R i t a M c G r a t h T h o u g h t S p a r k s

WhyUncertaintyIsYourFriendIf You’reLookingForBigReturns

It’s tempting to invest in areas that promise certain returns for a given investment. Unfortunately, by the time an opportunity has become so well understood that anyone could pursue it, it is well on the way to commoditization. To find big payoffs, you must be willing to explore high uncertainty bets.

R i t a M c G r a t h T h o u g h t S p a r k s

You might well have heard it from me, but this quote is actually from Bansi Nagii and Geoff Tuff (then partners at the Monitor Group) authors of a great 2012 Harvard Business Review article “Managing Your Innovation Portfolio.” In that article, they tell the same stories I tell, of companies dimly recognizing that just adding a twist here or a tweak there to their line of offerings is eventually going to lead them to a dull, less-and-less profitable slide into decline and irrelevance.

Let’s

understand why that is.

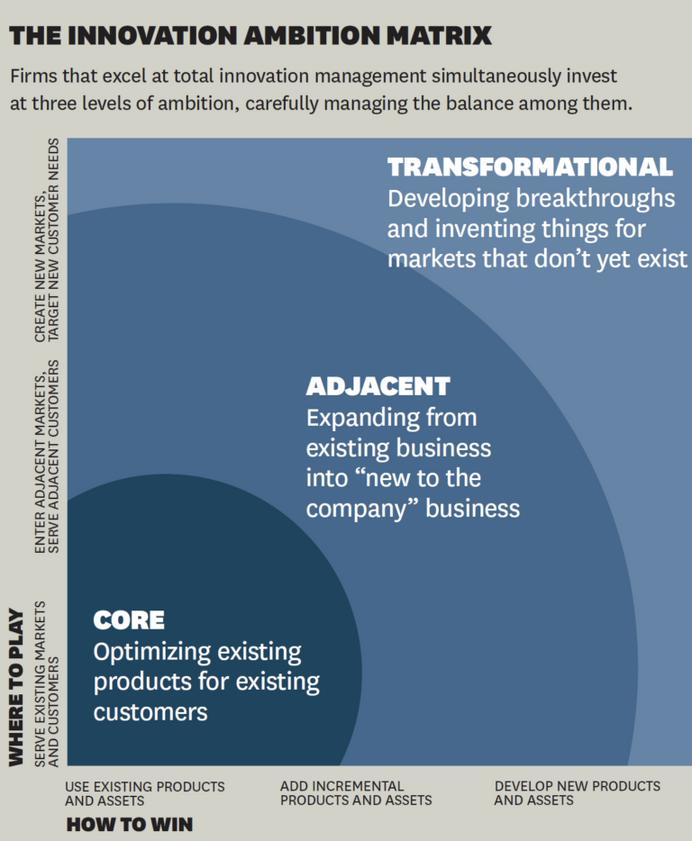

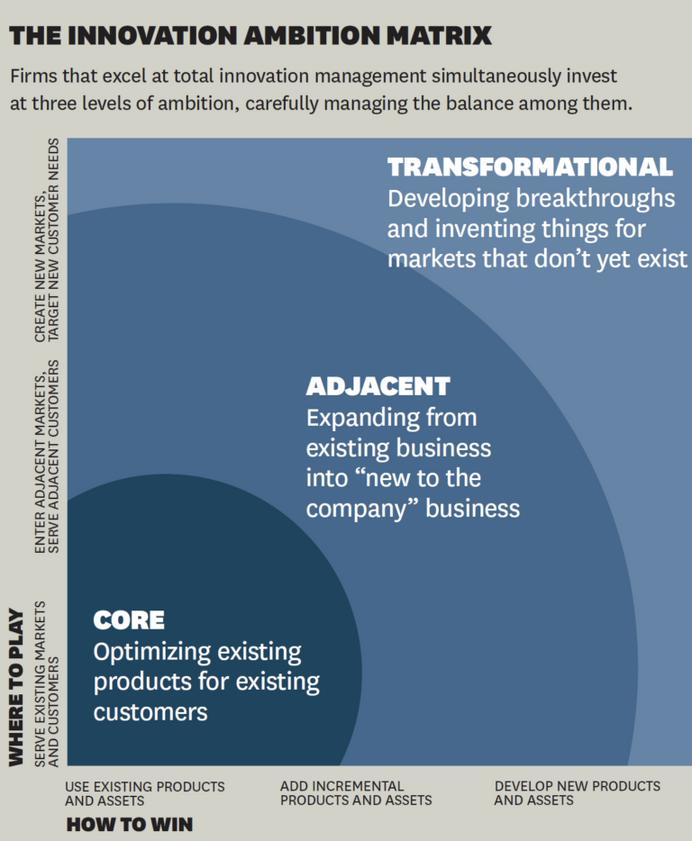

Just as we do at Valize, they recommend looking at investments in new capabilities across a spectrum of uncertainty (we do the analysis using software). They call this the “innovation ambition matrix.”

“THEVIABILITYOFA COMPANYDEPENDSONITS ABILITYTOINNOVATE.”

R i t a M c G r a t h T h o u g h t S p a r k s

THERIGHTWAYTO ALLOCATE,ANDTHE SURPRISING RELATIONSHIPWITH RETURNS

Nagji and Tuff then did a study to see whether paying attention to your innovation portfolio has performance effects. What they found was that, indeed, it does. They correlated the allocation of resources across the elements of the portfolio with share price. The data revealed a pattern: Companies that allocated 70% of their innovation activity to core initiatives, 20% to adjacent ones and 10% to transformational ones outperformed their peers, typically realizing a P/E premium of 10% to 20%. As they note, “our subsequent conversations with buy-side analysts revealed that this allocation is attractive to capital markets because of what it implies about the balance between short-term predictable growth and longer-term bets.” That all seems sensible.

R i t a M c G r a t h T h o u g h t S p a r k s

MANAGING TRANSFORMATIONAL POTENTIAL–ACAVEAT

To Nagaji and Tuff’s analysis, we would add one major caveat. Yes, the biggest returns lie in the transformational space. But only if these are managed using the logic of real options. A real option is a small investment that you make that buys you the right to make a future choice, when more information is available.

Managing option is the smallest and fastest investments you can make to learn whether there is a huge upside that you might capture. If things don’t look good, you simply stop making such further investments. Sure, you might lose money on a few of them, but the huge returns possible to high quality options allows you to write the poor quality ones off without even looking back. It’s a numbers game, as Alberto Savoia so often points out.

R i t a M c G r a t h T h o u g h t S p a r k s

AND

IFYOU

DON’T INVESTIN TRANSFORMATION?THE COMMODIZATION MONSTERAWAITS

In 2003, just as the tech economy was recovering from the dot.com crash and the early winners of the initial digital implosion were starting to demonstrate viable business models, Nick Carr, writing in the Harvard Business Review, argued that inevitably, the marvels of IT which were generating hefty profit margins would be subject to the forces of commoditization, eventually ending up with all the charm and profitability of a public utility.

Just as happened to the railroads and electric companies before them, Carr suggested that the explosion of investment in digital assets would eventually lead to a per-unit decline in the value of those assets.

R i t a M c G r a t h T h o u g h t S p a r k s

R i t a M c G r a t h T h o u g h t S p a r k s

Toescapecommoditization,investmentin innovationisessential.Leadersknowthis.And yet,asIdiscussedinarecentarticle,theystill allowthemselvestogetdistractedbythe seemingcertaintyofmakinginvestmentsinthe corebusiness.

IMPLICATIONS

The implications seem obvious, at least to those of us who’ve spent our careers in the areas of strategy and innovation. Manage your portfolio of investments across ranges of uncertainty. Make sure you aren’t putting all your resources –people, assets and budget – into the core. Figure out the processes you need to navigate the pressures of keeping today’s business humming along even as it prepares for inevitable obsolescence or transformation.

IMPLEMENTDISCOVERY DRIVENGROWTHINYOUR ORGANIZATION

growth@valize.com

When everyone around you is frozen in the headlights, this is a great time to make low-risk but determined moves into future spaces. We can provide a blueprint. Reach out

to

to learn more.

R i t a M c G r a t h T h o u g h t S p a r k s

Book Now R i t a M c G r a t h T h o u g h t S p a r k s

WANTTOSPARKSOMETHINKINGIN YOUROWNORGANIZATION?

https://thoughtsparks.substack.com/