Growth & Innovation

the companies in question and reproduced in good faith.

the companies in question and reproduced in good faith.

Welcome to Spotlight, a bonus report which is distributed eight times a year alongside your digital copy of Shares

It provides small caps with a platform to tell their stories in their own words.

The company profiles are written by the businesses themselves rather than by Shares journalists.

They pay a fee to get their message across to both existing shareholders and prospective investors.

These profiles are paid-for promotions and are not independent comment. As such, they cannot be considered unbiased. Equally, you are getting the inside track from the people who should best know the company and its strategy.

Some of the firms profiled in Spotlight will appear at our webinars and in-person events where you get to hear from management first hand.

Click here for details of upcoming events and how to register for free tickets.

Previous issues of Spotlight are available on our website.

Members of staff may hold shares in some of the securities written about in this publication. This could create a conflict of interest.

Where such a conflict exists, it will be disclosed.

This publication contains information and ideas which are of interest to investors.

It does not provide advice in relation to investments or any other financial matters. Comments in this publication must not be relied upon by readers when they make their investment decisions.

Investors who require advice should consult a properly qualified independent adviser. This publication, its staff and AJ Bell Media do not, under any circumstances, accept liability for losses suffered by readers as a result of their investment decisions.

Written by Neil Shah, executive director, content, and strategy at Edison

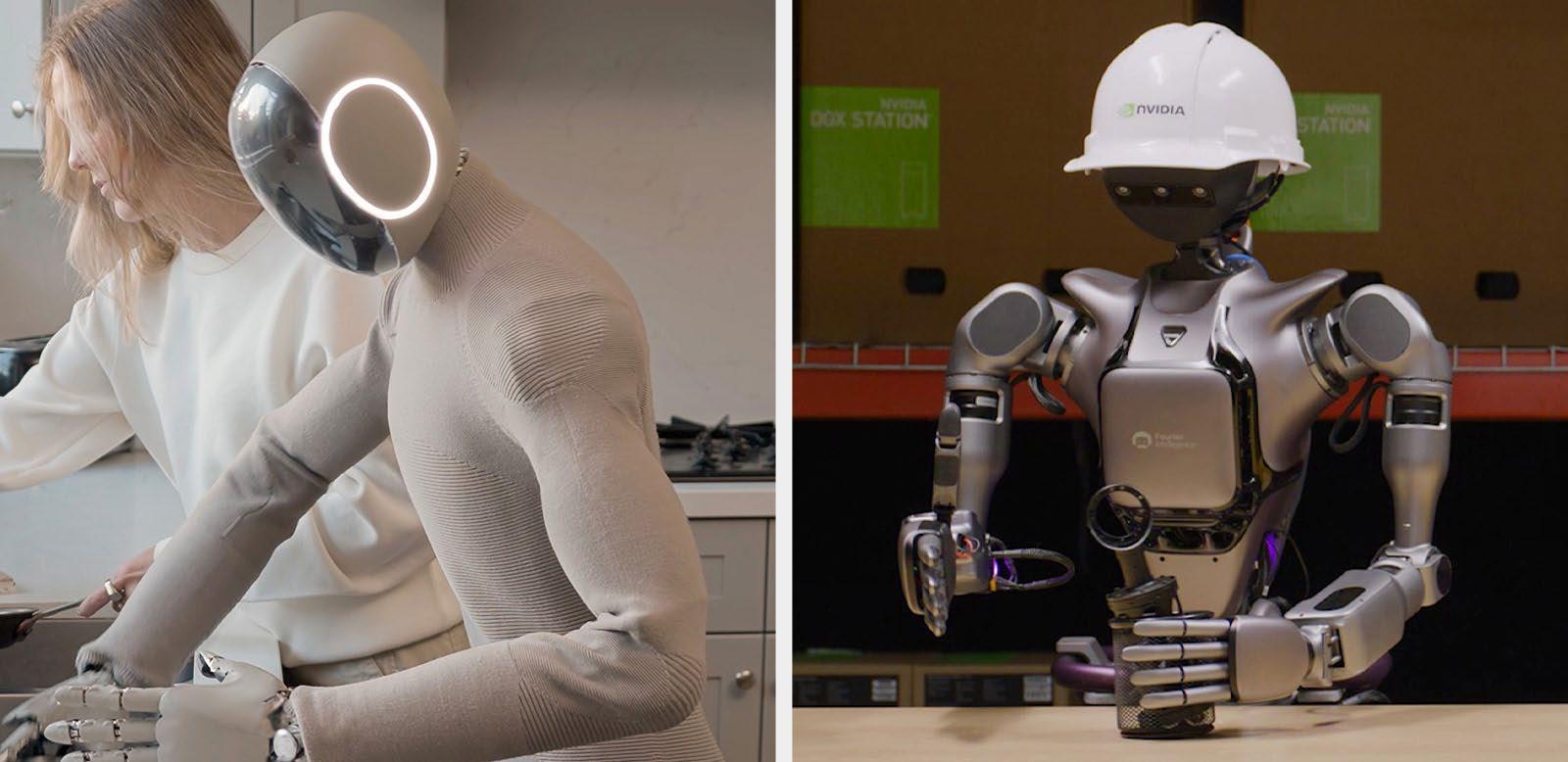

Remember when robots were just sciencefiction fantasies or clunky machines bolted to factory floors? That world is vanishing before our eyes. While you’ve been focused on generative AI and digital transformation, a silent revolution has been brewing – one that could transform entire industries more profoundly than anything we’ve seen before.

By 2030, the global economy will face a staggering 50-million worker shortage, according to projections highlighted by Nvidia CEO Jensen Huang during his keynote speech at the 2025 GPU technology conference, a crisis that will hit labour-intensive sectors particularly hard. The struggle to hire and retain quality staff isn’t just a passing problem; it’s an early warning of a structural shift that could define the future of work across healthcare, manufacturing, retail and beyond.

What if the solution to the workforce gap isn’t finding more humans but instead creating entirely new workers?

The first generation of robots (‘Robot 1.0’ as industry insiders call them) revolutionised manufacturing but remained firmly caged. Painstakingly pre-programmed for specific routines in controlled environments, they were glorified assembly-line tools with no hope of handling the unpredictable chaos of a hospital ward, retail floor or construction site.

If you’ve been dismissing robotics based on these limitations, you’ve missed the quantum leap that’s occurred.

‘The age of generalist robotics is here,’ declared Jensen Huang. Nvidia’s groundbreaking Isaac GR00T N1 model represents the world’s first open-source foundation for humanoid development. It is a platform designed to accelerate the creation of adaptable, intelligent robots capable of operating in diverse environments and performing complex tasks.

The technical breakthrough comes from GR00T N1’s dual-system architecture, inspired

by human cognition. Its ‘fast-thinking’ system enables real-time motor control while its ‘slowthinking’ system supports high-level reasoning and planning. This combination allows humanoid robots to perform tasks with both speed and deliberation, precisely what realworld operations demand.

In healthcare, the implications are profound. Humanoid robots are poised to address critical staffing shortages that leave nurses overworked and patients underserved. These robots can:

• Handle routine patient monitoring tasks, freeing nurses for specialised care.

• Transport supplies, medications, and equipment throughout facilities.

• Assist with patient mobility and rehabilitation exercises.

• Disinfect rooms and equipment to hospital standards.

• Provide 24/7 monitoring for fall-risk patients.

With healthcare systems worldwide facing unprecedented staffing challenges, these capabilities could transform both economics and patient outcomes.

According to Precedence Research, the global healthcare automation market was valued at $37.8 billion in 2021 and has been projected to reach just over $90 billion by 2020, with a CAGR (compound annual growth rate) of 10.33% from 2022 to 2030.

For industrial applications, the next generation of robots offers something previous automation couldn’t: adaptability. Figure AI, backed by Nvidia, Microsoft, Jeff Bezos and OpenAI, has already secured its first commercial contract with BMW to deploy humanoid robots directly

alongside human employees. Unlike their predecessors, these robots can:

• Shift between different assembly tasks as production needs change.

• Handle materials of varying shapes and weights.

• Operate safely alongside human workers without safety cages.

• Learn new processes through demonstration rather than programming.

• Perform quality inspections using advanced vision systems.

Morgan Stanley forecasts that humanoid robots could become a $80 billion market in the US alone by 2035, adding at least 50 basis points to annual industrial GDP growth.

Amazon is already demonstrating the transformative potential in logistics. In just three years, the e-commerce giant has developed six new warehouse robots, covering the entire fulfilment process.

Morgan Stanley calculates that every 10% of US retail units flowing through Amazon’s next-generation robotic warehouses could generate annual savings of $1.5–3 billion. If Amazon reaches 30–40% automation by 2030, total savings could exceed $10 billion, according to Morgan Stanley.

In retail environments, humanoids are expanding beyond back-of-house operations to customerfacing roles, where they can:

• Recognise and interact with products across varied merchandising displays.

• Process natural language requests from customers with regional accents.

• Navigate crowded environments without collisions.

• Detect and respond to suspicious behaviour.

• Restock shelves during quiet periods, while tracking inventory in real-time.

Most surprisingly, humanoid robots are making inroads into construction, traditionally one of the least automated industries. Here, they’re being deployed to:

• Handle repetitive, physically demanding tasks like bricklaying.

• Operate in hazardous environments that pose risks to human workers.

• Provide precision installation of components in high-tolerance situations.

• Work extended hours to accelerate project timelines.

• Gather and process site data for real-time project management.

HP (formerly Heward-Packard) estimates the construction robotics market will grow at a CAGR of 15.50% between 2023 and 2028, citing benefits around efficiency, reduced waste, improved safety, and lower carbon emissions.

Three converging breakthroughs have finally unlocked what decades of research couldn’t achieve:

1. Hardware evolution.

2. Processing power.

3. AI simulation training.

In the 2024 economic paper ‘The impact of robots on labour market transitions in Europe’ it’s noted that robots have only led to job losses in high-wage countries. The paper cites the US where this has been seen. At a time when labour costs are rising, for sectors where labour typically represents 30–50% of operating costs, this deflationary force could reshape fundamental business models.

This isn’t just a technology story; it’s a geopolitical one. If robots reshape the global workforce, they’ll reshape global power dynamics as well. China isn’t waiting to find out who leads this revolution. In Morgan Stanley’s Humanoid 100 list, which tracks roboticsexposed stocks, China holds a 63% share in the humanoid robot supply chain, having significant advantages in the ‘body’ segment.

For Western businesses with global operations, this introduces new considerations

around technology adoption, supplier relationships and long-term strategic planning. The nation that leads in humanoid development may gain advantages that extend far beyond economic metrics into questions of national security and global influence.

While widespread humanoid deployment remains several years away, we believe forwardthinking executives should:

1. Audit labour-intensive processes.

2. Develop early partnerships.

3. Reimagine physical spaces.

4. Invest in data infrastructure.

5. Prepare your workforce.

Elon Musk has claimed that Tesla’s humanoid robot platform, Optimus, could eventually be worth more than Tesla’s entire car business. While Musk is known for bold predictions, he has created enough multi-billion companies to generate credibility on this point.

For business leaders across sectors, the question isn’t whether humanoid robots will transform their industries, but how quickly, and which companies will capture the advantages of early adoption versus those left struggling to catch up.

This is an excerpt from a report: The humanoid revolution walking your way: How robots are stepping out of science fiction by Edison, first published in April 2025. Other thematic reports are available at www.edisongroup.com/thematics

Despite improved protocols, over 834,000 people in the UK suffer hospital-aquired infections (HAIs) every year. That’s enough to fill Wembley Stadium nine times. Globally, HAIs affect 3–10% of patients, impacting millions of lives and costing healthcare systems tens to hundreds of billions of dollars each year.

But HAIs are more than statistics. They lead to longer hospital stays, increase strain on already burdened healthcare staff, delay surgeries for patients on waitlists, and have devastating patient outcomes.

Health systems worldwide are urgently seeking innovative strategies to prevent infections before they begin.

Approximately 67% of HAIs are caused by pathogens that can colonize the nose, making it one of the most important (and overlooked) areas to disinfect in hospital patients.

But the nose is also a difficult area to treat effectively using conventional methods— especially in fast-paced clinical settings.

Ondine Biomedical (OBI:AIM) has developed a patented light-activated antimicrobial platform. Its lead product, Steriwave, eliminates harmful bacteria, viruses, and fungi in the nasal passages in just five minutes—without damaging human tissue or contributing to antimicrobial resistance.

Steriwave uses a light-sensitive microbial stain that is gently swabbed inside the nostrils and then illuminated for a few minutes with a safe red light. This triggers a chemical reaction that destroys pathogens without harming the surrounding tissue.

Steriwave is already making a significant impact in hospitals across Canada and the UK. The technology has been safely administered to over 200,000 patients and has demonstrated infection rate reductions of 50-80% in realworld settings. In addition to reducing infections, Steriwave has been associated with decreased antibiotic use, significantly shorter lengths of stay, over 2x reduction in mortality, and fewer readmissions, all of which contribute to improved patient outcomes and substantially reduced healthcare costs.

The treatment is approved for use in Canada, the UK, the EU, and other jurisdictions, and is gaining traction across leading health systems. In England and Wales, Steriwave is listed on NHS Supply Chain, streamlining purchasing access for hospitals nationwide.

Steriwave’s commercial reach is further amplified through a strategic distribution agreement with Mölnlycke Health Care, a global leader in surgical and wound care. Mölnlycke has begun selling Steriwave in the UK, with expansion to EU and MEA markets to follow. The partnership gives Ondine access to Mölnlycke’s extensive hospital relationships, integrating Steriwave as a key product in its infection control portfolio.

Steriwave’s ease of integration into existing hospital workflows makes it particularly attractive to care teams under pressure, offering a straightforward, effective solution that enhances patient safety without disrupting operations. It is also backed by independent modelling from the York Health Economics Consortium, which found net savings of 149p to 238p for every £1 spent on Steriwave, suggesting the potential to save UK Hospitals c.£200 million per year.

Steriwave’s use for presurgical nasal decolonization represents a total addressable market worth £3 billion in annual revenue across North America and Europe alone. With a current market value of only £40 million on AIM, Ondine is trading at a fraction of the market it aims to capture.

To access the US market, Ondine launched its pivotal US Phase 3 trial in December 2024 in partnership with HCA Healthcare, the largest hospital group in the country. The trial aims to confirm for the FDA what has already been demonstrated in other jurisdictions: that Steriwave safely and effectively reduces surgical site infections.

A second major growth area lies in intensive care units (ICUs), where patients face especially high infection risks. A four-month pilot study launched in March 2025 is the first step toward capturing this £2 billion ICU market. Steriwave’s proven ability to prevent infections presents a compelling case for broader adoption in this high-need setting.

With a proven, scalable platform, strong clinical momentum, and a pressing global need, Ondine Biomedical presents a differentiated opportunity in the infection control market. Steriwave is already making a real-world impact, starting in presurgical settings and expanding into critical care, offering a significant market opportunity of its own. But this is just the beginning.

Ondine’s proprietary photodisinfection platform extends far beyond Steriwave, with therapies in development for critical indications such as chronic sinusitis, ventilator-associated pneumonia, burns, and surgical wounds—each targeting major gaps in infection control with large market potential.

For investors seeking exposure to cuttingedge health innovation with proven, real-world results, Ondine offers a unique opportunity to invest in a company poised to drive longterm value across multiple high-need clinical settings—while helping reduce antibiotic use and save lives.

Following on from a comprehensive strategic review, the board has developed a detailed roadmap that is designed to accelerate the company to the next phase of development, increasing the underlying value of the business, and enhancing returns to shareholders.

Significant organisational changes are underway, aimed at capturing growth opportunities both in the UK and internationally. These include strengthening market positioning, cross-selling to the existing customer base, and entering new industry sectors.

TouchStar (TST:AIM) has grown from a mobile computing solutions specialist into a comprehensive provider of end-to-end, integrated systems and managed services.

Dominant in the UK fuel delivery sector, it now aims for significant international expansion.

TouchStar is an established and financially stable business, it’s trusted software and hardware solutions is embedded into its customers’ operational processes, giving it a sticky and growing ARR (annual recurring revenue) stream. Over the last five years, ARR streams have grown to become 44% of total revenues. TouchStar’s contracts typically span three to five years in duration with inflationary linked uplift clauses.

Headquartered in Manchester and employing 58 staff, TouchStar designs and develops its own software and hardware, retaining full intellectual property rights. While development was initially a blend of in-house and outsourced resource, the company has now moved to onshoring

development. It has a strong customer service culture with clients placing high value on the company’s technical knowledge, responsive support, and service ethos.

TouchStar is both profitable and cash generative, funding investments in software, technology, and organic growth from operational cash flow.

The company has no debt, and surplus cash is now being returned to shareholders.

Significant changes are being made to the company. It has launched a significant investment programme in people, technology, sales support, and marketing - laying strong foundations for scalability.

Lynden Jones has been appointed CEO to lead TouchStar into this next phase. Under his leadership, TouchStar’s Fire and Security business has transformed, with revenue growing 29% over the last two years.

The division has improved operational efficiency, successfully

enhancing customer experience and increased profitability. The company has gained access to new and exciting sectors and the financial performance was further improved by a move to a SAAS recurring revenue driven model.

TouchStar has refined its sales and marketing messaging with a clear, concise focus which is ‘to be recognised as the champion of the depot.’ This messaging underpins the company’s strategic marketing and sales efforts.

Building on the company’s strong market position, fuel delivery, TouchStar is pursuing a strategy to deepen long-term customer relationships by offering a full end-to-end solution for the depot environment. The company’s capabilities span fire and security, scanning, and proof of delivery, all of which can be seamlessly integrated with customer’s internal systems.

This focused approach presents a considerable cross selling opportunity, enhancing customer value and accelerating growth. The start point will target TouchStar’s existing customer base, creating a pathway into related depot environments such as biomass and bulk gas, and eventually into the mainstream of warehouses and retail markets.

The company is also exploring acquisition possibilities that can help compliment this growth strategy. These are expected to be bolton funded from operational cashflow.

TouchStar’s 1–3-year UK strategy centres on ‘championing the depot’. The next logical steps are warehouses, ‘depots with a roof,’ and retail outlets, ‘depots with a roof and a till.’ These three verticals are linked and present a logical way forward.

A concise message targeting depots has started, supported by increased event participation and a new website launch planned for the third quarter of 2025. The goal is clear: to make TouchStar synonymous with depotbased technology solutions.

This strategy broadens the appeal of the TouchStar brand, enabling it to attack the remaining market share of fuel depots and

to leverage its customer base to construct a valid path of growth over the medium and longer term.

In 2025, TouchStar is financing the building blocks to scale and expand a European fuel delivery business, where it currently holds a low market share. This investment sets the stage for a 2026 plan of attack, the aim of which is to replicate the company’s UK success abroad.

The company believes this has the potential to be a substantial business and has the resources to support this ambition.

TouchStar enters 2025 better placed than the previous year, with a higher order book and a strong pipeline of opportunity.

While there is still much to be done, the company has commenced the implementation of a comprehensive plan to regenerate forward momentum and capitalise on the potential of the business, with the objective of enhancing long term shareholder value.

(p)