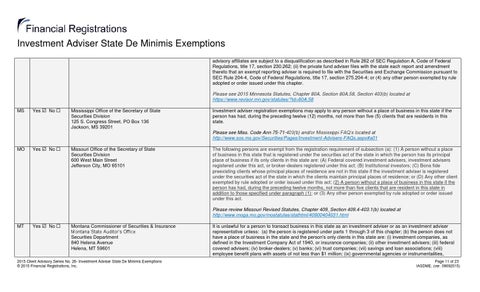

Investment Adviser State De Minimis Exemptions advisory affiliates are subject to a disqualification as described in Rule 262 of SEC Regulation A, Code of Federal Regulations, title 17, section 230.262; (ii) the private fund adviser files with the state each report and amendment thereto that an exempt reporting adviser is required to file with the Securities and Exchange Commission pursuant to SEC Rule 204-4, Code of Federal Regulations, title 17, section 275.204-4; or (4) any other person exempted by rule adopted or order issued under this chapter. Please see 2015 Minnesota Statutes, Chapter 80A, Section 80A.58, Section 403(b) located at https://www.revisor.mn.gov/statutes/?id=80A.58 MS

Yes No

Mississippi Office of the Secretary of State Securities Division 125 S. Congress Street, PO Box 136 Jackson, MS 39201

Investment adviser registration exemptions may apply to any person without a place of business in this state if the person has had, during the preceding twelve (12) months, not more than five (5) clients that are residents in this state. Please see Miss. Code Ann 75-71-403(b) and/or Mississippi FAQ’s located at http://www.sos.ms.gov/Securities/Pages/Investment-Advisers-FAQs.aspx#a01

MO

Yes No

Missouri Office of the Secretary of State Securities Division 600 West Main Street Jefferson City, MO 65101

The following persons are exempt from the registration requirement of subsection (a): (1) A person without a place of business in this state that is registered under the securities act of the state in which the person has its principal place of business if its only clients in this state are: (A) Federal covered investment advisers, investment advisers registered under this act, or broker-dealers registered under this act; (B) Institutional investors; (C) Bona fide preexisting clients whose principal places of residence are not in this state if the investment adviser is registered under the securities act of the state in which the clients maintain principal places of residence; or (D) Any other client exempted by rule adopted or order issued under this act; (2) A person without a place of business in this state if the person has had, during the preceding twelve months, not more than five clients that are resident in this state in addition to those specified under paragraph (1); or (3) Any other person exempted by rule adopted or order issued under this act. Please review Missouri Revised Statutes, Chapter 409, Section 409.4-403.1(b) located at http://www.moga.mo.gov/mostatutes/stathtml/40900404031.html

MT

Yes No

Montana Commissioner of Securities & Insurance Montana State Auditor’s Office Securities Department 840 Helena Avenue Helena, MT 59601

2015 Client Advisory Series No. 26- Investment Adviser State De Minimis Exemptions © 2015 Financial Registrations, Inc.

It is unlawful for a person to transact business in this state as an investment adviser or as an investment adviser representative unless: (a) the person is registered under parts 1 through 3 of this chapter; (b) the person does not have a place of business in the state and the person's only clients in this state are: (i) investment companies, as defined in the Investment Company Act of 1940, or insurance companies; (ii) other investment advisers; (iii) federal covered advisers; (iv) broker-dealers; (v) banks; (vi) trust companies; (vii) savings and loan associations; (viii) employee benefit plans with assets of not less than $1 million; (ix) governmental agencies or instrumentalities, Page 11 of 23 IASDME. (ver. 09092015)