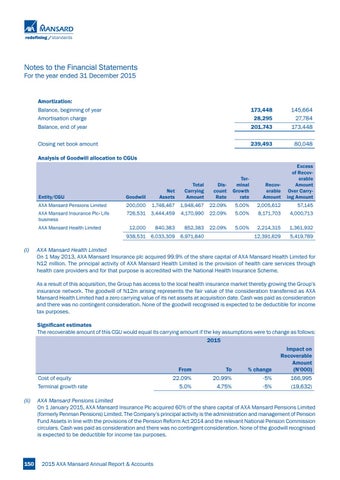

Notes to the Financial Statements For the year ended 31 December 2015

Amortization: Balance, beginning of year

173,448

145,664

Amortisation charge

28,295

27,784

Balance, end of year

201,743

173,448

Closing net book amount

239,493

80,048

Analysis of Goodwill allocation to CGUs

Total Carrying Amount

Discount Rate

Terminal Growth rate

Recoverable Amount

Excess of Recoverable Amount Over Carrying Amount

Entity/CGU

Goodwill

Net Assets

AXA Mansard Pensions Limited

200,000

1,748,467

1,948,467

22.09%

5.00%

2,005,612

57,145

AXA Mansard Insurance Plc- Life business

726,531

3,444,459

4,170,990

22.09%

5.00%

8,171,703

4,000,713

12,000

840,383

852,383

22.09%

5.00%

2,214,315

1,361,932

938,531

6,033,309

6,971,840

12,391,629

5,419,789

AXA Mansard Health Limited

(i) AXA Mansard Health Limited On 1 May 2013, AXA Mansard Insurance plc acquired 99.9% of the share capital of AXA Mansard Health Limited for N12 million. The principal activity of AXA Mansard Health Limited is the provision of health care services through health care providers and for that purpose is accredited with the National Health Insurance Scheme. As a result of this acquisition, the Group has access to the local health insurance market thereby growing the Group’s insurance network. The goodwill of N12m arising represents the fair value of the consideration transferred as AXA Mansard Health Limited had a zero carrying value of its net assets at acquisition date. Cash was paid as consideration and there was no contingent consideration. None of the goodwill recognised is expected to be deductible for income tax purposes. Significant estimates The recoverable amount of this CGU would equal its carrying amount if the key assumptions were to change as follows: 2015

Cost of equity Terminal growth rate

From

To

% change

Impact on Recoverable Amount (N'000)

22.09%

20.99%

-5%

166,995

5.0%

4.75%

-5%

(19,632)

(ii) AXA Mansard Pensions Limited On 1 January 2015, AXA Mansard Insurance Plc acquired 60% of the share capital of AXA Mansard Pensions Limited (formerly Penman Pensions) Limited. The Company’s principal activity is the administration and management of Pension Fund Assets in line with the provisions of the Pension Reform Act 2014 and the relevant National Pension Commission circulars. Cash was paid as consideration and there was no contingent consideration. None of the goodwill recognised is expected to be deductible for income tax purposes.

150

2015 AXA Mansard Annual Report & Accounts