+ NEW QUALIFIERS’ LIST

FIRST WOMEN

The female Fellows who made history 100 years ago

KALPANA SHAH

Interview with the new IFoA president

RUGBY HEROES

Champions of the game from our profession

Saluting actuaries who blazed a trail, in the field or on the field

The magazine of the Institute and Faculty of Actuaries

SEPTEMBER 2023 theactuary.com

Software & Service. Anywhere. Anytime.

Risk management and regulatory compliance require efficient, trustworthy economic scenario generation.

Milliman’s Economic Scenario Generator uses the computing power of the cloud to quickly deliver robust scenarios. Our consultants are here to help you navigate internal and external reviews, simplifying the process from start to finish

Benefit from unparalleled experience with the Milliman Economic Scenario Generator.

Visit milliman.com/economicscenariogenerator

AUp Front

4 Editorial Yiannis Parizas stresses the power we all have to make a difference

5 CEO comment Stephen Mann on building a warm and welcoming profession

6 IFoA news

The latest IFoA updates and events

Features

12 Interview: Kalpana Shah

The new IFoA president on the importance of soft skills, diversity and challenging the status quo

16 Talent: Model players

To mark the Rugby World Cup, Kenneth Bogle salutes a squad of actuaries who excelled on the pitch

19 Environment: Tipping the balance

Our climate may be reaching a tipping point – but so is public demand for change, says Alex Martin

20 Environment: Storming the capital

When factoring climate risk into capital requirements, why is there so much uncertainty and inconsistency, asks Jérôme Crugnola-Humbert?

24 Health: Better than cure

We already have the knowledge to cut cancer rates, say Tobias Schiergens and Debbie Smith

27 Pensions: Dynamic handling

Gareth Connolly and Phil Hardingham explore the pros and cons of a dynamic discount rate

28 General insurance: Business interrupted

How did insurers fare with the mass of Covid business interruption claims? Jeremy Keating investigates

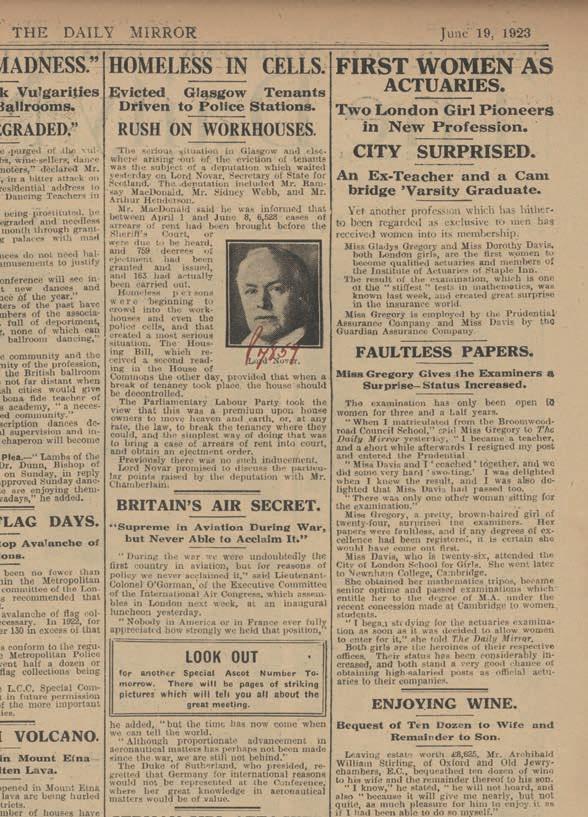

30 Talent: City surprised

Liz Bowsher tells the story of the first female qualifiers, 100 years ago

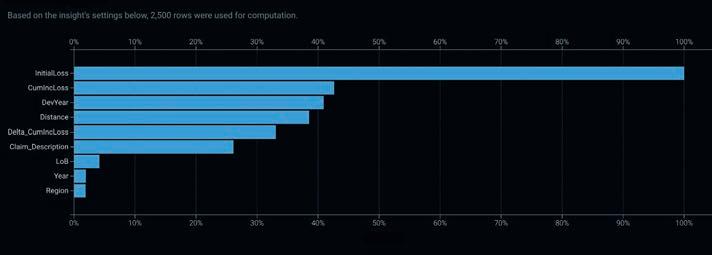

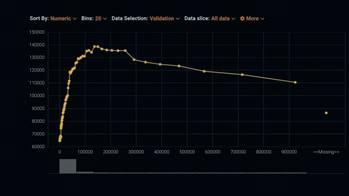

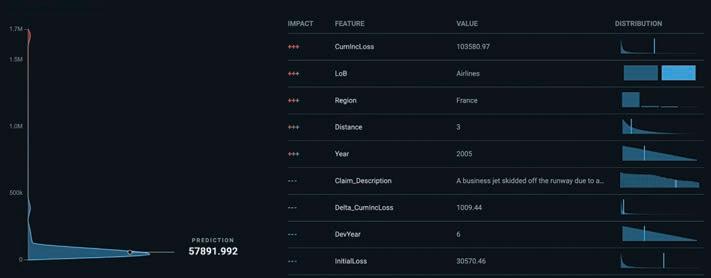

32 Data science: Auto pilot

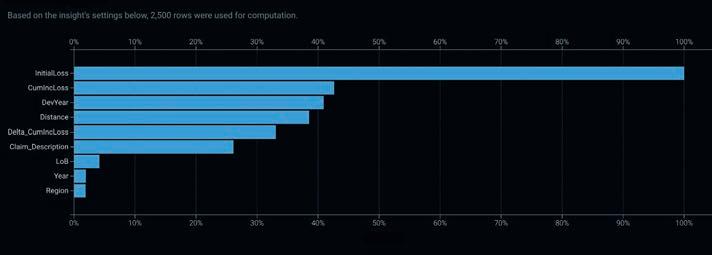

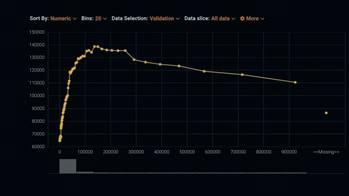

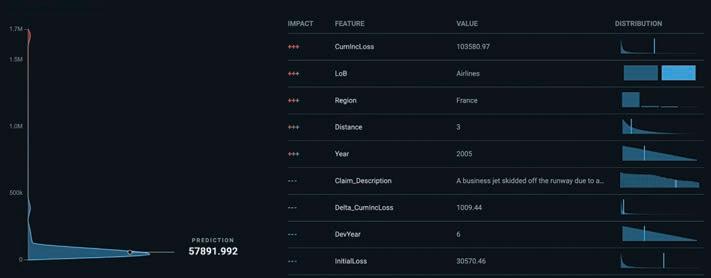

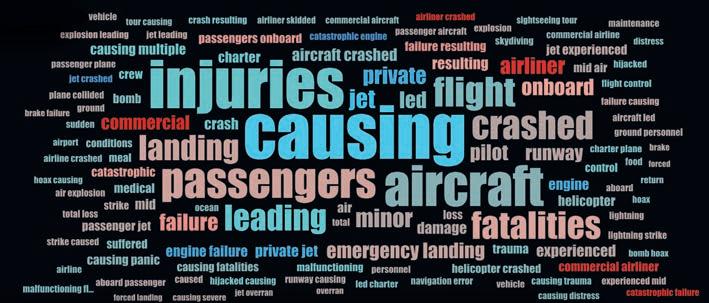

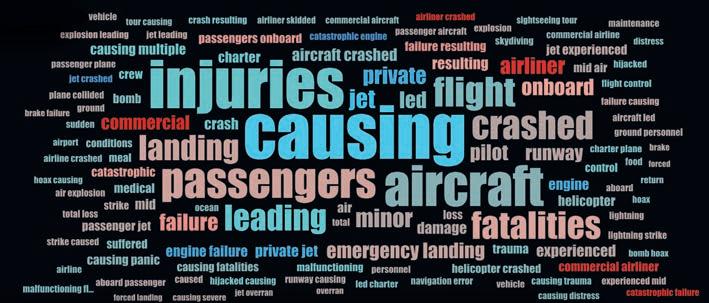

Darius Sabas and Maximilian Hudlberger consider an individual loss development approach

Get the app

You can read The Actuary magazine on any Apple or Android device. Get the app and explore to read more online, download resources, or share content on social media. It’s an exclusive free benefit for our members. Download for Apple at: www.theactuary.com/ipad Download for Android at: www.play.google.com

37 Modelling: Walk the line

How can we balance accuracy and transparency? Mikołaj Skraburski and Dawid Kopczyk discuss

At the Back

41 Extra-curricular Musicals conductor Adrian Portell takes us behind the scenes

42 Soft skills: The F-word

Don’t fear failure, says Alexia Panayiotou – it’s essential to success

44 Puzzles

45 People and society news News from the actuarial community

46 Student

Impostor syndrome comes for us all at some point, admits Vrishti Goel

Online specials

Bank crises: a risk too far?

Darshan Purmessur uses the collapse of Silicon Valley Bank in March to stress the importance of enterprise risk management. And have you seen our first podcast yet? www.theactuary.com

See additional content, including actuarial news, at www.theactuary.com

Sign up for our weekly email newsletter at bit.ly/1MN3bXK

COVER: SHUTTERSTOCK

12 Y

www.theactuary.com SEPTEMBER 2023 | THE ACTUARY | 3 Inside this issue

September 2023

46

The Actuary: theactuary.com

IFoA: actuaries.org.uk

PUBLISHER

Redactive Publishing Ltd

9 Dallington Street, London EC1V 0LN

PUBLISHING DIRECTOR

Anthony Moran

MANAGING EDITOR

Melissa Walton +44 (0)20 7880 6246 melissa.walton@redactive.co.uk

SUB-EDITOR

Kate Bennett

DISPLAY SALES

theactuary-sales@redactive.co.uk

+44 (0)20 7324 2753

RECRUITMENT SALES theactuaryjobs@redactive.co.uk

+44 (0)20 7880 6234

ART EDITOR

Sarah Auld

PICTURE EDITOR

Akin Falope

SENIOR PRODUCTION EXECUTIVE

Rachel Young +44 (0)20 7880 6209 rachel.young@redactive.co.uk

PRINT PCP

SUBSCRIPTIONS

EDITOR Yiannis Parizas editor@theactuary.com

FEATURES EDITORS

● Travis Elsum:

Environment and sustainability

● Alex Martin:

Environment and sustainability

● Sachal Gandotra: General insurance

● Rajeshwarie VS: General insurance

● Blessing Mbukude: Life

● Aqib Merchant:

Pensions and investments

● Ruolin Wang: Pensions and investments

STUDENT EDITOR Adeetya Tantia student@theactuary.com

IFOA EDITOR

Kate Pearce +44 (0)20 7632 2118 kate.pearce@actuaries.org.uk

EDITORIAL

ADVISORY PANEL

Peter Tompkins (chairman), Chika Aghadiuno, Nico Aspinall, Naomi Burger, Matthew Edwards, Jessica Elkin, Richard Purcell, Sonal Shah, Nick Silver

Subscriptions from outside the actuarial profession: UK: £110 per annum. Europe: £145 per annum. Rest of the world: £175 per annum.

Contact: The Institute and Faculty of Actuaries, 7th floor, Holborn Gate, 326-330 High Holborn, London WC1V 7PP. +44 (0)20 7632 2100 kate.pearce@actuaries.org.uk.

Changes of address: please notify the membership department membership@actuaries.org.uk

Delivery queries: contact Rachel Young rachel.young@redactive.co.uk

Published by the Institute and Faculty of Actuaries (IFoA).

The editor and the IFoA are not responsible for the opinions put forward in The Actuary. No part of this publication may be reproduced, stored or transmitted in any form, or by any means, without prior written permission of the copyright owners.

While every effort is made to ensure the accuracy of the content, the publisher and its contributors accept no responsibility for any material contained herein.

© Institute and Faculty of Actuaries, Sept 2023

All rights reserved ISSN 0960-457X

Human nature

Last month, Fitch downgraded the creditworthiness of the US, lowering its rating from AAA to AA+. This was prompted by what it saw as the country’s substantial and escalating general government debt. As a result, higher borrowing expenses are expected, with the increased perception of default risk. At the same time, interest rates are still marching upward, hiked in the UK for a 14th time in a row.

The only solution to all our problems, of course – whether fixing the global financial situation or avoiding catastrophic climate change or beating ill health – is people. All of us contribute in our own way; it’s not just about Earth’s leaders. It pays to remember that they’re human too (or perhaps you think we’re constantly reminded of that fact?). They fail, as academic Alexia Panayiotou stresses on page 42. In fact, she points out, people aren’t good leaders if they don’t.

Two ‘ordinary’ women had an impact on the world a century ago, when they decided to pursue the new opportunity for women to enrol for exams to become actuaries (p30). They rocked the City in doing this, the first women to become Fellows of the Institute of Actuaries in 1923. On page 16 we celebrate another group of actuaries – those who played rugby in their spare time. They may have been amateurs but they were superstars on the field, often gaining international glory.

This issue, we also meet new IFoA president Kalpana Shah (p12), who has plenty of positive plans for change. Plus, we look at how people have helped businesses through their Covid interruption claims (p28); how they are using machine learning for a more bespoke approach to estimating insurance loss (p32); and how they are contributing to cancer prevention (p24). Go do your thing.

YIANNIS PARIZAS EDITOR

editor@theactuary.com

www.theactuary.com Upfront Welcome 4 | THE ACTUARY | SEPTEMBER 2023

Awards 2021 Awards 2022 Gold Best Association Magazine > 25,000 Silver Best Association Digital Transformation 2021 MEMBERSHIP EXCELLENCE AWARDS WINNER Best Website

A profession for all

With our AGM and presidential address taking place this month, I want to begin by saying congratulations to our new president, Kalpana Shah, as well as to president-elect Kartina Tahir Thomson and our new Council members. You can find out more at actuaries.org.uk/ifoa-council-elections

I also want to say a huge personal thank you to Louise Pryor, our outgoing immediate past president. Louise was part of the selection panel when I was interviewed for the IFoA back in 2019, and the opportunity to work with her was one of the reasons I was keen to join as CEO. When you are asked to lead the implementation of Council’s major and ambitious transformational strategy, involving a lot of catching up and aggressive timelines, as well as having to make our way through the immediate and later impacts of the Covid pandemic, some things will go well and others will be more challenging. That is inevitable and Louise has always been one of my ‘go to’ people for counsel and general sense-checking. I have valued that, as well as her appreciation for the work my colleagues are doing to bring Council’s vision for the IFoA and the wider profession to life.

This year, as well as celebrating our 175th anniversary since the founding of the Institute of Actuaries, we are also marking 100 years since the first women qualified as actuaries, following votes by the Faculty of Actuaries and the Institute of Actuaries to permit them to enter the profession – you can read more about these remarkable women on page 30 of this issue. The actuarial profession has certainly progressed since then, as our changes in leadership show.

As a small profession, we need to be a warm and welcoming community if we are to be sustainable. As a result, Council has agreed that the IFoA needs to be committed to championing and embodying the benefits of a globally diverse and inclusive profession. As part of our Diversity, Equity and Inclusion strategy (bit.ly/IFoA_DEIStrat), we are supporting the actuarial profession to become a natural attractor of diverse talent. Leadership and culture play a key role in

this. People want to see role models with whom they can identify and aspire to be like.

At the beginning of my career as a young lawyer working at a big City law firm, I got to work closely with the organisation’s first ever female partner and saw first-hand the hurdles she had to overcome, sometimes on a daily basis, due to her sex. While progress has been made in terms of gender diversity, the data from our UK members –collected from a City of London Socio-Economic Diversity Taskforce survey earlier this year – suggests that the UK actuarial profession performs less well from a socio-economic diversity perspective than the wider financial and professional services sector, in terms of membership and senior leadership. This wider sector is still substantially drawn from people whose backgrounds are already professional ones. What is especially important is whether the members who responded to that survey felt that their social background had been a hindrance to their careers. Those who were at early and senior stages felt much less strongly about this than those who were a few years into their careers. This suggests that competing on core actuarial skills may be a leveller and that members are more confident in handling situations once they have reached a senior level. However, when actuaries start moving into management, supervisory roles or using their skills more widely, those from lower socio-economic backgrounds find the profession to be less accessible and inclusive.

This has a negative impact on those individuals and is bad for the profession – especially as embracing diversity of thought and perspective is essential to an actuary’s role. Many of our member firms are undertaking some great initiatives to change this, complemented by work that the IFoA is doing. We may not see the benefits immediately but I am glad that the work is starting now to build a more representative future for the profession, from which everyone will surely benefit.

STEPHEN MANN is the chief executive of the Institute and Faculty of Actuaries

STEPHEN MANN is the chief executive of the Institute and Faculty of Actuaries

AUTUMN 2022 | THE ACTUARY | 5 www.theactuary.com

Upfront CEO

STEPHEN MANN

SEPTEMBER

As a small profession, we need to be a warm and welcoming community to be sustainable

CAREERS

New event makes students aware of actuarial futures

We were delighted to welcome more than 50 first and second-year students to our first actuarial careers showcase, More than Just Maths, in June.

The event was part of our flagship IFoA Conference and brought representatives from nine of the largest actuarial employers together with students studying maths-based degrees across the UK and Ireland.

The students learnt about a wide range of actuarial careers, graduate scheme opportunities and how to stand out from the competition when applying for a graduate role.

The showcase included structured networking sessions, informative presentations and interactive discussions, enabling employers to show the range of actuarial science career paths and the growing demand for actuaries across various sectors.

Employers valued the opportunity to encourage students from a diverse range of backgrounds into the actuarial profession. Andy Rogan, interim head of capital and commercial at Lloyds Banking Group,

emphasised how IFoA careers events support graduate recruitment. “The IFoA’s actuarial careers showcase is an important, engaging and innovative way of attracting high-quality graduates to our profession,” he said. “It is a privilege to support it.”

Facilitated networking with employers helped to connect students to potential internship, placement and employment opportunities. Yidan Zhang, a second-year student at the University of Bath, appreciated the chance to meet employers and fellow students: “The event was a fantastic opportunity to connect with a diverse group of individuals and employers.”

By hosting More than Just Maths during our June conference, we were proud to provide a new platform for the IFoA and the actuarial industry to support the next generation of talent. We and the industry are committed to empowering students and shaping the profession’s future.

If you are an actuarial employer and would like to be involved in future careers showcase events, please contact employers@actuaries.org.uk

Presidential address

At the AGM on 6 September, Matt Saker handed over the IFoA presidency to Kalpana Shah. She will be making her inaugural presidential address at 11am BST on 14 September at Staple Inn Hall, London. You can book a free place to attend in person, or to have access online.

Book your place at bit.ly/IFoA_pres_ address_2023 The Council election results were also announced at the AGM on 6 September and are available at actuaries.org. uk/ifoa-council-elections

Volunteers needed for Diversity Action Group

Would you like to help the IFoA grow an inclusive culture within the actuarial profession? The Diversity Action Group is looking for proactive, engaged and passionate volunteers to join its managing committee. Could you encourage individuals and organisations to embrace diversity of thought and create a profession in which all members feel they belong and can succeed?

This is an exciting opportunity for interested volunteers to develop their diversity, equity and inclusion (DEI) knowledge, raise awareness of key topics and contribute to long-term cultural change in the profession. Applications close 17 September.

Find out more and apply at bit.ly/IFoA_DAG

‘The careers showcase is an engaging and innovative way of attracting high-quality graduates to our profession. It is a privilege to support it’

Upfront News www.theactuary.com INBRIEF... 6 | THE ACTUARY | SEPTEMBER 2023

Andy Rogan, Lloyds Banking Group

More global mentoring to meet demand

During the past year, the IFoA Foundation funded two innovative approaches to mentoring recent graduates, kick-starting their careers and increasing diversity in the actuarial profession.

Initially, 10 mentee places were offered on the Actuarial Mentoring Programme, delivered by Moving Ahead. For the first time, the scheme was opened to recent graduates from all backgrounds, anywhere in the world.

The Foundation was inundated with applications, with the scale of the demand fuelling curiosity about this group’s needs. Once mentees had been selected, a questionnaire was sent to the other applicants, revealing many common themes.

This in turn led the trustees to create an additional, group-based mentoring pilot project to expand the available support.

Working with Protagion Active Career Management, a six-month scheme was set up at pace and launched in January, with more than 50 individuals keen to take part.

Life-changing impact

Mentees from both programmes report significant positive impacts on their personal and professional development. They have grown in skills and confidence, they say, found direction and new motivation, broadened their understanding of professional opportunities and built up their professional networks.

Rymon, Zimbabwe

“A transformative experience, connecting with actuaries from a wide range of industries and backgrounds, giving a broader perspective on the profession and the diverse career paths available”

Sripriya, India

“It helped me to become a better version of myself and understand the real impact I could have as an actuary”

Benyapa, Australia

“An invaluable chance to connect with like-minded individuals who share a passion for actuarial science. It inspired me and strengthened my aspiration to pursue a career in the industry”

Refilwe, UK

“It’s given me a new network, new opportunities and knowledge and tips to help me navigate a successful career”

Several participants describe the experience as “life-changing”. Some of the relationships formed are so strong that there are plans to continue meeting and supporting each other.

Delighted with the evidence that mentoring

ACTUARIAL MONITORING SCHEME

is making a difference to aspiring actuaries’ career trajectories around the world, the Foundation is working on a new programme to launch this year.

“We are inspired by the commitment of this international group of bright graduates, who seized the opportunity of mentoring to give themselves the best possible start to their careers,” said trustee Chantal Bond. “Their active engagement and constructive feedback helps us to develop more ways to support yet more aspiring actuaries from all backgrounds, globally.”

Sponsor a mentee

IFoA members are invited to sponsor a mentee. We hope that the personal backing of established actuaries will further motivate mentees, welcome them into the IFoA’s vibrant global community and help them to foster their networks. Sponsors will receive progress reports and have the option to connect with mentees.

Your donations ensure that targeted early-career support is available to recent graduates who are striving to succeed and play an active part in the profession.

As Kesha from Mauritius puts it: “The actuarial journey is a tough one but it can definitely get better if we are guided and supported.”

Interested in sponsoring a mentee? Go to bit.ly/IFoA_Found_donate

New thematic reviews – data and divorce

We have recently launched two new thematic reviews and would welcome submissions in the following areas:

Data science

With data science’s influence and public profile growing rapidly, we want to make sure we have the right resources in place to support our members and serve the public interest.

If you are one of an increasing number of members whose work involves data science, we want to understand how you and your organisation are using it –including artificial intelligence and machine learning.

Pensions on divorce Actuaries directly advise members of the public on pensions sharing in divorce cases,

making this a significant area of work in terms of the public interest and upholding the profession’s reputation.

If you are a member whose work involves advising on and calculating pensions sharing in divorce cases, we want to hear from you on current actuarial practice in this area. This review will become part of our Actuaries as Experts series.

Do get in touch to give us your invaluable insights on both these important topics.

Both reviews close to submissions on 31 October. Find out more at bit.ly/IFoAreviews or email reviews@actuaries.org.uk

The IFoA Thematic Review Programme is part of the Actuarial Monitoring Scheme. Visit bit.ly/IFoA_AMS

SEPTEMBER 2023 | THE ACTUARY | 7 www.theactuary.com Upfront News

IFoA FOUNDATION

Three more firms awarded QAS accreditation

In the past two months, the IFoA has awarded three new Quality Assurance Scheme (QAS) accreditations. Such accreditations show an organisation’s commitment to fostering a working environment that supports actuaries to do their best quality work.

Isio’s Actuarial & Consulting and Investment Advisoryservice lines joined the scheme on 17 July. Isio delivers services to trustee, corporate and public sector clients and provides independent strategic advice to institutional investors such as pension funds.

HS Actuarial, a pensions consultancy providing advice to trustees and sponsors of defined benefit pension schemes, joined on 24 July, and actuarial consultancy KA Pandit of India joined on 12 August – the country’s first QAS accreditation.

The QAS is the IFoA’s outcomes-based accreditation scheme for employers of actuaries. It forms a key part

of our strategy and is a great example of how we work with employers of our members. QAS offers employers an independent review of their policies and procedures, as well as practical support, guidance on good practice, and public recognition of the standards met by accredited organisations.

The QAS outcomes assessed are: Professionalism; Development and Training; and Organisational Culture. Each year, an accredited organisation must show that it continues to meet the outcomes and has taken steps to continually improve – the ethos at the scheme’s heart.

We estimate that 18,500 people worldwide are directly covered by QAS policies and procedures, including approximately 70% of Practising Certificate Holders. There are currently 42 QAS accreditations.

Talk to us about what accreditation could do for your team: qas@actuaries.org.uk

SUBSCRIPTIONS

Membership fees updated

At the IFoA, we want to support our members better by enhancing the services you have told us are most important to you and by continuing to invest in projects that will transform your member experience.

For the past three years, even though prices have been rising overall globally, we have frozen your IFoA subscription fees.

This year, we have undertaken a wide-ranging review of our fees to ensure that they are fair and sustainable, and that they reflect the benefits of IFoA membership.

Our new fees have been designed around these principles, and aim, as always, to continue delivering value for money for you and your employers.

Reduced rates

To support members on lower incomes and ensure fairness in our reduced-rate subscriptions, we have introduced a mid-tier reduced rate, simplified the eligibility criteria and raised the threshold at which members qualify.

If your gross taxable income is £8,300 or less, you will be eligible for reduced-rate membership.

If you are a Fellow or Associate and your gross taxable income is between £8,301 and £25,999, you will be eligible for our new mid-tier reduced rate.

Actuarial Analyst......................................................................................£260 Student Actuarial Analyst .......................................................................................£190 Student ..........................................................................................................................£260 Affiliate ..........................................................................................................................£100 Mid-tier reduced subscription ...............................................................................£260 Reduced subscription ................................................................................................£83

Reduced rate – non-practising Fellow .................................................................£375

Reduced rate – non-practising Fellow (for Fellows registered as non-practising before 1 August 2023 and who are eligible to pay the lower reduced rate of £73 for the 2022-23 subscription year) ......................£143

Reduced rate – non-practising Associate ..........................................................£275

Reduced rate – non-practising Associate (for Associates registered as non-practising before 1 August 2023 and who are eligible to pay the lower reduced rate of £73 for the 2022-23 subscription year) .......................£123

Reduced rate – fully retired .......................................................................................£83 Practising certificate fees.....................................................................................£1,040

Renewing your membership

All subscriptions will be due on 1 October 2023. As we make upgrades online, particularly to the members’ area of our website, you may experience some disruption to services. In recognition of this, we will not be applying surcharge payments for late payment this year. We appreciate your patience during this period.

You can find out more at our 2023-24 membership fees FAQ web page: bit.ly/IFoA_subs

Upfront News www.theactuary.com 8 | THE ACTUARY | SEPTEMBER 2023

Annual subscription fees for 2023-24 Fellow .............................................................................................................................£750 Fellow Dual Membership .........................................................................................£375 Associate ......................................................................................................................£550 Associate Dual Membership ..................................................................................£275 Certified

QAS

IMAGE: SHUTTERSTOCK/NOUNPROJECT

EMPLOYER HUB

The IFoA recognises that employers play an important role in supporting our members as they progress through their careers – so we are delighted to launch our new online Employer Hub, a resource we have developed in partnership with a variety of actuarial employers.

Employers have told us that they want quick, easy access to the full range of IFoA support and resources, so we’ve designed the hub to have everything that they need to support their actuaries, in one place.

GI AWARD

This year’s Brian Hey Prize

The winner of the 2023 Brian Hey Prize, the annual award for the best general insurance research paper, will be annnounced at the GIRO conference in Edinburgh, 1-3 November.

The prize is open to IFoA members and non-members; to be eligible, the paper’s substantive contents should ideally have been presented at an IFoA event in the 12 months up to and including GIRO 2023. Submitted research papers could be technical, in which case we expect to see innovative techniques or new applications of existing techniques; or practical, in which case we expect to see development of evidence-based guidelines or recommendations for good practice.

A literature review that does not advance new techniques might be considered but would have to show a contribution to the research effort. The prize is not generally awarded for content that educates and informs people on pre-existing ideas.

Papers should enable the reader to understand the problem they are addressing, form an initial view on some of the consequences of adopting the approach, and implement the approach independently in the context of their own work. Those that do not satisfy one or more of these requirements, on the grounds that they are addressed in a separate paper or presentation, are unlikely to win.

Find out more about the prize at bit.ly/Brian_Hey_Prize

For queries or to enter, email communities@actuaries.org.uk

Save

In-person Sessional Meetings this autumn

14 September (London/webinar): Developments in the alternative risk transfer market for defined benefit schemes –Capital Backed Funding Arrangements Working Party

20 September (London/webinar): Cyber risk within capital models – Cyber Risk Working Party

4 October (London/webinar): Biodiversity and nature related risks for actuaries: an introduction – Biodiversity Working Party

20 October (London/webinar): Validating operational risk models – Operational Risk Working Party

14 November (London/webinar): Consideration of the Proxy Modelling Validation Framework – Proxy Modelling Working Party

27 November (Edinburgh/webinar): Robust mortality forecasting in the presence of outliers – Stephen J. Richards

Upfront News www.theactuary.com SEPTEMBER 2023 | THE ACTUARY | 9

September and December we are holding six sessional meetings, with the

to attend either in-person or via webinar.

Between

opportunity

To find out more about the sessionals and other events, take a look at our events calendar actuaries.org.uk/events-calendar the dates

New one-stop shop for employers

We’ve worked closely with employers to collate resources that will help any actuarial employer, whatever their size and location, to support their actuaries and students through qualification and ongoing professional development. Visit the hub: actuaries.org.uk/ about-us/employer-hub If you are an actuarial employer and want to know more about how the IFoA can work with you to support your actuaries, contact our employer team: employers@actuaries.org.uk

In the hothouse

Why did you write it and what is it about?

We wrote it to answer the question, ‘Why is there a disconnect between climate scientists and financial services on climate risk – and who is right?’

Scientists think it will be catastrophic if we fail to limit climate change and to push ourselves out of the ecological niche in which our civilisation developed. This is referred to as a ‘hothouse’ scenario, where we don’t reduce emissions and global temperature increases to 3°C or 4°C of warming.

However, the findings of the Taskforce on Climate-related Financial Disclosures don’t reflect this view. Many of the published results show the economic impact of a hothouse scenario as benign and, indeed, very similar to the impact of transitioning to a low-carbon economy, where global warming is limited.

Our research showed that the climate scientists are right – we are systemically understating climate risk in financialservices scenario modelling.

Why is there such variation in climate change modelling?

You are walking through a forest and the bush next to you rustles. How do you react? If it’s a cat, no worries. If it’s a tiger, you react – realistic risk estimation is important.

Climate scenario results differ because a range of assumptions and model methodologies are used. Estimates of global GDP impact by 2100 in a hothouse world range from -73% to a milder -18%, to ongoing GDP growth.

Many climate models assume that because we have so far only

seen cats in the forest, we will only ever see cats, not tigers. They simply exclude many of the risks we expect to face, such as sea level rise and mass migration, because they are based on past data.

Model choice has a big impact too. Russ Bowdrey and János Hidi’s article ‘Under the bonnet’ (bit.ly/Under_the_ bonnet), from The Actuary’s March 2022 edition, shows how wildly results can differ between general equilibrium and nonequilibrium models.

Actuaries need to be clear on assumptions and methodology, and how these contribute to model uncertainty and limitations. It’s criticial that model users are aware of this.

Actuaries set assumptions using data but there is limited relevant data for climate modelling. What is the solution?

Climate is a difficult game of global averages and local extremes. We can’t model everything precisely and we need to understand the significant uncertainty in physical climate modelling. The Earth system is complex and critical assumptions about how much and how quickly the planet will warm with a given level of greenhouse gases have fat-tailed distributions.

First, we need to explore tail scenarios, rather than treating best-estimate climate inputs to our models as fixed. We may have seriously underestimated how much global warming to expect – it might be a sabre-toothed tiger in the bush.

Second, we propose a reverse stress-testing approach. It is not clear that we could survive higher levels of warming (4°C, 5°C or 6°C) – so assume ruin or close to ruin at 6°C and work backwards from there. The point isn’t that we

lose everything at 6°C of warming – the point is that impacts start to be so severe after 2°C of warming that we should take action to ensure we don’t go past that point. We will never have perfect models for a set of risks we have never faced before. So, third, we recommend firms create shortterm narrative scenarios that are realistic, decision-useful and capture the complex basket of risks we now face.

What are the implications of all this for climate change risk management?

The implications are profound. Moving from best-estimate climate assumptions to the tails of distributions implies a scenario in which the planet is warming more quickly than we expected. This means carbon budgets are smaller than those we are currently working with.

This reinforces the need to race to zero by reducing emissions, removing greenhouse gases from the atmosphere and repairing broken parts of the climate system. We just need to improve our speed of progress dramatically.

Read The Emperor’s New Climate Scenarios: Limitations and assumptions of commonly used climate-change scenarios in financial services, by the IFoA with Exeter University, at bit.ly/Emperors_ climate_scenarios or scan the QR code

www.theactuary.com 10 | THE ACTUARY | SEPTEMBER 2023 Upfront News

The co-author of the recent IFoA research paper

The Emperor’s New Climate Scenarios explains why we really need to get a move on

SANDY TRUST works in financial services on climate change and sustainability

O

n 10 July at the Mansion House in London, chancellor of the exchequer

Jeremy Hunt set out a collection of reforms targeting the financial services sector that will have significant implications for actuaries. The speech had a particularly strong focus on measures to improve outcomes for pension savers (via the ‘Mansion House Compact’) and reform the UK’s wider pension marketplace. It also featured aims to strengthen the UK as a listing destination, increase the agility and dynamism of the financial services regulatory regime, and respond to new technologies.

Pensions measures and reforms

The core of the government’s growth strategy is to pursue greater green and infrastructure investment from private capital, so the chancellor announced that he would increase the availability of capital for high-growth companies. He and the wider government regard the pensions marketplace as a key enabler of this ambition.

With this in mind, Hunt announced the Mansion House Compact: a voluntary commitment by a number of the UK’s largest defined contribution (DC) pension providers to allocate a minimum of 5% of their default funds to unlisted equities by 2030. The government expects that the package could boost the average pension pot by around 12% over a career.

On collective DC schemes, Hunt stated that the government would publish a consultation response setting out its intention to consult on new draft regulations. On defined benefit (DB) schemes, he said that the Department for Work and Pensions would issue a call to evidence on the role of the Pension Protection Fund and the part played by DB schemes in productive finance, as well as a consultation response on a permanent superfunds regulatory regime for DB pensions.

The chancellor re-committed the government to publishing a joint consultation response with The Pensions Regulator and the Financial Conduct Authority on a new ‘Value for Money Framework’ for DC schemes. He also re-committed responses to other consultations on small pots and

Spotlight on: Mansion House reforms

Changes to listings

Describing an objective to make the UK the global ‘capital for capital’, the chancellor announced that the government would establish a new ‘intermittent trading venue’ by the end of 2023 to improve private firms’ access to capital markets before they list. It will also publish draft secondary legislation replacing retained EU Prospectus Legislation, and put in place a new regime for consolidated tape.

‘Smarter’ regulatory framework

In the context of the UK’s exit from the EU, Hunt stated that the government was pursuing a ‘radical’ overhaul of the UK’s existing financial services framework to better tailor its infrastructure to the British economy outside of the bloc’s regulatory orbit.

Significant measures here included offering a delivery plan that builds on the regulatory reform Policy Statement launched as part of the December 2022 Edinburgh Reforms package. Moreover, the government will deliver a response to the consultation that sets out its plans to replace the Packaged Retail and Insurance-based Investment Products Regulation with a bespoke UK regime.

New technology

decumulation, which apply additional requirements to DC schemes to support further consolidation.

Debbie Webb, Pensions Board chair at the IFoA, welcomed the measures (see webpage bit.ly/pension_growth_ protect), but cautioned that they ought to be set against the context that ‘the primary purpose’ of a pension fund is to provide retirement income, and that any investment in new assets should take place where longevity is considered and there is an appropriate risk/return ratio.

Finally, the chancellor paid attention to the transformative impact that future technologies would have on UK financial services. The government regards ‘getting ahead’ here as paying dividends in securing London’s position as a global financial centre, both post-Brexit and in a new innovative era. As such, Hunt unveiled a consultation on the ‘Digital Securities Sandbox’, which enables the adoption of digital asset technology. He also launched an independent review into the future of payments to deliver the next generation of retail payments. This will be led by Joe Garner, former chief executive of Nationwide Building Society.

SEPTEMBER 2023 | THE ACTUARY | 11 IMAGE: SHUTTERSTOCK www.theactuary.com Upfront News

Taking a closer look at the chancellor’s July speech, which covered pensions, regulatory reform and new technology

TOP TALENT

12 | THE ACTUARY | SEPTEMBER 2023

orn in Bristol, new IFoA president Kalpana Shah (pronounced ‘Kalpnah’) moved to London when she was three years old – and this was just one small part of an epic family journey, which started with her ancestors moving away from Gujarat in India at the beginning of the 20th century. Some of Shah’s grandparents were born in Kenya, as were her parents. While she herself was raised in the UK capital, her family always gave her a strong sense of her cultural history, especially during long holidays spent in Kenya and India, watching Bollywood films and studying Hindi, Gujarati and Indian classical dance.

Shah says attending school in London gave her a strong sense of modern expectations and allowed her to navigate different social norms, teaching her how to harness the best from different cultures while developing an understanding of her own identity and values. This was further heightened when she attended City, University of London: “I met different types of people from all walks of life, with ambition and drive,” she recalls. “I guess this environment gave me a glimpse of different life choices I could make.”

Ascent to actuary

Shah has 30 years’ business experience and is currently a non-executive director (NED) for several organisations – but admits that she didn’t have a career plan after graduating: “I took up different jobs that seemed

interesting and these opened up unexpected opportunities.” Her first ‘real’ job, in the early 1990s, was in data entry at the London Commodity Exchange, where she was quickly encouraged to apply for a role in business development, later becoming head of the statistics department. She remembers it as a fiery environment, working with traders and brokers and delving into the world of institutional investments.

Shah then moved into insurance, working for Groupama subsidiary GAN as deputy to the underwriting director. “My big project was to help underwriters and actuaries work together to build marine pricing models that were simple enough to use on a day-to-day basis,” she explains. “I was also involved in defining the reinsurance strategy and gradually became more interested in the work of actuaries.”

This led her to take on a role as an actuary at Hiscox, during which time she qualified as a Fellow of the IFoA; she was later appointed group chief actuary. In the best part of two decades there, she says, “I saw the company grow from a small UK Lloyd’s managing agency to an international group working on a diverse range of products.” She adds that, over the years, her role became increasingly about providing oversight, advice and judgment.

After this, taking the non-executive route seemed an obvious step. She currently sits on the boards of Riverstone, Markel, Asta and Just Group, having taken on her first NED role in 2016.

Outside the boardroom

Shah became IFoA president-elect in June 2022 and has just started her one-year tenure,

Features Interview

For someone who believes in role models, new IFoA president Kalpana Shah offers much inspiration herself. She tells Yiannis Parizas about her career path, the need to challenge stereotypes, and why upskilling for actuaries may actually involve some unlearning

B

SEPTEMBER 2023 | THE ACTUARY | 13

Features Interview

but she is no stranger to voluntary work. She worked for the NHS in a voluntary capacity at the height of the Covid pandemic, managing a team of actuaries that helped with planning and emergency analytics. Shah is also a liveryman and committee member of the Worshipful Company of Insurers, a court member of the Worshipful Company of Actuaries, a regular judge for the Women in Insurance Awards and a frequent speaker on insurance and diversity-related topics, as well as mentoring women and people who are at career crossroads; in addition, she has in the past served as a trustee for a children’s charity. What drives this urge to give back?

“Like many actuaries, my primary measures of success weren’t money, influence or seniority – although they have been a welcome part of being an actuary,” she observes. “They were initially about being a good daughter and being happy. As a mother, success includes raising children who are happy and contribute to society. In recent years, this has extended to honestly challenging myself about what I want to achieve and, for me, happiness includes contributing more widely, helping to promote causes and organisations.” This process of reflection led Shah to opt for a better work-life balance, stepping out of executive life to become a portfolio NED.

Outside of work, Shah is a mother to two daughters and a son, and enjoys travelling and trying out new things. “I loved backpacking in my youth, although I fear those days are behind me!” she jokes. She enjoys skiing, scuba diving and water rafting, and was once a keen dancer who performed on television and at events, including for the late Diana, Princess of Wales. Another brush with showbiz came when Shah had the opportunity to model Jimmy Choo shoes for the day – something that came about after she was recognised in Cranfield University’s 2019 50 Women to Watch list.

Developing our skillset

Shah believes in dispelling stereotypes and promoting a more accurate, nuanced understanding of the profession – for example, she notes, while actuaries have a reputation for being analytical and detail oriented, this doesn’t mean they don’t collaborate. “Consensus-building is an essential skill for actuaries, and many actuaries work together in teams to solve

QUICK-FIRE Q&A

Who do you admire the most?

Carol Vorderman, the former maths genius of the TV programme Countdown. She is good-natured, glamorous and a confident maths maestro – a woman not allowing herself to be defined by stereotypes.

What are you afraid of?

A wasted life – I am trying to make my life as full and meaningful as possible.

What gets you out of bed in the morning?

Nothing – and everything. Sometimes it’s my family, sometimes it’s a project (work or home-related), sometimes it’s the sunshine and the idea of just getting on with things.

What was your best holiday?

Ticking Everest Base Camp off my bucket list (albeit by helicopter) with my family will stay with me forever.

What is your proudest accomplishment?

I believe in cherishing moments and not necessarily big goals, which allows me the joy in everyday achievements. Somehow these moments have added up to a life that has earned my father’s approval!

What do you do to relax?

Long walks, puzzles and time with my family.

What’s your favourite food?

Chinese food and potatoes, whether fried, baked or spiced.

complex problems and to develop new products and services.”

She is a strong believer that the IFoA encourages actuaries to be more than just problem solvers, promoting a learning mindset that encompasses using judgment, empowering creativity and applying professionalism. These qualities add value and give confidence to those relying on their opinion. “Actuaries are good at learning new technical skills and have proven to be highly adaptable in an increasingly regulated and technological world,” she says. “They have been so successful that those working outside

14 | THE ACTUARY | SEPTEMBER 2023 www.theactuary.com

of insurance are recognising that the skills actuaries have could contribute to solving other problems, too.”

The key to adding the greatest value, she remarks, is being able to articulate views in a way that engages the audience and allows actuaries to contribute to the discussion. “This requires what we call ‘soft skills’ but these are not really soft at all.”

How can actuaries develop these skills?

According to Shah, by unlearning some of the behaviours that have served us well in our qualifying journeys. For example, we are taught to work hard, be the best and get good

scores, which works for passing exams – “but people don’t like working with people who don’t value their opinion and are competing with them rather than working with them,” Shah warns.

A vision for the profession

Shah was a member of the IFoA’s Audit and Risk Committee between 2019 and 2021, and has been a member of Council since 2019 and of the management board since 2021. She was motivated to go for the presidency by her vision for an improved profession, which she describes as “a relevant and vibrant actuarial

Features Interview

profession, working in a variety of fields and adding value to society”.

She loves engaging with members and understanding more about what they want, highlighting the importance of actively seeking feedback and input to ensure their needs are being met. “The IFoA provides a wide range of valuable resources and benefits to members, including access to cutting-edge research, professional development opportunities and a supportive community,” she says. “The curriculum is constantly evolving to keep pace with the changing needs of the actuarial profession and ensure that students are well-prepared for their future careers, providing them with the opportunity to pursue a rewarding career in many different countries.”

Shah is also passionate about challenging biases and misconceptions that prevent talented individuals from pursuing actuarial careers. “I believe in the power of role models,” she says. “Seeing people with different life experiences and personalities breaks down stereotypes and makes the profession more inviting to a wider crosssection of society.”

What would she like to see the IFoA do more of? “Deeper collaborations with actuarial organisations around the world –this can help to amplify the voice of the profession and provide a stronger and more unified message to stakeholders,” she says. “The world is more connected than ever, and the IFoA’s international reach helps connect its members with a global network of professionals, opportunities and perspectives.” In working together, Shah adds, we can share knowledge, resources and perspectives, and solve some of the most pressing challenges facing our profession and our society.

www.theactuary.com SEPTEMBER 2023 | THE ACTUARY | 15

IMAGES: PETER SEARLE

‘Those working outside the profession are recognising the skills actuaries have’

Features

Talent

A

t first glance, rugby and actuarial science may not be obvious bedfellows. All that sweating and aggression appears at odds with the contemplative world of mathematical modelling. And yet rugby and the actuarial profession have many connections. Plenty of actuaries have played the game, some at the highest level. Others have given their administrative expertise and financial skills to help run it.

Rugby was originally favoured by educationalists because, in theory, it developed character and resilience, turning young boys into ‘men’. It was also a way to network, being a mostly middle-class pastime. Today, rugby retains close links with the professions.

Several independent rugby-playing schools were established in Edinburgh during the 1800s to meet the growing demand for well-educated, able, professional men. The city was an important financial centre, second only to London, and it is no accident that the Faculty of Actuaries (FoA) was founded there in 1856.

ALEC ROBERTSON

1 Scotland cap

Predictably, many Fellows and students have been involved in rugby. An early example was Alexander (‘Alec’) Weir Robertson (1877-1941). Born into a dynasty of Edinburgh accountants, he enrolled as an FoA student in 1895 and was admitted as a Fellow in 1901. He had a long and successful career in accounting and was director of several leading financial companies, such as the Commercial Bank of Scotland.

In March 1897, he won his only international rugby cap in Scotland’s defeat against England at Fallowfield,

Manchester. Commonly for the time, Robertson was a sporting all-rounder, being captain of the Honourable Company of Edinburgh Golfers.

PHIPPS TURNBULL

6 Scotland caps

Robertson played club rugby for his old school side, Edinburgh

Academicals, where in the 1890s he formed an effective partnership with fellow actuary Phipps Turnbull (1878-1907). Turnbull enrolled as a student of the faculty in 1897 and was admitted as a Fellow in 1902. He played six times for Scotland, in 1901 and 1902. Fast and elusive, he scored a debut try against Wales at Inverleith in February 1901 and was

As the Rugby World Cup kicks off this month, Kenneth Bogle reveals a squad of champions from the actuarial community, which has long had an affinity with the sport

www.theactuary.com

16 | THE ACTUARY | SEPTEMBER 2023

ever-present in the Scottish Championship-winning side of that year. Contemporary Andrew Flett described him as “a star of the first magnitude… Tall and not very robust, he was a fearless tackler and his handling of the ball was unsurpassed, but it was as a runner that he excelled. With a long stride, he seemed to glide through the opposing defence at high speed, apparently without effort.”

Turnbull died in his twenties, and, like several early Fellows, he is buried in the Dean Cemetery, Edinburgh.

ERIC MILROY 12 Scotland caps

Proudly on display in the IFoA’s Edinburgh office is a beautiful war memorial commemorating the FoA’s six Fellows and 37 student members who died in the First World War. Among them is Eric Milroy, who won 12 caps for Scotland between 1908 and 1914, twice as captain. A combative scrum-half, in 1910 he

toured South Africa with the British team – the forerunner of the British & Irish Lions.

Milroy was born in Edinburgh in 1887. An intelligent young man, he was educated at George Watson’s College, Edinburgh, and later played for his school’s old boys’ side, Watsonians – the leading Scottish club of the day. He graduated with honours from the University of Edinburgh in 1910 and took a job with Alec Robertson’s family firm, A&J Robertson. He enrolled as a student with the faculty in 1912.

Shortly after the First World War’s outbreak in August 1914, Milroy joined the 9th Royal Scots, subsequently serving on the Western Front with the 8th Black Watch. Lieutenant Milroy fought at the Battle of the Somme and was declared missing in action during the assault on the village of Longueval on 18 July 1916, aged 28. His body was never found or identified, and he is commemorated on the Thiepval Memorial to the Missing in France.

Rugby takes its name from Rugby School in Warwickshire, where the pupils developed a handling game in the early 19th century.

Knowledge of the new game was spread by old boys and, in the 1850s and 1860s, ‘Rugby rules’ were adopted throughout Britain and Ireland, then the Empire.

Unlike association football, rugby was, historically, an amateur sport and players were not allowed to make money from it. That changed in 1995 when it went professional

Features Talent

Milroy’s mother, Margaret, refused to accept that her son had died and believed that one day he would return. According to family legend, she always kept a light on at night so that he could find his way home safely.

WILLIAM ROBERTSON International referee

While rugby is a sport of brawn, its Byzantine laws (never ‘rules’) have always appealed to the intellect. The IFoA library holds a scrapbook dedicated to the life of William Alexander Robertson (1877-1940), actuary and international referee.

Described in his Scotsman obituary as “one of the soundest actuaries Scotland ever turned out”, Robertson attained his Fellowship of the faculty in 1900 and was president from 1938-40. In a long financial career, he became manager of the Century Insurance Co in Edinburgh and co-authored Actuarial Theory (1907), a standard textbook for a generation of actuarial students.

In 1920, Robertson officiated two rugby internationals, including Ireland v England at Lansdowne Road, Dublin. This was a highly charged match because of the volatile political situation in Ireland, and Robertson is said to have received death threats if England won. In the event, England were victorious and Robertson was applauded off the field by the sporting Irish supporters.

TERRY ARTHUR 2 England caps and Wasps legend

South of the border, Terence (‘Terry’) Gordon Arthur (1940-2022) was a significant leader among investment actuaries and an England rugby international. Arthur’s actuarial career

IMAGES: SHUTTERSTOC K/ WORLD RUGBY MUSEUM

Actuaries Phipps Turnbull (back row, fourth from left) and Alec Robertson (seated, third from right) helped Edinburgh Academicals XV win the Scottish Championship in 1900-01. The team mascot was Accie the terrier

www.theactuary.com

SEPTEMBER 2023 | THE ACTUARY | 17

Features Talent

was recorded in his obituary in The Actuary in May 2022. Among his many achievements, he served on the Institute’s Council and acted as treasurer. He was a member of the Adam Smith Institute and an Associate Fellow of the Institute of Economic Affairs.

Arthur also contributed to prestigious journals and was in great demand as a speaker at conferences. In 1975, he published 95 Per Cent is Crap: A Plain Man’s Guide to British Politics, an entertaining book in which he took to task those in authority who made illogical or inconsistent statements. He followed this in 2007 with Crap: A Guide to Politics, a devastating exposé of the intellectual confusion and economic ignorance that he felt had come to dominate public pronouncements.

In the 1960s, Arthur, a centre three-quarter, was an outstanding performer with Wasps (who then played at Sudbury, London). He scored 50 tries in 100 appearances and is a ‘Wasps Legend’. In January 1966, he won his first international cap in England’s defeat against Wales at Twickenham and the following month played in a drawn match against Ireland. He also played at county level and for the Barbarians.

FAFFA KNOETZE 2 South Africa caps

In South Africa, Francois ‘Faffa’ Knoetze, born 1963, was educated at the University of Stellenbosch, one of the great rugby nurseries, and played over 100 times for Cape Town-based Western Province – including the side that won South Africa’s premier domestic competition the Currie Cup in 1985 and 1986. In 1989, Knoetze, who played at centre and stand-off, represented his country in two test

DR KENNETH BOGLE is knowledge and publications assistant at the IFoA Library in Edinburgh

matches against a World XV. In a lovely fraternal gesture, fellow actuary and rugby international Terry Arthur sent him a congratulatory letter upon his qualification as an actuary and selection for the South African tour of France and England in 1992.

Knoetze started his actuarial career in the pensions and life divisions of insurer Sanlam before joining consulting firm Alexander Forbes, where he was valuator and consulting actuary to several pension and provident funds. In 2013, he joined investment holding company Remgro to focus on its interests in financial services and sports industries.

After his playing career, Knoetze served for four years as chair of MyPlayers, an organisation for professional rugby players in South Africa, and was on the board of English club Saracens when Remgro was a club shareholder. He is a member of the South Africa Rugby Board and chair of Stellenbosch Football Club, which plays in South Africa’s Premier Soccer League.

MALCOLM MURRAY Edinburgh Borderers

In a successful financial career that often intertwined with rugby, Malcolm Murray (born 1938) was president of the FoA from 1994-96. A player with Edinburgh Borderers, Murray used his business acumen and contacts to bring much-needed sponsorship into the Scottish game in the early 1990s.

Following his retirement, he served on various committees with the Scottish Rugby Union, including a charity for injured players, and in 1995 he was awarded a CBE for services to the insurance industry and to public life in Scotland. A former president of Hawick RFC, Murray, then a sprightly 68-year-old, made his only (and brief) appearance for his home club during a tour to Prague in 2006.

KATIE ASHBRIDGE Oxford Blue

Women’s rugby developed in the 1980s and 1990s, and there is now an annual Women’s Six Nations Championship and Rugby World Cup – and some countries have started to award professional contracts to female players. Kathryn (‘Katie’) Helen Ashbridge (1982-2007) was educated at Malvern College, Worcestershire, and after a gap year teaching underprivileged children in Peru she studied at St Edmund Hall, Oxford.

After graduation she moved to London to begin her actuarial career with Watson Wyatt. Popular and outgoing, she was a talented athlete and musician. She loved to play rugby and won a double Blue for women’s rugby at Oxford in 2002 and 2003.

Tragically, Katie passed away in her mid-twenties. She is commemorated by a bronze statue outside the sports hall of her old school, depicting her as a teenage girl playing netball.

www.theactuary.com 18 | THE ACTUARY | SEPTEMBER 2023

Above: Programme for the match in which Terry Arthur gained his second cap for England, in a draw with Ireland

magine a glass of water on the table next to you. A toddler races through your house, nudging the table. The glass wobbles, your heart rate soars, and the glass returns to its stable state.

Our planetary systems are like this, with feedback loops that help to balance changes as we knock various systems out of line. We pump carbon into the atmosphere and the forests suck it up. We heat the sea, so it forms clouds to block the sun. The world has an impressive capacity to balance itself… against small perturbations.

Back to our glass of water. As you reach to take a sip, the toddler’s father comes rushing through the house, giving your table a big knock. Water goes everywhere. The glass rolls to a stop, reaching an alternative stable state. A new normal ensues –one in which you continue to be thirsty and your floor is soaked.

This is what we are doing to our planet. By pushing Earth’s capacity to rebalance beyond what is possible, we run the risk of placing it in a new, inhospitable stable state: hotter and more volatile, with higher sea levels and generally a less pleasant place in which to live.

A saving grace?

Climate modelling has shown us how close we are to Earth’s tipping points. Once the Greenland ice sheet falls below a certain altitude, its increased exposure to warmer air will begin an irreversible melting process; to refreeze would require a far colder temperature than that of today. Similarly, once the Amazon has been cut down to a small enough size, it may no longer be able to create enough rainfall to sustain a rainforest, and we might be referring to the Amazon Savannah.

population. This brings me to our first positive tipping point: worldwide demand for change

In 2020 and 2021, the UN undertook the largest survey of opinion on climate change ever conducted. It contacted 1.2 million respondents across 50 countries and found that 64% believed climate change was a global emergency. And these results were consistent across all geographies. All over the world, we have moved to a new stable state in which climate is factored into decisionmaking at the highest level. However, public desire alone isn’t sufficient – intervention must also

ALEX MARTIN is sustainability features editor for The Actuary

Features Environment

be affordable. While some might argue that the cost of Earth system collapse is more than a monetary amount, we live in a world in which government spending is scrutinised by the media and the public. Again, tipping points come in: the exponential decrease in costs

All new technology is expensive when first introduced; the first mobile phone cost approximately $3,000 in the Eighties. However, as the technology develops further, demand increases, leading to more investment and development. Today, a mobile phone can be bought for £20.

We are seeing the same trends in renewable energy, with the cost of wind turbines, batteries and solar panels having fallen dramatically during the past decade. Electric cars will soon be as affordable as combustion-engine vehicles (indeed, if we consider the lifetime of the vehicle, they already are). Once cost parity is reached, we will see a tipping point into a new stable state in which electricity is the dominant fuel.

Tipping the balance

However, this very tipping point behaviour might be our saving grace. The challenges we face are so large that they demand government-driven change. What does it take to make that happen?

For a government to intervene, it must feel that there is sufficient desire for change among the

How actuaries can help

Cost and desire might not be sufficient to prompt government intervention but they are certainly necessary, and both are moving in the right direction. But are they moving quickly enough? As we improve our climate models, we will get a sense of how various behaviours work against each other. Actuaries are able to see both sides of the coin but we must make our influence felt. We will need to update our risk models to reflect the reality of physical tipping points. We can also influence long-term capital allocation within financial services to accelerate positive socio-economic tipping points.

Whether you are a glass-half-full or a glass-half-empty person, we can all agree that we need to keep the glass on the table.

I

Bizarre though it sounds, the very thing that’s blighting the Earth could be its saviour, says Alex Martin

www.theactuary.com SEPTEMBER 2023 | THE ACTUARY | 19

Storming the capital T

here is a growing awareness of the financial sector’s role in climate change and wider sustainability objectives such as the UN’s Sustainable Development Goals. This includes not just the potential consequences for financial companies themselves (outside-in, or financial materiality) but also the external impacts of their activities (inside-out, or double materiality).

Such considerations are increasingly informing financial regulation and supervision, from mandatory ESG (environmental, social and governance) disclosures to climate stress tests. Going further, the potential integration of climate risk into quantitative capital requirements is now being actively researched and debated in global regulatory circles.

Why is climate risk different?

Insurance companies, banks and pension funds are increasingly exposed to a variety of climate-related risks, which can be classified along several axes: Physical risks (such as floods, wildfires and heatwaves) and transition risks (such as asset repricing, technological changes and climate litigation) Asset risks (depreciation of carbon-intensive

JÉRÔME CRUGNOLAHUMBERT is director, sustainability services at Deloitte Switzerland, and Actuarial Association of Europe chairperson, sustainability and climate-related risks

IMAGE: ISTOCK

20 | THE ACTUARY | SEPTEMBER 2023 Features Environment www.theactuary.com

Climate risk has marched into all areas of finance but many questions remain unanswered. Jérôme Crugnola-Humbert discusses the issues around incorporating it into prudential capital requirements

investments) and liability risks (increases in climate-related payouts)

Acute risks (such as tropical storms) and chronic risks (such as sea-level elevation) Risks related to existing books of business and to future sales

Micro-prudential risk specific to individual companies and macro-prudential risks impacting the whole financial system.

There are two main conceptual approaches to incorporating such climate risks into prudential capital frameworks:

Green-supporting factors – rewarding behaviour and strategies that promote positive action on or adaptation to climate change through lower capital requirements

Brown-penalising factors – imposing higher capital requirements on entities that invest in or undertake actions that are adverse to the climate.

However, this assumes that definitions for ‘green’ or ‘brown’ are available and generally agreed on, and that there is clarity around the objectives for including climate risk in prudential capital frameworks: is it meant only to reflect risk-based principles (financial materiality) or also to mobilise the financial sector in the fight against climate change (double materiality)?

On the issue of definitions, sustainable taxonomies such as the EU taxonomy for sustainable activities can create a level playing field. However, only a few jurisdictions have launched such initiatives (and their lists of sectors and criteria do not always agree), and no taxonomy of harm has yet been adopted (except for some proposals from NGOs such as the World Wide Fund for Nature).

On the issue of objectives, there is a risk that these will be politicised rather than follow a science-based approach, as well as fears that they could lead to ‘green bubbles’. We also note that in the fight against climate

change, marginal change in capital treatment is likely to provide a weaker incentive than tax reform or direct subsidies such as the US’s Inflation Reduction Act (unless these capital changes are massive, as in the One for One campaign’s proposal that banks and insurers hold one dollar of capital in reserve to cover themselves for the potential future loss of every dollar invested in fossil fuels).

Beyond these general principles, there are numerous additional obstacles to the inclusion of climate risk in capital requirements, such as:

Climate is an emerging risk with limited historic data and requires a forwardlooking assessment

It is a systemic risk that is potentially hard to hedge or from which to diversify There is not always a direct link between climate change mitigation and actuarial risks. For instance, rewarding carbon emissions reduction may have an effect in the long-term without immediately reducing the risk

Climate risk has a long-term component that is not a natural fit for the typical one-year risk horizon of many capital frameworks.

In addition, climate change does not just increase risk (in other words, variability around the best estimate). It also has a trend component that should inform the bestestimate valuation itself. For instance, the concept of ‘stranded assets’ is at odds with conventional market consistency, as it assumes that some investments (such as fossil fuel companies or real estate exposed to physical risks) are likely to suffer from a major loss in value at some future point and are thus incorrectly priced by the supplydemand dynamics of current markets.

As such, assessing and managing climate risk requires a new methodological paradigm, shown in Table 1.

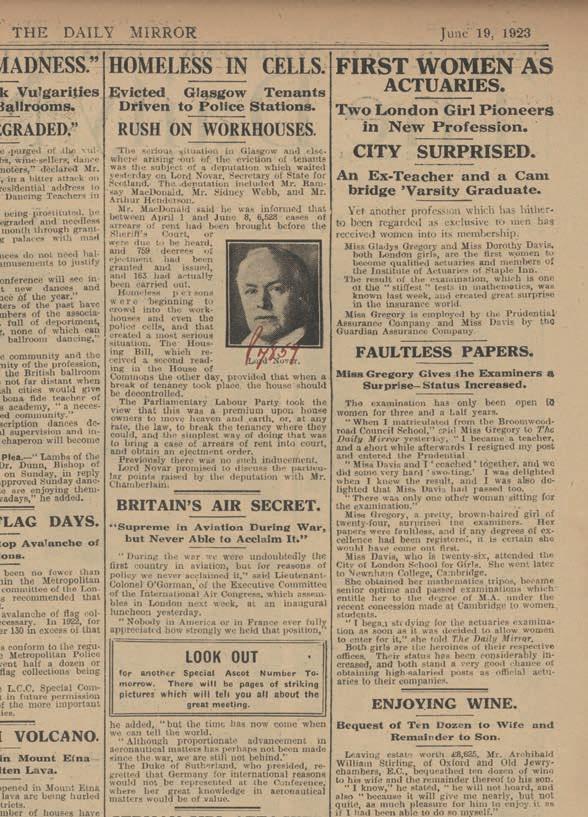

TABLE 1:

LOOKING TO……THE PAST …THE PRESENT…THE FUTURE MethodologyStatistics Market-consistency Forward-looking Underlying worldview ‘Tomorrow can be extrapolated from yesterday’ ‘Today’s financial markets include all relevant information’ ‘Tomorrow will be different and must be explored holistically’ ExamplesMortality tables, non-life loss triangles Market-consistent balance sheet Climate risk scenarios Professional judgment involved Choice of statistical models, historical data, discount rate Market references, ultimate forward rates Integrated assessment models, future physical and social tipping points Features Environment SEPTEMBER 2023 | THE ACTUARY | 21 www.theactuary.com

The need for a forward-looking approach

Features Environment

In addition, the incorporation of climate change into prudential risk frameworks follows a ‘reverse journey’. Financial transformation projects such as Solvency II usually unfold naturally from ‘Pillar 1’ (quantitative requirements) to ‘Pillar 2’ (risk management, governance and strategy) and ultimately to ‘Pillar 3’ (reporting and disclosures). Due to the urgency around the environment, climate (and sustainability in general) is proceeding in reverse order: ESG reporting is already required for large companies, while risk strategies are still works-in-progress and quantitative capital requirements lie further along the horizon.

Guidance and initiatives

There is no international framework for incorporating climate risk into prudential capital requirements. The International Association of Insurance Supervisors recently launched a series of consultations on climate risk supervision, building on its 2021 Application Paper on the Supervision of Climate-related Risks in the Insurance Sector and following similar work carried out by the Basel Committee for Banking Supervision. However, capital requirements (ICP 17) are not currently in scope.

While we lack a global framework, thoughtpieces and climate scenario initiatives have been published in several jurisdictions. Some regulators and financial supervisors (such as the Bank of England and Japan’s Financial Services Agency) have expressed interest in the idea but haven’t yet implemented concrete steps. An increasing number of jurisdictions have introduced climate stress testing but without any links to capital requirements; it seeks to illustrate plausible alternatives rather than assign actual probabilities. This has been the case in places such as the Netherlands, the UK, France, Canada, Australia, the EU and New Zealand.

Financial supervisors are increasingly issuing climate risk guidance and asking that

climate be considered within enterprise risk management frameworks such as the Internal Capital Adequacy Assessment Process or Own Risk and Solvency Assessment. This may be reflected in direct regulation or supervisory expectations (such as in the EU, New York State or Bermuda) or indirectly through the mandating of climate reporting standards that themselves include climate scenario analysis, such as the Taskforce for Climate-related Financial Disclosures or the International Sustainability Standards Board.

lending in 2020. It initially allowed for a capital discount for lending on housing with a sufficient energy efficiency rating, and now applies to green bonds, solar power plants, sustainable agriculture, energy efficiency and e-mobility.

Meanwhile, Guernsey introduced a green factor for life insurers’ fixed income assets in 2021, applied through a discount on the spread risk capital. Eligible assets must be determined in line with the Guernsey Green Fund rules, and the discount notably requires amendment to investment and risk policies, prior supervisory approval and disclosure to policyholders.

The EU has already introduced general climate and sustainability considerations into Solvency II, with capital requirements to be impacted in the future. This includes a planned update of the natural catastrophe module in the Standard Formula (the need to recalibrate due to increasing physical risks has been acted on, but the new parameters have not yet been set).

Modelling climate change scenarios entails new challenges, such as incorporating long-term business projections, climate tipping points and non-linearities. However, no financial company needs to perform such analyses from scratch. Open-source material from the International Panel on Climate Change (IPCC) and the Network for Greening the Financial System (NGFS) can be used, assuming they are properly evaluated and adapted to fit the institution’s risk profile. An increasing body of literature is being published, and additional supervisory guidance is being developed in jurisdictions such as the EU and New Zealand.

First regulatory developments

Actual changes in capital requirements are still rare, but there have been a couple of European examples (in both cases through a supporting factor on assets). Hungary introduced a green factor for sustainable

In addition, the European Insurance and Occupational Pensions Authority published an initial consultation in 2023, Prudential Treatment of Sustainability Risks: Discussion Paper; this sought feedback on the potential inclusion of new climate transition risk considerations for asset risk, and of climate adaptation strategies for insurance underwriting risk.

Stepping up

Finance is clearly a key part of the climate transition, and the potential introduction of climate-related capital requirements is an important area where actuaries, risk managers, economists, climate scientists and other professionals should come together and develop new ways of collaborating in order to contribute to the necessary effort.

This article is adapted from a talk given at the 2023 International Congress of Actuaries in Sydney, Australia

An increasing number of jurisdictions have introduced climate stress testing but without any links to capital requirements

Source: Crugnola-HumbertJetal.Climatescenariotesting–whatfinancialcompaniesneedtoknow.Deloitte,2023

FIGURE 1: Leveraging the work of the IPCC and NGFS

Financial institution

Economic framework (NGFS)

Climate trajectories (IPCC)

Climateandeconomy feedback

www.theactuary.com 22 | THE ACTUARY | SEPTEMBER 2023

Climateandfinancial feedback

Climate Risk for Insurers series sponsored by

How to choose the right climate model

Discussions around the pros and cons of different climate models and scenario sources focus more on the differences than the commonalities. Sustainability and environmentalism are factionalised.

Unfortunately, normative divisions also lead to a tendency for climate modelling and scenario analysis to be explained or presented badly – if not outright dismissed. For experienced users of quantitative risk models, the maxim ‘all models are wrong, some are useful’ is a good guide. Looking for the perfect model is not the aim. The first step in choosing a climate model is to try to avoid being drawn into a ‘Which side are you on?’ debate.

One way to do this is to start with a focus on the end goal of your analysis. Most actuaries and risk managers working for insurers employ one of the three approaches shown in the figure below. What defines an appropriate choice of climate model is if you are able to use and interpret it to suit your needs.

To date, most climate risk asset modelling has focused on the bottom-up approach; to model real asset and credit risk. Typically, this is achieved by using either publicly available climate modelling – such as those provided by the Network for Greening the Financial System (NGFS) or Principles for Responsible Investment (PRI)– or proprietary commercial modelling capabilities. Often, bottom-up modelling will miss some key strategic risks; for example, it may assume that

yield curves and credit spread levels are held constant.