Launch of the South Australian Small Business Strategy 2023 - 2030.

This important strategy will guide government policies and programs that will empower you to take your business to new heights, with 20 initiatives designed to build workforce and skills development, drive jobs and growth, make it easier access to information and services, and increase diversity and sustainability across the sector.

Stay tuned for more details as the Hon. Andrea Michaels MP Minister for Small and Family Business and the State Government look forward to sharing with you these exciting new steps in our commitment to South Australia’s small and family businesses.

Annual Wage Review 2023

The Fair Work Commission has announced:

• the National Minimum Wage will be increased to $882.80 per week or $23.23 per hour

• a 5.75% increase to minimum award wages.

The increase applies from the first full pay period starting on or after 1 July 2023.

You can read more about the Fair Work Commission’s decision and subscribe to their email updates here: https://www. fairwork.gov.au/newsroom/news/awr-2023

Yesterday was Micro, Small and Medium-sized Enterprises Day (MSME Day)

World Micro, Small and Medium-sized Enterprises Day (MSME Day) is a terrific annual opportunity to say thank you to the enterprising women and men who are the lifeblood of our communities.

This year’s theme is “small business matters”.

We depend so heavily on the small and family-run businesses in our lives – they matter greatly to our communities and our economy and this is the perfect time to celebrate the vital and deeply personal commitment made by our small and family businesses.

We can all show our support by being a kindly customer –patient and understanding, with good and generous intent. Small businesses are run by real people facing similar challenges as a bigger businesses but usually without the support to do it.

This day is coordinated by the Australian Small Business and Family Enterprise Ombudsman.

June 2023 | Issue #83 The CONNECTOR admin@printlord.com.au | 08 8258 0156 northernbusinessbreakfast A partnership between the Rotary Club of Salisbury and the Rotary Club of Elizabeth EVENT ENQUIRIES breakfast@salisburyrotary.com.au www.facebook.com/mynbb

@rebeccaretz @becalisonau @becalisonau becalison com au hello@becalison com au Alison Bec M A R K E T I N G Let s connect

FREE Networking Event - Influence Your Business Future

Wednesday 19th July 23 - 5.15pm for 5.30pm start (Innovation House).

At the next FREE Polaris networking event there will be food, drinks and plenty of networking with like-minded people. Reflect back on your achievements for the 2022-2023 financial year and get ready to take on the 2023-2024 financial year.

Gary will speak about “The Best Way to Predict the Future is to Create It”.

Gary is a communication coach, leadership mentor and keynote speaker. He works with individuals and organisations who want to realise the potential of the situation that they find themselves in. Gary will help us all to:

• Reflect back on the successes you’ve had in the past year

• Think positively about the challenges that exist in our current environment

• See the opportunities within those challenges

• Develop the mindset and tools to be able to take advantage of those opportunities

• Set a goal for success in the coming year

Gary understands how the way we think and make decisions –and then carry them out – influences the outcomes we achieve and will provide you with the mindset and tools you need to set yourself up for an exciting and productive new business year.

Book yourself a ticket TODAY! https://www.eventbrite.com.au/e/ influence-your-business-future-tickets-645741238427

Paid family and domestic violence leave for some employees

From 1 February 2023, employees of non-small business employers (employers with 15 or more employees on 1 February 2023) can access 10 days of paid family domestic violence leave. This includes part-time and casual employees.

Employees employed by small business employers (employers with less than 15 employees on 1 February 2023) can access paid leave from 1 August 2023. Until then, they can continue to take unpaid family and domestic violence leave.

Is your business ready? Modified your policies, adapted your HR recording system, spoken to your staff. (Note – even Xero Payroll can’t yet manage elements of this with recommendations that Employer also maintain a separate record of use)

With this leave type there are some specific rules – such as the 10 days resets on the anniversary date of an employees commencement, it is a draw down leave entitlement not a pro rata accumulation of entitlement, evidence requirements are defined and it can’t be recorded on payslips (risk from perpetrators).

More information from https://www.fairwork.gov.au/leave/ family-and-domestic-violence-leave

Supplied by NBB: trestle, table cloth and chairs

Exhibitor pull up banners, promo materials, giveaways, business card draw, etc and a 2 minute promotion of their business

June to December available (excl. October), 1 booking per business per calendar year

Promote your business with an expo table. $100 Enquiries on the day with Toni

Anne

Tax Time

To support businesses to meet their Tax obligations, the Australian Taxation Office offers a range of tools and services to make it easier for you to get your tax and superannuation right.

The ATO wants to help you manage and grow your business and get back on track if you need to and also recommends that you speak with your registered tax or BAS agent for help.

One key resource is the Small business tax time toolkit

The 2023 Toolkit will be released shortly, and has a range of fact sheets to help you with:

• home-based business expenses

• motor vehicle expenses

1. Temporary full expensing

Under temporary full expensing, eligible businesses can deduct the business portion of the cost of eligible depreciating assets first held and used, or installed ready for use between 7:30 pm (AEDT) on 6 October 2020 until 30 June 2023.

You can use the temporary full expensing tax return label guide to help identify which labels you will need to complete in your tax return. This will ensure you correctly claim or opt out of the temporary full expensing measure. A loss from using temporary full expensing does not mean you can defer a non-commercial loss.

• travel expenses

• claiming deductions for the cost of digital expenses

• using business money and assets

• pausing or permanently closing your business.

You will be able to find this guide on their Supporting your small business page https://www.ato.gov.au/Business/Bus/ Supporting-your-small-business/

Below we’ve picked out three items to discuss further:

1. Depreciation - temporary full expensing

2. What are Expenses?

3. Tax amnesty for overdue returns December 1, 2019 –February 28, 2022

2. Tax Time tips - What are tax deductions?

Tax deductions allow you to lower the total amount of your taxable income by offsetting it with any necessary out-ofpocket expenses you have made during the financial year. The idea is that you may be able to claim enough deductions to reduce your taxable income, hence securing a bigger tax refund.

However, this doesn’t work for all expenses. The criteria for tax deductions are as follows:

• The expense must be directly related to your work or income-generating activity

• You can not have had the expense already reimbursed by your employer

• You will need the correct receipt or bank statement as evidence. But for expenses which fall into a greyarea category, like home internet which is used for both personal and work-fromhome purposes, you’ll need to work out how much of that expense relates to your income-generating activity.

Contact your local tax agent or accountant for advice on how to get the best return.

3. Tax Update – Small Businesses granted Tax Amnesty

The Australian Taxation Office (ATO) is encouraging small businesses that have overdue income tax returns, fringe benefits tax returns or business activity statements to take advantage of a new amnesty to get their lodgments back on track.

The amnesty was announced in the 202324 Budget. It applies to tax obligations that were originally due between 1 December 2019 and 28 February 2022 and runs from 1 June 2023 to 31 December 2023.

To be eligible for the amnesty, the small business must be an entity with an aggregated turnover of less than $10 million at the time the original lodgment was due.

During this time, eligible small businesses can lodge their eligible overdue forms and the ATO will then proactively remit any associated failure to lodge (FTL) penalties.

When forms are lodged with the ATO under the amnesty, businesses or their tax professionals will not need to separately request a remission of FTL penalties. The ATO encourage all businesses to lodge any overdue forms even if they are outside the eligibility period. Whilst forms outside the amnesty eligibility criteria will attract FTL penalties, the ATO will consider your circumstances and may remit such penalties on a case-by-case basis.

The ATO offers a range of support options, including payment plans. Many small businesses are also able to set up their own payment plan online.

The amnesty applies to income tax returns, business activity statements, and fringe benefits tax returns. It does not apply to superannuation obligations and excludes other administrative penalties such as penalties associated with the Taxable Payments Reporting System.

“New Dawn” - Ukraine Crisis Update Local Clubs Providing Direct Aid

Rotary District 9510 (which includes Elizabeth and Salisbury clubs) are assisting people impacted by the Ukraine humanitarian crisis. We have built a direct relationship with Ukraine Rotary District 2232 and NGO “New Dawn” to ensure all funds raised go directly to areas in need.

There is no medical support service in this area, all facilities were previously destroyed.

The photo’s which show the devastation from flooding and the new Medical Centre Building.

If you would like to help please donate at the link below: https:// donations.rawcs.com.au/58-2022-23

Rotary Australia Overseas Aid Fund (Managed by RAWCS) has Deductible Gift Recipient (DGR) registration and has been listed as a Charitable Fund so we can accept Australian tax deductible donations from individuals or organisations.

This is a Multi Club project in Rotary District 9510 auspiced by Rotary Club of Northern Yorke Peninsula.

Rotary are #PeopleofAction and we hope to have a positive impact on these people in these communities that need our humanitarian help.

This project is to provide humanitarian aid and essential supplies to Ukrainians in Odesa and regional villages in south eastern Ukraine.

As you may be aware with the failure to a dam wall (destroyed by bombing) recently upstream of Kherson there is extensive flooding in Kherson and surrounding villages.

This is the area of operation for our Ukraine-New Dawn Project. New Dawn have pivoted rapidly from distributing aid to villagers to assisting with evacuating people impacted by the flooding. Internally Displaced Persons (IDPs) are receiving aid from “New Dawn.”

Our project has also recently funded a new Modular Medical Centre built in Kyiv for the project. The Medical Centre has been located in a village designated by the Ukraine Department of Health.

on Monday nights 6.15pm for 6.45pm. Membership enquiries welcome. www.elizabeth.rotaryaust.org www.facebook.com/RotaryClubofElizabeth

Membership

www.salisburyrotary.com.au www.facebook.com/RCSalisbury

Rotary Club of Elizabeth meets at the Elizabeth Tavern

Rotary Club of Salisbury (SA) meets at the Old Spot Hotel on Monday nights 6pm for 6.30pm.

enquiries welcome.

The NBB July Networking Event

Wednesday 26th July 2023 6:45am coffee 6:45am – 8:30am. Playford Bowling Club, Goodman Rd, Elizabeth SA 5112 Fourth Wednesday of the month.

July Wednesday, 26th 7am Breakfast

August Wednesday, 23rd 7am Breakfast

September Wednesday, 27th 7am Breakfast

October Wednesday, 25th 6pm Cocktail

November Wednesday, 22nd 7am Breakfast

Dec Wednesday, 13th (TBC) 7am Breakfast

January No breakfast

February Wednesday, 22nd 7am Breakfast

First Aid in the Workplace

Do you understand your obligations as a small or medium business? How many first aid kits or trained people do you need? In South Australia there is an excellent ‘Model Code of Practice: First Aid in the Workplace” – its readable, straight forward and designed for employers.

“We didn’t realise we needed another first aider trained – not knowing left us open to financial fines or liability if something had gone wrong. We strongly suggest businesses conduct a 5 minute review to the SA Code of Practice”.

You can access it here from Safework SA https://www.safework. sa.gov.au/__data/assets/pdf_file/0004/136264/First-aid-in-theworkplace.pdf

Or simple link https://tinyurl.com/bztxtmry

Defibrillators to become compulsory in SA.

The Automated External Defibrillator (Public Access) Bill 2002 was passed by the SA Parliament on 30 November 2022. The Act will come into force for government agencies (‘the Crown’) on 1 January 2025 (s 2), and for everyone else on 1 January 2026 (Schedule 1), giving time for necessary regulations to be written and for Automate External Defibrillators (AEDs) to be purchased and installed.

March Wednesday, 27rd 7am Breakfast

April Wednesday, 24th 7am Breakfast

June Wednesday, 26th 7am Breakfast

$30 (Or $55 for two people) includes a keynote speaker, food, prize draws and networking. Book your tickets via Eventbrite.

How We Can Help

·

·

·

Rosemar y Caruso - Director (08) 8233 7290

36 Park Terrace, Salisbur y, SA, 5108 Johnstonwithers.com.au

The Act refers to a ‘designated building or facility’ which means (s 3 definition of ‘public building’ and s 5)

• Public building or facility (such as a public swimming pool, library, local government office or town hall);

• Sporting facility listed in the regulations;

• School, tertiary education or skills training facility;

• Correctional facility;

• Custodial police station;

• Retirement village;

• Residential aged care facility;

• Caravan park;

• Residential park;

• Casino or other gambling facility;

• Theatre;

• Commercial building; or

• Other building types listed in the regulations.

The term ‘prescribed building’ means (s 5)

• Any building ‘used for commercial purposes’ built or subject to major works after the commencement of the Act (1 January 2026) if the building has a floor space greater than 600m2; or

So if your business is operating in a building with floor space greater than 600m2 it is likely you will need to comply.

To see the SA Legislation click here; https://tinyurl.com/4u4d4ept

Month Date Format Subject to change

Wills & Estates

Family Law

Injur

y Claims

Commercial Law

G et In Contact

Are you ready to reach more people at the Northern Business Breakfast?

Standing out in the crowd to reach your customer can be difficult, but one way to do this when attending the Northern Business Breakfast is to include a featured article in the Connector.

The Connector is given to 120 attendees, plus circulated to local businesses, and sent out to our email database of 1,100 subscribers each month.

If you are looking for articles to include in the Connector, here are three types of articles you could write.

Plus, at the end, there is an end-of-financial-year offer that won’t want to miss.

Promote Your Offer and How It Benefits Them:

Do you have a heck yes offer, that you know will benefit the people reading the Connector?

Write a featured article about your product or service that emphasises the benefits it brings to. Provide insights into the unique features, solutions, or special offers that make your business stand out. By focusing on the value your offer provides, you can capture the interest of potential customers and entice them to take action.

Example: “Unlock Your Business Potential with XYZ SoftwareBoost Efficiency and Save Time!”

Profile of Who You Are and What You Do:

Are you wanting to increase brand awareness?

Write a featured article that introduces you and your business. It will help you build trust and establish a personal connection with your audience. Highlight your background, expertise, and the mission behind your business.

Example: “Meet the Team Behind ABC Co. - Passionate Experts Committed to Delivering Exceptional Solutions”

Educational Article to Showcase Expertise:

Providing value to your audience will help position you as the expert in your field. Write a featured article that offers valuable insights, industry trends, or tips and tricks related to your area of expertise.

Example: “Mastering Marketing Analytics: A Comprehensive Guide to Optimizing Your Campaigns”

Exclusive EOFY Offer

Book Your Feature article spot by Friday, June 30:

Receive $50 off the regular price by locking in your feature articles for the remainder of 2023, by Friday 30th June.

See Bec at the Northern Business Breakfast, or email her at hello@becalison.com.au

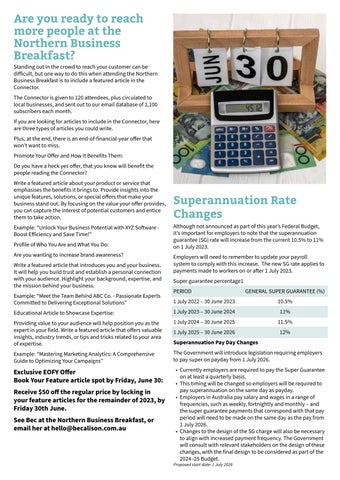

Superannuation Rate Changes

Although not announced as part of this year’s Federal Budget, it’s important for employers to note that the superannuation guarantee (SG) rate will increase from the current 10.5% to 11% on 1 July 2023.

Employers will need to remember to update your payroll system to comply with this increase. The new SG rate applies to payments made to workers on or after 1 July 2023.

Super guarantee percentage1

Superannuation Pay Day Changes

The Government will introduce legislation requiring employers to pay super on payday from 1 July 2026.

• Currently employers are required to pay the Super Guarantee on at least a quarterly basis.

• This timing will be changed so employers will be required to pay superannuation on the same day as payday.

• Employers in Australia pay salary and wages in a range of frequencies, such as weekly, fortnightly and monthly – and the super guarantee payments that correspond with that pay period will need to be made on the same day as the pay from 1 July 2026.

• Changes to the design of the SG charge will also be necessary to align with increased payment frequency. The Government will consult with relevant stakeholders on the design of these changes, with the final design to be considered as part of the 2024–25 Budget.

Proposed start date: 1 July 2026

PERIOD GENERAL SUPER GUARANTEE (%) 1 July 2022 – 30 June 2023 10.5% 1 July 2023 – 30 June 2024 11% 1 July 2024 – 30 June 2025 11.5% 1 July 2025 – 30 June 2026 12%

Move across to Google Analytics 4 to avoid losing data

In the world of data analytics, staying ahead of the curve is essential for businesses. As we approach the deadline of July 1st, 2023, it’s time for you to make a crucial decision: transitioning to Google Analytics 4 (GA4). This shift marks a significant milestone, as Universal Analytics will stop collecting data, making GA4 the future of data analysis for businesses.

The Evolution of Google Analytics:

Since 2005, Google Analytics has been a cornerstone for businesses seeking to understand user behavior, optimise marketing strategies, and make data-driven decisions. Over the years, Universal Analytics has served as the go-to tool for tracking website and app interactions, providing valuable insights into audience behavior, traffic sources, and conversion rates.

However, with the rapid evolution of technology and the increasing complexity of user interactions across multiple devices and platforms, Universal Analytics faced limitations in keeping up with the changing digital landscape. Recognizing the need for a more advanced and comprehensive solution, Google introduced Google Analytics 4.

What is Google Analytics 4?

Google Analytics 4 is the next generation of Google’s analytics platform, designed to provide businesses with a more holistic and future-proof approach to data analysis. Built upon a foundation of machine learning and advanced tracking capabilities, GA4 offers a range of features that enable businesses to gain deeper insights into user behavior, track cross-device interactions, and unlock the full potential of their data.

Why Transition to Google Analytics 4?

Enhanced Cross-Platform Tracking: GA4 addresses the challenge of tracking user interactions across multiple devices, such as smartphones, tablets, and desktops. With Universal Analytics, user journeys across different devices were fragmented. In contrast, GA4 uses a user-centric model, allowing businesses to understand how customers engage with their brand across various touchpoints.

Advanced Machine Learning Capabilities: GA4 leverages machine learning algorithms to provide businesses with powerful insights into user behavior, customer segmentation, and predictive analytics. This enables businesses to identify trends, personalise user experiences, and optimise marketing campaigns more precisely.

Deeper Integration with Google Marketing Platform: As part of the Google Marketing Platform, GA4 seamlessly integrates with other powerful tools like Google Ads, Google Tag Manager, and Data Studio. This integration empowers businesses to streamline their marketing efforts, create custom audiences, and track conversions across different channels.

Future-Proofing Your Analytics: With the digital landscape constantly evolving, GA4 ensures that businesses are wellequipped to adapt to future changes. By adopting GA4 now, businesses can stay ahead of the curve and avoid disruption when Universal Analytics officially stops collecting data.

Preparing for a Smooth Transition:

To make the transition from Universal Analytics to GA4 seamless, businesses need to follow a few key steps:

Assess and Audit Existing Analytics Setup: Evaluate your current tracking and data collection methods, ensuring that all essential data points are accounted for. Identify any gaps in data collection and develop a migration plan accordingly.

Set Up a New GA4 Property: Create a new GA4 property alongside your existing Universal Analytics property to run in parallel. This ensures that data continues to be collected during the transition period, allowing for accurate comparisons.

Familiarise Yourself with GA4 Features: Explore the new features and capabilities of GA4, such as event-based tracking, enhanced reporting, and machine learning insights. Take advantage of resources provided by Google, including documentation, tutorials, and community forums.

Update Tracking Codes and Implement Data Streams: Replace existing Universal Analytics tracking codes with GA4 tracking codes on your website, app, and other digital properties. Configure data streams to ensure accurate data collection from various sources.

Follow Bec Alison Marketing on Facebook f or more tips about marketing.

Follow for more tips

LUC K Y DR AW FOR ATTENDEES ONLY ake your Connector home, on our social media. If your number is drawn send a photo of your Connector within 5 days to breakfast@salisburyrotary.com.au and we will advise how to collect your prize. The Northern Business Breakfast is Proudly sponsored by the following organisations northernbusinessbreakfast A partnership between the Rotary Club of Salisbury and the Rotary Club of Elizabeth EVENT ENQUIRIES breakfast@salisburyrotary.com.au www.facebook.com/mynbb 2nd and 4th Monday nights in the month The Elizabeth Tavern, Elizabeth Way, Elizabeth www.elizabeth.rotaryaust.org Rotary Club of Salisbury (SA) Inc. Mignon Clark 0402 824 645 6.00pm for 6.30pm, Mondays Old Spot Hotel, 1955 Main North Rd, Salisbury Heights www.salisburyrotary.com.au OPEN 7 DAYS A WEEK LUNCH & DINNER GAMING ROOM BOTTLESHOP ACCOMMODATION 8258 2096 | oldspothotel com au e