THE TEXAS COMMERCIAL REAL ESTATE NEWS SOURCE | JUNE 2024

THE TEXAS COMMERCIAL REAL ESTATE NEWS SOURCE | JUNE 2024

Our experts have the creativity and know-how to tackle your toughest supply chain challenges, continuously giving you a competitive edge to realize your success.

THE TEXAS COMMERCIAL REAL ESTATE NEWS SOURCE

PRESIDENT & CEO

Jeff Johnson jeff.johnson@rejournals.com

PUBLISHER

Mark Menzies menzies@rejournals.com

SENIOR VICE PRESIDENT

Benton Mahaffey benton@REDnews.com

TEXAS SALES DIRECTOR

April Daniel April.Daniel@rejournals.com

BUSINESS DEVELOPMENT EXECUTIVE

Learyn Jackson Learyn.Jackson@rejournals.com

CLASSIFIED DIRECTOR

Susan Mickey smickey@REDnews.co

Texas Brokers: 8,150

Texas Leasing/Tenant Rep: 6,232

Texas Investors: 4,979

Texas Developers: 4,710

Outside Texas Investors, Brokers, Developers etc: 26,387

TOTAL QUALIFIED ONLINE

RED news DISTRIBUTION: 50,458

To subscribe to REDnews call (713) 661-6300 or log on to REDnews.com/subscription.

Partner Engineering and Science: Navigating environmental challenges and sustainability in Texas CRE The commercial real estate industry in Texas faces a unique set of environmental challenges and opportunities. Partner Engineering and Science, Inc., a leading environmental services firm, is at the forefront of helping clients navigate these complexities.

DFW to ATX to HOU: Industrial markets flourish across Texas Texas' industrial sector is experiencing a sustained boom, with major cities like Dallas, Austin and Houston all witnessing significant growth.

REDnews Events: Dallas Fort Worth Multifamily & Apartment Summit

REDnews Events: Houston Commercial Real Estate Summit

REDnews Events: North Texas Industrial Real Estate Summit

Thriving dynamics in Texas retail markets: Insights from Houston, Dallas, Austin and the Rio Grande Valley Each region of Texas offers a tapestry of opportunities for investors, developers and retailers alike.

Scoop/People on the Move 6 22 24 26 28 10 14 15 16 18

Resilience. Continued growth. Those are the hallmarks of Houston’s industrial distribution market Resilience and sustained growth. That's what Lee & Associates says that the Houston industrial distribution market demonstrated during a challenging first quarter of 2024.

Houston’s office market still working through challenges The office vacancy rate in the Houston market rose to 26.7% as of the end of the first quarter, according to the latest research from Colliers.

The grass isn’t always greener: Many workers who jumped ship during COVID now regret it The Great Resignation saw workers quit their jobs in droves—but many are now regretting it.

The commercial real estate industry in Texas faces a unique set of environmental challenges and opportunities. Partner Engineering and Science, Inc., a leading environmental services firm, is at the forefront of helping clients navigate these complexities. With a focus on due diligence, innovative solutions and sustainability strategies, Partner empowers Texas CRE investors and developers to make informed decisions and future-proof their projects.

“One major issue is the potential wave of distressed assets due to factors such as declining property values in various sectors, stagnant rent growth, higher interest rates and a tight credit market,” said Summer Gell, a principal at Partner and an environmental science expert. “As a result, many investors have been focusing on property maintenance due diligence such as asbestos

Continued on Page 8>

and mold, to carefully consider measures to avoid liabilities and reduce losses on distressed assets.”

Another emerging challenge is perfluorinated alkyl substances (PFAS) contamination. The Environmental Protection Agency's recent classification of PFAS as hazardous substances necessitates its inclusion in Phase I Environmental Site Assessments (ESAs).

“Partner has been preparing for the implications of the new PFAS regulation, integrating this into the firm’s due diligence processes,” Gell said. “This includes offering specialized guidance and support to commercial real estate investors in Texas on how to navigate the challenges presented by the new EPA regulation and its impact on property investments.”

Innovation is also a hallmark of Partner's approach. Gell pointed to the growing adoption of vapor intrusion mitigation systems in Texas developments. These systems prevent hazardous vapors from entering buildings, safeguarding occupant health and facilitating smoother transactions. Partner leverages risk assessments aligned with ASTM standards to identify potential vapor concerns and recommend mitigation measures.

“Incorporating vapor intrusion mitigation barriers during construction can significantly benefit commercial properties by mitigating potential

health risks and enhancing the property's marketability,” Gell said. “These measures can also minimize liability for property owners and increase the overall value of the building. This proactive approach to environmental challenges demonstrates how innovative solutions can be successfully integrated into commercial real estate projects.”

Sustainability is another critical area where Partner guides Texas CRE stakeholders, helping them minimize both financial and physical risks. Partner advocates for setting clear decarbonization goals using frameworks like the Carbon Risk Real Estate Monitor (CRREM) Pathway.

“By adopting sustainable measures, CRE investors and owners can futureproof their assets and enhance the long-term value of their investments,” Gell said. “By focusing on sustainability, developers and investors not only align with global trends but also contribute to the overall resilience and success of their commercial real estate projects.”

The future of Texas CRE looks increasingly electric, Gell added, noting the growing shift to electric vehicles, which necessitates incorporating EV charging stations into properties. Partner recognizes this trend and its alignment with environmental, social and governance (ESG) goals.

“By

“Not only do these stations align with ESG goals, but they also enhance property value by attracting and retaining tenants and customers as the shift to EVs gains momentum,” Gell said. “With national incentives available, now is an opportune time to invest in EV charging infrastructure.” The Securities and Exchange Commission's (SEC) new climate-related disclosure regulations, coming into effect in 2025, will significantly impact the CRE sector as well, Gell stressed. These regulations necessitate transparency regarding climate risks and mitigation efforts. Partner, through its Partner Energy division, offers comprehensive ESG consulting

services designed to help clients navigate these evolving regulations and investor expectations.

“By partnering with seasoned professionals and leveraging multidisciplinary solutions, clients can achieve cost savings, operational efficiencies and enhanced tenant satisfaction while promoting environmental stewardship,” Dell said.

Learn more about Partner Engineering and Science at www.partneresi.com.

Texas' industrial sector is experiencing a sustained boom, with major cities like Dallas, Austin and Houston all witnessing significant growth. The Lone Star State’s individual markets paint a picture of vibrancy, innovation and expansion.

Dallas industrial sector is ‘incredibly blessed’

“I know it sounds like a cliché we hear over and over, but the DFW area is so much healthier and has so much more activity than almost every market in the country,” said Allen Gump, executive vice president at Colliers DallasFort Worth. “We are all incredibly blessed to be in a market that is this vibrant with the best real estate community of any in the world.”

He attributed the vibrant market to a robust developer community, strong investor interest and record leasing activity.

“For the last several years there has been a great deal of money looking for great places to invest,” Gump said. “And since we were having record leasing and net absorption, that led to more projects coming to fruition. Depending on the submarket you’re looking at, developers are being more prudent and rather than building spec, they’re waiting for the tenants. So this will slow down the amount of speculative building for the time being.”

When selecting locations and project types, factors like competition, leasing trends, labor pools and highway access are crucial, Gump stressed. Project size alignment with market demand and profitability against construction costs are also vital considerations.

“It's important to know that if you’re going to build a 1 million square foot building, how many others are built or under construction vs. 1 million square foot deals in the market?” Gump said. “Sometimes it’s better to be ‘pad-ready’ and wait for the tenant to surface.”

The Texas CHIPS Act, which incentivizes semiconductor development, is impacting the Dallas market. The legislation not only stimulates chip production but also drives demand for ancillary industrial facilities from suppliers, further amplifying activity.

“It truly has a multiplying effect on industrial demand even if these plants are being built by the companies that are going to occupy,” Gump said.

While he anticipated a natural slowdown in demand after years of rapid growth, Gump saw this as a temporary adjustment.

Continued on Page 12>

that lasting long due to development restrictions implemented by local municipalities.

“This presents opportunities for industrial users to take advantage of a more balanced market than what we’ve been experiencing for the last few years,” Gump said. “Also, users and investors are seeing opportunities to purchase new buildings that probably wouldn’t have been offered the last several years. The investor community is still very healthy and money is available for the right projects.”

‘Booming population’ fuels Austin industrial

Austin's industrial real estate market is experiencing strong growth, fueled by population expansion and corporate relocations, including Tesla and Samsung. The region absorbed around 1.7 million square feet of space in Q4 2023 alone.

“We've had a record amount of new space finish construction every year since 2021 and our market has grown roughly 37 percent in terms of square footage since that time,” said Ace Schlameus, senior managing director in JLL Austin. “We could continue tremendous growth, which I expect and fully anticipate happening.”

Sustaining recent growth rates may be challenging, but the region remains well-positioned for long-term expansion due to population growth and evolving consumer preferences. Challenges include utility infrastructure limitations and permitting timelines. Stakeholders will need to address these issues to accommodate growing demand for industrial space.

In fact, Georgetown and Far Northeast have emerged as key submarkets in Austin's industrial landscape due to their strategic location and infrastructure development, particularly the expansion of SH 130. Schlameus predicted the 130 corridor will fill up quickly.

“It’s available flat land off of a major thoroughfare and close to town,” he said.

Far south Austin may have availability now, but Schlameus doesn’t see

“There's probably slightly an oversupply in that area, but it's very unique in that it's going to be between two top ten U.S. cities and just 20 minutes south of Austin,” Schlameus said. “I think far south will do very well.”

Schlameus suggested leveraging second-generation industrial space and targeting specific sectors such as distribution and logistics to optimize occupancy and stimulate further growth. Austin's central location, robust infrastructure and favorable business climate make it a compelling opportunity for investors and developers. The region continues to attract businesses and residents, solidifying its position as a leading hub for industrial innovation and growth.

“We might be a bit pricier than some other Texas cities, but we're smack dab in the middle of everything, thanks to our prime location off a major interstate,” Schlameus said. “Plus, with the rise of e-commerce, the demand for fulfillment centers and last-mile logistics is through the roof. Austin's booming population means there are plenty of rooftops to deliver to.”

Houston ‘checks all the boxes’ for industrial demand

Despite a slowdown in new construction activity during Q1 2024, Houston's industrial market remains robust, underscoring its resilience and appeal to investors and corporations. Population growth, Port of Houston expansion and a business-friendly environment are key drivers, according to Nathan Wynne, executive vice president within CBRE National Partners.

“Frankly, I think Houston's been overlooked by many and it needs to be front and center,” Wynne said.

Houston's industrial market witnessed significant absorption in Q1 2024, surpassing 4.2 million square feet. The market has absorbed more than 20 million square feet for three years in a row, a trend Wynne expected to continue in 2024.

“When you add this many people to a particular MSA, it's going to be a driving force, not only locally, but we're seeing a lot of regional DCs that are established in Houston,” he said. “I predict Houston will be top five in net absorption nationally at the end of the year, and might finish in the top two.”

Richard Quarles, senior managing director at JLL Houston, attributed the continued absorption to the South submarket's performance, driven by spillover demand from the Southeast port submarket.

“This absorption reflects the market's resilience and suggests a positive outlook for overall performance,” Quarles said,” noting that a major retailer completed its second build-to-suit project in as many quarters. ”With the volume of deals in our tenants in the market pipeline, we expect occupier demand to continue converting to strong leasing and net absorption over the course of the year.”

As new space is gobbled up, Wynne anticipated rent growth throughout 2024. He noted that the development pipeline is significantly slowing down as well which will fuel the acceleration..

“If we continue to see the demand that we've been seeing, this market's going to get extremely tight by Q4 of this year, and definitely by Q1 of next year,” Wynne said. “I think early 2025 is when you're really going to start to see another big pop in rents.”

Despite the historical narrative that Houston’s industrial market is tied exclusively to oil prices, its tenant base has diversified to address consumer needs in the fast-growing metro.

“Houston checks all the boxes for drivers of industrial demand,” Quarles said. “The Port of Houston plays a pivotal role in stimulating industrial job growth across various sectors like energy, manufacturing, logistics and petrochemicals.”

These sectors, Quarles emphasized, significantly contribute to job creation in the greater Houston area.

“Notably, new-to-market deals, primarily from logistics, distribution, energy and construction industries accounted for a significant portion of leasing volume in 2023,” Quarles said. “This influx, attracted by competitive rental rates, land availability and a skilled labor pool, underscores Houston's appeal as a thriving business hub, ensuring both stability and growth in the industrial sector.”

Looking ahead, he stressed that stakeholders must remain vigilant of emerging trends and challenges. Wynne emphasized the particular importance of monitoring credit markets, interest rates and economic stability, particularly amidst election-year dynamics.

“From my perspective, getting visibility into where the economy is going and where rates will ultimately settle out will help underwriting and provide more investor confidence,” Wynne said. “We're all very fortunate to be in the industrial space. It’s hard to complain about much given the run we've been on. The fundamentals are so strong here and across Texas that we’ll continue to move forward in a very positive way.”

Immersed in the insightful conversations of our Industrial Update Panel.

Attendees networking.

AUGUST 15, 2024

4:30PM-6:00PM COCKTAIL HOUR 6:00PM DINNER & PROGRAM

JW MARRIOTT HOUSTON BY THE GALLERIA 5150 Westheimer Road, Houston, TX

Nominate and Submit Your Projects, People and Company Today! SUBMISSION DEADLINE: JUNE 21, 2024

From Houston's diverse economy to Dallas's thriving selectivity, Austin's tight market dynamics, and the Rio Grande Valley's cross-border prowess, each region of Texas offers a tapestry of opportunities for investors, developers and retailers alike. By embracing innovation, sustainability and community-centric approaches, stakeholders can navigate the complexities of the retail landscape, seize emerging opportunities and chart a course towards long-term prosperity in the vibrant markets of Texas.

‘Be agile, innovate’ to succeed in Houston’s retail sector

Houston’s retail landscape remains resilient in the face of change,

characterized by a low vacancy rate of 5.2% and stable rents. This strength is attributed to a myriad of factors, according to industry experts.

“Houston's population has been steadily growing, fueled by a combination of job opportunities, affordable housing and a diverse economy. Key sectors such as energy, healthcare, manufacturing and technology are driving this growth,” said Nathaliah Naipaul, CEO and partner at XAG Group. “As the population expands, the demand for retail goods and services also rises, which in turn strengthens the retail market.”

Infrastructure enhancements, including improved transportation

networks, further bolster the sector by improving accessibility to retail centers, Naipaul added, noting that XAG Group exemplifies this adaptability by prioritizing sustainability and curating unique shopping experiences.

“I believe vacancy remains low because there is a lack of new quality space being constructed,” said Jonathan Hicks, principal at Edge Realty Partners.

“The reason there is a lack of new construction is due to high costs of construction and high interest rates; it is very hard to build anything right now with affordable rental rates.”

Hicks argued that this, along with rising labor and inventory expenses for existing tenants, has contributed to stable rents as landlords navigate this challenging terrain.

Despite a recent uptick, the vacancy rate remains healthy. Hicks viewed this as a temporary phenomenon, a result of squeezed margins for retailers. Conversely, Naipaul interpreted it as a sign of a balanced market.

“This stability is reassuring for retailers, landlords and investors, as it reduces the risk of significant fluctuations in rental rates or property values,” she said. “Landlords and property owners may have more negotiating power when leasing out retail space. Like us at XAG Group, we see many maintaining diverse tenant mixes, investing in property maintenance and improvements and staying informed about local economic and market trends.”

Looking ahead, retail development continues with 3.2 million square feet underway. While some projects may encounter delays at the permitting stage, Naipaul suggested that developers perceive opportunities driven by robust employment rates and consumer confidence. Hicks believed much of this construction is user-driven, with developers exercising caution due to affordability concerns.

“Developers are telling me it is almost impossible to build space that is sustainably affordable to tenants,” he said. “I heard recently that a developer was just happy to have a tenant move into their project and build out the space – their risk of failure was much higher than normal, but the landlord would at least have a built out space in their retail center that may be more attractive to the next tenant.”

The rise of e-commerce necessitates adaptation for traditional retailers. Hicks observed stores evolving into fulfillment centers and enhancing customer experiences through interactive displays and vendor-led classes. Naipaul highlighted XAG Group's strategy of extending the shopping experience outdoors with seating, gardens and event spaces, fostering a more inviting and community-oriented atmosphere.

“Multi-functional outdoor spaces accommodate various activities like markets and fitness classes, with amenities such as Wi-Fi and charging stations,” Naipaul said. “By integrating outdoor areas, retailers differentiate themselves, appeal to a broader demographic, and enhance the overall retail experience, emphasizing sustainability and eco-friendliness.”

For long-term success, stakeholders must adapt to evolving consumer preferences, embrace technology and prioritize sustainability, Naipaul suggested. This entails integrating mobile payments and augmented reality, along with strategic location selection and tenant mixes that cater to food, beverage and entertainment desires.

“Retailers should be agile, innovate in response to consumer trends and invest in sustainability practices to attract eco-conscious shoppers,” Nailapul said. “By focusing on these strategies, businesses can navigate the evolving market and position themselves for long-term success in Houston's retail sector.”

Hicks anticipated further retail closures due to rising interest rates on business loans. He saw opportunity in repurposing existing buildings and acquiring failed businesses' space at a discount. A key takeaway for investors, according to Hicks, is the current disconnect between owners and tenants.

“I have tenants who are prepared to expand, but the majority require purchasing rather than leasing,” he said. “In most cases, the purchase prices are at or above market, but so many owners continue to wait for a lease. Many owners are also waiting to see what happens with interest rates, but I’m being told by many sources that rates are not expected to change much, if at all, before the end of this year.”

‘Momentum’ describes retail sector success in Dallas

Dallas distinguishes itself with a thriving retail market, defying challenges

encountered by other sectors. Robert Franks, managing director at JLL Dallas, attributes this resilience to a burgeoning population and the proliferation of grocery stores, particularly with the entrance of H-E-B. Sun Belt markets like Dallas benefit from high population growth and historically low vacancy rates.

“The fundamental principles of supply and demand are at play here,’ Franks said. “With vacancy rates at an all-time low, costs have increased, leading to record-high rental rates. We anticipate this trend to persist as the baseline market has been fundamentally shifted. Landlords now have the luxury of being selective with tenants, as quality vacancies attract numerous options.”

While advantageous in the short term for landlords, Franks noted that excessively high rents could strain tenants in the long run.

Investment opportunities abound across various retail property types in Dallas. While larger assets are scarce, single-tenant buildings and smaller strip centers offer promising entry points.

“Now is a great time to look at well-placed assets with lower rents that can be repositioned long-term,” Franks said.

The rise of e-commerce has catalyzed the transformation of older malls. Malls with prime locations undergo redevelopment into mixed-use hubs, integrating multi-family housing and entertainment options. Notable examples include Collin Creek Mall, Willow Bend and Valley View Mall.

“Landlords are fighting to keep up with changing customer behavior,” Franks said. “In Dallas, Class A malls continue to experience high demand, while Class B and C malls struggle to compete. These older, outdated assets are now ripe for redevelopment into mixed-use, multi-family, or entertainment centers.”

Savvy investors and developers leverage data analytics to assess location suitability and shopper demographics. This data, encompassing demographics, competitor performance, and even cell phone usage, is indispensable for making informed long-term real estate decisions.

“The growth trajectory of the Dallas retail sector remains strong, fueled by the region's status as one of the fastest-growing metroplexes in the U.S.,” Franks said. “Momentum is expected to continue, with asset performance and value creation opportunities here being as strong as ever.”

‘Varied opportunities’ available for retailers, developers in Austin

At the end of 2023, Austin's retail sector boasted an impressive 96.8 percent occupancy rate, a testament to its resilience.

“The city's zoning and planning regulations have historically limited the availability of new development spaces, creating a supply scenario that is markedly lower than demand,” said DeLea Becker, owner, founder and broker at Beck-Reit Commercial Real Estate and Beck-Reit Asset Management. “This regulatory environment, coupled with Austin's rapid population increase and its status as a technological and cultural magnet, has sustained low vacancy rates and high demand for retail space.”

“Despite being underbuilt, Austin boasts a dense and expanding population,” echoed JD Torian, director at Cushman & Wakefield. “The purchasing power of young professionals plays a significant role in sustaining a resilient retail market. Additionally, tourism contributes to the market’s strength. Austin remains affordable for buyers, making it an attractive destination for both residents and visitors alike.”

Becker described a landscape where landlords hold sway, with high demand leading to competitive leasing dynamics and rising rental rates.

“This means navigating a landscape where they might have to absorb a larger portion of the build-out costs themselves, which could affect their budgeting and design choices,” Becker said. “Tenants must be financially prepared to invest more upfront in their leased spaces, which underscores the necessity for thorough financial planning and possibly seeking out alternative funding sources for their fit-outs.”

For investors, Torian emphasized the importance of considering longterm tenant mix and prioritizing sales performance over aggressive rent increases.

“Attempting to raise rental rates without robust sales could jeopardize businesses,” he said. “To achieve success, investors must comprehend and prioritize the tenant mix within the local retail market. Striving for a 10 percent rental factor may not align with tenants’ needs and could ultimately backfire for landlords, who risk inflating costs solely for the sake of higher rents.”

The recent elimination of parking minimums by the Austin City Council marks a significant change, according to Becker, who saw it as ushering in a new era of denser, more efficient development.

“This shift also revitalizes older buildings and smaller empty lots previously hindered by stringent parking requirements, allowing them to be repurposed into previously disallowed retail, offices, restaurants, event spaces, etc.,” Becker said. “By reducing the need for extensive parking, these properties can now contribute more actively to the urban tapestry, promoting a diverse and innovative use of space, increasing value and demand for landlords' buildings and opening up new opportunities for architects and developers.”

Looking at specific property types, Becker highlighted the unique opportunities each presents. Freestanding buildings offer high visibility and attract stable tenants. Neighborhood centers benefit from foot traffic and are less susceptible to economic downturns. Power centers expand with pad sites for additional tenants. Malls transition into mixed-use spaces with entertainment and leisure options. Outparcels and pad sites are developed to optimize space for quick-service businesses.

“For investors, understanding these distinctions and trends is key to capitalizing on the varied opportunities within Austin’s retail landscape, from stable neighborhood centers to innovative uses of traditional mall spaces,” Becker said. “An investor's short-term and long-term goals tend to guide which retail asset type they favor when making investments and planning developments.”

Austin's retail sector presents a high-stakes, high-reward environment, she added. While Becker acknowledged potential short-term market fluctuations, she emphasized the city's long-term potential, driven by

a resilient consumer base. Investors and developers are advised to adopt a long-term perspective, brace for short-term headwinds and seize the opportunities within this dynamic market.

‘Vibrant retail environment’ draws shoppers to McAllen

The Rio Grande Valley has emerged as a major international trade hub, attracting a diverse range of retailers and investors.

“The opportunity is in the growth of quality jobs, education, healthcare and lifestyle of which McAllen is leading the way on all counts,” said Mike Blum, partner at NIA Rio Grande Valley. “McAllen, Texas, stands out as a powerhouse city and the epicenter of the Rio Grande Valley, boasting impressive retail sales for 2023.”

The gross sales tax for the McAllen MSA was upwards of $10.6 billion, Blum shared.

“By capitalizing on the region's diverse shopping venues, increased foot traffic, cultural exchange and logistical advantages, retailers can position themselves for success in this dynamic and rapidly evolving market,” said Rebecca Olaguibel, Director of Retail and Business Development for the City of McAllen. “With the rise in international trade, there has been a corresponding increase in foot traffic from both local residents and international shoppers. This creates a vibrant retail environment and provides retailers with a larger customer base to target.”

McAllen's reputation as a premier shopping destination is attributed to several factors, according to Roger Stolley, associate at NIA Rio Grande Valley. Easy access from Mexico, a modern airport with convenient connections and a renowned shopping mall (La Plaza Mall) position McAllen as a shopping paradise.

The city also boasts a vibrant entertainment scene, with a convention center, performing arts spaces and a symphony orchestra. While historically reliant on Mexican shoppers, McAllen's retail sector has diversified, although Mexican visitors remain a significant customer base, Blum shared.

“Many of the travelers from Mexico have been banking in McAllen for generations,” he said. “They come to visit their money.”

When they choose to spend it, shoppers in McAllen can choose from everything from high-end luxury brands or budget-friendly deals.

“McAllen actively promotes itself as a shopping destination through various marketing initiatives and promotional campaigns,” Olaguibel said. “These efforts help raise awareness of the city's retail offerings and attract shoppers from neighboring regions.”

Looking ahead, the expansion of international bridges, growth in warehousing and manufacturing and the addition of the UT Health Cancer Treatment Center solidify the Rio Grande Valley's position as a dynamic trade and commerce destination. This unique blend of factors creates an attractive environment for retailers and investors seeking to capitalize on the region's potential.

Resilience and sustained growth. That's what Lee & Associates says that the Houston industrial distribution market demonstrated during a challenging first quarter of 2024.

In fact, the Houston market bucked the national trend, seeing its industrial distribution vacancy rate fall during the first three months of 2024. That’s unusual today, with many markets across the country seeing industrial vacancy rates rise during the beginning of the year.

That's the positive news from the first quarter Houston Industrial Distribution Market report released earlier this month from Lee & Associates.

What accounts for the Houston market’s resilience even during challenging times? Lee & Associates pointed to Houston's strong transportation and distribution infrastructure as a reason for the industrial distribution market's continued resilience.

The Houston market did see a slight decrease in new direct-space leasing for facilities with more than 350,000 square feet. But tenants requiring more than 500,000 square feet were active enough to make up for this.

Overall, the Houston industrial distribution market saw more than 5.8 million square feet of leasing activity.

Notable leases included Hinton Lumber renewing its 450,000 square feet at Independence Logistics Park and Essendant renewing 240,000 square feet at 7677 Pinemont Drive.

The Northwest submarket outperformed all other submarkets with 2.3 million square feet of new leases during the first quarter 2024, followed by the Northeast and North submarkets with 1.1 million square feet and 939,690 square feet, respectively.

Large occupiers leasing 500,000 square feet plus represented 42.7% of the market while tenants leasing between 250,000 to 499,999 square feet represented 12.3% of the market.

Tenants include Grainger for 1.2 million square feet at Roberts Ranch Business Park in the Northwest and United Airlines for 509,600 square feet at 59 Logistics Center in the Northeast submarkets.

There have been some headwinds, though, in this market. Lee & Associates reported that net absorption fell to slightly more than 2.33 million square feet in the first quarter. That is down from more than 4.29 million square feet of net absorption in the Houston industrial distribution market in the fourth quarter of 2023.

Most occupancy gains throughout the first quarter of 2024 occurred in the Northwest, Northeast, Southeast and Far West submarkets, where more than 81.9% of Houston’s net collective gains were registered.

Almost all the positive absorption recorded across the market was fueled by newly delivered products, along with pre-leasing activity.

The number of new deliveries fell, too. Lee & Associates reported that the Houston market saw the delivery of more than 3.94 million square feet of new industrial distribution space in the fourth quarter. That is down from a much higher 9.26 million square feet of deliveries during the previous quarter.

The Southeast market emerged as a significant contributor to projects under construction, notably those exceeding 350,000 square feet.

Although the delivery of new inventory saw a temporary slowdown at the start of the year, Lee & Associates said that it expects the industrial distribution market to rebound as ongoing construction projects near completion by the end of 2024.

C.E. Erwin III, principal of Lee & Associates Houston’s industrial division, said that the Houston region continues to attract tenants seeking efficient distribution centers. This, he said, should help guarantee continued growth in the area's industrial real estate sector.

The office vacancy rate in the Houston market rose to 26.7% as of the end of the first quarter, according to the latest research from Colliers.

In its first quarter 2024 Houston Office Market Report, Colliers said that this vacancy rate remains on the rise, jumping 50 basis points from a rate of 26.2% in the fourth quarter of 2023.

The vacancy rate was also up from the first quarter of 2023. Back then, Houston's office vacancy rate stood at 25.8%.

And that's not the only sign that Houston's office market continues to face challenges. Colliers also said that office leasing activity dropped to 2.3

million square feet in the first quarter of this year. That is down 17.3% from the fourth quarter of 2023.

Absorption numbers weren't impressive, either. Colliers reported that Houston's office market reported negative net absorption of 616,399 square feet during the first quarter. That's a reversal from the fourth quarter of last year, when the Houston office market saw 563 million square feet of positive net absorption.

"As we progress into 2024, Houston’s overall office market continues to experience a soft leasing environment with Class-A product on the west side winning the majority of the activity," said Danny Rice, president of Colliers

Houston. "This post-pandemic trend continues as companies evaluate their offices amid evolving return-to-work policies to deliver locations closer to where employees live."

New construction activity is down, too. According to Colliers' report, the Houston office market had 214,400 square feet of new office construction underway during the first quarter. That is down from 601,000 square feet in the fourth quarter of last year and 969,200 square feet in the first quarter of 2023.

The average asking rent for office space did remain consistent, though, with Colliers reporting that this figure stood at $30.31 a square foot as of the end of the first quarter. That's not much different from the average asking rent of $30.71 a square foot from one year earlier.

Houston’s Class-A average rental rate decreased to $35.64 a square foot from the previous quarter but did show a slight increase year-over year.

Leasing activity dropped 17.3% from the previous quarter to 2.3 million square feet. The Westchase submarket accounted for 14% of the first quarter’s office leasing total while three other submarkets, the West Loop, CBD and Katy Freeway West/Energy Corridor leased more than 200,00 square feet each, accounting for 47% of the total.

"Office-using employment that directly corelates to office space is gaining but not translating to office leasing activity," Rice said. "Interest rates are still causing a slowdown on the investment side, both in sale numbers and lower pricing."

This doesn't mean that there wasn't some office activity during the first quarter.

Skanska completed its 386,323-square-foot building, 1550 on the Green, in the Central Business District. The new property is 35% leased by law firm Norton Rose Fulbright, which is expected to move in by the third quarter of this year.

CityCentre Six, a proposed 308,000-square-foot office property in Katy Freeway East, will break ground during the second quarter. Construction is beginning after the project secured a lead tenant, Dow Chemical, which preleased about 75% of the building, or 229,658 square feet, in December of last year.

When it comes to leasing activity, tenants are still looking for quality space. Class-A properties accounted for 65.5% of the first quarter’s 2.3 million

square feet of leasing activity, with totals down 17.3% from the previous quarter and 41.1% year-over year.

Of the quarter’s total leasing, 46% occurred in properties in west Houston, including three different buildings within the CityWest Place development in Westchase.

Noble Corporation topped the list in size, leasing 110,250 square feet at 2101 CityWest. Bechtel signed an expansion lease of 77,262 square feet at 2103 CityWest, and Enstor Gas leased 43,598 square feet at 2107 CityWest.

The space-exploration business is also providing a boost to Houston's office market. Axiom Space, which recently opened a new headquarters building in the Houston Spaceport, also renewed a 63,716-square-foot space in Hercules II at 1290 Hercules in the NASA/Clear Lake submarket.

In addition, Texas A&M recently announced its plans to build a cutting-edge research and training facility next to NASA’s Johnson Space Center in the submarket.

The Great Resignation saw workers quit their jobs in droves—but many are now regretting it.

A new survey of US workers reveals those who changed jobs since the pandemic are significantly less satisfied with their jobs than their colleagues who stayed.

What’s causing job hoppers to regret their decision? The Conference Board survey found that leadership and culture saw the greatest gaps in satisfaction between the job switchers and job stayers.

But aside from “people issues” moving the needle, money also matters: Higher wages enticed many to take new jobs in the COVID era, but those who switched jobs now report less satisfaction with wages. This is possibly due to inflation taking a bigger bite out of their paychecks.

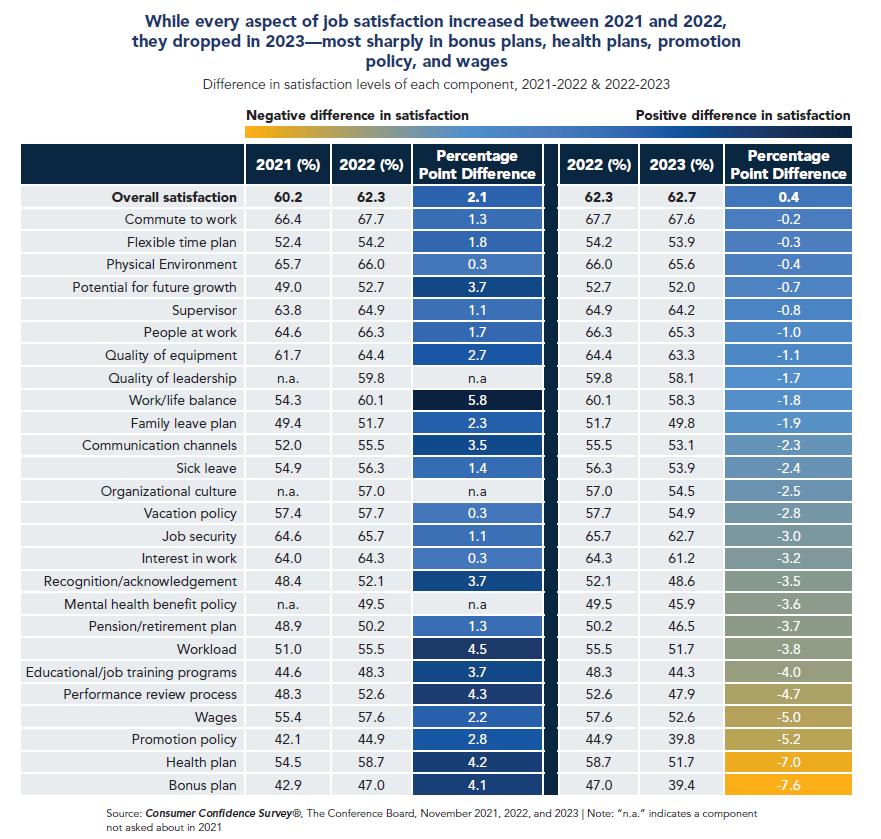

While overall job satisfaction remained virtually unchanged—ticking up 0.4 points to 62.7%—every individual driver of job satisfaction declined. The

largest declines were primarily in financial benefits such as bonuses, hardbase benefits, wages, and promotions—underscoring the sting of stubborn inflation.

“After more than a decade trending upwards, overall US worker job satisfaction may have finally plateaued,” said Allan Schweyer, Principal Researcher, Human Capital with The Conference Board. “To avoid declining job satisfaction, leaders should maintain or improve key drivers such as flexible work arrangements and career development opportunities while ensuring that wages and core benefits remain competitive.”

Key findings include:

The grass isn’t always greener. Workers who changed jobs since the pandemic began are far less satisfied.

• Workers who left their jobs since the pandemic’s onset are much more dissatisfied than those who didn’t.

• Job switchers’ overall job satisfaction is down 5.6 percentage points—a big decline.

• Driving the dissatisfaction: leadership quality, communications, interest in the work, co-workers, job security.

Newer workers are also less satisfied.

• Overall satisfaction was lowest among those who worked in their current job between six months and three years.

• Almost half of those who said they intended to leave their jobs within six months were workers in their jobs for fewer than three years.

• They expressed greater intent to leave within the next six months due largely to dissatisfaction with bonuses, promotions, training, recognition, and performance reviews.

Staying put has its benefits: Once an employee hits the three-year mark, satisfaction increases substantially.

• Satisfaction rose from 58.2% to 63.6% once an employee met the three-year threshold.

• Satisfaction continued to increase until employees reached the 10year mark.

Has job satisfaction finally plateaued? Every single driver of satisfaction declined.

• Sentiment declined across all 26 components of job satisfaction, compared to 2022.

• Overall satisfaction remains virtually unchanged, ticking up 0.4 points to 62.7%.

“Provided pay and benefits are competitive, leaders will gain the most by offering strong growth opportunities, quality leadership, and work-life balance.”

Workers feel the bite of inflation.

• The largest declines in satisfaction were primarily in financial benefits such as bonuses, hard-base benefits, wages, and promotions.

The least satisfied group is fully on-site workers. The hybrid model wins the day.

• Fully on-site workers reported the lowest job satisfaction at 60.2%.

• Satisfaction for fully remote workers was 64.1%.

• Overall job satisfaction for hybrid workers was 65.5%.

Women are far less satisfied than men.

• For the 6th year in a row, women are significantly less satisfied across almost all 26 job satisfaction components surveyed.

• The largest gaps between men and women were related to

wages, bonuses, potential for growth, health benefits (including mental health policies), and retirement plans.

Workers are placing a bigger premium on culture and work experience than before.

• While wages and key benefits remain vital to job satisfaction, in 2023 workers were more focused on positive work culture and experience than they were the previous year.

“This year’s survey results indicates that job satisfaction is about so much more than wages,” said Diana Scott, US Human Capital Center Leader, The Conference Board. “While wages and key benefits still matter, workers were more focused on positive work culture and experience. Provided pay and benefits are competitive, leaders will gain the most by offering strong growth opportunities, quality leadership, and work-life balance.”

Mohr Partners is proud to recognize the 2023 accomplishments of Marty Shelton, SIOR, CCIM, a Managing Director in its Austin office.

Shelton posted a banner year in 2023, tallying over $100 million worth of transactions as a TenantRepresentative Broker, which consisted of 15 total deals, including five client assignments in Canada and three in Mexico.

“Congratulations to Marty Shelton for his exceptional performance in 2023,” Mohr Partners Chairman & CEO Robert Shibuya said. “Achieving $100 million in transactions is a testament to his dedication, expertise and unwavering commitment to excellence.”

Shelton joined Mohr Partners in April 2015 and works closely with the firm’s Global Corporate Services team and brokerage teams to oversee corporate real estate transactions for national portfolio clients.

Shelton has had his CCIM designation since 2010 and has been an SIOR member since 2021. He graduated with honors from both the University of Texas and Texas A&M University-Commerce.

Dunaway is pleased to announce Cristina Criado, PE, as the newest addition to our Dallas team.

Cristina joins Dunaway as a Vice President and Principal, bringing with her over three decades of engineering experience as the owner of CRIADO and Associates. As a Principal and Vice President at Dunaway, Cristina will lead strategic initiatives and business development efforts in North Texas to identify opportunities that align with our regional growth plans, in addition to coaching and mentoring.

Range Realty Advisors is pleased to introduce Daniel Batey as their newest Partner, specializing in land brokerage opportunities for single-family, multifamily, industrial, and investment properties in the DFW’s northern market areas. With a strong emphasis on discipline, accountability, and integrity, Daniel not only guides his clients toward their goals but also contributes to the expansion of the DFW market. Over his five-year tenure at Range, Daniel’s exceptional performance has established him as a top producer in the highly competitive North Texas market. Additionally, Daniel demonstrates exceptional leadership qualities and actively seeks opportunities for personal growth and development. It is these qualities that have enabled him to advance into this new role.

Paladin Partners, a fullservice commercial real estate company, announced today that Robert Miller has joined the firm as a new partner.

“We are extremely honored to have Robert join the team.” said Conrad Madsen, SIOR, Co-Founder and Partner of Paladin. “Adding him to the firm allows us to have significantly better coverage on the western side of DFW and helps bring our vision of opening an office in Fort Worth one step closer to reality.”“Ultimately Robert wanted a platform that truly fosters culture, collaboration, and equity opportunities all behind a unified approach, and we were lucky to be a perfect fit for his vision. He will be a key contributor to the team for many years to come.”

“Can’t say enough about Robert. He is an outstanding addition to our firm, and we look forward to being able to provide more serviceability to our clients across Tarrant County and beyond. It’s not often you find a guy that has spent decades at the same company wanting to make a move and we are very fortunate to have him. He will be instrumental to our continued growth.” said Greg Nelson, Co-Founder and Partner. “We are all about the character of the man first and

foremost and Robert checks all those boxes with flying colors. It was a very easy decision for us to add him to our team.” continued Nelson.

Savills appointed Cally Miltenberger as copresident for its Texas region.

Miltenberger is an accomplished commercial real estate executive with deep roots in the Dallas FortWorth metroplex and has over 19 years of industry experience.

As Co-President, Texas Region, Miltenberger will partner with current Texas President Mark O’Donnell to execute a strategic expansion of Savills across the region. This newly combined leadership team will be responsible for implementing the firm’s investment strategy within the commercial brokerage, capital markets, and consultancy divisions across the Dallas Fort-Worth, Houston, Austin, and San Antonio markets.

In addition, Miltenberger and O’Donnell will support the Savills global occupier services (GOS) platform and collaborate with the team to identify portfolio pursuits and administer regional transactions. Miltenberger will be based in Dallas and will work closely with the local brokerage and consulting teams.

Miltenberger joins Savills from Link Logistics where she was vice president of customer solutions where she worked closely with the most critical clients within the global supply chain. Previously, she was a client solutions leader for CBRE where she focused on winning and structuring successful partnerships with multi-market occupier clients across all industries and ranging in size from Fortune 500 companies to the middle market.

Prior to these roles, Cally spent over a decade as a management consultant in EY’s Strategy and Transaction Group focusing on developing and implementing bespoke strategies and initiatives for corporate real estate organizations. In her early career, she gained experience as a tenant rep broker at JLL, a capital markets analyst at The Staubach Company, and a staff consultant at PwC. Miltenberger has been recognized for her professional accomplishments, including receiving CREW Network’s National Impact Award, and being elected as the CREW Dallas president in 2022.

Houston, Texas • Redlands, California

National Environmental Services, with offices in Houston, Texas and Redlands, California, is an environmental consulting company, established in 1995, that conducts a full range of reliable and cost-effective environmental assessment and corrective services, with competitive pricing and convenient turnaround.

• Phase I Environmental Site Assessments (ASTM E1527-21)

•Transaction Screens (ASTM E1528-22)

• Asbestos & Lead-Based Paint Inspections (Licensed Texas Asbestos Consulting Agency)

• RSRAs (Records Search with Risk Assessments)

• Phase II Subsurface Investigations*

• Remediation and Corrective Activities*

• Soil, Water, and Air Testing Ser vices

• Indoor Air Quality/Mold Sur veys (Licensed Mold Consulting Agency)

• Underground Ground Storage Tank Testing Ser vices*

* Performed in Texas in partnership with Terrain Solutions, Inc., Texas Geoscience Firm Registration # 50018

National Environmental Services

5773 Woodway Dr, Suite 96, Houston, TX 77057: Phone (281) 888-5266

700 East Redlands Blvd, Suite U618, Redlands, CA 92373: Phone (951) 545-0250

Toll Free: (833) 4-Phase1 www.nationalenv.com • www.gabrielenv.com

June 18, 2024

Houston

Multifamily and Apartment Summit

- 4 hours of CE Approved

June 25, 2024

Austin

Industrial Real Estate Summit

- 4 hours of CE Approved

June 2024

Dallas Summit

- 4 hours of CE will be applied for

August 15, 2024

Texas REDnews Real Estate Awards

6/21 Nominations Deadline for Texas REDnews Real Estate Awards