5 minute read

Supply Chain Finance Market Trends, Growth, and Forecast 2025-2033

Global Supply Chain Finance Industry: Key Statistics and Insights in 2025-2033

Summary:

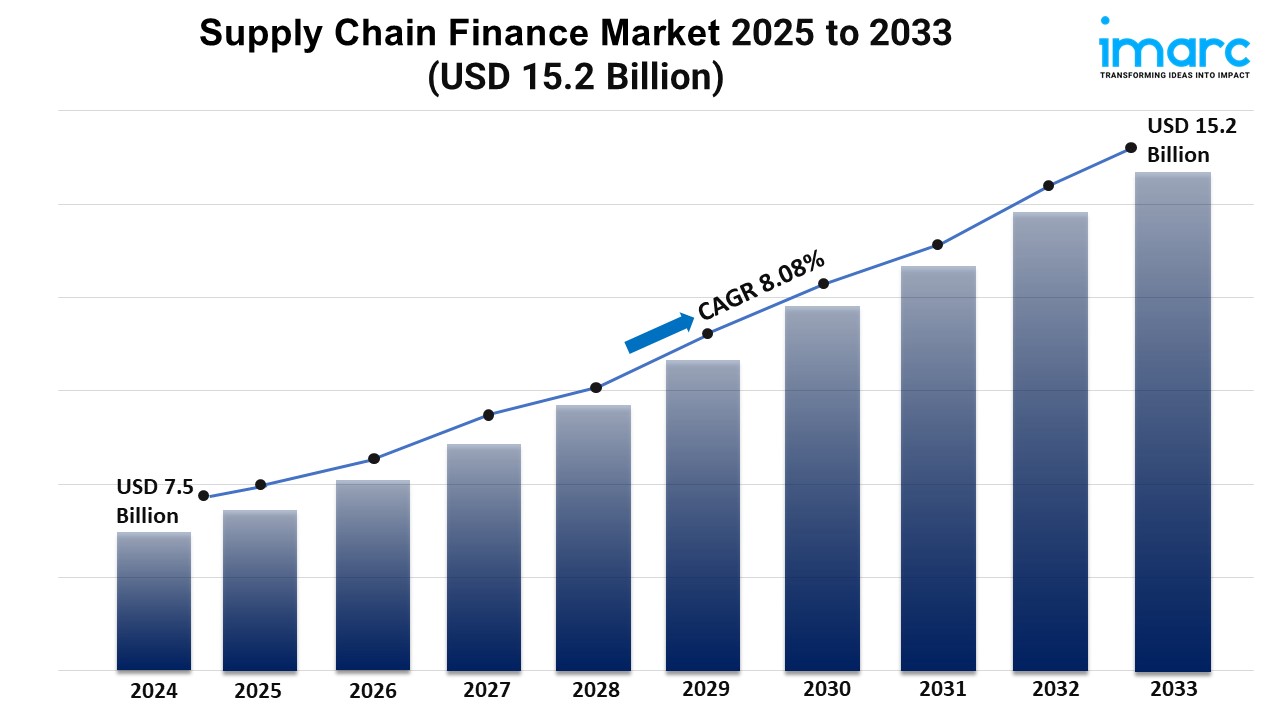

The global supply chain finance market size reached USD 7.53 Billion in 2024.

The market is expected to reach USD 15.22 Billion by 2033, exhibiting a growth rate CAGR of 8.08% during 2025-2033.

Asia Pacific leads the market, accounting for the largest supply chain finance market share.

Banks account for the majority of the market share in the provider segment due to their established trust, extensive financial networks, and access to capital.

Export and import bills hold the largest share in the supply chain finance industry.

Domestic represents the leading application segment.

Large enterprises remain a dominant segment in the market.

The rise in demand for liquidity solutions in global supply chains is a primary driver of the supply chain finance market.

Ongoing advancements for making supply chain finance more accessible, efficient, and secure are reshaping the supply chain finance market.

Industry Trends and Drivers:

Increasing Demand for Liquidity Solutions in Global Supply Chains:

When ventures start venturing into international operations, the issue of customized sources of cash becomes paramount. Supply chain finance (SCF) solves this problem by providing suppliers with early working capital to access full and fast payments while retaining the benefit of long payment terms. It can also be seen that this setup has the effect of improving cash flows of the suppliers as well as the buyers along the supply chain. SCF is especially beneficial to industries which have long production cycles, including manufacturing, retailing and agriculture as it maintains steady operations without incurring on standard forms of debt. By releasing the cash trapped in invoices, SCF enhances the relation between buyers and suppliers thus a strong supply chain network. It also decreases monetary tension and helps organizations focus on investments in strategic processes, a revival of inventory, or an enhancement of response times to new market conditions.

Growing Adoption of Technology in Financial Services:

Technological evolution is again on the rise in the supply chain financing where access to financing is becoming easier, quicker and safer. Tenders such as blockchain, artificial intelligence (Al), and cloud computing facilitate SCF by reducing the complications of credit assessment, transaction processing. Of particular value is the utilization of Blockchain technology to increase transparency and reduce intermediaries in cross-border trade. At the same time, AI helps financial institutions to automate evaluation of credit risks and to assess the overall financial status of small-supply chains, which have limited access to financing. Cloud platforms improve general entry and allow real-time tracking of transactions and interaction between GTM parties. This empowers an even better and reliable SCF system delivery solution that helps reduce frauds and mistakes, thereby enhancing the uptake of the system. In particular, such technologies help minimize some administrative issues and provide businesses with deep and timely information about supply chain conditions, thus supporting the growth of efficient and reactive supply chain images.

Increased Focus on Resilience and Risk Management:

Modern global disruptions are also revealing the presence of new shocks that may affect the supply chain in the future. This shift is aided by supply chain finance solutions which provide financial surety and freedom to the suppliers to survive demand volatilities or disruptions. SCF permits undertaking immediate working capital which cuts off dependence on conventional funding, which may prove inaccessible or expensive in the event of economic fluctuations. Such assurance makes the suppliers remain focused as well as provide constant supplies to the business. Similarly, it optimises cash flow volatilities thereby enabling companies to accurately anticipate occasional shocks. It is an important tool for businesses as it provides the much needed aggregate supply chain flexibility and loosens up the rigid, doomsday supply chain model which is commonplace today for the manufacturing sector especially when volatile markets are anticipated.

Request for a sample copy of this report: https://www.imarcgroup.com/supply-chain-finance-market/requestsample

Supply Chain Finance Market Report Segmentation:

Breakup By Provider:

Banks

Trade Finance House

Others

Banks exhibit a clear dominance in the market due to their established trust, extensive financial networks, and access to capital, which are essential for providing large-scale supply chain finance solutions.

Breakup By Offering:

Letter of Credit

Export and Import Bills

Performance Bonds

Shipping Guarantees

Others

Export and import bills represent the largest segment as they are crucial in international trade, providing immediate liquidity for cross-border transactions.

Breakup By Application:

Domestic

International

Domestic holds the biggest market share because companies prioritize managing cash flow and reducing risk within local supply chains.

Breakup By End User:

Large Enterprises

Small and Medium-sized Enterprises

Large enterprises account for the majority of the market share since they rely heavily on supply chain finance to manage extensive supplier networks and optimize cash flow, giving them a substantial share.

Breakup By Region:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

Asia Pacific dominates the market attributed to its strong trade environment, regulatory support, and financial infrastructure.

Top Supply Chain Finance Market Leaders:

The supply chain finance market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

Asian Development Bank

Bank of America Corporation

BNP Paribas

DBS Bank India Limited

HSBC

JPMorgan Chase & Co.

Mitsubishi UFJ Financial Group Inc.

Orbian Corporation

Royal Bank of Scotland plc (NatWest Group plc)

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145