10 minute read

arTs&cuLTurE

from June 8, 2017

Rowling in the deep

The first Harry Potter book was published 20 years ago this month. His story—and author J.K. Rowling’s—still mean a lot to some Renoites.

Advertisement

by Nisha Sridharan

June 26, 1997, marked the beginning of an era. Who hasn’t fantasized about getting a letter from Hogwarts on their 11th birthday or dreamt of walking into the castle on the hill?

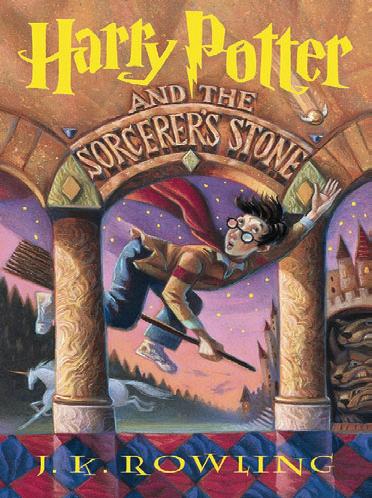

Harry Potter is now a household name. Last year, millions of people lined up in bookstores to have a peek into the world of Harry’s future, and movie theaters saw a horde of older people queuing up to watch Fantastic Beasts and Where to Find Them, J.K. Rowling’s spinoff. It all began 20 years ago with a dream on a train and a book called Harry Potter and the Philosopher’s Stone, as it's known in the U.K. and most Englishspeaking countries. It was first published by Bloomsbury, with an initial print run of 1,000 copies. Now, over 450 million copies from the seven-book series have been sold.

Fantasy fan worlds

Potter’s story is not just a story about the fantasy world of Rowling, it has a million other people’s stories attached to it.

One such story is that of Lindsey Novello, a case manager in Reno who is part of the Geek Girl Brunch group. She credits her love of reading and books to Harry Potter. She recalls her teacher reading the books in class one day, which made her fall in love with the story.

The books have been an escape from reality into a fantasy world. Novello said Potter’s story helped her when she was subjected to abuse, bullying and depression. She’s engaged to be married in September, and she has all plans in motion for her dream geek wedding.

There have been a lot of themed weddings and events related to the wizarding world. Barnes & Nobles hosted its first ever Harry Potter Magical Holiday Ball last December in Reno. The Geek Girl Brunch has hosted Harry Potter-themed lunches, the most recent in August 2016.

Life changing events

The books, stories and characters have had a big impact on people through the years. Diana Grace, a former pediatric assistant and speech-language pathologist who recently moved to Reno, is one of them. As a cancer survivor, she's taken great strength from the books. In 2006, at age 16, she underwent chemotherapy. The Kids Wish Network offered to fulfil a wish, and at 17, her wish was granted. She met the cast of the Harry Potter films.

But being a Potterhead is not only about the books and the movies. From collectible wands to visiting the Wizarding World, there are a multitude of options for indulging in fandom.

Grace has her collection of wands and merchandise from her favorite house, Ravenclaw. She would also love to one day have a custom license plate reading RVNCLW.

PHOTO/COURTESY DIANA GRACE

In 2006, Diana Grace was a teen who’d recently undergone chemotherapy treatment for cancer. She met Emily Watson and other members of the Harry Potter cast through the Kids Wish Foundation. “Rowling in the deep” continued from pg. 21

a story of a young boy studying in a wizarding world. After years of writing and personal struggles, including the loss of her mother, becoming a parent and getting divorced, she pulled through with her manuscript in 1995. Eight publishers rejected the manuscript before Bloombsbury offered a modest advance to Rowling, who eventually went from living off of state wages to being one of the richest people in the world. Several sources estimate her net worth to be about $1 billion.

Sara Anne Marie, who works at the Reno Little Theater, said that Rowling was a great inspiration and is super interesting to read about.

“One of my favorite things that came out of her fame was her commencement speech at Harvard University, where she talked to graduates of Harvard about failing and the benefits of failure,” she said. “As someone involved in the arts, one of the things I take from her story is that you have to trust yourself as an artist and that what you are doing matters.”

The beauty of the world of Harry Potter is that there is always more to add onto it. There are potential stories from the past about the Marauders or the fantastic beasts’ era and stories set in the future, such as the 2016 play Harry Potter and the Cursed Child.

To commemorate the anniversary, Rowling is launching a free online book club. Also, the first Harry Potter books are getting new covers with each Hogwarts house crest on them. Those are available for pre-order.

Seven books, eight movies, 4,224 pages and millions of hearts after the initial printing, one might ask a Potterhead about their love for the franchise, “After all this time?” The answer would inevitably be, “Always.” Ω

FRIDAY TONIC

SATURDAY

FIVE FOR FIGHTING

775-786-5700 • 800-648-5966 eldoradoreno.com

- EDUCATIONAL ADVERTISEMENT Paid Advertisement Why Haven’t Senior Homeowners Been Told Th ese Facts?

Keep reading if you own a home in the U.S. and were born before 1955.

It’s a well-known fact that for many senior citizens in the U.S. their home is their single biggest asset, often accounting for more than 50% of their total net worth.

Yet, according to new statistics from the mortgage industry, senior homeowners in the U.S. are now sitting on more than 6.1 trillion dollars of unused home equity.1 With people now living longer than ever before and home prices back up again, ignoring this “hidden wealth” may prove to be short sighted.

All things considered, it’s not surprising that more than a million homeowners have already used a government-insured Home Equity Conversion Mortgage or “HECM” loan to turn their home equity into extra cash for retirement.

However, today, there are still millions of eligible homeowners who could benefi t from this FHA-insured loan but may simply not be aware of this “retirement secret.”

Some homeowners think HECM loans sound “too good to be true.” After all, you get the cash you need out of your home but you have no more monthly mortgage payments.

NO MONTHLY MORTGAGE PAYMENTS?2 EXTRA CASH?

It’s a fact: no monthly mortgage payments are required with a government-insured HECM loan;2 however the homeowners are still responsible for paying for the maintenance of their home, property taxes, homeowner’s insurance and, if required, their HOA fees.

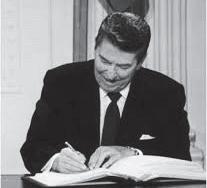

Another fact many are not aware of is that HECM reverse mortgages fi rst took hold when President Reagan signed the FHA Reverse Mortgage Bill into law 29 years ago in order to help senior citizens remain in their homes.

Today, HECM loans are simply an eff ective way for homeowners 62 and older to get the extra cash they need to enjoy retirement.

Although today’s HECM loans have been improved to provide even greater fi nancial protection for homeowners, there are still many misconceptions.

For example, a lot of people mistakenly believe the home must be paid off in full in order to qualify for a HECM loan, which is not the case. In fact, one key advantage of a HECM is that the proceeds will fi rst be used to pay off any existing liens on the property, which frees up cash fl ow, a huge blessing for seniors living on a fi xed income. Unfortunately, many senior homeowners who might be better off with HECM loan don’t even bother to get more information because of rumors they’ve heard.

Th at’s a shame because HECM loans are helping many senior homeowners live a better life.

In fact, a recent survey by American Advisors Group (AAG), the nation’s number one HECM lender, found that over 90% of their clients are satisfi ed with their loans.

While these special loans are not for everyone, they can be a real lifesaver for senior homeowners like Betty Carter, who recently took out a HECM loan with AAG so that she could fi nally get the extra cash she needed to fi x up her house.

“With the help of AAG, I have been able to repair my home’s foundation that I had been putting off for several years, refi nish the hardwood fl oors, paint the interior and will have the exterior painted within a few days. My house is starting to look like my home again and it feels good,” says Carter.

Th e cash from a HECM loan can be used for any purpose. Many people use the money to save on interest charges by paying off credit cards or other high-interest loans. Other common uses include making home improvements, paying off medical bills or helping other family members. Some people simply need the extra cash for everyday expenses while others are now using it as a “safety net” for fi nancial emergencies.

If you’re a homeowner age 62 or older, you owe it to yourself to learn more so that you can make an informed decision. Homeowners who are interested in learning more can request a free 2017 HECM loan Information Kit and free Educational DVD by calling American Advisors Group toll-free at 1-(800) 791-7830.

At no cost or obligation, the professionals at AAG can help you fi nd out if you qualify and also answer common questions such as: 1. What’s the government’s role? 2. How much money might I get? 3. Who owns the home after I take out a HECM loan?

You may be pleasantly surprised by what you discover when you call AAG for more information today.

FACT: In 1988, President Reagan signed

an FHA bill that put HECM loans into law.

1Source: http://reversemortgagedaily.com/2016/06/21/seniors-home-equity-grows-to-6-trillion-reverse-mortgage-opportunity. 2If you qualify and your loan is approved, a Home Equity Conversion Mortgage (HECM) must pay off any existing mortgage(s). With a HECM loan, no monthly mortgage payment is required. A HECM increases the principal mortgage loan amount and decreases home equity (it is a negative amortization loan). AAG works with other lenders and nancial institutions that offer HECMs. To process your request for a loan, AAG may forward your contact information to such lenders for your consideration of HECM programs that they offer. Borrowers are responsible for paying property taxes and homeowner’s insurance (which may be substantial). We do not establish an escrow account for disbursements of these payments. A set-aside account can be set up to pay taxes and insurance and may be required in some cases. Borrowers must occupy home as their primary residence and pay for ongoing maintenance; otherwise the loan becomes due and payable. The loan also becomes due and payable when the last borrower, or eligible non-borrowing surviving spouse, dies, sells the home, permanently moves out, defaults on taxes or insurance payments, or does not otherwise comply with the loan terms. American Advisors Group (AAG) is headquartered at 3800 W. Chapman Ave., 3rd & 7th Floors, Orange CA, 92868. V11082016