already expressed that price increases will be difficult to accept in 2026, so we will have to focus on strategies to minimise any price increases. We will maintain our focus on quality and customer service. We will also be taking every opportunity that we can to speak with all levels of government regarding what politicians say about manufacturing versus what is actually happening.

Australian made packaging will come under further pricing pressures in 2026, based on global changes, interactions and trade. With the US and the EU now on different paths when it comes to sustainability, companies are increasingly prepared to spend less on more sustainable packaging solutions as the ‘political will’ is no longer as strong in many countries around the world.

The most significant challenge is getting all levels of government in Australia to recognise the value and importance of the Australian manufacturing and packaging sectors and to reduce the red tape and high costs that are associated with manufacturing in this country.

Geographically, we are also surrounded by countries with lower costs of production and lower input costs. The government needs to recognise this imbalance and address it. Opportunity wise, if the geopolitical situation continues to deteriorate and global supply chain routes continue to be under pressure (or threat), this could provide a boost to local manufacturers, who can offer customers a “safe haven” against geopolitical risks.

Our industry plays a crucial role in the life of all Australians, yet I feel many Australians do not place enough importance on having a strong, resilient, manufacturing and packaging sector.

Many packaging companies are ‘sweating the assets’, meaning they are not investing in new plant or equipment. This may make their short-term financials look healthier, however you pay the price in the long-run.

I would love to see the industry support each other more and have a co-ordinated plan to get all levels of government to understand what the industry adds to Australia and why the industry needs their attention and support.

For 2026, growth will be hard to come by and packaging companies should have a conservative outlook. The words “speed to market” will remain very relevant in 2026 and if you can keep your lead times short and your pricing stable, this could be a good combination that results in growth.

In terms of innovations, there will be an increase in decoration capabilities, down gauging (using less material), and increased percentage of recycled content usage in packaging.

In 2026, Impact International is working to introduce a new flip top cap to the market. Historically, flip top caps have been produced using Polypropylene (PP). The project we are working on involves the use of High Density Polyethelene (HDPE).

By switching our caps from PP to PE, we can offer the market a mono material tube, which has an increased rate of recyclability. This will also help our customers meet the targets set by APCO.

Once released to the market, customers will have the opportunity to purchase a mono material tube, produced using carbon neutral energy and by partnering in our sustainable forest initiative, our customers can also offset the carbon footprint of the materials used to produce their tubes. We believe this makes our tubes some of the most sustainable available anywhere in the world.

2025 was a pivotal year for Impact Labels, marked by significant investments in technology, talent, and upgrades to our Brisbane facility. Fortunately, these commitments were matched by strong performance, with revenue climbing nearly 10 per cent compared with 2024.

Until 2025, our trade arm hadn’t been a major focus, but over the year we found an effective rhythm and workflow for integrating these jobs seamlessly into our operations.

We also navigated several challenges –particularly those that come with introducing new machinery and upgrading facilities while still managing the day-today demands of packaging. This required extensive coordination, people management, and space planning.

Like many packaging suppliers servicing the food and beverage sector, we felt the indirect pressures of shifting consumer purchasing trends. Rising living costs heavily influenced both the type and

quantity of products ending up in shoppers’ baskets, and some of our clients saw noticeable declines in order volumes.

What Impact Labels did particularly well was doubling down on personalised communication and offering greater flexibility in meeting packaging needs. With a diverse client base producing everything from essential grocery staples to discretionary products, a one-size-fitsall approach simply doesn’t work.

Looking to 2026, the industry is set to see stronger collaborations among packaging vendors as they seek to broaden product ranges and increase share of wallet.