MARCH 23' UPDATE

SPONSORED BY:

A few days ago we submitted 3 separate grants to MTC/ABAG (Metropolitan Transportation Commision/Association of Bay Area Governments) for a total of $1.15 million in partnership with all seven cities, the County, and STA. The first and largest grant is to advance the development of the 12 Priority Production Areas (PPAs) across the county. These are the areas that all seven cities have designated for job creation. For context, MTC/ABAG has put forth a Bay Area 2050 plan and one of the key pillars is to align jobs with housing. Solano County is an area of focus due to the 140,000 of our residents who commute out of the county to work each day. Given that our housing is still affordable relative to the rest of the Bay, there’s a great opportunity to bring higher paying jobs in manufacturing and advanced manufacturing to Solano County so that folks can work closer to home. This provides for cleaner air, a better quality of life, less traffic, and better health outcomes. If awarded, we will use the funding to ensure that these PPAs are ready to take advantage of any and all infrastructure dollars, have an abundance of power, and that we are preparing the workforce necessary to support these new companies. The other two grants were submitted to develop Priority Development Areas that are adjacent to the Fairfield/Suisun train station. This transit oriented development will bring vitality to both of the downtowns that are walking distance from this area. Special shout out to the invaluable Sean Quinn, my advisor, mentor, who I want to be when I grow up, for doing the heavy lifting on this.

I also had the pleasure of attending my first (and surely not last) Crab Feed in Solano County. Cade Beckwith and the Police Officer’s Association put this on in support of the Public Safety Academy in Fairfield which has been an unqualified success since it was founded with a 100% graduation rate. In addition to solid academic achievement, Public Safety Academy students graduate with proficiency in communications, problem-solving, critical thinking

technology applications, leadership and teamwork, and ethics and legal responsibilities. I was the guest of Jana Modena, a friend and civic leader and sat with her raucous, hat wearing, tribe of seasoned Crab Feeders. The event raised thousands of dollars to pay for uniforms and support students in need.

Lastly, I’m excited that this edition is the first in a six part partnership with UC Davis It’s one of our goals to get our UC more connected to Solano

The Mare Island Company galvanizes all who make this place their world. Visionary CEOs looking for inspired workspace. Local residents or workers building community. Visitors seeking less-traveled trails. All play a role in what Mare Island can and will be.

Everyone at The Mare Island Company are excited about the future that builds on Mare Island’s storied past, creating new opportunity for all who live, work, visit, and play here. Visit www.mareislandco.com to learn more about their shared vision and opportunities to define your company’s future.

Solano Mobility’s programs for older adults, people with disabilities, Veterans, and low-income individuals are a result of extensive community outreach and studies conducted over the last nearly 20 years by the Solano Transportation Authority (STA) to identify mobility challenges affecting this population in Solano County. These popular programs continue to assist our residents and enable them to keep their independence.

BayREN C&S Training: 2022 Energy Code Changes – Nonresidential

March 16 – 9am-10:30am

Decarbonization - Implications for the Gas System and What Local Governments Are Doing March 21 – 9am-12pm

REGISTER HERE REGISTER HERE

(Click the image below to view BayREN newsletter)

The Solano-Napa SBDC conducts a variety of no-cost virtual business trainings every month on subjects that include business planning, finance, marketing, human resource management, expansion and growth, and best practice programs designed to help small business owners use the most valuable and up-to-date techniques possible to increase sales and profit. Our trainings are led by Solano-Napa SBDC's experienced business advisors and are great opportunities for clients to obtain applicable, real-world information and helpful advice as they start or grow a business.

Data show that up to 80% of New Year’s resolutions fail by February, often because the goal was too big or too vague. When making changes, it’s important to view them as habits we want to form and making them manageable enough to increase repetition. Consider intentions and values; focus on the type of person you want to be and how this aligns with who you are, rather than focusing on results. This will help to maintain motivation when obstacles arise.

Creating SMART goals can help. SMART stands for Specific, Measurable, Achievable, Realistic and Time-bound. If you say “I want to exercise more this year,” then say to yourself, “I am going to exercise by walking for 15 minutes a day, five times a week, for the next month.” Shift the goal from being vague to something that is very specific, achievable and more focused on process. It has the potential to be highly attainable.

Let’s take another common resolution – eating healthier. Think about ways you could break that down. It could mean you are buying groceries or having groceries delivered once per week and making home-cooked meals twice per week. If you’re someone who’s really busy, what is a goal that is smaller that you could start with that you can continue to build on? If you start too big, saying, “I am going to make a home-cooked meal every day for every meal,” it’s likely it won’t be attainable. If we start smaller, like committing to cooking dinner at home on Thursday nights, we can increase our sense of self-efficacy and incrementally increase habits. Combine cooking with doing something pleasurable (e.g., listening to a podcast or catching up with a friend on the phone). This is known as temptation bundling, which has been shown to increase habit formation.

Another example: Rather than saying you want to spend less time on your devices, be specific by saying you will leave your phone in another part of your home while you are eating dinner or exercising. Put the phone on “do not disturb” during times you don’t want to be interrupted or use an app that controls the amount of time you spend online or on social media. Consider deleting certain apps from your phone or enlist a friend to hold you accountable.

Tying your new habit to other routines is also effective. For example, a minute of meditation with your morning coffee, or listing three things you’re grateful for while brushing your teeth at night. You could combine stretching or doing pushups while watching a television show in the evening.

When you slip up, pay attention to how and why, then get back on track. Let go of the shame and blame. Learn from this experience. If you regret buying a doughnut on the way to work, maybe you need to find a different route to avoid the temptation. Build a contingency plan moving forward and you’ll be more successful.

Give yourself grace! Strive for intention, not perfection. Let who you want to be guide you.

Starting a business can be a daunting task. There are so many things to think aboutfrom the initial planning stages to marketing your business and everything in between. One of the most important decisions you will make is how to fund your business. There are a variety of options available, and it can be difficult to decide which one is right for you. Let’s discuss the pros and cons of some of the most popular funding methods for businesses.

When you need to borrow money, one option is to get a loan from a credit union or a bank. There are two main types of business loans: secured and unsecured. A secured loan is supported by collateral, such as fixed assets, accounts receivable, or equipment. This means that if you fail to repay the loan, the financial institution can seize the collateral. An unsecured loan does not require collateral, so it is riskier for the financial institution. As a result, unsecured loans often have higher interest rates than secured loans.

Pros: Lower interest rates. Can be easier to obtain than other types of financing. Cons: Strict repayment terms can be a problem if your business does not generate enough revenue. You may have to provide collateral, which you could lose if you cannot repay the loan.

Small Business Administration (SBA) loans are a type of financing available to small businesses through the Small Business Administration, a federal government agency. SBA loans are attractive to small businesses because they typically have low-interest rates and longer repayment terms. In addition, the SBA guarantees a portion of the loan, which makes it easier for small businesses to obtain financing.

Pros: Backed by the government. Lower interest rates.

Cons: Difficult to qualify for. Strict requirements.

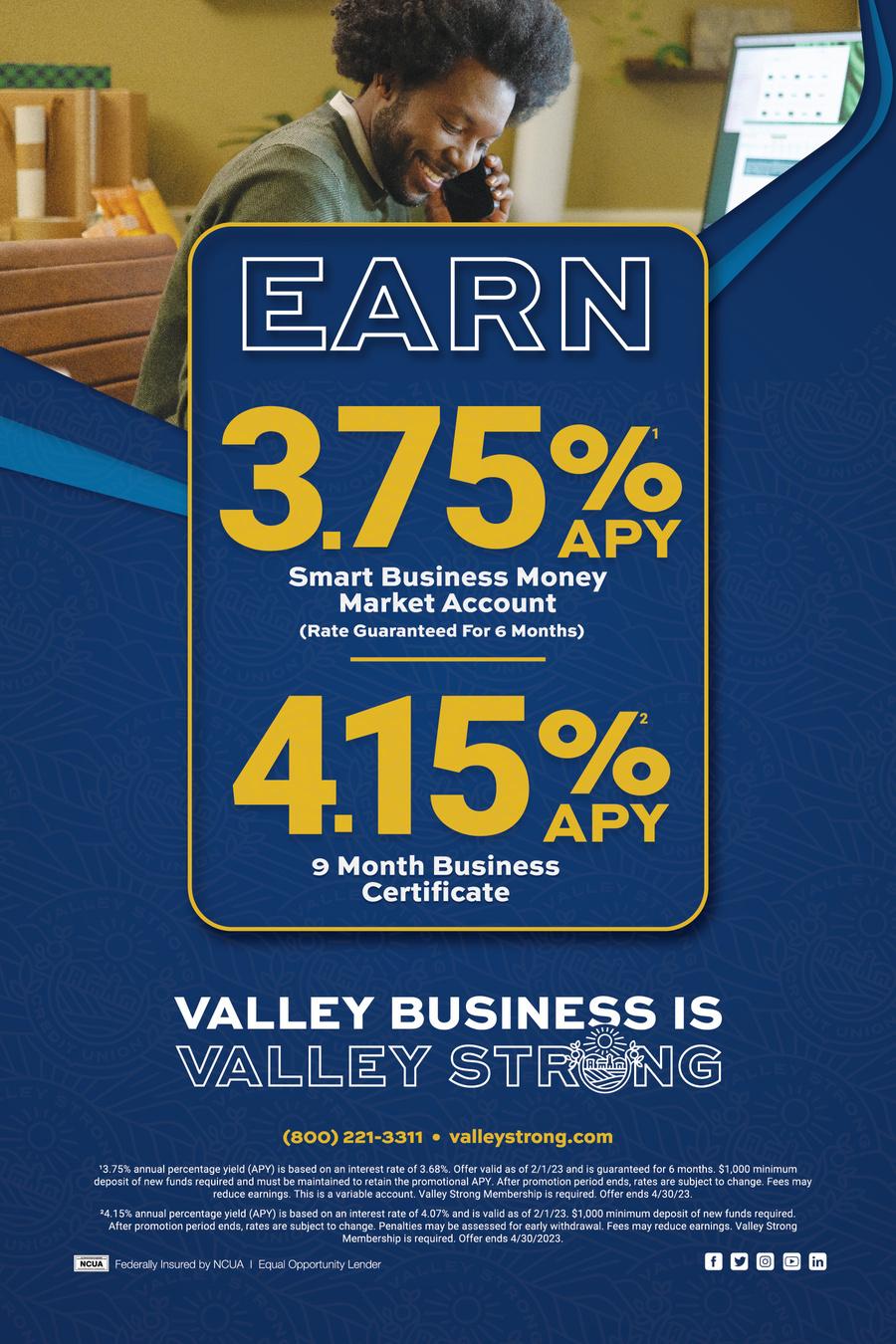

A Money Market Account (MMA) is a type of savings account that typically pays higher interest rates than a traditional savings account. To qualify for an MMA, you usually need to maintain a higher balance than you would in a regular savings account. MMAs are FDIC & NCUA insured, which means your money is insured up to $250,000 if the bank or credit union fails.

Pros: Higher interest rates than a regular savings account. Your money is NCUA or FDIC insured up to $250,000

Cons: You usually need to maintain a high balance to qualify for an MMA. The interest rate may be variable, which means it could go down as well as up.

Another excellent option for funding small businesses is applying for a grant. The most important thing to remember is that grants are not loans - you do not have to repay the money. This can be a great advantage, as it means you can use the money to grow your business without having to worry about repaying a loan.

Pros: You do not have to repay the money. Can be used for a variety of purposes.

Cons: Can be incredibly competitive to obtain. Requires a strong business plan.

Peer-to-peer lending is a form of lending in which individuals borrow and lend money to each other without the use of a traditional financial institution such as a bank. In recent years, peer-to-peer lending has become an increasingly popular option for those looking for an alternative to traditional lenders.

Pros: Loans can be obtained with lower interest rates. Loan terms can be tailored to the borrower's needs. Lower barriers to entry than traditional banks. More flexible than traditional lenders.

Cons: It may not be suitable for those who need a large loan. The borrower's credit score may be a factor in determining the interest rate.

Venture capital is a type of private equity funding that is typically used to finance early-stage businesses with high growth potential. Venture capitalists are typically looking for companies that have the potential to generate significant returns through an initial public offering (IPO) or by selling the company. In exchange for their investment, venture capitalists typically receive a minority equity stake in the company.

It is important to note that venture capitalists typically want to see a return on their investment within three to five years. As such, companies seeking venture capital funding need to have a clear plan for how they will generate profitability within this time frame.

Pros: Can provide significant funding for early-stage businesses. Can be used for a variety of purposes

Cons: Venture capitalists typically want to see a return on their investment. Companies seeking venture capital funding need to have a clear plan for profitability.

Bootstrapping is a type of funding where entrepreneurs use their own personal resources to finance their business venture. This could include savings, investments, and even credit cards. Bootstrapping is often associated with highgrowth startups that have limited access to outside capital.

Pros: Gives entrepreneurs complete control over their business. Forces entrepreneurs to be creative and resourceful. Can pay off handsomely if the business is successful.

Cons: Is a risky strategy. Requires a lot of personal resources. Limited access to outside capital

There is no single answer to the question of how to best fund your small business. The right method for you will depend on a number of factors, including the amount of money you need, how much control you want to maintain over your company, and the level of risk you are willing to take. However, some methods of funding are more popular than others, and each has its own set of pros and cons.

Weighing the pros and cons of each option will help you to decide which one is right for you. At Valley Strong, we believe that local businesses make the biggest impact in our communities and we are here to help. Get in contact with your local business member service representative at (209)365-1008 or visit valleystrong.com.

(CLICK IMAGES TO LEARN MORE)

B a s i c s o f R e f i n i n g a n d

R e n e w a b l e D i e s e l

View an updated presentation on the Basics of Refining and Renewable Diesel