SWITCHED

TECHNOLOGY SOLUTIONS & INNOVATIONS

MACHINE LEARNING

Should we be worried about artificial intelligence?

MACHINE LEARNING

Should we be worried about artificial intelligence?

The metaverse is here. But how far have we actually come?

BANKING IN THE CLOUD

How African fintech is revolutionising the industry

PUBLISHED BY

Picasso Headline,

A proud division of Arena Holdings (Pty) Ltd, Hill on Empire, 16 Empire Road (cnr Hillside Road), Parktown, Johannesburg, 2193 PO Box 12500, Mill Street, Cape Town, 8010 www.businessmediamags.co.za

EDITORIAL

Editor: Brendon Petersen

Content Manager: Raina Julies | rainaj@picasso.co.za

Contributors: Megan Ellis, Papi Mabele, Conrad Steyn, Monica Sasso, Lindsey Schutters

Copy Editor: Anthony Sharpe

Content Co-ordinator: Natasha Maneveldt

Digital Editor: Stacey Visser vissers@businessmediamags.co.za

DESIGN

Head of Design: Jayne Macé-Ferguson

Senior Designer: Mfundo Archie Ndzo

Junior Designer: Bulelwa Sotashe

Cover Image: istock.cm/ Thinkhubstudio

SALES

Project Manager: Mark Geyer markgeyer@picasso.co.za | +27 21 203 3531/ +27 67 348 9784

PRODUCTION

Production Editor: Shamiela Brenner

Advertising Co-ordinator: Johan Labuschagne

Subscriptions and Distribution: Fatima Dramat fatimad@picasso.co.za

Printer: CTP Printers, Cape Town

MANAGEMENT

Management Accountant: Deidre Musha

Business Manager: Lodewyk van der Walt

General Manager, Magazines: Jocelyne Bayer

Years ago, when working at a big global tech company, I was dealing with a customer who was upset that a specific movie wasn’t playing on their TV.

While it was an understandably frustrating experience, no one could understand why this customer was as livid as they were. After speaking to them for a few minutes, I eventually discovered that this was a single parent of a special needs child, and the only time they were able to get a few minutes to themselves to make a cup of coffee or even go to the bathroom was when their child was watching this movie, which was not playing on the TV.

It was in that moment that I understood the impact of technology on our lives, a viewpoint that was only strengthened during the pandemic-related lockdowns.

Technology is more than the latest, flashiest new phone, tablet or computer, and it’s more than all the talk about how 5G or artificial intelligence (AI) or autonomous vehicles or robotics are going to change our lives. It has become an integral part of society, culture and business, and to relegate it to the backs of our minds and treat it as something that only has

vague impact on our current tasks does us all a disservice.

As things like social media, AI and automation continue to reinvent the way we communicate, interact and do business, it’s more important than ever to understand the potential impact of these ever-evolving technologies.

Due to the fast-paced nature of the technology industry, it’s understandable that many of us battle to keep up. That’s why we launched Switched

We’re currently told to think of technology as a tool, but that implies the use of blunt force. Rather, I prefer to think of it as an instrument. Only by understanding its nuances, by devoting time to understanding and thereby mastering it, can we create art or meaningful impact.

Our job is to walk that road with you, helping to foster that sense of wonder as well as a balanced understanding of what’s possible and what isn’t. We hope you enjoy the journey.

Editor Brendon PetersenShould we be worried about artificial intelligence?

Has the metaverse bubble burst or is it the future of the internet?

Facing up to the fundamental challenges impacting the realisation of fully autonomous vehicles.

10

Cloud-based

11

Highlights of the technologies shaping the financial services sector.

12

With fibre rapidly rolling out to businesses, cloud applications are now affordable and accessible solutions for any size of business, from small, medium and micro enterprises to large corporates. As the top global cloud providers commit to establishing data centres in South Africa, the high costs, IT and regulatory hassle that came with routing via the United States and Ireland, precluding many businesses from embracing cloud connectivity, have been removed. The cloud is now more accessible and affordable.

A crucial factor in implementing cloud solutions for a distributed workforce is the quality of the internet connection. Because of its high capacity, reliability, security and relatively low cost, fibre internet connectivity provides the connection over which cloud connectivity takes place. Transferring data between users and the cloud is a bandwidth-hungry process, requiring a stable and speedy connection such as fibre that can carry trillions of bits per second. A fibre connection providing symmetrical upload and download speeds capable of handling a vast amount of traffic over the internet to and from your cloud host, with minimal latency – the time it takes for data to travel between its source and destination, measured in milliseconds – is a must.

Another crucial fibre consideration when migrating to the cloud and transferring huge tranches of data is scalable capacity. The initial data migration requires moving terabytes or even petabytes of existing data and files to the cloud, and needs “burstable capacity” – a very large capacity fibre connection to handle the volumes, and then scale back to normal daily operational needs once you’re officially “in the cloud”.

MetroFibre Networx is a fibre infrastructure and internet service provider, so this burstable capacity is easily facilitated on an ad-hoc basis – no need to sign a massive (and more expensive) fibre contract for a lengthy period when you only need it during the data migration. Another key benefit of working with a fibre provider that can offer both the fibre infrastructure and ISP service in

one solution is having the flexibility and additional capacity for disaster recovery planning and business continuity when needed.

The Carrier Ethernet 3.0 (CE 3.0) program is a Metro Ethernet Forum (MEF) framework through which service providers and equipment vendors in any geography can demonstrate their compliance with globally recognised MEF Carrier Ethernet service specifications. CE 3.0 standards accelerate the deployment of Carrier Ethernet services (fibre) for business by reducing the time and resources needed to assess service offerings and equipment as the MEF compliance immediately verifies that the services are fully standardised for global deployment.

MetroFibre Networx owns and manages South Africa’s first globally compliant Carrier Ethernet 3.0 (CE 3.0) open-access fibre network, which improves access, scalability and reliability for clients. It connects over 60 cloud, application, voice and internet service providers with their customers. Through strategic partnerships and relationships with Teraco, MetroFibre can also directly link customers to cloud operators such as Microsoft Azure, AWS and Google.

The cloud provides many significant benefits for businesses – from distributed yet connected and collaborative workforces, access to files from anywhere, anytime, better security through access controls and encryption, easier backup and recovery, a lower total cost of ownership for hardware and software deployment, upgrades and IT maintenance, and savings on storage space and expensive real estate, among others.

Another key driver in the accelerated move to cloud migration is South Africa’s energy insecurity and the massive impact of load shedding. Businesses are preparing for total grid collapse, although the probability remains low. Big data centres are prepared for the worst, ensuring that whatever happens to the grid, they remain fully operational and accessible, and continue to provide uninterrupted cloud services to clients

Moving a full on-premises data centre off the grid using solar-back or generators is a costly exercise – this is where migrating to a cloud provider makes financial sense for businesses. You want your data, platforms and workloads in the cloud, safe, secure, and accessible.

Symmetric speeds, bandwidth, reliability, burstable capacity, low latency and enhanced security and backup are important considerations when planning cloud migration, and fibre internet makes that possible..

Scan this QR code to go directly to the MetroFibre website.

For more information: www.metro bre.co.za

TRANSFERRING DATA BETWEEN USERS AND THE CLOUD IS A BANDWIDTH-HUNGRY PROCESS, REQUIRING A STABLE AND SPEEDY CONNECTION SUCH AS FIBRE THAT CAN CARRY TRILLIONS OF BITS PER SECOND.Gary Webster

“I think we are at the start of a gold rush right now, and I think the launch of GPT version four was the catalyst that everybody needed to understand what we capable of doing in this realm,” says Dawood Patel, CEO of customer experience consulting firm Helm. “I think, up until that point artificial intelligence (AI) wasn’t what I would say theoretical, but it was abstract and understood by very few, because it didn’t connect to humans on our level. I think humans being able to interact with something like ChatGPT, on a level that makes life easier, is for me an inflection point on our journey towards bigger things. Scarier things, but bigger.”

Helm Engine is the company’s home-baked AI that powers its portfolio of solutions including chatbots, text-to-speech/ speech-to-text and computer vision insights. Since the release of the consumer-facing version of ChatGPT in November 2022, the technology has gone viral and AI awareness is at an all-time high, making the sales pitch for AI solutions easier.

Consulting estimate compound annual revenue growth of over 30 per cent from 2022 to 2030. For context, the global AI market in 2021 generated R1.7-trillion, while analysts have estimated the 2030 revenue at over R33-trillion. Market acceleration for AI since Facebook first tested an algorithm-based social feed in 2009 has been astronomical. Every tech company has incorporated AI into its services in some way, and the race is only heating up.

AI-enabled devices are everywhere. Nearly 77 per cent of devices today use AI technology in one form or another.

* Source: pega.com

Describing AI as a threat to humanity is easy. From IBM Deep Blue’s victory over chess grandmaster Garry Kasparov in 1997, to the infamous IBM Watson sweep on Jeopardy! in 2011, humans have been taking losses to bots at an alarming rate.

Modern generative pre-trained transformer (GPT) language models that ingest text data and stitch coherent sentences together when asked to summarise knowledge or in response to questions are impressive, but there is still room for growth in establishing reasoning and even more room for improvement when combining these powerful models with computer vision and object recognition.

“OpenAI trained GPT3 – the language model that underpins the publicly accessible ChatGPT – on a couple billion parameters,” explains Aizatron Group computer vision lead engineer

There are three types of artificial intelligence:

1. Artificial Narrow Intelligence (ANI): The only form of AI on the market at the moment.

2. Artificial General Intelligence (AGI): A form of AI that mimics how a human reasons, still only a theoretical concept to date.

3. Artificial Super Intelligence (ASI): Also only conceptual right now, ASI involves complex and logical AI that is capable of reasoning beyond human capabilities and that has the ability to build emotional relationships.

* Source: connect.comptia.org

Joseph Lumbahe. “GPT4 is trained on trillions of parameters. I’m not going to say we’re reaching a level of cognitive computing, but what we’re experiencing now with ChatGPT is getting very close.”

Computer vision can help computers to think. ChatGPT learned from text data. Add computer vision, and it will be able to see the world through cameras and make decisions based on that. “The autonomy goes up a level because it doesn’t need to be fed text data any more,” says Lumbahe. “That’s when it becomes close to human.”

Early AI advocates Elon Musk and Steve Wozniak are now raising concerns about the broader implications of the current AI arms race. They argue that “human-competitive intelligence can pose profound risks to society and humanity” and called for a semester-long halt on AI development in a recent petition.

The latest versions of AI are making breakthroughs that speed up critical research in healthcare and the fight against climate change, but also displacing humans in jobs.

The big issue, however, is that the companies that make AI engines can’t fully explain how these algorithms arrive at the decisions they make. And it is those explanations that are crucial to inform the regulations governing the intersection of humans and AI, and keeping us safe.

“OpenAI trained GPT3 – the language model that underpins the publicly accessible ChatGPT – on a couple billion parameters. GPT4 is trained on trillions of parameters.”

– JOSEPH LUMBAHE

Complex artificial intelligence models are sweeping across the technology landscape, and humans are not yet ready to put up an adequate fight.

Dawood Patel

62%

The percentage of people, according to a recent survey by Wunderman Thompson, New Realities: Into the Metaverse and Beyond, who believe that virtual worlds lack inclusivity.

Source: WEF

82%

The percentage of people who have heard of the metaverse and who believe that companies should make special efforts to ensure digital worlds are accessible to everyone.

Source: WEF

The metaverse started out as a science fiction concept, first coined in Neal Stephenson’s novel Snow Crash, with people using virtual reality (VR) hardware to enter an immersive, expansive digital world.

We are years away from realising this concept of the metaverse, but the building blocks are in place.

Balkissa Idé Siddo, Meta’s public policy director for Sub-Saharan Africa, says that the metaverse is the future of the internet, with the level of immersion setting it apart from previous internet technologies. “We don’t communicate just through written words, sounds or images. We use multiple senses, body language, and spatial awareness.

“The metaverse is the next evolution of the internet, and it’s this sense of presence that sets it apart,” continues Siddo. “It spans a range of technologies, including VR headsets that transport you to whole new environments, augmented reality glasses that project computer-generated images onto the world around you, and mixed reality experiences that blend physical and virtual environments.”

She notes that we’re still at the very early stages of development, so the possibilities of the metaverse may still be beyond our comprehension in many ways. “Just as it was hard to imagine the internet of today back in the 1990s, it’s hard to fully grasp what the metaverse will be a decade from now.”

However, Siddo gives a few examples of the possibilities of the

metaverse, including wearing glasses that give you directions in your line of sight or which can overlay translations of street signs in a foreign language. Another possibility is interacting with a 3D hologram of someone rather than using traditional video-calling technology.

While the metaverse is a concept with global reach, this doesn’t mean it will be implemented in the same way in every region. As such, unique approaches will need to be taken according to local context. Mic Mann, CEO of Africarare, says that those building metaverses in Africa will need to take into account the context of the regions they’re launching in, as well as the regulations and compliance requirements of specific countries.

Africarare is a 3D VR experience that takes place in Ubuntuland and is dubbed South Africa’s first metaverse. Through Africarare’s platform, users can buy land, engage in exhibitions and art purchases, and visit immersive spaces in Ubuntuland.

One of the biggest ways Mann expects the metaverse in Africa to differ is the way that people access these digital worlds. “For us at Africarare, we’re really focusing on mobile because we believe it’s the easiest way to get adoption in Africa. We believe that the cellphone can actually help leapfrog into the metaverse in Africa, because people can very easily connect.”

In February this year, Sanlam made history by being the first to launch a media campaign in the metaverse. Click here to have a look.

Whether by phone or PC browser, you enter Ubuntuland as a 3D avatar. “You can have different types of experiences, be they social or commercial,” says Mann. Ubuntuland is already home to different experiences, including meeting rooms and an art exhibition space. Meanwhile, as more brands come on board, additional experiences are under construction.

While the metaverse is still in early development, one of the concerns that arises is whether there will be a repeat of the hard lessons and experiences from the previous generation of social media. A more immersive digital world also means that problems such as harassment and hate speech can be hard to moderate.

Siddo says that Meta is working with companies, creators, developers, and policymakers in building its metaverse. “Our approach is guided by four core values: privacy, which translates to incorporating meaningful transparency and control features into our products; safety and security, providing tools for people to take action or seek help if they encounter something they are uncomfortable with; economic opportunity, to foster a thriving digital economy; and inclusion.”

The company is also partnering with institutions such as Howard University to examine historical barriers to information technology and explore solutions to these.

The metaverse has proved to be one of the biggest buzzwords of the past few years, even prompting Facebook to change its parent company name to Meta. But as the hype fades and we’re left with the results of this trend, how far has the metaverse actually come, asks MEGAN ELLISBalkissa Idé Siddo WATCH SANLAM’S METAVERSE CAIMPAIGN

In 2015, the World Economic Foundation identified six megatrends that were set to change the face of business and society and every single one was aligned with the concept of digital transformation. From how the internet would become a social and physical extension of people’s lives and experiences through to compute and storage everywhere to the Internet of Things (IoT), Artificial Intelligence (AI) and the digitisation of matter, these trends are now an inherent part of society today.

Some of these trends have already reached significant milestones, others are expected to achieve their tipping points – a critical point that results in unstoppable change – over the next few years. One such milestone is the megatrend of people and the internet, where their interaction with the web becomes a ‘mental, social, and physical extension of themselves’, and is expected to reach 80% of people with a digital presence on the internet by 2023 with the tipping point in 2025. Today, 59% of the world’s population uses social media and enhance their digital presence through online platforms and connections. This is only set to become more immersive as trends like the metaverse continue to gain traction.

Tackling these challenges to mitigate risk requires a holistic approach, typically implemented in phases. As a systems integrator, we are well positioned to implement end-to-end solutions that reduce risk in a comprehensive way.

There is no silver bullet that will instantly protect organisations such as these. Developing effective solutions requires taking a consultative approach, where we understand their current level of maturity, use proactive assessments to expose vulnerabilities, address low hanging exposure for quick wins, and develop a sustainable plan to improve the organisation’s risk profile over time.

Important measures to mitigate risk also include the introduction of zero trust strategies, monitoring and evaluation, and the implementation of a Security Operations Centre.

Driven by the pandemic and the need for people to find innovative ways of working and connecting online, digital has become as much a part of daily life as cars and shopping. It has reshaped how people communicate and collaborate and it has supercharged productivity and performance. In the 1980s, communication was in person or by post. Today it’s faster than a thought. Organisations can’t afford to be left behind which makes 2023 an opportunity to focus on platforms and technologies that empower people from anywhere and that ensure their online presence is always on. This is where solutions that provide access, data networks, wireless and unified collaboration capabilities are key as they enable industry and fulfil online requirements through omnichannel applications.

Our most important customer, is yours.

It’s been just over 10 years since digital transformation became an integral part of the business environment, writes Rebatho Madiba, Managing Executive, Digital Platform Solutions, BCX, but as it grows older, is it meeting expectations?

Another megatrend, one that’s now so commonplace in boardroom discussions that it’s hard to imagine a business without it, is that of compute, communications and storage everywhere. The tipping point for this technology is anticipated to be in 2025 with, as cited by Statista, just over five billion people on the internet as at April 2022. This highly connected population has seen the radical and accelerated transformation of online experiences which has, in turn, driven the need for scalable and elastic computing power that can be accessible from anywhere, and that can deliver on demand.

Moving forward, applications and services will only get hungrier for data and capability. Industry 4.0 and Industry 5.0 technologies and innovations will have to be rendered from highly reliable and flexible platforms and quantum compute is very likely to bring physics into computer science to create devices and environments that are minute – that optimise space and capacity. Moving forward, companies need to collaborate with service providers that offer a wide spectrum of cloud and computing solutions that can directly address their challenges and help them overcome obstacles impacting on their scale and productivity. This is particularly true of the challenge of data sovereignty that has inhibited many companies, especially in Africa.

IoT has, of course, been a part of the IT landscape for a long time but has only recently started to deliver on the promises it made when it first entered the business

landscape. Today, the number of IoT connected devices worldwide is expected to reach 29 billion by 2030, says Statista, and is at 13 billion as at 2022 and, according to the IoT Industry Council of South Africa, IoT is expected to reach an installed base of 21.5 billion active and connected devices by 2025 in this country. Add to this the connected realm of the metaverse and the megatrends of compute and people, and you can see how IoT is about to become an integral part of the metaverse and thriving business operations.

To fully realise the potential of this technology, companies should ally themselves with partners that have a proven IoT track record and who can empower them with technologies that are appropriate for their industry and niche. This could be Industrial IoT (IIoT) solutions that drive visibility into the oil and gas pipeline, through to IoT within retail and automotive logistics that translate customer experiences and vehicle monitoring through intelligent IoT applications.

BCX has this proven track record across all key megatrend touchpoints and has proven value in its applications and solutions designed to help organisations reshape their investments into AI, automation, machine learning and compute. With our support, you can fully realise the potential of digital transformation as it stands today – a more mature and far more powerful entity that can fundamentally refine your growth and operations.

We’ve got a long way to go before we can fall asleep behind the wheel without a worry, writes

PAPI MABELE

PAPI MABELE

Auto makers have been big on self-driving cars over the past few years. With Audi being the first to break both the autonomous speed and distance records back in 2014, and Ford proclaiming it would strive to be the first to offer an autonomous vehicle “to the masses”, it’s nevertheless Mercedes-Benz that has stolen the show so far with its jaw-dropping EQ range of Intelligent Drive vehicles, while Tesla has made all of the talk a reality to some extent.

While the first advances have come in the form of more advanced parking systems, autonomy in slow-moving traffic situations and the ability to engage autopilot on highways, over the next couple of years we’ll see auto manufactures taking steps from one corner to the other. But, of course, there are some challenges along the way.

The recent tech and car shows have been full of spiels and self-praise about how manufacturers have achieved this or that level of autonomy, paving the way for the self-driving cars and driverless taxis of the future. While we shouldn’t downplay their achievements in pushing autonomous driving technology and hardware forward, it’s quite a leap to go from “now” to “the future”.

It’s still not clear what went wrong in the fatal Uber accident back in 2018, but it’s clear that something did go badly wrong. A self-driving car should be equipped with sensors that will identify objects, especially pedestrians, in the worst conditions possible. That includes conditions where humans would normally fail, because these machines are supposed to be better than us. These sensors work perfectly well in good weather and daylight, but they have limitations. Cameras aren’t as effective

DID YOU KNOW?

Goodyear and Bridgestone want to equip the tyres of autonomous vehicles with sensors that can gather and relay data on friction and road conditions, helping the vehicles decide, for instance, how fast to take a turn or how soon to start braking.

* Source: wsj.com

Autonomous cars should also be able to make split-second decisions and halt or swerve in an instant for those unexpected taxi cut-o s experienced daily on our roads.

at night-time, and apparently radar systems “get frustrated” in heavy rain. More importantly, such cars should also be able to make split-second decisions and halt or swerve in an instant for those unexpected taxi cut-offs experienced daily on our roads.

The self-driving craze caught governments unprepared. Many have scrambled to put laws in place to regulate the development and testing of self-driving cars, but not ours. Now they will be scrambling again to ensure that accidents don’t happen and that relevant parties will be held liable when they do.

To be fair, most of our laws and regulations are made in reaction to incidents. Very few have the foresight to act on what has yet to happen. Technology, however, rarely waits for the law to catch up and, just like with drones, lawmakers and authorities are being challenged to work faster before tragedy strikes for the first, second or more times.

Here’s the thing: the self-driving cars of the future won’t have safety drivers. Some might not even have anyone inside capable of driving at all, not to mention any wheel. Many car makers paint a picture of a future where a driver or passenger can simply sit back and relax, maybe chat and play, with nary a worry. Of course, they paint the ideal future, not what we have at the present.

We don’t have the ability to remove the driver from the equation right now; the driver cannot tune out and stop paying attention to the road, explains Kristin Kolodge, vice president of auto benchmarking and mobility development at J.D. Power. But this may be coming as soon as next year. Veteran automotive broadcaster and commentator Avon Middleton agrees we’re nowhere near the “Level 5” or “fully autonomous” stage yet, but currently evolving from “Level 2” to “Level 3” (also known as “conditional automation”).

Pedestrians, unfortunately, might be at the losing end of this development in autonomous vehicles. Particularly in a country like South Africa, where 35–40 per cent of road deaths are pedestrians, they cannot be ignored in this equation. We have a long way to go before our roads are ready for safe interactions between people and vehicles.

One thing’s for sure, however: the promise of autonomy is putting swagger back in the once-troubled car industry’s stride. Despite a continued threat from car-sharing and all-electric car firms, the old auto makers now have something to work toward, and it’s something they’re all convinced we want.

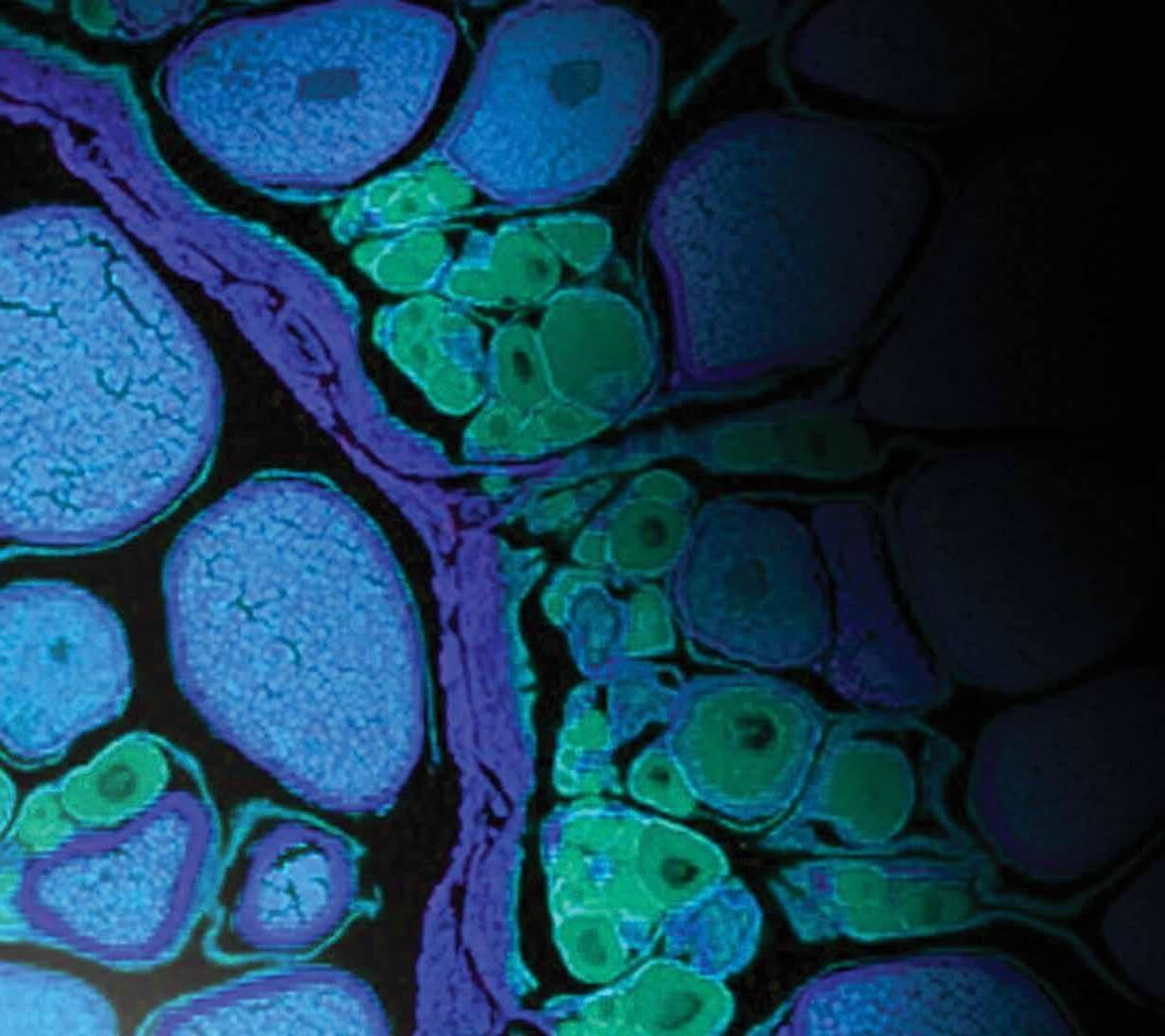

Cloud-based technology enables and improves digital finance in a host of ways, writes MONICA SASSO

Hat

Hat

Banking has traditionally by and large been a sector where new ideas take a great deal of time to manifest. Case in point, a not-insignificant number of US consumers still use paper cheques, despite readily available card and online payment facilities.

That’s less the case in Africa, where the fintech sector has propelled the continent to new heights, with many financial services taking a digital form. That digital form is made possible by adopting cloud-based technologies that enable institutions and start-ups to reach their clients, offer them new products and transform their banking experience.

South Africa’s banking sector is undergoing a revolution, with the emergence of disruptors like digital-only vendors and service providers moving to usurp historical players by offering an upgraded, more accessible experience.

Businesses such as Bank Zero, while offering traditional banking services for both consumers and businesses, are not positioning themselves as brick-and-mortar banks with an accompanying mobile app, but rather as banking apps, period. This does not just reflect a localised trend. Though they may still use cheques, more than four in five Americans used some form of digital payment in 2021.

In response to this digital transformation, cloud service providers can support banks in developing new ways to acquire revenue, gather insights about their clients, and synchronise business units to ensure unified decision-making and improved reaction and implementation times. Computing costs can also be scaled up

according to the needs of the business while avoiding installation delays or investment costs. Cloud technology can also improve the security of a bank’s infrastructure. Environments are made more secure both on and off-site, and comprehensive cybersecurity protocols can deter digital attacks. This is especially important given the proliferation of digital services and the nature of the sector. Money, whether it’s in a vault or in cyberspace, needs to be protected.

According to the McKinsey Global Banking Annual Review, banks and other financial services providers are replicating the model used by companies such as Apple, Netflix and Spotify by taking their existing services and transforming them into a digital experience embedded in consumers’ daily lives. Integration is the name of the game, where a user still has access to the facilities, but that access is streamlined.

When it comes to digital services, cloud-based solutions are central to upgrading customer experience. By way of a centralised network to store data, deliver on software-as-a-service principles and accommodate client analytics, a cloud approach enables a banking portal that offers the services clients need while also giving institutions the tools to gather data on them and create products that directly respond to their needs. Cloud enables enterprises to explore the potential of big data, backed by innovations in machine learning and underpinned by reliable software that works together to deliver informative insights.

Big data is all the rage in nearly every sector, which in turn creates a demand for people with the skills to leverage it. Africa already faces a shortage in skill sets that are essential for IT and fourth industrial revolution development, but where big data, AI and fintech are concerned, the effect of that shortage is compounded. The 2021 ICT Skills Survey identified database designers and administrators as hard-to-fill vacancies in South Africa, illustrating that it’s one thing to get the infrastructure in place, but another to secure the talent to use it.

However, the infrastructure itself can help address that obstacle. Open-source software, by way of being decentralised and collaborative in nature, can help unify systems (and by extension the people who work on them), making them easier to implement and maintain. The opensource approach is not a niche one. With the appropriate security protocols pertinent to banking, as well as the services of a trustworthy vendor, financial institutions can implement solutions that are not only accessible and scalable, but also invite innovation thanks to the potential for branching systems.

Cloud technology does not exist in a vacuum in any sector. A company’s technology and human ecosystems play a role in how effective it is. And by taking a holistic view of technology’s role in banking, we can draw the roadmap to a new kind of banking experience.

, financial services EMEA chief technologist at Red

A cloud approach enables a banking portal that o ers the services clients need while also giving institutions the tools to gather data on them and create products that directly respond to their needs.

At the Huawei Intelligent Finance Summit, themed “Unleash Digital, Non-Stop Banking, Create New Value Together”, the company shared its top fintech trends

Not that long ago, if you wanted to make a financial transaction, you had to be prepared to wait. In pre-internet banking days that frequently meant waiting for the bank to open, but even today people know how frustrating not being able to make payments over weekends can be, for example. In a world where apps allow you to transfer money to a friend instantly, that’s no longer good enough. Customers want to be able to access everything to do with their finances all at once, and players across the fintech spectrum must cater to that. In the future, banking will be driven by new tech developments like machine learning and the cloud, which will drive speed and efficiency, enabling more people than ever before to access reliable banking services that meet their needs and match their lifestyles.

In order to feed that demand for nonstop banking and transactions as well as innovation, back-end infrastructure will be increasingly important. Things like storage, fibre optic networks, IP networks and data communication, which enable “multi-domain collaboration” solutions, will likely prove vital to the next wave of fintech innovation. The convergence of big data and AI on cloud platforms, for instance, helps fintech providers solve governance problems caused by data silos, and helps with the data storage and transfer that are necessary for any financial institution.

With the deepening of digital transformation in the financial and banking sectors worldwide, the all-round “cloudification” of financial services has become a trend. This will have a couple of effects. First, it will help improve system stability and reduce downtime for fintech offerings. But it will also enable digital inclusion by making it easier for players in the sector to build support services such as digital wallets, super-apps and micro-loans.

In a country with as high a mobile phone penetration rate as South Africa, it should hardly be surprising that mobile tech has been at the heart of so many fintech innovations. Going forward, mobile’s importance will only grow.

As futurist and author Brett King noted at the Huawei Intelligent Finance Summit, “the bank account of the world is a smartphone”. While Africa may have been an early pioneer in this shift, it’s happening all over the world. “In 2017, the number of transactions across the Chinese mobile wallet ecosystem passed all of the plastic card transactions in the world for the first time,” King added. “Half of the world will use a mobile wallet by 2025, credit and debit card use will be down to 30 per cent of global commerce, and cash around 10 per cent.”

5

While we’ve made up a lot of ground when it comes to moving money around quickly –payments that would once have taken days to clear now take a matter of seconds – that speed needs to be matched with trust. People need to know that when they make a payment, it will get to its recipient every time. That need to build trust will only make the back-end systems that ensure system stability and constant up-time more important.

In order to ensure that fintech players are positioned to embrace the digital-first approach that will be critical to their competitiveness, they will need to adopt an approach that is “Multidomain collaboration, End-to-end experience, Green, and Autonomous” (MEGA). That means making full use of secure, reliable, agile and intelligent ICT infrastructure.

While the need to be green fits into the MEGA point above, it’s worth pointing out that sustainability will be increasingly important for South African fintech players, especially when it comes to attracting international investments. Here, the right digital energy solutions can help to provide an uninterrupted and green power supply for the banking sector, effectively addressing power deficit issues and supporting nonstop banking.

The past few decades saw massive changes in the fintech space, with start-ups and traditional players alike now deeply invested in innovation. That level of innovation isn’t going to slow down any time soon either. So, in order to remain competitive, players across the sector will have to ensure that they have everything in place, from mindset to back-end infrastructure, to ride the next wave of fintech evolution.

Cybersecurity is becoming increasingly critical for organisations as they navigate a rapidly evolving technology landscape. The COVID-19 pandemic has accelerated the shift to a hybrid world, where people work from multiple locations, devices and networks. As a result, organisations are generating more data from more diverse sources than ever before, and this is increasingly becoming a target for cybercriminals.

According to Cisco’s first-ever Cybersecurity Readiness Index, only 19 per cent of organisations in South Africa have the “Mature” level of readiness needed to be resilient against modern cybersecurity risks. The index has been developed against the backdrop of a post-COVID, hybrid world, where users and data must be secured wherever work is done. The report highlights where businesses are doing well and where cybersecurity readiness gaps will widen if global business and security leaders don’t take action. It measures the readiness of companies to maintain cybersecurity resilience against modern threats across five core pillars: identity; devices; network; application workloads and data.

The survey asked

6 700 private-sector cybersecurity leaders across 27 markets to indicate which of these solutions they had deployed and the stage of deployment. Companies were then classified into one of four stages of increasing readiness: Beginner; Formative; Progressive; and Mature.

Against a backdrop of growing cybersecurity threats, organisations need to manage complexity and secure their data to create safe, seamless working environments. By CONRAD STEYN , CTO and head of engineering at Cisco Sub-Saharan Africa

82%

The percentage of businesses that expect a cybersecurity incident in the next 12 to 24 months.

* Source: Cisco Cybersecurity Readiness Index

given the risks. The report found that 82 per cent of respondents expect a cybersecurity incident to disrupt their business in the next 12–24 months. The cost of being unprepared can be substantial, as 57 per cent of respondents said they had experienced a cybersecurity incident in the past 12 months, and 17 per cent of those affected said it had cost them at least R9-million.

The move to a hybrid world has fundamentally changed the landscape for companies and created even greater cybersecurity complexity. Organisations must stop approaching defence with a mix of point tools and instead consider integrated platforms to achieve security resilience while reducing complexity. Only then will they be able to close the cybersecurity readiness gap.

clear picture of what businesses have been doing to protect their operations across South Africa and, more importantly, what steps still need to be taken to deliver secure, seamless online environments. With the right investments and strategies, companies can improve their cybersecurity readiness and minimise the risks of cyber threats.

1. Identity. Verify the identity of everyone who tries to access network resources and information.

2. Devices. Verify all employee and infrastructure devices and protect them from being accessed by bad actors.

3. Network. Safeguard people, devices, applications, and data on the network as they are critical to the viability of the company.

4. Application workloads. Protect against application workload attacks that could lead to sensitive data breaches, productivity loss, and irreparable reputation damage.

South African organisations fared better than the 15 per cent global average of companies being in the Mature stage. However, this number is still low

Business leaders must establish a baseline of “readiness” across the five security pillars to build secure and resilient organisations. This need is especially critical given that 78 per cent of the respondents plan to increase their security budgets by at least 10 per cent over the next 12 months. By establishing a base, organisations can build on their strengths and prioritise the areas where they need more maturity to improve their resilience.

Achieving security resilience must remain a top priority for businesses, especially with highly distributed teams and devices leading to a rapidly expanding attack surface. Cisco’s Cybersecurity Readiness Index provides a Conrad

5. Data. Protect data from unauthorized access, use, disclosure, disruption, modification, or destruction using robust security measures.

Source:CiscoCybersecurity Readiness Index

way the world does business has changed, so the way you insure your business should change too

That’s why Discovery Business Insurance offers shared-value insurance, giving you:

Appropriate cover for any situation; allowing you to focus on your business ambitions.

Up to 30% of vehicle premiums back for driving well.

Technology-enabled risk management provides tools to help clients assess their business risks to avoid interruptions to their business.

Discovery Business Insurance:

Insurance for a new way of doing business.