11 minute read

Environmental, Social & Governance Factors in AM Best’s Credit Ratings

Author: Mahesh Mistry, AM Best

Advertisement

ESG—environmental, social and governance—has gained significant traction in recent years, to improve transparency of risks not captured by standard financial metrics so that informed choices can be made by stakeholders. Understanding and integrating ESG principles into strategy is becoming increasingly important for (re)insurers. Whilst there has been strong consideration for ethical and moral values, aspects such as the sustainability and management of climate-related risks are prominent for the insurance industry. Insurers play a unique role in ESG as risk carriers, asset managers and institutional investors, providing protection to individuals and communities.

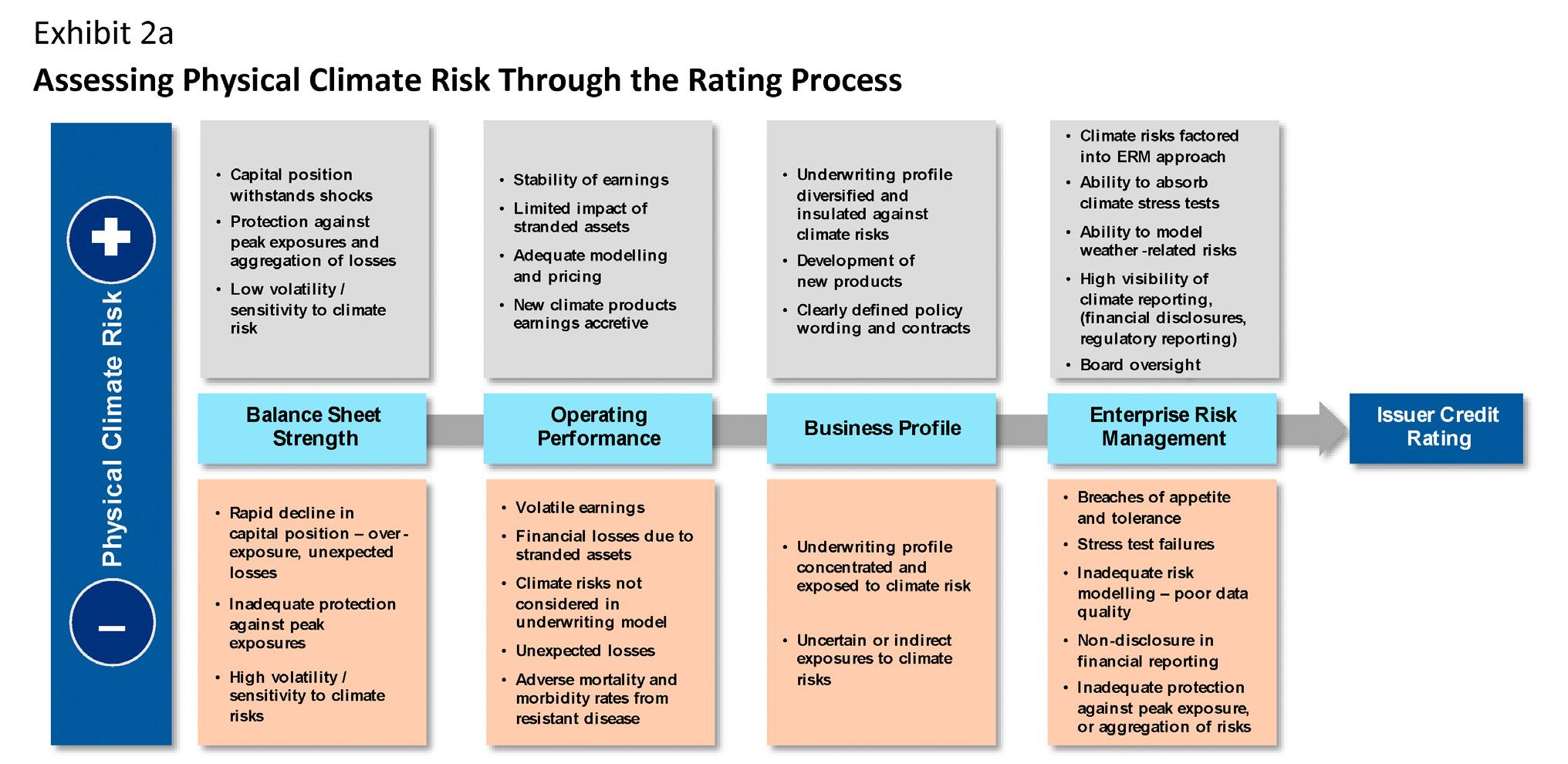

With limited but developing industry-wide ESG standards in place, market participants may find it overwhelming to fully understand how to implement and disclose ESG practices. AM Best’s view is that ESG factors, when material and relevant, play an important role in the financial strength of a (re)insurance company. Any material or relevant factors have always been considered as part of AM Best’s rating approach. AM Best’s perspective on credit ratings is forward-looking, as we seek to understand all the risks and opportunities that could impact a (re)insurer’s financial strength and creditworthiness. AM Best’s analysis includes identifying the impact of credit factors related to ESG on a (re)insurer’s credit ratings. Certain ESG factors may not impact (re)insurer’s financial strength today but may do so in the future or may become more relevant. ESG factors have the potential to affect—positively or negatively— any of the building blocks in AM Best’s analysis: balance sheet strength, operating performance, business profile, or enterprise risk management.

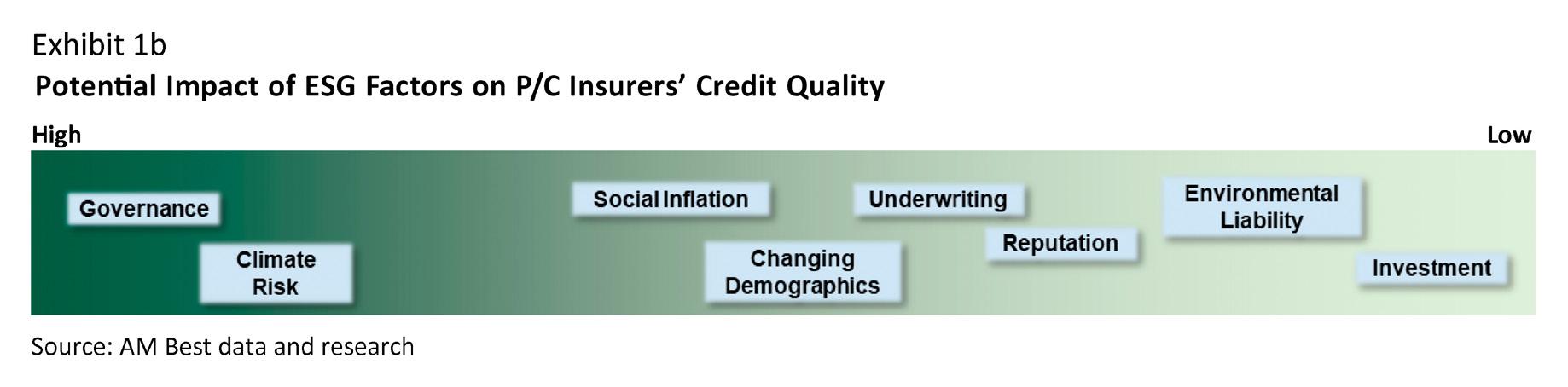

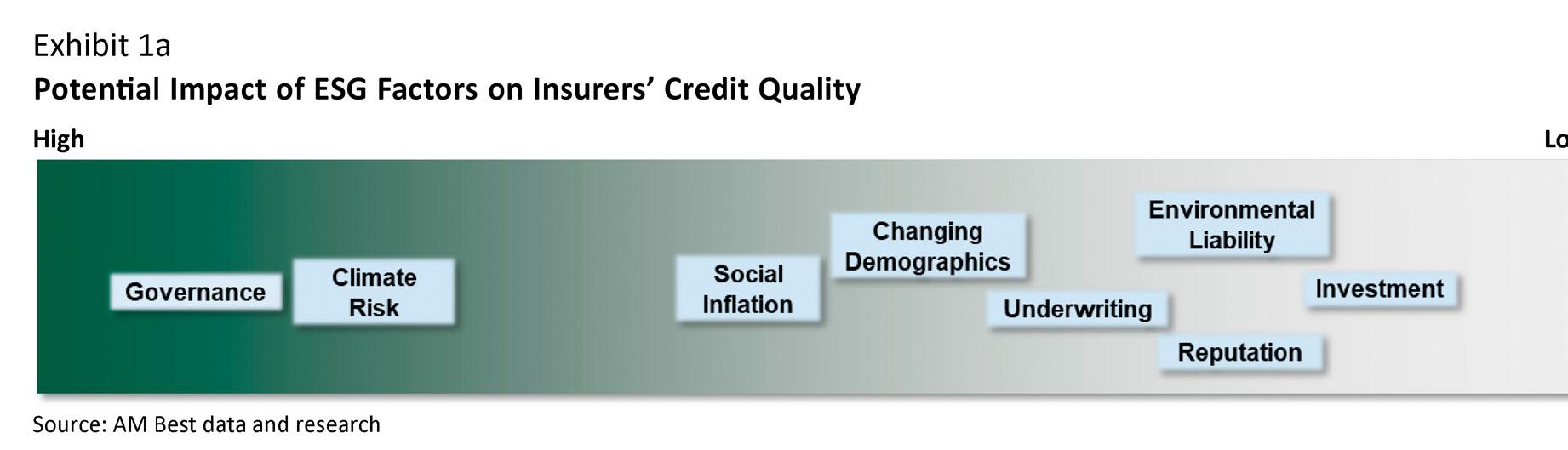

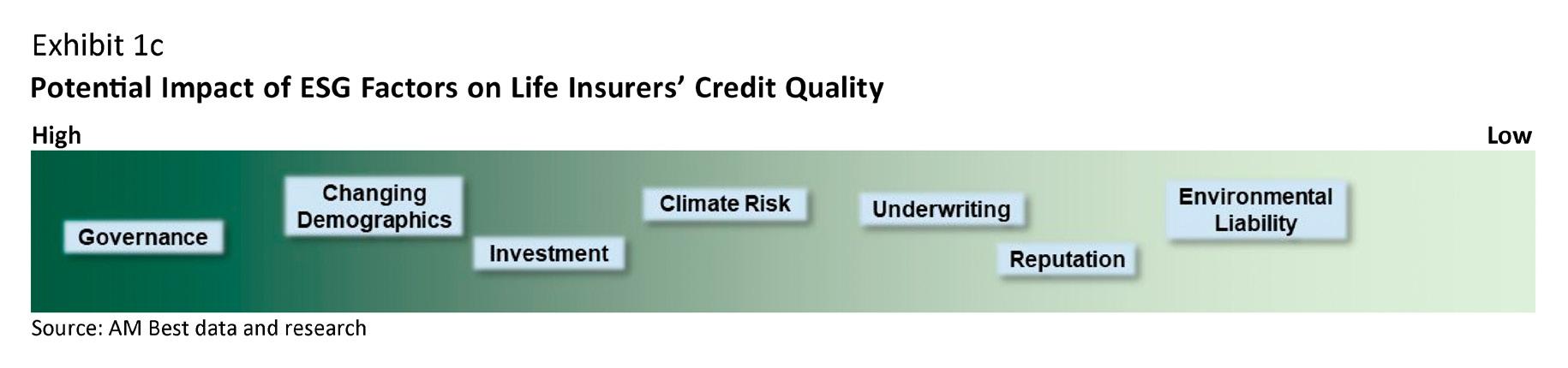

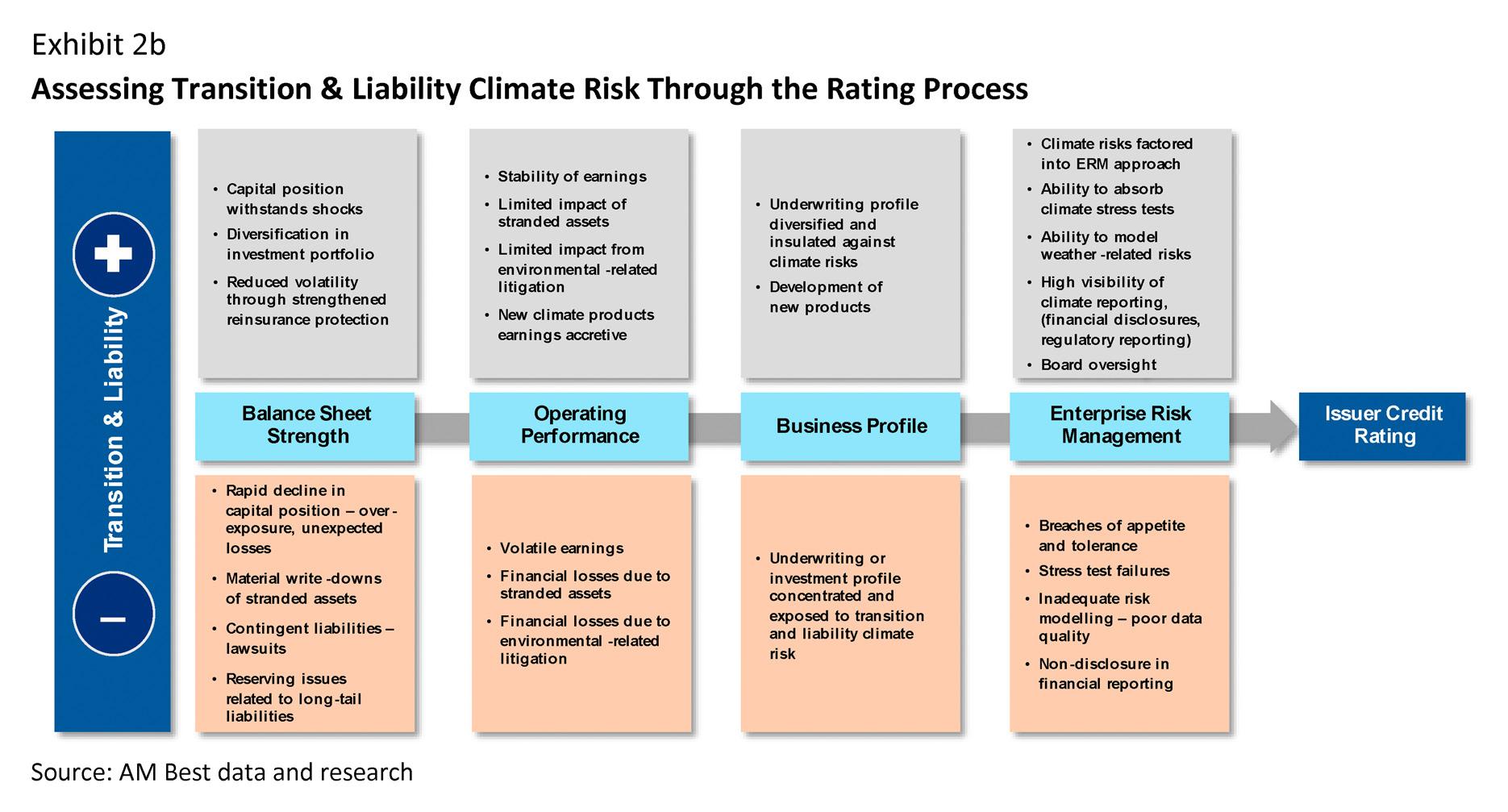

The impact of ESG factors on financial strength may vary depending on a company’s profile, gross and net exposures, and level of risk transfer, as well as the markets in which it operates. AM Best acknowledges that ESG risks are not the same across industries, which makes sense since risks relevant to one industry may not be relevant to another. Furthermore, even within the insurance industry, different factors may be more relevant to a particular (re)insurer. For example, a large, global reinsurer with material catastrophe exposure will have different ESG considerations than a small life insurer in the midwestern US. Overall, the greatest threats to a (re)insurer’s financial strength are inadequate governance practices and an inability to appropriately manage climate risk. Exhibits 1a, 2b and 3c illustrate that ESG factors are not uniform and that management of these exposures is equally as important as the exposure to these factors.

For climate-related risk, there are three main areas of focus for the insurance market: physical, transition and liability related risks. Exhibit 2a and 2b show the importance of climate risk and how the management of this risk can enhance or diminish credit quality over time. Physical risk captures the changing frequency and intensity of weather-related events; transitional risk is associated with transition to a low-carbon economy; and liability risk relates to possible increases in litigation arising from pollution or contamination, for example. All these factors can impact the creditworthiness of an insurer and affect its financial strength, performance and reputation. However, ESG can also create opportunities for the market, as changes in customer preferences and lifestyles may create new product opportunities.

Balance sheet strength

Environmental factors are considered a severe threat to the balance sheet strength of property and casualty insurers because of the potentially significant, rapid and unexpected impact of such losses. In the context of environmental risk, AM Best generally classifies weather-related events such as hurricanes, cyclones, wildfires, droughts, storms and floods as events affected by climate risk. AM Best expects insurers accepting climate-related risk to demonstrate that they can effectively manage it—including consideration of the material impact of climate trends, with the potential for increased severity and frequency of weather-related events—and have the financial wherewithal to absorb potential losses.

Asset risk is another key component of the balance sheet strength assessment. From a credit rating perspective, AM Best will discuss how ESG is integrated into investment policy, whether negative screening takes place, and the company’s commitment to green, sustainable or ethical investing. AM Best will also seek to understand whether the investment strategy improves diversification—or increases concentration in the asset portfolio—and whether this translates into improved earnings. One medium- to longterm concern relates to exposure to stranded assets and a company’s ability to transition its asset portfolio, to ensure that there are limited write-downs due to these assets. An important consideration is that strong ESG integration does not necessarily translate into higher credit quality for an investment portfolio.

Operating performance

A growing number of market participants are implementing exclusion criteria in their underwriting lines thereby eliminating certain toxic risks—the most common being controversial weapons, coal-based energy production and extraction, and tar sands. At the same time, ESG risks are being considered in the underwriting process through risk selection, geocoding and other metrics, to avoid areas subject to higher climate-risk-related loss severity. Changes in the insurance portfolio mix may have a material impact on underwriting margins, trends and volatility.

AM Best will also consider in its rating analysis the potential for ESG-related litigation and the impact of social inflation on an insurer’s earnings and financial results. In addition, key to the discussion about ESG integration is determining if any sustained enhancements to the composition of investment portfolios will ultimately translate into prolonged improvements in the performance of assets held by insurers.

Business Profile

Insurers are withdrawing from certain types of business not in line with their ESG principles but are also recognizing opportunities such as the development of new products that incorporate social and environmental factors. For life and health writers, this may include products that promote a healthy lifestyle. For P/C insurers, this may be the development of products or solutions to support risks connected with renewable energy.

Changing demographics offer both challenges and opportunities for insurers. Those who are attuned to customer needs, are innovative and have access to data will be most successful in defending their market positions. Alternatively, the business profile assessment may be impacted negatively following an ESG-related scandal, which has the potential to materially damage a company’s reputation and brand and could have repercussions for the company’s ability to generate new business and retain existing customers.

Enterprise Risk Management

Governance is relevant for all (re)insurers and is captured under AM Best’s enterprise risk management (ERM) building block. Governance, which can impact financial strength, has always been an important consideration in AM Best’s ERM framework evaluation. Solid corporate governance is essential for establishing a company’s risk culture as well as implementing the structures, processes and policies a (re) insurer abides by. The governance aspect of ESG takes into account financial and non-financial risks, including insurance activities, financial irregularities, management or board disputes, regulatory intervention or solvency breaches, and fraud monitoring. The severity of incidents is important to credit quality.

Changing Dynamics

The ESG landscape continues to evolve, with regulation and government being a key impetus for ESG activities. The drivers for ESG action in different jurisdictions will depend on the importance in a jurisdiction; as such, inaction on ESG principles in some countries may have limited implications on credit quality, at least over the short term. However, the growing importance of ESG in some insurance markets means that (re)insurers need to adapt to changing operating environment to ensure business models are protected, strategies remain relevant and ultimately financial strength remains in good health.

Changes at ICIC: new CEO, Board of Directors, Chairman of the Board and additional officers

Mrs. Hagit Chitayat-Levin, who has served as CEO of the Company for approximately 6.5 years ended her tenure on October 31, 2022, and was appointed as a Director of the Company as of November 1, 2022. Mrs. Adi Nov, who has served as VP of Marketing and Business Development of the Company for approximately 7 years has been appointed as CEO of the Company and her tenure commenced on November 1, 2022.

Mr. Ori Rubinovitch, who has served as deputy CEO of the Company and Head the Insurance and Claims departments, has been appointed to be the active Chairman of the Board of Directors of the Company and his tenure commenced on January 1, 2023.

Adi Nov, CEO Company: ICIC

Mr. Ofer Resh, who has served as VP of Information and Operating Systems of the Company, has been appointed as deputy CEO, Head of Innovation and Technology, and his tenure commenced on January 1, 2023.

Mr. Erez Levi has been appointed as Senior VP, Head of the Insurance Division and his tenure commenced on November 1, 2022.

Ofer Resh

Deputy CEO, Head of Innovation and Technology Company: ICIC

Ester Ash, VP

Marketing and Business development Company: ICIC

Mrs. Ester Ash has been appointed to the position of VP Marketing and Business Development of the Company, and her tenure commenced on November 2, 2022.

Adv. Adva Perets Ovadya, who has served as General Counsel and Regulation and Compliance Supervisor of the Company for about 4 years, has been appointed to be General Counsel, VP Legal, Claims and Regulation, and her tenure commenced on November 1, 2022.

Mrs. Reut Israeli, CPA (ADV.), who has served as Finance Director of the Company for about a year, has been appointed to be VP, CFO and her tenure commenced on January 1, 2023.

Mrs. Nadya Trushina who has served as Deputy Risk director, has been appointed to be VP, Insurance Division and her tenure commenced on January 1, 2023.

Mrs. Merav Dotan who has served as head of Customer Relations division, has been appointed to be VP, Customer Relations and her tenure commenced on January 1, 2023.

Mr. Amit Leon who has served as head of Marketing division, has been appointed to be VP, Marketing and his tenure commenced on January 1, 2023.

Amit Leon VP, Marketing Company: ICIC

Atradius appoints Head of ESG

Atradius has appointed Carine Cavallier in the newly created role of Head of ESG. In this role, Carine will be the strategic lead in shaping Atradius’ ESG ambition and enable the delivery of Atradius’ various sustainability commitments across the different business units in alignment with parent company Grupo Catalana Occidente. In addition, she will oversee the operational management of sustainability reporting across different Atradius international businesses.

Carine Cavallier brings over 15 years’ experience in the field of sustainability and has expertise on topics such as sustainable finance, climate risks, carbon footprint, corporate governance, and employee engagement. The past fifteen years, she has been Director of ESG and Sustainability at Banco Sabadell in Barcelona. Carine studied at universities in Paris, Warwick and Buenos Aires and has Masters’ degrees in International Business Administration, Law and Environmental Policy.

Sompo International appoints Nicholas Burnet as CFO

Nicolas Burnet has been appointed as the chief financial officer at Sompo International Nicolas Burnet has been appointed as the new chief financial officer at Sompo International, the Bermudian-based global provider of commercial and consumer property and casualty re/insurance.

Mr Burnet, who also becomes a member of the executive team, reports to James Shea, CEO of Sompo International, and is based in Boston. Mr Burnet succeeds Michael McGuire, who after 20 years with Sompo International, formerly Endurance Specialty, has decided to step down from his role as CFO.

The new appointee has joined Sompo International from PartnerRe, where he most recently served as CFO. Before that, Mr Burnet spent nearly 16 years with Zurich Insurance Group in various leadership positions, including group head of planning and performance management, CFO for general insurance and global life CFO.

Mr Burnet said: “I’m thrilled to join Sompo International at such an important time in the organisation’s growth journey. I’m looking forward to building on its record of exceptional delivery in close collaboration with the leadership team and colleagues globally.”

New appointments at Munich Re

Munich Re has appointed Thomas Blunck (57) as CEO of the Reinsurance Group with effect from 1 January 2023, following the retired Torsten Jeworrek. The Supervisory Board has also appointed Clarisse Kopff (50), with effect from 1 December 2022 as new member of the Munich Re Board of Management.

Clarisse Kopff is heading the Europe/Latin America Non-life Division and the Global Financial Risks Division. The French citizen Clarisse Kopff has been with Allianz Group for the past 21 years. She joined Munich Re from her position as Allianz Trade’s CEO. Before that, she was CFO at Allianz France and at Euler Hermes.

Clarisse Kopff, Munich Re Board of Management

Hannover Re appoints Gregor Rümelin as General manager

Gregor Rümelin got promoted to General Manager. On his new role, he is now responsible for the markets: North America, Europe (w/o Spain, Portugal, Turkey), Israel, Africa (w/o MENA).

Over the last 12 years, Gregor collected within our division broad experience across different regions in our lines of business.

Gregor Rümelin General Manager, Company: Hannover Re

MS Reinsurance appoints new Chief of Staff

MS Reinsurance, part of insurance group MS&AD and domiciled in Switzerland, has appointed Serge Taleb to the role of Chief of Staff.

Serge Taleb Chief of Staff Company: MS Reinsurance

Prior to his new position, Taleb held the role of EMEA Property Product Lead at MS Amlin for almost four years. Before that he spent almost a year at AXA XL as Senior Underwriter. He has also held a couple of positions at XL Catlin, where he worked for over three years. Taleb joined in 2015 as an Underwriter before being appointed Senior Underwriter in 2017. Throughout his career Taleb also held positions at Catlin Re and Allianz SE, all of them based in Switzerland.

Appointment of Grishma Kewada as COFACE country manager for Singapore

Coface is pleased to announce the appointment of Grishma Kewada as Country Manager for Singapore effective April 1st 2023. She reports to Graham Crozier, CEO of Coface South East Asia & India. Since joining Coface in 2019, Grishma has gained a wealth of experience and understanding of the business from her roles as Regional Head of Commercial Operations and as Regional Head of Risk Management.

Grishma has over 16 years of experience in investment banking and insurance. Prior to joining Coface, she worked at Prudential, Allianz, Credit Suisse and JP Morgan and lived in China, Thailand and Singapore.

“Thanks to her extensive experience in the banking and insurance industries, Grishma will strengthen Coface capabilities as we are looking to growth our business in Singapore”, said Graham Crozier, CEO of Coface for South East Asia & India. “In her previous roles, Grishma has successfully led and driven change across our regional risk management and commercial operations. She is well positioned to deliver on our growth agenda in Singapore, a key market in the Asia-Pacific region. Grishma’s appointment further cements our strategy of hiring the best talents and promoting them to senior roles within the Coface organization. This appointment also highlights Coface’s commitment to diversity in its senior management’,said Hugh Burke,CEO of Coface for the Asia Pacific Region.

Grishma Kewada currently serves as the President of the Financial Women’s Association (FWA) Singapore and as a Board Member of the Singapore Council of Women Organisations, in the capacity of Treasurer.

Appointment of Jonathan Steenberg as COFACE economist for the United Kingdom and Ireland

Coface is pleased to announce the appointment of Jonathan Steenberg as Economist for the United Kingdom and Ireland. He reports to Bruno De Moura Fernandes, head of macroeconomic Research at Coface and is based in London. Jonathan joined Coface’s Economic Research team in January this year.

This team is made of specialists based in Europe, Middle East, America and Asia, who serve the company’s clients and Coface internal experts. The department produces macroeconomic analyses, country/sector risk assessments and thematic reports that enable companies around the world to assess the environment as accurately as possible control their risks and optimise their development. Jonathan’s appointment strengthens the Department’s expertise, whose quality & added value are widely recognised by all Coface stakeholders.

A graduate of the University of Copenhagen, Jonathan Steenberg began his career as an economist within the Financial Stability Company (Danish Resolution Authority for financial institutions) contributing to the development of restructuring plans for financial institutions, and producing research and policy analyses on various topics relevant to resolution planning. In 2020, he joined the Berne Union as an Economic Research Analyst, later Associate Director for Economic Research, focusing on economic research within the export credit and investment insurance industry for which the Berne Union is the international association. The association brings together the world’s largest export credit agencies, multilateral financial institutions and private underwriters of credit and political risk insurance.