Integrated Annual Report 20 23

Letter from the President

The year 2023 marked a change of pace in the SACMI story. The strong volume growth seen over the last three years resulted in a scaling-up of the Group, with consolidated revenues breaking the 2 billion euro threshold, the best result ever.

In 2023, SACMI strengthened its reputation and leadership by investing in new products and skills, and by taking customer support facilities and services to the next level.

The achieved result is particularly encouraging when one considers the unstable macroeconomic and geopolitical backdrop, which has necessitated continuous adjustments to strategy in order to mitigate business risks, provide customers with optimal service and identify, together, new growth opportunities.

Key contributing factors to the excellent operating result included a continuation of the strong economic recovery that began in 2021 and gathered pace in 2022. For the first six months of the year, order acquisitions proceeded apace, allowing the company to achieve systematic growth and engage in orderly operational management.

The second six-month period proved to be stormier as a combination of factors - high interest rates, persistently high energy prices, the Middle East crisis - inevitably impacted the market, slowing or postponing customers' investment decisions and raising new questions about both macroeconomic and geopolitical medium-term scenarios.

Component procurement regained fluidity in 2023. In parallel, careful planning and monitoring of orders kept project lead-times under control,

maintaining customer satisfaction levels and coupling manufacturing requirements with balanced finances.

Early 2024 was, again, characterized by remarkable complexity. Alongside the expected investment slowdown in some sectors (e.g. ceramic plant engineering), demand remained stable across other SACMI businesses, as did the acquisition of new orders. The high degree of internationalization and cross-industry diversification have stabilized SACMI’s long-term performance and constitute effective risk mitigators.

Within the reporting boundary, Capex and R&D expenditure are expected to remain consistent as part of an innovation strategy that focuses on digitalization and environmental sustainability. That strategy aims to make SACMI technologies and processes increasingly green, automatic, flexible, resilient and capable of effective interaction with end markets

In this context, 2023 further strengthened the fundamentals of the SACMI Group, ensuring the solidity that is vital to further development and instilling confidence in the future as our 105 th anniversary approaches.

“Inaugurate your sustainable factory”

From a Sustainability Reporting perspective, 2023 saw the tasks of measurement, control and strategic governance move another decisive step

closer to the CSRD (Corporate Sustainability Reporting Directive) standards that will come into force in 2025.

The year 2023 also involved an expansion of the ESG (Environmental, Social, Governance) performance reporting boundary beyond the Italian companies of the SACMI Group to some of the main foreign companies, in particular our production sites around the world; by 2024 the scope is expected to extend to the entire Global Network. For a complex, highly internationalized organization like SACMI, the goal we’ve set ourselves is ambitious: we aim not just to define a coherent sustainability performance reporting logic for all SACMI companies but also to strategically link it to daily planning/strategizing within the individual Businesses.

To enact this, in 2023 SACMI established the Corporate Innovation Management team to align SACMI innovation strategy with the drivers of digitalization and sustainability, the emphasis being on professional development, skills enhancement and infrastructure. On the other hand, an extension of the ESG perimeter has expanded the resources and professional capacities available to our corporate Green team’, set up in collaboration with the Imola Board and other managerial bodies. The team currently includes 128 people.

This collective effort is also reflected in the sustainability messaging. A good example of this was the extension of the Up To Us campaign to all SACMI businesses. This now covers all sustainable practices aimed at customers (the machine range, systems, services that help reduce consumption, raise efficiency and make factories healthier and safer) and policies designed to make our manufacturing sites (the parent company in Imola and all other SACMI companies in Italy and worldwide) sustainability trailblazers, fully aligned with international best practices.

The formula “Inaugurate your sustainable factory” was chosen to promote the consultancy services SACMI provides to customers. Such consultancy ensures sustainability is implemented effectively, profitably and in alignment with plant digitalization to take the market towards higher green standards.

As per SACMI standard practice, the bulk of the

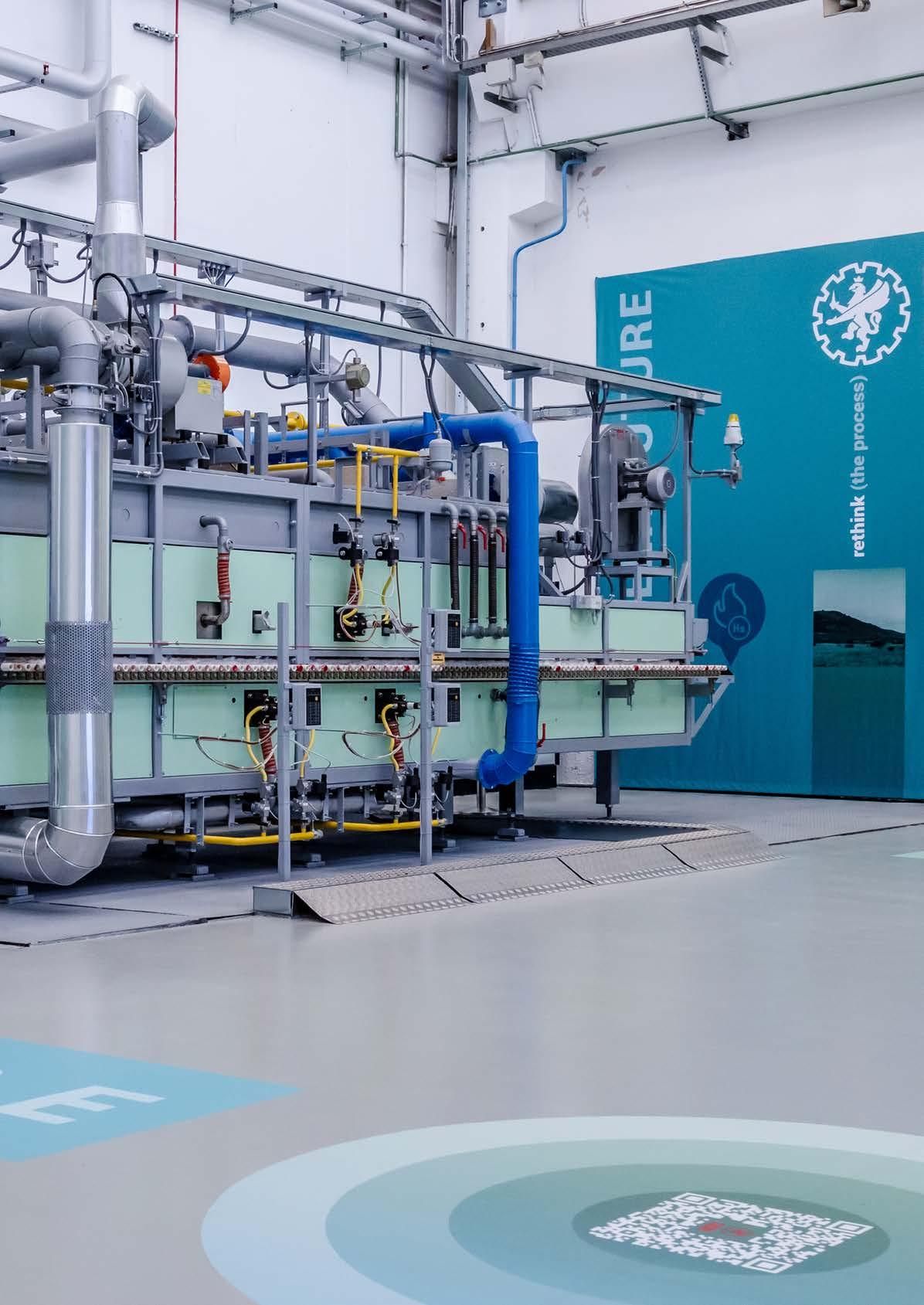

effort was directed at translating these principles into first-time technologies, tangible results that we previewed during the year. Perhaps the best such example was the first tile to be fired in a kiln that is 100% hydrogen-fueled. Moreover, developments in the packaging sector - where SACMI works alongside major global brand owners to implement a 3Rs (reduce-reuse-recycling) strategy - produced the first practical solutions from a D4R (design for recycling) perspective. With digitalization confirmed as a strategic factor - and a prerequisite for ‘practicing’ sustainability2023 also saw Artificial Intelligence driving the development of new ‘Industry 5.0’ investment opportunities based on collaborative logic between humans, machines and systems

Financial performance

The 2023 income statement was the best in the SACMI Group’s entire history.

In 2023, consolidated revenues exceeded €2 billion this figure comprises revenues generated by BMR, which was included in the consolidation area last February following its complete takeover by SACMI Imola. This figure confirms forecasts and is 12% higher than its 2022 counterpart.

Operating margins also improved significantly, ending the squeeze caused by the post-pandemic inflation shock and generating satisfactory EBIT and EBITDA.

At the end of the year, the Net Financial Position (NFP) was positive at 53 million euros, net of the effects of the BMR takeover. After 2022, the year 2023 again saw sub-optimal cash flow on account of the significant number of orders still in progress. This was highlighted by the level of warehouse stock. In 2024 stabilization of production volumes will allow progressive conversion of the Net Working Capital (NCC) accumulated over the last two years into cash, making for a healthier NFP. Control of NCC dynamics to protect operating cash flows remains central to management strategy.

In July, SACMI Imola stipulated a €75 million MLT loan with Cassa Depositi e Prestiti to purchase the remaining 80% of BMR. Given their considerable market shares and a demonstrable ability to

influence ceramic slab/tile trends, SACMI and BMR - and their technologies - are acknowledged as playing a decisive role in keeping ‘Made in Italy’ ceramics competitive. The merging of BMR into SACMI strengthens the entire Italian ceramic system by boosting its qualitative advantages and uniqueness.

In general, the Group continues to enjoy a solid financial debt structure, oriented towards the medium-long term and mainly characterized by fixed interest rates. At the end of the year, Net Equity stood at 883 million euros, a further improvement on an already-impressive 2022 figure. In addition to the complete takeover of BMR, other major operations during the year included the establishment of SacmiCassioli Intralogistics, a joint venture between SACMI and Cassioli that supplies plant logistics automation solutions worldwide.

Looking to a 2024 that, despite multiple sources of uncertainty, aims to stabilize the key financial performance indicators, it will be crucial to continue investing heavily in innovation, also - indeed, above all - to achieve R&D goals that make production processes more environment-friendly.

Markets and trends

End-of-year indicators were positive for all SACMI Businesses. In most cases, the results were the best ever both in terms of machine sales and the increasingly important area of spare parts sales and after-market services.

An exceptional recovery in 2022 and the large backlog of orders and projects undoubtedly contributed to the result. Simultaneously, the market has rewarded SACMI's ability to respond to new needs by providing ready-to-use innovations that offer customers tangible, measurable advantages. For example, in the Rigid Packaging sector SACMI has been delivering ready-to-use solutions for some time to help the market transition towards the new tethered standard.

System digitalization has again proved to be a valuable cross-business driver. This is coordinated by the Digital Innovation & Automation HUB, which has now instituted the figure of the Digital Business Agent to impel digital innovation within individual SACMI Businesses and translate it into products/services that meet new market needs.

In terms of scenarios and trends, 2023 closes a two-year period of uninterrupted growth following the recovery begun in 2021. Consequently, the market is suffering from a (cyclical) slowdown in investment in some sectors that now have overcapacity (e.g. ceramics); in parallel, though, it continues to reward SACMI products where they deliver product, process and service innovation

At global level, China has posted below-expected growth rates despite its confirmation as an increasingly important market, also with a view to the direct manufacture of machine or system parts.

India is performing well: a steadily growing middle class is driving demand for high-quality products in various sectors (home, food, etc.).

The decision to invest in Africa is revealing itself to be a far-sighted one: double-digit growth continued into 2023, making it, in fact, the Rigid Packaging Business's leading market. Signs from Europe are more contrasting. The major players continue to go for the ‘premium’ SACMI range, albeit against a backdrop of high interest rates, persistently high energy costs, and uncertainties linked to the winding-down of the post-lockdown manufacturing incentives implemented by governments in several countries.

SACMI technology, innovation and service have gone from strength to strength in the Americas especially in Brazil, Argentina and Mexico, but also in the USA and Canada, where SACMI is set to build the world’s first zero-impact sanitaryware plant.

With regard to plant digitalization/automation strategy - also a key factor in making processes more environment-friendly - 2023 saw advances with many of the proposed innovations (e.g. systems that reduce in-factory water requirements or automate further stages to improve workplace health and safety).

SACMI's work in the Energy sector is increasingly strategic, both in terms of results achieved and prospects. All-round solutions have been developed, ranging from the design and management of renewable energy power plants to Protesa’s broader role as an Energy ‘Competence Center’ in support of SACMI Businesses.

Continuing an already-observed trend, 2023 saw the development of new after-market businesses and services. This was achieved both by strengthening teams and on-site facilities and by making the most of opportunities provided by the latest digital tools; the latter include the new scheduled plant maintenance assistance packages, increasingly popular with customers thanks to the evident advantages they deliver in terms of efficiency, cost control and resource optimization.

Employment and training

Another trend that continued into 2023 was steady growth of the workforce. The SACMI Group now employs more than 5,200 people, +8% compared to 2022.

This expansion has occurred throughout the Global Network and is particularly evident in the lower age brackets, with more than 50% of new hires in 2023 aged under 30. This policy - alongside high levels of employee loyalty and low employee turnover (<6% in Italian companies) - favors the inter-generational development that has always been a SACMI hallmark.

Investment and man-days dedicated to Research and Development continued to rise in 2023, as did the number of patents. At Group level, almost 6,000 (5,970) patents have been filed: that’s more than one per employee. In 2023 alone, 272 new inventions were registered.

The SACMI Academy remains vital to the skills enhancement strategy. The 70,517 training hours that involved both Italian and network companies marked a significant increase in the number of training hours provided (+32% on 2022) and the average training hours (17 per employee, +31%).

The 22,200 hours of Health, Safety and Environment training brought the total to nearly 93,000 hours

The Academy’s role as a training hub, not just for employees but also customers, partners, schools and universities, continues to expand. In 2023, it again acted as a 142-strong in-company ‘nursery’ made up of thesis students, doctoral students, research fellows, interns and those collaborating on ITS and local degree courses.

Communities and the Planet

Over the last 3 years, SACMI has allocated 1.9 million euros to local and international charity projects, mainly in health, assistance and education. The parent company SACMI Imola’s main initiatives included a major donation to the Casa Gialla project run by Ageop Ricerca, which has been at the forefront of pediatric oncological research, treatment and support for over 40 years.

Integrated Annual Report 2023 / Letter from the President

Taking a network-wide perspective, pro bono projects focus on people’s dignity, starting with their basic education and healthcare rights. Every year, ongoing attentiveness to the needs of communities - in collaboration with the main associations and voluntary organizations that operate in them - results in several projects being enacted.

In 2023, SACMI again took an approach that favors local suppliers, thus strengthening local industry and nurturing long-term partnerships. To cite a key figure, it should be noted that, in 2023, the SACMI Group purchased goods and services valued at approximately 1.28 billion euros and that 89% of that expenditure involved suppliers based in the region/country where the relevant SACMI headquarters is located.

Last but not least, we can also confirm that the environmental profile of our manufacturing sites improved further in 2023. SACMI has reduced its dependence on non-renewable energy sources (-9% natural gas consumption, +10% self-produced electricity), reducing direct emissions by 9% and greenhouse gas emissions by 8%. Water usage (-9%) and waste production (-13%) are also down.

This progress is set to continue in 2024, in parallel with the definition of the Group Sustainability Plan to be drawn up on the basis of strategy and in accordance with application of the CSRD Directive.

“The

2023 financial year saw a strengthening of the SACMI Group’s economic fundamentals, instilling confidence and encouragement for the future.

Solidity will be a must for further development.”

PaoloMongardi

Presidentof SACMI Imola SC

CHAPTER 1

SACMI

SACMI Group

SACMI is an international industrial group with a daily mission to improve people's quality of life. It accomplishes this by providing solutions with high-tech content that help everyone meet their basic needs

Our story

SACMI was founded in 1919 in the town of Imola, Italy, on the initiative of 9 young mechanics and blacksmiths united by the same ideal: work as a means to improve their social standing and that of the community. This happened at an extremely difficult time for Italy. The First World War had ended and there was a severe economic crisis, with high unemployment and inflation.

From its origins as a workshop for ‘small mechanical repairs’, the 1930s saw SACMI produce its first own-brand machines, mainly for the nascent agro-industrial sector. During the bombing of the Second World War, it was our own workers who risked their lives to save the machines and equipment. Later, in an Italy liberated from German occupation, SACMI was the one of the first companies to get back on its feet.

SACMI was founded in Imola (Italy) in 1919, on the initiative of 9 young mechanics and blacksmiths.

From its origins as a workshop for ‘small mechanical repairs’ it has grown to become a global industrial Group with 73 manufacturing, distribution and service companies in 27 countries

Between 1948 and the early 1950s SACMI developed two key innovations that would make company history: the first ceramic press and the first complete machine for crown caps Years of intense development followed as SACMI worked alongside the growing Italian ceramic and packaging industries. Our vocation for ‘plant engineering’ began to take root. This saw the development of comprehensive solutions, from raw material to finished product, especially in the ceramic sector. Expansion into foreign markets began, with the first branches opening in Spain and Brazil in the 1960s. Other branches and foreign offices would soon follow across all Group businesses. By 1963, exports were already accounting for more than 50% of revenues.

In 1989 the SACMI Research Center was established. Between 1990 and 1994, SACMI developed compression technology, which would go on to be the world’s leading plastic cap manufacturing technology, flanking the historical crown cap business. With the development of preform machines, bottling lines and labeling machines, this put us in a position to supply complete plants to the packaging sector too.

The 2000s saw SACMI enter new areas, such as chocolate processing and packaging machines. In 2008 we entered the Metal Powder sector, the first step towards a strong, well-organized presence in the automotive sector. Expertise in ceramics continued to grow, resulting in the launch of Continua+ technology, now the global benchmark for slab and sub-size forming. In parallel, SACMI developed Deep Digital, a new approach to digital, integrated control of surface decoration/glazing.

This was followed by the creation of a Business Unit that focuses on developing Advanced Technologies and Materials: the aim was to make the most of skills already acquired by the Group and intercept new opportunities for growth, especially in sectors linked to electric mobility and high-performance components.

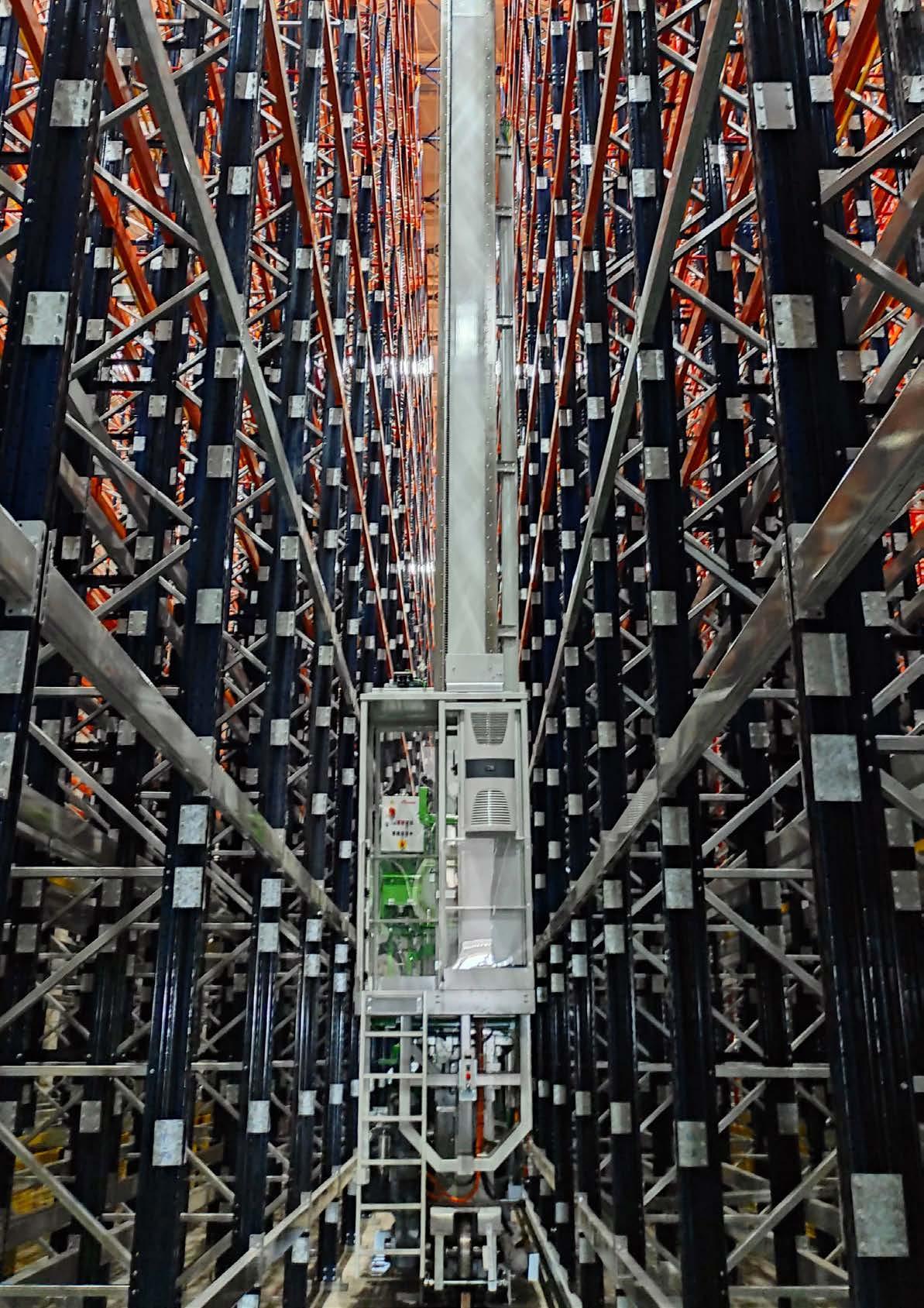

The 2020s see SACMI pushing ahead with investments in process automation digitalization and sustainability . For example, the ‘circular economy’ concept is being approached from a plant engineering perspective. This involves the development of systems for full recovery of raw materials and water purification. In parallel, a complete re-think of thermal processes focuses on alternative fuels and efficient heat recovery so that individual machines or even entire plants can run on ‘zero fuel’. Such activities go hand in hand with the Research & Development of eco-sustainable materials (e.g. in the packaging sector) and the technological progress needed to implement the transition to a greener industry. Alongside digital innovation, which cuts across businesses, SACMI supports important investments in core businesses, in particular in completing the offer in the ceramic end-of-line and intralogistics.

The year 2023 and, to an even greater extent, 2024 mark the emergence of Artificial Intelligence as a key SACMI investment driver: here, new opportunities are being explored both at individual machine level (management and maintenance, quality control, Customer Service) and to take plant design towards an "Industry 5.0" model based on collaborative human-machine-system logic.

It’s up to us to protect the future

vision

Ensuring the company handed to future generations is an even better one.

mission

Research and innovation

We invest in cutting-edge research, driving technological innovation.

Quality

With a sharp focus on product and service quality, we provide effective answers to the real needs of global markets.

Synergy

Our flexibility lets us make full use of technological synergies and implement operational integration across widely differing industries.

Sustainability

Our Group drives economic growth by creating solutions and projects that prioritize the global community and the protection of the planet.

Loyalty and integrity

We take pride in our openness and transparency. Discussions are in-depth, decisions taken together, promises maintained. We play by the rules, putting people and communities first.

Freedom with responsibility

We’re free thinkers with an entrepreneurial spirit, we take the initiative and take responsibility for the results of our work. If we make a mistake, we see it as a valuable learning opportunity.

Innovation

We’re guided by a passion for research and innovation.

Partnership and cooperation

We build long-term, mutually respectful, rewarding business relations with customers by working together. Working together because together we’re stronger.

Belonging

Our roots run deep, yet our vision is decidedly future-focused.

SACMI: a global presence

Dialogue with stakeholders and materiality analysis

SACMI sees its relationship with all stakeholders as crucial to both business and the value creation process. The term ‘stakeholders’ refers to all those internal and external subjects who interact with SACMI on a daily basis and have a specific interest in attaining the organization’s goals from an economic, environmental and social perspective.

Relations based on dialogue and continuous involvement reflect the company’s sense of responsibility with regard to the communities with which it interacts and its wish to create shared, lasting value. Accurately identifying one's stakeholders through the ongoing monitoring of expectations, needs and opinions provides a solid basis for an effective engagement process.

Stakeholders are those subjects on which an organization depends for its survival: for SACMI these are its members, employees, partners, suppliers, customers, public institutions, the academic and research world (including universities and schools), professional associations, other industry-related operators, trade unions, the media, and the local and international community.

SACMI takes a proactive approach towards a plurality of worldwide interlocutors. It promotes constant dialogue to listen to their needs, as it is

acutely aware that such discussions provide mutual opportunities for growth and development.

As part of ESG auditing, materiality analysis aims to identify environmental, social, economic and governance aspects considered relevant and significant for SACMI's businesses and its stakeholders

In recent years, several standardization and regulatory bodies have expanded the concept of materiality within an ESG context. More specifically, the Corporate Sustainability Reporting Directive (CSRD), approved in late 2022 by the EU, and the International Sustainability Standards Board (ISSB), recently established by the International Financial Reporting Standard (IFRS) Foundation, refer to the double-materiality concept.

SACMI has therefore chosen to conduct an initial analysis of dual relevance by mapping and quantifying not just the impacts (positive or negative, actual or potential, short- or long-term) that its activities might directly or indirectly have on the environment, people and human rights (Impact Materiality), but also the risks and opportunities that ESG aspects can exert on its resilience, performance and Business Continuity (Financial Materiality).

Professional associations and media

Specifically, 16 potentially material issues and the impacts associated with them were identified beginning with the material topics identified in 2022, as per the main international standards and frameworks adopted in sustainability reporting (GRI Standard, SASB, TCFD, ESRS), and by way of two workshops involving the main corporate areas. These topics have, traditionally, been grouped within seven sustainability areas Governance, Environment, Human Resources, Economic Responsibility, Suppliers and Partners, Local Community, Product and Customer Responsibility.

The 16 topics and their related impacts were assessed by the workshop participants and the personnel of Italian companies of the SACMI Group by way of a questionnaire. To identify the ESG issues and impacts that are truly ‘material’ for SACMI, a so-called materiality threshold was defined with regard to analysis concerning both Impact Materiality (generated impacts) and Financial Materiality (impacts suffered).

At the end of the entire process, the results were assessed and validated by all members of the Organization's internal Workgroup.

For each of the 13 topics found to be material for SACMI, the following table describes the main impacts the company’s activities have on the economy, the environment and people, including any impact on human rights, and identifies the company activities that generate, directly or indirectly, the identified impacts. The main risks and opportunities to which the Organization is exposed in the short, medium and long term are also illustrated. Lastly, the 2030 Agenda Sustainable Development Goals (SDGs) associated with each material topic are presented.

AREA: Human Resources MATERIAL ISSUES: Resource development and training

RELATIVE IMPACT OF SACMI (positive and/or negative):

• Workers have the opportunity to embark on a path of professional growth and realize their full potential

• Availability of courses to strengthen and develop professional skills

• Capacity to attract and retain resources and ensure stable employment

RELATIVE IMPACT ON SACMI (positive and/or negative):

Level of exposure to operational risks linked to inadequate technical and/or soft skills on the part of company personnel

• Worker motivation and retention, with a potential impact on company ‘attractiveness’

AREA: Human Resources MATERIAL ISSUES: Workplace health and safety

RELATIVE IMPACT OF SACMI (positive and/or negative):

Protection of the well-being, health and safety of employees and all individuals whose tasks are under the direct control of the organization (e.g. temporary workers, contract researchers, interns, etc.)

RELATIVE IMPACT ON SACMI (positive and/or negative):

• Corporate administrative liability for accidents in the workplace (fines, legal action, damage to corporate image, suspension of production, etc.)

AREA: Human Resources MATERIAL ISSUES: Welfare and life-work balance

RELATIVE IMPACT OF SACMI (positive and/or negative):

• Offering a positive working environment and implementing a set of programs intended to improve employees’ work-life balance results in their psycho-physical well-being, with consequent impacts on the degree to which they can effectively realize their full potential

RELATIVE IMPACT ON SACMI (positive and/or negative):

• Level of exposure to operational risks linked to staff turnover and insufficient employee retention

• Level of exposure to risks associated with an increase in absenteeism

AREA: Environment MATERIAL ISSUES: Environmental responsibility

RELATIVE IMPACT OF SACMI (positive and/or negative):

• Protection of ecosystems and preservation of biodiversity

• Safeguards for local communities/areas concerning exposure to extreme weather events (e.g. floods, hurricanes, desertification, etc.)

RELATIVE IMPACT ON SACMI (positive and/or negative): Level of exposure to operational risks related to energy market volatility

AREA: Environment MATERIAL ISSUES: Energy efficiency

RELATIVE IMPACT OF SACMI (positive and/or negative):

• Possibility of lowering energy costs through energy efficiency actions/projects

• Safeguards for local communities/areas concerning exposure to extreme weather events (e.g. floods, hurricanes, desertification, etc.)

RELATIVE IMPACT ON SACMI (positive and/or negative):

• Level of exposure to operational risks related to energy market volatility

Integrated Annual Report 2023 / SACMI Group / Dialogue with stakeholders and materiality analysis

AREA: Environment MATERIAL ISSUES: Decarbonization

RELATIVE IMPACT OF SACMI (positive and/or negative):

• Protection of ecosystems and biodiversity

• Exposure of local communities/areas to extreme weather events (e.g. floods, hurricanes, desertification, etc.).

Accentuation or mitigation of climate migration

RELATIVE IMPACT ON SACMI (positive and/or negative):

Adoption of low-emissions components with consequent prevention of sanctions resulting from noncompliance with laws and regulations (also of a voluntary nature)

AREA: Governance MATERIAL ISSUES: Contrasting corruption

RELATIVE IMPACT OF SACMI (positive and/or negative):

• Protection of the well-being, health and safety of employees and all individuals whose tasks are under the direct control of the organization (e.g. temporary workers, contract researchers, interns, etc.)

RELATIVE IMPACT ON SACMI (positive and/or negative):

• Corporate administrative liability for accidents in the workplace (fines, legal action, damage to corporate image, suspension of production, etc.)

AREA: Governance MATERIAL ISSUES: Ethics and integrity in business conduct

RELATIVE IMPACT OF SACMI (positive and/or negative):

• Availability of investment/capital for the benefit of the individual company and the wider economic ecosystem in which it operates

• Well-being and prosperity of the main stakeholders with whom the Organization interacts

RELATIVE IMPACT ON SACMI (positive and/or negative): Prevention or (vice versa) imposition of administrative/prohibitive/criminal sanctions stemming from any non-compliance with laws and regulations (also of a voluntary nature)

AREA: Economic responsibility, suppliers and partners

MATERIAL ISSUES: Supplier management and assessment

RELATIVE IMPACT OF SACMI (positive and/or negative):

• Availability of raw materials and products/services of high environmental and social performance

• Management of environmental/social impacts along the supply chain

• Well-being and prosperity of all stakeholders along the supply chain RELATIVE IMPACT ON SACMI (positive and/or negative):

• Level of exposure to operational risks related to market volatility

• Product/service innovation

AREA: Local communities MATERIAL ISSUES: Relationships with local communities

RELATIVE IMPACT OF SACMI (positive and/or negative):

• Availability of investment/capital for the benefit of the individual company and the wider economic ecosystem to which it belongs (e.g. the industry, the geographical area etc.)

• Improvement of local socio-economic conditions

RELATIVE IMPACT ON SACMI (positive and/or negative):

• Reinforcement or erosion of the organization's reputation in the eyes of its key stakeholders (e.g. customers, financial institutions, investors, etc.)

AREA: Local communities MATERIAL ISSUES: Partnerships with schools and universities

RELATIVE IMPACT OF SACMI (positive and/or negative):

• Well-being and prosperity of the main stakeholders with whom the Organization interacts (e.g. employees, local communities, business partners, etc.)

• Development of the innovative, productive and economic capacity of the area and the market within which the company operates

RELATIVE IMPACT ON SACMI (positive and/or negative):

The Organization’s capacity to attract investment and access capital

AREA: Product and customer responsibility

MATERIAL ISSUES: Product quality and safety

RELATIVE IMPACT OF SACMI (positive and/or negative):

• Safeguards for the environment, biodiversity, ecosystems and the people in areas where SACMI operates

RELATIVE IMPACT ON SACMI (positive and/or negative):

• Customer acquisition and retention levels

• Compliance with market-required product quality and safety levels

Reinforcement or erosion of the organization's reputation in the eyes of its key stakeholders

AREA: Product and customer responsibility

MATERIAL ISSUES: Capacity for innovation

RELATIVE IMPACT OF SACMI (positive and/or negative):

Market availability of products with high environmental performance

RELATIVE IMPACT ON SACMI (positive and/or negative):

• Reinforcement or erosion of the organization's reputation in the eyes of its key stakeholders

For further information on the tools used to monitor organizational processes, please refer to the specific sections.

Integrated Annual Report 2023 / SACMI Group / Dialogue with stakeholders and materiality analysis

Partnerships

The materiality matrix

The above-described results stem from an aggregation of the responses obtained from the corporate population and the participants in the two workshops. These are illustrated in the materiality matrix shown in the figure. Note that "internal stakeholders" refers to the main members of the ESG data collection workgroup, involved via workshops, while "external stakeholders" refers to the corporate population. Financial materiality is represented by the size of the topic-related circle.

The topics shown to be material and the relative impacts associated via the above-described process are generally in line with the material topics of the previous reporting cycle. Specifically, the new topics identified for 2023, as compared to 2022, refer to the area of Product and customer responsibility, Economic responsibility, suppliers and partners, and Environment.

More specifically, reference is made to:

• Capacity for innovation

• Product quality and safety

• Supplier management and assessment

• Decarbonization

In accordance with the logic by which a topic is considered material if it is a priority from the perspective of Impact Materiality, Financial Materiality or both, Decarbonization is deemed material as it obtained the maximum rating with respect to financial materiality, despite being below the threshold established for Impact Materiality.

2023 closes a three-year period of excellent performance for the business, the best in SACMI's history.

Throughout the first part of the year, order acquisitions for new installations remained strong. The slowdown observed in the second six months was, in many respects, predictable and cyclical. It was the result of a fairly prolonged period of over-investment in output capacity, itself partly an offshoot of post-lockdown policies enacted by governments in several countries as they sought to stimulate industrial production and provide consumers with greater liquidity in the Covid/post-Covid period.

Higher interest rates also contributed to this cyclical inversion by causing a downshift in global construction; this occurred in parallel with a financial crisis in the Chinese construction sector. Moreover, worsening geopolitical tensions - first and foremost (but not only) the Russia-Ukraine conflict - placed constraints on the free movement of goods.

In the latter part of 2023 and, to an even greater extent, in early 2024, this generated a significant falloff in global demand for tiles, with a marked slowdown in customers' investment projects.

Against this backdrop and despite greater competitive pressure from Chinese competitors as they struggle with sluggish domestic demand, SACMI maintained shares and volumes across all markets.

Technologies and markets

In 2023 the total number of Continua plants installed worldwide rose to 170, confirming its status as the go-to solution for all companies looking to enter the large ceramic slab market and advantageously manufacture coordinated sub-sizes.

1.1

Tiles

SACMI maintained shares and volumes across all markets. Digitalization and automation of plants continues apace to improve the finished product and help customers innovate

Simultaneously, new solutions in the range (PCR2180 and PCR210) have started to gain ground, with major projects finalized both in the traditional markets of Italy and Spain but also in China, Vietnam, India and the Far East.

With traditional pressing instead, 2023 saw the arrival of new, strengthened high-added-value packages (energy, environment and self-diagnostics kits). Sales of accessories were high, with the SPE new Plana ejector performing particularly well. Moreover, a new family of PHC Red Edition presses - manufactured directly in SACMI Nanhai - was launched to maintain leadership across Asia.

Trends in body preparation continue to favor larger machines (mills and spray dryers are increasingly larger and more powerful) as they raise efficiency and contain costs: several projects have been implemented in South America, especially in Brazil where SACMI retains its position as the leading partner for the switch from red bodies to porcelain stoneware.

Moving on to kilns the FMA Maestro remains the world’s best-selling firing solution. ‘Widemouthed’ configurations designed to fire large slabs are particularly popular on account of their reliability. The FMD Maestro range of new fully digital solutions has also been expanded, with various projects completed around the globe.

In the end-of-line area, 2023 saw the company make the strategic decision to expand the finishing range by attaining 100% ownership of BMR, leading to new projects and synergies in Europe, North Africa and Brazil.

After several months of steady investment, Turkey too has felt the impact of fierce Chinese competition as rivals seek to make it a strategic bridgehead from which to enter European markets. In areas where the Chinese competition is considerable, the Business continues to focus on safeguarding its position in the pressing arena and, more generally, on strengthening the SACMI Nanhai facility, pivotal to maintaining a presence in China’s ‘economic sphere’.

In Asia, India remains the leading country in

terms of both completed and potential projects, as many customers are leaning towards the high end of the market.

Product strategy

In 2023, SACMI continued to follow a threepronged strategy: digitalization/automation of ceramic processes and plants, their sustainability, and ceramic products and their innovation The aim is to bolster SACMI's position as a supplier of integrated industrial systems by deploying strategies that focus on the finished product and deliver solutions designed to put customers on the path to success.

More specifically, 2023 saw us move closer to total integration-digitalization of ceramic line machines, from implementation of new filling devices on the Continua+ to coordination with Deep Digital devices (DHD and DDG). The result: the creation of new products that offer texture and aesthetics on a par with marble and natural stone, offering customers fresh market opportunities.

One of the year’s key events was SACMI Ceramic Innovation Open Week held in parallel with the Cersaie fair. Taking place in both Imola and Casalgrande - and involving SACMI’s product design partners, BMR and Stylgraph - the event garnered highly positive feedback, in terms of both attendance (over 400 people) and appreciation.

Part of the new Open Labs format, the Open Week provided an opportunity to showcase new solutions such as the V-Nature devices on the Continua+, which seamlessly combine in-body and on-surface decoration. Also on show was the new hydrogen kiln prototype, alongside the pure hydrogen production and storage station at the Salvaterra facility. The week also highlighted the work done by the Full Digital Decoration Laboratory. Here, Tile-related digital printing know-how is being extended, with good growth opportunities, to other sectors such as Metal Packaging.

The Open Week offered a unique opportunity to respond to customers seeking to differentiate their products in terms of technology (e.g. the

ability to enter new segments with higher added value), production process sustainability and digitalization.

Customer Service

Improving on an already-impressive 2022, Customer Service performed outstandingly during the year, achieving record results.

Alongside encouraging spare parts sales, 2023 saw consolidation of the new Smart and Secure Service scheduled maintenance-assistance plans. Increasingly appealing to customers, these plans have led to the signing of new contracts and won over new customers (e.g. Mexico, Turkey, etc.). Similarly - and in synergy with the new digital services (S.P.A.C.E.) - the company continued its strategy of strengthening local facilities (new Rio Claro Technical Center in Brazil, the launch of the Morbi area technical hub in India). In parallel, scheduled maintenance plans and indepth training for SACMI machines and plants were promoted.

This explains why, despite significant shrinkage in global demand, 2024 could still be a positive year for SACMI, with the value proposition being further enhanced by focusing on the finished product, digitalization, plant sustainability and state-of-the-art customer support.

Quality control

Key technological innovations

Expansion of the machine range with a sharp focus on the development of ultra-large spray dryers to optimize production and boost overall process efficiency. Development of the ‘hybrid’ spray dryer (gas-hydrogen and gas-electric) completed.

On Continua+, consolidation of the latest models in the range, with more versatile management of sub-sizes (PCR2120), higher speeds and a wider compaction front (PCR2180).

New V-Nature devices for the controlled deposit of powders on the compaction belt and the creation of combined in-body and on-surface decorations have been incorporated on the Continua+. Used in combination with the DHD and DDG decorators, these devices provide 3D texturing on a par with natural materials, opening up new fields of use in the furnishing and interior design sectors.

In traditional pressing, the new high-added-value Self-diagnostics kit, Energy Saving Pack and P. Back Environment kit were upgraded. This approach, which will also involve medium-term development, aims to make the machines more energy-efficient, allow recovery-reuse of raw materials and streamline any repair work in the event of breakdowns (i.e. greater plant availability).

The exclusive DDG system for the creation of material effects and textures continues to perform well on the market. The machine range was expanded with new variants (e.g. specific heads for water-based inks) and upgrades to the CRONOs graphics control software.

Alongside improvements to coordinated DHD+DDG digital applications, new mechatronic systems (e.g. alignment devices), capable of executing the ultra-precise combined application of inks and materials while reducing waste, were also developed.

The Maestro kiln range was developed further, most notably the FMD digitally-controlled version, which is designed to optimize consumption, minimize emissions and maximize product quality. Design, development, construction and testing of the world’s first kiln (FMH) to be fueled with 100% hydrogen (zero emissions) proceeded apace. Further improvements were also made to the zero fuel dryer, designed to augment factory energy efficiency and re-use the heat contained in the kiln fumes. Construction of the new gas-electric hybrid dryer SACMI Forni&Filter continued to develop and market solutions that recover thermal waste from the chimney using heat exchangers. First successful installation of the new RTO-UP system for post-combustion of the organic compounds found in the kiln fumes.

Completion of the D-Line range for packaging/sorting with the new high-performance D-Roll packaging machine and the new D-Pick&Place palletizer. Consolidation of process control systems (new Flawmaster for finished product quality

control in the sorting zone) and development of a new monitoring system for unfired materials leaving the forming zone (OPTIMA).

Development of HERE modules dedicated to product quality and maintenance control/planning continues. First automatic batch tracking systems covering the entire production line installed.

Body preparation

Development of gas-hydrogen and gas-electric

new hybrid ATM

Continua+ | V-Nature and Deep Digital

Forming through-veining

New devices for digital

-250,000 consumed on each press kWh/year

Drying and firing

100 of raw materials recovered tons/year -66% to repair mean time

Consolidation of the and kiln heat recovery solutions (RVE+RVA)

“zero fuel” dryer

RTO-UP

New system for post-combustion of organic compounds in kiln fumes

Impact on sustainability

Energy Thanks to low consumption (0.04 kWh/m2), the 170 Continua lines in operation worldwide have saved 143 GWh of electricity compared to traditional lines of equivalent productivity, helping prevent the emission of over 57,000 tons of CO2 into the atmosphere. Digitally-controlled Maestro FMD kilns have reduced heat energy consumption and related CO2 emissions by 7%. During 2023, the 11 Maestro FMD kilns in operation saved, compared to traditional kilns of equivalent capacity, 2,400 MWh thermal meaning 5,200 tons less CO2 eq in the atmosphere.

Consolidation of the Zero Fuel’ dryer range, designed to boost factory energy efficiency and retrieve thermal waste from kiln fumes. Compared to a traditional dryer, consumption is reduced by 7,700 MWh thermal, preventing the in-atmosphere emission of 1,500 tons of CO2 eq per year.

New energy packages on the PH presses reduce their electricity consumption by up to 25%, the equivalent of 250,000 kWh per year per press.

Emissions

Decarbonization

Solutions for retrieving thermal waste from the chimney (via heat exchangers) reduce heat loss. In the configuration in which the recovered hot fumes are directed to the spray dryer, consumption is reduced by 3,250 MWh thermal, preventing the emission of 650 tons of CO2 eq per year per production line.

In 2023 the first innovative RTO-UP post-combustion system was completed, successfully removing 95% of the organic compounds (VOC) and odors in the kiln fumes.

First prototype of an electric generator for spray dryers with a hybrid power supply (gas+electric). First trial in the lab.

Compared to traditional kilns, Maestro FMH kilns (hybrid gas-hydrogen with mixes containing up to 50% H2) reduce CO2 emissions by as much as 23%. If powered by a fuel mix containing 50% hydrogen, each FMH kiln would allow a manufacturer to reduce direct CO2 eq emissions by more than 1,500 tons per year.

Design, development and construction of the world’s first kiln to be 100% hydrogen-powered, with zero CO2 emissions into the atmosphere. Each FMH kiln powered by 100% hydrogen from a renewable source would avoid the emission of approximately 6,800 tons of CO2 eq each year. This kiln lets users modify the gas-hydrogen mix. By increasing the proportion of hydrogen from 50% to 80% the reduction in total emissions would more than double (-55% vs -23%). If the kiln were to run on H2 only, that figure would jump to 100% (zero-emissions kiln). Following start-up, completed in October 2023, SACMI performed the first firing tests on the new 100% hydrogen-powered kiln. In the coming months, the company aims to continue quality tests on customer-supplied products.

The new gas+electric hybrid dryer provides an opportunity to partially decarbonize the process. Each of these new machines can reduce consumption by 1,460 MWh thermal lowering emissions by up to 290 tons of CO2 eq per year if powered with electricity from renewable (photovoltaic) sources.

Raw materials/ waste/ process control

Development of special DHD machine heads for the use of water-based inks to reduce the use of solvents and pollutants. Each new DHD machine that uses water-based inks prevents the emission of approximately 50 tons of CO2 eq per year.

The ‘wet’ part of DDG decoration has also been adapted to use new heads for water-based (not solvent-based) glues. Each new working DDG that uses water-based glues prevents the emission of approximately 150 tons of CO2 eq per year.

In general, development of new alignment devices for coordinated DHD+DDG applications has further optimized the use of raw materials (inks, glues, grits and effects), with an accompanying reduction in water and energy consumption.

On the 170 Continua+ lines installed worldwide, ultra-low hydraulic oil requirements (90% less than on a traditional or discontinuous press) have prevented the production of over 73,000 liters of used oil

New process control and feedback systems (OPTIMA) have reduced fired waste by eliminating defects before they can reach the kiln. This means materials can be recycled, thus avoiding the subsequent processing (firing, decoration, etc.) of defective items and the associated waste of energy and resources. This makes it possible to achieve savings of approximately 400 MWh thermal per year on each line, cutting CO2 eq emissions by 80 tons What’s more, recycling the raw waste back into the preparation process can cut raw materials consumption by 690 tons per year.

Use of the Environment P.Back Kit on PH presses allows the retrieval of up to 100 tons/ year of raw materials and their reuse in the process. With the Self-diagnostic Kit, instead, the Mean Time to Repair can be reduced by up to two thirds, streamlining plant control on the part of the operators.

Decarbonization

FMH Maestro Kiln

-23%

CO2 emissions

Hybrid gas+electric dryer

-1,500 tons/CO2 eq emitted every year

-1,460 MWh thermal -290 tons/CO2 eq emitted every year

Raw materials/waste/process control

DHD (Digital Humid Decoration)

Hydrogen kiln

Development of first hydrogen-fuelled kiln

-6,800 tons/CO2 eq emitted every year 100%

Continua+

special heads

Development of for water-based inks

-50 tons/CO2 eq emitted every year

Energy consumption the lowest on the market

0.04 kWh/m2

90% less oil needed compared to a traditional press

Integrated Annual Report 2023 / SACMI Group / Tiles

-73,000 liters of waste oil

Sanitaryware

In 2023, as in 2022, the Business benefited from the actualization and/or rebooting of multiple projects as the industry exited the Covid-induced slowdown. End-of-year results were excellent, the best ever for the Business.

The various product families have regained significant volumes, favoring saturation of production facilities. These results look even more encouraging when one considers that the industry has been struggling with the rising cost of electronic components, robotics and refractory materials, all of which are widely used in automation projects.

Markets

In Italy, SACMI continues to supply prestige brands. Alongside standard machines, it implements innovative projects such as robotic finishing and glazing, which have also benefited from government incentive schemes. More specifically, the installation of new RobotClean stations continues apace, confirming the standard-setting soundness of this new product.

Looking further afield, the key markets continue to trend towards highly automated projects, not just in Europe but also in Turkey, Bangladesh, Brazil and China. This matches and rewards a Business strategy that seeks to adapt automation solutions to customers’ individual needs.

All the major groups have again placed their confidence in SACMI products, especially so in Mexico, China, Portugal, Finland, Hungary, France, China and the United Arab Emirates. Note also that numerous complete plant projects are under way.

1.2

The 2023 result was the best ever. All the major Italian and foreign groups renewed their confidence in SACMI products.

Casting and glazing solutions, plus highly innovative projects such as robotic finishing, played pivotal roles

These include the launch, in Canada, of the world’s first sanitaryware factory to be powered with 100% renewable ( hydroelectric ) energy The plant is expected to become operational in 2024-25.

In the general industry segment, where most sales are concentrated in Italy, promotion of Gaiotto-supplied technology continues, both in and beyond the ceramic sector.

Products and projects

On all markets, the standard machines and plants are dominated by the casting and glazing product families. One of the year's key milestones was the sale of the 280 th AVM which remains the world’s best-selling high-pressure casting solution.

Investment in highly innovative projects continued in 2023 (albeit with some postponement in order to prioritize order execution and reduce the considerable backlog carried over from 2022): the AVI one-piece (large rim) project and the development of automatic green/white finishing, with the latest release of the SmartOffline NG software offer two outstanding examples. The latter project covers a range of uses, underlining just how important it is for SACMI to retain mastery of all those technologies, software included, that help factory personnel implement automation processes.

Development of the RobotLoad (automatic loading-unloading) and Qualitrack (robotic quality control) solutions continued throughout the year, the goal being to adapt the SmartOffline software to these stages too. From a digitalization perspective, in-Cloud connection of machines via software (HERE and MDC, Machine Data Collector) and dedicated sensors on production modules are increasingly significant.

With regard to sustainability, the in-the-field projects with the most direct impact include - in addition to the previously mentioned factory powered by renewables - consolidation of the new waste water ultra-filtration system prototyped in 2022 and successfully installed by a major customer in early 2023.

Another step towards enhanced sustainability was made with the development of glazing stations that feature resin screens to facilitate cleaning and glaze recovery.

More generally, a medium-term strategy aimed at reducing the average weight of manufactured items is being implemented. This could lead to raw material savings of up to 30% and energy savings of up to 10% . However, it will also pose technological challenges in order to prevent any warping or functional-mechanical issues that might stem from thinner, lighter articles. This project is already at an advanced stage of development with a major Italian customer.

Again from an environmental viewpoint, in 2023 the Business pioneered sustainable packaging ’, a project that seeks to reduce/recover/re-use machine packaging. Two pilot projects are under way with two leading Italian customers: once they’ve been completed, the solution could be extended to other SACMI businesses/production facilities.

Scenarios

Following two years of uninterrupted growth, 2023 delivered an excellent result. In the second half of the year, however, ever-higher production costs and worsening geopolitical tensions led many customers to cut back on investment, downsizing or postponing projects, including some that were already under way: a volatile and complex market that, given the high cost of credit, makes it increasingly burdensome for our customers to maintain high levels of stock. Such signs are not to be underestimated because in 2024 the focus will be on cost control and providing greater added value for individual product families.

Customer service continues to play a crucial role, not just in terms of its contribution to the business but also as a strategic tool for maintaining direct contact with customers, regardless of new machine sales performance. From this perspective, customers are increasingly appreciative of SACMI's ‘consulting’ services, which involve periodic contact and on-site visits. Further growth in this direction will be strategically vital to strengthening mutual trust with customers, also at the technical team level.

Key technological innovations

Modelling / Molds A new automatic machining center for the manufacture of molds and case molds using CAD/CAM milling techniques was started up. This investment reflects the ongoing trend towards producing molds with ‘by tooling’ technology, which is fast replacing traditional ‘by casting’ flows (the former already accounts for 60% of output). Digitalization of the modeling process has been extended to include the production of supports, prototypes, molds and case molds.

Creation of highly automated casting projects with multi-mold AVB machines. Development of AVI casting plant accessories for the production of complex items such as one-piece WCs. More generally, SACMI continues its strategy of combining high module productivity/flexibility with finishing automation.

Development of automatic finishing solutions both on casting modules (green finishing) and on dried articles (white finishing, RobotClean). Expansion of the Smart Offline platform to extend its use to green finishing and complex multi-robot lines, together with white finishing and glazing, areas in which the system has demonstrated several key advantages such as faster programming and optimization of patterns and processes.

Acceleration of the Qualitrack 2.0 automatic sanitaryware sorting project, involving collaboration with a major international digital solutions provider and the University of Bologna. The goal: to be ready to present the latest system version, which incorporates AI, at upcoming trade fairs.

Impact on sustainability

Water The first plant in Italy to retrieve and treat water from the pressure casting department using ultra-filtration technology was tested: in the first 7 months alone, this saved approximately 1,500 cubic meters of water, plus considerable quantities of solid precipitate that provide high-grade raw materials to feed back into the process. Studies aimed at delivering a solution that recovers 90% of the water used throughout the production process - with the development of standard solutions for differently sized plantshave been completed.

Here, collaboration with the University of Bologna, which involves support from final-year students, is ongoing.

A highly innovative project located in North America - and the first of its kind in the world - will see sanitaryware manufactured in a plant powered by electricity from renewable sources (hydroelectric). The keystone of that project is the new Riedhammer TRS-E full electric roller kiln.

In Europe, development of a high-density tunnel kiln (with double-decker kiln cars) continues: this will reduce consumption and emissions as it can be fueled with gas-hydrogen mixtures containing up to 80% hydrogen.

A new self-cleaning porous resin panel is being tested to simplify cleaning of glazing booths and raise the percentage of recoverable solid glaze. In 2023 the design stage was completed; a prototype has already been installed in the Lab pilot plant glazing module and is undergoing tests with a key customer.

A system that recovers the scrap produced in ‘by tooling’ mold-making has been developed. The aim is to achieve total re-use of resin by suitably grinding and treating it so it can be employed as a polymeric filler in the primary formula. The possibility of recovering all the swarf for use in supports, case molds or paneling is also being explored.

A sustainable packaging pilot project was set up to reduce packaging by using more sustainable materials, retrieving/reusing the packaging used for machines sold and shipped in Italy and some parts of Europe.

Development continues to focus on achieving complete automation of the different stages of production. This also aims to improve health and safety in the factory with operators increasingly assigned to off-line supervision and programming tasks instead of work that is physically tiring, repetitive and/or potentially dangerous. In 2023 there was a sharp focus on the development of automatic finishing, both green (in Europe casting modules for the production of fully automatic WCs were tested) and white (in Italy, an automatic line with 14 robots in series for the complete finishing and glazing of WCs, integrated with automatic quality control). Development

of a new, complete white finishing (RobotClean) + robotic glazing (RobotGlaze) line was also completed. Installation and start-up are expected in 2024, the goal being to combine technical solutions with customized plant layouts that reflect actual production requirements.

Tableware

After the sudden slowdown in 2020, the sector has made a slow but encouraging recovery. Order acquisitions picked up rapidly in the second half of 2022 when orders for both 2022 and 2023 were received.

Markets

Portugal, Romania, Brazil, United Arab Emirates, India, Bangladesh are some of the markets that saw key projects finalized during the year.

Specifically, in the ‘old world' - and in keeping with the strategy of leading European retailers - the market showed a near-obsession with sustainability issues. For example, SACMI supplied a customer with all the key machines needed to finalize the first European tableware (plate) manufacturing project to use ceramic scrap as a raw material: a project rewarded by the leading European retailer, who in 2023 launched the first plate collections made from recycled material.

Further successful projects include a new production line for cups with handles, located in Portugal . Major cup line orders were also received in India, where the outlook is bright on account of the Indian government's decision to limit imports of Chinese products.

The steadily recovering Tableware market is increasingly focused on leveraging sustainability to add value to finished products. Some of the year’s most significant projects included complete plants, with SACMI sole supplier for the entire machine range Integrated Annual Report 2023 / SACMI Group / Whiteware

Forming / Finishing

Products and projects

The most noteworthy projects included two complete plants, the only ones in the world to be built during this period, with SACMI sole supplier for all the machines in the portfolio These projects offer a not-to-be-missed opportunity to implement further synergies among SACMI Group companies, opening the way to the promotion of new products and the delivery of new integrated, automatic production lines.

In tableware firing, most sales are accounted for by kilns for glazed items, an area in which Riedhammer’s expertise and the quality of their solutions are unrivalled.

In terms of automation-linked innovation, major projects carried out in the field of automatic finishing gained considerable market acknowledgement. Spray glazing systems are increasingly in demand as replacements for traditional dip glazing technology as they allow for the application of reactive glazes that produce aesthetic effects during firing.

Scenarios

Since 2022 the world’s total output of tableware machines has grown by over 45%. However, in the second half of 2023, the sector also suffered a sharp slowdown in investment. The start of 2024 was marred by unstable demand for finished products and further uncertainties regarding product types, which depends on the share of demand from the Ho.Re.Ca. sector.

Nevertheless, the year laid the basis for a further strengthening of SACMI's role in the industry: it reorganized operations, renewed the SAMA management team and bolstered its reputation with customers thanks to the successful conclusion of several projects. Moreover, its always-available support, consultancy and customer assistance services were strengthened.

Forming / Finishing

Key technological innovations

Testing of isostatic pressing line with a PHO700 equipped with dual automatic finishing for irregularly shaped and circular plates. The line was successfully started up at a key customer’s plant, with SAMA and Gaiotto involved in developing the automation.

A leading European customer doubled the capacity of its cup production line with isostatic pressing (able to process special geometries such as cups with non-circular cross-sections). The plant features automatic finishing, a robotic cup handling system and automatic handle gluing.

Consolidation of bone china tableware manufacturing expertise, with projects successfully implemented for leading customers. Exquisite yet difficult to produce, bone china tableware is valued by airline caterers as it reduces on-board weight, saving on aviation fuel.

Testing of PH700 line with

dual automatic finishing

Cup production line with isostatic pressing and automatic handle gluing spray glazing

Automatic finishing and

Impact on sustainability

European project for the manufacture of plates made entirely from production scrap: in early 2023 the project was completed with the delivery of several key machines (most notably the spray dryer) to one of our customers; Europe’s main retail player was a driving force on the project and later launched the first collections on the market.

Start-up of the isostatic cup pressing line which, compared to the classic jiggering system, delivers significant energy savings and drastically reduces waste (less than 35%).

All latest-generation kilns are equipped with heat recovery systems and optimized firing curve control to minimize consumption and emissions.

Advanced Materials 1.3

Metal

Record sales were achieved in 2023, largely driven by the sheet metal shaping press sector.

Demand for heat exchangers continued to rise. This resulted in the sale of six new PHL1500 lines (and the acquisition of contracts for another ten similar lines), three new PHL16000s (the largest presses SACMI has ever supplied on this market) and 2 PHL5000s: all these machines will go to the world's leading heat exchanger maker, with whom SACMI has enjoyed mutually rewarding business relations for years.

In parallel, the Powder Metal market continued to shrink, partly as a result of the transition towards electric mobility. Nevertheless, the latter still saw the acquisition of two new customers and the installation of some new presses for existing customers.

Against this backdrop, investment in the development of a helical gear compaction system proceeds apace: the market continues to show keen interest in the system, with the potential for concrete opportunities in the near future.

Note also that the DWL (mold wall lubrication) system has been optimized, generating strong interest from a market that continues to seek out new applications for press & sintering technology. Towards the end of 2023, work began on combining these two technologies in order to offer the market a high-density helical part manufacturing solution.

In the Cookware field, a leading European customer selected SACMI as its technological partner to launch a new project in the forming sector. This involved the supply of a 5000-ton PHP press, complete with loading and unloading automation for the cold forging process.

The record results of 2023 were driven by sales of sheet metal deformation presses (for heat exchangers).

In the hard metal segment, the quest for new opportunities continues with the development of ‘helical gear’ and mold lubrication (DWL) solutions

Key technological innovations

Development and testing of the 16,000-ton PHL press.

DWL (mold wall lubrication) optimized on powder metal presses. Optimization of the helical gear system and assessment of a combination of the two technologies (DWL+HG) to press high-density helical components.

Sale of the first 80-ton electric press - to be used in technical ceramics - to a leading American customer in the medical sector. To be installed in 2024.

Development and promotion of new smart service packages on presses. Design work began on a system that incorporates sensors on machines for the purposes of data collection, real-time operating status monitoring and maintenance planning.

Impact on sustainability

Industrialization of the DWL system, a powder metallurgy technology that eliminates the need for lubricant in metal powders thus shortening thermal cycles and, therefore, reducing consumption and CO2 emissions.

Increased expertise in the development of electric presses which, compared to hydraulic presses, cut consumption on average by up to 60-70%

Design of a system to reduce energy consumption on metal waste compaction hydraulic presses. Once the technical feasibility study was completed, a solution was put forward to a key customer.

New smart service packages for presses mean fewer inefficiencies (and, therefore, less waste of energy and resources) stemming from frequent downtimes and wear.

Advanced Materials

Refractories

Industry performance continues to be affected by geopolitical tensions which have wiped out sales opportunities in markets that were previously highly receptive (Russia, Ukraine, Iran, etc.).

Note that the persistence of the Russia-Ukraine conflict has prevented adequate coverage of the Russian refractory market, which had always been of considerable importance to the business. We are also witnessing a general slowdown in the market. This is partly due to key players having already completed projects over the last 3-4 years and a certain return of investments in Asian countries, where price competition is remarkably high.

Despite this backdrop, LAEIS has retained leadership on international markets, installing ten new presses and strengthening its positioning in China and India as a result of effective marketing of the machines produced directly by SACMI Nanhai.

The year bore the first fruits of synergy with Gaiotto: an order from a major Turkish customer for a series of pressed brick handling robots has now moved on to the executive phase.

The Korea-based project to manufacture saggers - containers made of refractory material that are used to heat-treat lithium-ion battery anode and cathode powders - was completed with the installation of three new 1,000ton hydraulic presses and a Riedhammer kiln. This solution is generating considerable customer interest due to fast-growing demand in the electric mobility sector and, therefore, for the materials used in the relative processes.

Despite the foreclosure of opportunities in once receptive areas, SACMI maintains its leadership with a range of solutions acknowledged as the most reliable on the market. First installation of the innovative sagger production solution

n general, on a refractory market which remains closely tied to the global production of crude steel, the SACMI range is acknowledged as being the most reliable and comprehensive, with good synergies between the various Group companies and production facilities ( LAEIS SACMI Imola SACMI Nanhai , then Riedhammer for the kilns and Gaiotto for automation).

All the top players remain extremely loyal and this allows us, even at a time of market sluggishness, to seize opportunities for the revamping and upgrading of existing machines. A further boost to the sale of spare parts has come from polarization of the market, with more and more large groups acquiring smaller companies, restructuring them and putting technological adaptation plans into action.

Key technological innovations

Production Inspection Consolidation of direct production of refractory presses in SACMI Nanhai, both the SACMI (PHR) and LAEIS (HPF) models, to better intercept market opportunities. Strengthening of synergies between SACMI and LAEIS to offer customers revamping plans for the already-installed SACMI machine pool.

Development of a new refractory press control system. Fine-tuning of a system for live quality control of pressed bricks, in collaboration with Gaiotto. Development of a complete plant concept (targeting the fast-growing Indian market). Upgrading of assistance packages (smart service).

Consolidation

of direct production of

refractory presses

revamping plans

between SACMI and LAEIS to provide for existing presses

New plant concept for ‘live’ quality control of pressed bricks

Impact on sustainability

Launch of a project to develop a new generation of refractory presses with low energy consumption.

For its part, Riedhammer is implementing new electric-hydrogen firing solutions to lighten the environmental footprint of the process.

A new ‘complete plant’ concept and promotion of press maintenance packages (smart service) to optimize resources and reduce waste. A new dashboard that gathers data on machine operating states was also implemented in 2023, laying the basis for further development of scheduled maintenance plans..

Advanced Materials

Technical Ceramics

Technical ceramics have a broad, diverse application range. In this sector, much of the focus is on the sale of stand-alone machines, in concert with a network of companies made up of SACMI Imola , LAEIS (presses), Riedhammer (kilns) and Alpha Ceramics (the latter plays a key role in both testing and direct production).

Riedhammer completed assembly of a lining plate line for one of the world’s leading aerospace firms and plans new investment projects for the current year.

Assembly of a cladding plate line for a global player in the aerospace sector was completed

Carbon

As in the previous year, 2023 saw stable performance, with finalization of several key projects with major players. For example, a major revamping project on a 2010 kiln was completed and two new kilns were sold in Kazakhstan and China. In Europe, instead, a key project got under way in Spain: this is now nearing the final engineering phase. Major new projects were launched in the Middle East, their timelines extending into 2025.

Sector performance remains tightly bound to the sale of heat treatment solutions for carbon electrodes and anodes (for the special steels and aluminum sectors); growth opportunities continue to be restricted by ongoing Russia-Ukraine conflict.

Projects with leading market players finalized. Kazakhstan and China stand out, as do new projects being launched in Spain and the Middle East.

Advanced Materials

Lithium

Volumes proved to be highly satisfactory. As the year progressed, the market continued its gradual shift away from China. Nevertheless, the country still retains the vast majority of lithium battery production capacity.

Several new ‘giga-factories’ are being started up in Europe, the USA and Canada . Thanks to extensive experience in the thermal treatment of anodic and cathodic powders and an excellent market reputation, Riedhammer is starting to acquire major projects in these countries. Consequently, in 2023 Europe saw an expansion of direct production, an area previously dominated by China.

More generally, the year strengthened synergies between SACMI companies with expertise in this sector, most notably Gaiotto which provides sagger handling systems for use in calcining kilns. Several new contacts were established with anodic and cathodic powder producers who are interested in acquiring grinding, spray drying and handling solutions.

Overall, the lithium market continues to grow, opening the way to fresh, strategic opportunities for SACMI along the value chain that align with the specific heat treatment phases in which Riedhammer is already well positioned.

The trend towards a partial shift of production outside China continues, with the launch of new ‘gigafactories’ in Europe, the USA and Canada.

During the year, synergies between the various SACMI companies strengthened against the backdrop of a steadily growing lithium market

Research and Development

Key technological innovations

Design and production of applications for gas kilns that run on fuel mixes with a high percentage of hydrogen

Design of a kiln combustion air pre-heat system that recycles air from inside the kiln itself (via a Venturi burner).

Design of a water heating system that uses exhaust fumes.

Optimization of electric roller kilns

Optimization of sagger automation systems for the lithium industry with optical and flaw detection sensors (to extend sagger lifespan).

Participation in new plant projects in China, Europe and USA. Analysis of supply chains and technologies for recycling used batteries

The innovative lithium calcining process that requires no saggers in the kilns continues to undergo development.

Development of a new tunnel kiln to boost productivity on calcining lines.

Consumption and emissions Recycling

Impact on sustainability

Lower consumption and emissions on kilns that use hydrogen burners or electric heating elements . Utilization of thermal waste to heat air and water.

Energy and emissions savings thanks to a new lithium calcining process that requires no in-kiln saggers.

Development of engineering and layout for a plant that grinds battery cells and separates their constituent materials.

Design-patenting of an i nnovative recycling system that uses pyrolysis in a rotary kiln design of a production process exhaust gas treatment system. Further potential plant concepts, also for the recycling of different materials, are undergoing analysis.

Consumption and emissions

New hydrogen burners and heating elements, re-use of

thanks to new system that avoids using saggers in kilns

Design and patenting of an innovative recycle system via pyrolysis in

Rigid Packaging

In 2023 the Business achieved net growth, further improving on a 2022 that had already outperformed 2021. Orders remained high throughout the year, up 26% on the previous year and outstripping forecasts by 5%. Spare parts sales also performed well, with significant gains (+19% in 2022, +44.5% in 2023 ).