7 minute read

Cyber Insurance Market Trends, Growth, and Forecast 2025-2033

Market Overview:

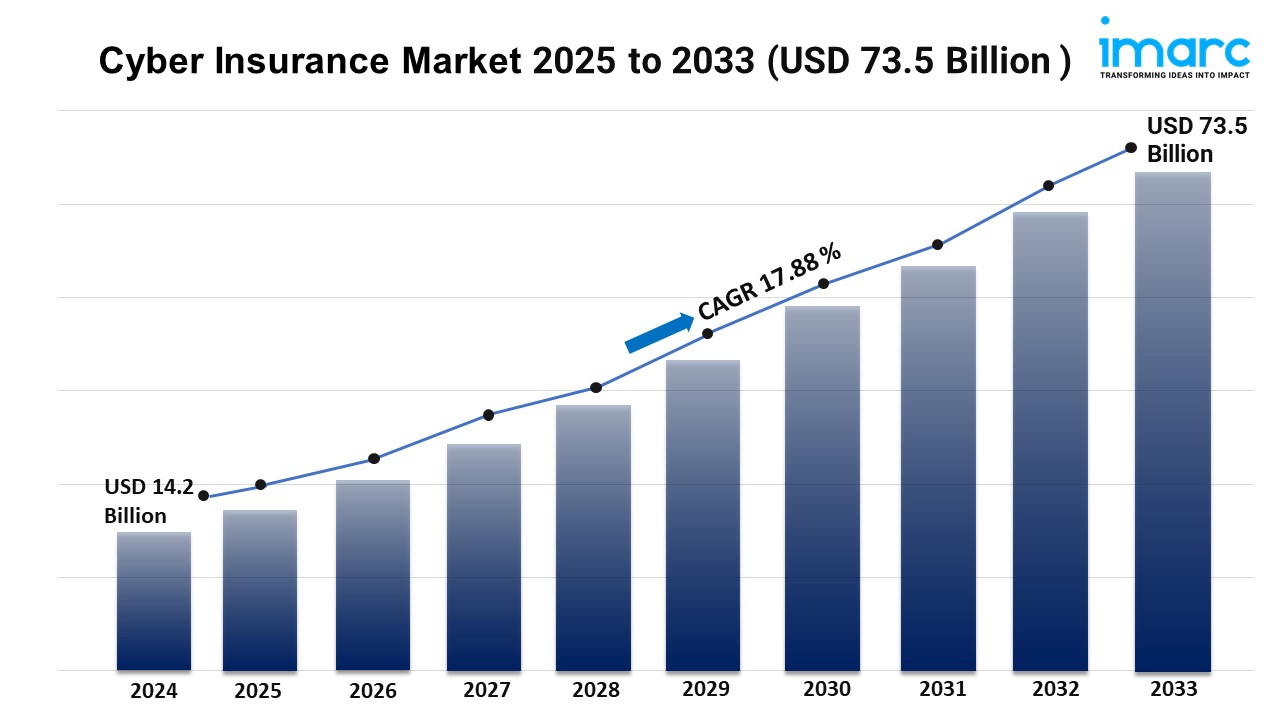

The cyber insurance market is experiencing rapid growth, driven by rising frequency and sophistication of cyberattacks, regulatory and compliance pressures, and increased digital transformation and cloud adoption. According to IMARC Group's latest research publication, “Cyber Insurance Market Size, Share, Trends and Forecast by Component, Insurance Type, Organization Size, End Use Industry, and Region, 2025-2033”, The global cyber insurance market size was valued at USD 14.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 73.5 Billion by 2033, exhibiting a CAGR of 17.88% from 2025-2033. This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/cyber-insurance-market/requestsample

Our report includes:

Market Dynamics

Market Trends And Market Outlook

Competitive Analysis

Industry Segmentation

Strategic Recommendations

Growth Factors in the Cyber Insurance Market

Rising Frequency and Sophistication of Cyberattacks:

The escalating number and complexity of cyberattacks are driving demand for cyber insurance. Organizations face threats like ransomware, phishing, and data breaches, which can result in significant financial losses and reputational damage. For instance, the 2021 Colonial Pipeline ransomware attack disrupted fuel supplies across the U.S., highlighting the need for robust cyber protection. Companies are increasingly recognizing that cybersecurity measures alone may not suffice, prompting them to seek insurance to mitigate financial risks. Cyber insurance policies now often cover incident response costs, legal fees, and business interruption losses, making them essential for businesses navigating an evolving threat landscape. This growing awareness is expanding the market as firms prioritize risk transfer solutions.

Regulatory and Compliance Pressures:

Stringent data protection regulations are fueling the growth of the cyber insurance market. Laws like the GDPR in Europe and CCPA in California impose heavy fines for data breaches, compelling organizations to secure coverage to offset potential penalties. For example, a major retailer faced millions in fines after a 2020 data breach exposed customer data, underscoring the financial risks of non-compliance. Cyber insurance helps businesses manage costs associated with regulatory investigations and customer notifications. As governments worldwide introduce stricter privacy laws, companies are turning to insurance to ensure compliance and financial stability, driving market expansion as policies evolve to address regulatory complexities.

Increased Digital Transformation and Cloud Adoption:

The rapid shift to digital operations and cloud-based infrastructure is a significant growth factor for cyber insurance. Businesses adopting technologies like cloud computing and IoT face new vulnerabilities, such as misconfigured cloud settings leading to data leaks. A 2022 case involving a misconfigured AWS server exposed sensitive data for thousands of users, illustrating these risks. Cyber insurance provides a safety net for losses from such incidents, including data recovery and legal liabilities. As organizations embrace digital transformation to stay competitive, the demand for tailored insurance solutions grows, encouraging insurers to innovate with policies that address emerging risks in cloud and digital ecosystems.

Key Trends in the Cyber Insurance Market

Customized and Industry-Specific Policies:

The cyber insurance market is seeing a shift toward tailored policies designed for specific industries. For example, healthcare providers require coverage for HIPAA violations, while retailers need protection against point-of-sale breaches. Insurers are developing specialized products to address unique risks, such as a policy for a hospital network that covered ransomware-related patient data losses in 2023. These customized offerings ensure businesses receive relevant protection, increasing market appeal. Insurers are also incorporating risk assessment tools to help clients identify vulnerabilities, fostering proactive cybersecurity. This trend reflects the market’s maturation as insurers align products with the distinct needs of diverse sectors.

Integration of Cybersecurity Services:

Insurers are increasingly bundling cybersecurity services with policies, a trend reshaping the market. Beyond financial coverage, policies now include access to incident response teams, forensic experts, and cybersecurity training. For instance, a major insurer partnered with a cybersecurity firm in 2024 to offer policyholders real-time threat monitoring, reducing breach impacts. This integration enhances policy value by helping businesses prevent and respond to incidents effectively. Companies benefit from proactive risk management, while insurers reduce claim frequency. This trend is gaining traction as businesses seek comprehensive solutions, positioning cyber insurance as a critical component of organizational resilience.

Emphasis on Risk Quantification and Underwriting:

The cyber insurance market is evolving with a focus on advanced risk quantification and underwriting practices. Insurers are using data analytics and AI to assess a company’s cybersecurity posture, enabling more accurate pricing and coverage decisions. For example, a 2023 case saw an insurer deny a claim due to inadequate cybersecurity controls, highlighting the importance of thorough underwriting. Insurers now require detailed risk assessments, such as penetration testing results, before issuing policies. This trend ensures fair pricing and encourages businesses to strengthen their defenses, fostering a more sustainable market as insurers balance risk exposure with competitive offerings.

We explore the factors propelling the cyber insurance market growth, including technological advancements, consumer behaviors, and regulatory changes.

Leading Companies Operating in the Global Cyber Insurance Industry:

Allianz Group

American International Group Inc.

AON Plc

AXA XL

Berkshire Hathaway Inc.

Chubb Limited (ACE Limited)

Lockton Companies Inc.

Munich ReGroup or Munich Reinsurance Company

Lloyd's of London

Zurich Insurance Company Limited

Cyber Insurance Market Report Segmentation:

Breakup By Component:

Solution

Services

Solution exhibits a clear dominance in the market due to the increasing need for comprehensive cybersecurity measures and proactive risk management.

Breakup By Insurance Type:

Packaged

Stand-alone

Stand-alone represents the largest segment attributed to its dedicated, extensive coverage tailored to address the unique risks associated with cyber incidents.

Breakup By Organization Size:

Small and Medium Enterprises

Large Enterprises

Large enterprises hold the biggest market share, as they possess more notable assets and data that need protection.

Breakup By End Use Industry:

BFSI

Healthcare

IT and Telecom

Retail

Others

BFSI accounts for the majority of the market share, driven by the high exposure to cyber risks and the critical need to safeguard sensitive financial data and transactions.

Breakup By Region:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

North America dominates the market owing to its advanced technological infrastructure, higher incidence of cyber-attacks, and stringent regulatory requirements mandating robust cybersecurity measures.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145