THE 2023 ANNUAL INDUSTRY LEADERS FORUM

Vanguard Luxury Brands is very proud to have won Australia’s top award, the ALIA award for:

2022, 2018, 2015 and 2013.

As well as being Highly Commended for this award in 2014, 2016, 2017 and 2019.

We’re incredibly humbled by the support from the industry and we are so glad to see our favourite venues filling up again.

See you at the bar!

Keep up to date with the latest off-premise news, products, promotions, trends and insights, that are 100% focused on helping you run a better liquor store

Despite easing COVID restrictions, 2022 still came with its own unique set of challenges, largely driven by the impacts of the pandemic environment. What the leaders in this year’s National Liquor News Industry Leaders Forum have demonstrated though, is that this industry is a smart one and no stranger to handling adversity.

As Kylie Lethbridge, CEO of the Independent Brewers Association, said in this year’s issue –2022 brought no “magic wand” to instantly right all our issues. It was up to all of us to stay agile, respond to each pressure as it came, and find the best way through.

It was supposed to be the year in which we all got back to ‘normal’, but looking back on 2022, it’s clear that there is no going back, only moving forward. Trends and circumstances that exploded towards the start of the pandemic still remain important, whether it’s a push towards more online and omnichannel shopping experiences, the movement supporting more local products, or even the growing consumer base generally ‘drinking better’, the best and brightest of Australia’s liquor sector have been taking note and delivering on what consumers and industry partners want.

This year’s Industry Leaders Forum edition is our biggest ever, packed to the seams with the insights of businesses who have restructured, innovated, pivoted and/or held strong in 2022, and will continue to do so in 2023. It features the

thoughts of leaders of all sectors from all corners of the country, sharing how they’ve executed strategies of success and what this means for their future and another big year for the industry ahead. This is complemented by some of the top data, research and analysis organisations our nation has to offer, who give the inside scoop on what this all could mean at the macro level.

This is an essential guide of industry knowledge for 2023, developed to help your business navigate what will be another interesting year.

Thank you to all the incredible thought leaders who were involved with putting together not only the biggest Leaders Forum ever, but the biggest issue of National Liquor News in our 40+ year history.

Thank you also to the amazing team around me that has gone the extra mile to make this issue what it is - Kea Thorburn, Shane T Williams, Seamus May and Deb Jackson, as well as Natasha Jara and Tony Willson.

Final thanks go to you, our readers – you are the beating heart of this industry, and who we do all of this for.

Here’s to 2023!

Cheers, Brydie Brydie Allen, Editor 02 8586 6156 ballen@intermedia.com.au

Get the facts DrinkWise.org.au

PUBLISHED BY: Food and Beverage Media Pty Ltd

A division of The Intermedia Group 41 Bridge Road GLEBE NSW Australia 2037 Tel: 02 9660 2113 Fax: 02 9660 4419

Publisher: Paul Wootton pwootton@intermedia.com.au

Editor: Brydie Allen ballen@intermedia.com.au

Journalist: Seamus May smay@intermedia.com.au

General Manager Sales –Liquor & Hospitality Group: Shane T. Williams stwilliams@intermedia.com.au

Group Art Director –Liquor and Hospitality: Kea Thorburn kthorburn@intermedia.com.au

Prepress: Tony Willson tony@intermedia.com.au

Production Manager: Jacqui Cooper jacqui@intermedia.com.au

Subscription Rates

1yr (11 issues) for $70.00 (inc GST)

2yrs (22 issues)for $112.00 (inc GST)

– Saving 20%

3yrs (33 issues) for $147.00 (inc GST)

– Saving 30%

To subscribe and to view other overseas rates visit www.intermedia.com.au

or Call: 1800 651 422 (Mon – Fri 8:30-5pm AEST) Email: subscriptions@intermedia.com.au

The Intermedia Group takes its Corporate and Social Responsibilities (CSR) seriously and is committed to reducing its impact on the environment.

We continuously strive to improve our environmental performance and to initiate additional CSR based

projects and activities.

As part of our company policy we ensure that the products and services used in the manufacture of this magazine are sourced from environmentally responsible suppliers.

Ltd (the “Publisher”). Materials in this publication have been created by a variety of different entities and, to the extent permitted by law, the Publisher accepts no liability for materials created by others. All materials should be considered protected by Australian and international intellectual property laws. Unless you are authorised by law or the copyright owner to do so, you may not copy any of the materials. The mention of a product or service, person or company in this publication does not indicate the Publisher’s endorsement. The views expressed in this publication do not necessarily represent the opinion of the Publisher, its agents, company officers or employees. Any use of the information contained in this publication is at the sole risk of the person using that information. The user should make independent enquiries as to the accuracy of the information before relying on that information. All express or implied terms, conditions, warranties, statements, assurances and representations in relation to the Publisher, its publications and its services are expressly excluded save for those conditions and warranties which must be implied under the laws of any State of Australia or the provisions of Division 2 of Part V of the Trade Practices Act 1974 and any statutory modification or re-enactment thereof. To the extent permitted by law, the Publisher will not be liable for any damages including special, exemplary, punitive or consequential damages (including but not limited to economic loss or loss of profit or revenue or loss of opportunity) or indirect loss or damage of any kind arising in contract, tort or otherwise, even if advised of the possibility of such loss of profits or damages. While we use our best endeavours to ensure accuracy of the materials we create, to the extent permitted by law, the Publisher excludes all liability for loss resulting from any inaccuracies or false or misleading statements that may appear in this publication.

Copyright © 2023 - Food and Beverage Media Pty Ltd

magazine has been printed on

produced

from sustainably sourced wood and pulp fibre and is accredited under PEFC chain of custody. PEFC certified wood and paper products come from environmentally appropriate, socially beneficial and economically viable management of forests.

The Intermedia Group’s Environmental Responsibility National Liquor News proudly partners with Retail Drinks Australia.

FOR MORE INFORMATION, PLEASE CONTACT YOUR LOCAL CAMPARI REPRESENTATIVE.

Coopers has broken the soil on its brand new $50m home development, with construction expected to be completed around May 2024.

An official sod-turning event marked the start of the construction, which will include a whisky distillery, restaurant and bar, dedicated tasting room and microbrewery.

Coopers Brewery Managing Director, Dr Tim Cooper, said the public response to the development, which was announced in April last year, has been overwhelmingly positive.

“This is an exciting expansion for Coopers, and represents a significant investment for the company, with an emphasis on maximising Australian input throughout the process,” Dr Cooper said.

“As a proud Australian company, we hope to create a welcoming experience for local, national and international visitors, while positioning our brewery for the future.

“Today marks a major milestone and our team is excited to see our vision start to become a reality.”

Following a competitive tender process, Coopers appointed Australian construction company Built to deliver the new development.

Built General Manager, SA, Chris Bate said: “This project will help bolster job creation providing in excess of 500 on-site local South Australian jobs during the construction phase and many more in the manufacturing of material prior to site delivery.

“Our highly experienced local team are looking forward to delivering a high-quality result that both the Coopers team and the people of South Australia can be proud of for many years to come.”

Studio Nine Architects’ unique curved design of the two-storey development has been inspired by the iconic Coopers’ roundel label. The curved structure encompasses a sloping amphitheatre that will showcase the brewery grounds and maltings.

Premium craft beer retailer, Beer Cartel, has closed its bricks and mortar store and moved its business 100 per cent online.

Co-Founder, Richard Kelsey, said the change has been driven by the move to a new warehouse to bring Beer Cartel and its sister business, Brewquets, back into one location. The requirement of the new site and licensing restrictions meant having a bricks and mortar store was not possible.

He added: “We’d like to say a big thanks to all the customers that have come to support the store from when it first opened in 2011 to now. When we first started, online sales of alcohol in Australia were small. It was the support of those that came to the store that helped keep us moving forward during the early years.”

Beer Cartel was based on Sydney’s North Shore, but Kelsey said it was very humbling that the store would get regular visitors from as far away as the Blue Mountains and Central Coast.

“There’s been lots of familiar faces and relationships that we’re definitely going to miss, but we’re not going away, we’ll be look at bringing more of the offline side of the business online,” he said.

While it is the end of Beer Cartel having a store front connected to the warehouse, Kelsey said it isn’t the end of their bricks and mortar aspirations.

“We’ll be looking at options for this going forward and see if there are any opportunities to open a store, including partnering with others in the industry,” he said.

Spirits Platform has launched a new website, which contains a number of features designed to bring the distributor’s premium brands and liqueurs closer to the trade.

The website has been optimised for mobile devices, reflecting the trade’s viewing habits, and has been designed to showcase each premium brand, with stories, events and cocktail recipes available as well. Each brand page provides history, production, and brand information along with detailed tasting notes.

Spirits Platform CEO, Ian Atherton, said: “This redesign is an important part of our vision to create an environment where premium brands are given the focus and brand-building support required to succeed.

“This is about empowering our industry partners to maximise the advantages of the premium brands we offer.”

A prominent feature of the new site is Spirits Academy, a program that supports and educates bartenders and retailers about the history, production and flavours of spirits and liqueurs, with a wide range of courses on offer.

“Our website was built with our customer in mind, providing a hub of resources, a place where they can get information, education and inspiration easily,” said Kathy Bouzios, Spirit Platform’s Digital Marketing Manager.

Visit the new Spirits Platform website at: https://spiritsplatform.com.au/

The Ashmead family has added to its remarkable estate vineyard holdings in Nuriootpa and Greenock, by purchasing the Wilton Hill Vineyard in Eden Valley.

Cameron and Allister Ashmead, the second generation owners of Elderton Wines, seized the “once in a generation opportunity” for the purchase, which they have described as one of Eden Valley’s most extraordinary and unique vineyard sites.

One of the highest altitude vineyards in the Barossa, atop Mengler Hill, Wilton Hill Vineyard has 23.75 ha of vines, some of which were planted over 100 years ago. The Ashmead family will utilise the great opportunity of the vineyard’s old vine Shiraz, Cabernet and Riesling, as well as exceptional younger Grenache vines too.

Allister said: “We are fortunate to bring this amazing vineyard into our treasured estate holdings. Along with the talents of our experienced and passionate vineyard, winemaking and cellar door teams, we believe that this vineyard addition will cement our position as a real contributor to the Barossa’s future success story through growing and making some of Australia’s most delicious and sought-after wines.”

In December, 1800 Tequila held a two day low-waste cocktail and dining experience in Sydney’s Royal Botanical Gardens.

On 28 November, Bombay Sapphire presented its new Citron Pressé Gin to guests from the hospitality, drinks and media industries at Sydney’s Smoke Bar.

The spirit itself is a citrus-led gin infused with 100 per cent natural fruit and no added sugar, and is said to take its inspiration from the classic Tom Collins cocktail.

Corina Retter, Bombay Sapphire Brand Ambassador, introduced the spirit, while guests were treated to five different cocktails and an RTD ‘Citrus Collins’, while enjoying the start of the summer on the rooftop bar overlooking Darling Harbour.

The activation featured ‘The Recycled Bar’, which was constructed entirely from waste destined for landfill, hosted in collaboration with Clean Up Australia. The event aimed to educate drinkers on Australia’s waste problem, with the country producing 78 million tonnes of waste annually.

Low-waste 1800 Tequila cocktails and zero-waste canapés were served, while artwork from 20 sustainable artists was exhibited.

Cognac and the Australian summer are perhaps not immediately associated, but this is an attitude Cognac Monnet looked to change with a recent event held at Sydney’s Nola Smokehouse. Here, guests were introduced to the full Monnet range, including the approachable ‘Sunshine Selection’ expression.

Cognac Monnet is known for its famous art-deco ‘sunshine in a glass’ poster, and online cocktail personality Josh Deane was also on-hand to show how the spirit could be incorporated into warm-weather cocktails.

Calabria Family Wine Group believes in selecting and working with high-quality brands that share their core family values of working hard, being innovative and staying true to your vision. “Our expansion from a single producer-owned and operated wine company to a wine group housing some of Australia’s best-loved wine brands, and a selection of diverse international wine distribution partnerships, is an exicting time in our 75 year history.” Bill Calabria AM. calabriafamilywinegroup.com

More than 500 people came together in late 2022 in the spirit of education and celebration, for the Retail Drinks Industry Summit and Awards.

Late last year, Retail Drinks Australia brought together the retail industry inperson again for a huge day of activity at Sydney’s Sofitel Wentworth. The day kicked off with the organisation’s annual general meeting, followed by the Retail Drinks Industry Summit, and concluding with the 2022 Retail Drinks Industry Awards, with over 500 members and industry stakeholders in attendance across the day.

The Retail Drinks Industry Summit kicked off with an opening by the association’s Chair, John Carmody, who introduced the Hon. Kevin Anderson MP, Minister for Hospitality and Racing in the NSW Government.

“At the end of the day, the hospitality and liquor industry is something so important to our economy, so we should be driving it and we should be making sure that we continue to push forward, to make it easier for you to do business and connect with your customers,” Minister Anderson said.

Michael Waters, CEO of Retail Drinks, also welcomed the crowd, introducing the huge

program for the day that would address the association’s two core areas of work: policy and advocacy. In describing this alongside the accomplishments of Retail Drinks, Waters encouraged members to embrace the opportunity of the day.

“Change is good, and it’s also often hard. But to succeed in business or in life, you must run towards it,” Waters said.

Throughout the course of the day, more than 20 speakers across over 10 presentations and panel discussions explored a range of relevant and current topics, including regulation, responsibility and sustainability; industrial relations reform; workplace wellbeing; talent attraction and retention; market, category, shopper and consumer insights; online alcohol sale and delivery; the evolution of the online shopper; and omnichannel retailing. It was a cracking program, delivering value to independent, chain or online-only liquor retailers, retail banner groups, wholesalers, producers, suppliers, and service providers of the retail liquor sector.

The online world was one of the key themes for multiple keynotes and panels. This was the

case for Rose Yip of Australia Post, who noted that online retail spend overall has increased by 5.2 per cent since 2019, with one in 10 purchase dollars now spent online.

Also reviewing the online opportunity within the omnichannel shopping environment was a panel chaired by Andy Young, Associate Publisher of The Shout and featuring David Gyte of Liquor Marketing Group, Richard Kelsey of Beer Cartel, Kate Bell of Shorty’s Liquor and Bruno De Sousa of DoorDash. This panel discussed how there has been a shift towards creating more options for shoppers, with a huge range of different touchpoints to cater to all types of shopping mission.

A general goal of the Retail Drinks Industry Summit was to help members continue to succeed by making the smartest and most informed business decisions. A key element of this for the liquor industry revolves around responsibility and regulation, covered in differing ways in the Summit.

One highlight in this topic was a panel chaired by Jonathan Russell, Head of Policy & Advocacy for Retail Drinks, featuring The Hon Michael Lavarch, Chief Adjudicator of

the Alcohol Beverages Advertising Code Scheme, Helen Strachan of Pernod Ricard Winemakers, Richard Fifer of Endeavour Group, and Scott Towers of Red Bottle Group. This panel delved into why it is important for the industry to be one step ahead of community expectations, while building and genuinely living up to a reputation of responsible service.

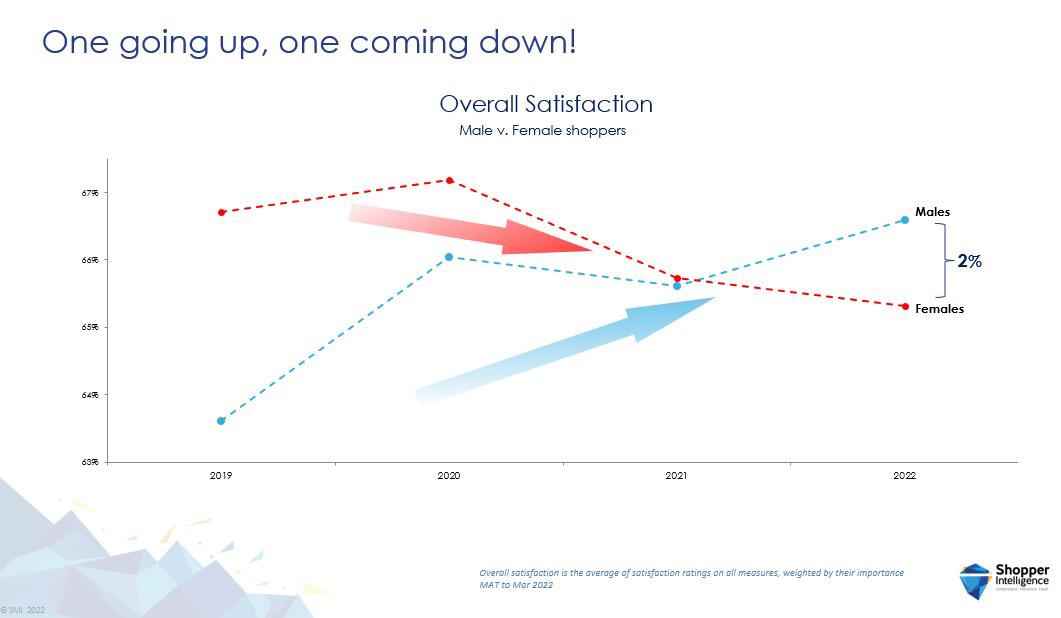

Throughout all sessions, the pulsing heart of the Australian liquor industry was revealed throughout countless data points. As IRI and Growth Scope stated in their joint presentation about market, category, shopper and consumer insights, this is incredibly useful to the industry right now, given a new baseline for retail has been set from the tumultuous environment of the pandemic.

The final part of the day was the Retail Drinks Industry Awards, which recognised excellence across the off-premise industry in both retail and supplier categories.

Carmody introduced the awards, hailing the quality and quantity of the nominees and finalists.

“After a huge 250 per cent uplift in nominations last year, it was incredible to see the nominations grow by a further 20 per cent this year across all categories, to over 400 in total,” Carmody said.

“It’s great to see as it demonstrates that members and the broader industry value and appreciate our annual awards program.”

Waters echoed Carmody’s sentiments, adding: “All member stores that are nominated were independently mystery shopped, assessing the complete customer experience against over 28 criteria. For the average store mystery shopped, this year the score was 79.8 per cent, a four per cent overall improvement on last year.

“The top 50 finalists in Liquor Store of the Year achieved an average mystery shop of 91.2 per cent.”

At the event, National Liquor News caught up with some of the winners to get a sense of their emotions. For Shanais Marcus-Hogue of Dan Murphy’s Tamworth, winner of Liquor Store Manager of the Year, it was a triumphant moment.

“I’m really delighted, I’ve applied for this a couple of times, and to finally get a win… Liquor is my career, it’s not something I’m going to walk away from. Liquor is really special to me,” she said.

Young Liquor Retailer of the Year had a joint winner, with Oliver Francis of Vintage Cellars Brighton and Josh Towers of Red Bottle Group both taking out the win.

Francis said: “In terms of my career, it’s a great next step to go more into buying, and it will give me that really good base to bring all this experience with me to going into a bit more of a store support environment.”

Bottlemart Blackrock’s Matt Surman won Liquor Store Owner of the Year, and said the awards provide a crucial target for the industry.

“They’re very important, they’re definitely encouraging you to get better, so it gives you a bit of recognition that you’re on the right track, doing good stuff,” he said.

Liquor Store of the Year was won by BWS Windradyne, with the award accepted by BWS Relief Area Manager, Leeanne Cunningham. Store Manager, Alissa Humphries, reflected after the win and said: “The entire team is pumped and buzzing after the win. It’s incredible to be recognised on a national level.” ■

Sales Representative of the Year: Alistair

Harris, Pernod Ricard Australia

Beer Supplier of the Year: Lion

Wine Supplier of the Year: Treasury Wine Estates

Spirits Supplier of the Year: Diageo Australia

Services Partner of the Year: Australia Post

Supplier of the Year: Diageo Australia

Liquor Store of the Year: BWS Windradyne

Bathurst, NSW

Large Format Liquor Store of the Year: Dan Murphy’s West End Sunshine, VIC

Online Retailer of the Year: Good Pair Days

Young Liquor Retailer of the Year: Oliver

Francis, Vintage Cellars Brighton, VIC, and Josh Towers, Red Bottle Group, NSW

Liquor Store Manager of the Year: Shanais

Marcus-Hogue, Dan Murphy’s Tamworth, NSW

Liquor Store Owner of the Year: Matt Surman, Bottlemart Blackrock Cellars, VIC

Oliver Francis & Josh Towers Leeanne Cunningham

Piña Colada is a new flavour for the new year from alcoholic seltzer brand, Hard Fizz, after the flavour proved to be a popular choice at the brand’s Gold Coast brewery.

And while the flavour is described as having a distinct creamy flavour, it is actually perfectly clear, like the other SKUs in the Hard Fizz range.

Hard Fizz Head Brewer, Paul Wootton, said: “I’m not joking, this is the most delicious drink I’ve ever tasted. Most of the time, I’m playing around with fruity extracts to come up with our flavours but we thought, let’s take on a cocktail for a challenge, and the result is Piña Colada.”

The flavour was originally a short term collaboration between Hard Fizz and Gold Coast pizza institution Justin Lane, but after proving popular at the restaurant and the brewery, the decision was made to put the flavour into mass production.

Hard Fizz Head of Marketing, Joel Scott, said: “The beauty of FIZZ HQ is we can essentially ‘focus group’ small batches of new, experimental flavours and if people like them, we can retail them properly.

“I can’t tell you how many times people have told me they love Piña Colada Fizz so that’s why we’ve canned it.”

Like the other flavours in the Hard Fizz range, the new Piña Colada is 99 per cent sugar free, and is available now.

One of the leading sparkling wine producers in England, Nyetimber, has entered the Australian market after appointing Déjà Vu Wine Co. as its exclusive importer and distributor.

Eric Heerema, Owner and CEO of Nyetimber, said: “As the sales of sparkling wine continue to increase in Australia, with an obvious focus on quality, we look forward to working with Déjà Vu to introduce our wines to this exciting market and lead the growth in awareness of both Nyetimber and the English sparkling wine category.”

Andrew Cameron, Director at Déjà Vu Wine Co., added: “It is a great honour to be appointed as Nyetimber’s partner in Australia and our team is excited to introduce their finest cuvees to wine lovers across the country. We fully believe that Nyetimber’s firm philosophy in both winemaking and brand building will lead to great success in Australia and we are looking forward to playing a part in contributing to the brand’s international prosperity.”

This is the latest addition announced to Déjà Vu Wine Co’s growing distribution portfolio, which also just took on local wine label, Margan Family Wines.

Doozy is a hard seltzer brand founded by Sydney Swans players Ollie Florent and Will Hayward, along with Harry Hayward and brand agency Richards Rose. Despite launching in early 2022, it has now already expanded its range and its team, bringing on fellow Swans teammate Isaac Heeney as a key investor, while creating new style SKUs and refreshing the brand.

Watermelon flavour has been added to the Doozy seltzer collection, while the core range has also seen the addition of two new vodka soda RTDs: Twisted Lemon and Wild Raspberry. These vodka sodas come in at a higher strength with six per cent ABV, helping take the range into more occasions.

Co-founder, Digby Richards, said: “We’ve put a lot of thought and hard work into this new range, from the recipe to the brand to the new packaging, and hope that people like them as much as we do.

“The best thing about Doozy is that it is deliciously uncomplicated and incredibly agile, and we can align with young Aussies’ tastes and attitudes when they change. Will, Ollie and Harry have tested the tastes and quality with their mates and their networks, and we’ve been humbled by the feedback.”

Doozy’s hard seltzer range has a RRP of $22 per four pack of 330ml cans, while the Doozy vodka soda RTD range has a RRP of $24 per four pack of 330ml cans.

Independent Australian brewer, Moon Dog, has released a re-formulated version of the brand’s ginger beer, designed to be zingier, sweeter and more refreshing than ever.The new Moon Dog Ginger Beer is low in sugar, but with a naturally sweet, juicy and slightly spicy classic ginger taste.

Chris Hysted-Adams, Moon Dog Flavourologist and Product Manager, said: “We know consumers are turning to low sugar alternatives and we wanted to create a product that still gives the full flavour of a ginger beer but still ticks all those boxes of being low sugar, low carb and made with all natural ingredients.

“This really is just the beginning for us. We have plans to refresh the ginger beer shelf and really innovate in a space that has always maintained the traditional flavours and styles.”

House of Fine Wine has announced the addition of two new Australian wine labels to its distribution portfolio of premium brands. Skillogalee Estate, based in the Clare Valley, and Fermoy Estate, based in Margaret River, will be distributed by House of Fine Wine from 1 March.

David Bird, Managing Director of House of Fine Wine, said: “We are proud to welcome Skillogalee and Fermoy into the House of Fine Wine portfolio. Two brands with decades of proud history and experience yet dynamic and future focused, we look forward to working together to bring these exceptional wines to customers and consumers around Australia.”

These latest additions join a growing House of Fine Wine portfolio, which also features Champagne Bollinger, Champagne Ayala, Delamain, Villa Maria, Esk Valley, Leftfield, Vidal Estate, Levantine Hill and Soul Growers.

One of the largest sustainably certified wineries in the Adelaide Hills, Sidewood, has announced the release of a new alcohol free sparkling wine, which it says is the first of its kind to be made with 100 per cent Adelaide Hills fruit.

The new wine was developed in response to the growing demand for premium non-alcoholic wines, according to Sidewood Owner and Vigneron, Owen Inglis.

“We found there was no option for NOLO drinkers, who wanted a premium, quality, zero-alcohol wine. We wanted to make something we’d be happy drinking ourselves,” Inglis said.

Named ‘Nearly Naked’, the new wine uses the same fruit from the Sidewood Estate vineyards, with the alcohol carefully removed using spinning cone technology. This ensures that the fresh aromas, flavours and mouthfeel that Sidewood is known for remains in the final wine.

Sam Evans, Marketing Manager at Sidewood, added: “Brand, packaging and quality of liquid are extremely important factors for NOLO wines. Our team set out to give customers the most premium and quality experience as possible for a zeroalcohol wine, from popping a cork to taking your first mouthful.”

Independent Broome-based Moontide Distillery has released a brand new innovation, bringing its highly popular Pride Tide Gin into RTD format for the first time.

Initially created to commemorate Broome Pride, the Pride Tide Gin captures the essence of a tropical beach party, with flavours of pineapple, coconut and passionfruit combined with juniper, coriander and a rainbow of native Kimberley botanicals. It’s been brought together in a can with a citrusy effervescent tonic, for a convenient and refreshing G&T that can be enjoyed anywhere, any time.

Moontide Distillery worked with drag queen star Kween Kong to be one of the faces of the new RTD, with the launch coming this month in line with Sydney’s hosting of World Pride.

Moontide Distillery’s Trish Davidson said Pride Tide Gin has a special place in the hearts of the distillery’s team.

“We have been proud supporters of Broome Pride Inc. since our first year of operation,” said Davidson.

“Part proceeds of every bottle and can of Pride Tide Gin goes directly to this local Broome not-for-profit that supports LGBTQIA+ individuals in the Kimberley region by facilitating Broome’s Mardi Gras Festival and other community events.”

Australia’s wine industry is known for being an innovation leader, with many local winemakers creating strong potential for alternative varietals, writes Brydie Allen.

We’re pretty lucky in Australia to be surrounded by so many incredible wines in so many corners of the country. Our local winemakers and their regions are known worldwide for exceptional work with key varietals, from Barossa Shiraz to Margaret River Chardonnay and much more.

Aside from the classics though, Australia’s wine industry is also known for its leading innovation, and with the freedom that is not seen within many European regions, the possibilities at our winemakers’ and grapegrowers’ fingertips are almost endless.

One such area of exploration can be found within the ever-expanding range of alternative grape varietals in which many independent Australian wineries play and lead. Some varietals start small, but then are executed so well that they become accepted as mainstream wine options by the domestic consumer market (e.g. Pinot Gris/Grigio). Meanwhile, other varietals inch themselves more shelf space as awareness about them grows, while some stay rare hidden gems.

For the most knowledgeable wine consumers, interesting varietals coming from our local winemakers are embraced as exciting options. But what about the regular punter?

Peter Lloyd, General Manager of Coriole Vineyards in McLaren Vale, says the evolving success of alternative varietals shows a continued thirst for them in Australia. As a longtime local leader in this space, being the first

producer in Australia to plant Fiano and Piquepoul vines, Coriole has seen this develop over time.

“Alternative varietals come and go, some graduate to become mainstream and others may fall by the wayside for viticultural, marketing or winemaking reasons, what is important is to keep experimenting but also do a little homework prior,” Lloyd said.

This is why wine label Alpha Box and Dice prefers a different term when describing these grapes.

“We like to think of our different wine varieties as ‘emerging’ rather than alternative. Many of them are now proven to thrive and produce outstanding wines in the regions that they weren’t traditionally planted, which indicates that their prevalence of production, consumer awareness and demand in the market is sure to continue to grow,” said the winery’s Jared Brown.

There are many reasons for wine producers to add alternative varieties to their lineup.

At Coriole, where alternative varietals like Fiano, Piquepoul, Sangiovese, Montepulciano, Cinsault and more make up more than half of the winery’s volume, the interest came in the 1980s while looking for alternatives for French varietals.

“We were interested in the new possibilities and the unique expressions that could be created from

Peter Lloyd General Manager Coriole Vineyards

“Wine is daunting enough as it is to many consumers so it’s important to find ways to communicate all the great things about these varietals.”

the varietals. This of course has broadened to find varieties that suit our climate and our viticultural future,” said Lloyd.

For Pizzini Wines in King Valley, which has an alternative collection featuring Brachetto, Lambrusco, Verduzzo, Teroldego and many more, it was a decision made in the early 1990s to help put the winery and the region on the map.

“It was a big risk to take back then, but we knew it would be worth it,” said Brand Manager, Natalie Pizzini.

“We knew that for the King Valley to differentiate itself from all of the other Australian wine regions we needed to create a niche market - we couldn’t compete with Chardonnay from the Yarra, Cabernet from Margaret River or Shiraz from the Barossa.”

At Oliver’s Taranga Vineyards, with a portfolio that features the likes of Vermentino, Tempranillo and Mencia alongside more mainstream grapes, having that alternative side provides “light and shade”, according to Winemaker, Corrina Wright.

“It also provides new wines for different occasions. Fiano and Vermentino in particular work really well in this region - they have lovely high natural acidity, lots of texture and some saline qualities that work really well with the food we get from our oceans. Having beautiful wines with vines that are drought, heat and disease tolerant - that’s pretty good all around,” Wright said.

In the Barossa, Lou Miranda Estate and Levrier

Wines by Jo Irvine are two producers that are doing some interesting things with alternative varietals, stemming from the work of previous generations.

Lou Miranda Estate, for example, has heroed Sagrantino in its Fierce III brand, developed as a modern take on the traditions the Miranda family has held in the industry since 1939. Sisters Lisa, Victoria and Angela have been the second generation at the helm since 2019, and while Sagrantino had been experimented with under the winery since their father planted vines in 2009, the sisters released their version of the varietal within the Fierce III collection as a symbol of the fresh take they’ve brought into the business.

Jo Irvine’s alternative hero at Levrier Wines is a Meslier single varietal sparkling wine, of which she says there are only 20 hectares planted worldwide, with two hectares in the Adelaide Hills. Irvine said her father saw the potential of the Meslier grape in the 1980s on a trip to France, and she was able to learn and experiment with him until she launched the wine under her own label.

“Meslier is only used to make sparkling wine, that we know of, but it is usually blended into house styles of Champagne… As far as I know, it has never been

used as a single varietal in sparkling wine, so we make the only one in the world,” Irvine said.

Whether they were previously aware of them or not, consumers are not shying away from trying alternative wine varietals, with this becoming a key drawcard for some cellar doors.

Lloyd says: “Many people visit us to try our alternative varieties - that’s why they know about us. They are then surprised to see we make great Shiraz as well!”

It’s a similar story at Pizzini, where guests to the cellar door are coming specifically to try the wide range of Italian varieties.

Wright, who is also President of the Australian Alternative Varieties Wine Show (AAVWS), said people are always looking for something new, and that will only grow as more alternative varietals are stocked in the retail sector.

“I think a lot of people can get bored by the same wines, even great wines like McLaren Vale Shiraz. They want to have different things to taste and talk about. That is why we’re seeing a massive demand increase through South Australia and the eastern seaboard as well,” Wright said.

Key to the success of any liquor category is education - do consumers know what a product actually is and what it can offer them? There are several strategies that wine brands are using to educate consumers about alternative wines.

The cellar door team at Oliver’s Taranga is renowned for its educational abilities, which saw it become the first cellar door team to ever take out the WCA Wine Communicator of the Year Award in 2022.

“Wine is quite intimidating in the first place, let alone with varietals that you’ve never heard of... I think our staff do a really great job of making everyone feel like they’re on an adventure and there’s no judgment, so why not have a go and try something different? More often than not, people find something that’s pretty good and it goes into their repertoire,” Wright said.

At Coriole, Lloyd said this comfort is created by helping “provide a frame of reference, i.e. make sure those trying Sangiovese for the first time are expecting a dry and tannic style… Once they have something

to latch on to, they are very comfortable to explore.”

Irvine’s approach is to create ‘sensory plates’, which give consumers the chance to taste similar flavours to what they can find in the wine (e.g. green apple slices to match the green apple notes of Meslier). It’s not a food pairing that presents complementary flavours, but rather helps people learn how to identify and understand the flavour notes of different wines.

At Alpha Box & Dice, education comes from many angles. While the cellar door staff tell the story of the brand and each varietal, the winery has also collaborated with artists in the creation of each label to draw attention to the different varietals. The Alpha Box & Dice online store also builds into the educational process, utilising Shopify abilities to add engaging and interactive features.

“Consumers can click on the wine they are interested in to find out more about the backstory of that variety, the winemaking process, and tasting notes with best pairings,” Brown said.

All the winemakers in this story agree that opportunity in retail can come from multiple levels for alternative varietals, from the connoisseur to the average punter. In general, consumers are increasingly enjoying being explorers, seeking out new experiences that surprise and delight them, and that they can show off to their friends.

And as they explore these wines, they become

aware of how well they can fit into the Australian lifestyle. A lot pair incredibly well with food, while others have lighter and refreshing styles perfect for hot weather, and others stack up some serious value at their price points. With more than 100 alternative varietals tasted at the 2022 AAVWS, there are plenty of angles to explore in the sector.

Of course, it’s not as simple as whacking dozens of different and unusual wine varieties on the shelf and hoping they get a fraction of the love shown to our mainstream wines. As Lloyd noted, success all hangs on the ability of the retailer to surface the wines and why consumers would enjoy them.

“Wine is daunting enough as it is to many consumers so it’s important to find ways to communicate all the great things about these varietals,” he said.

“The lifestyle element helps here as it’s easily relatable - Piquepoul with new season’s oysters, Sangiovese with Italian tomato-based dishes, Negroamaro with a charcuterie board, etc.”

Pizzini believes this can all be achieved through close connections between retail and the wineries.

“It requires the makers to spend more time helping to educate those working in retail. Many of the lesserknown varieties are a hand-sell and require staff to be interested in talking about the wines to their customers – what to expect from the wine, what to serve it with, how long to cellar before the wine,” Pizzini said.

“This all helps to build excitement around these wines.” ■

Corinna Wright Winemaker Oliver’s Taranga Vineyards

“Having beautiful wines with vines that are drought, heat and disease tolerantthat’s pretty good all around.”

Some of the key trends to watch for the year ahead have been identified within this year’s National Liquor News Industry Leaders Forum.

“There’s still more work for us in the fortified space, particularly if we take cues from overseas markets where innovations in using fortified as a cocktail ingredient and white tawny take hold.”

– Andrew Calabria, Calabria Family Wine Group

– Andrew Calabria, Calabria Family Wine Group

“Alternative packaging formats targeting various drinking occasions and sustainability advantages will continue to be a key driver for innovation, whilst channel specific and exclusive product offers will remain important to the trade.”

– Karl Martin, Hill-Smith Family Estates“A trend for 2023 is the rise in unusual wine varietals and styles. In 2022, we saw changes in the consumption of traditional red and white varietals, whereas the consumption of niche varietals and lighter styles, like Malbec, Sangiovese and spritz, have experienced growth that will likely continue.”

– Bryan Fry, Pernod Ricard Winemakers

– Bryan Fry, Pernod Ricard Winemakers

“The ginger beer category and ‘better for you trend’ are the ones to watch.”

– Corey Leeson, Independent Liquor Retailers“We can see there’s a consumer need on both sides of the ABV ledger. Some drinkers are searching out higher-ABV products packed with flavour… on the other side, the ‘better for you’ category continues to grow, with a desire for lower-ABV products that don’t compromise on flavour.”

– John Hoedemaker, Good Drinks Australia“Consumer preferences have evolved for younger wine drinkers, with lighter, more refreshing styles becoming increasingly popular.”

– Peter Neilson, Treasury Premium Brands“Affordable indulgence will play a role this year as people look for simple social enjoyment.

Wine categories like Prosecco, Tasmanian sparkling and rosé are well placed to capitalise on these occasions.”

- Dean Carroll, Brown Family Wine Group

- Dean Carroll, Brown Family Wine Group

“We see lots of growth potential across all the segments in beer. We see opportunity in the no-, low- and midstrength segment as consumers continue to moderate what they drink. We also see opportunity at the premium end where our craft plays.”

– Danny Celoni, Carlton & United Breweries

– Danny Celoni, Carlton & United Breweries

“Wine diversification is worth noting as consumption of niche varietals grows to reflect a more involved wine drinking population and their desire to try new things.”

– Darren De Bortoli, De Bortoli

– Darren De Bortoli, De Bortoli

“We have already started to see flavour innovation and exploration attract new customers to engage in classic categories - an example of this is Fruity Beer. We expect this macrotrend of flavour exploration to continue well into 2023.”

– Steve Donohue, Endeavour Group“Beer has the major category share and will see continued pressure from other categories, however I believe there is positive opportunity within beer that will see a re-education of this category.”

– John Carmody, Liquor Legends

– John Carmody, Liquor Legends

“Pre-batched cocktail solutions [will be a big trend] and we are well placed to take advantage. TAILS will continue to lead this trend and RTD canned cocktails which will continue to deliver on convenience.”

– Donna Mulholland, Bacardi-Martini“I think the year will be characterised by continued innovation across the Australian distilling industry and locally-owned and produced brands will continue to win share against the establishment.”

– Drew Fairchild, Top Shelf International

– Drew Fairchild, Top Shelf International

“I think there could be a dark horse in the brandy and Cognac categories. We have seen consumer engagement into these growing, albeit from a smaller base, but still one to watch.” –

Drew Doty, Proof Drinks Australia

Drew Doty, Proof Drinks Australia

“Consumers will continue to want to know more about the brands they are purchasing and this will only help agave spirits, with consumers not only drinking better tequila but also understanding the other great agave distillates.”

– Howard Baynie, Agave Lux

– Howard Baynie, Agave Lux

“There will be premiumisation across all categories but particularly in bourbon and we are well positioned through our Wild Turkey Master’s Keep releases. In the UK and US, rum is back in growth and is something to watch out for in this market.” – Simon Durrant, Campari Australia

“I think there will be the continued growth of Australian spirits, pre-made/ready to serve cocktails and low/no ABV.” – Blake Vanderfield-Kramer, Feels Botanical

“Low-ABV alcohol and cocktail options will continue to gain traction, both in trade and with consumers.” – Lucille Rose, Regal Rogue

“The RTD category, specifically pre-mixed alcoholic drinks with cocktails or tequila, remains strong and seem to be increasing in shelf space in-store.”

– Maurice Melis, Global Endeavours Australia

– Maurice Melis, Global Endeavours Australia

“We predict a shift towards higher ABV RTD products. We are seeing rapid growth in our six per cent ABV RTD range already.”

– Alex Bottomley and Marcus Kellett, Ampersand Projects

“Whilst seltzers and light flavoured RTDs will still have their place, we are backing a consumer shift towards more flavour in their RTDs and certainly an increasing focus on value for money.”

– Paul Weaving, Drink Craft

“We will see less disposable income to spend on alcohol purchases. Customers will still want to support ‘local’, but some might not be trading up as often as they have been.” – Josh

Towers, Red Bottle

Towers, Red Bottle

“Whilst there was a shift toward premiumisation during the pandemic we have definitely started to see a shift over recent months back to some lower price offers and lower spends per shop.”

– Tim Boydell, Vintage House Wine and Spirits

– Tim Boydell, Vintage House Wine and Spirits

“Consumer demand for less but better is set to continue, which we keeping seeing through the acceleration of the super-premium category.”

– Eveline Albarracin, Brown-Forman“I believe that there will be a greater effort by small to medium size overseas brands, especially from Europe, to seek and develop export markets.”

– Brenton Quirini, Empire Liquor

“We’ll continue to benefit from the broad health and mindfulness trend. That’s the mega trend that’s been sitting there for close to 10 years now.”

– Mark Livings, Lyre’s Spirits Co“I think the notion of the spritz as a style of serve is something that Australians will be loving - long, refreshing, slightly lower alcohol, with bubbles and served in a wineglass.”

– Andy Gaunt, Fever-Tree

“We still see the move to quality over quantity as the key consumer driver. Secondly, we see the focus on sustainability across businesses.”

– Cameron Syme, Great Southern Distilling Co“Cost of living pressures will have an effect on consumption and therefore frequency of shopping behaviour.”

– Adrian Moelands, Thirsty Camel

Victoria“I believe we will see the role of e-commerce and delivery slow in growth… however, I do see click and collect growing.” – Chris

Baddock, Australian Liquor Marketers“Most suppliers in all categories are introducing smaller pack formats, value packs or focusing on four and six pack formats to soften price shock.”

– Paul Esposito, Independent Liquor Group

– Paul Esposito, Independent Liquor Group

“The winners [in retail] will be those who maintain connection with and service to their customers across more of their shopping occasions.”

– Gavin Saunders, Liquor Marketing Group

All we know is Riesling.

As we began to emerge from pandemic restrictions, 2022 brought a whole set of new and unique challenges, many of which will continue into 2023. Here, leaders from all over the Australian liquor industry share their thoughts and experiences with this market environment, highlighting key opportunities for success in the year ahead.

The independent Australian producer attributes its competitive edge to a strategy of consumer-focused innovation.

Ampersand Projects continued on its upward trajectory in 2022, recording impressive year on year growth and performance.

Two of the brand’s Co-founders and Directors, Alex Bottomley and Marcus Kellett, said the year’s numbers were incredibly strong, with 265,000 9L cases sold in FY22, at over 2400 stockists nationwide, across a portfolio of 22 SKUs and counting. Those are some huge results for an independent Australian company in its fifth year to continue to grow while competing against huge multinational players.

Bottomley described this competitive edge and said: “We have a track record of delivering unique and innovative products to the market that meet a consumer need or unlock a problem. We have always tried to innovate to deliver against consumer needs, regardless of cost.”

Kellett added: “Brand strength is a competitive edge, as we have created a brand that people want to associate with. The iconic symbol (&) is easily recognised on all our packaging and loyal followers are happy to tag us on their social media accounts sharing their experiences and proudly wearing our merchandise.”

Ampersand Projects has an incredibly engaged consumer following, which it attributes largely to doing things that other companies “cannot or are not willing to do.”

Alongside always free merch, the team manages all social media themselves, which gives the accounts a uniquely personal touch. It all goes back to that ultra consumer-focused nature of Ampersand Projects, boosted by a strong understanding of and connection

to the Australian liquor industry.

“Staying close and in tune to the trade is key to our innovation strategy. There is no doubt that there is also an element of intuition involved. The three founders have all had significant experience in the industry and this helps when it comes to a sense of what will and what won’t work,” said Bottomley.

Ampersand Projects will be maintaining this strength in 2023 by doing what it does best.

“Innovation is and will always be one of our key strategic pillars. We need to innovate to continue to stay relevant and compete in a space that is dominated by global companies,” said Kellett.

The immediate focus in 2023 for this strategy will be focused on a groundbreaking NPD pipeline, as Ampersand Projects continues to work closely with offpremise partners to drive growth in-store. Supporting this will be an upweighted sales force to improve national distribution, with the brand moving from a third party service to its own in-house warehouse and logistics solution to streamline operations.

2023 will also be about maintaining the brand strength that consumers instantly recognise and connect with.

“We are lucky to have established a first mover advantage in a competitive space, having first entered the market in 2018,” Bottomley said.

“As more competitors hit the market it’s survival of the fittest to retain shelf space and presence. We reinvest in innovation and our customers to ensure that when it comes to a purchase decision, we are top of mind.” ■

Throughout last year, Ampersand Projects continued to expand its strengths with NPD innovations in a number of areas:

• High ABV RTD: Vodka Soda & Pine Lime 6% (which became the brand’s fastest growing NPD ever)

• Cocktails in a can: Tequila & Margarita, and Gin Fizz &

• Flavoured full spirits: Vodka & Passionfruit, Vodka & Pine Lime, and Purple Gin &

• Draught: Vodka

Soda & Pine Lime (the brand’s first foray into onpremise keg format)

After a year of increasing the standing of agave spirits in Australia, specialist supplier Agave Lux is looking to expand its portfolio and support the retail sector with further education.

“2022 was a year of building strong foundations for future growth for Agave Lux and importantly, Agave Spirits in Australia,” says Howard Baynie, Managing Director of Agave Lux.

Agave Lux, which focuses on the import and distribution of agave spirits, also widened its own operations over the past 12 months.

“Our people and capability grew in 2022, enabling us to provide greater reach in venue and to consumers. We see education as the key lever to unlock what agave spirits are and that there is more to it, than just tequila,” Baynie said.

Like other suppliers that specialise in an overseas portfolio, freight proved an issue in 2022 for Agave Lux, as did increased supply costs.

“As not only importers but also part owners of some agave brands in Mexico, we saw the cost of doing business impacting both our Australian and Mexican business, shipping delays impacted our ability to bring new news to Australia in a timely fashion,” Baynie said.

Meeting growing demand is identified as one of the paramount objectives for Agave Lux over the new year.

“Continuing to lead category education remains our continued focus, [as does] sourcing new products to meet the growing demand,” Baynie says.

“As consumers continue to ‘peel back the onion layers’ of brands across all categories, this will benefit agave spirits due to the

Baynie suggests that the experiences of the last few years have illustrated the importance of having a wide range of agave spirits in-store.

“As consumers start to become more aware of agave-based cocktails, it will be important for retailers to expand not only their tequila offering but importantly looking into mezcal and other agave distillates,” he says.

“I think this was evident during lockdown, your favourite bar could no longer serve you your favourite cocktail and the explosion of the home bartender came to life with retailers having to grow their range to meet that demand.”

heritage and authentic production methods behind the products.

“We see managing the growing demand of Australian consumers and forecasting as a priority to stay in front of.”

Agave spirits obviously depend heavily on their core ingredient – the agave plant, which can take up to ten years to reach maturity. According to Baynie, this is likely to lead to difficulties for the category and its quality in the future.

“The current demand for tequila and

mezcal is not sustainable, so to meet this skyrocketing demand (it is well known) that the decline in traditional farming and production shortcuts have created a real murkiness that is starting to creep into the category, that, at times, can confuse and even mislead consumers,” he said.

“We encourage all consumers to better understand who are behind the brands you are purchasing from and importantly how the products are truly being made and with what additives.” ■

Positive results in a number of areas has shown a growing consumer love for shopping local, according to Chris Baddock, CEO of Australian Liquor Marketers.

The independent liquor channel was a bright area in 2022 for Metcash, parent company of Australian Liquor Marketers (ALM). In the first half results of the company’s financial year (May to October 2022), ALM showed strength in a number of areas.

In this period, ALM saw continued increased preference for local neighbourhood shopping and at-home consumption, leading to increases in shopper basket sizes. In the numbers, this was reflected by an 11.6 per cent increase in total sales (including charge-through), a 1.3 per cent increase in wholesale sales to ALM’s network of Independent Brands Australia (IBA) bannered retailers, and a 14 per cent increase in sales of Owned and Exclusive brands. Retail growth was complemented by great results in the on-premise segment too, with a 47.8 per cent increase in sales to these customers.

Chris Baddock, CEO of ALM, said such impressive performance has been driven by consumers’ growing love for local independent liquor.

“The attractiveness of local shopping (convenience) with a wide as well as local range and being able to serve the local community through locals who own the store has helped to deliver the results,” Baddock said.

The strength of the independent liquor retail channel has been a key highlight for Baddock in 2022, alongside ALM’s ability to support customers in the on-premise as the sector recovered from pandemic restrictions. Such an environment also created core challenges to navigate in 2022, with staff shortages, supply chain issues and inflation affecting both the ALM business and IBA retailers.

And while unpredictable economic conditions are likely to remain challenging in 2023, Baddock is confident in the entire ALM network’s ability to overcome them.

“As proven during the past three years, both IBA and the independent retailer has shown agility to react and adapt to the ever-changing needs of our customers,” he said.

The mantra for IBA is simple - to champion successful independents. Baddock said there are three main focuses to this mission that the company will develop further this year.

The first is being famous for the right brand and offer, by building brands which appeal to every liquor shopper across supermarket

attached (IGA), convenience retail (Cellarbrations, The Bottle-O and Thirsty Camel), speciality destination (Porters) and Big Box (Cellarbrations and The Bottle-O super stores). IBA has a store and program which appeals to all shoppers’ needs.

The second focus is to be a frictionless order to cash wholesaler, as Baddock explained.

“This year we will launch R.O.S.S (Retailer One Stop Shop) where all ALM customers will be able to access their needs located in one portal. In addition, we will expand ALM Connect and continue to build the extended aisle so retailers can access product from across the industry which may not always be in our warehouses,” he said.

Finally, IBA will be creating “sticky shoppers and customers”, by continuing to enhance the group’s e-commerce offer, and taking its loyalty program from trial to a full launch.

Baddock added: “We will continue to ensure our retailers have the right range at a competitive price - a focus that will never end!”

As the liquor retail industry evolves into 2023, Baddock said the partnership between retailers and suppliers will be incredibly important, especially with NPD and innovation. Owned and exclusive brands, particularly in the value sector, will be big players to create category growth in this space.

“I would like to thank all retailers and suppliers for their partnership – we truly believe that working together and understanding our role in the eco-systems builds a sustainable independent liquor trade,” Baddock concluded. ■

Marketing Director, Donna Mulholland, has hailed the success of Grey Goose and Patrón in 2022, while tipping the brands for further growth in the new year.

It was an excellent year for BacardiMartini Australia’s stable of exceptional spirits brands in 2022, as described by Marketing Director, Donna Mulholland.

“Grey Goose and Patrón have both enjoyed a stellar year and have continued to gain share as the number one super premium vodka and tequila respectively,” Mulholland said.

“We will continue to put a strong focus on growing the presence of the four, fabulous premium brands which are at the heart of our portfolio: Grey Goose vodka, Patrón tequila, Bombay Sapphire gin and of course Bacardí rum.”

Bacardi-Martini Australia has expanded this offering into new, different categories across the last year too.

“We’ve also launched new RTDs and Tails Cocktails, our premium prebatched cocktail solution, which is now delivering hassle-free, quality cocktails quickly and consistently across the country,” said Mulholland.

“RTDs are a star performer and they continue to grow as we continue to drive the premiumisation trend and deliver on the convenience which is so important to today’s consumers. And we will continue to extend the presence of our RTD and Tails portfolios [in 2023].”

Bacardi-Martini Australia is not immune to the wider economic headwinds that

businesses of all kinds are having to contend with at the moment.

“Like every other FMCG company, inflationary pressures and supply chain challenges will be ongoing challenges in the year ahead,” Mulholland says. However, Bacardi-Martini Australia is predicting new launches and innovations will provide a strong opportunity to weather such challenges for a successful 2023.

“Innovations are key to our growth strategy and with new launches like Bombay Citron Pressé, Bombay Sapphire Premier Cru, Grey Goose Essences and new Bacardí RTDs, we are on track for another strong year,” Mulholland said.

Another key component of the strategy for 2023 will be meeting several key sustainability targets on a global scale, as part of a wider movement towards carbon neutrality.

“By the end of 2023, we will have cut all single-use plastic from our POS materials and our secondary gift packs. This marks a major milestone in our mission to make Bacardi a plastic-free company by 2030,” Mulholland said.

“Next year, we will also be introducing technology at our Bacardí rum distillery in Puerto Rico, the largest premium rum distillery in the world, which will cut our greenhouse gas emissions in half and help us take another major step in our journey to net zero.” ■

Another 2022 triumph for Bacardi-Martini Australia came in the form of company culture recognition. Mulholland said culture means a lot to the company, and helped it be named as a Great Place To Work for the second consecutive year.

“What differentiates Bacardi from any other company is the strength of our culture. We empower our teams to act with a freedom and an entrepreneurial spirit that sets them apart from others and allows them to establish, long-term, unbeatable partnerships with our customers,” Mulholland explained.

“As a family-owned company for the last 160 years, it’s in our DNA and it’s why we are constantly innovating to ensure we deliver what our consumers want when they want it.”

LAUNCHED BY A SPONTANEOUS BUNCH OF PUBLICANS NEARLY 15 YEARS AGO, THIRSTY CAMEL HAS BECOME ONE OF AUSTRALIA’S MOST RECOGNISED INDEPENDENT RETAIL BRANDS; WE’RE THE LOVABLE MAVERICK OF THE LIQUOR WORLD, AND PROUD OF IT.

350 Thirsty Camel stores dotted across the country.

The best in drive through convenience.

State specific loyalty programs to drive retention and repeat purchase.

Insight driven marketing campaigns all year round.

A succinct core range of products allows venues to work with supply partners to accommodate their local needs and customer base, utilising data driven insights and trends our core range covers all categories delivering strong margins and profitability.

State based opt in programs including a Craft Beer and Premium Spirits program allow flexibility to work with global leading brands and up and coming local products to reflect current trends.

BrightSide will be expanding its team again this year to continue supporting and connecting with the drinks industry in what is expected to be a dynamic 2023.

Being long time specialist recruiters for the drinks industry, Sue Lauritz and Amber King, Directors at BrightSide Executive Search, know a thing or two about how to find the right candidate for their clients.

And even with a candidate tight market providing its challenges, the BrightSide team sees this challenge as an opportunity.

“In this market our clients need our help more than ever,” say King and Lauritz. “We just need to be well positioned to support them to find the right hire as efficiently as possible. With our talent team in place, our extensive database, and strong networks, we are well placed to do this.”

King and Lauritz have grown their talent team over the past 12 months, with three new staff members, servicing the entire country. And this team will continue to grow into 2023.

“Our team bring skills in recruitment, talent mapping and headhunting, however we all have a huge passion for the industry overall, which makes it easier, even in a tough market. We love what we do and are continually making connections with candidates with a range of experience across sales and marketing, category, trade, digital, online, innovation and insights and at all levels,” they say.

“We’ve found that more businesses are outsourcing their recruitment to someone they trust and who knows the market. And after 15 years of being specialists and dedicated to the drinks industry, we can safely say we do.”

Looking to the year ahead, BrightSide is preparing to relaunch its website with a brand new look and feel in the first quarter. And aside from this, the immediate focus will be fulfilling current job briefs and tapping into the active candidate market.

While there is more movement in the market, candidates are very particular with their job wish list, with things like a hybrid home/office work model a must, along with a genuine passion for the brands they represent.

As King and Lauritz said: “Candidates are very definite with what they’re looking for in their careers and their expectations of employers. We often hear that if there is no work from home flexibility, then it’s not the company for them. People want to be trusted and feel they have proven they can do their jobs remotely some of the time.

“The right culture continues to be a key factor in someone

Amber King and Sue Lauritz Directors BrightSideAs the only dedicated drinks specialist in the country, BrightSide has a key message to the industry when it comes to 2023 recruitment.

“We are here to support the industry and after 15 years we know what we are doing, what our clients need and what candidates are looking for to make their next career move,” King and Lauritz said.

“Lean on us for your recruitment needs so your team can stay focused on their own roles within the business.”

considering a role or not. Also, longer term career progression and if the business is a good ‘corporate citizen’ are also key factors, especially around sustainability.”

With more certainty and confidence in the jobs market, BrightSide expects to see an increase in people making career changes. So how can businesses put their best foot forward in their recruitment searches in 2023?

“By being on the front foot,” say King and Lauritz. “Failing to plan is planning to fail. Sit down with your key leaders to determine your recruitment needs; where are potential gaps, know what your internal moves / promotions and new head counts are going to be and plan with BrightSide accordingly.” ■

2022 saw Brown Family Wine Group re-introduce a historic Australian grape strain, and the brand is looking to develop this success in the new year.

For Dean Carroll, CEO of Brown Family Wine Group (BFWG), NPD has given the company tremendous stimulus in 2022, and will continue to do so over the next 12 months.

One example of this from 2022 was with the launch of a Tarrango wine under the Brown Brothers label. Tarrango is an Australian grape strain first developed by CSIRO in the 1960s, but a new wine expression of this varietal had not been introduced to the Australian market since the 1980s. As part of the promotion for this new product, BFWG worked with Foxtel on documentary, Next in Wine: Survival & Succession, to tell this story.

“Tarrango has been relaunched very successfully this year and the opportunity will continue to grow as consumers look for softer reds often chilled to better meet the environment in which we live,” Carroll said.

“We created and released a Foxtel documentary on the development of Tarrango, a unique refreshing red varietal, and the Brown Brothers generational family story which has so far been viewed by over 160k people, with sales of Tarrango exceeding expectations.”

This new product will continue to be a focus for BFWG in the year ahead, alongside many other NPD initiatives.

“We are very excited about our NPD pipeline and some of the potential we see for our recently released NPD. In 2022 we released our Brown Brothers Zero range with Moscato, Prosecco and Prosecco Rosé and we see huge potential in both the Low and Zero space over the upcoming year,” Carroll explained.

“These products have opened up new routes to market for our brands and ultimately access to a new consumer base which is very exciting.

“We are particularly excited about the opportunity we see for Fiano with its easy drinking flavoursome style and will be investing in building its awareness and adding more to our portfolio in the year ahead to complement our current Brown Brothers offerings.

“Our goal with much of our NPD this year will focus on recruitment into wine and rejuvenating wine as an option for younger consumers. In recent years those consumers have clearly been reluctant to enter the category which is a concern and an opportunity for the wine industry.”

Carroll identified that 2023 is likely to bring some difficult economic times, but he nevertheless sees a chance to increase awareness for BFWG.

“We see a great opportunity to build our brands for future prosperity and double down on our focus on customer, shopper and consumer,” Carroll said.

“Early in the year we are upweighting our platforms in the e-commerce space to enable greater connection and agility with our direct customers particularly those who visit or have visited our cellar doors.”

BFWG’s ongoing and deepening connection with Tasmanian wine will also be an opportunity for 2023.

“When we purchased our Tasmanian vineyards in 2010 it was always with the long term in mind,” said Carroll.

“Our goal is to make the best possible wine from the beautiful region of Tasmania with particular focus on premium Pinot Noir and sparkling. Ultimately once our production grows, we would love to take these wines to the world and show how magnificent Tasmanian wine can be.” ■

Eveline Albarracin, Vice President and Managing Director for Brown-Forman ANZPI, discusses what has continued to be responsible for the company’s strategy of success.

For Brown-Forman, 2022 was a unique year of opportunities alongside challenges. Overall, Managing Director, Eveline Albarracin, says that “it was a strong year for our business on a number of fronts.”

“When I reflect on the past year, there is so much to be proud of across our brands, our partnerships, and of course our brilliant people – the bedrock to our success,” she says.

One highlight for Brown-Forman was receiving Great Place To Work certification in October 2022.

“This independent authority on workplace culture recognised our team for operating with clear purpose, for putting people first and for truly championing diversity and inclusion – qualities I am inspired by every day,” said Albarracin.

When it came to the Brown-Forman portfolio of brands, Jack Daniel’s was one high performer across 2022, with Albarracin noting how it maintained its position as “number one spirits trademark in the Australian market”.

Some great examples of NPD could be responsible for this, with Brown-Forman launching Jack Daniel’s Bonded, a super-premium 50 per cent ABV offering from one single distilling season and a first for the brand in 25 years; and Jack Daniel’s Apple and Soda, a lighter profile RTD using the Jack Daniel’s Tennessee Apple Whiskey Liqueur.

Jack Daniel’s is predicted to continue on a journey of success into 2023, as part of a number of new brand initiatives for BrownForman. This includes Jack Daniel’s partnership with the McLaren Formula One team, to expand the brand to a new set of consumers while focusing on responsible drinking.

Albarracin continued: “Our recent acquisition of the ultra-premium Gin Mare brand will help accelerate growth of our light spirits portfolio alongside Fords Gin, tapping into those consumer occasions that call for lighter and more accessible offers. And our acquisition of Diplomatico Rum further boosts our presence in super premium - we look forward to continuing to build this brand across our key channels.”

Albarracin sees Australia’s thirst for spirits deepening in support of such initiatives throughout the next 12 months.

“With the rise of cocktail experimentation, we expect to see continued excitement and trial of spirits from existing consumers, as well as broadening appeal off the back of these new occasions,” she said.

Eveline Albarracin Vice President and Managing Director Brown-Forman ANZPI“Tequila is a real standout, now the fastest growing spirits category in Australia, and riding this wave of discovery are our premium brands El Jimador and Herradura, the perfect and vital component for the popular Margarita cocktail trend.”

In 2022, as we moved further away from the pandemic, BrownForman saw strong demand for locally produced RTD products. With continued economic uncertainty on the cards, Albarracin does believe performance of ultra-booming categories like this will normalise, but Brown-Forman will be ready.

She said: “As we enter a ‘post-pandemic’ era, we remain committed to leading with innovative and creative thinking, ensuring we continue to build relevance with evolving consumer cohorts, and working closely with our suppliers and partners to deliver sustainable growth.” ■

The group has celebrated a number of strategic achievements in 2022 that are set to be built upon in 2023.

Looking back on the last 12 months, Andrew Calabria, third-generation Sales & Marketing Manager, says: “2022 has been a whirlwind of a year, but the Calabria Family Wine Group continues to grow and succeed in achieving the strategic goals we have set out to achieve.”

A key strategic point of the Calabria Family Wine Group (CFWG) portfolio in 2022 was the McWilliam’s brand. Further integrating this into CFWG has been an important task since the brand was acquired in 2021.

“This included a portfolio review across Calabria’s and McWilliam’s wines, ensuring the McWilliam’s master brand logo is prominent across the collection and setting the foundations for further NPD and innovations that speak to the heritage of the McWilliam’s brand,” said Calabria.

This heritage was heroed in 2022 already with a major launch of the McWilliam’s portfolio - the redevelopment and relaunch of McWilliam’s Hanwood Estate and the Aged Tawny collection.

“The McWilliam name has always been at the forefront of the fortified category, and this range of age-statement releases is an exciting step towards showcasing the diversity of Tawny across multiple lengths of barrel ageing in a premium way,” said Calabria.

2022 was also a busy year for other arms of the CFWG business. On the international front, the company saw exciting growth in imported wines with the launch of Champagne Deutz and Fontanafredda, which extended CFWG’s potential reach in independent retail channels. Then on the Calabria front, the group saw some great success.

“Two of our packaging-lead releases remain top performers in their price and varietal brackets. The beautiful Bélena range, which celebrates the true partnership of my Dad and Mum - the second generation of the Calabria Family Wine Group - marked its official launch in the market with an event in Sydney and a national personalisation campaign in-store,” Calabria said.

“Additionally, our Kings of Prohibition range continues to see strong growth and industry recognition, with the range receiving the Best Package Series Design at the PACKWINE Awards and the brand celebrating the inaugural ‘Kings of Prohibition Day’ - an official wine holiday we created on the same day as Repeal Day (the end of prohibition).”

These brands, alongside the reinvigorated McWilliam’s fortified range, have seen

some key success in the retail sector in 2022, particularly with bespoke trade campaigns like the Kings of Prohibition BBQ competition and the custom label promotion for the Bélena range, which Calabria said: “has seen great uptake by consumers looking to create a custom label for this beautiful range of wines.”

Looking ahead to 2023, core high performing brands, such as Kings of Prohibition, will be an important component of the CFWG objectives. Bélena, for example, will see a major consumer and national media promotion, with the grand prize giveaway for a diamond.

“The statement bottle has been a hit with retailers, which has seen this range double in size in just one short year, and we look forward to growing awareness for the collection with this campaign in 2023,” said Calabria.

It will be an exciting year for the McWilliam’s brand too, with the reopening of the Hanwood Estate Cellar Door after its redevelopment.

“The site is an important part of Australia’s wine history, and we look forward to celebrating this with the newly developed cellar door sometime next year,” said Calabria.

Finally, 2023 will see CFWG continue to overcome a “perfect storm” of supply chain challenges brought on by the shortage of labour, container delays, and limited access to dry goods. Calabria predicts this “is going to prove a challenge through the new year, but one we’re well equipped to tackle.” ■

Having the agility to respond to consumer and customer needs will continue to serve Campari Australia well in 2023, according to Managing Director, Simon Durrant.

In today’s fast moving Australian liquor market, it’s important for suppliers to have their finger on the pulse. For Campari Australia, this was a core goal in 2022 that delivered multiple highlights for the company, and will continue to be integral to its strategies in the year ahead.