4 minute read

INNOVATION NATIONS

Over the past decade or so, we’ve heard plenty in the media – both regional and global – about how the Middle East is intent on diversifying away from an oil-based economical structure to a new model. This new model is rooted around several key elements, namely, tourism, cultural leadership, sustainability, sporting events and innovation.

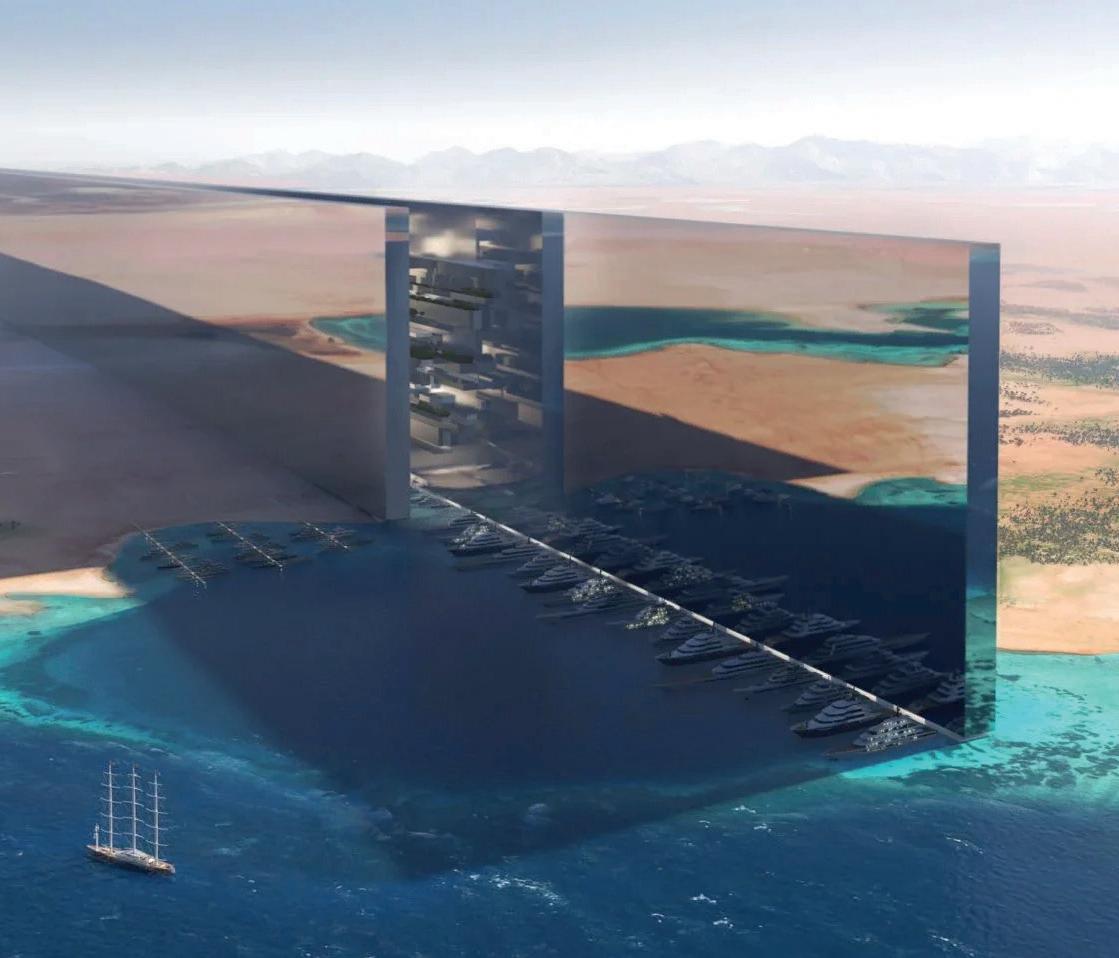

We have witnessed this with the grand ambitious plans in Saudi Arabia to build buildings of astounding heights, new revolutionary cityscapes and to become a global leader in social and cultural development, not to mention sustainability. The UAE led the way on this in many ways, becoming a leading light of a new generation of global players, while Qatar too recently showed its credentials during an exciting and impressive World Cup.

Advertisement

Yet the core point here is that we may be on the cusp of the era when Middle Eastern nations are no longer ‘diversifying away’ from oil-based economies, but actively have already made that jump. One could argue that Saudi are perhaps still in that process with Vision 2030, yet Dubai in particular seems to have already made the transition.

A very modern measure of how this has occurred is what happens when one googles ‘Dubai’ and sees what suggestions follow. Is it ‘oil’, ‘money’ or ‘sheikhs’ that arises? No, it is actually ‘time’, ‘YouTube’, ‘technology 2023’, and ‘holidays’ that come up as the leading suggestions. This rather cursory, although still very revealing, form of research shows us what the majority of people are searching for when it comes to Dubai. You could say that’s a job well done by the Dubai government in moving the public perception of Dubai from oil towards tourism and innovation.

Innovation Nation: UAE

It is no secret that the Middle East region is now home to some of the most innovative, forward thinking cities in the world, but also to those who are up-and-coming in terms of future vision. But to begin, let’s clarify what we mean by “innovation”. In its most simple sense, innovation is about creating new solutions and experiences. It has been found time and time again that those who put innovation at the forefront of their thinking tend to outperform and overtake others who stick to the way things have always been.

In 2020, the Boston Consulting Group stated that the Middle East ranks second only to China in its level of commitment to innovation. Meanwhile, the UAE has now made it up to 31st in the Global Innovation Index, with Dubai and Abu Dhabi leading the way. In fact, Dubai has actually been named as the ‘city of the future’.

Dubai is very much on its way to becoming a ‘smart city’, meaning a city that is digitally connected, highly automated, and extremely efficient, which is why it is home to some of the most exciting technological innovations today. One example of this is Expo 2020 – an exhibition which was said to be ‘uniting the world in one place by providing a global experience dedicated to bringing people together, building bridges between communities and nations, and inspiring action and delivering real-life solutions to real-life challenges’, such events show Dubai’s ability and capacity to be a genuine global leader.

This is evidenced perfectly in the UAE’s ambitious plan to realise Hyperloop, a super-speed new transport system that has the power to revolutionise both cargo and passenger transport. Currently, under development between Dubai and Abu Dhabi, Hyperloop is a ‘sealed tube or system of tubes with low air pressure through which a pod may travel largely free of friction or resistance’. The end product is expected to be ready by the end of the decade.

With regard to telecommunications, Etisalat in the United Arab Emirates is the fastest mobile network in the world. It offered average download speeds of 193.88 Mbps and average upload speeds of 29.87 Mbps during Q1-Q2 2021, showing how the UAE is at the forefront of connectivity – a vital metric for a smart city.

With regards to AI, IBM believes AI could contribute more than US$300 billion by 2031 to Middle East GDP. In fact, the UAE appointed its first minister of AI after estimating this technology might add $182 billion to the economy by 2035.

Innovation in Logistics

The Middle East region’s logistics industry has garnered a good reputation in the last decade or so, generally performing well despite many challenges such as the global pandemic, turbulent global markets and a disjointed global strategy surrounding trade. Logistics has become core to several GCC countries’ future development plans, with the region’s logistics market proving a fundamental pillar of regional economies.

In 2015, logistics accounted for 13% of Saudi Arabia’s GDP, and 10% of the UAE’s – figures that will have undoubtedly risen in the interim thanks to both countries’ ambitious diversification and development plans. And the region’s growing capabilities have given it international recognition. According to the World Bank’s latest Logistics Performance Index, the UAE ranked 13th out of 160 countries, outdoing the likes of Canada, France, Finland, Denmark, and Australia. Against its emerging market peers, the UAE ranks first. Similarly, a January report by Kuwaiti logistics firm Agility placed the UAE as the third best logistics centre among 50 emerging markets, behind China and India. Bahrain was ranked fifth, with Oman in sixth and Saudi Arabia in seventh position. But while an external view suggests plain sailing, there are continual challenges, changes and developments that regional logistics firms must contend with and adapt to in order to stay at the front of the pack. A major contributor to this is technology, which has and is changing the logistics industry at an accelerated rate. From artificial intelligence (AI) to blockchain, and big data to robotics, logistics players are on a constant mission to understand and implement new and developing technologies in the most effective and efficient ways possible.

2023 has seen a stuttering start with worldwide trade struggling to find its flow. With the multivariate forces of geopolitical instability – most notably the Russian invasion of Ukraine, which has divided key players on the global stage and sent energy costs spiralling – new sustainability demands, and disagreements on strategies, the present state of play is a turbulent picture.

In this piece, we will break down the key issues affecting the container shipping sector, highlight the key themes for the present, and end by offering an outlook to the future, which will hopefully be smoother sailing than at present.

Rates

Another key reason for the present instability revolves around how manufacturers and distributors are battling to reduce excess inventories