Introduction to Federal Income Taxation in Canada 43rd Edition 2022-2023

Edition by Nathalie Johnstone , Devan Mescall , Julie Robson Test bank Sample

Dear Students,

Our latest product is designed specifically for students like you. With features and tools that can help you stay organized, manage your time effectively, and achieve your academic goals, our product is the perfect solution for students who want to succeed.

Our free sample is included in the attached PDF file. And if you're interested in learning more or purchasing the full version, you can contact us via email at [Tbworld2020@gmail.com] or on WhatsApp at [https://wa.me/16154344133].

Don't let the challenges of school hold you back - give our product a try today and see the difference it can make in your academic life. We look forward to hearing from you soon.

Best regards,

Edition by Nathalie Johnstone , Devan Mescall , Julie Robson Test bank

Multiple Choice Exam Questions

Tybee lives in Detroit, Michigan, USA. She commutes daily to Waterloo, Ontario, Canada, where she is employed by Ford Motor Company of Canada Limited. She works 9 am to 5 pm, Monday through Friday. Which one of the following best indicates Tybee’s residency status for Canadian income tax purposes for 2022?

(a) A full-time resident

(b) A part-year resident

(c) A non-resident

(d) A deemed resident (sojourner)

2) XYZ Inc. provides Samantha Davis with a company car. The car is leased for $800/month (including 13% HST and excluding insurance) and was made available to her for eight months. ABC pays all of the operating costs which amounted to $3,500 in 2022. Samantha drove 13,000 kilometres in 2022 of which 8,000 were for business. What is the minimum taxable benefit that Samantha must include on her 2022 personal tax return?

(a) $2,850 rounded

(b) $2,100 rounded

(c) $6,117 rounded

(d) $7,001 rounded

3) Which of the following is a taxable benefit?

(a) A cash Christmas gift to an employee from the employer valued at $450.

(b) Payment of the tuition for an employee completing a degree that will benefit the employer.

(c) A 20% discount on the employer’s merchandise, available to all employees.

(d) Subsidized meals offered to all employees of the company assuming the price is approximately equal to the cost.

4) Hulk Protein Supplements Ltd. is a CCPC. Bruce Lily, one of the employees, was granted a stock option on October 11, 2014 for 10,000 shares at $3 per share. Bruce exercised the stock option on September 30, 2017 when the market price was $6 per share. In February 2022, Bruce purchased a new home and sold the shares for $7 each. The fair market value on October 11, 2014 was $4. What is the effect of the above on Bruce’s income for tax purposes, assuming Bruce wants to minimize taxes?

(a) $15,000 in 2017

(b) $20,000 in 2022

(c) $30,000 in 2017

(d) $35,000 in 2022

Introduction to Federal Income Taxation in Canada 43rd Edition 2022-2023

Sample

Introduction to Federal Income Taxation in Canada 43rd Edition 2022-2023

Edition by Nathalie Johnstone , Devan Mescall , Julie Robson Test bank Sample

5) Cherizia Gold presents the following information with her 2022 tax return:

What is the minimum taxable capital gain (rounded to the nearest dollar) to be reported on Cherizia’s tax return?

(a) $1,048

(b) $623 (c) $675 (d) $1,675

6) River Rose, a sole proprietor, purchased an unlimited life franchise (arm’s length transaction) at a cost of $100,000 during 2022. The maximum tax deduction related to the franchise for the taxation year ending December 31, 2022 is:

(a) $2,500

(b) $3,750

(c) $7,500

(d) $10,000

7) On June 1, 2022 Beta Ltd, a CCPC, purchased a franchise for $115,000. The franchise has a limited life of 13 years. Assuming this is the only depreciable asset owned by Beta, which one of the following amounts represents the maximum amount of capital cost allowance that Beta can deduct for its year ended July 31, 2022? Ignore the leap year.

(a) $115,000

(b) $13,269

(c) $2,218

(d) $7,780

8) Lambda sold a capital property on October 31, 2022 for $200,000 with a cash down payment of $15,000. The balance of $185,000 is payable on October 31, 2026. The adjusted cost base of the property was $115,000 and the selling costs were $7,000. Which one of the following amounts represents the minimum taxable capital gain (rounded to the nearest dollar) in 2022?

(a) $39,000

(b) $5,850

(c) $7,800

(d) $15,600

Capital Gains: Shares $1,600 Personal-use property 850 Listed personal property 900 Capital losses: Shares $ 850 Personal-use property 1,100 Listed personal property 300 Listed personal property losses of prior years 105 Net capital losses from 2019 310

Introduction to Federal Income Taxation in Canada 43rd Edition 2022-2023

Edition by Nathalie Johnstone , Devan Mescall , Julie Robson Test bank Sample

9) ScarpyLtd., a public company and a manufacturer with a December 31 year-end. On January 1, 2022, the undepreciated capital cost for Class 10.1 was $17,850. The Class 10.1 car was purchased in 2020 for $35,000. During 2022, it was sold for $21,000. A new automobile was purchased for $40,680, which included HST of $4,160. ABC Ltd. is registered to collect and remit HST. What is the maximum CCA allowed combined (rounded to the nearest dollar) for the two cars for 2022?

(a) $17,289

(b) $17,978

(c) $19,967

(d) $17,798

10) Jonas Laliberte is a self-employed therapist. He meets with all of his clients in his 400 square foot home office. The entire house has a square footage of 2,400 square feet. Greg incurred the following costs:

What are the total expenses deductible from business income?

(a) $1,000

(b) $1,350

(c) $1,517

(d) $2,350

11) K Corporation Inc., a public company, owns a restaurant business that it carries on in rented premises. The lease was signed January 1, 2021 and expires on December 31, 2026 (six years in total), and has two successive renewal options for two years each. K Corporation Inc. had an opening balance in 2022 in Class 13 of $26,000 that resulted from $32,000 of leasehold improvements made during the 2021 taxation year. K Corp Inc. made an additional $14,000 of leasehold improvements to the same premises during its 2022 taxation year-end which ends December 31, 2022. What is the maximum CCA that K Corp. Inc. can claim in 2022 for its Class 13 assets?

(a) $3,000

(b) $7,000

(c) $6,000

(d) $9,000

12) During the 12-month period ended December 31, 2022 ABC Co., a CCPC, purchased a $40,000 (excluding tax of HST of 13%) passenger vehicle for use by its salesperson in conducting his employment. What is the maximum capital cost allowance that ABC Co. can claim for 2022, assuming that the company is a HST registrant (i.e., the company remits HST)?

(a) $15,300

(b) $38,420

(c) $20,340

(d) $34,000

13) In 2022, Alpha’s employer provided him with an employer-owned automobile costing $33,900 (including HSTof $3,900) for 12 months. His kilometres for personal use were 5,000 out of a total

Utilities $1,600 House insurance 700 Business liability insurance 500 House maintenance 1,000 Mortgage interest 3,700 Property tax 1,100 Office supplies 500

Introduction to Federal Income Taxation in Canada 43rd Edition 2022-2023

Edition by Nathalie Johnstone , Devan Mescall , Julie Robson Test bank

Sample of 20,000 kilometres. Operating costs paid by his employer during 2022 were $3,503 (including HST of $403). Which one of the following statements is true for 2022?

(a) Alpha’s minimum operating cost benefit is $1,450.

(b) Alpha’s minimum operating cost benefit is $1,017.

(c) Alpha cannot elect to use ½ of his standby charge as his operating cost benefit.

(d) Alpha’s minimum standby charge is $8,136.

14) Kappa Limited, a public company, paid $10,000 to purchase computer application software (before apply HST) on January 31, 2022. Kappa Limited has a December 31 year-end. What is the maximum tax deduction that Kappa Limited can claim in respect of the above expenditure for its taxation year ended December 31, 2022, assuming that Kappa is registered to collect and remit HST?

(a) $8,250

(b) $10,000

(c) $11,300

(d) $15,000

15) Bauer Bikes Ltd. (BBL) sold a warehouse on the waterfront in Waterloo on March 15, 2022. The City of Waterloo purchased the property and intends to demolish the building and use the land as part of a waterfront bicycle trail. The total proceeds paid to BBL were $420,000. The adjusted cost base of the land is $80,000. The capital cost of the building was $90,000 and the UCC of the building was $12,000. BBL has allocated all of the proceeds to the land. What will be the impact on Division B income for BBL for the above sale?

(a) $170,000

(b) $158,000

(c) $164,000

(d) $(12,000)

16) Jamal Ling made a permanent move to London England on August 15 of this year, after having lived in Canada all of his life. Jamal is 22 years old. Which one of the following best indicates Jamal’s residency status for Canadian income tax purposes for this year?

(a) A full-time resident

(b) A part-year resident

(c) A non-resident

(d) A deemed resident (sojourner)

17) Xi Limited was incorporated in Nova Scotia on May 21, 1959. The corporation has never carried on business in Canada, but held its annual directors’ meeting in Nova Scotia each year from 1959 through 1964. Which one of the following best describes Xi Limited’s residency status for Canadian income tax purposes for 2022?

(a) A deemed resident (sojourner)

(b) A full-time resident

(c) A non-resident

(d) A part-time resident

18) Pi has purchased a vacant lot. He hopes that someday, once he meets his future bride and settles down, he will build a home and raise his family on the property. This year, Pi paid $800 of property taxes and $1,000 of interest on the loan he obtained to purchase the lot. Which ONE of the following statements is TRUE?

Introduction to Federal Income Taxation in Canada 43rd Edition 2022-2023

Edition by Nathalie Johnstone , Devan Mescall , Julie Robson Test bank Sample

(a) Pi can deduct the $1,000 of interest but not the property taxes paid in this year on the basis that the land may generate a capital gain on the land some day.

(b) Pi could deduct all of the above expenditures if he were to rent the land to a farmer for the year for $2,000.

(c) The property is a personal-use property and, thus, none of the above expenditures can ever be deducted, even if the property is rented in the year.

(d) Pi can claim the principal residence exemption on any future sale of the land if he decides to sell the land without building a home.

19) Rho Limited is in the midst of constructing a new building to house its administrative staff. The building began construction on December 4, 2021, and will be completed for occupancy on January 31, 2023. Which of the following expenditures made during 2022 is DEDUCTIBLE to Rho Limited in computing its income from business for its taxation year ended December 31, 2022?

(a) CCA on new office furnishing in storage as of December 2022, pending occupancy of the building.

(b) Cost paid to the security company to patrol and protect the property during 2022.

(c) Interest on the construction loan, related to the cost of the land on which the building is significantly constructed.

(d) The landscaping costs related to the building paid during 2022.

20) Clip Ltd.’s income statement for accounting purposes for its year ended December 31, 2022 shows a profit of $180,000 from the sale of widgets to a valued customer. The gross proceeds were $300,000 and the cost of sales was $120,000. The gross proceeds of $300,000 are payable in four equal instalments of $75,000, due on June 1 each year, commencing June 1, 2022. The deduction necessary to reconcile accounting income to income for tax purposes for 2022 in respect of this transaction is:

(a) Nil

(b) $135,000

(c) $144,000

(d) $45,000

21) On April 30 , 2022, a personal residence owned by James Day, which originally cost $280,000, was converted into a rental property. At this time, the rental property had a fair market value of $340,000. What is the maximum capital cost allowance that could be claimed for 2022 on this rental property (assuming no restrictions)?

(a) $20,400

(b) $13,600

(c) $18,600

(d) $12,400

22) On June 1, 2009, Sabrina purchased a condominium in Brandon, Manitoba, for $130,000. She lived in the condominium until she married in August 2013. At that time, she moved into a rented apartment in Winnipeg, Manitoba, with her new husband. She commenced to rent her condominium in late 2013, at which time it was valued at $145,000. In December 2022 she sold the condominium for $180,000 to generate some cash to pay for a new house. Assuming that Sabrina elected under subsection 45(2) in respect of the condominium in 2013, what is the approximate minimum taxable capital gain that she will realize in 2022 on the sale?

(a) $50,000

Introduction to Federal Income Taxation in Canada 43rd Edition 2022-2023

Edition by Nathalie Johnstone , Devan Mescall , Julie Robson Test bank Sample

(b) $35,714

(c) $7,143

(d) $8,929

23) Mega Ltd., which has a May 31 year-end, had its factory vandalized in August 2022. The vandals managed to completely destroy a valuable piece of machinery. This was a customdesigned manufacturing asset included in class 53 and is the only asset in the class. The destroyed machinery had an original cost of $500,000 and a May 31, 2022 undepreciated capital cost of $187,500. Mega received insurance proceeds of $345,000 for the destroyed machinery. Due to advances in technology, a new machine cost only $280,000 and was in place for use by December 1, 2022. What is the impact on income for tax purposes to Mega for its taxation year ended May 31, 2023 in respect of the above machinery?

(a) Recapture of $157,500

(b) CCA of $91,875

(c) CCA of $61,250

(d) CCA of $122,500

24) Mrs James died on September 30, 2022. At the date of her death, she had the following capital assets, which were left to the beneficiaries indicated.

What is the minimum amount that must be included in Mrs. James income for her final tax return in respect of the above assets?

(a) $190,000

(b) $127,500

(c) $135,000

(d) $82,500

Asset ACB/Capital Cost UCC Fair market value Beneficiar y Shares in publicly traded company $10,000 n/a $100,000 Spouse Car $40,000 $40,000 $10,000 Spouse Rental building $45,000 $15,000 $150,000 Daughter

Introduction to Federal Income Taxation in Canada 43rd Edition 2022-2023

Edition by Nathalie Johnstone , Devan Mescall , Julie Robson Test bank Sample

25) An auditor reviewing French Corporation discovered that $100,000 of corporate revenue was being deliberately recorded in the books as a debit to Bank and a credit to shareholders loan.

Which of the following statements is true?

(a) This transaction is an example of tax planning.

(b) This transaction is an example of tax avoidance.

(c) This transaction is an example of tax evasion.

(d) This transaction does not fit any the above categories.

26) Western Corporation and Eastern Corporation are both owned by the same sole shareholder. An auditor reviewing Western Corporation discovers that the sole shareholder took steps to direct income earned by Eastern Corporation to Western Corporation to prevent losses from expiring in Western Corporation.

Which of the following statements is true:

(a) This transaction is an example of tax planning.

(b) This transaction is an example of tax avoidance.

(c) This transaction is an example of tax evasion.

(d) This transaction does not fit any the above categories.

27) An auditor reviewing Mary's personal tax return sees that she purchased an RRSP to lower her personal taxes.

Which of the following statements is true:

(a) This transaction is an example of tax planning.

(b) This transaction is an example of tax avoidance.

(c) This transaction is an example of tax evasion.

(d) This transaction does not fit any the above categories.

28) Francis moved to Canada from India on April 30 20, 2022. Which of the following accurately describes Frank's tax status for 2022?

(a) Francis will be taxed in Canada on all her worldwide income earned in 2022 because the time she spent in Canada exceeds 183 days.

(b) Franciswill be taxed in Canada on all her worldwide income earned in 2022, multiplied by the number of days spent in Canada and divided by 365.

(c) Francis will be taxed in Canada on all her worldwide income earned from April 30, 2022 to December 31, 2022, except for gains or losses on the sale of capital property owned prior to entering Canada.

(d) Francis will be taxed in Canada on all his worldwide income earned from Aprl 30 20, 2022 to December 31, 2022.

Introduction to Federal Income Taxation in Canada 43rd Edition 2022-2023

Edition by Nathalie Johnstone , Devan Mescall , Julie Robson Test bank Sample

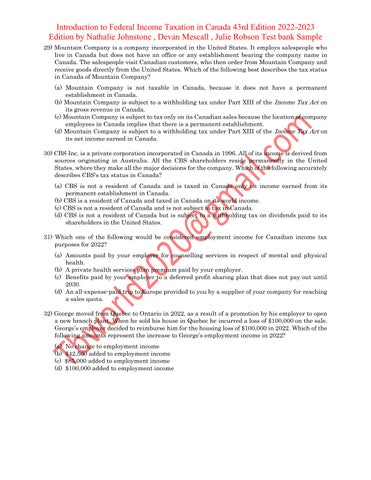

29) Mountain Company is a company incorporated in the United States. It employs salespeople who live in Canada but does not have an office or any establishment bearing the company name in Canada. The salespeople visit Canadian customers, who then order from Mountain Company and receive goods directly from the United States. Which of the following best describes the tax status in Canada of Mountain Company?

(a) Mountain Company is not taxable in Canada, because it does not have a permanent establishment in Canada.

(b) Mountain Company is subject to a withholding tax under Part XIII of the IncomeTaxActon its gross revenue in Canada.

(c) Mountain Company is subject to tax only on its Canadian sales because the location of company employees in Canada implies that there is a permanent establishment.

(d) Mountain Company is subject to a withholding tax under Part XIII of the IncomeTaxActon its net income earned in Canada.

30) CBS Inc. is a private corporation incorporated in Canada in 1996. All of its income is derived from sources originating in Australia. All the CBS shareholders reside permanently in the United States, where they make all the major decisions for the company. Which of the following accurately describes CBS's tax status in Canada?

(a) CBS is not a resident of Canada and is taxed in Canada only on income earned from its permanent establishment in Canada.

(b) CBS is a resident of Canada and taxed in Canada on its world income.

(c) CBS is not a resident of Canada and is not subject to tax in Canada.

(d) CBS is not a resident of Canada but is subject to a withholding tax on dividends paid to its shareholders in the United States.

31) Which one of the following would be considered employment income for Canadian income tax purposes for 2022?

(a) Amounts paid by your employer for counselling services in respect of mental and physical health.

(b) A private health services plan premium paid by your employer.

(c) Benefits paid by your employer to a deferred profit sharing plan that does not pay out until 2030.

(d) An all-expense-paid trip to Europe provided to you by a supplier of your company for reaching a sales quota.

32) George moved from Quebec to Ontario in 2022, as a result of a promotion by his employer to open a new branch plant. When he sold his house in Quebec he incurred a loss of $100,000 on the sale. George’s employer decided to reimburse him for the housing loss of $100,000 in 2022. Which of the following amounts represent the increase to George’s employment income in 2022?

(a) No change to employment income

(b) $42,500 added to employment income

(c) $85,000 added to employment income

(d) $100,000 added to employment income

Introduction to Federal Income Taxation in Canada 43rd Edition 2022-2023

Edition by Nathalie Johnstone , Devan Mescall , Julie Robson Test bank Sample

33) Bill is the president and CEO of Connection Ltd. Connection Ltd.'s main business is to provide motivational speeches to encourage higher productivity for its corporate clients. Bill takes his wife, Mary, to Paris on a three-day convention on motivational speeches. Mary represents Connection Ltd. at the convention, and hands out brochures and gives a talk on motivational speeches, but she is not an employee of Bill's company. Which of the following statements is true for 2022?

(a) The cost of the hotel for Bill's wife would be added to Bill's employment income because she is not an employee of the company; thus, a personal benefit was received.

(b) Fifty per cent of the trip's cost for Mary would be added to Bill's employment income because she is not an employee of the company.

(c) The cost of the trip for Mary would be added to her personal tax return as employment income even though she is not a regular employee of the company.

(d) No employee benefits will be added to either Bill's or Mary's income since Mary was primarily engaged in business activities on behalf of Connection Ltd.

34) Wajeeha is given the choice in the calendar year of 2022 to receive a pay raise, either as a salary increase of $7,200 or as a benefit of a company leased car that will cost her employer $600 per month to rent, including HST. Wajeehahas come to you for advice so that she can minimize her employment income and thereby minimize her taxes. Which of the following statements is true?

(a) She should be indifferent between the two choices.

(b) She should accept the salary as it will result in lower employment income and a lower tax payable

(c) She should accept the leased automobile as it will result in lower employment income and a lower tax payable.

(d) She should ask her employer to lease a cheaper car and then pay the difference between the monthly leasing costs as part of her salary.

35) Narith operates a small consulting business from his home. The office in his home is his principal place of business. Which of the following correctly describes the home office expenses that can be deducted for tax purposes for 2022?

(a) He can only deduct property taxes, utilities, and repairs.

(b) He can deduct mortgage interest, property taxes, utilities, insurance, and repairs.

(c) He can only deduct property taxes and utilities.

(d) He does not qualify for home office deductions.

36) Krishna is employed by a national real estate company and earns commission income. Hardip is an independent real estate broker and earns commission income. Both maintain an office in their homes as a principal location of work. Which of the following statements is false regarding the tax treatment of their incomes from real estate sales for 2021?

(a) Hardip can incur a non-capital loss, but Krishna cannot.

(b) Hardipand Krishna can deduct a portion of their property tax and house insurance

(c) Hardip can deduct a portion of her home mortgage interest, but Krishna cannot.

(d) Hardip and Krishna can claim CCA on their computers.

Introduction to Federal Income Taxation in Canada 43rd Edition 2022-2023

Edition by Nathalie Johnstone , Devan Mescall , Julie Robson Test bank Sample

Employment compensation 2022

The pension plan is a defined contribution (money-purchase) plan. The contributions shown above were matched by equal contributions made by the employees. Reconciling accounting income to Division B income, you discover that the following portion of RPP contribution should be disallowed from being expensed by the MBA Corporation for tax purposes for the year ended December 31, 2022.

(a) $nil

(b) $10,900

(c) $12,120

(d) $13,690

38) Which one of the following is deductible in computing income from a business or property?

(a) $6,000 of legal expenses related to the purchase of an investment in shares.

(b) $5,000 of legal expenses for the purposes of obtaining a permit to sell Microsoft products

(c) Interest paid on a loan used exclusively to purchase investments in a tax-free savings account.

(d) $6,000 of donations to a federal political party.

39) During its year ended December 31, 2022, ABC Ltd. purchased a new truck (not considered a passenger vehicle) costing $50,000. In the same year, the company sold an 18-wheeled truck (which had been purchased three years earlier for $125,000) for $80,000. At the beginning of the current year, the Class 10 UCC balance was $70,000. Which one of the following amounts best represents the maximum CCA deduction for Class 10 for 2022, assuming that all amounts are net of HST because ABC Ltd. is an HST registrant?

(a) $12,000

(b) $6,000

(c) $43,500

(d) $25,500

40) A taxpayer has a Class 8 pool with three office desks, originally costing $500 each, left in the class. Which of the following statement is true when it comes to calculating CCA for 2022?

(a) A terminal loss occurs when there is a balance in the pool just before the last asset is sold.

(b) Recapture can occur even if there are still assets left in the pool. For example a sale of an asset causes the pool's remaining UCC balance to become negative.

(c) Each desk should be set up as a separate Class 8 asset.

(d) When it comes to the sale of the Class 8 assets only the market value should be credited to the pool.

37) While examining the books and records in the general and administrative expense account of MBA Corporation, you come across the following contribution to the registered pension plan made by the company on behalf of two key employees for the year ended December 31, 2022: Contribution to Registered Pension Plan 2022 President $16,000 $180,000 Vice President $14,000 95,000