Unlocking the potential of price elasticity in general insurance INTERVIEW Paul Dalziel talks refocusing the economy on wellbeing ENVIRONMENT How could global temperature changes affect mortality? RISK A new framework for tackling geopolitical risk in the 21st century The magazine of the Institute and Faculty of Actuaries NOVEMBER 2022 theactuary.com

39 Investment: The unfolding of time

Jon Exley considers whether investors are thinking about the passage of time in the right way

42 World view: Indonesia

Puneet Nayyar reflects on nine years spent in this Asian archipelago

get to grips with the biodiversity crisis, say Alex Martin and Ryan Allison

matter of

Ziling Jiang considers private assets

the PRA’s proposed matching

At The Back

Student

Ciara Izuchukwu on a recession’s implications for insurance

need to

the

proactive in

actuarial niches,

Nick Spencer and Nico Aspinall

Choosing a

Yiannis Parizas and Phanis Ioannou

commercial

insurance:

behaviour

open-

Could behavioural modelling play a

in general insurance? Damiano Massimi and Thibault Imbert discuss

The latest news, updates and events

Megha Srivastava on moving continents and staying focused

Exclusive

nation

With inflation soaring, what’s next for the Bank of England?

www.theactuary.com

for all

at bit.ly/1MN3bXK

Get the app Did you know you can also read The Actuary magazine on any tablet or Android phone? Click through to read more online, download resources, or share on social media via our links in the app. It’s an exclusive free benefit for our members. Download on the App Store at: www.theactuary.com/ipad Visit: www.play.google.comCOVER: PÉTER CSUTH Additional content including daily news can be found at

Weekly newsletter:

the latest actuarial news, features and opinion direct to your inbox, sign up

Up Front 4 Editorial Ruolin Wang introduces a diverse issue for a diversifying profession 5 President’s comment Matt Saker on the benefits of the Chartered Actuary designation 5 CEO’s comment The IFoA has delivered huge change during the past year and a half, says Stephen Mann – with more to come 6 IFoA news The latest IFoA news and events 12 Letters A Features 14 Interview: Paul Dalziel Changing the focus of economies from growth to wellbeing 14 28 A s V 18 Environment: Boiling point Dan Gill, Rajinder Poonian and Alex Harding examine the impact of temperature changes on mortality 24 Risk: Unsteady states What’s the best way to prepare for geopolitical risk? Lawrence Habahbeh shares his thoughts 27 Investment: Options open Michael Sher on making portfolios more climate-friendly 28 Environment: A steep decline Actuaries must

30 Regulation: A

adjustment

under

adjustment changes 33 Careers: Be

change We

be

carving out new

say

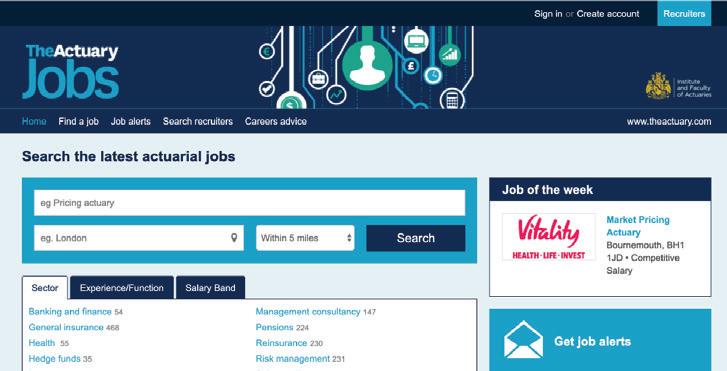

34 Technology:

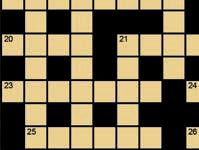

pricing architecture

compare

and

source pricing solutions 36 General

Model

role

www.theactuary.com NOVEMBER 2022 | THE ACTUARY | 3 Contents November 2022

43

44 People/society news

46 Puzzles 47 Forging ahead

Web

Inflation

bit.ly/3TzowHx

PUBLISHER

Redactive Publishing Ltd 9 Dallington Street, London EC1V 0LN

PUBLISHING DIRECTOR

Anthony Moran

MANAGING EDITOR

Sharon Maguire +44 (0)20 7880 6246 sharon.maguire@redactive.co.uk

SUB-EDITOR

Kate Bennett

DISPLAY SALES

theactuary-sales@redactive.co.uk +44 (0)20 7324 2753

RECRUITMENT SALES

theactuaryjobs@redactive.co.uk +44 (0)20 7880 6234

ART EDITOR Sarah Auld

PICTURE EDITOR Akin Falope

SENIOR PRODUCTION EXECUTIVE Rachel Young +44 (0)20 7880 6209 rachel.young@redactive.co.uk

PRINT PCP

EDITOR Ruolin Wang editor@theactuary.com

FEATURES EDITORS

Kimberly Chimsasa: Pensions and investment

Travis Elsum: Environment and sustainability

Alex Martin: Environment and sustainability Blessing Mbukude: Life Fiona Neylon: General insurance Yiannis Parizas: General insurance and data science

Rajeshwarie VS: General insurance

PEOPLE/SOCIETY NEWS EDITOR social@theactuary.com

Sharon Maguire sharon.maguire@redactive.co.uk

STUDENT EDITOR Adeetya Tantia student@theactuary.com

IFOA EDITOR Kate Pearce +44 (0)207 632 2118 kate.pearce@actuaries.org.uk

EDITORIAL ADVISORY PANEL Peter Tompkins (chairman), Chika Aghadiuno, Nico Aspinall, Naomi Burger, Matthew Edwards, Jessica Elkin, Richard Purcell, Sonal Shah, Nick Silver

INTERNET

The Actuary: www.theactuary.com Institute and Faculty of Actuaries: www.actuaries.org.uk

Venturing forth

The last edition of The Actuary went to press on 26 September 2022, and what a month it’s been. In an online exclusive, Richard Silveira’s exploration of the Bank of England’s future monetary policy couldn’t have come soon enough – you can read it at bit.ly/3TzowHx

As IFoA president Matt Saker alludes to in his column (p5), many actuaries are venturing outside of our traditional fields. In this issue, Nick Spencer and Nico Aspinall, two members of Project New Horizon, set out ways in which the actuarial community can support our growth into new areas (p33).

Subscriptions

SUBSCRIPTIONS

£130 per annum, rest of the world: £160

annum.

Contact: The Institute and Faculty of Actuaries, 7th floor, Holborn Gate, 326-330

+44 (0)20 7632 2100

Changes of address:

Delivery

Holborn, London WC1V 7PP.

kate.pearce@actuaries.org.uk.

notify the

Young E: rachel.young@redactive.co.uk

Published by the Institute and Faculty of Actuaries (IFoA) The editor and the IFoA are not responsible for the opinions put forward in The Actuary. No part of this publication may be reproduced, stored or transmitted in any form, or by any means, without prior written permission of the copyright owners.

While every effort is made to ensure the accuracy of the content, the publisher and its contributors accept no responsibility for any material contained herein.

© Institute and Faculty of Actuaries, November 2022 All rights reserved ISSN 0960-457X

In our technical features articles, we have a truly diversified and multi-disciplinary issue this month. We read about the potential impacts that climate change could have on mortality (p18), compare different technological options in insurance pricing (p34), apply a framework for understanding our exposure to geopolitical risks (p24) and, in the cover article, consider an approach to understanding price elasticity (p36).

Finally, in the interview, Alex Martin asks Paul Dalziel what it means to take wellbeing into consideration in economic decision-making, both at a national level and at the level of individual businesses (p14).

I hope you enjoy this issue.

RUOLIN WANG EDITOR

Upfront News www.theactuary.com4 | THE ACTUARY | NOVEMBER 2022

from outside the actuarial profession: UK: £100 per annum. Europe:

per

High

T

E

please

membership department. E: membership@actuaries.org.uk

queries: contact Rachel

editor@theactuary.com theactuary.com

Ruolin Wang is a Solutions Manager at Schroders. Any views are her own and not those of Schroders.

Upfront

MATT SAKER

STEPHEN MANN

MATT SAKER

STEPHEN MANN

A crucial vote Listening and acting

This month we will be asking qualified members to vote on the proposal to introduce new designations for IFoA qualified actuaries – ‘Chartered Actuary (Associate)’ and ‘Chartered Actuary (Fellow)’.

In September I wrote about why I support this proposal and believe the new designations will have a positive impact on our status and success (bit.ly/3ENMc6I). The term ‘Chartered’ is used in other professions and is an untapped asset for the IFoA and our members. Use of the word ‘actuary’ is not currently protected, and Chartered designations will distinguish between IFoA actuaries and others who practise actuarial work, reflecting your status. This change will not have any impact on where the bar is set for Associate and Fellowship. Our qualifications’ rigour and quality will not change, so there is only upside in terms of enhanced nomenclature.

Employers have told us that rebranding as ‘Chartered Actuary’ will give our qualifications global appeal and broaden IFoA actuaries’ relevance across industries and sectors, encouraging non-traditional actuarial employers to use actuarial qualifications more flexibly in their businesses. This will enhance the employer proposition and enable us to attract a broader range of graduates.

As actuaries diversify into new sectors, we need to consolidate recognition outside our traditional spheres. We want to establish the title ‘actuary’ for our members more strongly in new sectors and highlight the relevance of our skills to employers’ changing needs.

More details can be found on our website, and I encourage you to vote in favour when voting goes live in mid-November.

We have been carrying out a huge listening exercise in the past couple of years to help us transform your IFoA experience. During the past 12–18 months, this has led to the delivery of more than 15 new initiatives and countless other minor improvements. Initiatives have included online exams, an improved Virtual Learning Environment, a new thought leadership programme and a more user-friendly website. We’ve also been working to make our culture more member-centric, and in our recent employee survey, more than 90% of colleagues agreed or strongly agreed that we put our members at the heart of everything we do.

We need to keep improving and have exciting plans for 2023, including the launch of the digital communities and a new member portal that will make accessing our services simpler. An online examination solution is also in development. We also want to provide value for money; membership fees have fallen for qualified actuaries by 16% in real terms since 2017 and will remain flat for the upcoming year. Many of these things are the culmination of years of hard work; thank you for your patience while they have become visible.

One important area is the IFoA’s role in upholding high standards. Our Regulatory Board has recently published its annual report (bit.ly/3CLCNdb) reflecting its first full year with an increased remit, including responsibility for disciplinary and enforcement matters, and the public interest regulatory aspects of our qualification and admissions frameworks. The report also highlights its regulatory work to enhance transparency and accessibility.

I echo Matt’s sentiments on Chartered Actuary. The benefits are huge, protecting the profession’s status, enhancing the value of IFoA qualifications and standards, and supporting the growth of the profession, so please do cast your vote.

MATT SAKER is the president of the Institute and Faculty of Actuaries

I would like to finish by continuing my wellbeing theme. Society is increasingly competitive, and we are often told that ‘nice people finish last’. This mindset is not part of our natural biology and is driven by our environment. There are huge benefits in receiving warmth and compassion, but showing it to others also brings benefits for our own wellbeing. Why not introduce an act of kindness into your day? It can be a small thing, like paying a compliment, or something more significant. It’s hard to see a downside.

STEPHEN MANN is the chief executive of the Institute and Faculty of Actuaries

Finally, our next annual member survey launches this month. We want to know what you think about the progress we’ve made and where you are looking for more. I hope you can see that we have been listening, and acting on what you have told us.

AUTUMN 2022 | THE ACTUARY | 5www.theactuary.com Upfront CEO

NOVEMBER

Creating a more inclusive profession together

Since our previous update in September, the IFoA has been working with members, volunteers and partners to improve diversity, equity and inclusion (DEI).

Leadership and culture

The IFoA responded to the Financial Services Skills Commission (FSSC)’s Menopause Impact Survey, as well as encouraging members’ employers to take part. Following the launch of its report Menopause in the Workplace: Impact on Women in Financial Services (bit.ly/Menopause_Finance), the FSSC’s survey will show how the sector is building menopause awareness across the workplace, and how firms are supporting employees experiencing menopause transition.

DEI at the IFoA

The IFoA celebrated National Inclusion Week with a series of daily activities and resources for colleagues, including a six-part blog series (bit.ly/NIW_Share) from IFoA education actuary Sally Calder. Sally’s popular and well-received blog series looked at autism and neurodiversity in the workplace from a personal perspective, covering topics including neurodiversity and creativity, and how to support neurodiverse people.

DEI in our community

The IFoA partnered with the Institute for Public Policy and Research to host a fringe event at the Labour Party conference in Liverpool on 26 September. Former chair of the General Insurance Board Sameer Keshani led a discussion on the poverty

premium in insurance, alongside Shadow Work and Pensions Secretary Jonathan Ashworth MP, Treasury Select Committee member Emma Hardy MP, and Martin Coppack of Fair By Design.

We continue to work closely with the FSSC, having signed up to its Access, Diversity and Inclusion Commitment in April. We are monitoring its DEI workstream, with a particular focus on projects investigating how financial services firms are developing and implementing menopause programmes and policies, and how to develop neurodiversity initiatives.

The IFoA’s Quality Assurance Scheme (QAS) is supporting its members through DEI specialist reviews this year, with QAS accredited firms audited on the scheme’s DEI sub-outcome. Firms receive tailored recommendations on their policies, procedures and DEI practices, and guidance on how to go above and beyond the schemes’ DEI sub-outcome requirement.

Supporting members in their work

The 2022/23 Actuarial Mentoring Programme (AMP) launched in October with the support of the IFoA, the Pensions Investment Corporation and the IFoA Foundation. The AMP is a cross-company mentoring initiative that is designed to improve diversity and inclusion within the actuarial profession.

You can find out more about how the IFoA is putting DEI at the heart of its work in our DEI Strategy bit.ly/IFoA_DEIStrat

IN BRIEF...

Impact Report

We have published our second Impact Report, showcasing members’ achievements during the past year. Find out how actuaries have contributed not just to the profession but also society, bringing their skills and abilities to bear across numerous areas. From volunteering for boards or committees to developing and piloting new courses and credentials, and from giving evidence at select committees to ensuring that sustainability stayed high on the agenda, actuaries have shown their willingness to deploy their skills and expertise for the public good. Our Impact Report pays tribute to their work – read it at bit.ly/IFoA_Impact2022

The CMI is looking for volunteers

The Continuous Mortality Investigation (CMI) is looking to appoint experienced volunteers to its Executive Committee, which oversees its work (on behalf of the directors of CMI Limited).

The CMI seeks to produce high-quality impartial analysis, standard tables and models of mortality and morbidity for long-term insurance products and pension scheme liabilities on behalf of subscribers and, in so doing, to further actuarial understanding. More information is available at bit.ly/3rKbLhf

To find out more, please view the volunteer vacancy at bit.ly/3ezqmcu. The closing date for applications is 13 November.

Regulatory Board publishes annual report

The Regulatory Board has published its annual report for 2021/22, highlighting its key achievements of the past year and setting out its work plan for the year ahead. It reflects the first full year as the new Regulatory Board with an increased remit, including responsibility for disciplinary and enforcement matters, and the public interest regulatory aspects of the IFoA’s qualification and admissions frameworks.

The past year’s highlights include the start of the IFoA-led reflective practice discussions under the Continuing Professional Development Scheme, a review of the UK Practising Certificates regime, a consultation on proposals related to climate change, and thematic reviews under the Actuarial Monitoring Scheme, including those on the topics of general insurance pricing, trust-based funeral plans and climate risk. Read the report at bit.ly/3CLCNdb

DIVERSITY

Upfront News www.theactuary.com

IMAGES: SHUTTERSTOCK/ALAMY

6 | THE ACTUARY | NOVEMBER 2022

The IFoA at party conferences

Since 2018 the

First was the Labour Party conference in Liverpool, where delegates, buoyed by the party’s polling lead, were optimistic about returning to power at the next election. Our fringe event focused on our Poverty Premium campaign, where former General Insurance Board chair Sameer Keshani was joined by Shadow Work and Pensions Secretary Jonathan Ashworth MP and Treasury Select Committee member Emma Hardy MP.

The mood at the Conservative Party conference in Birmingham was gloomier, with many MPs staying away. A highlight was our panel discussion on ‘demographic dilemmas’ and how we can provide long-term sustainable support for an ageing population. IFoA member Stuart McDonald spearheaded the discussion, and panellists included Financial Times columnist and former head of the No 10 Policy Unit Camilla Cavendish and Alzheimer’s campaigner John Teeling, who gave a moving account of his own experience.

POLITICS

Life: 23–25 November Plus www.actuaries.org.uk/Life2022 Life and GIRO – back in person Book now! GIRO: 21–23 November Plus www.actuaries.org.uk/GIRO2022

IFoA has attended the Labour Party and Conservative Party conferences, which offer an opportunity for us to engage with political and policy stakeholders on our key policy priorities. It was great to see that our fringe sessions drew large, engaged audiences and fostered excellent discussions.

Above: Shadow Secretary of State for Work and Pensions, Jonathan Ashworth MP, speaking at the Labour Party conference in Liverpool Left: Members of the audience clap as they attend the Conservative Party’s annual conference in Birmingham

www.theactuary.com NOVEMBER 2022 | THE ACTUARY | 7 Upfront News

©20 © 22 Conning Asset Management Limited. All Rights Reserved GEMS® Economic Scenario Generator LEARN MORE ABOUT OUR SOFTWARE AT CONNING.COM/SOFTWARE-AND-SERVICES Driving risk models in 17 countries across Europe, North America and Asia Europe | North America | Asia

Mr Robert James Hammond FIA

On 8 June 2022 the Disciplinary Tribunal Panel considered a charge of misconduct against Mr Robert James Hammond (the respondent).

The charge relates to the period March–August 2021. It was alleged that, being at the time a member of the IFoA, the respondent sent emails and made statements to Person A and Person B about his HMRC tax payment and/or debt status that he knew to be untrue. It was also alleged that he sent screenshots and attachments to Person B that did not show the true amount of tax outstanding. His actions were alleged to be dishonest and in breach of the Integrity principle of the Actuaries’ Code (version 3.0) in that he failed to act honestly and/or with integrity.

The panel found all elements of the charge proved, by reason of admission, and that they constituted misconduct. It determined that the most appropriate and proportionate sanction was suspension of IFoA membership for two years.

ADJUDICATION PANEL MEETING

Mr Peter Gatenby FIA

On 13–14 June 2022 the Adjudication Panel considered an allegation of misconduct against Mr Peter Gatenby (the respondent), relating to the preparation of an Actuarial Report on Pensions on Divorce for Person A and Person B.

The panel found evidence to support the allegation that when calculating the pension credit in the Principal Civil Service Pension Scheme (PCSPS), Nuvos Scheme pension, the respondent used an incorrect pension factor and pension age, and did not adequately explain why he used a pension age of 65 for calculating the pension credit in the PCSPS. This was found to be in breach of paragraph(s) 1, 3, 3.1, 3.2, 3.3 and/or 5 of TAS 100.

The panel also upheld that, when responding to Person A’s complaint about the report, he: advised Person A that he had calculated the pension credit in the PCSPS correctly when he knew that the pension factor and/or pension age he used was not correct, which was misleading; did not respond appropriately to Person A when asked to confirm that he had notified his professional indemnity insurer of her complaint.

The panel found that there were associated breaches of the Actuaries’ Code (version 3.0) compliance, competence and care and communication principles, and that the allegations disclosed a prima facie case of misconduct. Taking all information into account, it was satisfied that the appropriate and proportionate sanction was a reprimand, a £7,500 fine and a period of education, training or supervised practice.

MEMBER SURVEY

Are we getting it right? Take three minutes to let us know

It takes just three minutes to let us know how we’re doing in this year’s IFoA member survey, so please watch out for the email carrying your unique link from membersurvey@actuaries.org.uk

During the past few years the IFoA has been listening and learning to better provide what you need to meet the changing demands of your career.

We have done a lot on the basis of your feedback, including holding or reducing fees to deliver better value for money, publishing annual Impact Reports to show how we’re enhancing the profession’s profile, modernising continuing professional development to make it more meaningful, making online events free for all members, launching learning and credentials in banking, data science, climate and IFRS 17, building a new website with improved navigation and functionality, and launching the IFoA Foundation to support those working in the profession during difficult times.

Our programme of member insight includes surveys and focus groups to build data on your experience, informing decisionmaking at the highest level.

“Through gathering data and developing insights we have a

better understanding of the wider IFoA membership and how we can support you in your career,” said chief executive Stephen Mann. “We see members who care passionately about the profession and the importance of keeping standards high, and who want the IFoA to make a difference in some of the bigger issues out there, as well as providing good value for money and being easy to transact with.

“Gaining a richer understanding of what is important helps us to focus our efforts on your priorities, knowing that they are grounded in evidence. So when we know that your time is precious but there is a demand for learning support, we are able to launch a new and much simpler modern virtual learning environment.

“But the power of our insight depends upon your participation to make sure we get as rich a picture as possible. Our 2021 full-length member survey saw a response rate of 12.5%. Our 2020 short survey hit 18.5%. The larger the sample, the more confidence we can have that we’re living up to our promise to be member led.

“I am asking you to help us by adding your voice. To keep improving, we need to hear from as many members as possible.”

Upfront News www.theactuary.com NOVEMBER 2022 | THE ACTUARY | 9

IMAGE: SHUTTERSTOCK

DISCIPLINARY TRIBUNAL PANEL HEARING

Find full copies of published determinations at bit.ly/IFoA_Disciplinary

“We need to hear from as many members as possible”

Why we’re voting

for Chartered Actuary

Between 15 November and 13 December, all qualified members will be asked to vote on adopting ‘Chartered Actuary’ designations: Chartered Actuary (Fellow) and Chartered Actuary (Associate). The IFoA believes that this will protect the status of the title ‘actuary’, increase recognition of the level of qualification actuaries have achieved, and support the future growth of the profession.

Sandy Trust

Director, Sustainable Finance, EY

Adding Chartered status to our qualifications will make them even more attractive in the highly competitive global financial services market in which actuaries work. It will also help to encourage the recruitment of actuaries into wider fields, including sustainability, which is rapidly becoming an important skillset for actuaries to have if they are to remain relevant.

Chartered Actuary.

Here five members tell us why they are supporting the proposal to move to Chartered Actuary.

John Taylor

Non-executive director and president of the IFoA, 2019/20

Cynthia Yuan

Senior risk director, China Re

Being a Fellow or Associate of the IFoA is very renowned in China –not just because of the wide range of subjects that need to be passed, but because it also requires sharp business sense and other soft skills. Chartered Actuary will show that we have the qualities required to do that role. It shows the competence and integrity that is needed to manage the risks in this changing world. It shows the legacy carried forward from the world’s oldest actuarial organisation, and that we are sincerely trying to do the right thing to serve the public interest.

Introducing the Chartered Actuary title will only be good for the profession. Reinforcing the Associate qualification as a desirable destination will help the profession compete for new graduates. And, as a Fellow myself, I don’t foresee that it will undermine existing Fellows: employers that value Fellows will continue to do so. Moreover, I can look forward to belonging to a profession that remains dynamic as it becomes more attractive to new graduates.

Marjorie Ngwenya

Non-executive director and president of the IFoA, 2017/18

Why do I support Chartered Actuary? During my term as president, the IFoA consulted with members on the Chartered Actuary proposal. Chartered is an internationally recognised term that will enhance our already respected title. This change will also recognise more prominently the Associate qualification. That’s why I’ll be voting ‘Yes’ to Chartered Actuary.

Upfront News www.theactuary.com10 | THE ACTUARY | NOVEMBER 2022

Nico Aspinall Chief investment officer, Connected Asset Management

I support the Chartered Actuary proposal because it will help improve the brand of qualified actuaries both in the UK and around the world. Most people are amazed when they find out that the word ‘actuary’ is not protected –anyone can call themselves an actuary, regardless of whether they’re qualified or not. Putting ‘Chartered’ in front of ‘actuary’ protects us and will ensure that no one can take advantage of our great name or bring our profession into disrepute. I think it’s also an important stepping stone towards a profession that really values the general skillset in a variety of business contexts. We need to get Chartered actuaries out into wider domains, where they can help address many societal issues, from climate change to artificial intelligence and many points in between. For me, the Chartered Actuary proposal is a positive move and I’m hopeful we can get a good turnout to show we’re ready to face the future.

The vote runs from 15 November to 13 December. Whichever way you vote, it’s important to have your say, so please do cast your vote.

A packed agenda for the first Council update of sessional year

Council’s first meeting of the sessional year took place on Wednesday 28 September by videoconference. We welcomed the new Council members elected at the June AGM to their first formal Council meeting.

As this was the first meeting of the sessional year, we took time to discuss how we would work together this year and what we would focus on. We also considered the results of our annual effectiveness review for 2021–22 and what we could learn from it.

Council received its regular updates from the chief executive and the chair of the Management Board, and noted the work undertaken to rearrange planned activities around the mourning period for the late Queen Elizabeth II. Many activities are underway to improve the member experience and the way you engage with us, and we hope you will see the benefit of these in the coming months.

During the past year, we have been carrying out work to develop and implement a revised risk management framework for the IFoA, to enable us to better identify and oversee threats and opportunities to the profession. At this meeting, Council gave feedback on the latest drafts of some of the key materials underpinning this work, including risk appetites and a new strategic risk register. We look forward to reviewing a revised iteration of the framework at our November meeting.

As part of our strategic commitment to a modern regulatory regime, Council received an update from its Regulatory Strategy Steering Group on the UK government’s review of actuarial regulation, and the proposed introduction of a new

statutory regulator (the Audit and Governance Authority) to replace the non-statutory Financial Reporting Council. While no major policy announcements have been made since our June meeting, we are keeping a close eye on wider developments to ensure we are appropriately informed and positioned to represent the profession’s best interests.

Council considered the nominations of Stuart McDonald MBE and Sundeep Raichura for receipt of the IFoA’s Finlaison Medal, and emphatically approved them – we extend our congratulations to both!

We then discussed our Nominations Committee’s recommendation on how future nominees for Honorary Fellowship of the IFoA should be identified and scrutinised. This discussion was scheduled before the recent member vote on proposed changes to the process, but was given greater emphasis after members decided not to support the proposal. Council agreed with the Nominations Committee’s recommendations to strengthen the robustness of our internal scrutiny of nominees, and to ensure nominees are aligned to and able to contribute to the IFoA’s strategic aims.

Council also agreed proposed changes to the IFoA’s Regulations, which are intended to better reflect its responsibilities as a controller of members’ data. Formal notice of these proposed changes will be posted on our website shortly.

Council’s next meeting will take place in person in London on 30 November 2022. The minutes of our meetings are available at bit.ly/2u1gmx9 and you can contact us at presidents@actuaries.org.uk

Upfront News www.theactuary.com NOVEMBER 2022 | THE ACTUARY | 11

COUNCIL UPDATE

IMAGE: SHUTTERSTOCK

New Practising Certificates Scheme

The IFoA’s new Practising Certificates (PC) Scheme comes into effect on 1 December. It introduces more flexibility into the process for applicants and takes a more proportionate approach, with less focus on the annual renewal process.

The new approach moves to a competency-based criteria, promoting a more effective, fair and inclusive process for members looking to obtain and retain a PC.

Find more information on the new scheme, together with the PC Handbook, new application forms and example applications, at bit.ly/3ENDFku. The IFoA has also produced guidance to assist current and future PC holders in completing their application.

The format of the UK Practice Modules (UKPM) is changing to an online workshop. The updated resources will be available from 1 December and further detail can be found at bit.ly/3S6uq1F

Information about transitional arrangements for existing PC Holders and non-PC Holders who have sat the current UK Practice Modules is also available on the PC pages of the IFoA’s website, together with a list of FAQs about the new scheme.

We welcome any questions about the new scheme and application process – get in touch at practising.certs@ actuaries.org.uk

More comments are posted online about news stories published on www.theactuary.com

A RESPONSE FROM THE IFOA

A right to move on

Our last issue featured a letter from Peter Shellswell, who wrote in to share his concerns over certain aspects of the IFoA’s disciplinary process (‘A right to move on’, October 2022).

Here, the IFoA responds.

Dear Mr Shellswell, Thank you for your letter to the editor in relation to the public naming of individuals who are subject to the IFoA’s disciplinary process.

We appreciate that being subject to a disciplinary investigation is stressful, and that for some members the publication of adverse findings is more concerning than any sanction imposed. The IFoA aims to support members through the disciplinary process by progressing cases as efficiently as possible, allowing individuals sufficient time to respond to the allegations against them, and being available to answer questions about the disciplinary process and the options available.

The IFoA also operates a Capacity for Membership process as an alternative to the Disciplinary Scheme, which is intended to support members who are experiencing significant issues of health that are impacting their ability to hold membership of the IFoA.

In disciplinary proceedings, the rights of the individual subject to an allegation must be weighed against the public interest. Openness and transparency are fundamental to the IFoA’s disciplinary processes. Publication of determinations allows members and the public to understand how and when disciplinary action has been taken by the IFoA. Publishing named determinations provides protection for the public by allowing easy access to recent adverse disciplinary decisions against members and enables the public to make informed decisions.

In addition, holding hearings in public and publishing determinations ensures fairness in

the disciplinary process and provides reassurance that the IFoA has acted appropriately, proportionately and consistently. This helps to protect and maintain public confidence in our processes and the profession.

The IFoA’s Disciplinary Committee has published guidance to help panels determine whether to publish a notice of hearing or determination, what information should be published and how long for. Respondents’ names are not published in all cases – for example, if an allegation is dismissed by the Adjudication Panel, details, including the name, will remain confidential. In other circumstances, while there is a presumption in favour of publication for the reasons given, it is open to the panel to anonymise, redact or direct that a determination should not be published, for example where the consequences of publication on an individual outweigh the duty to keep the public informed. The issue is considered carefully in each case, and it is open to the respondent to make submissions on this point to the panel. This enables the individual’s rights to be weighed against the need to protect the public and confidence in the profession.

Thank you again for sharing your views on this matter. We really value all feedback on the IFoA’s disciplinary processes and will continue to keep the Disciplinary Scheme under review to ensure that it meets best practice and follows the principles of better regulation.

JENNY HIGGINS, HEAD OF DISCIPLINARY INVESTIGATIONS

PRACTISING CERTS

Upfront News www.theactuary.com12 | THE ACTUARY | NOVEMBER 2022

Mitigate model specification risk and see your business in a new light! ™ Insureware’s platform ICRFS ICRFS™ is a high-powered analytical and data management system created by Insureware. Unique modeling frameworks for the design of models for single LoBs, or multiple LoBs, that mitigate model specification risk. Assumptions going forward are controllable, transparent, explicit, auditable, and linked to trends and volatility found in the data. Get critical insights into Risk Capital, ORSA, Solvency II, and IFRS 17. Benefits include: optimal retention strategies, efficient risk capital management, multiple contract management, and much more. Inflation is rising globally. Use ICRFS and find out: • inflation trends in your data; • sensitivity to future inflation; and • create benchmark scenarios for reserving and pricing. Get ICRFS™ to get an edge over your competitors! The world’s best long-tail liability Enterprise Risk Management system with unparalleled insight and intelligence.

n 1933, Professor Paul Dalziel’s grandfather lost his job at the height of the Great Depression. He and Dalziel’s grandmother had just married and found out that they were expecting their first child; they were to remain without income for six years.

The impact of such a struggle passes through the generations. For Dalziel, fresh out of school in the late 1970s, it sparked a question that he was to spend the next 50 years trying to answer: “How is it that systems break down so that people are unable to create good lives for themselves?”

As part of his quest, he has become a world expert on wellbeing economics, and was the lead author of Wellbeing Economics: The Capabilities Approach to Prosperity – Palgrave Macmillan’s fifth most downloaded book on economics in 2018.

What is wellbeing economics?

Dalziel’s underlying belief is that “the primary purpose of economics is to contribute to enhanced wellbeing of persons”. ‘Wellbeing’ is a broad term that covers a variety of topics, from reducing child poverty or domestic abuse to improving people’s mental health or self-reported happiness. It is purposefully

broad because economics can help to make so many areas of our lives better.

The main objective in the current economic discourse is to grow the economy – specifically GDP. However, GDP doesn’t capture changes in child poverty rates or the value of the natural world. It doesn’t consider the vast amount of volunteering that takes place around the country or the unpaid work done in the home – predominantly by women.

Dalziel argues that “the ultimate test of whether economic policy is doing a good job is not how fast the economy has grown, but what kinds of lives are people living. What can they create with the resources the economy is producing?”. Wellbeing economics attaches much more importance to these questions than to the growth of GDP.

The New Zealand option

Dalziel isn’t alone in holding these views. In 2019, New Zealand’s Labour government introduced the world’s first ‘wellbeing budget’ in response to concerns that little progress had been made on child poverty or the climate emergency, despite economic growth.

While he doesn’t want to oversell the change, Dalziel describes a shift in emphasis that took place throughout New Zealand’s

www.theactuary.com14 | THE ACTUARY | NOVEMBER 2022 Features Interview BACKGROUND IMAGE: SHUTTERSTOCK

Paul Dalziel talks to Alex Martin about the true purpose of economics and the lessons we can draw from the 2019 New Zealand wellbeing budget

www.theactuary.com NOVEMBER 2022 | THE ACTUARY | 15

Features Interview government, prompted by the new framework within the wellbeing budget. Under the new system, any budget policy proposal must improve at least three out of 12 domains. These domains include things such as social connections, subjective wellbeing, housing, health and the environment, cutting out the ‘middleman’ of growth so that “the civil servants and the cabinet making the decisions were focusing on what is the impact of this decision on wellbeing”.

An example of this new way of thinking was a ban on issuing new permits for offshore oil and gas exploration. While increased oil and gas production might improve economic growth, it does not align with the impact of climate change on future wellbeing.

As we discuss how New Zealand’s economy has developed in the three years since the wellbeing budget was introduced, Dalziel explains that one of the leading criticisms is that it hasn’t gone far enough. Given that one of the domains is ‘work’ and another is ‘consumption’, it is easy to construct a policy that “is not that different from what we used to do – a GDP-plus”.

A shift in emphasis can take time to make a difference. Even so, Dalziel suggests that we need to look at redesigning key economic systems. His term is ‘Wellbeing 2.0’: a framework that builds on the lessons of the past three years. Much will depend on the outcome of the 2023 New Zealand election.

New Zealand is not the only economy trying to move the focus from GDP to wellbeing – Dalziel describes how countries with strong leaders are joining the Wellbeing Economy Government partnership: “Iceland, Scotland, Wales, Finland, New Zealand have visionary leaders who are committed to the practice of designing economic policies that respect planetary boundaries and expand capabilities for people to create good lives.”

The role of business

It isn’t just governments that are leading the shift in focus from growth to wellbeing. “The fundamental concept of business bringing together resources to expand capabilities for wellbeing is really important,” says Dalziel. Decentralised markets give the choice of how to exchange goods and services to the person who is best placed to know what is best for their own wellbeing.

Governments and business therefore need to work together, he says, and “the trick is for

the government not to set itself up in opposition to business”. Creating partnerships and incentives for things such as “green technology” will help to ensure that companies operate along the same lines as the wellbeing budget.

In terms of the finance industry, Dalziel observes that “financial companies are very sensitive to risks, and it is becoming apparent that climate change is creating systemic risks that portfolio diversification isn’t strong enough to cope with.” Looking at the impact of Pakistan’s recent floods, he provides an example. “If we had similar storms, [New Zealand’s] Canterbury Plains could easily go underwater. What does that mean for any of the major trading banks that have diversified their portfolio across the Canterbury Plains? Suddenly, all of that [investment] could be at risk if we had an extreme weather event on that scale.”

higher risks for insurers and investors alike. One area of creativity and entrepreneurship that will be required in the insurance industry is learning how to underwrite for these risks.

Dalziel doesn’t think the job is done, though. “The big gap, globally, is how do we marry the wellbeing narrative with the distinctive contribution that business has to make to expanding capabilities for leading good lives?”

Rediscovering relationships

There is also a deep and complex connection between economic growth and wellbeing in our own lives. Dalziel brings up a recent study that showed an increase in the percentage of each day that Americans spend alone: “We have become isolated from nature and isolated from each other, and we’ve made those sacrifices in the name of economic growth.” Part of the movement towards wellbeing economics is to rediscover our relationships with each other and the natural environment.

It isn’t just about climate change. The impact of wellbeing economics on the finance industry extends to issues that it wouldn’t typically consider to be in its purview. Dalziel explains that as a country shifts focus from growth to wellbeing, it becomes more aware of poor business practices.

Lenders and insurers must start to consider their borrowers’ and customers’ ‘social licence to operate’, he says. For example, New Zealand’s dairy industry is leeching nitrates into rivers and lakes, and while these businesses contribute to economic growth, there is currently a backlash against them, prompting regulation in line with the wellbeing economics framework. Regional councils will now need to have regard to the quality of the water for its own sake – expressed in Māori as Te Mana o te Wai, or the integrity of the waterway.

Investments that disregard their social responsibilities will increasingly become

It was workers in New Zealand who set up the first social security system in the world in the 1930s. Despite increasing hardships, they were willing to accept a levy on their wages to fund a welfare state that would pay for universal education and free healthcare. In contrast, as we look around the world today, the dominant question seems to be “how can I maintain my standard of living, or how can I reinforce my privilege?”.

Dalziel’s view is that despite the extra wealth resulting from economic growth, “we haven’t become better people… yet we can. Humans have this amazing capability for solidarity and generosity, but when it comes to designing national economies, we seem to lose all that and it becomes more ‘what’s in it for me?’”

He argues that “governments must empower people, including future generations, so that people can create lives they value and have reason to value within the limits of planetary boundaries.” He expects that we are coming to the top of an S-curve of economic growth and should expect the never-ending increase in GDP to slow, or even flatline. It is a poor measure of most of the things that matter in a country; perhaps we should take our steer from New Zealand and the wellbeing economics movement to find a better way.

www.theactuary.com16 | THE ACTUARY | NOVEMBER 2022

“The ultimate test of economic policy is not how fast the economy has grown, but what kinds of lives are people living”

Climate

Integrating ESG into portfolio management and underwriting workflows: the state of the market

As insurers move towards automation and further digitisation of their underwriting processes, accurate data and sophisticated analytics are becoming increasingly important. This is particularly significant in environment, social and governance (ESG). ESG factors and scores offer insurers new insights into risk and decision-making, but also bring new data integration challenges. Insurers that meet these challenges can benefit from considerable competitive advantage.

To understand more about the commercial property and casualty (P&C) industry’s journey to implement ESG scores, Moody’s Analytics and RMS, a Moody’s Analytics Company, carried out a comprehensive, independently-run market survey. The results, plus our experts’ insights, help validate the current state of the market and identify pain points.

Progress on implementation

Our survey received 36 responses from commercial P&C (re)insurers, all from individuals engaged in portfolio management and underwriting functions. Respondents were from a range of institutions, with gross written premiums ranging from US$100m to over £5bn. Almost 80% were directors or more senior, including 14% at C level. The survey was global, with most respondents having operations in North America.

Why integrate ESG?

The survey results present some interesting data about the key drivers for commercial P&C insurers integrating ESG into their business. Of respondents, 65% identified

risk management as a key driver, with 81% identifying managing reputational risk in particular. While we expected this, given where many insurers are in their ESG journey, we were encouraged to see that one in three respondents also saw potential for unlocking new revenue opportunities. We believe that this number is likely to increase as insurers start to realise value and see the opportunities that they can derive from using ESG as an additional risk factor in risk selection, pricing and product development.

A phased approach

Our conversations in the market suggest that insurers have an appetite for rapid progress in integrating ESG into their businesses. However, they must take an iterative, phased approach rather than rushing towards full integration. The full paper explores this further.

Understanding correlations

Survey respondents were asked which correlations they wanted to understand further and could select more than one answer. Three quarters of respondents want to understand correlations between ESG risk and claims, almost two thirds want to understand correlation between ESG risk and premiums, and more than half want to understand ESG risk against natatural catastrophe model results.

This is consistent with a broader emerging theme around correlations with performance metrics. Insurers may find that they have multiple exposures around the same event. It is important here to take a holistic view of ESG.

Personalising the view of ESG risk

Of respondents, 52% are considering whether to personalise the view of ESG risk. This could include blending multiple data sources or weighting data elements that are important to the strategy and vision. We expect this figure to increase as insurers get ahead of the problem, develop frameworks, assign responsibilities and include ESG into their decisionmaking process.

Consistent market standards

The commercial P&C market often exhibits an approach where there is safety in numbers. The direction of travel is likely to be similar for many participants. Almost two thirds of the respondents indicated that they would like to be able to leverage a market standard ESG framework that further supports the peer consistency that is important in the commercial P&C market. This confirms our observations that insurers would welcome a standard framework that helps formalise the assessment process, but crucially still allows them to impose their unique view of the risk.

Download the paper at bit.ly/MoodysCRI

Moody’s has been engaging with the market and taking a partnership approach with our commercial P&C customers to develop a solution that considers ESG in the risk selection process. To find out more about how Moody’s ESG Insurance

Underwriting solution can help your business, contact us today.

Paul McCarney, director – advisory services, Shaheen Razzaq of RMS and Salman Siddiqui, director – industry practice lead, present the fifth executive summary in a series on climate risk topics for insurers

Risk for Insurerswhitepaper

series sponsored by

NOVEMBER 2022 | THE ACTUARY | 17www.theactuary.com

BOILING POINT

nsurers are spending an increased amount of time and effort on understanding how their financial position might be impacted as the consequences of climate change become more prevalent and severe. While the initial focus has been on assets, there is acknowledgement that a more holistic view is required that also considers liability exposure.

While the Bank of England’s 2021 Climate Biennial Exploratory Scenario overlooked liability risks, it did stress that mortality risk for life insurers could be material and should be seriously considered in the future. Former Bank of England governor Mark Carney has said that “the world is heading for mortality rates equivalent to the Covid crisis every year by mid-century unless action is taken”.

Life insurers’ liabilities could be impacted in several ways. Mortality assumptions alone are subject to primary effects such as temperature, air pollution and extreme weather, as well as secondary effects such as disease and food shortages. Since temperature and mortality data are publicly available and scientific research confirms a relationship between the two, we have explored the future impact of changing temperatures on mortality.

In the months since we started our analysis, the UK has experienced record-breaking temperatures, emphasising the importance of researching this topic. As part of our investigation, we modelled daily temperatures in a variety of climate change scenarios and quantified the consequential changes in future mortality rates.

Based on our findings, we believe that the frequency of extreme heat events in the UK will continue to rise, driving an increase in temperature-related deaths.

IMAGES: ISTOCK I

As quantifying climate risk exposure becomes increasingly important, Dan Gill, Rajinder Poonian and Alex Harding investigate the effect of rising temperatures on future mortality

www.theactuary.com18 | THE ACTUARY | NOVEMBER 2022 Features Environment

Predicting future temperatures

In July 2022, Coningsby, Lincolnshire recorded the UK’s highest-ever maximum daily temperature of 40.3°C. The Met Office red warning at the time stated that this heatwave would cause “population-wide adverse health effects, not limited to those most vulnerable to extreme heat, leading to serious illness or danger to life”.

Calibrating our model to a day where maximum temperatures reach 40°C, we would anticipate mortality rates for those aged 65 and over to rise by up to 10%. The July heatwave’s impact on UK mortality is unclear at the time of writing, but this is an area that needs to be closely monitored as the frequency and severity of heat events in the UK increases.

Our investigation takes a twostage approach, the first being a temperature model to predict UK future daily temperatures, the second a mortality model that measures the temperature–mortality relationship.

The 4most temperature projection model is built as a stochastic simulator that randomly selects from a range of climate scenarios to forecast future temperature pathways. The model leverages data from the Met Office’s UKCP18 investigation, which provides probabilistic scenarios for average temperature change during the next seven decades. The UKCP18 forecasts are split by global emissions scenarios known as representative concentration pathways (RCPs), where the first challenge comes from identifying how a weighting can be applied to each pathway. RCP8.5 is the worst-case (no action) scenario, but this is unlikely to occur, given government mitigation actions. For our

current model, these weightings are set using expert judgment.

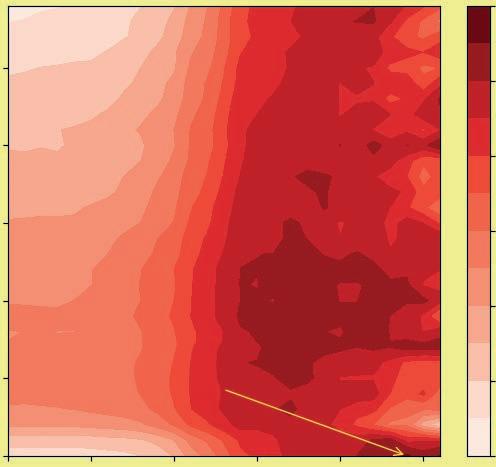

After calibrating, the Monte-Carlo Python model is used to yield the projections seen in Figure 1. The distribution represents temperature increases that are likely to occur during the next 70 years, relative to 2020. They generally show an upward trajectory –although, in extremely optimistic scenarios, the effects of climate change on temperature could be reversed. The array of pathways reflects the uncertainty of climate change effects and the extent to which human action can reduce the impact.

Converting these temperature increases from average to daily increases presents several challenges, including the question of whether daily temperature volatility would change over time. To model this, we must consider changes to extreme weather in the UK, as well as the climate. The expectation is that climate change will drive an increase in extreme weather, particularly through effects such as damage to the Gulf Stream weather system, but available research seems limited on this topic. This warrants further investigation to improve projections.

Temperature change and mortality

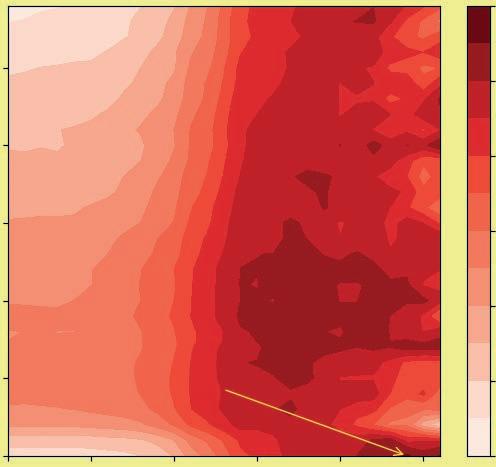

With daily temperatures forecasted, the next challenge is to build a mortality model that investigates the connection between mortality and temperature change. Scientific research to date examines the U-shaped relationship below which the curve shows the relative risk of mortality at various temperatures (Figure 2). Note how mortality sharply increases beyond pinch points at both hot and cold temperature extremes. Studies suggest that the relative risk of

Year Temperature increases (vs. 2020 baseline) 8 6 4 2 0 20202030204020502060207020802090 KEY:Percentile 50th 75th 99.5th Temperature (˚C) Relative risk of mortality -3 24 FIGURE 2:

The ‘U-shaped’ relationship between temperature and mortality highlights the pinch-point temperatures (red) and point of lowest mortality (blue). The temperatures labelled are calibrated via the 4most mortality model.

FIGURE 1: Future temperature pathways, based on the 4most temperature projection model. www.theactuary.com20 | THE ACTUARY | NOVEMBER 2022 Features Environment

mortality in temperature-related death grows with age, so our investigation focuses on those aged 65 and over.

The model was parameterised for these extreme temperature definitions and for the lag effect – the number of days following an extreme temperature event where a resultant spike in mortality is observed.

Our findings suggest optimum parameter values: a minimum temperature for hot events of 24˚C with a lag of zero days, and a maximum temperature for cold events of -3˚C with a lag of 10 days (Figure 3). These figures can then be validated by comparing them with findings from scientific research papers. With parameters assigned, we investigated the relationship between temperature and mortality.

The models show that the impact of temperature change is greater for cold events than for hot events – 1˚C colder for a cold event causes a 1.69% increase in mortality, whereas 1˚C hotter for a hot event causes a 1.48% increase.

As the planet warms, the frequency of cold events reduces, so fewer people are expected to die from coldrelated illness – but this will be counteracted by the frequency of heat-related illnesses as the number of hot events increases substantially. We have focused on hot events here, but both elements will need to be considered –especially for UK insurers with large annuity books, where longevity improvements in winter months could reduce liabilities.

We explored several scenarios created by the temperature model to show how the increasing occurrence of hot events would impact the expected number of deaths. Even in the

median scenario, the number of deaths expected to occur on hot event days from 2040–54 is significantly larger than the number of deaths experienced for such events in the recent past (Figure 4). The biggest increases in number of deaths can be seen for the oldest age group, 90-plus, where in the 99.5th percentile the expected number of deaths is more than double what was experienced between 2005 and 2019.

The current analysis is limited by data availability; if we had more data on deaths caused by temperature events, causes of death, and data on actual age rather than age groups, we could create more informative model results. In addition, the current mortality model doesn’t allow for future mortality improvements after 2021, so there will be further considerations about how human physiology and healthcare may adapt to cope with a changing climate.

Are you capturing this risk?

The human impact of climate change is a complex problem, and with research still in its infancy in some areas, it is a challenge for the insurance industry to understand its exposure to these risks. However, while arguing immateriality has been sufficient in the past, increasing regulatory pressure to quantify financial exposures (for example via the insurance stress test) suggests that it’s only a matter of time before more comprehensive climate stresses are required.

We believe it is increasingly clear that the incidence of extreme heat events will grow as UK climate change transpires, resulting in an escalation of heat-related deaths. Companies with mortality or longevity risk exposure should leverage internal and external data to ensure their

models are capturing this risk and providing the capability to understand how capital positions will be impacted – both today and in the future.

FIGURE 4: The expected number of deaths on hot event days from 2040-54 across the 50th, 75th and 99.5th percentiles, compared to historic data from 2005-2019.

FIGURE 4: The expected number of deaths on hot event days from 2040-54 across the 50th, 75th and 99.5th percentiles, compared to historic data from 2005-2019.

liability

FIGURE 3: Goodness of fit for lag and pinch-point temperatures. The darker the area, the better the fit. Age group Total deaths per 100,000 40,000 30,000 20,000 10,000 0 65-6970-7475-7980-8485-8990+ KEY: Historical 2005–19 Percentile 2040–54 50th 75th 99.5th Minimum temperature (˚C) Extreme heat Lag 25 20 15 10 5 0 0.9880 0.9872 0.9864 0.9856 0.9848 0.9840 0.9832 0510152025 Optimal parameters www.theactuary.com NOVEMBER 2022 | THE ACTUARY | 21 Features Environment DAN GILL is a client partner at 4most RAJINDER POONIAN is a managing consultant at 4most ALEX HARDING is an actuarial consultant at 4most

Convergence between actuarial and data science is coming

Guillaume Béraud-Sudreau, chief actuary and co-founder of Akur8, presents the results of Akur8’s Global Pricing Survey, providing direct insights into the pricing challenges and expectations of non-life insurance carriers worldwide

Akur8 has surveyed more than 100 non-life pricing professionals across 34 countries, covering all lines of business, to find out about their pricing practices, limitations, business impact and the outlook for the future of ratemaking.

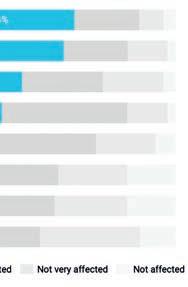

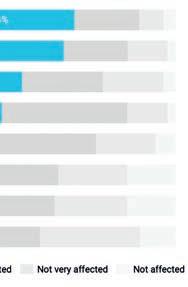

According to the survey, pricing is perceived as the most important competitive differentiator for insurers in the marketplace, being deemed ‘very important’ or ‘extremely important’ by 81% of the respondents. This indicates that property and casualty insurance, like many other markets, is seen as primarily price driven. This perception is influenced by the fact that respondents are all insurance pricing professionals, but is also likely reinforced by the current macroeconomic outlook, which is driving customers to be price cautious and sensitive.

With pricing widely recognised as being the first strategic lever for insurers, we would expect pricing teams to feel well equipped for embracing their day-to-day activities. However, the results of the survey indicate otherwise: according to respondents, pricing teams are facing several challenges, chiefly a lack of data (described as ‘very affecting’ or ‘extremely affecting’ by 70% of respondents) and internal resources (described as ‘very affecting’ or ‘extremely affecting’ by 67% of respondents), followed by the lack of collaboration and automation.

From our perspective, many of these challenges are interrelated. Lack of automation is linked to manual ratemaking approaches that are common practice in the market. This manual work contributes to a lack of resources and understaffed actuarial teams, preventing actuaries from investing time in new data acquisition and exploration. Streamlined and automated

Figure 1: How much is your business affected by each of the pricing challenges below?

pricing, in contrast, allows actuaries to focus their time and energy on valueadded tasks and decision making.

The challenges caused by a lack of automation have been worsened by the effects of COVID-19, which have disrupted existing trends and made the use of historical data more complex. The head of pricing for a leading Irish carrier states: “COVID-19 has really disrupted trend experience, resulting in inconsistent patterns” – exacerbating the difficulties of challenges related to insufficient data,

resources and automation.

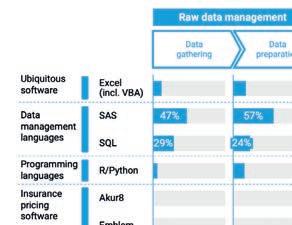

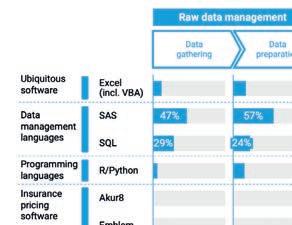

Traditional pricing tools and approaches remain manual and iterative, limiting the ability to leverage external data in quantity and variety. When asked to specify the name of the software or programming language they use at each stage of the pricing process, respondents provided the information shown in Figure 2, attesting to the general undertooling across the pricing process:

Reliance on legacy tools holds insurers back from leveraging pricing’s full potential as a business lever. The typical actuary is largely absorbed by repetitive tasks and cannot fully focus on decision making.

Looking into the types of models used for pricing, generalised linear models (GLMs) stand out as the market standard for non-life technical and commercial pricing, with 66% of respondents using them for technical pricing and 51% for commercial pricing. They are widely used because they are transparent and explainable, while black box generalised

www.theactuary.com22 | THE ACTUARY | NOVEMBER 2022 Advertisement feature Shutterstock

boosted models are often only used as a complement or for exploratory purposes. However, in terms of the external data sources used to feed these models, there seems to be little variety, with only five different types of data sources quoted by all respondents. This is consistent with the prevailing manual modelling approach.

When looking into the future of ratemaking, pricing teams report that they expect major untapped value potential to be liberated by automation such as native machine learning, and by integrated cloud-based pricing processes, allowing for unlimited data exploration and seamless collaboration. These expectations are directly mirroring the challenges reported by pricing teams, given the limitations of manual rate

modelling approaches.

For early adopters of automated ratemaking tools such as Akur8, these benefits are already materialising. One of Akur8’s clients states: “On a combined ratio basis we’d be looking at a 6% improvement in our performance based on the work we did with Akur8. That’s a huge improvement for us, and is basically the difference between the class of business being loss making and performing well.” We believe the adoption of automated pricing platforms will further accelerate in the future as business performance improvement fuels market differentiation.

Respondents share this belief, with 88% expecting convergence between data science and actuarial science to bring

value to the pricing process; this convergence can be materialised using an automated but transparent pricing approach. It is also underlined by the high importance of business expertise and decision making, which are only possible if actuaries can move away from repetitive manual modelling tasks. As a pricing actuary at a major US managing general agent puts it: “I deeply believe that machine learning will lead to higher underwriter profits. Besides, offering a transparent and visually explainable pricing process that can be updated regularly will be a dramatic improvement for the team.”

Ultimately, this survey supports Akur8’s mission to revolutionise insurance pricing with transparent artificial intelligence. Ratemaking automation paves the way for actuarial and data-science convergence and provides tangible operational value. At Akur8, we know the future of insurance pricing is available now. We empower pricing teams to make better decisions more quickly, and to generate immediate, measurable business impact.

Figure

Figure

2:

Which software or programming language do you use at each stage of the pricing process?

Figure

3: How valuable would the improvements below be for your pricing team over the next five years?

If

you are interested in learning about the full results of Akur8’s

first

global pricing survey, go to www.akur8. com/white-papers/ global-pricing-survey

Or

you can scan this QR code

NOVEMBER 2022 | THE ACTUARY | 23www.theactuary.com

Lawrence Habahbeh considers what a geopolitical risk framework for the 21st century would look like

In recent months, firms have heightened their awareness of geopolitical risk. Such risks can have financial and economic consequences in the short, medium and long terms. A firm’s geopolitical risk exposure does not just involve its own direct exposure, but also extends upstream to supply chains and counterparties and downstream to clients.

Geopolitical risks increase the likelihood of business and supply chain interruption, and of armed conflicts destabilising trade and investment flows. In a globalised, densely interconnected world that faces new challenges and opportunities, geopolitical risk should be a factor in the strategic decision-making of all firms with a significant overseas presence.

Definitions

Geopolitics is the role that geography plays in a state’s political character, dictating its strategic value, how it takes part in global affairs, and its relationship with the rest of the world.

I would define geopolitical risk as the expected and unexpected losses that arise from firms’ upstream, direct and downstream exposures to short and medium-term geopolitical risk factors. These can include political factors such as revolutions, coups, contested elections, ethnic conflicts, and the activation of separatist and irredentist movements. They can also include long-term geopolitical trends and strategic risk factors that act as threat multipliers to existing financial, economic and social risks, such as competition for natural resources, climate change, emerging technologies and mass migration.

Geopolitical risks can cause common consequences as they cascade through society. These events are systemic in nature, potentially impacting individual firms’ safety and soundness while also having broader implications for the stability of the global financial system.

What differentiates geopolitical risk from political risk? Political risks arise from within states’ political boundaries and are driven by internal political factors and situations. They include, for example, government expropriations and breaches of contract, discriminatory taxation, regulatory changes and civil war. Foreign investors protect themselves from political risk and enhance their reward profiles by diversifying their investments, evaluating the risk of political turmoil in the countries where they invest, and buying political risk insurance.

Geopolitical risk drivers

As the war in Ukraine has shown, it is becoming more important to understand major drivers of geopolitical risk in a transitioning world order. These include state collapse, regionalism, non-state actors, malicious use of emerging technologies such as artificial intelligence, lethal autonomous weapons, directed energy weapons, biotechnology and quantum technology, and the competition for the rare earth minerals needed for the renewable energy transmission, such as cobalt, copper and lithium.

These risks will drive future dynamics and relations between states, and in a geopolitically contested world, this competition could lead to more frequent geopolitical conflicts.

Global financial markets

Heightened geopolitical risks have historically led to lower stock prices in the short term. At the start of the Russia–Ukraine war, the Russian rouble–US dollar exchange rate dropped by more than 20%, volatility in the global equity indices increased sharply, and global bond indices reflected a higher default risk. This resulted in high yield spreads widening across the world: spreads in emerging markets widened by about 174 basis points following the start of the war, and by about 63 basis points in Europe and the US to reflect a higher geopolitical risk premium.

In the credit default swap (CDS) market, CDS spreads priced in a 55%–60% chance of a Russian sovereign default as five-year CDS spreads soared to a record high. While these represent higher risks of default, they also represent higher compensation for those who are willing to take the risks.

In short, geopolitical risks result in investors requiring a higher return on investments. This higher return, or geopolitical risk premium, acts as a cushion, compensating investors for the losses that could arise due to geopolitical events.

A geopolitical risk framework

The first step in effective geopolitical risk assessment is horizon scanning over the immediate, short, medium and long term. Such analysis should account for the potential trajectories of geopolitical risk event trends. This can be achieved by engaging with external experts to hear diverse perspectives on specific strategies to identify, evaluate and monitor these risks and the different approaches to cope with them, as there is typically no historical data for risk managers and underwriters to rely on.

IMAG ES: GETTY

STATES NOVEMBER 2022 | THE ACTUARY | 25 Features Risk www.theactuary.com

Features Risk

Some geopolitical trend questions to consider include:

What are the most significant geopolitical risks we face in the short term, and how is the firm’s risk profile positioned against these events? How would financial and macroeconomic shocks arising from these developments impact the firm’s direct, upstream and downstream risk exposures?

What are the most significant geopolitical trends in the medium and long term that will drive future dynamics between friends, foes and allies? How will this drive countries to think about who their major allies are? Specifically:

Who is the major power they must deal with?

Who is the major power that they can rely on?

The dynamics driving these questions are also factors that drive the risk of conflict. How is the firm’s risk profile positioned against negative shocks that could arise from the evolution of these trends?

In today’s context, example questions might be:

What will happen in Europe? Will a more secure or fragmented Europe emerge after the war in Ukraine? What are the implications of NATO expansion into Central Europe –for both Europe and the world? Will this lead to further escalation and more geopolitical conflicts? How will it impact investment and trade flows? How is the firm’s risk profile positioned against these developments?

Will Russia become a status quo power? How will that affect the global distribution of power, as well as the distribution of power within the strategic equations of post-Second World War global institutions and regional blocs?

How would the rise in the scope, scale and frequency of extreme climate events in the Middle East interact with the existing security risks and energy, food and water resource issues affecting relations between Middle Eastern countries?

What would be the regional and global security and economic implications of a complete takeover of Jordan by Hamas, Hezbollah and Iran?

On the other hand, how is the warm peace between Israel and six Arab States, coupled with the recent Negev Summit, creating positive regional momentum and driving regional integration and connectivity efforts for deeper co-ordination and interaction among participants through multilateral co-operation in the economic, political, security, food and water and energy spheres? How would this change the relationship between the Middle East and other regions of the world? What are the plausible structures for a multilateral regional architecture in the Middle East? How would these developments impact investment and trade flows to the region? What are the potential opportunities and rewards of enhancing regional peace and co-operation for the region and the world?

What are the possible developments in Asia-Pacific, in particular amid growing tension between the US and China and the Thucydides trap?

What scenarios would lead to, or avoid, large-scale social collapse due to several concurrent strategic risks, such as macroeconomic, geopolitical and climate risks in critical parts of the world?

How likely are these geopolitical risks to materialise?

What are the most likely, optimistic and pessimistic reasonable scenarios and consequences for firms’ exposures under each scenario?

What are the underlying causes or drivers and strategies of the actors involved that could make a geopolitical risk more likely than not to materialise?

How would the firm’s risk profile react to different timings (immediate, short, medium or long-term) of consequences?

Conduct scenario planning for assessing emerging geopolitical risks and the consequences of several future possibilities, including those that may seem highly unlikely.

Using Ukraine as an example, scenarios could be:

Ukraine capitulates

Regime change in Ukraine

Regime change in Russia

A broader NATO–Russia war

What are the economic, political and conflict war risk implications of a Fukushima-style nuclear accident in Ukraine’s Zaporizhzhia nuclear power plant – Europe’s largest nuclear station – and how would it affect the regional configuration of power? How would the firm’s direct, upstream and downstream risk exposures react in the short, medium and long term?

Quantify the expected and unexpected losses per scenario to create a geopolitical risk exposure map, based on a geopolitical risk event model that accounts for the intensity and size distribution of jumps in asset prices such as equity, bonds, foreign exchange, commodities and credit spreads associated with current and historical geopolitical risk events. Apply these jumps to current market prices of assets and do a full revaluation of portfolios based on a range of scenarios. What is the distribution of expected and unexpected losses per scenario, asset class, geography, counterparty, client, supplier and so on?

What we should do now to prepare?

Preparing for the worst

The world faces many concurrent strategic risks, such as COVID-19, systemic cyber attacks, the increase in scope, scale and geographic extent of climate risks, and a contested geopolitical landscape. These have all exposed the fragility and inadequacies of our current risk management models and enterprise risk systems.

The goal of a geopolitical risk framework is to help decision makers see what may lie beyond the horizon by applying out-of-the-box thinking, and to help them avoid failure of imagination in identifying these types of risks. It can also offer management an array of possible futures with a range of plausible consequences, including those that may seem unlikely.

Effective international co-operation through international and regional organisations can also help countries to overcome differences by opening new strategic prospects, enhancing the rewards for countries and firms alike. While we prepare for the worst, let us not forget to also strive for the best.

LAWRENCE HABAHBEH is a traded and enterprise risk specialist, a member of the Risk Management Board and chair of the Black Swans Insurance Working Party

www.theactuary.com26 | THE ACTUARY | NOVEMBER 2022

Engagement

that

does not change

for the

no changes to strategy are needed to stay within