1 minute read

IS WHATSAPP’S IN-CHAT PAYMENT A NEW CHAPTER FOR DIGITAL BANKS?

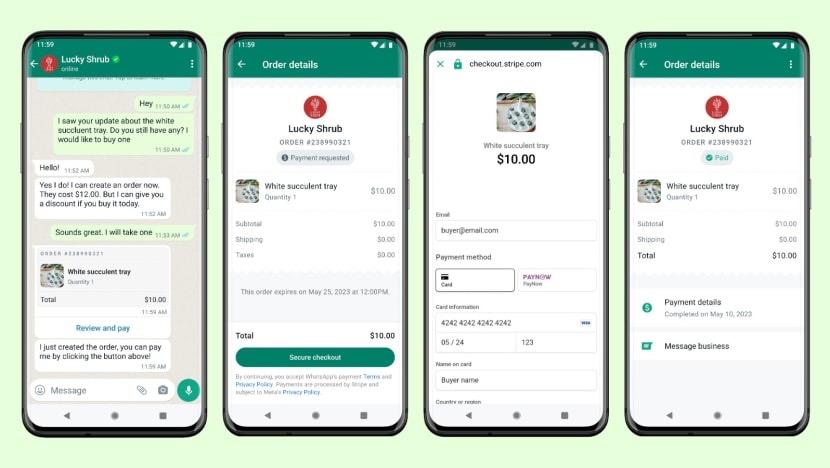

Following its successful launch in India and Brazil, WhatsApp is now introducing its feature allowing users to pay businesses directly within a chat in Singapore. This strategic rollout is particularly noteworthy given that WhatsApp has a massive user base of 4.6 million individuals in Singapore, equivalent to approximately 78% of Singapore’s total population.

Advertisement

But Singapore already has no shortage of digital payment services.

The introduction of WhatsApp’s in-chat payment in Singapore can provide valuable lessons for digital banks looking to gain widespread adoption.

These are three ways digital banks can continue to value-add to the Singapore market.

1) Keep it simple: One of the reasons why WhatsApp’s in -chat payment may be successful is due to the integration into the messaging app that users are already familiar with. Digital banks can learn from this and strive to make their own payment services as easy and seamless as possible. This could include instant transfer, automated payments and integration with other apps.

2) Leverage partnerships: WhatsApp has partnered with several major banks in Singapore to enable in-app payments. Digital banks can learn from this approach and actively seek out partnership with payment processors, fintech companies, and other organisations to enhance their own payment options and customer experience.

3) Provide value-added services: In addition to payments, WhatsApp has expanded its offerings to include features like transaction history, payment requests and customer support within the app. Digital banks can provide these services including personalised financial insights, spending categorization, and budgeting tools, to enhance the overall banking experience and drive take up.

Sources: Google Trends, CNA, The Straits Times.

One thing in the news in Singapore: