RitaMcGrath

Can’tBuyMeGrowth… ACautionaryTale

Thought Sparks

Recap:TheImagination Premium,aforwardlookingmetricforfuture growth

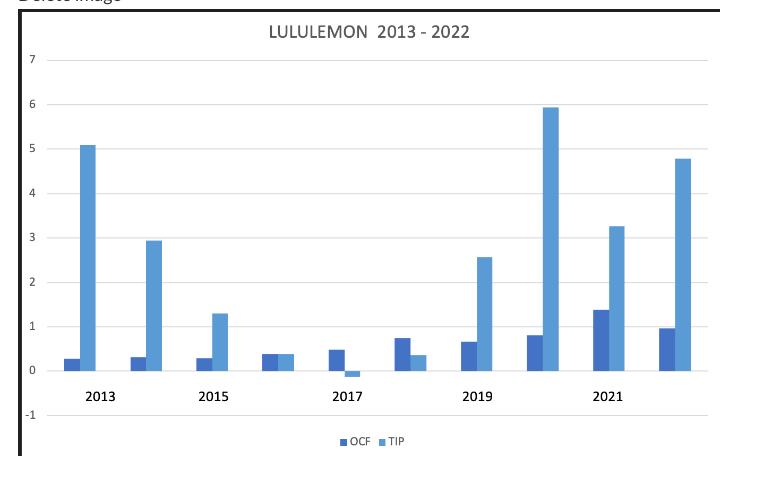

The share price, and hence market capitalization, of a publicly traded company reflects two sources of value. One is the value of the cash thrown off by company operations. The other is the perceived value of growth. Divide the value of growth by the value of operations and you get a metric we call the Imagination Premium (TIP).

A high TIP suggests that investors have confidence in management’s ability to generate organic growth through innovation. Think of a high TIP as a free boost to your market capitalization. Management has both imagined a bright future and effectively conveyed its vision to analysts and investors.

Acquisitionsareseldom theanswertoalow imaginationpremium

Acquisitions can indeed drive TIP higher, but only in very specific circumstances. The target company must already have a high TIP itself or be in a high TIP category (meaning that other similar companies have high TIP values). By definition, that means it’s going to be a pricey asset to buy because others have recognized its potential. The risk of overpayment is genuine (just ask Newscorp about MySpace).

CashflowandTIParenot thesamething

We have often been asked by management to weigh in on potential acquisition targets with a view toward understanding the likely consequences for TIP. We warn executive teams against acquiring low TIP companies. They may well add cash flow, but all too often cash flow without strong evidence of future growth opportunity does not excite investors.

Let’s walk through Lululemon’s acquisition of Mirror as an example of the kind of analysis we would do.

The pandemic, of course, was a boon to companies such as Lululemon. Freed from the office and the need to dress up, athleisure became everyday wear, not just something you wore for working out. Sales surged, as did TIP. Companies like Peleton were printing money. The workout at home craze benefitted other startups, like the subscription workout product, Mirror. As I’ve written about previously, Mirror was a seductive, sexy, high-growth startup with what it thought would be a compelling future sales story.

Apanicbuy?

Bewareofgoldrushes

The relationship between cash flow and TIP for 2021 shows how investors responded to the potentially transformative acquisition. Cash flow surged, even relative to the high-demand first year of the pandemic. TIP? Not so much. Investors didn’t buy the Mirror story.

The Mirror case further reflects a bigger theme. With gyms closed, the at-home fitness industry boomed. One observer likened it to a gold rush. Gold rushes bring out some of the worst biases in decision makers. There is a sense of urgency because everybody knows the rush won’t last forever. There is the belief that establishing a strong position early will be one that can be maintained.

Interestedinasimilar analysis?

For a free TIP estimate and ideas about what it implies, contact us.

Wanttosparksomethinkinginyourown organization? Book

https://thoughtsparks.substack.com/