7 minute read

Climate change risks and credit insurers: anticipation is key

Author: Alexis Garatti, Allianz Trade

Advertisement

Credit insurers play a crucial role in facilitating B2B exchanges at national and international levels. By offering insurance products that cover the possible default of clients, they enable their policyholders (ranging from small businesses to multinational corporations) to release essential resources for long-term investment and preserve their future competitiveness. Without such protection, these businesses would have to allocate a significant portion of their resources to absorb any unforeseen shocks from non-payment. In this regard, credit insurers also have a role to play in fighting climate change, which is accompanied with a significant amount of uncertainty. Recent global-level events such as the Covid-19 crisis and the Russo-Ukrainian conflict are the perfect illustration of this trend towards an increase in the frequency of extreme risks. They highlight two kinds of events which can affect firms and their financial stability: climate change and (geo)political events. In the first case, deforestation, whether voluntary or involuntary, increases the transmission or transmissibility of viruses from wild species to humans. In the second case, the transition of economies plays a crucial strategic role before and after the trigger of war. An indirect climate-related shock, physical or transitional, is involved in each case.

Climate Change and physical risks: Credit insurers should not under-estimate their systemic dimension

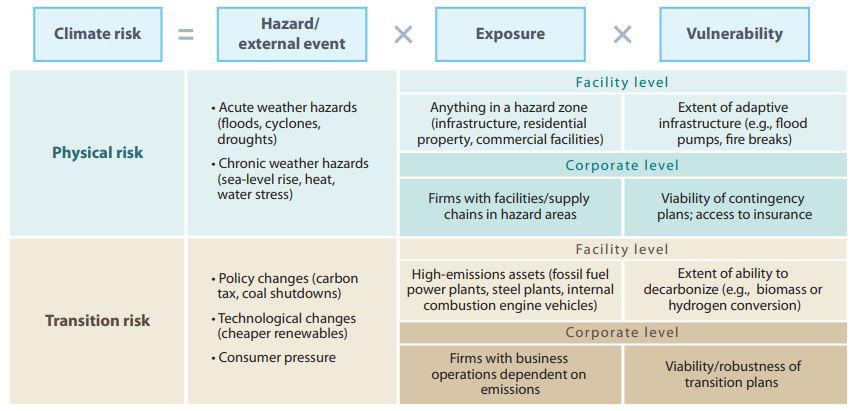

Physical risks refer to the risks associated with the physical impacts of climate change, such as extreme weather events, sea level rise, and other forms of natural disasters. In the trade credit insurance industry, physical risks may manifest in various ways, such as disruptions to supply chains, damage to infrastructure and assets, and increased insurance claims due to weather-related events. For example, a trade credit insurer may face physical risks if it provides coverage to companies in areas that are vulnerable to flooding or other weather-related events, which may increase the likelihood of defaults or insolvencies. Additionally, physical risks may lead to higher insurance premiums or reduced coverage for companies that operate in high-risk areas. Generally speaking, as not being a pure P&C type of business, trade credit insurance is being deemed as being relatively and naturally protected against physical risk. Yet recent experience demonstrates the inverse.

In the case of the Covid-19 crisis, we had indeed to deal with a physical risk: health restriction measures have brought most economies to a standstill, with an activity disruption or interruption in some sectors, and required strong state intervention to prevent a multiplication of business failures that would have ultimately led to a massive increase in unemployment. The physical risk eventually morphed into a systemic risk. States and credit insurers have coordinated their action to ensure the continuity of inter-company debt market in an extremely uncertain context. Those joint efforts have prevented a disproportionate tightening of business financing conditions and has kept inter-company relationships alive at the national and international levels, a necessary condition for allowing an economic rebound. All in all, this transformation of physical risk into systemic risk requires a close monitoring and coordinated reactions between public authorities and credit insurers.

The EIOPA (European Insurance and Occupational Pensions Authority) has acknowledged that natural catastrophes can have a significant impact on the trade credit insurance industry, and that climate change is expected to exacerbate this impact in the future. In a report published in 2019, EIOPA stated that “climate change may lead to an increase in frequency and severity of extreme weather events”, which in turn may have significant implications for the trade credit insurance industry, given the importance of weather-related risks in this sector.

The EIOPA has called on insurance companies to factor in the potential impact of climate change on their business models and risk assessments, and to develop appropriate strategies to manage these risks. This includes the development of stress testing scenarios that integrate the potential impact of natural catastrophes on their portfolios. In addition, EIOPA has encouraged the development of innovative insurance solutions to address the impact of climate change on the trade credit insurance industry, such as parametric insurance products that are triggered by specific weather-related events. Allianz Trade is already engaged in this exercise of mapping and estimating the materiality of those climate change risks, both for physical and transition aspects of things.

Climate change and transition risk: credit insurers should aim at anticipating by identifying stranded assets and accompanying companies in their net zero strategy

In the context of climate change, transition risk refers to the financial risks that companies and industries face as they transition to a low-carbon economy. This includes the risks associated with policy and regulatory changes, shifts in consumer preferences, and technological advancements that may impact the value of assets, investments, and business models. In the trade credit insurance industry, transition risks may manifest in various ways, such as the potential for reduced demand for products or services that are carbon-intensive, or the risk of stranded assets that are no longer viable in a low-carbon economy. There may also be risks associated with financing or insuring companies that are not aligned with the goals of the Paris Agreement, or with industries that are likely to face regulatory or reputational challenges due to their carbon footprint.

The Russia – Ukraine crisis offers a good example of a global – size type of transition risk suddenly materializing even if not apparent at first sight. The trigger of the conflict obviously deals with geo-strategic and historical reasons. There is no doubt on this. However, some works operated by the Integrated Assessment Modelling Consortium offers interesting insights in this regard. Its so-called Shared Socioeconomic Pathways (SSPs), describing five different scenarios of anticipation, more specially includes SSP3, where economic inequality gets worse in the world, leading to “increasing conflicts between regions”. In this uncooperative world, innovations are slow, growth as well and economies remain dependent on fossil energies. This is a world where temperatures increase by +4.5°C at the horizon of 2100. As an economy highly dependent on the export of energy, Russia was confronted with a wave of coordinated actions from the rest of the world post Paris Agreement in 2015 aiming at transitioning away from their dependence on oil and gas. At a global level, major economies are therefore expected to rapidly reduce their dependency on Russia. This is what we could characterize as a phenomenon of stranded asset, i.e. a rapid depletion in the value of Russian capital. This is difficult to judge whether or not this factor has played a significant role in precipitating the Russia – Ukraine.

However, there is little doubt on the fact that this phenomenon of stranded assets, in a perspective of transition risk, will be a source of political risk in the future. Allianz Trade already integrated ESG factor into its risk country ratings two years ago in order to anticipate such sources of risk at a national level.

Transition risk and stranded assets will also be a key concern for credit insurers when dealing with private companies. In order to estimate the magnitude of transition risk, we propose a methodology based on the utilization of financial market data allowing a forward-looking approach of transition risk for sectors and companies. Entelligent is a data provider specialized on climate. It has created an index called the Entelligent Climate Transition Index (ECTI) that is designed to measure the performance of companies that are better positioned to transition to a low-carbon economy while also managing their exposure to climaterelated risks. The ECTI is intended to be a tool for investors who are looking to incorporate climate considerations into their investment strategies.

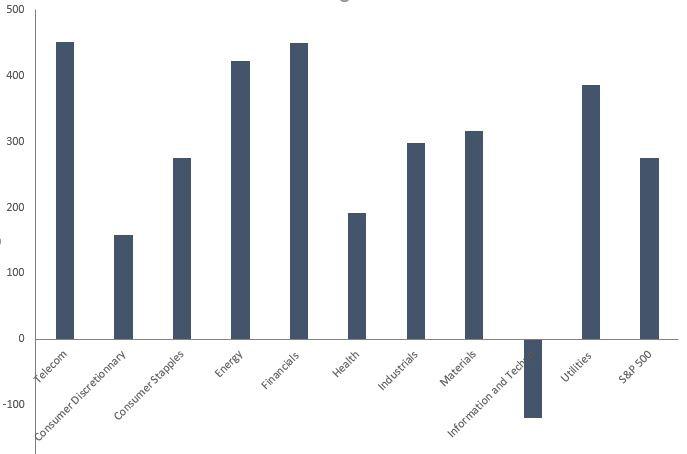

The chart 2 shows the relative performance of the different sectors of the S&P 500 versus the so-called SG Climate Transition Risk Index (available on Bloomberg), which is “designed to track the performance of a basket of US stocks selected from the S&P500 in function of companies’ sensitivity to future climate change scenarios as defined in the ECTI”. This is a way to visualize to which extent the market rewards portfolio strategies outweighing companies with credible transition strategies, a way to measure the confidence of the market in this “transition story”. Without any surprise, given the multiplication of extreme events recently, the SG Climate Transition Risk Index has outperformed the rest of the market, except for the Information and Technology Sector.

In order to capture the level of information in this index and get a proxy of expected transition risk across US sectors of the S&P 500 public companies, we estimate the spread at today’s date (March 2023) between the (100 re-based) index of performance for each sector of the S&P and the SG Climate Transition Risk Index. We can consider that this spread represents the risk premium that investors are ready to pay for being protected against the transition risk in the future. Again, without surprise (chart 3), we see that the Energy sector, as well as the Raw Material Sector and the Utilities sector face the largest transition risk and therefore are the most exposed to the phenomenon of stranded asset. More surprisingly, we find the Telecom sector is the worst performer compared with transition –ready companies.

In this case, there is a phenomenon of stranded asset in the sense that ICT companies continue gaining market shares on the Traditional telecom sector. In this respect, the out-performance of the ICT sector can also be associated with resilience in a context of transition, as we have already demonstrated the case that countries with stronger ICT infrastructures suffer in a lesser extend to extreme events such as the Covid . The financial sector including banks is also among the sectors the most exposed to transition risk as they continue supporting companies related to fossil energies. We have yet to observe the fact that a context of extremely low levels of interest rates between 2006 and today represents an important driver of this under-performance. In this respect, a context of low interest rate is also mirroring a lack of sustainable investment opportunities. All in all, we can also utilize such a market-based approach of transition risk with individual stocks. The relative performance of a certain company’s stock price versus the SG Climate Transition Risk Index can represent an indirect way of estimating its exposure to transition risk in a forward-looking manner.

Conclusion: by contributing to reduce market fragmentation, the Credit Insurance Industry represents a common good in this context of global warming

Through their insurance against the risk of default by buyers, the information they provide on these buyers or country/ sector risks, and their collection activities (recovering unpaid amounts from trades), credit insurers help reduce the fragmentation of markets and help reach structurally higher level of growth by unleashing precautionary savings of companies. From a microeconomic point of view, subscribing to short-term credit insurance preserves cash flow from uncertainties of non-payment, freeing up resources for long-term investment. Those traditional functions take a much bigger importance in the context of climate change, where fragmentation of markets and uncertainties have significantly increased: identifying companies and countries the most exposed to transition risk and helping all of them finance their transition will be a leitmotiv for Allianz Trade and the whole trade credit industry.