12 minute read

The Therapeutic Power of Making

By Nancy Monson The Therapeutic Power of Making Art

Like most Americans, I’ve been feeling empty, numb, shell-shocked and dumbfounded by the COVID-19 pandemic. I’ve been socially isolating as directed, except for daily walks. I am used to working from home as a freelance writer, but I’ve often had trouble concentrating on work and worry about spending even more time alone than I normally do.

A few days after the first directive to stay at home, I pulled out some of my sewing and quilting supplies, sorting through the many half-started projects, class and technique samples I’ve compiled for use “someday.” And suddenly, I was inspired and instantly so much happier.

I embarked on a “15 days of isolation” series of small art works. Part of my day is now spent designing little works, and then sewing or painting them. And while I’m creating, I forget about COVID-19 and the attendant health and financial crises it is wreaking on people around the world. My art is my little respite, distracting me from worries and giving me a sense of self-satisfaction.

'I Feel Peaceful and Removed from the Swirl'

This isn’t the first time I’ve encountered the therapeutic benefits of pursing a creative activity. When I was going through a divorce, quilting helped me to release the chaos within. When I can’t sleep, I make little drawings. And when I feel anxious and lonely, collaging helps ground me in happy memories.

“When I think about what is soothing to me about using my creativity to get through this time, it’s nature and art,” says Barbara Popolow of Arlington, Mass., who has been making little drawings of things she can view from her desk: plants, a candle, a neighbor’s window. “Putting these drawings together is like making a healing balm that soothes, repairs and strengthens. While I’m immersed in drawing, I feel peaceful and removed from the swirl.”

Likewise, Cheri Rose Bergeron of Bridgewater Corners, Vt., says “I am finding it very hard to focus on most things right now, but sewing grounds me.” Bergeron has made upwards of 80 fabric masks to donate to hospitals, family and friends.

“Making masks has made me feel like I am doing something on a small scale to help others and not just idly standing by. And in general, when I’m creating, my mind goes to a soothing place. Sewing drowns out the excessive noise surrounding me and cancels out a lot of my anxiety," says Bergeron.

Many people don’t think they are creative, while others simply feel too keyed up and anxious to know how to begin using art as therapy. They may put too much stock in making something noteworthy rather than simply drawing, painting, journaling, sewing, knitting, baking or whatever for its own sake.

But it’s the act that counts, not the end result. In fact, a recent study from Drexel University found that making art for 45 minutes a day reduces levels of the stress hormone cortisol — and you don’t even have to be good at it for art to be calming.

Ready to try? Here’s how:

Find a space to make

art. No need to have a studio or a separate room, or even a table or desk. “When I travel, I just take a little fourby-six pouch with a watercolor journal and some paints, pens and brushes,” reports Flora Bowley, an artist and yoga teacher in Portland, Ore., and author of Brave Intuitive Painting: Techniques for Uncovering Your Own Unique Style and Creative Revolution. “Don’t use a lack of space as an excuse for not starting to make art.” Advertisement

Begin with a ritual. Bowley recommends doing some yoga poses, meditating or lighting a candle to signal to yourself that you are moving into a state of receptivity and out of your everyday life. In difficult times like these, many of us are prone to overthinking, worrying and living in our heads rather than in our bodies.

“On a basic level, when you are disconnected from your physical body, it’s harder to access your creativity from that place,” Bowley says.

A ritual can help you move your awareness from the mind to the rest of the body so you can create more freely.

Play fast and loose. Do some finger painting or let some watercolors swirl on a page. “Put music on, close your eyes and draw or paint with your eyes closed for thirty seconds,” advises Bowley. “This will give you a starting point, and often the

shapes that come out of that exercise are more interesting and unpredictable than those you create with your eyes open. Focus on putting yourself in a feeling rather than a thinking state.”

Alternatively, try Bowley’s “Visual Riffing Exercise:”

I Using a marker, pen or pencil, divide a piece of paper into equal-size boxes. I Choose a universal shape —like a circle, square, rectangle, triangle or diamond — and draw it in each box. I Go from one box to the next, embellishing the shape you’ve chosen in different ways. For example, if you’ve chosen a circle as your shape, color it in completely in the first box, put tiny dots in it in the second box, put lines inside the circle in the third box, put a square in the circle in the fourth box and so on.

Note: Instead of a shape, you can riff on a theme like “home” or “isolation.”

“Each box gives you an opportunity to do something different and spontaneous, and loosens you up,” Bowley says.

Buy a kit or subscription. Companies like Creative Art Box, Let’s Make Art, Sketchbox and SmartArt are offering monthly subscription art kits that can inspire and motivate you so you don’t have to start from scratch.

Order online. You can order online supplies and kits from craft stores Joann and Michaels and either have your supplies delivered or pick them up in some areas.

Watch a video. Sites like Blueprint, Skillshare and Udemy run online art and creativity classes. And in addition to her regular online painting courses, Bowley is offering free “Together Apart” gatherings at 4 p.m. PT on Wednesdays and 10 a.m. PT on Saturdays where you join her virtually in her Portland studio to paint.

Nancy Monson is a writer, artist and coach who frequently writes about the connection between creativity and health. She is the author of Craft to Heal: Soothing Your Soul with Sewing, Painting, and Other Pastimes. Connect with her on Instagram

Source: www.nextavenue.org

How To Keep Your Retirement On Track

in a World of Low Returns

Financial Thoughts with Susan Moore

By Susan Clayton Moore, J.D.

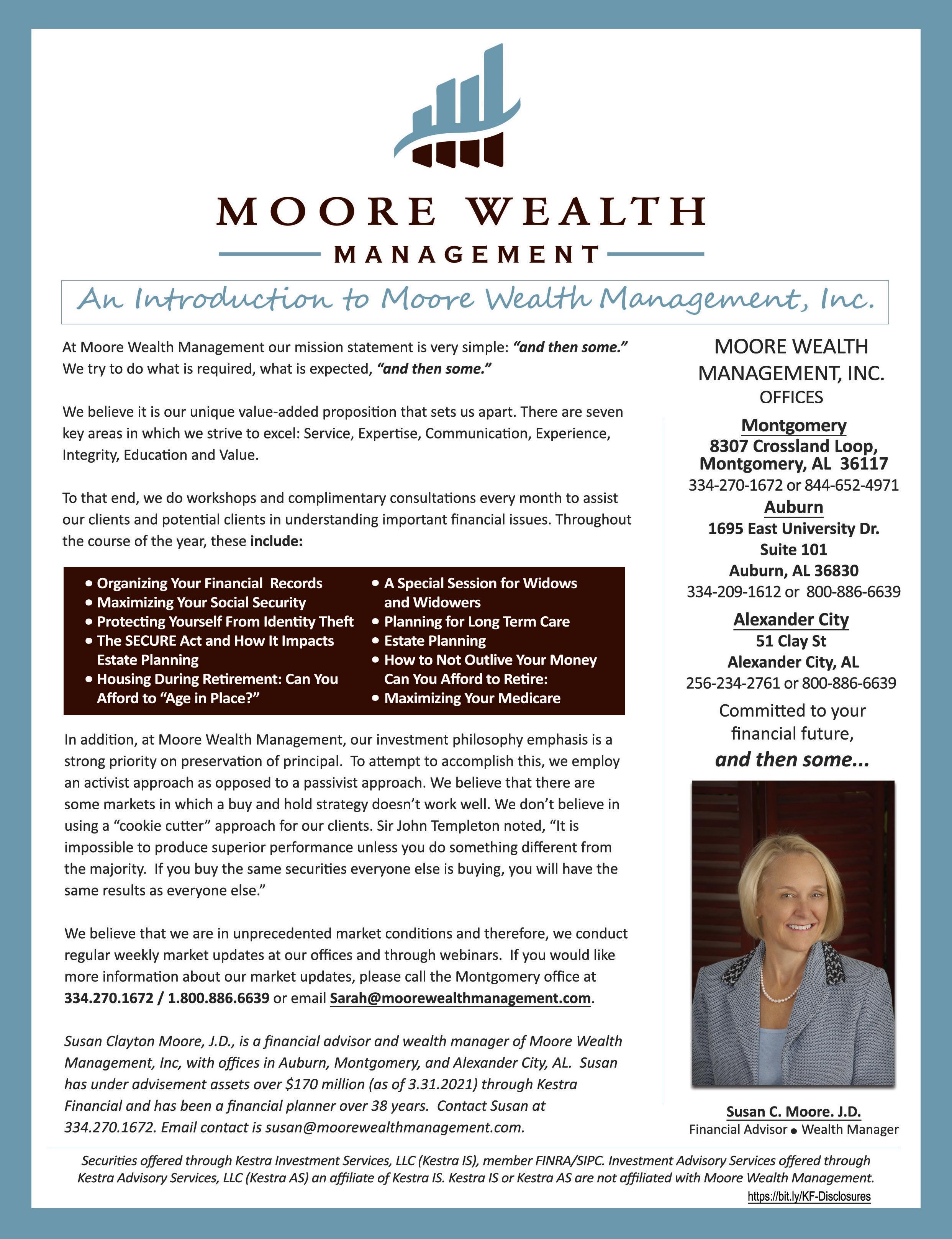

Principal of Moore Wealth Management, Inc.

As a retiree, are you at risk for outliving your income? A serious question for serious times. Recently, several key assumptions traditionally used in retirement income planning are being challenged by leading financial industry experts. Are retirees who made those traditional assumptions still okay?

For example, lately several famous market observers, including John Bogle¹, the founder of the Vanguard Group, have warned that investors should reduce their expectations for their stock market investment returns to 4% a year. Ray Dalio², founder of one of the largest and most successful hedge funds in the world, also recently warned that “investment returns will be very low going forward.”

In addition, several leading studies have challenged the validity of the traditional “4% rule.” Developed back in the 1990’s when interest rates were higher for CDs and bonds, the rule stated that if a retiree kept their withdrawals limited to 4% of their initial retirement portfolio balance, that it should provide a sustained income for thirty years of retirement. However, Wade Pfau³, a professor of retirement income at the American College of Financial Services and Michael Finke of Texas Tech University, found that given the sustained current level of low interest rates that the level of acceptable initial withdrawals needed to be limited to 2.85% to provide an income for thirty years of retirement. The Stanford Center on Longevity recently published a study that recommended that retirees should focus on sources that were not exposed to stock market risk to cover essential expenses, i.e., Social Security or an annuity of one type or another. It found that if income to cover essential expenses was exposed to stock market risk that the emotional cost of worrying about meeting expenses during a stock market downturn would prompt many investors to make ill-advised investment decisions.

On Wednesday, September 22nd, Susan Moore of Moore Wealth Management, Inc. will be conducting a complimentary webinar on methods of how to not outlive your retirement income. The workshop covers a number of issues including factoring in the above-mentioned changes to traditional assumptions, key risks (i.e., sequence rate of return and inflation), and various approaches to mitigating the risks of outliving your income.

If you would like to be included in the webinar, please call 334.270.1672 or sarah@moorewealthmanagement. com.

Susan Clayton Moore, J.D., is a financial advisor and wealth manager of Moore Wealth Management, Inc., with offices in Auburn, Montgomery, and Alexander City, AL. Susan has under advisement over $170 million (as of 3.31.2021) in brokerage and advisory assets through Kestra Financial and has been a financial planner over 38 years. Contact Susan at 334.270.1672. Email contact is susan@ moorewealthmanagement.com.

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory Services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS. Kestra IS or Kestra AS are not affiliated with Moore Wealth Management, Inc. The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney or tax advisor regarding your individual situation. https://bit.ly/KF-Disclosures

¹https://www.financial-planning.com/opinion/jack-bogle-forecasts-lowerstock-and-bond-returns ²https://www.zerohedge.com/news/2016-10-11/investment-returns-willbe-very-low-going-forward-ray-dalio-says-gold-could-prove-pr ³https://www.onefpa.org/journal/Pages/The%204%20Percent%20 Rule%20Is%20Not%20Safe%20in%20a%20Low-Yield%20World.aspx

A BOOM! FEATURE

Getting To Know You: Country Club Estates A Senior Living Community

Now Leasing in Midtown Montgomery Photos by Becca Frederick

Country Club Estates, a new affordable rental housing community is now leasing to Montgomery area seniors 55 years of age or older.

The new construction development is located at 2075 N. Country Club Drive and features 62 one- and two-bedroom apartments with units set-aside for veterans and individuals with disabilities.

Real estate developer Gulf Coast Housing Partnership (GCHP) and co-developer Volunteers of America Southeast (VOASE) worked together to construct the $12.6 million development which will contribute to the continued revitalization of Montgomery’s Mid-Town Community.

“Strong partnerships are the foundation of GCHP’s approach to real estate development and community revitalization,” said Kathy Laborde, GCHP President and CEO. “We are grateful for the support of VOASE and our financial partners who helped make this project possible.” Residents of Country Club Estates will enjoy apartment and onsite amenities that include in-unit washers and dryers, a fitness center, hair salon, outdoor pavilion, and on-site storage rental.

VOASE currently operates a center adjacent to the development and will provide and coordinate supportive services for residents.

“Working in union with Gulf Coast Housing Partnership we are excited to provide a new affordable housing option for seniors that is conveniently located near grocery stores, restaurants and health centers,” said Rob Rogers, VOASE Senior ExecutiveVice President. “Residents will also be offered additional services through VOASE and our partners, including on-site wellness checks, financial literacy training and computer classes.”

The development is financed with an Alabama Housing Finance Agency tax credit allocation, lending through NeighborWorks Capital, a capital contribution from Volunteers of America Southeast, equity investments through Stratford Capital, construction financing from BBVA and $500,000 in Affordable Housing funding from the Federal Home Loan Bank of Atlanta- through its member institution, BBVA.

Residents interested in leasing an apartment at Country Club Estates can call 334-293-0515 or visit the leasing office located at 2075 N. Country Club Dr. open Monday-Friday from 8 am – 5 pm.

After more than a year of ZOOMing for their classes, AUM OLLI members are excited to return to the classrooms when classes begin in September. Covid safety protocols will be observed in the small classes: social distancing and wearing masks.

AUM OLLI generally offers three categories of classes: discussion, active, and hands-on (do-it-yourself). Obviously, the latter two suffered during the pandemic, with only one active class continuing (Pain Management with Tai Chi) and no hands-on classes. In-person classes allow the full return of do-ityourself classes: jewelry making, pine needle basket weaving, creating art from torn paper, and decorating inexpensively for all seasons. hands-on classes. Discussion classes include World War II (two different approaches), the art class at the Montgomery Museum of Fine Arts, the brain bowl, and the history of Route #66.

Efforts to continue classes during the pandemic resulted in the creation of OLLI Shares: The University of Alabama, the University of Alabama – Huntsville, and Auburn University made some of their courses available via ZOOM. The initiative was successful enough that some offerings via ZOOM will continue through the fall term. To register for these shared courses, individuals need to become members of AUM OLLI, and register for the shared classes just like they register for the AUM in-person classes, without paying an additional fee. 12:35 p.m., also in the Center for Lifelong Learning. Other bonus opportunities include two book groups and a two-hour guided walk through the woods behind the AUM campus. Two field trips are also on the schedule, with full details to be offered a little later: wine and food tasting sessions at Peppertree Steaks and Wine (October 05, 07, 19, or 21) and a trip to Camden (December 10) for lunch at GainesRidge and holiday shopping at Black Belt Treasures.

Become an AUM OLLI member for the $50.00 annual fee and take advantage of all of these opportunities.

For details about these options, go to www.aum.edu/OLLI.

The discussion classes include some repeated classes and some new ones. The opportunity to write and print family stories and a photography course on the art of seeing bridge the discussion and AUM OLLI will continue to offer lunch presentations and bonus opportunities, programs included in the basic membership fee. The lunch presentations will be from 11:35 a.m. to

JOIN TODAY!

Tell your friends!