2 minute read

My Path

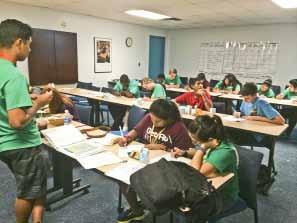

Summer financial literacy program empowers youth

Throughout the summer 17 Jr. Staff, ages 14-17, completed a financial literacy program called MyPath Savings.

Advertisement

MyPath Savings engages young people in banking and saving, transforming their first paychecks into an economic mobility pathway. The program seamlessly integrates relevant youth-owned savings accounts, innovative online and in-person financial education, and savings incentives into existing summer and school year youth workforce programs. The model uniquely leverages a powerful teachable moment as youth are earning and managing their own income, often for the first time. After delivering financial knowledge and connecting it to real-time financial action steps, MyPath Savings positions youth to connect their personal goals with their finances and achieve behavior change outcomes.

The program places an emphasis on setting and achieving a savings goal which was facilitated by first establishing a savings contract in which they pledged to save at least 10% of their paychecks. Jr. Staff then participated in three 60 minute financial education sessions. These sessions were developed by youth, delivered by Jr. Staff participating in the program and accompanied by online activities. The topics of the sessions included financial goal setting; budgeting and expense tracking; the power of compound interest; and an overview of the different types of financial institutions and products.

Through MyPath Savings Jr. Staff had an opportunity to engage with a mainstream financial institution, United Federal Credit Union, and be the sole owner of a savings/ checking account. The Jr. Staff not only had accounts opened, but they also had access to ATMs and online banking. Jr. Staff were required to have direct deposit and attained a savings incentive of $100 saving bonus upon completion of program and meeting their savings goal. Almost all of the Jr. Staff met their goals: 80% met their savings goals and 81% completed all of the online MyPath Savings financial education activities. In just over two months over the summer, the Jr. Staff save about 20% of their paycheck (approximately $115 savings/ youth, with some saving $400 over the summer). The Jr. Staff also increased their financial knowledge, adopted healthy financial behaviors, and saw changes in their attitudes toward their future which is evident from their comments below. This collaborative program is critical to getting improved financial empowerment outcomes

By Ta-Tiana anderson-Hall, liT CoordinaTor & saBrina Kansara, My PaTH

Wells Fargo Bank

Various locations www.wellsfargo.com Jaiden Quicksey, Age 11