Working through the challenging times in Kansas City

Challenging months. That’s what two commercial real estate veterans say await the Kansas City CRE market.

Aaron Mesmer, principal with Kansas City, Missouri-based Block Real Estate Services, and Kenneth Block, principal and managing member of the firm, told Midwest Real Estate News that while the fundamentals of most commercial sectors remain strong, high interest rates and construction costs have slowed both development and sales activity in the Kansas City market.

When will development and sales activity pick up here? That depends largely on what the Federal Reserve Board does with interest rates, Block and Mesmer said.

“There has been a general slowdown in new construction because of the rising expenses of construction and the higher interest rates,” Mesmer said. “In general, there is some reluctance of buyers to make new deals until there is more certainty in the market. We have seen the number of transactions fall off from where it was a year ago.”

By Dan Rafter, Editor

This doesn’t mean that the Kansas City commercial real estate market is in freefall mode. As both Block and Mesmer say, leasing activity remains high for most sectors. And if the Fed is near the end of its interest-rate hikes? That would be good news for this market.

“We are finding our footing a bit,” Mesmer said. “There are some opportunities out there for decent deals with reasonable returns. As a company, we are trying to get projects teed up and to the starting line for development.”

Development challenges

Block said that developers today face two challenges. Construction costs have risen, with the cost of labor and materials high today.

Then there are the higher interest rates bedeviling the commercial real estate industry. It’s made developing commercial properties, whether industrial, multifamily or retail, far more expensive.

MIXED-USE

The real star in today’s commercial real estate market? Mixed-use developments

By Dan Rafter, Editor

These are challenging times in the commercial real estate industry, with high interest rates slowing both the sales of existing commercial properties and the development of new ones. That doesn’t mean, though, that all asset classes are struggling equally.

One of the more successful commercial asset types today? Mixed-use developments that

CRE MARKETPLACE PAGE 46: BROKERAGE FIRMS DEVELOPERS MULTIFAMILY FINANCE REAL ESTATE LAW FIRMS FIRMS WWW.REJOURNALS.COM VOLUME 35 ISSUE 5 SEPTEMBER 2023 MINNESOTA | MISSOURI | NEBRASKA | OHIO | TENNESSEE | WISCONSIN | THE DAKOTAS | ILLINOIS | INDIANA | IOWA | KANSAS | KENTUCKY | MICHIGAN KANSAS CITY (continued on page 14)

The CityPlace Corporate Centre III building in Overland Park, Kansas, is an example of the type of office space that continues to attract tenants

MIXED-USE (continued on page 18)

Mark Menzies menzies@rejournals.com 312-933-8559 Detroit, MI | 9th Annual December 2023 - More Detail to Come! Contact Mark Menzies Today to Speak, Sponsor or Learn More About our 2023 Michigan Real Estate Awards! COMMERCIAL REAL ESTATE SUMMIT MICHIGAN +

Commercial Real Estate Lending Capital Markets 8 Reasons to Choose BankFinancial 's Mult ifamily Loan Program Loans of $250,000 to $3,000,000 1 Multifamily 5 Units and Above 2 LTV: Up to 65% / 80% (Dual Note) 3 Acquisition, Rate & Term, and Cash-out Refinances 4 5 3, 5, 7 & 10-year ARM Loans 6 Up to 30-year Amortizations 7 8 2nd Lien Line of Credit Loans and Investment Equity Loans Available* Capital Markets Loan Program Available Call Us Today to Discuss Your Next Commercial Real Estate Deal! 1.833.894.6999 1.833.894.6999 | BankFinancial.com All loans subject to credit and collateral approval. *BankFinancial must be the rst lien holder.

Working through the challenging times in Kansas City Challenging months lie ahead. That’s what two commercial real estate veterans say awaits the Kansas City CRE market.

The real star in today’s commercial real estate market? Mixed-use developments These are challenging times in the commercial real estate industry, with high interest rates slowing both the sales of existing commercial properties and the development of new ones. That doesn’t mean, though, that all asset classes are struggling equally.

The fundamentals are still strong: Cleveland commercial real estate market holding steady in challenging times Strong demand for multifamily properties. Demand that might even be higher for industrial. And an office sector that, while struggling, is showing signs of life. Those are the positives in today’s Cleveland-area commercial real estate market.

Not a nice-to-have but a must-have to stay in the game: Eight brownfield properties dotting Southeast Michigan might soon be home to new warehouses, distribution centers or manufacturing plants thanks to the Detroit Regional Partnership’s Verified Industrial Properties program.

Hanging tough: Kansas City’s multifamily sector shows off its resilience It’s little surprise that higher interest rates have slowed the number of multifamily sales in the Kansas City, Missouri, market. What these higher rates haven’t done, though, is slow the demand from renters for apartment space in this region.

Construction outlook: A market not for the faint of heart These are tough times for the commercial real estate construction industry, with both higher interest rates and rising materials costs making building new apartment towers, office buildings and industrial buildings more expensive. How are construction companies working through this challenging economy?

Looking for signs of a sales boost in the multifamily sector Like all commercial real estate sectors, the multifamily market has seen sales slow since the Federal Reserve Board started increasing its benchmark interest rate. But are there signs that sales activity might pick up next year? There might be.

Four words that sum up the apartment search in the Midwest? A real “suite” challenge Apartment seekers in Chicago are in for quite the challenge. But would you believe us if we said snagging a suburban rental is even harder?

Employees returning to the office?

It’s not happening yet … especially not in the United States Zoom made headlines in August when the videoconferencing company told employees who live near an office to work from that space at least two days a week.

DEPARTMENTS/COLUMNS

6 Editor’s Letter

36 The battle to bring workers back to the office: What’s the right approach?

38 PACE: The chameleon of CRE financing

39 Midwest News Briefs

43 People on the Move

46 Directory Listings

The Midwest’s commercial real publication, providing useful, unbiased and accurate coverage of the industry and its professionals since 1985.

WWW.REJOURNALS.COM

Publisher | Mark Menzies menzies@rejournals.com

Editor | Dan Rafter drafter@rejournals.com

ADVERTISING

Vice President of Sales & MW Conference Series Manager | Ernest Abood eabood@rejournals.com

Vice President of Sales | Frank E. Biondo frank.biondo@rejournals.com

Classified Director | Susan Mickey smickey@rejournals.com

Midwest Real Estate News brings real leaders together to explore the challenges and opportunities unique to their markets.

ADDRESS

1010 Lake St Suite 210, Oak Park, IL 60301 Midwest Real Estate News® (ISSN 0893-2719) is published bimonthly by Real Estate Publishing Corp., Oak Park, Il 60301 (rejournals.com). Current and back issues and additional resources, including subscription request forms and an editorial calendar, are available on the internet at rejournals.com.

4 | Midwest Real Estate News | September 2023 | www.rejournals.com

FEATURES 1 1 8 20 32 22 24 26 30

8 C M Y CM MY CY CMY K

Chicagoland’s Union Electrical Team LEARN MORE AT POWERINGCHICAGO.COM

All those COVID moves? Not all homeowners are happy where they ended up

By Dan Rafter, Editor

Remember all those people who moved during the early days of the COVID pandemic? News sites were filled with headlines of people moving from urban apartments to the suburbs. Others reported on renters finally making the move to homeownership in a bid for more space during the days when businesses were shut down and concerts and sporting events canceled.

Turns out, many of those who moved during the pandemic regret it.

A new study from All Star Home reports that one in five Americans who moved in the last three years regrets moving to a new residence or city. And many of them are already considering moving back to their former cities or neighborhoods.

That’s a lot of regrets because so many people moved during the last three years. According to All Star Home, a whopping 36% of Americans have moved during the last three years.

All Star Home surveyed 1,000 homeowners in August of 2023 about their moving habits and regrets. Survey respondents were 50% male, 49% female and 1% non-binary. Respondents ranged in age from 18 to 85, with an average age of 45.

What regrets have come with these moves? All Star Home says that nearly one out of every four people who moved to a new home since 2020 said they regret how much they paid for their new residence. They also said that they have buyers’ remorse when it comes to their new home.

Those with regrets say they are most upset about the unexpected costs of their move. Others say that they miss their old neighborhood or city or miss their old home.

Back to those unexpected costs. According to All Star Home, Americans who moved since 2020 spent an average of $4,000 on unexpected costs while making their move.

A total of 12% of the survey’s respondents said that they regret their move because of the new interest rate attached to their mortgage loan. According to All Star Home, 14% of the people who moved during the last three years have a mortgage interest rate near 7%, 17% have a 5% mortgage interest rate and 31% have an interest rate of 6%.

The survey also found that one in five survey respondents who regretted moving said that moving wasn’t worth

the hassle, while one in three said they would consider moving back to their former city or state.

But what about those Americans who haven’t moved in the last three years?

A total of 31% of respondents said they haven’t moved because they feel trapped in their current living situation because of high interest rates, while 79% said that they believe buying a home is significantly more difficult in 2023 than it has been in previous years.

Despite these hurdles, one in three survey respondents said that they plan on moving in the next three years.

Why do people want to move? According to All Star Home, the top reason is the desire for a new home. Rounding out the top reasons: Respondents wanted to move to a new city or town, wanted to move to a new state or wanted to move to live somewhere more affordable.

Midwest Real Estate News | September 2023 | www.rejournals.com 6 FROM THE EDITOR

Image provided by All Star Home.

Image provided by All Star Home.

Maintaining Skylines For Over 10 0 Years

International in 1938. As “ e Best Hands in the related damage, and deterioration to your masonry façade from store fronts to skyscrapers, historical landmarks to new construction.

Anyone Interested in Quality Workmanship

contact:

THE

PROFESSIONALS IN MASONRY RESTORATION

can

Administrative District Council #1 Call (630)

All members are medically evaluated and t tested and go thru 10 to 30 hours of OSHA training. Recognized by the City of Chicago for Sca old Training, members are also trained in Fall Protection and Silicosis Awareness. e Apprenticeship requires a minimum of 3 years training and is registered with the United States Dept of Labor. for a list of Signitory Contractors Websites: tuckpointers.weebly.com www.bacadc1.org Ad paid for by Tuckpointers Promotional Fund

941-2300

POINTER, CLEANER & CAULKER

The fundamentals are still strong: Cleveland commercial real estate market holding steady in challenging times

By Dan Rafter, Editor

By Dan Rafter, Editor

Strong demand for multifamily properties. Demand that might even be higher for industrial. And an office sector that, while struggling, is showing signs of life. Those are the positives in today’s Cleveland-area commercial real estate market.

What’s behind Cleveland’s solid performance? We spoke with Grant Fitzgerald, vice president and regional manager for the Cleveland and Colum-

bus regions with Marcus & Millichap. Here is some of what he had to say about the resilience of Cleveland’s CRE market.

Let’s start with the multifamily sector. Have higher interest rates slowed multifamily sales in the Cleveland market?

Grant Fitzgerald: Historical context is important. Transactionally, we are down from the last two years in multi-

family sales. But those years were such anomalies for everyone in every market. Historically, transaction volume in the multifamily sector today is consistent with what it usually has been. I’d say that things are going well in the apartment business. Yes, we are down in multifamily transactions from last year, as is everybody. But historically, we are above our average.

I assume that leasing activity in multifamily remains strong, though, right?

Fitzgerald: Vacancies and rental rates are both holding strong. I think our vacancy rate might be up slightly from the last couple of years, but historically these vacancy rates are low. According to our research department, Cleveland has the second-lowest multifamily vacancy rate among the major Midwest markets.

Why are apartment vacancy rates so low in the Cleveland market?

Photo by DJ Johnson via unsplash

Fitzgerald: Stability is the key. Cleveland’s pipeline of new apartment units is relatively low by any metric compared to other markets our size. That helps keep vacancies tight. But our other economic numbers are stable, too. Our employment rate and net migration rate are both stable. We never have the lowest unemployment

or lowest amount of net migration in the country. But we are never in a bad spot with those numbers, either. We have a stable population, employment situation and housing supply. That’s a good recipe for having people stay put. It’s a good recipe for keeping renters here.

There is an interesting trend happening in the multifamily sector here. Sometimes, the rents for Class-A apartment units are higher than your average mortgage payment here. With how tight the housing market is today, with such a low inventory of homes for sale, that is helping those Class-A properties, making them

COMPREHENSIVE LEGAL SERVICES

To assist buyers, sellers, landlords or tenants involved with retail, office, commercial, industrial, multi-family, residential or vacant real estate.

ACQUISITIONS, DISPOSITIONS & DEVELOPMENT

CLASS ACTIONS

CORPORATE TRANSACTIONS

EMINENT DOMAIN

FINANCE

INSURANCE RECOVERY

JOINT VENTURES & ENTITY FORMATION

LAND USE & ZONING

LEASING

LITIGATION

MAJOR TITLE & ESCROW CLAIMS

REGULATORY COMPLIANCE

SUBDIVISION PLATTING

ZONING, LAND USE & PERMITTING

more attractive. Class-C and Class-B apartment leasing activity is always strong here. Today, Class-A rentals are strong, too, thanks in part because the single-family housing market is so tight.

www.rejournals.com | September 2023 | Midwest Real Estate News 9 CLEVELAND

CLEVELAND | COLUMBUS | CHICAGO | FORT MYERS | NAPLES | SAN DIEGO AARON S. EVENCHIK Chair, Real Estate Practice Group aevenchik@hahnlaw.com | 216.274.2450 HAHN LOESER & PARKS LLP | HAHNLAW.COM | 216.621.0150 200 PUBLIC SQUARE | SUITE 2800 | CLEVELAND, OH 44114

CLEVELAND (continued on page 10)

Grant Fitzgerald

“Historically, transaction volume in the multifamily sector today is consistent with what it usually has been. I’d say that things are going well in the apartment business.”

How about industrial leasing activity? Is that strong today, too, in the Cleveland area?

Fitzgerald: It is healthy. That is true of most markets. I’d say that the construction of new industrial properties is down from the last couple of years but up when you look at our market historically. Vacancies are more or less flat, but they are very low. The Columbus market has seen a greater number of noteworthy industrial projects and companies moving to its area. But Columbus is close enough to Cleveland that the activity there is having a positive impact on Cleveland in terms of logistics hubs and warehouses needed. For the state of Ohio in general, the activity in Columbus has been a huge positive.

And despite the challenges of the economy, it doesn’t look like industrial leasing activity will be slowing any time soon.

Fitzgerald: I wouldn’t think so. This trend is not new, but retailers have been downsizing their footprints. The big-box

stores of the 1990s and early 2000s are becoming rarer. The same thing is happening with big indoor shopping malls. Retailers are sacrificing physical space and replacing it with distribution cen-

ters. That is a trend that is here to stay. I don’t see the gigantic Best Buys or Circuit City stores coming back in the way they were. That increase in the demand for warehouse space is not going away.

Just look outside your window and see how many Amazon trucks go buy. The same thing is happening in Cleveland that is happening across the country.

Midwest Real Estate News | September 2023 | www.rejournals.com 10

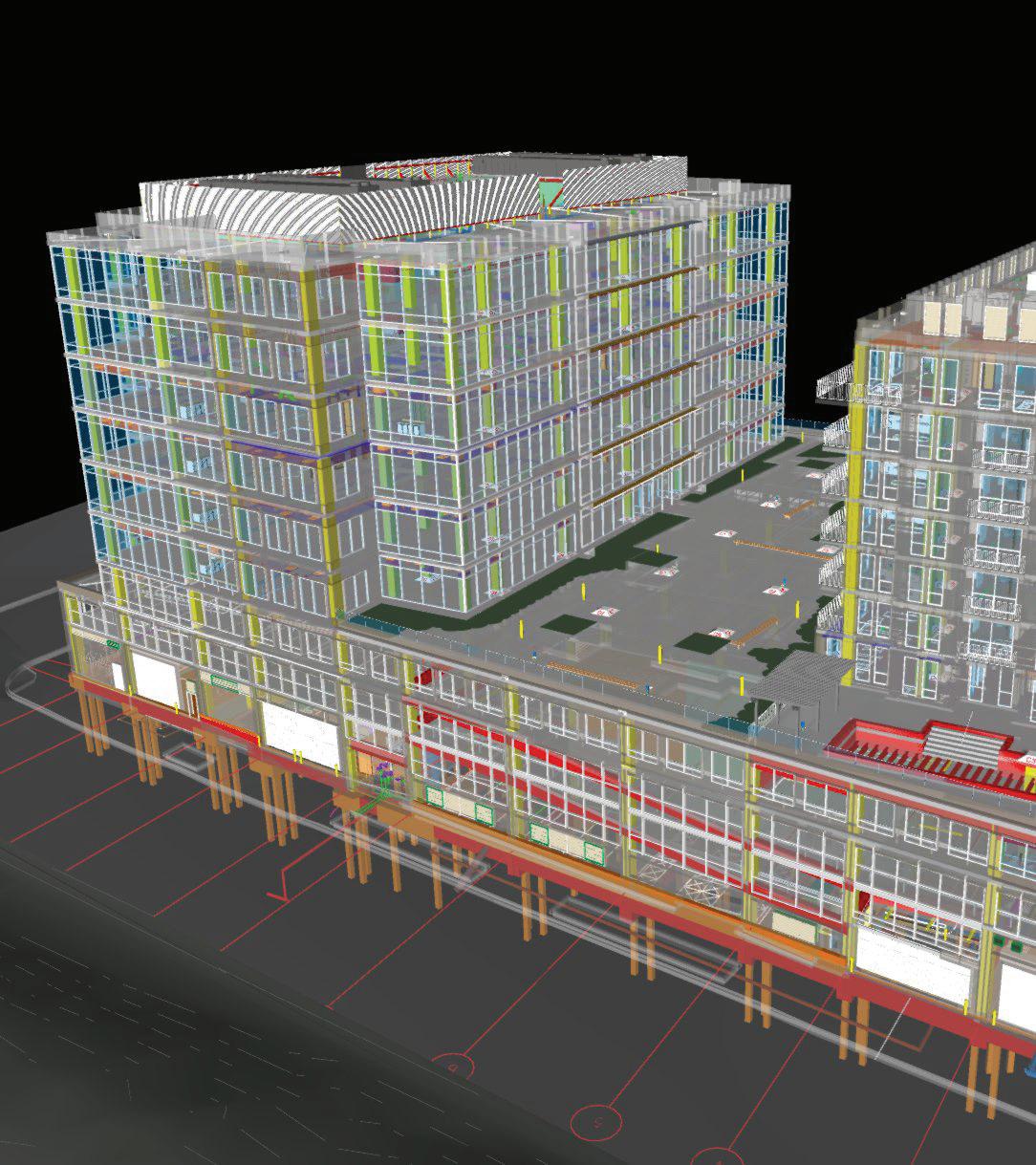

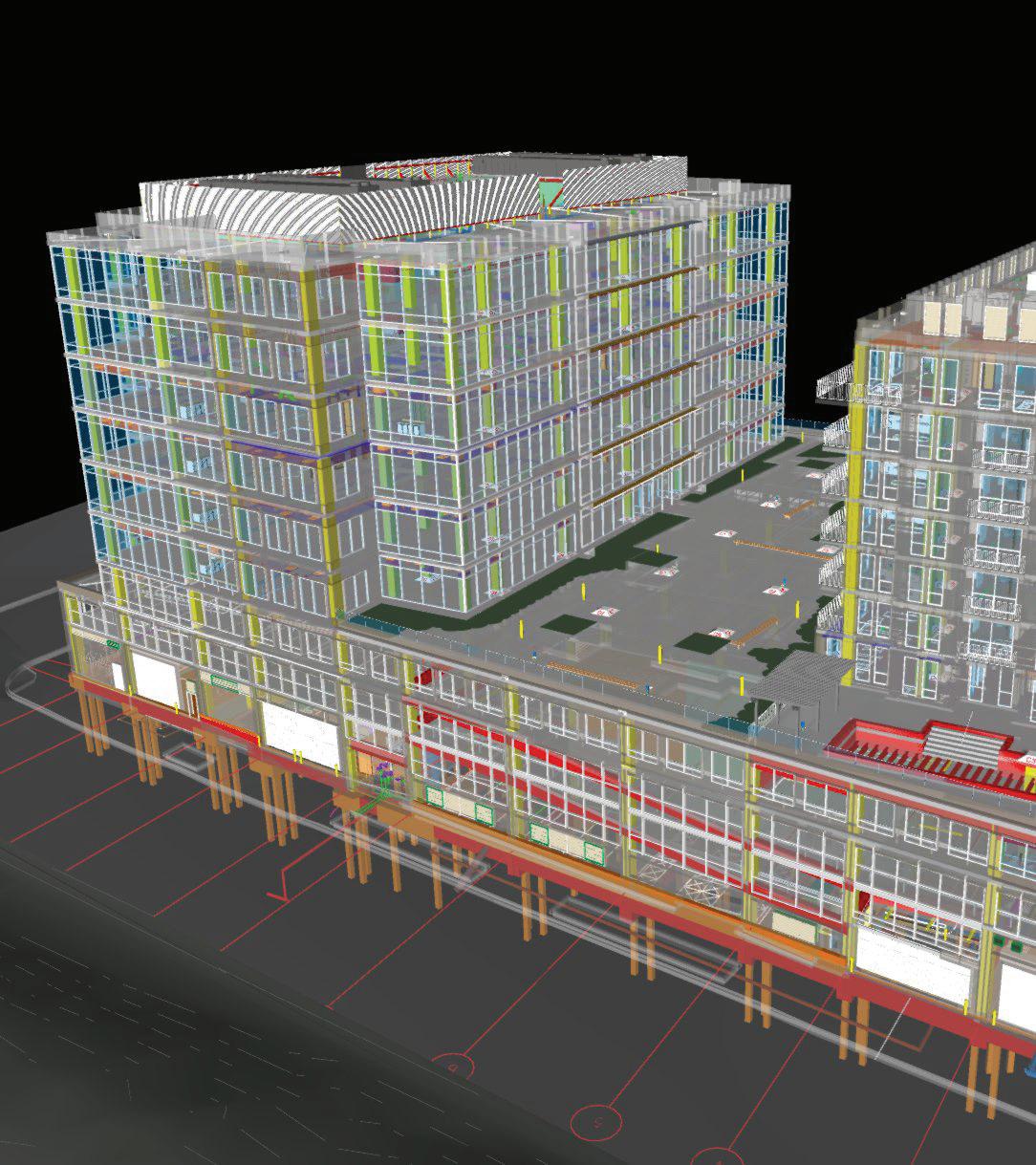

CLEVELAND (continued from page 9) CLEVELAND MIKE FURLONG, CM-BIM Managing Principal 330.414.9970 | mike.furlong@ipsvdc.com | www.ipsvdc.com • BIM Coordination Services • Site Logistics • 3D Content Creation • Revit® • Navisworks® • 3D Studio Max • Residential Design Integrated Project Solutions We protect your future project investments through BIM/VDC to improve construction coordination schedule, reduce unexpected challenges & improve your BOTTOM LINE!

Photo by Steve Dimatteo via unsplash

transaction volume would be down this year even without the higher interest rates, considering how much activity the market saw in 2021 and 2022?

Fitzgerald: Maybe not. I agree that it is inevitable that sales activity would have slowed at some time. You can’t have bull runs of transactional velocity forever. That’s not possible. The interest rates caused the change, but the change was inevitable.

There is a crop of people every year in every market who must sell for a variety of personal or business reasons. We had such a disproportionate number of those people trade in the last twoand-a-half years that the people who might have fallen into that category this year might have already completed their sales. They might have been off the table already. Of course, the higher interest rates haven’t helped. They created a gap between buyers and sellers. That is the domino that fell that put a halt on the high transaction

www.rejournals.com | September 2023 | Midwest Real Estate News 11 CLEVELAND

What about industrial sales activity? type in which sales activity is down anomalies. We are coming down off

Independently Owned and Operated / A Member of the Cushman & Wakefield Alliance Cushman & Wakefield Copyright 2023. No warranty or representation, express or implied, is made to the accuracy or completeness of the information contained herein, and same is submitted subject to errors, omissions, change of price, rental or other conditions, withdrawal without notice, and to any special listing conditions imposed by the property owner(s). As applicable, we make no representation as to the condition of the property (or properties) in question. 6100 Rockside Woods Blvd, Suite 200, Cleveland, Ohio 44131 +1 216 520 1200 • www.crescorealestate.com 799 E. 73RD STREET CLEVELAND, OHIO 44103 FOR SALE: 445,682 SF multi-tenant industrial complex on 27.44 AC, located in “Oppurtunity Zone” ELIOT KIJEWSKI, SIOR 202 MONTROSE WEST COPLEY, OHIO 44321 FOR LEASE: Several suites of varying sizes, proximate to the most substantial commercial corridor in the area BILL STEVENS 1277 WEST 6TH STREET CLEVELAND, OHIO 44113 FOR LEASE: 4,300 SF future restaurant space in the heart of Downtown Cleveland’s Warehouse District RYAN FISHER

CLEVELAND (continued on page 12)

Photo by Leo via unsplash

Would stability regarding interest rates help increase sales volume in the market?

Fitzgerald: It would help. It already has to some extent. There was a tremendous amount of uncertainty that really halted sales. There is already some stability again, though, that has encouraged people to get

transacting again or seriously consider it. I would anticipate next year that we will see an increase in sales velocity. We will see a more normal year. There was some delusion that these rates would come back down. That’s not logical, but some people thought it. Now that they haven’t, people are settling into it. I don’t expect to see a boom in sales activity, but I do expect next year to be an improvement on this year. It should be a more normal, average year.

Office markets have struggled across the country. Are you seeing any positives signs, though, in the Cleveland-area office sector?

Fitzgerald: Entering April, Cleveland had the fourth-lowest office vacancy rate among major U.S. markets for office. That is great. We are not building a lot of new office space, so vacancies remain reasonable. The office market here is certainly not booming, but the stability is a good sign.

We are seeing a shift in the office sector. It’s not bad or good. We are seeing it with large companies. Companies are reimagining what their headquarters spaces need to offer. It could be downsizing, or it could be a larger, more experiential footprint. The old office of 1980 to 2005 is just not cutting it for a lot of companies, not the way in which they are designed, positioned or located. Some companies are looking to move to a suburban location.

Others are seeing opportunities to get higher-quality space in the CBD. It will be a couple of years before we know what this new office market will look like.

The office sector seems to be doing OK in Cleveland, though. There is a lot of willingness from lenders to work with borrowers, something that did not happen in the Great Financial Crisis. Everyone knows that the office sector is struggling. Instead of lenders trying to do a ‘gotcha’ and take back properties, they are working with borrowers to make it a smoother process for everyone. That has allowed some breathing space in the market. That’s been a bright spot.

What about converting old office space to multifamily? Are you seeing that taking place in Cleveland?

Fitzgerald? I think the office conversion idea is much more challenging economically to implement than people think. It’s a nice idea, but when you look at the deals, nine out of 10 don’t come close to penciling out. We might see a little bit of conversion activity, but not as much as we are reading about it in the news. I don’t think it is as viable as some of the stories make it out to be.

Midwest Real Estate News | September 2023 | www.rejournals.com 12

CLEVELAND BUILDING COMMUNITY THROUGH MISSION DRIVEN CONSTRUCTION SINCE

www.amhigley.com

CLEVELAND (continued from page 11)

1925

CLEVELAND | DETROIT | PITTSBURGH | AKRON

“Entering April, Cleveland had the fourth-lowest office vacancy rate among major U.S. markets for office. That is great. We are not building a lot of new office space, so vacancies remain reasonable. The office market here is certainly not booming, but the stability is a good sign..”

First in Historic Renovation & Urban Infill byexact@brickkc.com 3829 Main Street Ste 103 Kansas City Missouri 64111 exactarchitects.com exact architects architecture services tax credit investments development consultation harvey dutton building Garment District Fully Capitalized 10th & walnut Downtown Core Seeking Investors the aines dairy Martini Corner Opening Spring 2024 anderson & abc Main Street Midtown 75% Capitalized Seeking Investors

“Team up inflation with higher interest rates, and it’s basically made doing projects really not that smart today,” Block said. “You can’t track where your costs are going when rates are rising. We’d get a price and then three weeks later, we’d get a new price. Because of this, we stopped all new projects this year.”

The good news? Most analysts are predicting that the Fed is at least near the top of where it will push its benchmark interest rate. There might be one or two more rate increases, but these won’t be major bumps.

And while Block is waiting for rate stability, the company is doing everything it can to get its projects ready to go. That way, when rates do settle and stability returns to the market, Block can jump quickly back to development work.

A sales slowdown

As in other markets, commercial real estate sales have slowed in the Kansas City region. That’s to be expected: Higher interest rates have convinced many sellers to hold onto their properties. And buyers aren’t happy with the prices that sellers are attaching to their commercial buildings.

“There was a lot of profit-making over the last several years,” Mesmer said. “There were many scenarios in which the sellers would sell but only if they could get a crazy number. They were getting that crazier number more often than you’d think.”

As Mesmer says, transaction volumes were higher than normal before interest rates began rising. They have been lower than normal for the last year. Mesmer predicts that transaction volume should normalize as interest rates stabilize.

This doesn’t mean that sales volumes will be as high as they were before the Fed began its series of rate hikes. Again, sales activity before the Fed’s moves was abnormally high. It won’t be easy for sales volume to match those highs.

“I don’t think anyone is saying that the Fed will raise rates another 400 basis points,” Mesmer said. “You can decide whether the Fed might raise its rate by 25 basis points or maybe another 50. But you won’t see that big increase again. When we see that stability, I think you’ll see more sellers willing to sell. For now, though, many are sitting on their properties and waiting to see what might happen.”

Some commercial sales will be forced by the structure of loan deals that were completed two or three years ago.

As Mesmer says, the first of these big financing resets will happen in the third quarter of this year.

“The fundamentals are still good for most commercial real estate types, except for office,” Mesmer said. “Multifamily rents have gone up. Industrial rents have gone up. But when the interest rate goes from 3.5% to 6.5%, does that cause an issue with the lender? Or does it mean staying involved in a property and devoting much of what was once cash flow to debt? This will play out during the next six to 12 months. In some cases, the borrowers are strong and will have the capital to put more money in. In others, the borrowers will be kicked off the horse.”

An office bright spot

The office sector is struggling in the Kansas City market, much like it is across the country. But Block pointed to one strength of this sector: office space located in mixed-use developments.

Block said that mixed-use developments remain in demand. And that includes office space located in them.

“Office in true, modern mixed-use developments, with restaurants, retail and living accommodations, is performing well,” Block said. “The rents are strong for these spaces, and so is

the demand. There is an interesting break with the haves and have-nots. The Class-B and C-plus office spaces are struggling quite a bit. Tenants don’t want to go into those spaces.”

Many of Kansas City’s older office buildings have been targeted for redevelopment, Block said, with many slated to become multifamily space or hotels.

Some of this has already happened in downtown Kansas City, Block said. Construction crews have transformed much of the class-C office space in the center of the city into apartment buildings or new hotels.

This has had a positive impact on Kansas City’s downtown, with Block saying that these repurposed projects have helped push down the office vacancy rate in the city’s urban core.

The challenge? Not all Class-C and -B office buildings can be converted affordably to other uses.

“Does the building work for that renovation?” Block asked. “You have to look at how the building is sized. You have to look at its core and the distance from the core to its outside walls to make sure it’s a good fit for residential units. Some buildings don’t fit correctly. They have too much core area, too much wasted space.

KANSAS CITY (continued from page 1)

Block Real Estate Services’ Residences at Galleria in Overland Park, Kansas.

“Some of these buildings are in the right locations, but some are in the wrong locations. Those that are in the wrong locations will be removed and some new product will be built. Those in the right locations are going to be repositioned if the economics make sense.”

Suburban office spaces with their large parking lots provide enticing development opportunities, too, Mesmer said.

With more people working from home, suburban office parks that once needed four parking spots for every 1,000 square feet might now need one-anda-quarter to one-and-a-half spots for the same amount of office space. This means that a portion of their parking lots can be used to house new developments.

Mesmer points to a suburban office development in Overland Park, Kansas. This building boasts a large parking lot. But because it no longer needs as many parking spaces, the owner is turning a portion of the lot into a Dunkin’ Donuts.

The flight to quality

Block says that the flight to quality is real in the Kansas City office market. When office users do move into new space, they are increasingly leasing a

smaller amount of space. That space, though, is higher quality.

This way, office users get a better quality of space while spending about the same amount of money.

“We have been fortunate in that the buildings that we build are always ClassA-plus with first-class locations,” Block

KANSAS CITY (continued pn page 16)

www.rejournals.com | September 2023 | Midwest Real Estate News 15

KANSAS CITY “Office

modern

developments, with restaurants,

accommodations,

The rents are strong for these spaces, and

the

There is an interesting

have-nots.” 175 COMMERCE CENTRE - BLDG. 1 OLATHE, KANSAS | 1,071,139± SF AVAILABLE DELIVERING JULY 2023 FOR LEASING OPPORTUNITIES: 4622 Pennsylvania Ave Kansas City, Missouri 64112 816.756.1400 • wwww.blockllc.com IN MORE THAN 360 OFFICE, INDUSTRIAL, RETAIL, MEDICAL OFFICE, AND MULTIFAMILY DEVELOPMENTS OF RETAIL, OFFICE AND INDUSTRIAL PROPERTIES UNDER MANAGEMENT OVER 45

in true,

mixed-use

retail and living

is performing well.

so is

demand.

break with the haves and

said. “We have attracted a great group of tenants to our office space. The quality of the space and the amenities a space offers are so important. What you must do to attract workers today is different than what you had to do 10, 15 or 20 years ago.”

The office sector remains in limbo largely because so many employees are still working from home. Some major companies are now requiring that their workers return to the office, at least on a hybrid basis.

But these moves have yet to result in a lower vacancy rate or more activity in the office sector.

Block, though, said that this will gradually change as more workers return to the office.

“Employers are finding that they are not getting the level of quality work out of employees when they are not in the office,” Block said. “They are not getting the synergy between employees. And don’t forget, part of the payment that

employers make to their employees is for their commute to the office. That has been figured into the employees’ pay. If employees are not commuting, the employer might say it needs to pay them less. They are not spending the time or money or gas to commute into work. That is starting to happen now. It is a very fluid office market today.”

The fundamental strength of other sectors

While the office sector continues to

struggle, other commercial sectors remain solid, such as multifamily and industrial.

Demand remains high for apartment and industrial space throughout the Kansas City region and the entire country.

Mesmer, though, said that he has seen a slowdown in rent growth in some multifamily markets. Fortunately, the Kansas City market has bucked that trend, he said.

“Kansas City developers were more reluctant to build a lot of product at once,” Mesmer said. “We have had fewer units delivered relative to our peer cities. Our rent growth is strong because of this lack of supply. In other markets, we are seeing a slowdown in rent growth. And that slowdown does have an impact on the number of transactions in this sector.”

The underlying fundamentals of the multifamily market remain strong, though, Mesmer said. That’s largely because the country is still undersupplied when it comes to housing.

“We think that the multifamily fundamentals will remain strong for some time,” Mesmer said.

The commercial industrial market has remained strong for several years, too. Demand remains exceedingly high for industrial space throughout the Kansas City market, Block said.

That doesn’t mean that even this sector doesn’t face challenges today.

Block pointed to the high costs of construction. As he says, the cost of

Midwest Real Estate News | September 2023 | www.rejournals.com 16

KANSAS CITY (continued from page 15)

KANSAS CITY

Kenneth Block

Aaron Mesmer

building a simple industrial property has risen more than 30% during the last two years. What might have cost $60 a square foot to build now costs $80.

At the same time, interest rates that were in the low 3% range are now in the high 6% range or at 7%. That makes the cost of borrowing money higher.

This means that developers have to charge higher rents for new buildings. Blocks says that industrial buildings that might have rented for under $4 a square foot are suddenly charging $6.40 a square foot.

“In the short term, industrial development activity has slowed in our market,” Block said. “Some buildings have been completed recently. But there is not a lot of new development taking place now. There is still good activity in the smaller, light distribution market. But that product is also filling up. It’s a weird market.”

Another challenge? Many banks are

not providing the financing that developers need today, with many sitting out until the economy stabilizes, Block said.

“A lot of banks are very cautious,” Block said. “If you come in with a deal at this point, they wonder what you are doing. ‘Don’t you realize that the marketplace is terrible?’ Everybody is looking at less money today. Some of the

big commercial brokerage companies are cutting back on people right, left and in-between. If you are doing 20% or 30% less business, you are clearly in a position where you don’t have the capacity to get the income you need. You have to cut expenses.”

Again, though, that doesn’t mean that there isn’t optimism in today’s market. Just look at Block Real Estate Services.

As Ken Block says, the company has probably 20 multifamily projects that it will be ready to develop once the economy improves and interest rates stabilize.

“We want to be ready,” Block said. “But we won’t start developing these projects until the exact clear moment that the market is settling down. When that happens is unclear now.”

www.rejournals.com | September 2023 | Midwest Real Estate News 17 Contact us today for your commercial real estate mortgage banking and investment sales needs. Visit berkadia.com/kansas-city to learn more. BUILT FOR THE NOW. AND THE NEXT. ® BUILT FOR KANSAS CITY. © 2023 Berkadia Proprietary Holding LLC. Berkadia® is a trademark of Berkadia Proprietary Holding LLC. Commercial mortgage loan banking and servicing businesses are conducted exclusively by Berkadia Commercial Mortgage LLC and Berkadia Commercial Mortgage Inc. This advertisement is not intended to solicit commercial mortgage company business in Nevada. Investment sales / real estate brokerage business is conducted exclusively by Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. Tax credit syndication business is conducted exclusively by Berkadia Affordable Tax Credit Solutions. In California, Berkadia Commercial Mortgage LLC conducts business under CA Finance Lender & Broker Lic. #988-0701, Berkadia Commercial Mortgage Inc. under CA Real Estate Broker Lic. #01874116, and Berkadia Real Estate Advisors Inc. under CA Real Estate Broker Lic. #01931050. For state licensing details for the above entities, visit www.berkadia.com/licensing 0823-432IG.. MICHAEL SPERO Senior Director Investment Sales michael.spero@berkadia.com 913.980.8698 JOHN J. SCHORGL Managing Director Mortgage Banking John.schorgl@berkadia.com 913.209.9815 NIKO VRENTAS Associate Director Investment Sales niko.vrentas@berkadia.com 913.991.0707

KANSAS CITY

“We want to be ready. But we won’t start developing these projects until the exact clear moment that the market is settling down. When that happens is unclear now..”

combine multifamily, retail, office or other property types in one building.

We spoke with Patrick Holleran, senior principal of business development, and Kent Wagster, principal, with St. Louis-based architecture firm HDA about the resilience of mixed-use developments and the reasons why these projects are often so successful.

Here is some of what they had to say. Why are mixed-use developments in such favor today? Why is demand so high for these properties on both the tenant and investor sides?

Patrick Holleran: From an investor’s standpoint, you have a broader renter base. There are multiple asset classes under one roof. It is consistent cash flow. The loss of one occupant has just a minimal impact on the revenue coming from that building. Compare that to an office tower that has a tenant taking 130,000 square feet. If that tenant leaves, the investors in that building are in big trouble. But when there is a mixture of uses, it’s a little easier to absorb the loss of one tenant.

What about from a development standpoint? What makes these properties attractive to builders and developers? And what about for tenants? What do they like about mixeduse developments?

Holleran: When you develop one of these mixed-use projects you conserve natural resources. These properties also encourage walking. Tenants will walk to a restaurant or bar in part of the development. Green space is often a part of these developments. You have outdoor spaces where renters can get some exercise and socialize. This all combines to make these projects attractive to tenants. It makes it easier to fill the spaces in these developments.

For the people who live and work in these developments, the convenience factor is huge. The last thing people want to do is get in their cars and drive five miles for something small and essential. When you can walk to get those items? It makes a difference. Even if you can’t get the item in the development in which you live, these mixed-use projects are often built in walkable communities in which you can find everything you need just a

short walk away. That makes it very convenient for the people who live, work and play in the development.

I know there is a growing demand from people for walkability.

Holleran: It’s so nice to have easy access to the things you need in your life, a coffee shop, gyms, medical clinics. A lot of developers crave these mixed-use developments that have the essentials that people need every day. It attracts people who want to live there and businesses that want to have an office there. It’s an all-around good thing.

It fosters this sense of community. If you have enough nearby amenities, you might not even need a car. Walking is good for your health. You can take the elevator down and walk to the restaurant, café or wherever you might be going.

Kent Wagster: There is the socialization aspect, too. You meet more people when you are walking instead of driving. It also creates safety. You are in what feels like a little town or village. When there are more people around, residents feel safer. There are so many people who work from home today. That’s a key factor, too. The younger

generation likes to have everything at their disposal. It’s easier to work from home when you are in a mixed-use development that gives you the opportunity to work in different places, such as a nearby coffee shop or restaurant.

What do developers need to keep in mind when creating a mixed-use development?

Holleran: To do it right, the development has to feel authentic. Developers need to be aware of where the building is and what the community needs. You can’t just build a mixed-use development on any available parcel. You have

Midwest Real Estate News | September 2023 | www.rejournals.com 18

MIXED-USE (continued from page 1) MIXED-USE

The Rail mixed-use development in St. Louis, designed by HDA.

“You meet more people when you are walking instead of driving. It also creates safety. You are in what feels like a little town or village. When there are more people around, residents feel safer.”

to do your research. What is the community lacking? What does the customer base want? The development needs to feel authentic. Research has to be done to make a mixed-used development work well.

Wagster: It’s important to remember, too, that mixed-use developments aren’t just for younger people. They serve residents of all ages. Many older people are gravitating to mixed-use developments. We see some mixeduse developments with more of a focus on senior living.

What kind of research do developers need to do to boost the odds of their mixed-use development succeeding?

Holleran: A developer should work with a consultant to do a market study. How much retail is needed in an area? What types of retail is the area lacking? How much housing is needed? How many apartment units can you put in the area? Is there the need for office space?

You can work with someone to do a market study or do it on your own. Doing that research takes time, though. You need to talk to local brokers and businesses. You need to drive the area and look at local apartment developments. What amenities do new apartment developments have? Were these new developments successful or did they miss the mark? Like anything

you do in life, it takes research. It takes working with the right professionals and taking the time to do a good job.

What kind of amenities are renters looking for today in new apartment developments?

Holleran: There has to be a good blend of indoor and outdoor amenities. People want areas for pets. They want outdoor courtyards. Some of the courtyards at new developments are unbelievable. The pools and cabanas that they feature are amazing. They might have misters spraying cool air. You almost feel like you are at a resort. It feels like you are on vacation at your own home.

The indoor amenities are equally impressive. They have workout facilities dressed to the nines. You can be a professional bodybuilder and still work out in the gyms in some of these developments. You can take yoga classes. They have additional storage areas. Some of these multifamily developments are so sophisticated that they feel like hotels, and I say that in a good way.

Wagster: They are getting very elaborate. Some feature pickleball or bocci ball courts. They might have a wide, flat area for outdoor games, movie nights or social nights. On the interior, we are also integrating some office space that tenants and residents can lease or check out. Some have theater spaces

How important is finding the right location for a mixed-use development?

Holleran: There has to be demand for a project like this. A good and experienced developer will have a very good feel for the neighborhoods in which a mixed-use development will work. A lot of them, for instance, are going up in old malls in the suburbs. Developers are buying those old malls and converting part of the space to big mixed-use developments with medical, multifamily, hospitality and office.

That’s different from what we see in urban areas. In many of the urban areas, you need to develop vertical mixed-use developments. But again, it has to be in the right location. We are seeing with all these large office towers around the country a greater opportunity to reposition these properties for a multitude of uses. We will see some of these office towers converted to mixed-use developments. But it has to be the right location and right developer.

a party room space.

www.rejournals.com | September 2023 | Midwest Real Estate News 19

that can double as an interior movie night area or

MIXED-USE

Please contact us for any upcoming project needs! 847.374.9200 · www.meridiandb.com DESIGN BUILD · GENERAL CONTRACTING CONSTRUCTION MANAGEMENT UNDER CONSTRUCTION... Ask us how we can help you incorporate sustainability into your next project! Think of us for your next Indianapolis area project... ARCHITECT: Curran Architecture CIVIL ENGINEER: Kimley-Horn Hobbs Station - Buildings 1 & 2 Plainfield, IN - 233,618 & 263,922 SF

HDA-designed Two Twelve Clayton, a multifamily development in Clayton, Missouri, with a pizza restaurant on its bottom floor.

Not a nice-to-have but a must-have to stay in the game: Detroit Regional Partnership program makes it easy for companies to find available land in Southeast Michigan

By Dan Rafter, Editor

Eight brownfield properties dotting Southeast Michigan might soon be home to new warehouses, distribution centers or manufacturing plants thanks to the Detroit Regional Partnership’s Verified Industrial Properties program.

The goal of this program, better known by its acronym of VIP by DRP, is to boost the site-readiness of brownfields throughout Southeast Michigan. The

program, which launched in October of last year, offers incentives to encourage partners to submit available properties to an online portal.

Developers can then search the portal to find sites that fit their needs.

That portal, www.verifiedindustrialproperties.com, is a key to the program: It highlights former brownfield sites that have been vetted for environmental, zoning and other develop-

ment-readiness factors. Third-party engineers verify the condition of vacant industrial parcels of 10 acres or more by evaluating how easy or difficult it would be to connect to utilities, whether wetlands mark the site, if there are easements for developers to deal with and other key factors.

Examples of sites listed in the portal include the former Summit Place Mall in Waterford Township, land owned by Walbridge in Lyon Township and land

tracts that are part of the Detroit Region Aerotropolis near Detroit Metro Airport.

“We created this program with the mission of creating new jobs for our residents,” said Justin Robinson, executive vice president with the Detroit Regional Partnership. “We can create those jobs by attracting new companies to Southeast Michigan. The industrial sector is very hot right now, and the goal of the program is to en-

Midwest Real Estate News | September 2023 | www.rejournals.com 20 DETROIT

courage developers and companies to look at this part of Michigan.”

As Robinson says, the industrial vacancy rate in the Detroit region ranges from 2% to 4%, incredibly low. There are few buildings available, then, for end users.

This is causing more developers and end users to search for usable vacant land on which they can build new industrial facilities. The VIP program can help these users find such land in Southeast Michigan.

“We are stepping up and going to work on this issue,” Robinson said. “The key word is ‘proactive.’ We want to be proactive in finding ready sites for end users. We are not able to do what some areas are doing and buy land. Our objective is to make sure that we identify the strengths and weaknesses of these brownfield sites and that we list this information in our online portal. We want end users to see and understand what is out there for them in this region.”

As Shannon Selby, vice president of real estate for the Detroit Regional Partnership says, if you do nothing, you get nothing.

Selby says that verifiedindustrialproperties.com currently features information about 28 sites in the Southeast Michigan region. Visitors to the website can search by minimum acres, county, brownfield sites and greenfield sites. Each land site boasts its own engineering report and list of key data, Selby said.

The work done by the Detroit Regional Partnership’s engineering partners is key to the program’s success, Selby said. These engineers do site reporting work that takes about 10 weeks to complete. They then prepare a report on the quality, benefits and challenges of the brownfield and greenfield sites.

“We are proactively going after sites,” Selby said. “We rank these sites and prioritize those that present the most opportunity to end users. End users who are from out of the country and who don’t know Michigan can get all the information they need on the Detroit region, down to the county and down to an individual land site. There is a lot of information on the site that can really help companies make a decision on which land sites might be right for them.”

When developers and end users look for industrial sites, they often search 25 to 50 regions, Robinson said. They need information quickly, which is something the VIP’s online portal can provide.

“The reality is that these are fast-moving projects,” Robinson said. “End users aren’t calling brokers locally. They want to see the information about available land in a centralized platform so that they can compare us against Columbus, Dallas or any of the other regions that they are considering.”

Robinson said that the Detroit Re gional Partnership is working with municipalities and the owners of available land to fund the physical site studies that provide the infor mation on VIP’s web portal.

“We want to provide all the mate rials a company needs to make a decision,” Robinson said. “We want to give them the information they need to understand the status of a site.”

“Determining site readiness is a team sport,” Selby added. “It takes a collaboration of a number of us to make this happen.”

It’s also a necessity to attract com panies to the region, Selby said.

“Having a program like this isn’t something that is nice to have,” Selby said. “It’s a must-have. Site selectors need as much information as they can find. Providing that in formation to them is mandatory if we want to stay in the game.”

Like in most parts of the country, the industrial sector is performing well in the Detroit market. Not even high interest rates, which have slowed industrial sales, have slowed the demand for industrial space by end users.

It doesn’t look like the demand for warehouse, distribution and manufacturing space will slow in the region anytime soon, either.

“During the early days of the pandemic, people worried that the industrial market would dry up,” Selby said. “But it didn’t. Demand for industrial space only accelerated during COVID. People wanted their packages on their front porches. That meant that companies had a demand for even more industrial space. It’s also why we need to have land ready for these companies.”

As Selby says, Michigan is a legacy industrial state. It’s why the state has so many brownfields ready for redevelopment. And it’s why recycling these sites and putting them back into use is so important for the state.

“The industrial market might have plateaued a bit recently, but it has plateaued at some of the highest activity levels we have ever seen,” Robinson said. “The scale of the industrial projects we are seeing, the intensity of the uses, is unlike anything we’ve ever seen.”

www.rejournals.com | September 2023 | Midwest Real Estate News 21

DETROIT • Asbestos / Lead /Mold Consulting • Building & Infrastruc ture E valuations • Construction Materials Testing • Environmental Services • Geotechnical Ser vices

Indoor Air Qualit y Consulting We Provide:

•

Justin Robinson

Shannon Selby

Hanging tough: Kansas City’s multifamily sector shows off its resilience

By Dan Rafter, Editor

It’s little surprise that higher interest rates have slowed the number of multifamily sales in the Kansas City, Missouri, market. What these higher rates haven’t done, though, is slow the demand from renters for apartment space in this region.

As E.F. “Chip” Walsh, a real estate entrepreneur in the Kansas City market says, demand for apartment space is still outpacing the supply in the city and its suburban communities. And that isn’t changing anytime soon.

And Walsh has a good perspective. He is the founder and principal of Kansas City’s Mercier Street, a commercial real estate development consulting firm. He is also the founder and principal of Sustainable Development Partners, LLC, a partnership of Kansas City-based real estate professionals.

It’s safe to say, then, that Walsh knows the multifamily market in Kansas City. Here’s some of what he told us about the resilience of this sector, the demand for new apartment developments here and what might happen to all those nearly vacant office towers in the region.

Let’s start with the obvious question: Have higher interest rates slowed sales activity in the multifamily sector in the Kansas City area?

E.F. “Chip” Walsh: I am more involved in the leasing side of the market. I have a multifamily project in the construction process and two others in the early stages of development. I don’t pretend to have my pulse on the sales side of the multifamily sector. But from what I am hearing, unlike on the coasts, Kansas City seems to be doing well overall, despite the economic challenges.

That is a reflection on this market. In Kansas City, we are still seeing rent growth in the multifamily sector. We still see a strong labor market here. We have added something like 16,000 jobs in the first seven months of the year and our unemployment rate is very low. Those metrics are helping the multifamily sector.

But do I think sales volume in this sector is down year-over-year? Yes. By how much? I’m not the best person to ask about that.

How about leasing activity? Is there still strong demand from renters for apartment space in the Kansas City region?

Walsh: Yes. Leasing demand is strong. Look at the affordability gap as one key metric. What would someone pay for the average rent in an area or for the

average home mortgage? Because of where interest rates are at today, many markets still favor renting. Renting is still more affordable in many markets, including ours. At the same time, we have a shortage of units overall in the Kansas City metropolitan area. This shortage is most acute in what would be called the affordable or workforce housing areas. We are doing just fine with luxury, but we need more workforce multifamily.

Those higher mortgage interest rates and our lack of enough supply are both positives for rent growth. They are also positives for leasing activity. Is our multifamily vacancy rate up? Yes, slightly. But overall, this market is performing well.

Are you seeing developers bringing new apartment units to the Kansas City area, helping to lessen that supply shortage?

Midwest Real Estate News | September 2023 | www.rejournals.com 22

KANSAS

CITY

The Cordish Companies’ Three Light Luxury Apartments recently opened in Kansas City’s Power & Light District.

KANSAS CITY

Walsh: We’re looking at a bi-state area here, Missouri and Kansas. This market includes two states, five counties and a lot of municipalities. Overall, I’d say there is good demand for new apartment units throughout the region and there is new product in the pipeline. If you look at the market on a year-over-year basis, though, it would not surprise me if the volume of new supply was down a bit.

The activity in Kansas City, Missouri, proper is a little more exciting. In the CBD we had a project for a new office tower near our T-Mobile Center. Earlier this summer, the developers repositioned it for multifamily. I do expect to see more of that as office space continues to go unused.

Do you expect to see more office space converted into multifamily?

Walsh: Right now, our CBD has a vacancy rate of about 25% in the office sector. And market wide, the most recent data for larger office buildings also showed a high vacancy rate in the second quarter. The owners of some of these office properties are going

to have to find ways to do conversions. Maybe they can use historic tax credits or some other type of financial incentive. Many of these conversions will require some sort of financial incentive.

These conversions can be expensive, though. Are there some buildings where converting from office to multifamily won’t make financial sense?

Walsh: That depends on so many factors. I had a deal five years ago where the office floorplates worked out well. How the office property was laid out made sense for a conversion. You do have to look at the key factors: How much of an open floor plan do you have once you take out the dividing walls? Where is the central core? When was the office building originally built? But there are some good opportunities in this market to convert office buildings to apartments. That’s why you have seen strong demand for this type of conversion in multiple markets.

Now that the pandemic seems mostly behind us, are you seeing people

returning to downtown Kansas City? Do people still want to live in the city’s urban core?

Walsh: Our urban core is still a desirable location for a renter. We are seeing that submarket come back. The office market in our urban core, though, is still lagging. We are seeing a lot of companies moving from existing space to a smaller office footprint. That is adding pressure to the upward vacancy rate we are seeing in the office sector downtown.

I think going forward, though, you will continue to see people wanting to live in downtown Kansas City. The Cordish Companies recently opened its Three Light Luxury Apartments in our Power & Light District. This comes on the heels of the company’s One Light and Two Light apartment developments. To me, that is another sign that our urban core is still desirable for renters.

There is also some talk that one of our professional sports teams, the Kansas City Royals, might relocate. One possible landing spot would be the central business district. They

are proposing a village concept with a mixed-use development adjacent to the new stadium, one that might include office and residential. That would be another boost to our urban core.

When it comes to amenities, what are renters looking for in new properties?

Walsh: There is an escalation war with amenities. If a property has something new, the next property has to match it and the next property has to go above and beyond. The days of having just a pool and community room are over. The amenities are not just for the people living in the buildings, either. They are for their pets. It’s important today to have properties that are dog-friendly. You see amenities such as cat- and dog-washing stations and on-site dog parks. Some properties offer dog-walking services. It really is a big change from what it used to be.

www.rejournals.com | September 2023 | Midwest Real Estate News 23

No longer run-and-gun: Dealing with a normalizing commercial construction industry

By Dan Rafter, Editor

Hurdles? Commercial construction companies face plenty today. The cost of construction materials continues to rise. Labor is more expensive and difficult to find. Then there are the high interest rates that have slowed sales and development activity across the commercial real estate business.

It’s combined to make navigating the business a true challenge today for commercial construction professionals.

But the good news? There is hope. The Federal Reserve Board has signaled that its interest-rate tweaks might be nearing their end. The price of materials isn’t rising as quickly as it once was, at least for some components. And the wait times for construction materials are finally starting to ease.

The big hope is that economic stability

will return to the country and industry sometime next year, and that this will make life easier for commercial construction companies.

“Yes, these are challenging times,” said David Julian, vice president of business development with Oak Brook, Illinois-based Krusinski Construction Company. “But the bigger and broader answer is that deals are still getting done. Buildings are still getting built. It’s much more challenging today, especially from the capital investments side. But there is still construction activity.”

Not all commercial properties are created equal, though. Julian said that certain property types are more difficult to build today.

He points to his experience at the I.Con Cold Storage 2023 conference recently held in Atlanta. Those participating in the conference said that it’s espe-

cially difficult to build spec properties today. Getting the financing for these projects is a hurdle that is too difficult for many deals to overcome.

But it’s far easier to qualify for financing and complete build-to-suit projects, Julian said.

“Those build-to-suit projects are still challenging because of rising interest rates and escalating costs for materials, but those deals are less cumbersome than the spec projects,” he said. “It’s one of those things: We were going 150 miles an hour when it came to construction activity. Now we are going 100 miles an hour. We are not going as fast, but we are still going 100 miles an hour.”

That brings up the big question: Would commercial construction activity have slowed this year – or maybe next –even if interest rates didn’t increase so dramatically?

Maybe, Julian said.

“I think normalizing is a good way to describe this market,” Julian said. “You can only sustain the pace we were on for so long before you run out of gas.”

Julian points to the actions of some of the larger distribution and logistics companies today. They are slowing their requests for new distribution centers and warehouses. But that doesn’t mean that these big players don’t need any new product.

“They went real fast, real fast, real fast for a long time. Now they have slowed down,” Julian said. “But they haven’t stopped completely. There are plans in place for them to approach that side of their businesses in a more strategic way. That’s normal. It’s no longer ‘runand-gun.’”

Julian said that Krusinski has seen an increase in opportunities in the manufac-

Midwest Real Estate News | September 2023 | www.rejournals.com 24

CONSTRUCTION

One of the bigger projects that Krusinski is involved in today is the consumer packaged goods (CPG) distribution center it is building for Kraft Heinz at the Chicago West Business Center in DeKalb, Illinois.

turing arena. That’s largely because of how fast technology is changing. Many of Krusinski’s manufacturing clients, those dealing in the food-and-beverage, products and services industries, need to reinvest in their technology.

These clients, then, need updated buildings and improved efficiencies with their power and waste systems.

This doesn’t mean that some projects haven’t been pushed from 2023 until next year. But there are many reasons for these changes. It’s not just because of interest rates and higher construction costs.

A land deal might have fallen through. The client might not have been able to get the land it wanted. As Julian says, it’s not always high interest rates and costs that scuttle a deal.

“There are a million-and-one reasons for a deal to die,” Julian said. “So many times, when a deal goes sideways it’s something that we haven’t seen before. We can then check that reason off the list.”

Overall, though, business is good at Krusinski. Julian says that the company celebrated its fifth-best year last year.

One of the bigger projects that Krusinski is involved in today is the consumer packaged goods (CPG) distribution center it is building for Kraft Heinz at the Chicago West Business Center in DeKalb, Illinois.

CONSTRUCTION

The project is a partnership with Krusinski, the Kraft Heinz Company and Trammell Crow Company to build one of the largest CPG distribution centers in North America. The $400 million center will cover 775,000 square feet when completed.

The new facility will feature national railway access served by Union Pacific Railroad and automation technology, including a 24/7 automated storage and retrieval system.

The project will bring 150 new jobs to the DeKalb region.

“Overall, the attitude out there is optimistic and positive,” Julian said. “It’s just a bit more challenging. When times get more challenging, you get closer to your own business, get closer to your client partners and take that ride together.”

While rising construction costs remain a challenge, there is some positives here, too. Julian said that the costs of some materials have come down, including steel, wood and timber.

“Are these costs going to get as low as they were pre-pandemic? No,” Julian said. “Again, the market is normalizing. Are these costs higher than they were? Yes. But the materials costs today are not preventing companies from building new buildings.”

There’s also some positive news surrounding interest rates. No one knows exactly what the Federal Reserve Board will do with its benchmark interest rate. But the hope is that the Fed is at least nearing the end of its rate hikes.

If it is, that will bring much-needed stability to the interest-rate environment. And that, Julian said, is what developers and commercial real estate professionals are looking for.

“The good news is that even though interest rates have climbed, deals are still getting done,” Julian said. “These issues are getting worked through over time.”

www.rejournals.com | September 2023 | Midwest Real Estate News 25

David Julian

Looking for signs of a sales boost in the multifamily sector

By Dan Rafter, Editor

Like all commercial real estate sectors, the multifamily market has seen sales slow since the Federal Reserve Board started increasing its benchmark interest rate. But are there signs that sales activity might pick up next year? There might be.

We spoke with Jeremy Morton, director with Chicago-based Interra Realty, about what the second half of 2023

might hold for the multifamily sector.

Let’s start with the big question: How have higher interest rates impacted the multifamily sector?

Jeremy Morton: The interest rates have a direct effect on pricing and how buyers underwrite buildings. Sales activity has tightened. It’s more important than ever for buyers to have a good relationship with lenders, whether

those lenders are local or national.

I did a handful of valuations in the spring in which interest rates were almost a point lower than where they are today. Those were brought to market and we slowly saw the interest rates tick up. Obviously, that has a correlation on pricing. There is a gap between buyer values and seller expectations. That’s why multifamily sales were slower in July and early August.

From what I understand, though, you have seen signs that we might see at least a small increase in sales activity in the coming months.

Morton: It is deal-specific. But in the last few weeks, we have seen an uptick in buyers interested in seeing buildings for sale and writing offers. That also

MULTIFAMILY (continued on page 28)

Midwest Real Estate News | September 2023 | www.rejournals.com 26

MULTIFAMILY

1924 S. Throop St. in Chicago is an example of the kind of apartment unit that is attracting strong renter demand.

2023 Omaha COMMERCIAL REAL ESTATE summit November 10, 2023 Scan for more information and to register www.rejournals.com/upcomingevent/ Speaking and Sponsorship opportunities available Ernie Abood eabood@rejournals.com 773-919-8799 Embassy Suites LaVista, Omaha Hotel & Conference Center 7:45am Breakfast, Registration, and Networking 8:45am - 12:00pm Program 8th Annual

has to do with sellers correcting their expectations. We have seen a few price reductions in listings in the last month. Buyers are active. It’s all about bridging the gap on the pricing.

We are still putting deals together. But things are moving a little slower. In terms of financing, it is taking more time to get everything lined up. No one is just slamming the financing together. Everyone is spending more time and due diligence on the front end, which is the key to getting deals done.

Activity is still solid, but there is a little more hesitation, a little more going

over deals with a fine-tooth comb. Instead of touring a building and making an offer that afternoon, buyers might spend a solid week reviewing the deal with brokers and lenders, checking the numbers.

Are you seeing that gap between what buyers expect to pay and sellers want to sell for starting to tighten?

Morton: I definitely am. Previously as brokers, we could market these properties on future rental growth. We can still do that, but it has to check out on current cash flow. Six months ago, as long as buyers were breaking even on their current cash flow, that was fine. Now we need a little more cushion. Some lenders are requiring nine months of

reserves to make sure there aren’t any delinquencies.

We are trying to be more transparent with everyone today, sellers in particular. Before sellers could shoot for a higher number and hope there would be a buyer who falls in love with the building. Today, you need to be more careful on how you underwrite buildings, otherwise you’ll be left with a stagnant building that won’t sell.

In the late spring and early summer, we had honest talks with sellers to help bridge that gap.

How strong is leasing activity in that sector? Interest rates haven’t slowed leasing demand, right?

Morton: Leasing is doing well. The new-construction multifamily buildings that I have been watching have been leasing out quickly with little to no concessions. The units with a greater number of bedrooms take a little longer to lease. There’s just a smaller number of renters looking for that size of a unit. But the one-bedroom and two-bedroom units are renting quickly while rental rates have gone up a little bit. Units are not staying vacant for long.

Back to sales activity. Are buyers and sellers waiting for some stability when it comes to interest rates? Are they waiting for the Fed to stop tweaking its benchmark rate?

Morton: That is the hope. I’ve talked to

Midwest Real Estate News | September 2023 | www.rejournals.com 28

MULTIFAMILY

MULTIFAMILY (continued from page 26)

Jerem Morton recently brokered a $4.2 million transaction that included the apartment building at 2300 W. 23rd St. in Chicago.

a good number of buyers. They want to buy right now. In their mind, they are confident that interest rates will go back down to some degree. When they go down, cap rates will follow. If they can buy at a higher interest rate and if they cover all their expenses and have some sort of return that they are comfortable with, they are happy. They are confident that in 12 months or so, if rates go down, the value of the property will go up. It is all about the relationship between interest rates and cap rates.

The multifamily sector has been one of the strongest commercial real estate performers for a long time. What are some of the reasons for this?

Morton: In Chicago, there is a great inventory of multifamily properties. But we still have not been able to keep up with rental demand. The higher interest rates have kept some people from buying single-family homes. There were people who planned to buy a home but instead are renting because

rising interest rates makes buying a home too expensive. They are deciding to rent longer than they would have otherwise. Because there is less turnover with available rental units, there is a growing demand for apartments. Lenders are putting units up for rent and sometimes getting 20 or 30 people who want to rent that space.

As we saw through COVID, people put a focus on where they live. They pay their rent on time. More people are

working remotely. They are in their homes longer during the day and they are prioritizing where they live. If they are struggling financially, they do everything they can to pay their rent first. Collections are high. Lenders are friendly when it comes to multifamily. They like the sector, too.

www.rejournals.com | September 2023 | Midwest Real Estate News 29

Jeremy Morton

MULTIFAMILY

“Leasing is doing well. The newconstruction multifamily buildings that I have been watching have been leasing out quickly with little to no concessions.”

Four words that sum up the apartment search in the Midwest? A real “suite” challenge

By Mia Goulart, Staff Writer

Apartment seekers in Chicago are in for quite the challenge (Seriously, I toured 10 units in the last few weeks alone). But would you believe us if we said snagging a suburban rental is even harder?

Actually, the challenge persists all across the Midwest. And while it’s great for the regional economy, it’s not so great for renter morale.

Though Miami was the most competitive rental market during this summer’s peak moving season, the Midwest has been declared America’s hottest apartment region, due to the wide range of housing options and a lower cost of living compared to the coasts.

In its newest report, RentCafe analyzed 139 markets in the U.S. where data was available, by using five relevant metrics to rank the nation’s hottest renting spots in peak season: (1) the number of days apartments stayed vacant; (2) the percentage of apartments that were occupied by renters; (3) how many renters applied for the same available apartment; (4) the percentage of renters who renewed their leases; and (5) the share of new apartments opened recently.

To determine the rental market’s competitiveness, they calculated a Rental Competitivity Index (RCI). In peak rental season, the national score was 60, which means that the apartment market was moderately competitive during the year’s busiest time for renting.

Let’s

get into it.

First up on the list, Milwaukee emerged as the second most competitive rental market in the country in peak rental season, with a RCI score of 116. Available rental apartments here fill within a month, with 16 renters competing for each vacant unit.

Following as the fourth-hottest rental market in the country, Suburban Chicago boasted a RCI score of 112. Cities like Joliet, Aurora, Naperville, Elgin or Skokie in Illinois—stretching as far as Gary and Hammond in Indiana—offer more space and a less-congested place to call home, driving competition, based on the report.

In fact, Suburban Chicago climbed six spots since the start of the rental

season. And with less that 5% of the rentals here available and little to no apartments built recently, 67.3% of apartment dwellers in the area decided to just stay put.

Not to mention, RentCafe reported that those who are looking for a new home must compete with 14 other renters to secure an apartment. On average, a vacant unit in Suburban Chicago is occupied within 33 days.

Other Midwestern markets that are highly competitive include Grand Rapids, Michigan; Omaha, Nebraska; Kansas City, Kansas; Cincinnati; and Chicago.

Midwest Real Estate News | September 2023 | www.rejournals.com 30

RENTAL

2023 St. Louis COMMERCIAL REAL ESTATE summit October 26, 2023 Scan for more information and to register www.rejournals.com/upcomingevent/ Speaking and Sponsorship opportunities available Ernie Abood eabood@rejournals.com 773-919-8799 Hilton St. Louis Frontenac 8:00am Breakfast, Registration, and Networking 9:00am - 12:00pm Program 6th Annual

Employees returning to the office? It’s not happening yet … especially not in the United States

By Dan Rafter, Editor

Zoom made headlines in August when the video-conferencing company told employees who live near an office to work from that space at least two days a week.

And Zoom isn’t the only big company that is mandating or strongly recommending that its employees return to the office. But are these orders actually bringing workers back to their cubi-

cles, conference rooms and collaboration spaces? Not really, according to a newly released study.

According to the second-quarter 2023 Workplace Utilization Index from XY Sense, office space around the globe was used just 30% of the time during the second quarter of this year.

This shouldn’t be too surprising to anyone watching the office sector

throughout the Midwest. Vacancies remain high here, and the majority of office employees are still working from home at least part of the time.

And Alex Birch, founder of XY Sense, told Midwest Real Estate News that this 30% figure might be the sign of a longer-lasting new normal in the office sector.

“This year we didn’t have any major COVID impediments where we saw new lockdowns,” Birch said. “Given that this is the first year of no new COVID developments and no new influence from COVID, are we starting to see what is a new normal in the office sector? Is this the effect of large enterprise companies dealing with long-term office leases?”

Midwest Real Estate News | September 2023 | www.rejournals.com 32

OFFICE

Photo by Pawel Chu via unsplash