Society Matters

Mapping worldwide sheep production The world sheepmeat market has seen surging prices in recent years as demand from emerging markets in Asia, the Middle East and Africa increases as a greater number of consumers move into the middle-income bracket. Across the globe sheepmeat consumption is forecast to grow at an average of 1.4% a year up to 2024, with consumption expected to grow by a total of 895,000t by the same year. That said, sheepmeat will continue to be a small-time player in the world meat market, predicted to account for just 5% of global meat supply in the next 10 years.

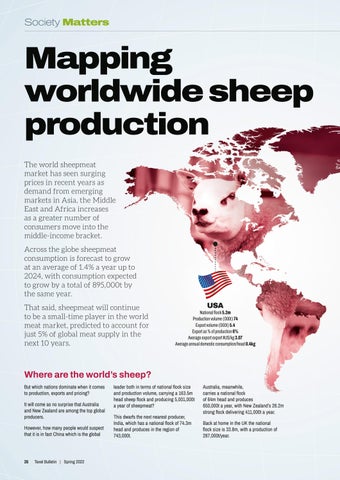

USA

National flock 5.2m Production volume (000t) 74 Export volume (000t) 5.4 Export as % of production 6% Average export export $US/kg 3.07 Average annual domestic consumption/head 0.4kg

Where are the world’s sheep? But which nations dominate when it comes to production, exports and pricing? It will come as no surprise that Australia and New Zealand are among the top global producers. However, how many people would suspect that it is in fact China which is the global

26

Texel Bulletin | Spring 2022

leader both in terms of national flock size and production volume, carrying a 163.5m head sheep flock and producing 5,001,000t a year of sheepmeat? This dwarfs the next nearest producer, India, which has a national flock of 74.3m head and produces in the region of 743,000t.

Australia, meanwhile, carries a national flock of 64m head and produces 650,000t a year, with New Zealand’s 26.2m strong flock delivering 411,000t a year. Back at home in the UK the national flock size is 33.8m, with a production of 287,000t/year.