1 minute read

Finance Update

With a set and hold strategy positioned for the OCR at 5.50%, the general consensus is that further increases are unlikely as this would go against the RBNZ's two most recent Forecasts in the February 2023 and May 2023 Monetary Policy Statements.

This is expected to ease by Q2 2024 once target inflation has been met. The market still remains competitive with banks fighting for market share during an era of reduced lending growth. Though interest rates aren't as cheap as they were during the dip, many have been taking advantage of the current housing market to upsize or get into their first home.

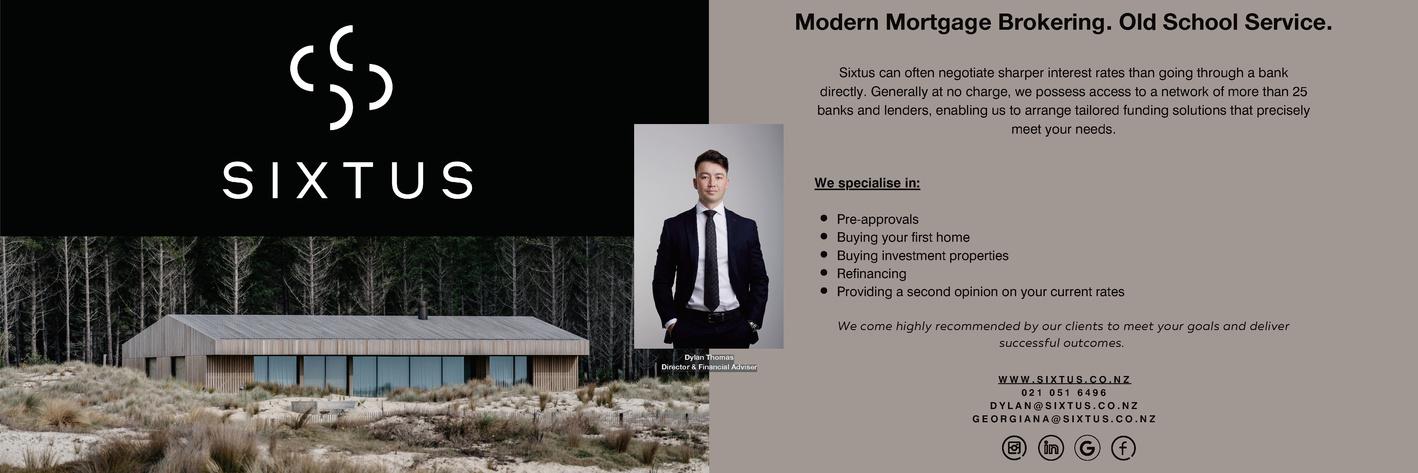

Advertisement

It's crucial to ensure your bank is providing a strong offering when buying or re-fixing which can be aided by the guidance of a Financial Adviser.